PDF (354 KB)

FEDERAL RESERVE SYSTEM

[Docket No. OP-1269]

Federal Reserve Bank Services

AGENCY: Board of Governors of the Federal Reserve System.

ACTION: Notice.

SUMMARY: The Board has approved the private sector adjustment factor (PSAF) for 2007 of $132.5 million and the 2007 fee schedules for Federal Reserve priced services and electronic access. These actions were taken in accordance with the requirements of the Monetary Control Act of 1980, which requires that, over the long run, fees for Federal Reserve priced services be established on the basis of all direct and indirect costs, including the PSAF. The Board has also approved maintaining the current earnings credit rate on clearing balances.

DATES: The new fee schedules and earnings credit rate become effective January 2, 2007.

FOR FURTHER INFORMATION CONTACT: For questions regarding the fee schedules: Jack K. Walton II, Associate Director, (202/452-2660); Jeffrey S.H. Yeganeh, Manager, Retail Payments, (202/728-5801); Edwin J. Lucio, Senior Financial Services Analyst, (202/736-5636), Division of Reserve Bank Operations and Payment Systems. For questions regarding the PSAF and earnings credits on clearing balances: Gregory L. Evans, Assistant Director, (202/452-3945); Brenda L. Richards, Manager, Financial Accounting, (202/452-2753); Jonathan Mueller, Senior Financial Analyst, (202/530-6291); or Jonathan Senner, Senior Financial Analyst, (202/452-2042), Division of Reserve Bank Operations and Payment Systems. For users of Telecommunications Device for the Deaf (TDD) only, please call 202/263-4869. Copies of the 2007 fee schedules for the check service are available from the Board, the Federal Reserve Banks, or the Reserve Banks� financial services web site at www.frbservices.org.

SUPPLEMENTARY INFORMATION:

I. PRIVATE SECTOR ADJUSTMENT FACTOR AND PRICED SERVICES

A. Background � Each year, as required by the Monetary Control Act of 1980 (MCA), the Reserve Banks set fees for priced services provided to depository institutions. These fees are set to recover, over the long run, all direct and indirect costs and imputed costs, including financing costs, taxes, and certain other expenses, as well as return on equity (profit) that would have been earned if a private business firm provided the services. The imputed costs and imputed profit are collectively referred to as the PSAF. Similarly, investment income is imputed and netted with related direct costs associated with clearing balances to estimate net income on clearing balances (NICB). From 1996 through 2005, the Reserve Banks recovered 98.4 percent of their total expenses (including special project costs and imputed costs) and targeted after-tax profits or return on equity (ROE) for providing priced services.1

B. Discussion - Table 1 summarizes 2005, 2006 estimated, and 2007 budgeted cost recovery rates for all priced services. Cost recovery is estimated to be 108.2 percent in 2006, which does not include the effects of FAS 158 discussed below, and budgeted to be 101.5 percent in 2007. The performance of the check service heavily influences the aggregate cost recovery rates because the check service accounts for approximately 80 percent of the total cost of priced services. The electronic services (FedACHSM, the Fedwire� Funds Service and National Settlement Service (NSS), and the Fedwire� Securities Service) account for approximately 20 percent of total costs.2

On September 29, 2006, the Financial Accounting Standards Board (FASB) issued a statement that significantly affects the Reserve Banks� priced services pro forma balance sheet as well as cost recovery in 2006 and thereafter. Statement of Financial Accounting Standards No. 158: Employers� Accounting for Defined Benefit Pension and Other Postretirement Plans (FAS 158) requires affected employers to record the actual funded status of their benefit plans on their balance sheets effective December 31, 2006, and any changes to the funded status in subsequent years. FAS 158 does not change the method used to periodically recognize these changes to the funded status of employers� benefit plans in the income statement. Because the Reserve Banks� benefit plans have net unrecognized losses, the existing “shareholders� will incur a loss of value upon the initial adoption of FAS 158, which will be reflected in cost recovery beginning in 2006.3, 4

These gains or losses that now must be recognized on the balance sheet stem from amendments to benefit plans, changes in actuarial and earnings assumptions, and differences between actuarial assumptions and actual experience. These factors can be highly volatile in any given year and, as a result, recognizing them could cause cost recovery to be significantly above or below 100 percent. To avoid short-run volatility in priced-services fees and their impact on the financial industry, past changes to these unrecognized gains or losses under FAS 158 will not be considered when setting priced-services fees, but they will continue to be factored into the fee setting process to the extent that they are recognized through the systematic approach required by GAAP. Future changes to these unrecognized gains or losses cannot be predicted and, therefore, cannot be considered in 2007 budgeted cost recovery. In light of the recent adoption of FAS 158, the Board will continue to study how incorporating these gains or losses affects its assessment of the Federal Reserve Banks� compliance with MCA's long-run cost recovery requirement.

Table 1

Aggregate Priced Services Pro Forma Cost and Revenue Performancea

($ millions)

| Year | 1b Revenue |

2c Total Expense |

3 Net Income (ROE) [1-2] |

4d Target ROE |

5e Recovery Rate After Target ROE [1/(2+4)] |

|---|---|---|---|---|---|

| 2005 | 994.7 | 834.7 | 160.0 | 103.0 | 106.1% |

| 2006 (estimate) | 1,020.2 | 871.0 | 149.2 | 72.0 | 108.2% |

| 2007 (budget) | 980.2 | 885.0 | 95.2 | 80.4 | 101.5% |

a. Calculations in this table and subsequent pro forma cost and revenue tables may be affected by rounding. Return to text.

b. Revenue includes net income on clearing balances (NICB). Clearing balances are assumed to be invested in a broad portfolio of investments, such as Treasury securities, government agency securities, commercial paper, municipal and corporate bonds, and money market and mutual funds. To impute income, a constant spread is determined from the historical average return on this portfolio and applied to the rate used to determine the cost of clearing balances. NICB equals the imputed income from these investments less earnings credits granted to holders of clearing balances. The cost of earnings credits is based on the discounted three-month Treasury bill rate. Return to text.

c. The calculation of total expense includes operating, imputed, and other expenses. Imputed and other expenses include taxes, FDIC insurance, Board of Governors' priced services expenses, the cost of float, and interest on imputed debt, if any. Credits or debits related to the accounting for pensions under FAS 87 are also included. Return to text.

d. Target ROE is the after-tax ROE included in the PSAF. Return to text.

e. Cost recovery is estimated to be 77.2 percent in 2006, including the estimated loss of $378 million resulting from the implementation of FAS 158. Future changes to these unrecognized items cannot be estimated. Return to text.

Table 2 presents an overview of cost recovery by service line for 2005 through 2007.

| Priced Service | 2005 | 2006 Budget | 2006 Estimatea | 2007 Budgetb |

|---|---|---|---|---|

| All services | 106.1 | 102.6 | 108.2 | 101.5 |

| Check | 106.1 | 102.4 | 109.1 | 101.5 |

| FedACH | 106.4 | 101.0 | 101.1 | 101.6 |

| Fedwire funds and NSS | 106.7 | 105.4 | 109.1 | 102.3 |

| Fedwire securities | 104.7 | 105.6 | 103.7 | 101.6 |

a. Including the FAS 158 effect, the reported recovery rates are: All services � 77.2%, Check � 78.0%, FedACH � 72.6%, Fedwire Funds and NSS � 78.6%, and Fedwire Securities � 65.1%. Return to text.

b. 2007 budget figures reflect the most recent data from Reserve Banks. The Reserve Banks will transmit final budget data to the Board in November 2006, for Board consideration in December 2006. Return to text.

1. 2006 Estimated Performance - The Reserve Banks estimate that they will recover 108.2 percent (77.2 percent including the effects of FAS 158) of the costs of providing priced services, including imputed expenses and targeted ROE, compared with a budgeted recovery rate of 102.6 percent, as shown in table 2. The Reserve Banks estimate that they will exceed $1 billion in revenue for the first time and that all services will achieve full cost recovery, excluding the effects of FAS 158. The Reserve Banks estimate that they will fully recover actual and imputed expenses and earn net income of $149.2 million compared with the target of $72.0 million. The greater-than-expected net income is largely driven by the performance of the check service, which had greater-than-expected Check 21 and paper return volumes, as well as greater-than-expected net income on clearing balances.

Other than the effects of FAS 158, greater-than-expected Check 21 volume has been the single most significant factor influencing priced services cost recovery as additional fee revenue has exceeded the costs of processing the unexpected volumes. The Reserve Banks have also continued their efforts to downsize their paper check-processing infrastructure as paper check volumes continue to decline nationwide. The Reserve Banks have already reduced the number of sites at which they process checks from forty-five in 2003 to twenty-two in 2006 and will discontinue processing checks at four other offices by early 2008. These check restructuring efforts have enabled the Reserve Banks to return to full cost recovery by reducing costs in line with the decline in revenues associated with paper check processing.

2. 2007 Private Sector Adjustment Factor - The 2007 PSAF for Federal Reserve priced services is $132.5 million. This amount represents an increase of $14.8 million from the 2006 PSAF of $117.7 million. This increase is primarily due to an increase in the cost of equity.5

3. 2007 Projected Performance - The Reserve Banks project a priced services cost recovery rate of 101.5 percent. The 2007 fees for priced services are projected to result in a net income of $95.2 million compared with the $80.4 million required to achieve full cost recovery. The major risks to the Reserve Banks' ability to achieve their budget targets are a greater decline in the Reserve Banks' paper check volume than the projected 24.0 percent, unanticipated problems with technological upgrades that could result in significant cost overruns, and lower-than-expected electronic payments volumes due to competition. In light of these risks, the Reserve Banks will continue to refine their business and operational strategies to improve efficiency and reduce excess capacity and other costs. These efforts should position the Reserve Banks to achieve their financial and other payment system objectives and statutory requirements over the long run.

4. 2007 Pricing - The following summarizes the changes in the Reserve Banks� fee schedules for priced services in 2007:

-

Check

- The Reserve Banks will raise paper check fees for forward collection check products 5.0 percent, return check products 9.6 percent, and payor bank check products 8.1 percent.

- The Reserve Banks will decrease Check 21 fees for FedForward products delivered to electronic endpoints 12.5 percent but to increase Check 21 fees for FedForward products delivered to substitute-check endpoints 3.1 percent. The Reserve Banks also will offer a restructured deposit discount of $0.003 for each check presented through FedReceipt products. FedReturn fees will remain unchanged.

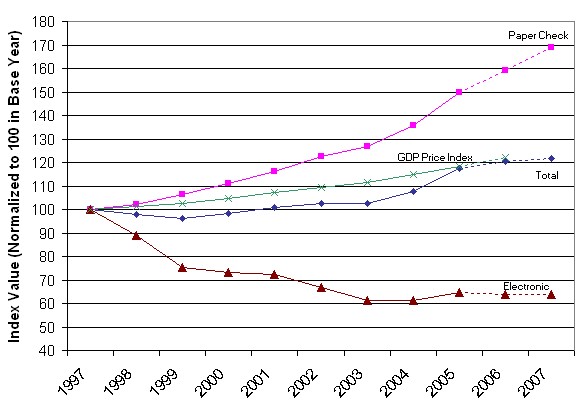

- With the 2007 fee changes, the price index for the check service will have increased 57 percent since 1997.

- The Reserve Banks will increase the monthly subscription fee for the Informational Extract File from $10 to $20.

- With the 2007 fee change, the price index for the FedACH service will have decreased 65 percent since 1997.

- The Reserve Banks will raise the surcharge for offline funds transfers from $20 to $30 and to decrease the online transfer fee by one cent in all pricing tiers.

- With the 2007 fee changes, the price index for the Fedwire Funds and National Settlement Services will have decreased 55 percent since 1997.

- The Reserve Banks will increase the online transfer fee by two cents, the monthly maintenance fee from $15 to $16, and the surcharge for offline securities transfers from $50 to $60.

- With the 2007 fee changes, the price index for the Fedwire Securities Service will have decreased 46 percent since 1997.

FedACH

Fedwire Funds and National Settlement Services

Fedwire Securities Service

5. 2007 Price Index - Figure 1 compares indexes of fees for the Reserve Banks� priced services with the GDP price index. The price index for all Reserve Bank priced services is projected to increase 1.0 percent in 2007, compared with the 2.3 percent growth anticipated in 2006. The price index for paper check and electronic payment services in 2007 are projected to increase 6.0 percent and 0.1 percent, respectively. Based on 2006 data available to date, the price index for all priced services is expected to increase an estimated 20.3 percent from 1997 to 2006, compared with an estimated 22.0 percent growth in the GDP price index over the same period.6

FIGURE 1

PRICE INDEXES FOR FEDERAL RESERVE

PRICED SERVICES

C. Private Sector Adjustment Factor - The method for calculating the financing and equity costs in the PSAF requires determining the appropriate levels of debt and equity to impute and then applying the applicable financing rates. In this process, a pro forma priced services balance sheet using estimated Reserve Bank assets and liabilities associated with priced services is developed, and the remaining elements that would exist if the Reserve Banks� priced services were provided by a private business firm are imputed. The same generally accepted accounting principles that apply to commercial entity financial statements also apply to the relevant elements in the priced services pro forma financial statements.

The amount of the Reserve Banks� assets that will be used to provide priced services during the coming year is determined using Reserve Bank information on actual assets and projected disposals and acquisitions. The priced portion of assets is determined based on the allocation of the related depreciation expense. The priced portion of actual Reserve Bank liabilities consists of balances held by Reserve Banks for clearing priced-services transactions (clearing balances), and other liabilities such as accounts payable and accrued expenses.

Long-term debt is imputed only when core clearing balances and long-term liabilities are not sufficient to fund long-term assets or if the interest rate risk sensitivity analysis, which measures the interest rate effect of the difference between interest rate sensitive assets and liabilities, indicates that a 200 basis point change in interest rates would change cost recovery more than two percentage points.7 Short-term debt is imputed only when short-term liabilities and clearing balances not used to finance long-term assets are insufficient to fund short-term assets. Equity is imputed to meet the FDIC definition of a well-capitalized depository institution for insurance premium purposes and represents the market capitalization, or shareholder value, for priced services.8, 9

1. Financing rates � Equity financing rates are based on the target return on equity (ROE) result of the capital asset pricing model (CAPM). In the CAPM, the required rate of return on a firm’s equity is equal to the return on a risk-free asset plus a risk premium. To implement CAPM, the risk-free rate is based on the three-month Treasury bill, the beta is assumed to be equal to 1.0, which approximates the risk of the market as a whole, and the monthly returns in excess of the risk-free rate over the most recent 40 years are used as the market risk premium. The resulting ROE influences the dollar level of the PSAF because this is the return a shareholder would expect in order to invest in a private business firm.

For simplicity, given that federal corporate income tax rates are graduated, state income tax rates vary, and various credits and deductions can apply, a specific income tax expense is not calculated for Reserve Bank priced services. Instead, the Board targets a pre-tax ROE that would provide sufficient income to fulfill its income tax obligations.10 To the extent that the actual performance results are greater or less than the targeted ROE, income taxes are adjusted using an imputed income tax rate. Because the Reserve Banks provide similar services through their correspondent banking activities, including payment and settlement services, and equity is imputed to meet the FDIC requirements of a well-capitalized depository institution, the imputed income tax rate is the median of the rates paid by the top fifty bank holding companies (BHCs) based on deposit balance over the past five years adjusted to the extent that they invested in tax-free municipal bonds.

2. Other Costs � The PSAF also includes the estimated priced services-related expenses of the Board of Governors and imputed sales taxes based on Reserve Bank estimated expenditures. An assessment for FDIC insurance, when required, is imputed based on current FDIC rates and projected clearing balances held with the Federal Reserve.

3. Net Income on Clearing Balances � The NICB calculation is made each year along with the PSAF calculation and is based on the assumption that Reserve Banks invest clearing balances net of imputed reserve requirements and balances used to finance priced-services assets. Using these net clearing balance levels, Reserve Banks impute a constant spread, determined by the return on a portfolio of investments, over the three-month Treasury bill rate.11, 12 The calculation also involves determining the priced-services cost of earnings credits (amounts available to offset service fees) on contracted clearing balances held, net of expired earnings credits, based on a discounted Treasury bill rate. Rates and clearing balance levels used in the NICB estimate are based on the most-recent rates and clearing balance levels.13 Because clearing balances are held for clearing priced-services transactions or offsetting priced-services fees, they are directly related to priced services. The net earnings or expense attributed to the investments and the cost associated with holding clearing balances, therefore, are considered net income for priced services activities.

4. Adopting FAS 158 � On September 29, 2006, FASB issued FAS 158: Employers� Accounting for Defined Benefit Pension and Other Postretirement Plans. This statement, effective for fiscal years ending after December 15, 2006, requires affected employers to show the actual funded status of their benefit plans by recognizing the deferred elements related to pension and postretirement accounting as adjustments to the related assets or liabilities on their balance sheets. These deferred elements include unrecognized gains or losses (resulting from changes in actuarial assumptions, such as the discount rate, and differences between these assumptions and actual experience) and prior service costs or credits (resulting from amendments to existing benefit plans).14 FAS 158 does not change the method used to periodically recognize these deferred elements in the income statement.

Because the Reserve Banks offer employees defined benefit pension and other postretirement benefits, the adoption of FAS 158 will affect the Reserve Banks� 2006 balance sheets and financial statement disclosures. Given that these benefits are provided to employees involved in priced services, the effects of the new accounting standard must also be included in the pro forma priced services balance sheet.15 The current estimate is net unrecognized losses for the December 31, 2006, deferred elements.

To reflect the funded status of the Reserve Banks� benefit plans on the 2006 pro forma priced services balance sheet as required by FAS 158, the Reserve Banks will record a reduction in the prepaid pension asset.16 The offset to the asset reduction will be twofold: The amount by which the pension asset is reduced, net of tax, will be reported as a negative component of equity called accumulated other comprehensive income (AOCI), while the remainder will be reported as a deferred tax asset.17 Similarly, the full unfunded status of the postretirement benefits liability must be recognized by increasing the liability on the priced services pro forma balance sheet, with the offsetting net-of-tax portion of this entry reflected in AOCI and the balance assigned to the deferred tax asset.18 Because priced-services equity is imputed at the minimum level necessary to meet the FDIC definition of a well-capitalized depository institution, any direct reduction to equity through AOCI as a result of FAS 158 will require the Reserve Banks to impute additional equity.19, 20

It is unclear whether a private firm with a similar balance sheet would actually raise additional equity to offset the FAS 158 balance sheet changes. Because most BHCs hold capital balances in excess of the minimum level to be considered well-capitalized, and because their pension assets and liabilities represent a comparatively small share of total equity, they may be able to absorb the FAS 158 adjustments and still maintain adequate regulatory capital levels.

For the purpose of measuring priced-services cost of equity, the Reserve Banks assume that existing shareholders will sustain an economic loss of value as a result of implementing the FAS 158 accounting changes.21 This assumption implies that these shareholders will expect a return on only the remaining portion of their investment (original investment amount less AOCI reduction) and that the new equity investors will expect a similar return on their investment. This will leave the cost of equity, and overall PSAF, virtually unchanged from what it was before the application of FAS 158, because the existing shareholder investment that was eliminated by the AOCI reduction will be replaced by the new equity required to replenish total equity to 5 percent of total assets and remain well-capitalized according to FDIC guidelines. NICB will increase, however, because this new equity will be available for investment.

Because the Reserve Bank benefit plans have net unrecognized losses, the Reserve Bank priced services will recognize this reduction in value in cost recovery for 2006. The Reserve Bank priced services assume that existing shareholders incur these losses upon the initial implementation of FAS 158, with the losses flowing to the shareholders rather than to the firm itself. Prices for 2007 and thereafter, however, will be set to achieve full cost recovery over the long run before the annual FAS 158 adjustments, with a measure of cost-recovery performance provided for each year that includes the FAS 158 adjustment. This approach will limit the increased year-to-year price volatility that would result from including annual FAS 158 adjustments in the setting of priced-services fees. It is also consistent with the FASB’s systematic approach of deferring recognition of prior service costs or credits and actuarial gains or losses to reduce the inherent volatility of these deferred items on current expense.

Including the annual FAS 158 adjustment in a measurement of priced services cost recovery, however, could produce highly variable actual cost recovery results from year-to-year that exceed or fall short of 100 percent. One component of the annual FAS 158 entry is unrecognized prior service cost, which arises from certain amendments to existing benefit plans and is amortized according to GAAP over a specific period (usually twelve to fifteen years). This factor will have a negligible effect on reported long-run cost recovery because the initial recognition of prior service cost (a negative adjustment to cost recovery) should eventually be offset by positive adjustments to cost recovery as this cost is amortized over time and incorporated into the price-setting process. The other component of the annual FAS 158 entry, unrecognized gains or losses, results from changes in actuarial assumptions (discount rates, return on plan assets, demographic changes, and so on) and differences between these assumptions and actual experience. These actuarial gains or losses could be highly volatile and may or may not offset each other for as long as the Federal Reserve continues to offer pension and postretirement benefits. For this reason, GAAP does not require the recognition of these gains or losses until they exceed a corridor of 10 percent of the greater of the benefit obligations or assets. In addition, because these factors and the resulting year-to-year changes in the associated assets and liabilities are not measured until after year-end and cannot be estimated for pricing purposes, long-run cost recovery could be greater or less than 100 percent depending on the amount of the actuarial gains or losses that are recognized each year.

5. Analysis of the 2007 PSAF � The increase in the 2007 PSAF is primarily due to an increase in the required ROE result provided by the CAPM, which offsets an overall reduction in imputed equity.

a. Asset Base � The estimated 2007 Federal Reserve assets, reflected in table 3, have decreased $1,303.0 million. There is a decline in imputed investments in marketable securities of $1,118.1 million and in imputed reserve requirements of $163.5 million, which are imputed based on the estimated level of clearing balances held, and in the prepaid pension asset of $446.9 million as a result of the FAS 158 accounting changes. These declines are slightly offset by an increase in items in process of collection of $262.2 million, due to higher estimated float receivables, and in the deferred tax asset associated with implementing FAS 158 of $159.3 million.

As shown in table 4, the assets financed through the PSAF have decreased. Short-term assets funded with short-term payables and clearing balances total $10.2 million. This represents an $18.2 million decrease from the short-term assets funded in 2006 due to an increase in expected short-term payables. Long-term liabilities and equity are greater than long-term assets; therefore, no core clearing balances are used to fund long-term assets.

b. Debt and Equity Costs and Taxes � As previously mentioned, core clearing balances are available as a funding source for priced-services assets. Table 4 shows that $10.2 million in clearing balances is used to fund priced-services assets in 2007. The interest rate sensitivity analysis in table 5 indicates that a 200 basis point decrease in interest rates affects the ratio of rate-sensitive assets to rate-sensitive liabilities and produces a decrease in cost recovery of 1.4 percentage points, while an increase of 200 basis points in interest rates increases cost recovery by 1.5 percentage points. The established threshold for a change in cost recovery is two percentage points; therefore, interest rate risk associated with using these balances is within acceptable levels and no long-term debt is imputed.

Table 6 shows the imputed PSAF elements, the pretax ROE, and other required PSAF costs for 2006 and 2007. The increase in ROE is primarily caused by an increase in the risk-free rate of return. Sales taxes increased from $7.7 million in 2006 to $8.5 million in 2007. The effective income tax rate used in 2007 increased to 31.5 percent from 29.8 percent in 2006. The priced-services portion of the Board’s expenses decreased $0.8 million from $7.5 million in 2006 to $6.7 million in 2007.

c. Capital Adequacy and FDIC Assessment � As shown in table 3, the amount of equity imputed for the 2007 PSAF is $742.9 million, a decrease of $65.1 million versus the imputed equity for 2006. This includes additional imputed equity of $361.0 million to offset the FAS 158 reduction to AOCI.

In 2007, the capital to total assets ratio and the capital to risk-weighted assets ratio both meet or exceed regulatory guidelines as required by the FDIC definition of a well-capitalized depository institution for insurance premium purposes. Equity is based on 5 percent of total assets, and capital to risk-weighted assets is 15.0 percent. Based on the final regulations recently adopted by the FDIC, the Reserve Bank priced services estimate a one-time assessment credit of $16.6 million. Because the estimated assessment for 2007 does not exceed the one-time assessment credit, no net FDIC assessment is imputed for 2007.

Table 3

Comparison of Pro Forma Balance Sheets

for Federal Reserve Priced Services

(millions of dollars � average for year)

| 2007 | 2006 | Change | |

|---|---|---|---|

| Short-term assets | |||

| Imputed reserve requirement

on clearing balances | 823.4 |

986.9 |

(163.5) |

| Receivables | 70.1 | 67.0 | 3.1 |

| Materials and supplies | 1.1 | 1.0 | 0.1 |

| Prepaid expenses | 30.2 | 26.8 | 3.4 |

| Items in process of collection22 |

5,388.9 |

5,126.7 |

262.2 |

| Total short-term assets | 6,313.7 | 6,208.4 | 105.3 |

| Imputed investments | 7,444.5 | 8,562.6 | (1,118.1) |

| Long-term assets | |||

| Premises23 | 395.2 | 385.8 | 9.4 |

| Furniture and equipment | 138.7 | 122.7 | 16.0 |

| Leasehold improvements and

long-term prepayments |

56.6 |

84.6 |

(28.0) |

| Prepaid pension costs | 349.1 | 796.0 | (446.9) |

| Deferred tax asset |

159.3 |

0.0 |

159.3 |

| Total long-term assets |

1,098.9 |

1,389.1 |

(290.2) |

| Total assets |

14,857.1 |

16,160.1 |

(1,303.0) |

| Short-term liabilities24 | |||

| Clearing balances and balances arising from early credit of uncollected items |

8,322.7 |

9,801.5 |

(1,478.8) |

| Deferred credit items22 | 5,300.3 | 5,194.2 | 106.1 |

| Short-term payables |

91.2 |

66.4 |

24.8 |

| Total short-term liabilities | 13,714.2 | 15,062.1 | (1,347.9) |

| Long-term liabilities24 | |||

| Postemployment/retirement benefits |

400.0 |

290.0 |

110.0 |

| Total liabilities | 14,114.2 | 15,352.1 | (1,237.9) |

| Equity25 |

742.9 |

808.0 |

(65.1) |

| Total liabilities and equity |

14,857.1 |

16,160.1 |

(1,303.0) |

| 2007 | 2006 | |||

|---|---|---|---|---|

| A. Short-term asset financing | ||||

| Short-term assets to be financed: | ||||

| Receivables | 70.1 | 67.0 | ||

| Materials and supplies | 1.1 | 1.0 | ||

| Prepaid expenses |

30.2 |

26.8 |

||

| Total short-term assets to be financed | 101.4 | 94.8 | ||

Short-term funding sources: |

||||

| Short-term payables |

91.2 |

66.4 |

||

| Portion of short-term assets funded with clearing balances26 |

10.2 |

28.4 |

||

| B. Long-term asset financing | ||||

| Long-term assets to be financed: | ||||

| Premises | 395.2 | 385.8 | ||

| Furniture and equipment | 138.7 | 122.7 | ||

| Leasehold improvements and long-term prepayments |

56.6 |

84.6 |

||

| Prepaid pension costs | 349.1 | 796.0 | ||

| Deferred tax asset |

159.3 |

0.0 |

||

| Total long-term assets to be financed | 1,098.9 | 1,389.1 | ||

Long-term funding sources: |

||||

| Postemployment/retirement benefits liability |

400.0 |

290.0 |

||

| Imputed equity27 |

742.9 |

808.0 |

||

| Total long-term funding sources |

1,142.9 |

1,098.0 |

||

Portion of long-term assets funded with core clearing balances26 |

0.0 |

291.1 |

||

| C. Total clearing balances used for funding priced-services assets |

10.2 |

319.5 |

||

Table 5

2007 Interest Rate Sensitivity Analysis28

(millions of dollars)

| Rate sensitive |

Rate insensitive |

Total | |

|---|---|---|---|

| Assets | |||

| Imputed reserve requirement on clearing balances |

823.4 |

823.4 |

|

| Imputed investments | 7,444.5 | 7,444.5 | |

| Receivables | 70.1 | 70.1 | |

| Materials and supplies | 1.1 | 1.1 | |

| Prepaid expenses | 30.2 | 30.2 | |

| Items in process of collection29 | 88.6 | 5,300.3 | 5,388.9 |

| Long-term assets |

|

1,098.9 |

1,098.9 |

| Total assets |

7,533.1 |

7,324.0 |

14,857.1 |

| Liabilities | |||

| Clearing balances and balances arising from early credit of uncollected items30 |

6,509.7 |

1,813.0 |

8,322.7 |

| Deferred credit items | 5,300.3 | 5,300.3 | |

| Short-term payables | 91.2 | 91.2 | |

| Long-term liabilities |

|

400.0 |

400.0 |

| Total liabilities |

6,509.7 |

7,604.5 |

14,114.2 |

Rate change results |

200 basis point decrease in rates | 200 basis point increase in rates |

|---|---|---|

| Asset yield ($7,533.1 x rate change) | (150.7) | 150.7 |

| Liability cost ($6,509.7 x rate change) |

(130.2) |

130.2 |

| Effect of 200 basis point change |

(20.5) |

20.5 |

| 2007 budgeted revenue | 980.2 | 980.2 |

| Effect of change |

(20.5) |

20.5 |

| Revenue adjusted for effect of interest rate change |

959.7 |

1,000.7 |

| 2007 budgeted total expenses | 826.0 | 826.0 |

| 2007 budgeted PSAF | 139.3 | 139.3 |

| Tax effect of interest rate change ($ change x 31.5%) |

(6.4) |

6.4 |

| Total recovery amounts |

958.9 |

971.7 |

| Recovery rate before interest rate change | 101.5% | 101.5% |

| Recovery rate after interest rate change | 100.1% | 103.0% |

| Effect of interest rate change on cost recovery31 | (1.4)% | 1.5% |

| 2007 | 2006 | |||||

|---|---|---|---|---|---|---|

| A. Imputed elements | ||||||

| Short-term debt32 | 0.0 | 0.0 | ||||

| Long-term debt33 | 0.0 | 0.0 | ||||

| Equity | ||||||

| Total assets from table 3 |

14,857.1 | 16,160.1 | ||||

| Required capital ratio34 |

5% |

5% |

||||

| Total equity | 742.9 | 808.0 | ||||

| B. Cost of capital | ||||||

| 1. Financing rates/costs | ||||||

| Short-term debt | N/A | N/A | ||||

| Long-term debt | N/A | N/A | ||||

| Pretax return on equity |

15.8% | 12.7% | ||||

2. Elements of capital costs |

||||||

| Short-term debt | 0.0 | 0.0 | ||||

| Long-term debt | 0.0 | 0.0 | ||||

| Equity35 |

742.9 x |

15.8%= |

117.3 |

808.0 x |

12.7%= |

102.5 |

| 117.3 | 102.5 | |||||

| C. Other required PSAF costs | ||||||

| Sales taxes | 8.5 | 7.7 | ||||

| Federal Deposit Insurance Corporation assessment |

0.0 |

0.0 |

||||

| Board of Governors expenses |

6.7 |

7.5 |

||||

| 15.2 |

15.2 |

|||||

| D. Total PSAF |

132.5 |

117.7 |

||||

| As a percent of assets |

0.9% | 0.7% | ||||

| As a percent of expenses36 |

16.3% | 15.8% | ||||

| E. Tax rates | 31.5% | 29.8% | ||||

Table 7

Computation of 2007 Capital Adequacy

for Federal Reserve Priced Services

(millions of dollars)

| Assets | Risk weight | Weighted assets | |

|---|---|---|---|

| Imputed reserve requirement on clearing balances |

823.4 |

0.0 |

0.0 |

| Imputed investments: | |||

| 1-year Treasury note37 | 4,481.1 | 0.0 | 0.0 |

| Commercial paper (1 month)37 | 2,305.1 | 1.0 | 2,305.1 |

| Commercial paper (3 months)37 | 367.6 | 1.0 | 367.6 |

| GNMA mutual fund38 |

290.7 |

0.2 |

58.1 |

| 8,267.9 | 2,730.8 | ||

Receivables |

70.1 |

0.2 |

14.0 |

| Materials and supplies | 1.1 | 1.0 | 1.1 |

| Prepaid expenses | 30.2 | 1.0 | 30.2 |

| Items in process of collection | 5,388.9 | 0.2 | 1,077.8 |

| Premises | 395.2 | 1.0 | 395.2 |

| Furniture and equipment | 138.7 | 1.0 | 138.7 |

| Leasehold improvements and long-term prepayments |

56.6 |

1.0 |

56.6 |

| Prepaid pension costs | 349.1 |

1.0 |

349.1 |

| Deferred tax asset | 159.3 |

1.0 |

159.3 |

Total |

14,857.1 |

4,952.8 |

|

Imputed equity for 2007 |

742.9 |

| Capital to risk-weighted assets | 15.0% |

| Capital to total assets | 5.0% |

D. Earnings Credits on Clearing Balances � The Board has approved maintaining the current rate of 80 percent of the three-month Treasury bill rate to calculate earnings credits on clearing balances.39 The Reserve Banks will continue to calculate earnings credits (amounts available to offset service fees) for the marginal reserve requirement adjusted portion of clearing balances at the federal funds rate.40

Clearing balances were introduced in 1981, as a part of the Board’s implementation of the Monetary Control Act, to facilitate access to Federal Reserve priced services by institutions that did not have sufficient reserve balances to support the settlement of their payment transactions. The earnings credit calculation uses a percentage discount on a rolling thirteen-week average of the annualized coupon equivalent yield of three-month Treasury bills in the secondary market. Earnings credits, which are calculated monthly, can be used only to offset charges for priced services and expire if not used within one year.41

E. Check Service � Table 8 below shows the 2005, 2006 estimate, and 2007 budgeted cost recovery performance for the commercial check service.

| Year | 1 Revenue |

2 Total Expense |

3 Net Income (ROE) [1-2] |

4 Target ROE |

5 Recovery Rate After Target ROE [1/(2+4)] |

|---|---|---|---|---|---|

| 2005 | 817.5 | 688.7 | 128.7 | 82.0 | 106.1% |

| 2006 (estimate) | 837.4 | 710.8 | 126.6 | 57.1 | 109.1%a |

| 2007 (budget) | 784.3 | 709.9 | 74.4 | 63.2 | 101.5% |

a. Including FAS 158, the estimated cost recovery for the check service is 78.0%. Return to text.

1. 2006 Estimate � For 2006, the Reserve Banks estimate that the check service will recover 109.1 percent of total expenses and targeted ROE, compared with the budgeted recovery rate of 102.4 percent. The Reserve Banks expect to recover all actual and imputed expenses of providing check services and earn net income of $126.6 million (see table 8).

The higher-than-budgeted cost recovery is the result of revenue that was $103.0 million higher than expected, which was partially offset by expenses that were $50.7 million greater than budgeted. The higher revenue is due to greater-than-budgeted electronic check collection and paper check return volumes, as well as greater-than-expected NICB. The higher costs were largely due to greater-than-budgeted personnel and materials costs related to Check 21 substitute check printing, pension costs, and imputed taxes.

The greater-than-expected electronic check volume can be attributed to faster-than-anticipated adoption of Check 21 products. The number of checks deposited and presented electronically has grown steadily in 2006 (see table 9). Year-to-date through August 2006, 10.3 percent of the Reserve Banks� volume was deposited and 2.2 percent was presented using Check 21 products.42 Depository institutions have been slower to accept check presentments electronically because financial incentives are generally stronger for electronic check deposit and because integrating electronic presentments into back-office processing and risk-management systems can be a complex and expensive undertaking.

Year-to-date figures, however, understate the current penetration rate of Check 21 products, as volume has increased throughout 2006. In August 2006, the Check 21 deposit penetration rate rose to 16.6 percent. This volume represents 42 percent of the value of checks collected through the Reserve Banks because many depository institutions are using Check 21 products to collect their higher value checks more rapidly. Recent trends, however, indicate that the average value of checks deposited using Check 21 products will decline because an increasing number of depository institutions are choosing to clear all of their checks using these products.

a. Deposit and presentment statistics are calculated as a percentage of total forward collection volume. Return statistics are calculated as a percentage of total return volume. Return to text.

For full-year 2006, the Reserve Banks estimate that paper forward-collection volume will decline 17.1 percent compared with a budgeted decline of 14.0 percent as more volume is deposited electronically (see table 10). Through August, paper forward-collection volume has decreased 16.6 percent compared with the same period in 2005. Through August, paper return check volume has decreased 17.5 percent from the same period in 2005. The Reserve Banks estimate that paper return volume will decline 21.2 percent for the full year compared with a budgeted decline of 31.7 percent.

| Budgeted 2006 Change |

Actual Change Through August 2006 |

Estimated 2006 Change |

|

|---|---|---|---|

| Total forward collection |

(14.0) | (16.6) | (17.1) |

| Returns | (31.7) | (17.5) | (21.2) |

2. 2007 Pricing � In 2007, the Reserve Banks project that the check service will recover 101.5 of total expenses and targeted ROE.

Revenue is projected to be $784.3 million, a decline of 6.2 percent compared with the 2006 estimate. This decline is driven by a $121.7 million drop in paper check fee revenue that is partially offset by a $52.7 million increase in Check 21 fee revenue.

Total expenses for the check service are projected to be $709.9 million, representing a $0.9 million decline. Increases in the pension costs and one-time expenses associated with the Check 21 initiative and the consolidation of check-processing offices will be offset by ongoing cost savings associated with projected declines in paper-check volume and efficiency improvements at restructuring sites. These cost reductions should enable the Reserve Banks to maintain full cost recovery. A key driver in the reduction of local check costs is the planned restructuring of four more check-processing sites by the second quarter of 2008.44

The Reserve Banks project that paper-check volume for forward products will decrease 24.0 percent, volume for return products will decrease 21.3 percent, and volume for payor bank products will decrease 5.5 percent. These expected volume declines will be partially offset by a projected increase in Check 21 volumes (see table 11). The Reserve Banks project that FedForward volume will increase 97.1 percent, FedReturn volume will increase 112.3 percent and FedReceipt Plus volume will increase 342.8 percent. The Reserve Banks� projected increase in Check 21 volume will result in a 49.5 percent increase in Check 21 product revenue to about $159 million. Board and Reserve Bank staff believe that the key to realizing Check 21 cost efficiencies for the System continues to be the widespread acceptance of electronic check presentments by paying banks.

| 2007 Budgeted Volume (millions of items) |

Growth From 2006 Estimates (percent) |

|

|---|---|---|

| FedForward | 2,636.4 | 97.1 |

| FedReturn | 44.7 | 112.3 |

| FedReceipt Plus |

1,686.8 | 342.8 |

In 2007, the Reserve Banks will continue to encourage the adoption of electronic check collection and presentment alternatives through price increases to paper-check products and price reductions for strategic electronic products. The price increases for paper products generally are distributed across most product categories, with generally higher price increases for nonstrategic product lines. The Reserve Banks also will continue to narrow the price ranges for

similar products across the System. In addition, the Reserve Banks will offer depository institutions greater incentives to deposit and accept checks electronically. As the use of Check 21-related products increases, the prices of paper products may be raised further to encourage adoption of electronic check collection and presentment alternatives.

For 2007, the Reserve Banks are targeting an overall price increase for paper-check services of 6.0 percent, including a 5.0 percent increase in forward-check collection fees and a 9.6 percent increase in return-services fees (see table 12). In addition, prices for payor bank services will increase 8.1 percent. To encourage further the adoption of electronic presentment, the Reserve Banks will decrease 12.5 percent the price for Check 21 items that are presented electronically, and increase 3.1 percent the price for Check 21 items that are presented as substitute checks. In addition, the Reserve Banks will offer a $0.003 discount per check presented through FedReceipt products to further encourage their adoption. This discount will be applied to fees for checks deposited with the Reserve Banks.

| Product | Fee Change |

|---|---|

| Paper check | 6.0 |

| Forward collection | 5.0 |

| Returns | 9.6 |

| Payor bank services | 8.1 |

| Check 21 | |

| FedForward (electronic endpoints) | (12.5) |

| FedForward (substitute check endpoints) | 3.1 |

| FedReturn | 0.0 |

| FedReceipt products | $(0.003)a |

a. FedReceipt customers will receive a $0.003 discount per check presented. The discount can be used to offset fees for checks they deposit with the Reserve Banks. Return to text.

The primary risks to meeting the Reserve Banks� budgeted 2007 cost recovery are higher-than-expected declines in paper check volume and slower-than-expected adoption by paying banks of FedReceipt products, as the manual processes associated with printing substitute checks and preventing duplicate checks from entering the processing environment will exert upward pressure on staffing levels and costs. Competitive pressure from direct electronic exchanges also poses a risk to the Reserve Banks� projected cost recovery. Other risks include unanticipated problems with check office restructurings or other major initiatives that may result in significant cost overruns.

F. FedACH Service � Table 13 below shows the 2005, 2006 estimate, and 2007 budgeted cost recovery performance for the commercial FedACH service.

Table 13

FedACH Pro Forma Cost and Revenue Performance

($ millions)

| Year | 1 Revenue |

2 Total Expense |

3 Net Income (ROE) [1-2] |

4 Target ROE |

5 Recovery Rate After Target ROE [1/(2+4)] |

|---|---|---|---|---|---|

| 2005 | 87.4 | 72.2 | 15.2 | 10.0 | 106.4% |

| 2006 (estimate) | 89.7 | 81.2 | 8.5 | 7.5 | 101.1%a |

| 2007 (budget) | 99.9 | 89.5 | 10.4 | 8.8 | 101.6% |

a. Including FAS 158, the estimated cost recovery for the FedACH service is 72.6%. Return to text.

1. 2006 Estimate � The Reserve Banks estimate that the FedACH service will recover 101.1 percent of total expenses and targeted ROE, compared with the budgeted recovery rate of 101.6 percent. The Reserve Banks expect to recover all actual and imputed expenses of providing FedACH services and earn net income of $8.5 million. Through August, FedACH commercial origination volume is 11.9 percent higher than the same period last year. For full-year 2006, the Reserve Banks estimate that FedACH originations will grow 12.4 percent, compared with the budgeted growth of 7.6 percent, because of greater-than-expected volume from Electronic Payments Network (EPN), the other ACH operator.

2. 2007 Pricing � The Reserve Banks will maintain processing and service fees at current levels with one exception. The monthly subscription fee for the Information Extract File will increase from $10 to $20.45 Pricing for this service has remained at $10 since its inception in 1998, and the higher price more accurately reflects the value of the file to the receiving depository institution.

The Reserve Banks project that the FedACH service will recover 101.6 percent of total expenses and targeted ROE in 2007. Total revenue is budgeted to increase $10.2 million from the 2006 estimate. Nationwide ACH volumes are expected to continue growing at double digit rates. This expected growth is largely attributable to volume increases associated with electronic check conversion applications � including checks converted at lockboxes or at the point of purchase. In early 2007, ACH rule changes will permit checks to be converted in processing centers or back offices, spurring further growth in ACH check conversion volume. The Reserve Banks expect FedACH commercial origination volume to grow by 12.0 percent. The primary risk to meeting the Reserve Banks� budgeted 2007 cost recovery is the loss of large ACH originators to EPN. Total expenses are budgeted to increase $8.3 million over the 2006 estimate. The Reserve Banks have budgeted increased costs for product development and service initiatives, such as FedACH risk management services.

G. Fedwire Funds and National Settlement Services � Table 14 below shows the 2005, 2006 estimate, and 2007 budgeted cost recovery performance for the Fedwire Funds and National Settlement Services.

Table 14

Fedwire Funds and National Settlement Services

Pro Forma Cost and Revenue Performance

($ millions)

| Year | 1 Revenue |

2 Total Expense |

3 Net Income (ROE) [1-2] |

4 Target ROE |

5 Recovery Rate After Target ROE [1/(2+4)] |

|---|---|---|---|---|---|

| 2005 | 67.3 | 55.2 | 12.1 | 7.9 | 106.7% |

| 2006 (estimate) | 71.3 | 59.7 | 11.6 | 5.6 | 109.1%a |

| 2007 (budget) | 72.7 | 64.7 | 8.0 | 6.3 | 102.3% |

a. Including FAS 158, the estimated cost recovery for the Fedwire Funds and National Settlement Services is 78.6%. Return to text.

1. 2006 Estimate � The Reserve Banks estimate that the Fedwire Funds and National Settlement Services will recover 109.1 percent of total expenses and targeted ROE, compared with a 2006 budgeted recovery rate of 105.4 percent. The greater-than-expected recovery rate is primarily attributed to higher-than-expected electronic connection revenue and NICB, which offsets slightly lower-than-expected fee revenue, as well as lower-than-budgeted operating costs. Through August 2006, online funds volume was 1.2 percent higher than it was for the same period last year. For full-year 2006, the Reserve Banks estimate that online funds volume will remain flat, compared with a budgeted growth of 3.0 percent, as they lose market share to CHIPS, their primary competitor. With respect to the National Settlement Service, the Reserve Banks estimate that the volume of settlement entries processed during 2006 will be 4.3 percent higher than the 2006 budget projection of flat growth.

2. 2007 Pricing � The Reserve Banks will decrease the online transfer fee by one cent in all pricing tiers and to raise the surcharge for offline transfers from $20 to $30. The one cent price reduction for online transfers should mitigate potential volume losses to CHIPS while the offline surcharge increase is intended to provide incentives for offline customers to migrate to online access.

In 2007, the Reserve Banks expect the Fedwire Funds and National Settlement Services to recover 102.3 percent of total expenses and targeted ROE. The Reserve Banks project 2007 total revenue to increase $1.4 million compared with the 2006 estimate. Total expenses for 2007 are budgeted to increase $5.0 million from the 2006 estimate primarily because of security and technology investments, including the cost of network modernization and enhancements to resiliency. Online volumes for 2007 are budgeted to remain flat compared with 2006 estimates.

H. Fedwire Securities Service � Table 15 shows the 2005, 2006 estimate, and 2007 budgeted cost recovery performance for the Fedwire Securities Service.46

Table 15

Fedwire Securities Service Pro Forma Cost

and Revenue Performance

($ millions)

| Year | 1 Revenue |

2 Total Expense |

3 Net Income (ROE) [1-2] |

4 Target ROE |

5 Recovery Rate After Target ROE [1/(2+4)] |

|---|---|---|---|---|---|

| 2005 | 21.3 | 17.4 | 3.8 | 2.9 | 104.7% |

| 2006 (estimate) | 21.8 | 19.3 | 2.5 | 1.8 | 103.7%a |

| 2007 (budget) | 23.3 | 20.9 | 2.4 | 2.0 | 101.6% |

a. Including FAS 158, the estimated cost recovery for the Fedwire Securities Service is 65.1%. Return to text.

1. 2006 Estimate � The Reserve Banks estimate that the Fedwire Securities Service will recover 103.7 percent of total expenses and targeted ROE, compared with a 2006 budgeted recovery rate of 105.6 percent. The lower-than-budgeted recovery is attributable to lower-than-expected fee revenue. The shortfall in fee revenue, however, is partially offset by higher-than-expected NICB revenue and lower-than-budgeted operating costs. Through August 2006, online securities volume was 3.3 percent lower than it was during the same period last year. For full-year 2006, the Reserve Banks estimate that online securities volume will be 3.0 percent lower than the 2006 budget projection. The lower-than-budgeted volume is due to a slowdown in mortgage financing.

2. 2007 Pricing � The Reserve Banks will increase the online transfer fee by two cents, increase the monthly maintenance fee from $15 to $16, and raise the offline transfer origination and receipt surcharge from $50 to $60. The increases will more closely align the fee and surcharges with the costs of providing these services.

The Reserve Banks project that the Fedwire Securities Service will recover 101.6 percent of total expense and targeted ROE in 2007. Total revenue is budgeted to increase $1.5 million from the 2006 estimate. Total expenses are expected to increase $1.6 million from the 2006 estimate. The Reserve Banks continue to invest in new technologies to migrate the Fedwire Securities Service applications to a distributed processing platform. Online and offline securities volumes in 2007 are projected to be unchanged against 2006 estimates.

I. Electronic Access � The Reserve Banks allocate the costs and revenues associated with electronic access to the Reserve Banks� priced services.47 There are currently four types of electronic access channels through which customers can access the Reserve Banks� priced services: FedPhone�, FedMail�, FedLine�, and Computer Interface (mainframe to mainframe).48 For 2007, the Reserve Banks will make changes to simplify the electronic access pricing structure by offering packaged solutions that include electronic access and accounting information services and eliminating a number of discrete service fees.

The Reserve Banks will offer seven electronic access packages that are supplemented by a number of premium (or � la carte) access and accounting information options. The first package provides access to information services through FedMail Email. The next two packages are FedLine Web packages, with three or five subscribers, that offer access to basic information and check services. The next two packages are FedLine Advantage packages, with three or five subscribers, that build upon the FedLine Web packages and offer access to FedACH and Fedwire services. The final two packages are FedLine Command and FedLine Direct, which allow for unattended connections over the Internet or through dedicated connections. FedLine Command is designed for FedACH functionality, while FedLine Direct, which is the replacement channel for Computer Interface customers, has both FedACH and Fedwire functionality. Both FedLine Command and FedLine Direct build upon the FedLine Advantage packages and include most accounting information services. The packaging of services will allow the Reserve Banks to eliminate many of the discrete fees associated with electronic access and accounting information services, such as setup fees, individual subscriber fees, and accounting report fees. The seven electronic access packages were developed based on current usage patterns and market studies.

In addition to the packaging of electronic access and accounting information services, the Reserve Banks will offer other changes to electronic access pricing for 2007. In particular, the Reserve Banks will begin charging $15 per month for FedMail Email for customers who only use the FedMail Email channel to access the Reserve Banks� priced services. Customers who access Reserve Banks� priced services through a FedLine connection will receive FedMail Email as part of their packaged solution. FedMail Fax will increase from $15 to $25 and will be offered only as a premium option. The Reserve Banks also will increase fees on FedLine Direct customers. The fee increases will be used, in part, to recover the costs of building and deploying the new Internet Protocol-based FedLine Direct access channel. FedLine Direct and the access channel that it is replacing, Computer Interface, are used by high volume customers, which are typically the largest depository institutions.

II. ANALYSIS OF COMPETITIVE EFFECT

All operational and legal changes considered by the Board that have a substantial effect on payments system participants are subject to the competitive impact analysis described in the March 1990 policy, “The Federal Reserve in the Payments System.�49 Under this policy, the Board assesses whether the changes would have a direct and material adverse effect on the ability of other service providers to compete effectively with the Federal Reserve in providing similar services because of differing legal powers or constraints or because of a dominant market position deriving from such legal differences. If the change creates such an effect, the Board must further evaluate the change to assess whether its benefits � such as contributions to payment system efficiency, payment system integrity, or other Board objectives � can be retained while minimizing the adverse effect on competition.

The Board believes that the 2007 fees, fee structures, or changes in service will not have a direct and material adverse effect on the ability of other service providers to compete effectively with the Reserve Banks in providing similar services. The changes should permit the Reserve Banks to earn an ROE that is comparable to overall market returns.

FedACH Service 2007 Fee Schedule

Effective January 2, 2007. Bold indicates changes from 2006 prices.

| Fee | |

| Origination (per item or record):50 | |

| Items in small files | $0.0030 |

| Items in large files | $0.0025 |

| Addenda record | $0.0010 |

Input file processing fee (per file): |

$2.50 |

Receipt (per item or record):51 |

|

| Item | $0.0025 |

| Addenda record | $0.0010 |

Risk Product: |

|

| Risk service subscription |

$20.00 /RTN /month |

| Risk origination monitoring criteria |

$15.00 /set of criteria /month |

| Risk origination monitoring batch |

$0.0025 /batch |

Monthly fee (per routing number): |

|

| Account servicing fee52 | $25.00 |

| FedACH settlement53 | $20.00 |

| Information extract file | $20.00 |

FedLine Web origination returns and notification of change (NOC) fee:54 |

$0.30 |

| Voice response returns/NOC fee:55 | $2.00 |

Non-electronic input/output fee:56 |

|

| Tape input/output | $25.00 |

| Paper output | $15.00 |

| Facsimile exception returns/NOC57 | $15.00 |

Canadian cross-border fee: |

|

| Cross-border item surcharge58 | $0.039 |

| Return received from Canada59 | $0.77 |

| Same-day recall of item at receiving gateway operator | $4.00 |

| Same-day recall of item not at receiving gateway operator | $7.00 |

| Trace of item at receiving gateway | $3.50 |

| Trace of item not at receiving gateway | $5.00 |

Mexico service fee: |

|

| Cross-border item surcharge58 | $0.67 |

| Return received from Mexico59 | $0.69 |

| Item trace | $11.50 |

Transatlantic service fee: |

|

| Cross-border item surcharge58 | |

| Austria | $2.00 |

| Germany | $2.00 |

| The Netherlands | $2.00 |

| Switzerland | $2.00 |

| United Kingdom | $2.00 |

| Return received59 | |

| Austria | $5.00 |

| Germany | $8.00 |

| The Netherlands | $5.00 |

| Switzerland | $5.00 |

| United Kingdom | $8.00 |

Fedwire Funds and National Settlement Services

2007 Fee Schedule

Effective January 2, 2007. Bold indicates changes from 2006 prices.

| Fedwire Funds Service | |

| Fee | |

| Basic volume-based transfer fee (originations and receipts) | |

| Per transfer for the first 2,500 transfers per month | $0.29 |

| Per transfer for additional transfers up to 80,000 per month | $0.19 |

| Per transfer for every transfer over 80,000 per month | $0.09 |

Surcharge for offline transfers (originations and receipts) |

$30.00 |

National Settlement Service |

|

| Basic | |

| Settlement entry fee | $0.80 |

| Settlement file fee | $14.00 |

Surcharge for offline file origination |

$25.00 |

Minimum monthly charge (account maintenance)60 |

$60.00 |

Special settlement arrangements61 |

|

| Fee per day | $100.00 |

Fedwire Securities Service 2007 Fee Schedule

(Non-Treasury Securities)

Effective January 2, 2007. Bold indicates changes from 2006 prices.

| Fee | |

| Basic transfer fee | |

| Transfer or reversal originated or received | $0.34 |

Surcharge |

|

| Offline transfer or reversal originated or received | $60.00 |

Monthly maintenance fees |

|

| Account maintenance (per account) | $16.00 |

| Issues maintained (per issue/per account) | $0.40 |

Claim adjustment fee |

$0.30 |

Joint custody fee |

$40.00 |

Electronic Access 2007 Fee Schedule

Effective January 2, 2007 (unless otherwise indicated). Bold indicates changes from 2006 prices.

| ELECTRONIC ACCESS PACKAGES (MONTHLY) | ||

FedMail Email |

$15.00 |

|

FedLine Web W3 |

$80.00 |

|

| Includes: | FedMail Email FedLine Web with three individual subscriptions Service Charge Information (SCI) Account Management Information (AMI) * Premium options limited to FedMail Fax and electronic access training |

|

FedLine Web W5 |

$125.00 |

|

| Includes: | FedMail Email FedLine Web with five individual subscriptions Service Charge Information (SCI) Account Management Information (AMI) Cash Management System Basic - Own report only |

|

FedLine Advantage A3 |

$300.00 |

|

| Includes: | FedLine Web W3 package FedLine Advantage with three individual subscriptions Virtual Private Network (VPN) maintenance * Premium options limited to FedMail Fax and electronic access training |

|

FedLine Advantage A5 |

$350.00 |

|

| Includes: | FedLine Web W5 package FedLine Advantage with five individual subscriptions VPN maintenance Intraday search download feature within AMI |

|

FedLine Command |

$650.00 |

|

| Includes: | FedLine Advantage A5 package One dedicated unattended connection over the Internet for ACH services Billing Data Format File (BDFF) Intra-Day File End-of-Day File (FIRD) Statement of Account Spreadsheet File (SASF) |

|

| FedLine Direct D56, D256, DT1 | D56 $2,000.00, D256 $3,000.00, and DT1 $3,500.00 |

| Includes: FedLine Command package One dedicated unattended connection for Computer Interface or FedLine Direct |

|

PREMIUM OPTIONS |

||

Electronic Access |

||

FedMail Fax (monthly per fax line) |

$25.00 |

|

Additional subscribers package (each package contains 5 additional subscribers) |

$75.00 | |

Maintenance of additional VPN |

$50.00 |

|

Additional dedicated connections62 |

||

| Primary: |

56K - $750.00 256K - $1,750.00 T1 - $2,250.00 |

|

| Contingency: | 56K - $650.00 256K - $1,650.00 T1 - $2,150.00 |

|

FedImage/Check 21 Large File Delivery |

Various |

|

Accounting Information Services |

||

Cash Management System |

||

| Basic � Respondent and/or subaccount reports (per report/month) |

$7.00 |

|

| Basic � Respondent/subaccount recap report (per month) |

$35.00 |

|

| Plus � Own report up to six times a day (per month) |

$50.00 |

|

| Plus � Fewer than 10 respondent and/or subaccounts and SASF (per month) |

$100.00 |

|

| Plus � 10 or more respondent and/or subaccounts and SASF (per month) |

$200.00 |

|

End-of-day reconcilement file (FIRD) (per month) |

$100.00 |

|

Statement of account spreadsheet file (SASF) (per month) |

$100.00 | |

Intraday search download file (per month) |

$100.00 |

|

By order of the Board of Governors of the Federal Reserve System, November 14, 2006.

Robert deV. Frierson

Deputy Secretary of the Board.

1. The ten-year recovery rate is based upon the pro forma income statements for the Federal Reserve Banks� priced services published in the Board's Annual Report. Return to text.

2. FedACH and Fedwire are registered servicemarks of the Reserve Banks. Return to text.

3. As used in this context, the term “shareholder� does not refer to the actual member banks of the Federal Reserve System, but rather to the implied shareholders who would have an ownership interest if the Federal Reserve priced services were provided by a private firm. Return to text.

4. Before FAS 158, generally accepted accounting principles (GAAP) required employers with pension and other postretirement benefit plans to disclose the funded status of the plans in their financial statement footnotes. Return to text.

5. The cost of equity increased due to an increase in the ROE, which is slightly offset by a reduction in imputed equity. Return to text.

6. In the first half of 2006, the GDP price index grew at an annualized rate of 3.3 percent. Return to text.

7. A portion of clearing balances is used as a funding source for priced-services assets. Long-term assets are partially funded from core clearing balances, which are currently $4 billion. Core clearing balances are considered the portion of the balances that has remained stable over time without regard to the magnitude of actual clearing balances. Return to text.

8. As mentioned in footnote 3, the term “shareholder� does not refer to the actual member banks of the Federal Reserve System, but rather to the implied shareholders who would have an ownership interest if the Federal Reserve priced services were provided by a private firm. Return to text.

9. The FDIC requirements for a well-capitalized depository institution are 1) a ratio of total capital to risk-weighted assets of 10 percent or greater; and 2) a ratio of Tier 1 capital to risk-weighted assets of 6 percent or greater; and 3) a leverage ratio of Tier 1 capital to total assets of 5 percent or greater. The Federal Reserve priced services balance sheet has no components of Tier 1 or total capital other than equity; therefore, requirements 1 and 2 are essentially the same measurement. Return to text.

10. Other taxes, such as sales taxes, are included in priced-services actual or imputed costs. Return to text.

11. The investment portfolio is composed of investments comparable to a BHC’s investment holdings, such as short-term Treasury securities, government agency securities, commercial paper, long-term corporate bonds, and money market funds. See table 7 for the investments imputed in 2007. Return to text.

12. NICB is projected to be $139.6 million for 2007 using a constant spread of 29 basis points over the three-month Treasury bill, and applying this rate to the clearing balance levels used in the 2007 pricing process. The 2006 NICB estimate is $113.2 million. Return to text.

13. July 2006 rates and balances were used to estimate the 2007 NICB. Return to text.

14. Previously, GAAP required employers with pension and other postretirement benefit plans to disclose these deferred elements in their financial statement footnotes. Return to text.

15. The costs associated with pension and postretirement benefits as recognized under GAAP have always been allocated to the priced services income statement as direct or indirect expense items. Return to text.

16. Although recognizing the deferred elements will result in a decrease to the pension asset and equity in 2006, the Reserve Banks could have increases or decreases to these balance sheet items in future years. Return to text.

17. Other financial accounting standards require that future tax consequences of events be recognized in an entity’s financial statements. FAS 158 requires employers to compute the AOCI adjustment net of tax. Return to text.

18. Although recognizing the deferred elements would result in an increase to the benefits liability and decrease to equity in 2006, the Reserve Banks could have increases or decreases to these balance sheet items in future years. Return to text.

19. Under current reporting requirements, FAS 158 adjustments to equity via AOCI would be included in the calculation of Tier 1 capital for regulatory purposes, thus reducing priced-services equity to below the well-capitalized threshold. Return to text.

20. The Federal Reserve priced services could elect to restore equity to an adequate, but less than well-capitalized, level and incur the resulting FDIC assessment. Return to text.

21. The value of equity reported in the pro forma priced services balance sheet is assumed to equal the market value of equity. Because priced-services fees are set to maintain this implied shareholder value (that is, not to substantially over or underrecover), the targeted ROE equals the market return these shareholders would expect priced services to earn, or recover, each year. Return to text.

22. Represents float that is directly estimated at the service level. Return to text.

23. Includes allocations of Board of Governors� assets to priced services of $1.4 million for 2006 and $1.2 million for 2007. Return to text.

24. No debt is imputed because clearing balances are used as an available funding source. Return to text.

25. The effect of the initial AOCI entry on the 2006 AOCI average daily balance is immaterial because this entry is made on December 31, 2006. The 2007 AOCI average daily balance is $(361.0) million. Return to text.

26. Clearing balances shown in table 3 are available for financing priced-services assets. Using these balances reduces the amount available for investment in the NICB calculation. Long-term assets are financed with long-term liabilities and with core clearing balances; a total of $4 billion in balances is available for this purpose. Short-term assets are financed with clearing balances not used to finance long-term assets. No short- or long-term debt is imputed. Return to text.

27. See table 6 for calculation of required imputed equity amount. Return to text.

28. The interest rate sensitivity analysis evaluates the level of interest rate risk presented by the difference between rate-sensitive assets and liabilities. The analysis reviews the ratio of rate-sensitive assets to rate-sensitive liabilities and the effect on cost recovery of a change in interest rates of up to 200 basis points. Return to text.

29. The amount designated rate-sensitive represents the amount of cash items in process of collection that have been credited to customers prior to settlement. Return to text.

30. The amount designated rate-insensitive represents clearing balances on which earnings credits are not paid. Return to text.

31. The effect of a potential change in rates is less than a 2 percentage point change in cost recovery; therefore, no long-term debt is imputed for 2007. Return to text.

32. No short-term debt is imputed because clearing balances are used as a funding source for those assets that are not financed with short-term payables. Return to text.

33. No long-term debt is imputed because clearing balances are used as a funding source. Return to text.

34. Based on the FDIC’s definition of a well-capitalized institution for purposes of assessing insurance premiums. Return to text.

35. The 2007 ROE is equal to a risk-free rate plus a risk premium (beta*market risk premium). The 2007 after-tax CAPM ROE is calculated as 5.18% + (1*5.64%) = 10.82%. Using a tax rate of 31.5%, the after-tax ROE is converted into a pretax ROE, which results in a pretax ROE of (10.82% / (1-31.5%)) = 15.8%. Return to text.

36. System 2007 budgeted priced services expenses less shipping are $811.1 million. Return to text.

37. The imputed investments are assumed to be similar to those for which rates are available on the Federal Reserve’s H.15 statistical release, which can be located at http://www.federalreserve.gov/releases/h15/data.htm. Return to text.

38. The imputed mutual fund investment is based on Vanguard’s GNMA Fund Investor Shares fund, which was chosen based on the investment strategies articulated in its prospectuses. The fund returns can be located at https://flagship.vanguard.com/VGApp/hnw/FundsByType. Return to text.

39. Two adjustments are applied to the earnings credit rate so that the return on clearing balances at the Federal Reserve is comparable to what the depository institution (DI) would have earned had it maintained the same balances at a private-sector correspondent. The “imputed reserve requirement� adjustment is made because a private-sector correspondent would be required to hold reserves against the respondent’s balance with it. As a result, the correspondent would reduce the balance on which it would base earnings credits for the respondent because it would be required to hold a portion, determined by its marginal reserve ratio, in the form of non-interest-bearing reserves. For example, if a DI held $1 million in clearing balances with a correspondent bank and the correspondent had a marginal reserve ratio of 10 percent, then the correspondent bank would be required to hold $100,000 in reserves, and it would typically grant credits to the respondent based on 90 percent of the balance, or $900,000. This adjustment imputes a marginal reserve ratio of 10 percent to the Reserve Banks.

The “marginal reserve requirement� adjustment accounts for the fact that the respondent can deduct balances maintained at a correspondent, but not the Federal Reserve, from its reservable liabilities. This reduction has value to the respondent when it frees up balances that can be invested in interest-bearing instruments, such as federal funds. For example, a respondent placing $1 million with a correspondent rather than the Federal Reserve would free up $30,000 if its marginal reserve ratio were 3 percent.

The formula used by the Reserve Banks to calculate earnings credits can be expressed as

e = [ b * (1-FRR) * r] + [ b * (MRR) * f]

Where e is total earnings credits, b is the average clearing balance maintained, FRR is the assumed Reserve Bank marginal reserve ratio (10 percent), r is the earnings credit rate, MRR is the marginal reserve ratio of the DI holding the balance (either 0 percent, 3 percent, or 10 percent), and f is the average federal funds rate. A DI that meets its reserve requirement entirely with vault cash is assigned a marginal reserve requirement of zero. Return to text.

40. This calculation adjusts earnings credits as though account holders could adjust their reserve requirement for a “due from deduction� for clearing balances held with a Reserve Bank. Return to text.

41. A band is established around the contracted clearing balance to determine the maximum balance on which credits are earned as well as any deficiency charges. The clearing balance allowance is 2 percent of the contracted amount, or $25,000, whichever is greater. Earnings credits are based on the period-average balance maintained up to a maximum of the contracted amount plus the clearing balance allowance. Deficiency charges apply when the average balance falls below the contracted amount less the allowance, although credits are still earned on the average maintained balance. Return to text.

42. The Reserve Banks also offer non-Check 21 electronic presentment products. In August 2006, 26.0 percent of the Reserve Banks� deposit volume was presented to paying banks using these products. The majority of checks presented through non-Check 21 electronic presentment products are delivered to the paying banks. Return to text.

43. The Reserve Banks� Check 21 product suite includes FedForward, FedReturn, and FedReceipt. FedForward is the electronic alternative to forward check collection; FedReturn is the electronic alternative to paper check return; and FedReceipt products are electronic receipt of Check 21 items. Under FedReceipt, the Reserve Banks electronically present only the checks that were deposited electronically or that were deposited in paper form and converted into electronics by the Reserve Banks. Under FedReceipt Plus, the Reserve Banks electronically present all checks drawn on the customer. Return to text.

44. In February 2003, the Reserve Banks announced an initiative to reduce the number of sites at which they process checks from forty-five to thirty-two. The Reserve Banks announced further rounds of restructurings in August 2004, May 2005, and May 2006. By the end of these announced restructurings in early 2008, the Reserve Banks will have eighteen check processing sites. Return to text.