FEDS Notes

October 06, 2021

The International Role of the U.S. Dollar

Carol Bertaut, Bastian von Beschwitz, Stephanie Curcuru1

An updated version of this note is available here.

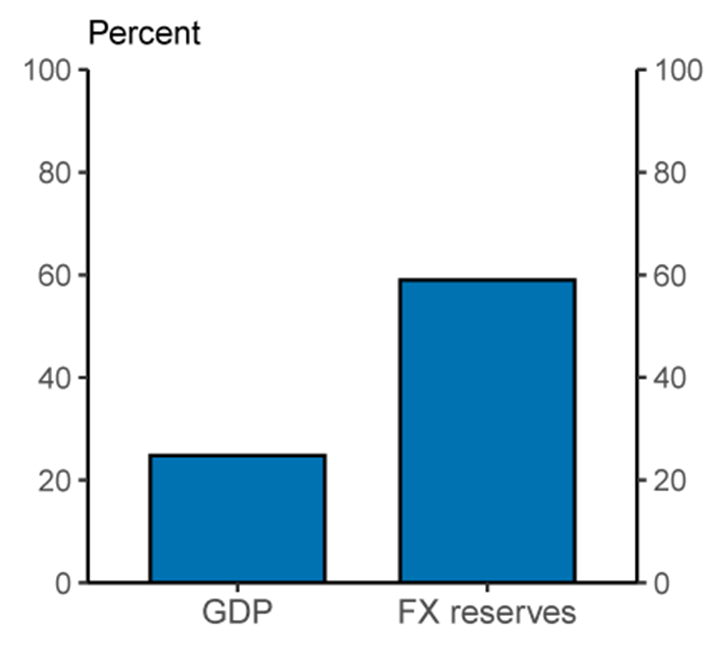

For most of the last century, the preeminent role of the U.S. dollar in the global economy has been supported by the size and strength of the U.S. economy, its stability and openness to trade and capital flows, and strong property rights and the rule of law. As a result, the depth and liquidity of U.S. financial markets is unmatched, and there is a large supply of extremely safe dollar-denominated assets. This note reviews the use of the dollar in international reserves, as a currency anchor, and in transactions.2 By most measures the dollar is the dominant currency and plays an outsized international role relative to the U.S. share of global GDP (see Figure 1). That said, this dominance should not be taken for granted and the note ends with a discussion of possible challenges to the dollar's status.

Note: U.S. share of 2020 nominal world GDP compared to the dollar's share of globally disclosed foreign exchange reserves in 2020-Q4. At current exchange rates.

Source: IMF COFER; IMF World Economic Outlook database.

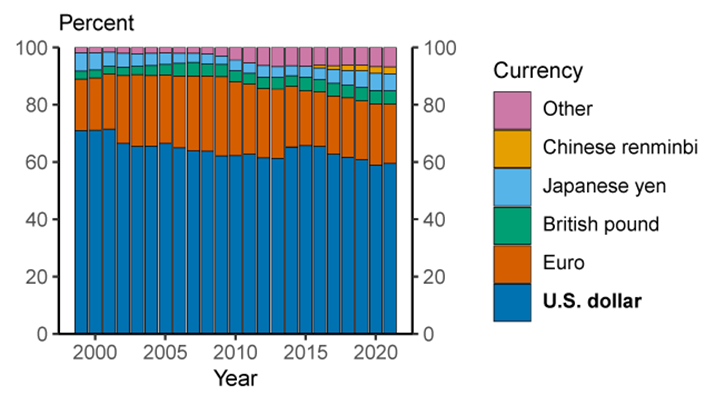

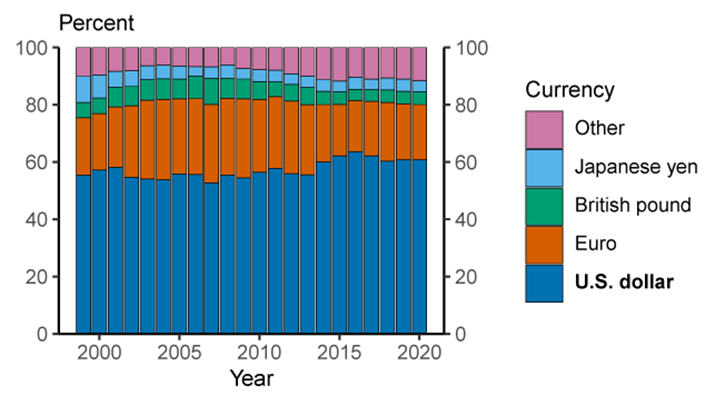

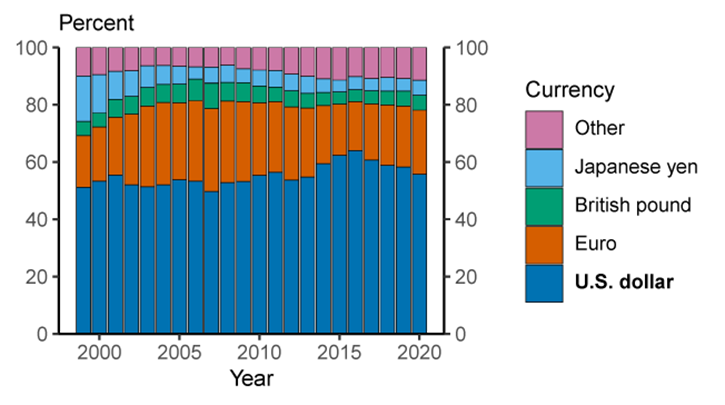

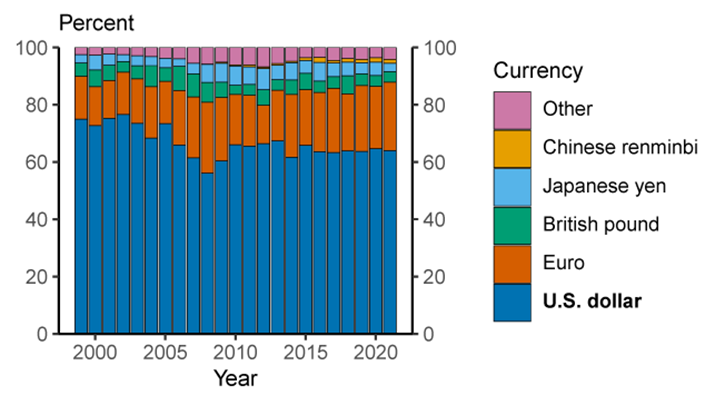

There is widespread confidence in the U.S. dollar as a store of value

A key function of a currency is as a store of value which can be saved and retrieved in the future without a significant loss of purchasing power. One measure of confidence in a currency as a store of value is its usage in official foreign exchange reserves. As shown in Figure 2, the dollar comprised 60 percent of globally disclosed official foreign reserves in 2021. This share has declined from 71 percent of reserves in 2000, but still far surpassed all other currencies including the euro (21 percent), Japanese yen (6 percent), British pound (5 percent), and the Chinese renminbi (2 percent). Moreover, the decline in the U.S. dollar share has been taken up by a wide range of other currencies, rather than by a single other currency. Thus, while countries have diversified their reserve holdings somewhat over the past two decades, the dollar remains by far the dominant reserve currency.

Note: Share of globally disclosed foreign exchange reserves. At current exchange rates. Data are annual and extend from 1999 through 2021. 2021 is 2021-Q1. Legend entries appear in graph order from top to bottom. Chinese renmimbi is 0 until 2015-Q2.

Source: IMF COFER.

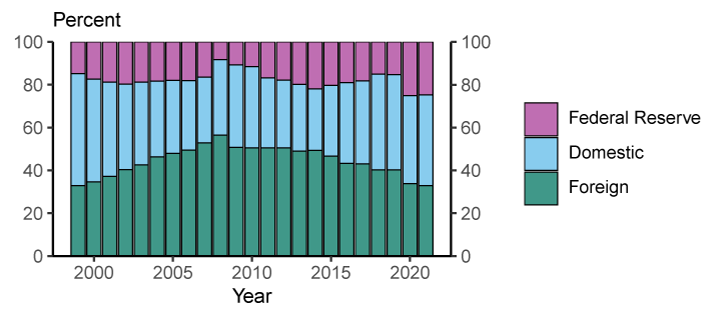

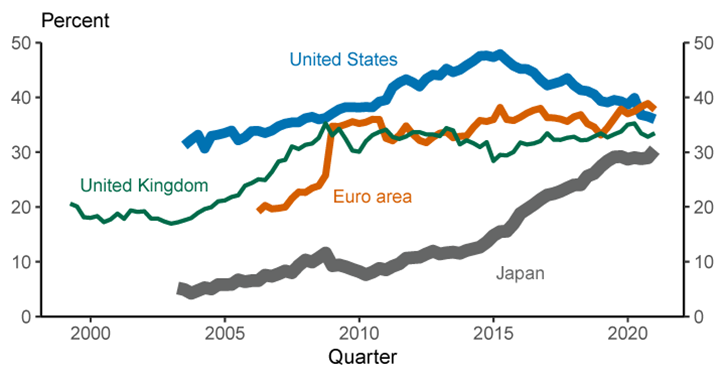

The bulk of these official dollar reserves are held in the form of U.S. Treasury securities, which are in high demand by both official and private foreign investors. As of the end of the first quarter of 2021, $7.0 trillion or 33 percent of marketable Treasury securities outstanding were held by foreign investors, both official and private (see Figure 3a), while 42 percent were held by private domestic investors, and 25 percent by the Federal Reserve System. Although the share of Treasuries held by foreign investors has declined from almost 50 percent in 2015, the current foreign share of Treasury holdings is comparable to the share of euro-area government debt held by investors outside of the euro area (shown in Figure 3b) and higher than the foreign-held shares of British or Japanese government debt.

3a. Holdings of marketable U.S. Treasuries

3b. Share of general government debt securities held by foreign investors

Note: Figure 3a legend entries appear in graph order from top to bottom. Figure 3b excludes domestic central bank holdings. Intra-euro area holdings of euro area debt securities are considered domestic holdings. General government debt securities includes local, state, and national debt securities. Figure 3a. data are annual and extend from 1999 through 2021. 2021 is 2021-Q1. Figure 3b. Data are quarterly and extend from 1999-Q1 through 2020-Q4.

Source: Financial Accounts of the United States, Table L.210. BIS debt securities statistics; World Bank/IMF Quarterly External Debt Statistics (QEDS), accessed through Haver Analytics; Bank of England; Bank of Japan; European Central Bank; Federal Reserve Board; Board staff calculations.

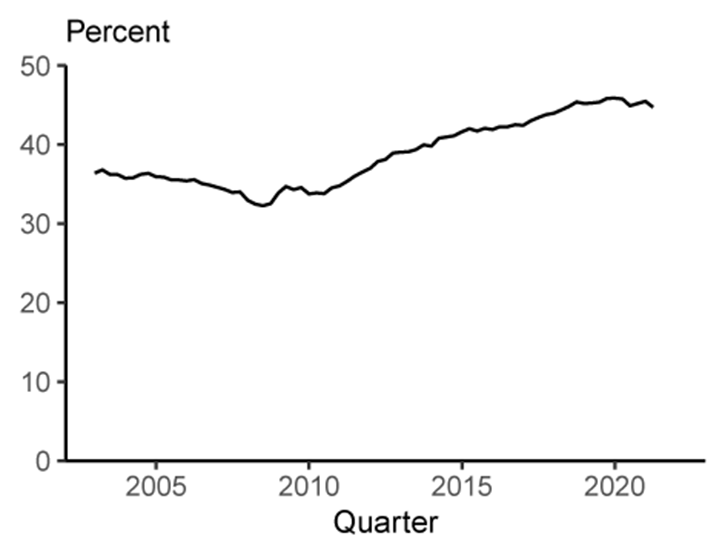

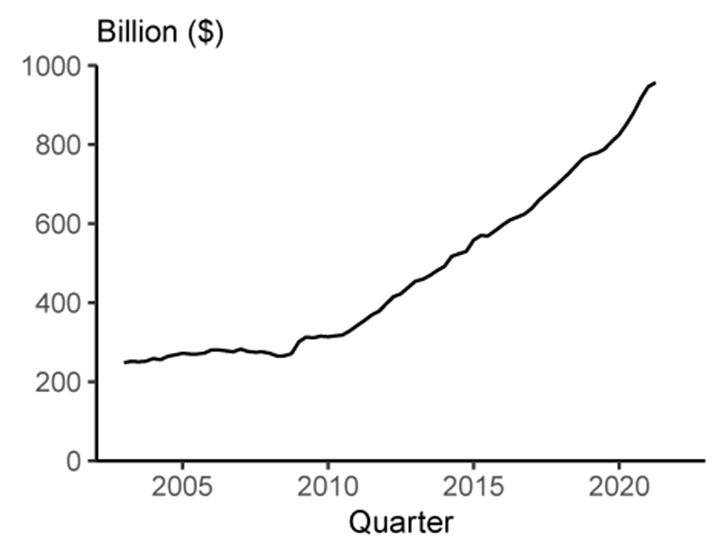

Foreign investors also hold substantial amounts of paper banknotes. As shown in Figure 4, the value of U.S. dollar banknotes held abroad has increased over the past two decades, both on an absolute basis and as a fraction of banknotes outstanding. Federal Reserve Board staff estimate that over $950 billion in U.S. dollar banknotes were held by foreigners at the end of the first quarter of 2021, roughly half of total U.S. dollar banknotes outstanding.

4a. Share of U.S. dollar banknotes

4b. Amount of U.S. dollar banknotes

Note: The exact amount of U.S. dollar banknotes held by foreigners is not known. This is most likely a conservative estimate. See Judson (2017). Data are quarterly and extend from 2002-Q4 through 2021-Q1.

Source: Financial Accounts of the United States, Table L.204; Factors Affecting Reserve Balances (H.4.1), Table 1; Board staff calculations.

Additionally, many foreign countries leverage the effectiveness of the U.S. dollar as a store of value by limiting the movements of their currencies with respect to the U.S. dollar – in other words, using it as an anchor currency. As Ilzetzki, Reinhart, and Rogoff (2020) highlight, the dollar's usage as an anchor currency has increased over the past two decades. They estimate that 50 percent of world GDP in 2015 was produced in countries whose currency is anchored to the U.S. dollar (not counting the United States itself).3 In contrast, the share of world GDP anchored to the euro was only 5 percent (not counting the euro area itself). Moreover, since the end of the Ilzetzki et al. sample in 2015, this anchoring has changed little. One exception might be the re-anchoring of the the Chinese renminbi from the U.S. dollar to a basket of currencies. However, the U.S. dollar and currencies anchored to the U.S. dollar comprise over 50 percent of this basket. So in practice, the Chinese renminbi remained effectively anchored to the U.S. dollar according to the Ilzetzki et al. definition, because in 90 percent of months between January 2016 and April 2021 the renminbi moved less than 2 percent against the U.S. dollar.4

The U.S. dollar is dominant in international transactions and financial markets

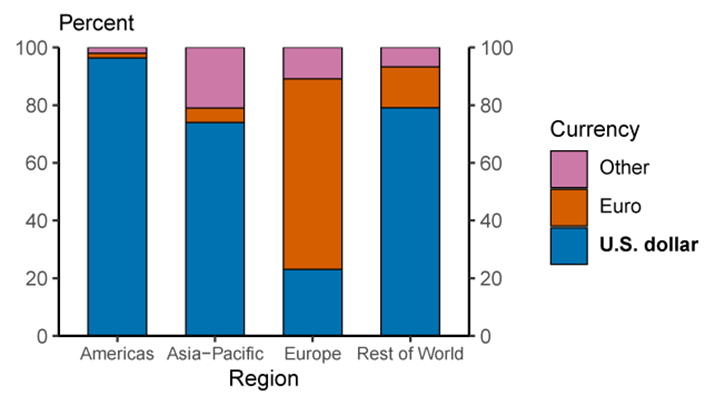

The international role of a currency can also be measured by its usage as a medium of exchange. The dominance of the dollar internationally has been highlighted in several recent studies of the currency composition of global trade and international financial transactions. The U.S. dollar is overwhelmingly the world's most frequently used currency in global trade. An estimate of the U.S. dollar share of global trade invoices is shown in Figure 5. Over the period 1999-2019, the dollar accounted for 96 percent of trade invoicing in the Americas, 74 percent in the Asia-Pacific region, and 79 percent in the rest of the world. The only exception is Europe, where the euro is dominant.

Note: Average annual currency composition of export invoicing, where data are available. Data extend from 1999 through 2019. Regions are those defined by the IMF. Legend entries appear in graph order from top to bottom.

Source: IMF Direction of Trade; Central Bank of the Republic of China; Boz et al. (2020); Board staff calculations.

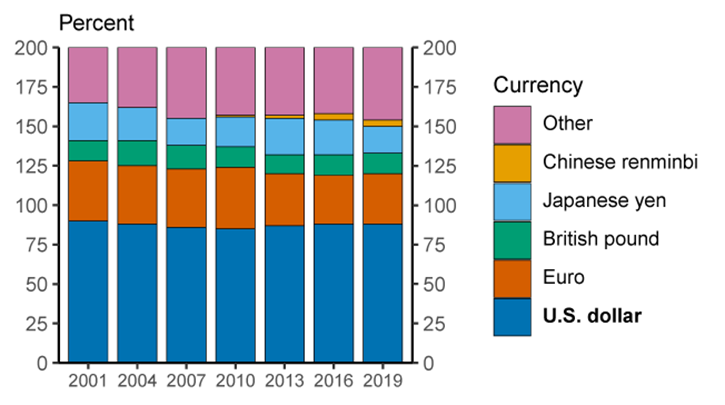

In part because of its dominant role as a medium of exchange, the U.S. dollar is also the dominant currency in international banking. As shown in Figure 6, about 60 percent of international and foreign currency liabilities (primarily deposits) and claims (primarily loans) are denominated in U.S. dollars. This share has remained relatively stable since 2000 and is well above that for the euro (about 20 percent).

6a. Claims

6b. Liabilities

Note: Share of banking claims and liabilities across national borders or denominated in a foreign currency. Excludes intra-euro area international liabilities and claims. At current exchange rates. Data are annual and extend from 1999 through 2020. Legend entries appear in graph order from top to bottom.

Source: BIS locational banking statistics; Board staff calculations.

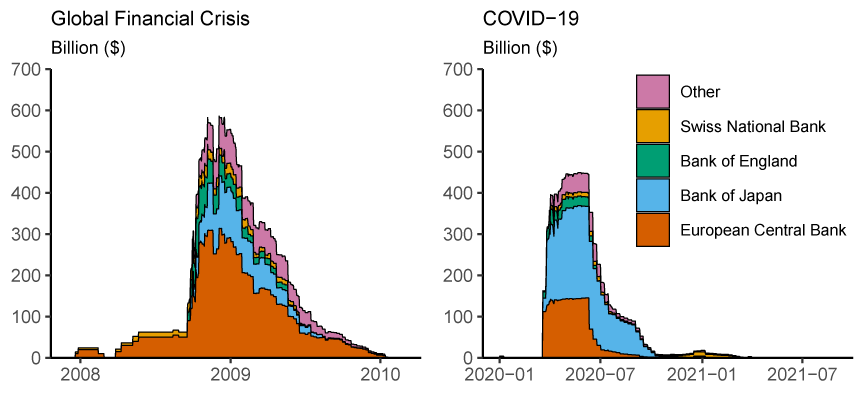

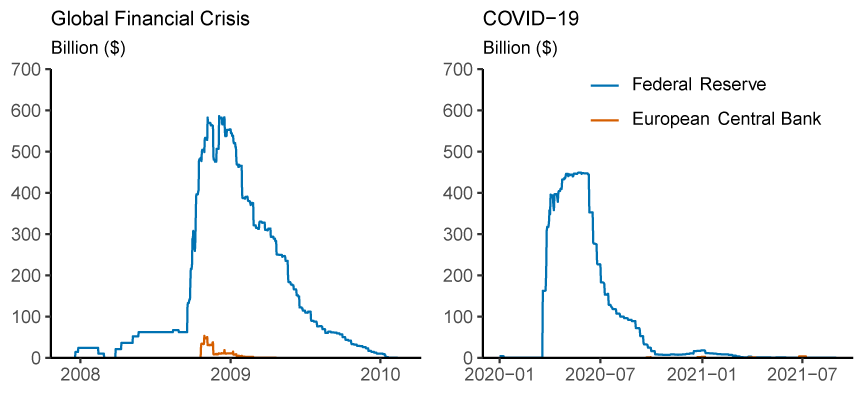

With dollar financing in particularly high demand during times of crisis, foreign financial institutions may face difficulties in obtaining dollar funding. In response, the Federal Reserve has introduced two programs to ease crisis-induced strains in international dollar funding markets, thus mitigating the effects of strains on the supply of credit to domestic and foreign firms and households. To ensure that dollar financing remained available during the 2008-2009 financial crisis, the Federal Reserve introduced temporary swap lines with several foreign central banks, a subset of which were made permanent in 2013.5 During the COVID-19 crisis in March 2020, the Federal Reserve increased the frequency of operations for the standing swap lines and introduced temporary swap lines with additional counterparties.6 The Federal Reserve also introduced a repo facility available to Foreign and International Monetary Authorities (FIMA) with accounts at the Federal Reserve Bank of New York, which was made permanent in 2021.7 Both the swap lines and FIMA repo facility have enhanced the standing of the dollar as the dominant global currency, as approved users know that in a crisis they have access to a stable source of dollar funding. The swap lines were extensively used during the 2008-2009 financial crisis and the 2020 COVID-19 crisis, reaching outstanding totals of $585 billion and $450 billion, respectively (see Figure 7a). Although other central banks have also established swap lines, non-dollar-denomindated swap lines offered by the European Central Bank and other central banks saw little usage (see Figure 7b). This fact highlights how crucial dollar funding is in the operations of many internationally active banks.

7b. Federal Reserve and European Central Bank swap line provisions

7b. Federal Reserve and European Central Bank swap line provisions

Note: In Figure 7a legend entries appear in graph order from top to bottom. Federal reserve swap line provisions to the Bank of England, Bank of Japan, and other central are at or near 0 prior to September 2008. Provisions to the Swiss National Bank are at or near 0 prior to March 2008. Provisions for the Swiss National Bank and Bank of England are at or near zero after June 2009. Figure 7b includes both swap line and repo provisions by the European Central Bank for the COVID-19 period. At current exchange rates. Data are daily and extend from December 1, 2007 through February 28, 2010 for the Global Financial Crisis, and January 1, 2020 through August 31, 2021 for the COVID-19 period. Swap line provisions for the European Central Bank are 0 (or near 0 when shown in billions) October 2008 and after February 2009.

Source: Federal Reserve Bank of New York; European Central Bank.

Issuance of foreign currency debt—debt issued by firms in a currency other than that of their home country — is also dominated by the U.S. dollar. The percentage of foreign currency debt denominated in U.S. dollars has remained around 60 percent since 2010, as seen in Figure 8. This puts the dollar well ahead of the euro, whose share is 23 percent.

Note: Foreign currency debt is denominated in a foreign currency relative to the country of the issuing firm (not the location of issuance). At current exchange rates. Data are annual and extend from 1999 through 2021. 2021 is 2021-H1. Legend entries appear in graph order from top to bottom. Chinese renmimbi is 0 until 2008.

Source: Dealogic; Refinitiv; Board staff calculations.

The many sources of demand for U.S. dollars are also reflected in the high U.S. dollar share of foreign exchange (FX) transactions. The most recent Triennial Central Bank Survey for 2019 from the Bank for International Settlements indicated that the U.S. dollar was bought or sold in about 88 percent of global FX transactions in April 2019. This share has remained stable over the past 20 years (Figure 9). In contrast, the euro was bought or sold in 32 percent of FX transactions, a decline from its peak of 39 percent in 2010.8

Note: On a net-net basis at current exchange rates. Percentages sum to 200 percent because every FX transaction includes two currencies. Legend entries appear in graph order from top to bottom. Chinese renmimbi is 0 until 2013.

Source: BIS Triennial Central Bank Survey of FX and OTC Derivatives Markets.

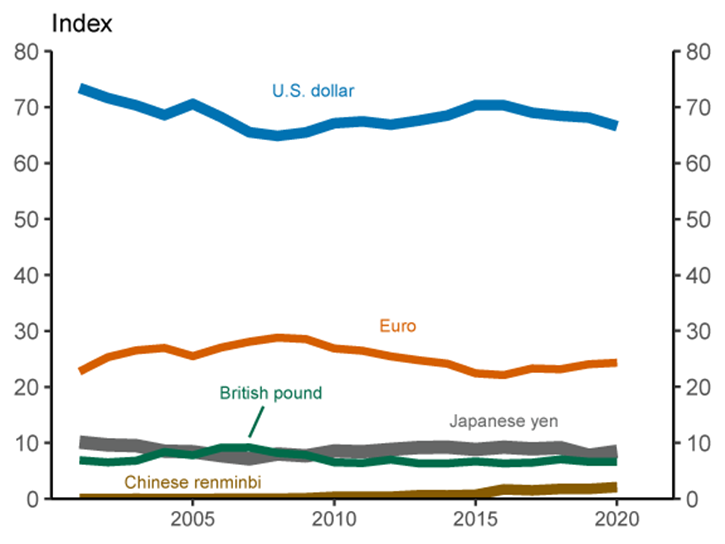

Overall, U.S. dollar dominance has remained stable over the past 20 years

A review of the use of the dollar globally over the last two decades suggests a dominant and relatively stable role. To illustrate this stability, we construct an aggregate index of international currency usage. This index is computed as the weighted average of five measures of currency usage for which time series data are available: Official currency reserves, FX transaction volume, foreign currency debt instruments outstanding, cross-border deposits, and cross-border loans. We display this index of international currency usage in Figure 10. The dollar index level has remained stable at a value of about 75 since the Global Financial Crisis in 2008, well ahead of all other currencies. The euro has the next-highest value at about 25, and its value has remained fairly stable as well. While international usage of the Chinese renminbi has increased over the past 20 years, it has only reached an index level of about 3, remaining even behind the Japanese yen and British pound, which are at about 8 and 7, respectively.

Note: Index is a weighted average of each currency's share of globally disclosed FX reserves (25 percent weight), FX transaction volume (25 percent), foreign currency debt issuance (25 percent), foreign currency and international banking claims (12.5 percent), and foreign currency and international banking liabilities (12.5 percent).

Source: IMF COFER; BIS Triennial Central Bank Survey of FX and OTC Derivatives Market; Dealogic; Refinitiv; BIS locational banking statistics; Board staff calculations.

Diminution of the U.S. dollar's status seems unlikely in the near term

Near-term challenges to the U.S. dollar's dominance appear limited. In modern history there has been only one instance of a predominant currency switching—the replacement of the British pound by the dollar. The dollar rose to prominence after the financial crisis associated with World War I, then solidified its international role after the Bretton Woods Agreement in 1944 (Tooze 2021, Eichengreen and Flandreau 2008, Carter 2020).9

However, over a longer horizon there is more risk of a challenge to the dollar's international status, and some recent developments have the potential to boost the international usage of other currencies.

Increased European integration is one possible source of challenge, as the European Union (EU) is a large economy with fairly deep financial markets, generally free trade, and robust and stable institions. During the COVID-19 crisis, the EU made plans to issue an unprecedented amount of jointly backed debt. If fiscal integration progresses and a large, liquid market for EU bonds develops, the euro could become more attractive as a reserve currency. This integration could potentially be accelerated by enhancements to the EU's sovereign debt market infrastructure and introducing a digital euro. Additionally, the euro's prominent role in corporate and sovereign green finance could bolster its international status if these continue to grow. However, even with more fiscal integration, remaining political separation will continue to cause policy uncertainty.

Another source of challenges to the U.S. dollar's dominance could be the continued rapid growth of China. Chinese GDP already exceeds U.S. GDP on a purchasing power parity basis (IMF World Economic Outlook, July 2021) and is projected to exceed U.S. GDP in nominal terms in the 2030s.10 It is also by far the world's largest exporter, though it lags the United States by value of imports (IMF Direction of Trade Statistics, 2021-Q2). There are significant roadblocks to more widespread use of the Chinese renminbi. Importantly, the renminbi is not freely exchangeable, the Chinese capital account is not open, and investor confidence in Chinese institutions, including the rule of law, is relatively low (Wincuinas 2019). These factors all make the Chinese renmimbi—in whatever form—relatively unattractive for international investors.

A shifting payments landscape could also pose a challenge to the U.S. dollar's dominance. For example, the rapid growth of digital currencies, both private sector and official, could reduce reliance on the U.S. dollar. Changing consumer and investor preferences, combined with the possibility of new products, could shift the balance of perceived costs and benefits enough at the margin to overcome some of the inertia that helps to maintain the dollar's leading role. That said, it is unlikely that technology alone could alter the landscape enough to completely offset the long-standing reasons the dollar has been dominant.

In sum, absent any large-scale political or economic changes which damage the value of the U.S. dollar as a store of value or medium of exchange and simultaneously bolster the attractiveness of dollar alternatives, the dollar will likely remain the world's dominant international currency for the foreseeable future.

References

Bank for International Settlements. BIS Data Bank.

Boz, E., C. Casas, G. Georgiadis, G. Gopinath, H. Le Mezo, A. Mehl, and T. Nguyen (2020). "Patterns in Invoicing Currency in Global Trade." IMF Working Paper No. 20-126.

Carter, Z. (2020). The Price of Peace: Money, Democracy, and the Life of John Maynard Keynes. Random House.

Committee on the Global Financial System (CGFS), (2020). "U.S. dollar funding: an international perspective." BIS CGFS Papers No 65.

Dealogic, DCM Manager, http://www.dealogic.com/en/fixedincome.htm.

The Economist (2020). "Dollar dominance is as secure as American leadership." https://www.economist.com/finance-and-economics/2020/08/06/dollar-dominance-is-as-secure-as-american-global-leadership. Accessed August 18, 2021.

Eichengreen, B. and M. Flandreau (2008). "The Rise and Fall of the Dollar, or When Did the Dollar Replace Sterling as the Leading International Currency?" NBER Working Papers No. 14154.

Judson, R. (2017). "The Death of Cash? Not So Fast: Demand for U.S. Currency at Home and Abroad, 1990-2016." International Cash Conference 2017.

Refinitiv, Thomson ONE Investment Banking with Deals module and SDC Platinum, http://www.thomsonone.com/.

Tooze, A. (2021). "The Rise and Fall and Rise (and Fall) of the U.S. Financial Empire." Foreign Policy https://foreignpolicy.com/2021/01/15/rise-fall-united-states-financial-empire-dollar-global-currency Accessed August 13, 2021.

Wincuinas, J. (2019). "The China position: Gauging institutional investor confidence." Economist Intelligence Unit. https://eiuperspectives.economist.com/financial-services/china-position-gauging-institutional-investor-confidence Accessed August 18, 2021.

1. We thank John Caramichael for excellent research assistance. Return to text

2. For a detailed discussion of the dollar's use in international financial markets see Committee on the Global Financial System (2020). Return to text

3. Their definition of anchored currencies includes currencies explicitly pegged to the dollar as well as currencies that move less than 2 percent against the dollar in over 90 percent of months. Return to text

4. Even excluding China, about 30 percent of world GDP (excluding the United States) is anchored to the U.S. dollar, significantly more than for any other currency. Return to text

5. Since 2013, the following six central banks have had permanent bilateral swap arrangements with each other: the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank. Return to text

6. Additional information about the Federal Reserve's central bank swap lines can be found at https://www.federalreserve.gov/monetarypolicy/central-bank-liquidity-swaps.htm. Return to text

7. The FIMA repo facility allows approved foreign central banks and other foreign monetary authorities to temporarily raise dollars by selling U.S. Treasuries to the Federal Reserve's System Open Market Account and agreeing to buy them back at the maturity of the repurchase agreement. Thus, it provides an alternative temporary source of U.S. dollars for FIMA account holders of Treasury securities other than sales of the securities in the open market. Additional information about the facility can be found at https://www.federalreserve.gov/monetarypolicy/fima-repo-facility.htm. Return to text

8. Because one currency is purchased and another currency is sold in FX transactions, each trade is counted twice, so the sum of the FX transactions measure is 200 percent. Return to text

9. U.S. GDP may have eclipsed British GDP as early as the late 1800s, but the dollar did not completely solidify its dominance until after the Bretton Woods Agreement in 1944 (Eichengreen and Flandreau (2008)). Return to text

10. Bloomberg's base case forecast predicts that Chinese GDP will exceed U.S. GDP in nominal terms in 2033 (https://www.bloomberg.com/news/features/2021-07-05/when-will-china-s-economy-beat-the-u-s-to-become-no-1-why-it-may-never-happen?srnd=premium&sref=c1gYoH2n). Return to text

Bertaut, Carol C., Bastian von Beschwitz, and Stephanie E. Curcuru (2021). "The International Role of the U.S. Dollar," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, October 06, 2021, https://doi.org/10.17016/2380-7172.2998.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.