Board of Governors of the Federal Reserve System

International Finance Discussion Papers

Number 1005, September 2010 --- Screen Reader

Version*

The Information Content of High-Frequency Data for Estimating Equity Return Models and Forecasting Risk

NOTE: International Finance Discussion Papers are preliminary materials circulated to stimulate discussion and critical comment. References in publications to International Finance Discussion Papers (other than an acknowledgment that the writer has had access to unpublished material) should be cleared with the author or authors. Recent IFDPs are available on the Web at http://www.federalreserve.gov/pubs/ifdp/. This paper can be downloaded without charge from the Social Science Research Network electronic library at http://www.ssrn.com/.

Abstract:

We demonstrate that the parameters controlling skewness and kurtosis in popular equity return models estimated at daily frequency can be obtained almost as precisely as if volatility is observable by simply incorporating the strong information content of realized volatility measures extracted from high-frequency data. For this purpose, we introduce asymptotically exact volatility measurement equations in state space form and propose a Bayesian estimation approach. Our highly efficient estimates lead in turn to substantial gains for forecasting various risk measures at horizons ranging from a few days to a few months ahead when taking also into account parameter uncertainty. As a practical rule of thumb, we find that two years of high frequency data often suffice to obtain the same level of precision as twenty years of daily data, thereby making our approach particularly useful in finance applications where only short data samples are available or economically meaningful to use. Moreover, we find that compared to model inference without high-frequency data, our approach largely eliminates underestimation of risk during bad times or overestimation of risk during good times. We assess the attainable improvements in VaR forecast accuracy on simulated data and provide an empirical illustration on stock returns during the financial crisis of 2007-2008.

Keywords: Equity return models, parameter uncertainty, Bayesian estimation, MCMC, high-frequency data, jump-robust volatility measures, value at risk, forecasting

JEL classification: C11, C13, C14, C15, C22, C53, C80, G17

1 Introduction

Modeling equity returns is central to risk management, derivatives pricing, portfolio choice, and asset pricing in general. Continuous time jump-diffusion models succeeding those pioneered by Merton (1969) and Black and Scholes (1973) are now commonplace. Typically, the inherent time-varying and stochastic nature of continuous market activity is represented by a combination of persistent and non-persistent latent stochastic volatility factors. The pronounced asymmetric return-volatility relation in equities, known also as leverage or volatility feedback effects, is captured by correlated return and volatility innovations. Sudden price revisions due to news and other market surprises give rise to jumps in returns, while the often abrupt changes in the level of market activity and risk has justified the introduction of jumps in volatility. The latent nature of volatility in such rich models, however, poses serious challenges for reliable inference based solely on daily or monthly return series, even the longest existing ones. It is thus critical to develop estimation methods exploiting relevant additional information that could help reduce the severe parameter and volatility estimation uncertainty.

Two different approaches have emerged to improve estimation

efficiency in this regard. The first approach relies on the cross

section of option prices over time.2 However, as pointed out

by Eraker, Johannes, and Polson (2003), it is unclear whether the

inclusion of option price data leads to decrease or increase of

parameter uncertainty given that the risk premia embedded in option

prices introduce additional parameters, which are typically

difficult to estimate. The second and seemingly more viable

approach avoids such complications by exclusively relying on daily

realized volatility measures extracted from nowadays ubiquitous

high-frequency intraday return data.3![]() 4 Our paper contributes to this second

line of research by utilizing high-frequency realized volatility

measures within a standard Bayesian Markov Chain Monte Carlo (MCMC)

estimation framework of popular equity return models. In

particular, we take explicitly into account the resulting

substantial reduction in parameter uncertainty and are able to show

sizeable economic gains when forecasting risk.

4 Our paper contributes to this second

line of research by utilizing high-frequency realized volatility

measures within a standard Bayesian Markov Chain Monte Carlo (MCMC)

estimation framework of popular equity return models. In

particular, we take explicitly into account the resulting

substantial reduction in parameter uncertainty and are able to show

sizeable economic gains when forecasting risk.

The most closely related studies to our work such as Alizadeh, Brandt, and Diebold (2002), Barndorff-Nielsen and Shephard (2002), Bollerslev and Zhou (2002), Corradi and Distaso (2006), Todorov (2009) among others have used classical rather than Bayesian estimation methods and have focused on using high-frequency volatility measures for assessing the goodness of fit of alternative model specifications without explicitly analyzing the economic value of reducing parameter uncertainty. These studies have largely ruled out the simplest known single factor stochastic volatility models with Poisson jumps in returns in favor of more complex specifications including one or more extra features such as a second stochastic volatility factor, pronounced non-linearities, jumps both in returns and volatility (possibly even of infinite activity).5 But rather than reconciling or refining such findings, our main goal is to go a step beyond specification testing and clearly demonstrate the economic gains from harnessing the information content of high-frequency volatility measures regardless of the underlying model.

To this end, we exploit recent advances in jump robust volatility estimation from high-frequency data such as Andersen, Dobrev, and Schaumburg (2009), Barndorff-Nielsen, Shephard, and Winkel (2006), Podolskij and Vetter (2009) and references therein to formally introduce an asymptotically precise volatility measurement equation directly within the standard state-space representation of popular equity return models estimated at daily or lower frequency. Then we adopt a standard Bayesian MCMC estimation framework allowing us to exploit the strong information content of such volatility measurement equation across a wide range of models featuring stochastic volatility, leverage effects, and jumps in returns and volatility. In terms of efficiency, our approach considerably improves on Bayesian estimation methods based on an identical state-space representation at a daily or lower frequency but without a volatility measurement equation such as Eraker, Johannes, and Polson (2003) and Jacquier, Polson, and Rossi (2004), among others.6 In terms of generality, we overcome major limitations of the quasi-maximum likelihood estimation methods for state-space formulations with volatility measurement equation pursued by Barndorff-Nielsen and Shephard (2002) who consider non jump-robust realized volatility measures and Alizadeh, Brandt, and Diebold (2002) who consider non jump-robust and less efficient range-based volatility measures. In particular, our approach incorporates leverage effects and jumps, necessary for modeling equity returns, as well as possibly two (one persistent and one non-persistent) stochastic volatility factors. We also offer an attractive alternative to existing moment-based estimation approaches such as Bollerslev and Zhou (2002), Corradi and Distaso (2006) and Todorov (2009) in terms of more fully exploiting the information content of high frequency volatility measures in various model settings via their state-space formulations. In particular, unlike these studies, the Bayesian estimation approach we propose allows us to easily account for parameter uncertainty and demonstrate the economic gains from using high-frequency volatility measures for model estimation and risk forecasting across a range of popular equity return models. 7

Our main contributions can be summarized as follows. First, we demonstrate theoretically and empirically that the parameters controlling skewness and kurtosis in popular equity return models estimated at daily and monthly frequency can be obtained almost as precisely as if volatility is observable by incorporating the strong information content of realized volatility measures extracted from high-frequency data. In particular, we extend the empirical findings in Alizadeh, Brandt, and Diebold (2002) by showing that not only the parameters controlling volatility of volatility but also those controlling leverage effects can be estimated several times more precisely by exploiting high-frequency volatility measures. Second, we show that our highly efficient estimates lead in turn to substantial gains for forecasting various risk measures at horizons ranging from a few days to a few months ahead when taking also into account parameter uncertainty. In fact, our approach not only reduces the root mean square prediction error but also shrinks and almost eliminates the forecast bias, which inevitably arises from the pronounced nonlinearities in the involved transformation of parameter and volatility estimates. As a practical rule of thumb we find that two years of high frequency data often suffice to obtain the same level of precision as twenty years of daily data, thereby making our approach particularly useful in finance applications where only short data samples are available or economically meaningful to use. Third, and most important in risk management applications, our simulation results reveal that risk forecasts stemming from traditional model inference on daily data tend to be overly conservative in good times (e.g. overestimating risk by as much as 30%) but they are not conservative enough in bad times (e.g. underestimating risk by as much as 10%). By contrast, risk forecasts based on our approach to exploiting high-frequency data are considerably closer to the truth in both bad and good times. Thanks to incorporating the strong information content of high-frequency volatility measures, we are able to better curb risk taking exactly when needed the most, i.e. early on in times of crisis, while avoiding unnecessary overstatement of risk in normal times. Finally, our findings are robust both across different models and jump-robust volatility measures on high frequency data that we analyze. This allows us to remain largely agnostic about the best suited ones, while making a strong case for the potentially large economic value of our approach to using high-frequency volatility measures in model estimation and risk forecasting or other closely related finance applications such as derivatives pricing.

The rest of the paper is organized as follows. Section 2 introduces our volatility measurement equations in detail. Section 3 incorporates such equations within the state space formulation of popular equity return models and develops appropriate Bayesian estimation methods. Section 4 documents the resulting gains in estimation efficiency and risk forecasting accuracy. Section 5 provides an empirical comparison of Value-at-Risk forecasts on S&P 500 and Google returns during the financial crisis of 2007-2008. Section 6 concludes.

2 Volatility Measurement Equations

Jumps in returns have been recognized as an important feature for continuous-time modeling of equity returns within standard no-arbitrage semimartingale setting. Moreover, recent progress in non-parametric volatility measurement based on high-frequency intraday data has made it possible to separate ex-post the daily continuous part of the volatility process from the daily return variation induced by discontinuities or jumps. Originally pioneered by Barndorff-Nielsen and Shephard (2004), jump-robust volatility estimators with different asymptotic and finite sample properties have been proposed by Andersen, Dobrev, and Schaumburg (2009), Barndorff-Nielsen, Shephard, and Winkel (2006), Podolskij and Vetter (2009) among others. A common feature among these and other high-frequency volatility estimators is that as the intraday sampling frequency increases, the arising measurement error shrinks to zero and converges to a known mixed normal asymptotic distribution.8

For our purposes, suitable asymptotic results of this kind directly imply asymptotically precise measurement equations that formally capture the extent to which the continuous and jump parts of daily total variance become ex-post nearly observable when high frequency intraday data is available. Such separation of the continuous and jump components of volatility can be directly utilized in state space form. In this section, we formally introduce a general form of the jump-robust volatility measurement equations that play a key role in our approach to estimating models in state space form and allow us to tackle considerably more general settings than those considered by Alizadeh, Brandt, and Diebold (2002) and Barndorff-Nielsen and Shephard (2002) in the absence of jump-robust volatility measures nearly a decade ago.

2.1 Jump-robust estimators of diffusive volatility

On a filtered probability space

![]() we

consider an adapted process

we

consider an adapted process

![]() , providing the following

jump-diffusion represention of the evolution of the logarithmic

price of an asset in continuous time:

, providing the following

jump-diffusion represention of the evolution of the logarithmic

price of an asset in continuous time:

| (1) |

Here ![]() is a locally bounded and predictable

process,

is a locally bounded and predictable

process, ![]() is cadlag and bounded away from zero

almost surely, while

is cadlag and bounded away from zero

almost surely, while ![]() is a jump process so that

is a jump process so that

![]() , whenever different from zero,

represents the size of a jump at time

, whenever different from zero,

represents the size of a jump at time ![]() . Without loss

of generality, we restrict attention to finite activity

jumps.9

. Without loss

of generality, we restrict attention to finite activity

jumps.9

For a day of unit length with ![]() discrete

observations of the logarithmic price process

discrete

observations of the logarithmic price process

![]() on

on

![]() we denote the

intraday time intervals and corresponding returns as

we denote the

intraday time intervals and corresponding returns as

![]() and

and

![]() ,

,

![]() . In what follows, we consider

standard continuous record in-fill asymptotics where the time

intervals characterizing the intraday sampling scheme uniformly

shrink towards zero as the sampling frequency

. In what follows, we consider

standard continuous record in-fill asymptotics where the time

intervals characterizing the intraday sampling scheme uniformly

shrink towards zero as the sampling frequency ![]() increases.

increases.

In this setting, the daily quadratic variation (QV) of the

observed process consists of the sum of its continuous and jump

parts,

![]() , and

is estimated consistently by the well established realized

volatility (RV) measure:10

, and

is estimated consistently by the well established realized

volatility (RV) measure:10

|

(2) |

Our main object of interest, though, is the diffusive part of

the quadratic variation defined as the integrated variance (IV),

![]() . It can be

conveniently estimated by various multipower variation measures

developed by Barndorff-Nielsen and Shephard (2004)

and

Barndorff-Nielsen, Shephard, and Winkel (2006) or

more recent analogous measures based on nearest neighbor truncation

developed by Andersen, Dobrev, and Schaumburg (2009).11In

the case of finite activity jumps, the most efficient multipower

variation measure that allows for an asymptotic mixed normal limit

theory is the realized tripower variation (TV) based on the product

of triplets of adjacent absolute returns:12

. It can be

conveniently estimated by various multipower variation measures

developed by Barndorff-Nielsen and Shephard (2004)

and

Barndorff-Nielsen, Shephard, and Winkel (2006) or

more recent analogous measures based on nearest neighbor truncation

developed by Andersen, Dobrev, and Schaumburg (2009).11In

the case of finite activity jumps, the most efficient multipower

variation measure that allows for an asymptotic mixed normal limit

theory is the realized tripower variation (TV) based on the product

of triplets of adjacent absolute returns:12

| (3) |

The TV estimator is only marginally less efficient than the corresponding MedRV estimator based on (two-sided) nearest neighbor truncation, taking the median instead of the product of triplets of adjacent absolute returns:13

med med |

(4) |

Hence, in our empirical analysis we rely on both TV and MedRV, allowing us to conclude that our main results are not sensitive to the particular jump-robust volatility measures that we use to derive volatility measurement equations. By presenting these equations below in generic form, we are able to abstract from the chosen jump-robust estimators that we are going to utilize in the state space formulation of various models for the sake of reducing parameter and volatility estimation uncertainty.

2.2 Generic asymptotic results and volatility measurement equations

Let

![]() be some jump-robust volatility

estimator applicable in the considered setting such as TV and MedRV

defined above. Then a central limit theorem (CLT) of the following

generic form holds:

be some jump-robust volatility

estimator applicable in the considered setting such as TV and MedRV

defined above. Then a central limit theorem (CLT) of the following

generic form holds:

|

(5) |

where ν is a known asymptotic variance factor

depending on the particular estimator (e.g. 3.06 for TV and 2.96

for MedRV), while

![]() is the integrated

quarticity controlling the precision of all such estimators.

Moreover, since the convergence in (5) is

stable, it is possible to apply the delta method to derive feasible

asymptotic results based on any consistent jump-robust estimator

is the integrated

quarticity controlling the precision of all such estimators.

Moreover, since the convergence in (5) is

stable, it is possible to apply the delta method to derive feasible

asymptotic results based on any consistent jump-robust estimator

![]() of

of ![]() .14 In

particular,

.14 In

particular,

|

(6) |

and

|

(7) |

The log transformation in (7) results in better finite sample approximation than (6), as already noted byBarndorff-Nielsen and Shephard (2005) and Huang and Tauchen (2005). This is especially useful for our purposes as we will focus our subsequent analysis exactly on logarithmic SV models.

In what follows, we denote the feasible estimate of the

asymptotic variance of

![]() implied by (7) as

implied by (7) as

![]() to obtain the following logarithmic volatility measurement

equation that we are going to utilize in the state space

representation of various logarithmic SV models (with leverage

effects and jumps) to improve estimation efficiency:

to obtain the following logarithmic volatility measurement

equation that we are going to utilize in the state space

representation of various logarithmic SV models (with leverage

effects and jumps) to improve estimation efficiency:

|

(8) |

where

![]() is independent of

the underlying process and the measurement error vanishes as the

intraday sampling frequency M increases. More generally, to make

explicit distinction between different days, we rewrite this key

equation as:

is independent of

the underlying process and the measurement error vanishes as the

intraday sampling frequency M increases. More generally, to make

explicit distinction between different days, we rewrite this key

equation as:

|

(9) |

where

![]() as above, while

as above, while

![]() ,

,![]() , and

, and ![]() stand,

respectively, for the true daily diffusive variance, its available

jump-robust estimate at any sample frequency M,

and the corresponding asymptotic variance on a given day of unit

length represented by the interval

stand,

respectively, for the true daily diffusive variance, its available

jump-robust estimate at any sample frequency M,

and the corresponding asymptotic variance on a given day of unit

length represented by the interval ![]() .

.

We restrict attention to moderate sample frequencies such as two

or five minutes (e.g. ![]() or M=78 over a typical trading day of six and a half hours) in

order to avoid complications arising from various market

microstructure effects that cannot be safely ignored.15Alternatively, for jump-robust

volatility estimation at higher frequencies one can resort to

noise-reduction techniques such as pre-averaging, introduced in the

context of multipower variations by

Podolskij and Vetter (2009).16

or M=78 over a typical trading day of six and a half hours) in

order to avoid complications arising from various market

microstructure effects that cannot be safely ignored.15Alternatively, for jump-robust

volatility estimation at higher frequencies one can resort to

noise-reduction techniques such as pre-averaging, introduced in the

context of multipower variations by

Podolskij and Vetter (2009).16

Quite similarly to the way we obtained equation (9) above, it is possible to single out also the jump part of volatility by using available asymptotic results for the difference between non jump-robust and jump-robust high frequency volatility measures, such as those exploited for moment-based estimation by Todorov (2009). What is important to keep in mind is that any such volatility measurement equations based on high-frequency data similar to (9) do not require knowledge of the exact intraday dynamics of the logarithmic price process. This observation is crucial for our analysis as it allows us to largely abstract from modeling complications due to non-trivial intraday market microstructure effects. Thus, in the next section we focus entirely on the estimation of popular parametric models for equity returns at daily or lower frequencies by directly bringing our generic daily volatility measurement equations based on high-frequency intraday data to the state space form of each model.

3 Equity return models and estimation

With this extra machinery at hand, our goal is to demonstrate the ease and importance of utilizing high-frequency data for more efficient estimation of a broad range of commonly used equity return models. On one side of the spectrum we consider a basic continuous-time diffusion model similar to the setting of Jacquier, Polson, and Rossi (2004) with log-volatility specification, leverage effect and no jumps. On the other side of the spectrum we also study a two-factor logarithmic SV model with leverage effects and compound Poisson jumps in returns. It offers a less restrictive setting than the two-factor models studied by Alizadeh, Brandt, and Diebold (2002) and Bollerslev and Zhou (2002) thanks to incorporating both leverage effects and jumps. Moreover, like the single-factor model, it can still be successfully fitted using information on daily data only, which we use as a natural benchmark for gauging the attainable efficiency gains from our approach to incorporating high-frequency data. Formally, by relying on Bayesian estimation methods, we are able to fully exploit the information content of high frequency volatility measures within the standard state-space form of the models. Hence, we can obtain a clean measure of the incremental value of high-frequency data compared to estimation based on daily data only.

As shown in Das and Sundaram (1999) among others, models with stochastic volatility, leverage effects and jumps allow for skewness and excess kurtosis of returns and make it possible to closely match stylized facts of empirical asset return distributions that have been extensively studied under both physical and risk-neutral measures. For example,Andersen, Benzoni, and Lund (2002) find that adding jumps in returns to single-factor stochastic volatility models can help better fit stock return skewness and kurtosis and better reproduce volatility smiles in option prices. Eraker, Johannes, and Polson (2003) further extend single-factor jump-diffusion models by adding jumps not only in returns but also in volatility, which Broadie, Chernov, and Johannes (2007) show to be important for fitting volatility skewness and kurtosis. Studies of stochastic volatility models with similar findings under risk-neutral measure include Bakshi, Cao, and Chen (1997), Bates (2000), among others. A unified approach using both returns and options data, pursued by Chernov and Ghysels (2000), Eraker (2004) and Jones (2003), has also stressed the importance of properly fitting the conditional skewness and kurtosis of return distributions at various return horizons.

From such broader modeling point of view, it is not our goal to use high-frequency data for the sake of improved specification testing as done, for example, by Alizadeh, Brandt, and Diebold (2002), Bollerslev and Zhou (2002), Corradi and Distaso (2006) and Todorov (2009). Instead, we go a step beyond specification testing and attempt to clearly demonstrate first the efficiency and then the economic gains from harnessing the information content of high-frequency volatility measures regardless of the underlying model.

As our workhorse for analysis, in this section we develop appropriate Bayesian estimation methods that allow us to easily incorporate high frequency volatility measurement equations (such as those presented in the previous section) directly in state space form of any model. In this regard, our estimation approach is closest to Barndorff-Nielsen and Shephard (2002), although they do not allow for jumps and use quasi-maximum likelihood rather than Bayesian estimation methods. By following a Bayesian Markov Chain Monte Carlo (MCMC) approach to estimation, we are able to easily take parameter uncertainty into account and demonstrate that high-frequency information helps greatly increase precision in the parameter estimates governing skewness and kurtosis of returns, which in turn leads to considerably more precise and less biased Value-at-Risk forecasts for multi-day returns. Thus, our study contributes directly to the growing body of evidence that high frequency returns are an important source of information in asset pricing and risk management.

Without loss of generality, here we restrict our exposition to one and two-factor models on opposite sides of the spectrum in terms of complexity. We impose a logarithmic specification for the stochastic volatility components in our models directly in line with Andersen, Bollerslev, Christoffersen, and Diebold (2007) who point out that lognormal/normal mixture models show great appeal in financial risk management in view of the empirically observed near lognormality of realized volatility coupled with the near normality of daily returns standardized by realized volatility.

3.1. One-factor log-SV model with leverage effects

We consider a standard one-factor log-SV model that provides a high level of simplicity and transparency, while it is still rich enough to allow for both skewness and excess kurtosis of asset returns. Our contribution consists in extending the equations of the model in state space form with our extra volatility measurement equation derived in generic form in Section2.2, which is the only difference compared to the standard specification in Jacquier, Polson, and Rossi (2004). It is worth noting that Jones (2003) has studied a similar system of equations with extra measurement equation coming from option implied volatilities. In our model we use high-frequency volatility measures as extra information, which in contrast to implied volatilities allows to theoretically derive the variance of measurement noise and does not require estimation of risk-premia related parameters. In order to facilitate the exposition, we first present the part of our single-factor model identical with Jacquier, Polson, and Rossi (2004). After standard first order Euler discretization as in Kloeden and Platen (1992), or cast directly as a discrete-time model, the system of equations takes the following form:

| = |  |

(10) | |

| = | (11) |

where ![]() is a

sequence of discrete times,

is a

sequence of discrete times,

![]() are sequences of jointly independent i.i.d.

are sequences of jointly independent i.i.d. ![]() random variables,

random variables,

![]() denotes the logarithmic

asset price or index level at time

denotes the logarithmic

asset price or index level at time ![]() ,

,

![]() is the drift part of the

return process,

is the drift part of the

return process,

![]() defines the speed of mean

reversion17 of the log-volatility process

ht towards its mean

defines the speed of mean

reversion17 of the log-volatility process

ht towards its mean

![]() ,

,

![]() defines the volatility of

volatility parameter,

defines the volatility of

volatility parameter,

![]() defines the typically

negative correlation between returns and volatility increments

known as leverage effect, and finally

defines the typically

negative correlation between returns and volatility increments

known as leverage effect, and finally ![]() is

a discretization parameter. In this paper we consider dynamics at a

daily frequency and fix accordingly

is

a discretization parameter. In this paper we consider dynamics at a

daily frequency and fix accordingly ![]() .18

.18

We next consider a version of the model new to the literature, where the discretized system of equations(10)-(11) is augmented by our additional daily volatility measurement equation based on high-frequency data, given by (9) above for this model as:

|

(12) |

where

![]() is a

sequence of i.i.d.

is a

sequence of i.i.d. ![]() random variables

independent of

random variables

independent of ![]() for j = 1, 2, while

for j = 1, 2, while

![]() is

some integrated variance measure such as MedRV or TV with

measurement error determined by the sampling frequency

is

some integrated variance measure such as MedRV or TV with

measurement error determined by the sampling frequency ![]() and efficiency

and efficiency

![]() as described

in Section 2.2. Note that both

as described

in Section 2.2. Note that both

![]() and

and

![]() are treated

as daily observations and are directly calculated as functions of

the available high frequency intraday returns at any suitable

sample frequency

are treated

as daily observations and are directly calculated as functions of

the available high frequency intraday returns at any suitable

sample frequency ![]() . As part of the volatility

measurement equation (12)

we also introduce an optional auxiliary parameter

. As part of the volatility

measurement equation (12)

we also introduce an optional auxiliary parameter

![]() , which serves the purpose of

correcting for the discrepancy between the log integrated variance

measures

, which serves the purpose of

correcting for the discrepancy between the log integrated variance

measures

![]() calculated

using open-to-close intraday data and the corresponding

log-variances of close-to-close daily returns represented by

calculated

using open-to-close intraday data and the corresponding

log-variances of close-to-close daily returns represented by

![]() .19 Note, that such correction is not

required, though, if we use open-to-close data for the daily

returns, in which case we simply impose

.19 Note, that such correction is not

required, though, if we use open-to-close data for the daily

returns, in which case we simply impose

![]() . To complete the probabilistic

set-up of the one-factor model, we assume that all random variables

are constructed on a probability space

. To complete the probabilistic

set-up of the one-factor model, we assume that all random variables

are constructed on a probability space ![]() with a given

filtration

with a given

filtration

![]() and all

processes are adapted to the filtration.

and all

processes are adapted to the filtration.

We keep the daily dynamics given by (10) and (11

) in the center

of our analysis, while (12)

serves the sole purpose of incorporating the information content of

high-frequency data without incurring modeling complications due to

market microstructure effects and other features of intraday data

not relevant for modeling of daily returns, as discussed in Section 2.2.

Thus, the use of non-parametric high-frequency volatility measures

![]() designed to be robust to known irregularities of intraday data

gives us an additional degree of freedom to implicitly allow for

high-frequency returns to follow possibly different dynamics from

that of daily returns.

designed to be robust to known irregularities of intraday data

gives us an additional degree of freedom to implicitly allow for

high-frequency returns to follow possibly different dynamics from

that of daily returns.

In order to find the contribution of high frequency information, we consider the above two versions of the model in state space form: (i) the one with daily returns only; (ii) the one including both daily returns and a daily volatility measurement equation from high frequency intraday data. The former is given by the system of equations (10)-(11), while the latter consists of all equations from the "daily only" model augmented by our additional volatility measurement equation (12).

3.2 Two-factor log-SV model with leverage effects and jumps

Alizadeh, Brandt, and Diebold (2002) and Bollerslev and Zhou (2002) provide strong support in favor of two-factor models of foreign exchange rates by utilizing high frequency data as part of non-Bayesian estimation procedures for specifications without leverage effects. Their first factor mimics the long-memory component in volatility, while the second factor has considerably smaller degree of persistence. Bollerslev and Zhou (2002) further find that even in the presence of a second short-memory stochastic volatility factor, it is still important to include also a jump component in the model. Therefore, we consider a two factor log-SV model with compound Poisson jumps in returns. Moreover, we extend the specification by incorporating leverage effects, which allows us to model also the negative correlation between return and volatility innovations typical for equity returns.

Thus, our two-factor logarithmic stochastic volatility model with Poisson jumps in returns represents a very general setting in the current literature. It still allows, though, successful estimation with the use of only daily data, for the sake of comparison to our approach with an extra volatility measurement equation. Similarly to our one-factor specification above, the discretized version of our two-factor model is given by the following set of equations in state space form, where the probabilistic setup and notation are analogous to those of our one-factor model:

|

(13) | ||

| (14) | |||

| (15) | |||

|

(16) |

We assume without loss of generality that

![]() and denote the

persistent and non-persistent volatility factors as ht and ft respectively. Other

than that, the parameters κf and

and denote the

persistent and non-persistent volatility factors as ht and ft respectively. Other

than that, the parameters κf and

![]() governing the short-memory factor

governing the short-memory factor

![]() have similar domain and

interpretation as their counterparts

have similar domain and

interpretation as their counterparts

![]() and

and

![]() for the long-memory factor

for the long-memory factor

![]() . We further assume for

identification purposes

. We further assume for

identification purposes

![]() , since only the total

(unconditional) mean log-volatility is identified in the model.

Also by construction,

, since only the total

(unconditional) mean log-volatility is identified in the model.

Also by construction,

![]() and

and

![]() are

sequences of jointly independent i.i.d.

are

sequences of jointly independent i.i.d. ![]() random

variables. Thus, we allow for leverage effects in both factors,

which is more explicitly seen by defining the innovations specific

to

random

variables. Thus, we allow for leverage effects in both factors,

which is more explicitly seen by defining the innovations specific

to ![]() and

and ![]() as:

as:

|

(17) | ||

| (18) |

In particualar, the instantaneous covariance matrix between return and volatility innovations is given by:

|

where we impose the positive definite restriction

![]() .

.

Our compound Poisson jump specification with normally

distributed jump sizes draws onAndersen, Benzoni, and Lund (2002),

Eraker, Johannes, and Polson (2003), and Johannes and Polson (2002).

In particular, we assume a maximum of one jump per day. The jump

increments in the interval

![]() follow the law of

follow the law of

![]() , where the

jump times

, where the

jump times

![]() are i.i.d.

are i.i.d.

![]() and the jump sizes

and the jump sizes

![]() are i.i.d.

are i.i.d.

![]() . The parameters

. The parameters

![]() and

and

![]() denote respectively the jump

intensity, mean and standard deviation of jump sizes. Since at a

daily frequency the jump intensity parameter

denote respectively the jump

intensity, mean and standard deviation of jump sizes. Since at a

daily frequency the jump intensity parameter ![]() is close to zero, our assumption of maximum one jump

per day is not binding.

is close to zero, our assumption of maximum one jump

per day is not binding.

Most importantly, we extend the state-space form of the model

with our volatility measurement equation (16), which is a

direct counterpart to equation (12)

in the one-factor model and specializes equation (9) given in

general form in section 2.2. Here

the high frequency measure of log integrated variance

![]() is an

estimate of

is an

estimate of

![]() as the total diffusive variance

in the two-factor model. The extra parameter

as the total diffusive variance

in the two-factor model. The extra parameter

![]() serves the same purpose as in the

one-factor model. It provides standard correction for the

discrepancy between log integrated variance measures

serves the same purpose as in the

one-factor model. It provides standard correction for the

discrepancy between log integrated variance measures

![]() calculated using open-to-close intraday data and the log variance

of close-to-close daily returns modeled by

calculated using open-to-close intraday data and the log variance

of close-to-close daily returns modeled by

![]() . For modeling the log variance

of open-to-close daily returns we simply restrict

. For modeling the log variance

of open-to-close daily returns we simply restrict

![]() .

.

In order to find the contribution of high frequency information, similarly to our one-factor model, we consider two versions of the two factor model: (i) the one with only daily returns; (ii) the one including both daily returns and a daily volatility measurement equation from high frequency intraday data. The former is given by the system of equations (13)-(15), while the latter consists of all equations from the "daily" model augmented by our additional volatility measurement equation (16).

3.3. Estimation

3.3.1. Markov chain Monte Carlo methods

We first briefly describe the general principles of Markov chain

Monte Carlo (MCMC) methods, with more detailed exposition in

Chib and Greenberg (1996), Johannes and Polson (2002) and

Jones (1998). Let ![]() denote the vector of

observations,

denote the vector of

observations, ![]() be the vector of latent state

variables and

be the vector of latent state

variables and ![]() be the vector of model

parameters. In Bayesian inference we utilize the prior information

on the parameters to derive the joint posterior distribution for

both parameters and state variables. By the Bayes rule, we

have:

be the vector of model

parameters. In Bayesian inference we utilize the prior information

on the parameters to derive the joint posterior distribution for

both parameters and state variables. By the Bayes rule, we

have:

where

![]() is the likelihood

function of the model,

is the likelihood

function of the model,

![]() is the probability

distribution of state variables conditional on the parameters and

is the probability

distribution of state variables conditional on the parameters and

![]() is the prior probability

distribution on the parameters of the model. Ideally we would like

to know the analytical properties of the joint posterior

distribution of Xand

is the prior probability

distribution on the parameters of the model. Ideally we would like

to know the analytical properties of the joint posterior

distribution of Xand ![]() ,

however, this is hardly feasible. The highly multidimensional joint

posterior distribution is very often too complicated to work with

and analytically intractable and hence even direct simulation from

the joint posterior distribution is hard to perform.

,

however, this is hardly feasible. The highly multidimensional joint

posterior distribution is very often too complicated to work with

and analytically intractable and hence even direct simulation from

the joint posterior distribution is hard to perform.

In the sequel we base our exposition on Jones (2003). The

idea behind MCMC methods is to break the highly dimensional vectors

of latent variables ![]() and parameters

and parameters ![]() into smaller pieces. The Gibbs sampler developed in

Geman and Geman (1984) considers partitioning of

into smaller pieces. The Gibbs sampler developed in

Geman and Geman (1984) considers partitioning of ![]() and

and ![]() into respectively

into respectively ![]() and

and

![]() subvectors

subvectors

![]() and

and

![]() . Then

the Markov chain is constructed by first defining starting values

of the chain

. Then

the Markov chain is constructed by first defining starting values

of the chain ![]() and

and

![]() and then iteratively forming the

chain

and then iteratively forming the

chain

The draws of

![]() are performed for each

are performed for each

![]() and each

and each

![]() by drawing from the

following transition densities:

by drawing from the

following transition densities:

| (19) | |

| (20) |

where

![]() and

and

![]() It can be shown that under mild conditions the chain

It can be shown that under mild conditions the chain

![]() converges to its

invariant distribution

converges to its

invariant distribution

![]() that is by construction a

joint posterior distribution of the model under consideration. The

proof of the Gibbs sampler convergence to invariant distribution,

sufficient conditions and some applications can be found in

Chib and Greenberg (1996).

that is by construction a

joint posterior distribution of the model under consideration. The

proof of the Gibbs sampler convergence to invariant distribution,

sufficient conditions and some applications can be found in

Chib and Greenberg (1996).

The Gibbs sampler algorithm provides a tractable method to draw from multidimensional and complicated distributions only if one can draw from all complete conditional distributions in equations (19) and (20). However, even one-dimensional complete conditional distributions can be in practice difficult if not impossible to draw from. In this case we replace a particular Gibbs sampler step by the Metropolis-Hastings (MH) step in Metropolis, Rosenbluth and Rosenbluth (1953). Chib and Greenberg (1996) provide further details about the MH algorithm. The main building block of our estimation method is based on the Gibbs sampler algorithm with some blocks replaced by MH steps.

After discarding a "burn-in" period of the first N draws, the discrete approximation

![]() of the

joint posterior density

of the

joint posterior density

![]() allows one to compute

various statistics. For example, the sample mean of the posterior

distributions can be taken to obtain parameter estimates for our

models. Likewise, one can estimate statistics of particular

interest in applications such as moment and quantile forecasts for

multi-horizon returns as well as associated risk measures such as

Value-at-Risk (VaR) or any other function of the conditional

multi-horizon return density such as the price of a derivative

contract. Moreover, parameter uncertainty is taken automatically

into account by integrating over the entire joint posterior

distribution of parameters and state variables. This important

property of MCMC estimation methods is especially valuable for our

purposes, as it allows us to show how increasing the precision of

parameter and volatility state estimation (by including our

volatility measurement equations (12)

and (16) gets

translated into more accurate conditional return density forecasts

and moments/quantiles in particular.

allows one to compute

various statistics. For example, the sample mean of the posterior

distributions can be taken to obtain parameter estimates for our

models. Likewise, one can estimate statistics of particular

interest in applications such as moment and quantile forecasts for

multi-horizon returns as well as associated risk measures such as

Value-at-Risk (VaR) or any other function of the conditional

multi-horizon return density such as the price of a derivative

contract. Moreover, parameter uncertainty is taken automatically

into account by integrating over the entire joint posterior

distribution of parameters and state variables. This important

property of MCMC estimation methods is especially valuable for our

purposes, as it allows us to show how increasing the precision of

parameter and volatility state estimation (by including our

volatility measurement equations (12)

and (16) gets

translated into more accurate conditional return density forecasts

and moments/quantiles in particular.

3.3.2. Bayesian MCMC inference for models with high frequency volatility measurement equations

We limit our exposition to describing our MCMC estimation procedure for the two-factor stochastic volatility models from Section (3.2).20 We put special emphasis on how to estimate models including our high-frequency measurement equations by offering a straightforward extension of estimation methods based only on daily returns.

Following the notation from the previous section, we need to

specify the vector of observations ![]() , the vector

of latent state variables

, the vector

of latent state variables ![]() and the vector of

parameters

and the vector of

parameters ![]() along with their appropriate

subdivision in line with the construction of the Gibbs sampler

algorithm. In particular, we define the following vectors, where

"Daily" stays for estimation based only on daily returns

(equations (13)-(15)) and "HF"

stays for estimation incorporating also volatility measures based

on high-frequency intraday data (equations (13)-(16)):

along with their appropriate

subdivision in line with the construction of the Gibbs sampler

algorithm. In particular, we define the following vectors, where

"Daily" stays for estimation based only on daily returns

(equations (13)-(15)) and "HF"

stays for estimation incorporating also volatility measures based

on high-frequency intraday data (equations (13)-(16)):

The partitions of ![]() and

and ![]() are given by

are given by

![]() ,

,

![]() ,

,

![]() ,

,

![]() ,

,

![]() ,

,

![]() ,

,

![]() ,

,

![]() ,

,

![]() and

and

![]() ,

,

![]() ,

,

![]() ,

,

![]() where

where

![]() ,

,

![]() . Thus, we treat each element of

the state vector

. Thus, we treat each element of

the state vector ![]() as a single block. For the vector

of parameters

as a single block. For the vector

of parameters ![]() all elements are treated as a

single block with the exception of

all elements are treated as a

single block with the exception of

![]() and

and

![]() . These parameters are

drawn jointly as in Jacquier, Polson, and Rossi (2004). Finally, the extra parameter

. These parameters are

drawn jointly as in Jacquier, Polson, and Rossi (2004). Finally, the extra parameter

![]() in equation

(16)

appears only in the "HF" model including high frequency

information and is estimated along with the rest of the parameters

or it can be exogenously specified following standard approaches in

the realized volatility literature to obtain variances for the

whole day such as Hansen and Lunde (2005). It is set to

zero when modeling open-to-close daily returns.

in equation

(16)

appears only in the "HF" model including high frequency

information and is estimated along with the rest of the parameters

or it can be exogenously specified following standard approaches in

the realized volatility literature to obtain variances for the

whole day such as Hansen and Lunde (2005). It is set to

zero when modeling open-to-close daily returns.

Having defined above all blocks for the latent state variables

X and parameters ![]() , we

apply the MCMC algorithm based on the Gibbs sampler presented in

Section 3.3.1. Since draws of

all parameters and jump related latent variables are standard in

the literature, we directly refer to Szerszen (2009) for the

imposed prior distributions on the model parameters

, we

apply the MCMC algorithm based on the Gibbs sampler presented in

Section 3.3.1. Since draws of

all parameters and jump related latent variables are standard in

the literature, we directly refer to Szerszen (2009) for the

imposed prior distributions on the model parameters ![]() and all other details.

and all other details.

Here we focus on addressing the fundamental difference between

estimation of the standard "Daily" and our "HF" version of the

model, which differ just by the additional volatility measurement

equation (16) based on

high-frequency data. The information provided by this extra

equation affects only the complete conditional posteriors of the

volatility states ![]() and

and ![]() . In particular, the MCMC update for

. In particular, the MCMC update for ![]() is given by

is given by

for t=1, 2, ..., T, where the second and fourth kernels on the

right hand side are omitted for t=1, while the first, third and

last kernels are omitted for t = T. The MCMC update for the second

factor ![]() is performed analogously.

is performed analogously.

Thus, an inspection of the above update expression reveals that

the only kernel affected by the high frequency information with

![]() is the last one

is the last one

![]() for the

for the ![]() factor and, similarly,

factor and, similarly,

![]() for the

for the ![]() factor. The rest of the kernels are

exactly those coming from inference based on daily returns only,

i.e. with

factor. The rest of the kernels are

exactly those coming from inference based on daily returns only,

i.e. with

![]() , which appear also with

, which appear also with

![]() . This is of key importance for

understanding how the extra information provided by high-frequency

data improves estimation efficiency in our "HF" versus "Daily"

approaches. The extra kernels

. This is of key importance for

understanding how the extra information provided by high-frequency

data improves estimation efficiency in our "HF" versus "Daily"

approaches. The extra kernels

![]() and

and

![]() in the MCMC updates of

in the MCMC updates of ![]() and

and ![]() ,

respectively, are very spiked around the mode for dates with low

values of

,

respectively, are very spiked around the mode for dates with low

values of

![]() in the

volatility measurement equation (16) and, hence,

they are very informative about the latent volatility states. The

attainable precision improvements increase with the sample

frequency

in the

volatility measurement equation (16) and, hence,

they are very informative about the latent volatility states. The

attainable precision improvements increase with the sample

frequency ![]() and depend also on

and depend also on

![]() , being a function

of the underlying volatility paths and the chosen high-frequency

integrated variance and quarticity measures as detailed in Section

2.2.

By contrast, the use of only daily data is equivalent to

artificially setting

, being a function

of the underlying volatility paths and the chosen high-frequency

integrated variance and quarticity measures as detailed in Section

2.2.

By contrast, the use of only daily data is equivalent to

artificially setting

![]() to

infinity in order to suppress the strong information content of

high frequency data provided by our volatility measurement

equation. In what follows, we analyze the gains in estimation

efficiency and risk forecasting accuracy from our "HF" versus

traditional "Daily" estimation as a natural benchmark for

comparison.

to

infinity in order to suppress the strong information content of

high frequency data provided by our volatility measurement

equation. In what follows, we analyze the gains in estimation

efficiency and risk forecasting accuracy from our "HF" versus

traditional "Daily" estimation as a natural benchmark for

comparison.

4 Estimation efficiency and risk forecasting accuracy

The ability to estimate parameters and volatility states more efficiently directly translates into more accurate risk forecasts. Moreover, the highly non-linear nature of the underlying transformation from noisy parameter and volatility estimates to risk forecasts implies reduction not only in the variance but also in the bias of the prediction errors. Our analysis in this section is designed to study the interplay between longer sample size and higher intraday frequency as an additional source of information introduced by our volatility measurement equation for the purpose of reducing estimation uncertainty. We document that even for the longest sample lengths encountered in practice there is a substantial efficiency gain from incorporating the extra information provided by high-frequency volatility measures. Moreover, for key model parameters controlling skewness and kurtosis we find that two or five years of high frequency data would suffice to obtain the same level of precision as twenty years of daily data. This suggests that our approach can be particularly useful in finance applications where only short data samples are available or economically meaningful to use.

It is possible to derive analytical results along these lines in certain more restrictive settings. An instructive example for a canonical log-SV model is given in the appendix. Monte Carlo analysis is the only viable option, though, for models that are not analytically tractable. Hence, we take a Monte Carlo approach to study estimation efficiency and the impact of parameter uncertainty on risk forecasting accuracy. We conduct considerably more thorough and extensive simulations than usual in order to properly document the substantial efficiency gains and improved precision of risk forecasts at horizons of up to a few months ahead regardless of the chosen model when high frequency information is included in the model. Perhaps the most important of our findings is that there is considerable asymmetry between bad and good times when it comes to the attainable improvements in risk forecasting accuracy: in good times we are able to largely eliminate overstatement of risk, while in bad times our approach helps avoid understatement of risk. From a practical point of view, this implies imposing an appropriate larger risk cushion exactly when needed the most, e.g. early on in times of crisis (rather than with a delay), while at the same time avoiding excessive risk cushion requirements in normal times. In this sense, our main purpose in what follows is to document both the efficiency gains for model estimation and forecasting and the implied potentially large economic value of our approach to incorporating the information content of high-frequency volatility measures for model estimation and risk forecasting.

4.1. Monte Carlo setup

In order to set-up the stage for Monte Carlo analysis we first

describe how to draw sample paths consistent with the data

generating process implied by our model specifications. Daily

dynamics of both returns and volatility are based on equations

(10)-(11) and (13)-(15)

respectively for the one-factor and two-factor log-SV models that

we consider. The intraday dynamics is based on a Brownian bridge

connecting consecutive daily sample points and producing valid

integrated variance measures

![]() and

corresponding scaled integrated quarticity measures

and

corresponding scaled integrated quarticity measures

![]() that govern our additional volatility measurement equations in

(12) and (16) as

described in Section 2.2. In

this way, we allow for potentially richer intraday dynamics than

the one at the daily frequency, possibly including also realistic

intraday market-microstructure effects that many novel

high-frequency volatility measures are designed to be robust to

when sampled at two to five minute frequency.21

that govern our additional volatility measurement equations in

(12) and (16) as

described in Section 2.2. In

this way, we allow for potentially richer intraday dynamics than

the one at the daily frequency, possibly including also realistic

intraday market-microstructure effects that many novel

high-frequency volatility measures are designed to be robust to

when sampled at two to five minute frequency.21

We draw 1,000 sample paths for each of the considered one- and two-factor log-SV models. For each sample path we estimate the underlying model parameters using different information sets: (i) daily data only; (ii) daily data with additional high frequency volatility measurements based on 5-minute or 2-minute intraday returns; (iii) the "infeasible" case of perfectly observed volatility.22 In order to study the interplay between additional information coming from more high frequency data and longer sample size in terms of number of days, we consider three sample windows of 2, 5 and 20 years. This gives a total of twelve one-factor and twelve two-factor specifications for the information sets used for model estimation. We estimate all specifications using the Bayesian MCMC methods described in Section 3 with 250,000 draws, where the first 50,000 draws are discarded as the burn-in sample. For the purposes of forecasting conditional return moments and quantiles, based on the obtained 200,000 draws of the posterior distribution of parameters and volatility states, we approximate multi-period conditional density forecasts by a cloud of 25,000,000 points. We then compare moments and quantiles of the obtained conditional density forecasts for the two different estimation procedures that we consider, depending on whether a daily volatility measurement equation based on high-frequency data is used or not.

4.2. Efficiency gains in parameter and volatility estimation

In Tables 1 and 2 we report parameter estimates, bias and root mean squared error (RMSE) of volatility related parameters governing equations (11) and (14)-(15) for our one-factor and two-factor specifications respectively. The true parameter values in each table represent our estimates on S&P 500 daily futures returns for the period October 2, 1985 - February 26, 2009.

For the one-factor model (Table 1) we attain up to few times

better precision when using high frequency data compared to only

daily data for estimating the parameters governing skewness and

kurtosis. This translates into RMSE reduction of as much as 70%. In

particular, we find that the information content of high-frequency

volatility measures improves the most the estimation efficiency of

the volatility of volatility parameter ![]() and

the leverage effect parameter

and

the leverage effect parameter ![]() in the

model.23 Moreover, the gains are consistent

across different sample lengths, even for the longest ones

typically encountered in practice such as 20 years, when daily

estimation is more likely to produce satisfactory results. As a

practical rule of thumb we find that two years of high frequency

data often suffice to obtain the same level of precision for these

parameters as twenty years of daily data. At the same time, a

comparison between the attainable improvement by switching from

daily to 5-minute estimation and any further increase in the

intraday sample frequency from 5 to 2 minutes and beyond (up to the

infeasible case of perfectly known volatility) reveals a rapid

decrease in the additional efficiency gains that can be obtained.

We also observe a substantial RMSE reduction for the parameter

governing persistence of volatility

in the

model.23 Moreover, the gains are consistent

across different sample lengths, even for the longest ones

typically encountered in practice such as 20 years, when daily

estimation is more likely to produce satisfactory results. As a

practical rule of thumb we find that two years of high frequency

data often suffice to obtain the same level of precision for these

parameters as twenty years of daily data. At the same time, a

comparison between the attainable improvement by switching from

daily to 5-minute estimation and any further increase in the

intraday sample frequency from 5 to 2 minutes and beyond (up to the

infeasible case of perfectly known volatility) reveals a rapid

decrease in the additional efficiency gains that can be obtained.

We also observe a substantial RMSE reduction for the parameter

governing persistence of volatility ![]() for

the shortest sample sizes, while still dominating the estimation

efficiency with only daily data across all sample sizes.

for

the shortest sample sizes, while still dominating the estimation

efficiency with only daily data across all sample sizes.

For the richer two-factor log-SV model (Table 2) these

substantial efficiency gains from incorporating high-frequency

volatility measures naturally get even larger. Moreover, a somewhat

larger part of the gains is due to bias reduction. It is important

to note that here skewness and kurtosis are driven not only by a

persistent volatility factor but also by a second non-persistent

factor. For the non-persistent factor we find that the gains from

incorporating high frequency information are more pronounced than

those from increasing the yearly sample length. We do not find such

evidence for the persistent factor, where both sources of

information play an important role in parameter estimation. This

implies bigger efficiency gains from incorporating high frequency

information for the parameters ![]() and

and

![]() governing skewness and kurtosis

arising from the non-persistent factor

governing skewness and kurtosis

arising from the non-persistent factor ![]() . The

reduction of parameter uncertainty for the persistent factor

. The

reduction of parameter uncertainty for the persistent factor

![]() is somewhat smaller but still very

visible.

is somewhat smaller but still very

visible.

The quality of risk forecasts depends not only on the degree of

parameter uncertainty but also on the degree of volatility

estimation uncertainty. In particular, it is important to assess

the impact of incorporating additional high frequency information

on the accuracy of estimation of terminal volatility states as they

play important role in forecasting risk. In Table 3 we report mean

estimates, bias and RMSE for the terminal volatility states

![]() and

and ![]() of the

two-factor log-SV model. Thus, we conclude that our volatility

measurement equation helps in estimating better not only model

parameters but also latent volatility states. Considerable

efficiency gains are obtained mainly for the persistent volatility

factor, while for the non-persistent factor we still observe slight

improvements. Similarly to parameter estimates, our findings for

volatility states are consistent across all considered sample

sizes. Moreover, the biggest efficiency gains take place when

moving from estimation based only on daily data to estimation

incorporating our volatility measurement equation based on 5-minute

returns. Further increase of the intraday sample frequency from

5-minutes to 2-minutes leads to additional efficiency gains of much

smaller magnitude. Overall, for the estimation of volatility states

adding high frequency information has somewhat bigger importance

than increasing the yearly sample length. This plays a major role

especially for short-term risk forecasting.

of the

two-factor log-SV model. Thus, we conclude that our volatility

measurement equation helps in estimating better not only model

parameters but also latent volatility states. Considerable

efficiency gains are obtained mainly for the persistent volatility

factor, while for the non-persistent factor we still observe slight

improvements. Similarly to parameter estimates, our findings for

volatility states are consistent across all considered sample

sizes. Moreover, the biggest efficiency gains take place when

moving from estimation based only on daily data to estimation

incorporating our volatility measurement equation based on 5-minute

returns. Further increase of the intraday sample frequency from

5-minutes to 2-minutes leads to additional efficiency gains of much

smaller magnitude. Overall, for the estimation of volatility states

adding high frequency information has somewhat bigger importance

than increasing the yearly sample length. This plays a major role

especially for short-term risk forecasting.

4.3. Precision improvements in risk forecasting accuracy

The documented substantial decrease in parameter and volatility estimation uncertainty implies non-trivial improvements in the accuracy of forecasts of conditional return moments and quantiles. We compare forecasts resulting from inference based on daily data to those utilizing 5-minute high frequency volatility measures. We restrict attention to the 5-minute frequency in accordance with our finding that it offers essentially the bulk of the attainable improvements based on our volatility measurement equation. We perform our analysis incorporating parameter and volatility estimation uncertainty for all three considered sample lengths of 2, 5 and 20 years.

In Tables 4 and 5 we report forecasts of conditional return moments respectively for one-factor and two-factor models. In Tables 6 and 7 we also report forecasts of conditional return quantiles. The considered forecast horizons are 1, 5, 10 and 20 days ahead and are presented in separate panels in each table. These forecast horizons are of primary interest in many finance applications.

Our main finding is that our more efficient parameter and state estimates incorporating the strong information content of high-frequency volatility measures translate into equally better conditional return density forecasts not only in terms of RMSE but also in terms of bias. The bias reduction is due to the pronounced non-linearities in the underlying transformation of parameters and state variables. The main message from our analysis summarized in Tables 4-7 is that for any model, any estimation sample length, and across all forecast horizons of interest, the forecasts incorporating the extra information from our volatility measurement equation clearly dominate those based only on daily data. Moreover, these results strengthen our rule of thumb that model specifications estimated with two years of high frequency data perform at least as good as the same model specifications estimated with twenty years of daily data, which in turn are considerably outperformed if estimated on twenty years of high-frequency data.

4.4. Forecast error reductions in good versus bad times

From risk management perspective it is important to know how the improvements in risk forecasting accuracy vary across good and bad times. To this end, in Table 8 we report relative errors of forecasts of the 0.01 and 0.05 conditional return quantiles at horizons of one (panel A), five (panel B), ten (panel C) and twenty (panel D) days ahead. The reported relative errors are calculated across 1,000 Monte Carlo replications as the mean of the percentage difference between a forecast based on parameter and state estimates and the forecast based on the corresponding true values. The results are sorted by the rank order of the true quantile forecasts from low (representing bad times) to high (representing good times), as indicated in the first column. In our model this is equivalent to sorting by terminal volatility state from high (representing bad times) to low (representing good times). Each three rows reported for ranks 1 (low) to 5 (high) of the true quantile forecasts contain results for three different sample lengths T equal to 2 years, 5 years and 20 years (as given in the second column), taking parameter and volatility estimation uncertainty into account. For each quantile and forecast horizon we report results for the two alternative Bayesian estimation procedures in adjacent column pairs: either with (right column denoted "HF 5-min") or without (left column denoted "Daily only") augmenting the underlying state-space formulation with our daily volatility measurement equation based on high frequency intraday data.

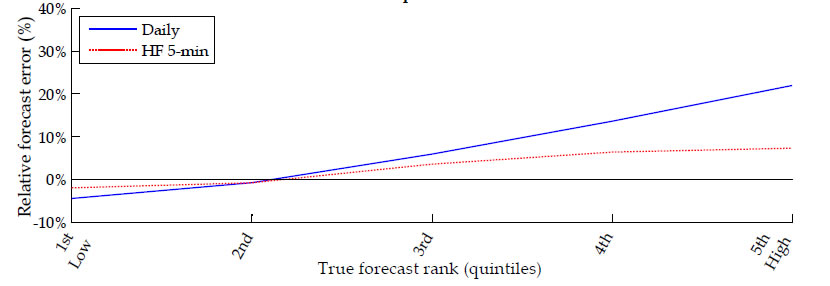

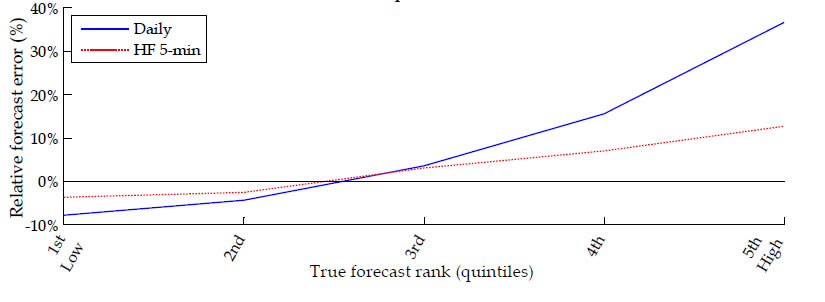

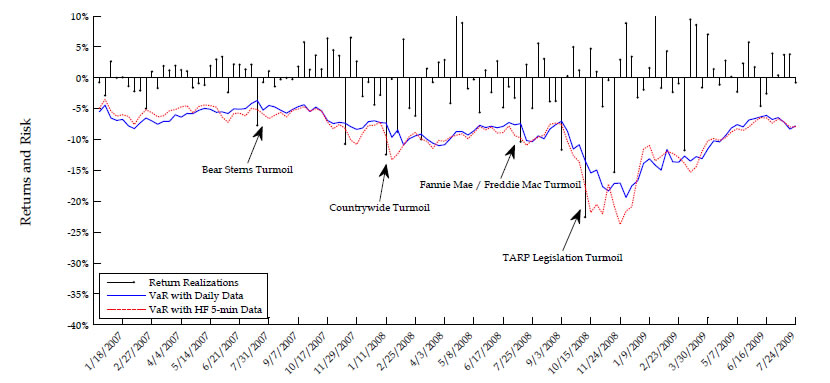

As a graphical summary of the results reported in Table 8, Figure 1 plots the one-percent VaR (top graph) and five-percent VaR (bottom graph) relative forecast errors at a five-day horizon as a function of the rank order of the underlying true forecasts from low (representing bad times) to high (representing good times). The resulting VaR forecast errors without utilizing our high-frequency volatility measures are plotted as a solid line (denoted "Daily"), while those incorporating the information content of intraday data for the latent daily volatility are plotted as a dashed line (denoted "HF 5-min"). The reported relative errors of conditional return quantile forecasts can be interpreted also as the percentage overestimation or understimation of the implied capital charge for market risk based on one-percent (quantile 0.01) and five-percent (quantile 0.05) VaR.

Both Table 8 and Figure 1 reveal that risk forecasts stemming from traditional model inference on daily data tend to be overly conservative in good times (e.g. overestimating risk by as much as 30%) but they are not conservative enough in bad times (e.g. underestimating risk by as much as 10%). By contrast, risk forecasts based on our approach to exploiting high-frequency data are considerably closer to the truth in both bad and good times.

Leaving the reported magnitudes aside, this result is very intuitive as the use of volatility measures based on high frequency data allows for considerably faster and more precise incorporation of major changes in the current volatility level compared to daily data alone. For example, in bad times when volatility goes up it should take a longer sequence of daily returns alone than in conjunction with high-frequency volatility measures to deliver volatility state estimates that are not downward biased. Similarly, in good times when volatility goes down it should take longer for daily data alone than in conjunction with high-frequency volatility measures to produce volatility state estimates that are not upward biased. Thus, the observed differences between the risk forecast errors in bad versus good times (Table 8 and Figure 1) are completely in line with the asymmetric increase in volatility state uncertainty, coupled also with higher parameter uncertainty (see Section 4.2 above), characterizing traditional daily estimation in comparison to the proposed approach utilizing also high-frequency data. In sum, thanks to incorporating the strong information content of high-frequency volatility measures, we are able to better curb risk taking exactly when needed the most, i.e. early on in times of crisis, while avoiding unnecessary overstatement of risk in normal times.

5 Empirical Illustration

Conditional return quantile forecasts play important role in risk management as they represent value-at-risk (VaR) forecasts. A key testable implication from our analysis in the previous section is that during bad times, e.g. early on in times of crisis, VaR forecast time-series based on our approach to exploiting high-frequency data will tend to "cross from above" the VaR forecast time-series stemming from traditional model inference on daily data. This is because, as explained above, the daily-based VaR forecasts are downward biased in bad times (when risk is elevated) and upward biased in good times (when risk is minimal), while our HF-based VaR forecasts are considerably closer to the truth in both bad and good times.

In order to test the empirical validity of this important risk management implication, we study the dynamics of five-day ahead VaR forecasts for S&P 500 and Google returns throughout the financial crisis of 2007-2008. Our goal is to illustrate the potentially large economic value from the proposed approach to incorporating the information content of high-frequency volatility measures. It is beyond the scope of this paper, though, to run a horse race between many viable alternative VaR forecasting techniques. We limit ourselves strictly to evaluating the empirical validity of our main testable implication with regard to HF-based versus daily-based VaR forecasts in the context of popular equity return models such as the fairly general two-factor log-SV model with jumps analyzed in the previous sections.

5.1. Data and estimation