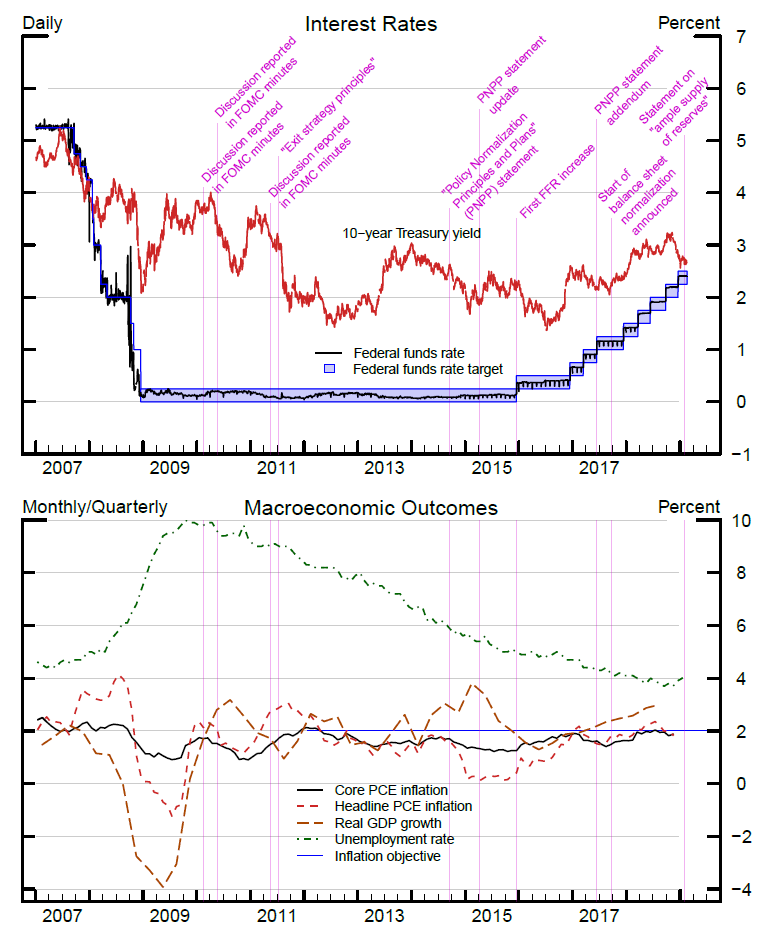

Timelines of Policy Actions and Communications:

Policy Normalization Principles and Plans

Starting in 2010, the FOMC began providing the public with periodic guidance about its plans to normalize the level of the federal funds rate as well as the size and composition of the Federal Reserve's balance sheet.

- February 17, 2010; May 19, 2010: The minutes for the January and April 2010 FOMC meetings report staff presentations and Committee discussions on some principles and strategies for normalizing the size and composition of the Federal Reserve's balance sheet over time.

- May 18, 2011; July 12, 2011: The minutes for the April 2011 FOMC meeting contain an extensive discussion on the strategy for normalizing the stance of monetary policy. Following that discussion, the minutes for the June 2011 FOMC meeting note that all FOMC participants but one agreed on key "exit strategy principles." Under these principles, reinvestments would cease and reserve-draining operations would be initiated before the first increase in the federal funds rate target; the interest rate on excess reserves (IOER) and the level of reserves would be adjusted to bring the federal funds rate toward its target; and sales of agency securities would be "aimed at eliminating […] holdings of agency securities over a period of three to five years."

- September 17, 2014: All FOMC participants but one agree on key elements of policy normalization, which are published in a separate postmeeting statement called "Policy Normalization Principles and Plans." The FOMC indicates that it will not conduct asset sales or reserve draining operations, in contrast to the exit strategy principles released in the minutes to the June 2011 FOMC meeting. The FOMC states that:

- "When economic conditions and the economic outlook warrant a less accommodative monetary policy, the Committee will raise its target range for the federal funds rate. During normalization, the Federal Reserve intends to move the federal funds rate […] primarily by adjusting the interest rate it pays on excess reserve balances. During normalization, the Federal Reserve intends to use an overnight reverse repurchase agreement facility and other supplementary tools as needed to help control the federal funds rate. The Committee will use [this facility (henceforth 'ON RRP')] only to the extent necessary and will phase it out when it is no longer needed to help control the federal funds rate."

- "The Committee intends to reduce the Federal Reserve's securities holdings in a gradual and predictable manner primarily by ceasing to reinvest repayments of principal […]. The Committee expects to cease or commence phasing out reinvestments after it begins increasing the target range for the federal funds rate; the timing will depend on how economic and financial conditions and the economic outlook evolve. The Committee currently does not anticipate selling agency mortgage-backed securities as part of the normalization process, although limited sales might be warranted in the longer run to reduce or eliminate residual holdings. The timing and pace of any sales would be communicated to the public in advance."

- "The Committee intends that the Federal Reserve will, in the longer run, hold no more securities than necessary to implement monetary policy efficiently and effectively, and that it will hold primarily Treasury securities, thereby minimizing the effect of Federal Reserve holdings on the allocation of credit across sectors of the economy."

- April 8, 2015: The minutes for the March 2015 FOMC meeting state that the Committee unanimously updated its Policy Normalization Principles and Plans, communicating that the Committee intends to:

- "Continue to target a range for the federal funds rate that is 25 basis points wide."

- "Set the IOER rate equal to the top of the target range for the federal funds rate and set the offering rate associated with an ON RRP facility equal to the bottom of the target range for the federal funds rate."

- "Allow aggregate capacity of the ON RRP facility to be temporarily elevated to support policy implementation; adjust the IOER rate and the parameters of the ON RRP facility, and use other tools such as term operations, as necessary for appropriate monetary control, based on policymakers' assessments of the efficacy and costs of their tools. The Committee expects that it will be appropriate to reduce the capacity of the facility fairly soon after it commences policy firming."

- December 16, 2015: With the increase in the federal funds rate from its effective lower bound, an implementation note complements the FOMC postmeeting statement. The implementation note provides the settings of the interest rates on required and excess reserve balances, and the offering rate for overnight reverse repurchase operations. These administered rates are intended to keep the federal funds rate within the target range set by the FOMC.

- June 14, 2017: The FOMC issues an addendum to its Policy Normalization Principles and Plans. All participants agree that:

- Principal payments "will be reinvested only to the extent that they exceed gradually rising caps." For Treasury securities, the FOMC anticipates that "the cap will be $6 billion per month initially and will increase in steps of $6 billion at three-month intervals over 12 months until it reaches $30 billion per month." For agency debt and mortgage-backed securities, the FOMC expects that "the cap will be $4 billion per month initially and will increase in steps of $4 billion at three-month intervals over 12 months until it reaches $20 billion per month. The Committee also anticipates that the caps will remain in place once they reach their respective maximums."

- The quantity of reserve balances would be reduced, "over time, to a level appreciably below that seen in recent years but larger than before the financial crisis."

- The Committee "would be prepared to resume reinvestment of principal payments […] if a material deterioration in the economic outlook were to warrant a sizable reduction in the Committee's target for the federal funds rate. Moreover, the Committee would be prepared to use its full range of tools, including altering the size and composition of its balance sheet, if future economic conditions were to warrant a more accommodative monetary policy than can be achieved solely by reducing the federal funds rate."

- January 30, 2019: The FOMC releases a statement indicating that all FOMC participants agree that:

- "The Committee intends to continue to implement monetary policy in a regime in which an ample supply of reserves ensures that control over the level of the federal funds rate and other short-term interest rates is exercised primarily through the setting of the Federal Reserve's administered rates, and in which active management of the supply of reserves is not required."

- "The Committee continues to view changes in the target range for the federal funds rate as its primary means of adjusting the stance of monetary policy. The Committee is prepared to adjust any of the details for completing balance sheet normalization in light of economic and financial developments. Moreover, the Committee would be prepared to use its full range of tools, including altering the size and composition of its balance sheet, if future economic conditions were to warrant a more accommodative monetary policy than can be achieved solely by reducing the federal funds rate."

Sources: FRED, Federal Reserve Bank of St. Louis.

Notes: Headline and core PCE inflation are shown on a 12-month basis. Real GDP growth is shown on a four-quarter change basis. The unemployment rate is on a monthly basis.