On August 4, 2003, the agencies issued an advance notice of proposed rulemaking (ANPR) (68 FR 45900) that sought public comment on a new risk-based regulatory capital framework based on the Basel Committee on Banking Supervision (BCBS)2 April 2003 consultative paper entitled "The New Basel Capital Accord" (Proposed New Accord). The Proposed New Accord set forth a "three pillar" framework encompassing risk-based capital requirements for credit risk, market risk, and operational risk (Pillar 1); supervisory review of capital adequacy (Pillar 2); and market discipline through enhanced public disclosures (Pillar 3). The Proposed New Accord incorporated several methodologies for determining a bank's risk-based capital requirements for credit, market, and operational risk.3

The ANPR sought comment on selected regulatory capital approaches contained in the Proposed New Accord that the agencies believe are appropriate for large, internationally active U.S. banks. These approaches include the internal ratings-based (IRB) approach for credit risk and the advanced measurement approaches (AMA) for operational risk (together, the advanced approaches). The IRB framework uses risk parameters determined by a bank's internal systems in the calculation of the bank's credit risk capital requirements. The AMA relies on a bank's internal estimates of its operational risks to generate an operational risk capital requirement for the bank. The ANPR included a number of questions highlighting various issues for the industry's consideration. The agencies received approximately 100 public comments on the ANPR from banks, trade associations, supervisory authorities, and other interested parties. These comments addressed the agencies' specific questions as well as a range of other issues. Commenters generally encouraged further development of the framework, and most supported the overall direction of the ANPR. Commenters did, however, raise a number of conceptual and technical issues that they believed required additional consideration.

Since the issuance of the ANPR, the agencies have worked domestically and with other BCBS member countries to modify the methodologies in the Proposed New Accord to reflect comments received during the international consultation process and the U.S. ANPR comment process. In June 2004, the BCBS issued a document entitled "International Convergence of Capital Measurement and Capital Standards: A Revised Framework" (New Accord or Basel II). The New Accord recognizes developments in financial products, incorporates advances in risk measurement and management practices, and assesses capital requirements that are generally more sensitive to risk. It is intended for use by individual countries as the basis for national consultation and implementation. Accordingly, the agencies are issuing this proposed rule to implement the New Accord for banks in the United States.

The framework outlined in this proposal (IRB framework) is intended to produce risk-based capital requirements that are more risk-sensitive than the existing risk-based capital rules of the agencies (general risk-based capital rules). The proposed framework seeks to build on improvements to risk assessment approaches that a number of large banks have adopted over the last decade. In particular, the proposed framework requires banks to assign risk parameters to exposures and provides specific risk-based capital formulas that would be used to transform these risk parameters into risk-based capital requirements.

The proposed framework is based on the "value-at-risk" (VaR) approach to measuring credit risk and operational risk. VaR modeling techniques for measuring risk have been the subject of economic research and are used by large banks. The proposed framework has benefited significantly from comments on the ANPR, as well as consultations organized in conjunction with the BCBS's development of the New Accord. Because bank risk measurement practices are both continually evolving and subject to model and other errors, the proposed framework should be viewed less as an effort to produce a statistically precise measurement of risk, and more as an effort to improve the risk sensitivity of the risk-based capital requirements for banks.

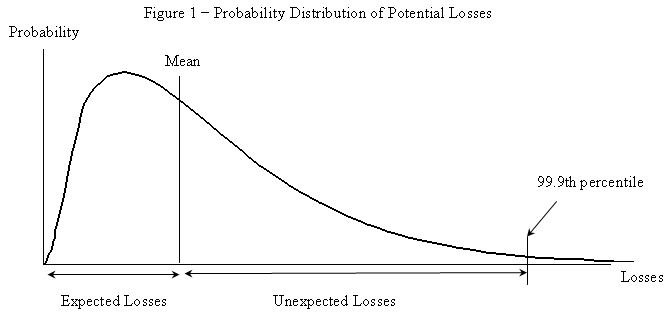

The proposed framework's conceptual foundation is based on the view that risk can be quantified through the assessment of specific characteristics of the probability distribution of potential losses over a given time horizon. This approach assumes that a suitable estimate of that probability distribution, or at least of the specific characteristics to be measured, can be produced. Figure 1 illustrates some of the key concepts associated with the proposed framework. The figure shows a probability distribution of potential losses associated with some time horizon (for example, one year). It could reflect, for example, credit losses, operational losses, or other types of losses.

The area under the curve to the right of a particular loss amount is the probability of experiencing losses exceeding this amount within a given time horizon. The figure also shows the statistical mean of the loss distribution, which is equivalent to the amount of loss that is "expected" over the time horizon. The concept of "expected loss" (EL) is distinguished from that of "unexpected loss" (UL), which represents potential losses over and above the expected loss amount. A given level of unexpected loss can be defined by reference to a particular percentile threshold of the probability distribution. In the figure, for example, the 99.9th percentile is shown. Unexpected losses, measured at the 99.9th percentile level, are equal to the value of the loss distribution corresponding to the 99.9th percentile, less the amount of expected losses. This is shown graphically at the bottom of the figure.

The particular percentile level chosen for the measurement of unexpected losses is referred to as the "confidence level" or the "soundness standard" associated with the measurement. If capital is available to cover losses up to and including this percentile level, then the bank will remain solvent in the face of actual losses of that magnitude. Typically, the choice of confidence level or soundness standard reflects a very high percentile level, so that there is a very low estimated probability that actual losses would exceed the unexpected loss amount associated with that confidence level or soundness standard.

Assessing risk and assigning regulatory capital requirements by reference to a specific percentile of a probability distribution of potential losses is commonly referred to as a VaR approach. Such an approach was adopted by the FDIC, Board, and OCC for assessing a bank's risk-based capital requirements for market risk in 1996 (market risk amendment or MRA). Under the MRA, a bank's own internal models are used to estimate the 99th percentile of the bank's market risk loss distribution over a ten-business-day horizon. The bank's market risk capital requirement is based on this VaR estimate, generally multiplied by a factor of three. The agencies implemented this multiplication factor to provide a prudential buffer for market volatility and modeling error.

The conceptual foundation of this proposal's approach to credit risk capital requirements is similar to the MRA's approach to market risk capital requirements, in the sense that each is VaR-oriented. That is, the proposed framework bases minimum credit risk capital requirements largely on estimated statistical measures of credit risk. Nevertheless, there are important differences between this proposal and the MRA. The MRA approach for assessing market risk capital requirements currently employs a nominal confidence level of 99.0 percent and a ten-business-day horizon, but otherwise provides banks with substantial modeling flexibility in determining their market risk loss distribution and capital requirements. In contrast, the IRB framework for assessing credit risk capital requirements is based on a 99.9 percent nominal confidence level, a one-year horizon, and a supervisory model of credit losses embodying particular assumptions about the underlying drivers of portfolio credit risk, including loss correlations among different asset types.4

The IRB framework is broadly similar to the credit VaR approaches used by many banks as the basis for their internal assessment of the economic capital necessary to cover credit risk. It is common for a bank's internal credit risk models to consider a one-year loss horizon, and to focus on a high loss threshold confidence level. As with the internal credit VaR models used by banks, the output of the risk-based capital formulas in the IRB framework is an estimate of the amount of credit losses above expected credit losses (ECL) over a one-year horizon that would only be exceeded a small percentage of the time. The agencies believe that a one-year horizon is appropriate because it balances the fact that banking book positions likely could not be easily or rapidly exited with the possibility that in many cases a bank can cover credit losses by raising additional capital should the underlying credit problems manifest themselves gradually. The nominal confidence level of the IRB risk-based capital formulas (99.9 percent) means that if all the assumptions in the IRB supervisory model for credit risk were correct for a bank, there would be less than a 0.1 percent probability that credit losses at the bank in any year would exceed the IRB risk-based capital requirement.5

As noted above, the supervisory model of credit risk underlying the IRB framework embodies specific assumptions about the economic drivers of portfolio credit risk at banks. As with any modeling approach, these assumptions represent simplifications of very complex real-world phenomena and, at best, are only an approximation of the actual credit risks at any bank. To the extent these assumptions (described in greater detail below) do not characterize a given bank precisely, the actual confidence level implied by the IRB risk-based capital formulas may exceed or fall short of the framework's nominal 99.9 percent confidence level.

In combination with other supervisory assumptions and parameters underlying this proposal, the IRB framework's 99.9 percent nominal confidence level reflects a judgmental pooling of available information, including supervisory experience. The framework underlying this proposal reflects a desire on the part of the agencies to achieve (i) relative risk-based capital requirements across different assets that are broadly consistent with maintaining at least an investment grade rating (for example, at least BBB) on the liabilities funding those assets, even in periods of economic adversity; and (ii) for the U.S. banking system as a whole, aggregate minimum regulatory capital requirements that are not a material reduction from the aggregate minimum regulatory capital requirements under the general risk-based capital rules.

A number of important explicit generalizing assumptions and specific parameters are built into the IRB framework to make the framework applicable to a range of banks and to obtain tractable information for calculating risk-based capital requirements. Chief among the assumptions embodied in the IRB framework are: (i) assumptions that a bank's credit portfolio is infinitely granular; (ii) assumptions that loan defaults at a bank are driven by a single, systematic risk factor; (iii) assumptions that systematic and non-systematic risk factors are log-normal random variables; and (iv) assumptions regarding correlations among credit losses on various types of assets.

The specific risk-based capital formulas in this proposed rule require the bank to estimate certain risk parameters for its wholesale and retail exposures, which the bank may do using a variety of techniques. These risk parameters are probability of default (PD), expected loss given default (ELGD), loss given default (LGD), exposure at default (EAD), and, for wholesale exposures, effective remaining maturity (M). The risk-based capital formulas into which the estimated risk parameters are inserted are simpler than the economic capital methodologies typically employed by banks (which often require complex computer simulations). In particular, an important property of the IRB risk-based capital formulas is portfolio invariance. That is, the risk-based capital requirement for a particular exposure generally does not depend on the other exposures held by the bank. Like the general risk-based capital rules, the total credit risk capital requirement for a bank's wholesale and retail exposures is the sum of the credit risk capital requirements on individual wholesale exposures and retail exposures.

The IRB risk-based capital formulas contain supervisory asset value correlation (AVC) factors, which have a significant impact on the capital requirements generated by the formulas. The AVC assigned to a given portfolio of exposures is an estimate of the degree to which any unanticipated changes in the financial conditions of the underlying obligors of the exposures are correlated (that is, would likely move up and down together). High correlation of exposures in a period of economic downturn conditions is an area of supervisory concern. For a portfolio of exposures having the same risk parameters, a larger AVC implies less diversification within the portfolio, greater overall systematic risk, and, hence, a higher risk-based capital requirement.6 For example, a 15 percent AVC for a portfolio of residential mortgage exposures would result in a lower risk-based capital requirement than a 20 percent AVC and a higher risk-based capital requirement than a 10 percent AVC.

The AVCs that appear in the IRB risk-based capital formulas for wholesale exposures decline with increasing PD; that is, the IRB risk-based capital formulas generally imply that a group of low-PD wholesale exposures are more correlated than a group of high-PD wholesale exposures. Thus, under the proposed rule, a low-PD wholesale exposure would have a higher relative risk-based capital requirement than that implied by its PD were the AVC in the IRB risk-based capital formulas for wholesale exposures fixed rather than a function of PD. This inverse relationship between PD and AVC for wholesale exposures is broadly consistent with empirical research undertaken by G10 supervisors and moderates the sensitivity of IRB risk-based capital requirements for wholesale exposures to the economic cycle. Question 1: The agencies seek comment on and empirical analysis of the appropriateness of the proposed rule's AVCs for wholesale exposures in general and for various types of wholesale exposures (for example, commercial real estate exposures).

The AVCs included in the IRB risk-based capital formulas for retail exposures also reflect a combination of supervisory judgment and empirical evidence.7 However, the historical data available for estimating these correlations was more limited than was the case with wholesale exposures, particularly for non-mortgage retail exposures. As a result, supervisory judgment played a greater role. Moreover, the flat 15 percent AVC for residential mortgage exposures is based largely on empirical analysis of traditional long-term, fixed-rate mortgages. Question 2: The agencies seek comment on and empirical analysis of the appropriateness and risk sensitivity of the proposed rule's AVC for residential mortgage exposures – not only for long-term, fixed-rate mortgages, but also for adjustable-rate mortgages, home equity lines of credit, and other mortgage products – and for other retail portfolios.

Another important conceptual element of the IRB framework concerns the treatment of EL. The ANPR generally would have required banks to hold capital against the measured amount of UL plus EL over a one-year horizon, except in the limited instance of credit card exposures where future margin income (FMI) was allowed to offset EL. The ANPR treatment also would have maintained the existing definition of regulatory capital, which includes the allowance for loan and lease losses (ALLL) in tier 2 capital up to a limit equal to 1.25 percent of risk-weighted assets. The ANPR requested comment on the proposed treatment of EL. Many commenters on the ANPR objected to this treatment on conceptual grounds, arguing that capital is not the appropriate mechanism for covering EL. In response to this feedback, the agencies sought and obtained changes to the BCBS's proposals in this area.

The agencies supported the BCBS's proposal, announced in October 2003, to remove ECL (as defined below) from the risk-weighted assets calculation. This NPR, consistent with the New Accord, removes ECL from the risk-weighted assets calculation but requires a bank to compare its ECL to its eligible credit reserves (as defined below). If a bank's ECL exceeds its eligible credit reserves, the bank must deduct the excess ECL amount 50 percent from tier 1 capital and 50 percent from tier 2 capital. If a bank's eligible credit reserves exceed its ECL, the bank would be able to include the excess eligible credit reserves amount in tier 2 capital, up to 0.6 percent of the bank's credit risk-weighted assets. This treatment is intended to maintain a capital incentive to reserve prudently and seeks to ensure that ECL over a one-year horizon is covered either by reserves or capital. This treatment also recognizes that prudent reserving that considers probable losses over the life of a loan may result in a bank holding reserves in excess of ECL measured with a one-year horizon. The BCBS calibrated the proposed 0.6 percent limit on inclusion of excess reserves in tier 2 capital to be approximately as restrictive as the existing cap on the inclusion of ALLL under the general risk-based capital rules, based on data obtained in the BCBS's Third Quantitative Impact Study (QIS-3).8 Question 3: The agencies seek comment and supporting data on the appropriateness of this limit.

The agencies are aware that certain banks believe that FMI should be eligible to cover ECL for the purposes of such a calculation, while other banks have asserted that, for certain business lines, prudential reserving practices do not involve setting reserves at levels consistent with ECL over a horizon as long as one year. The agencies nevertheless believe that the proposed approach is appropriate because banks should receive risk-based capital benefits only for the most highly reliable ECL offsets.

The combined impact of these changes in the treatment of ECL and reserves will depend on the reserving practices of individual banks. Nevertheless, if other factors are equal, the removal of ECL from the calculation of risk-weighted assets will result in a lower amount of risk-weighted assets than the proposals in the ANPR. However, the impact on risk-based capital ratios should be partially offset by related changes to the numerators of the risk-based capital ratios – specifically, (i) the ALLL will be allowed in tier 2 capital up to certain limits only to the extent that it and certain other reserves exceed ECL, and (ii) if ECL exceeds reserves, the reserve shortfall must be deducted 50 percent from tier 1 capital and 50 percent from tier 2 capital.

Using data from QIS-3, the BCBS conducted an analysis of the risk-based capital requirements that would be generated under the New Accord, taking into account the aggregate effect of ECL-related changes to both the numerator and the denominator of the risk-based capital ratios. The BCBS concluded that to offset these changes relative to the credit risk-based capital requirements of the Proposed New Accord, it might be necessary under the New Accord to apply a "scaling factor" (multiplier) to credit risk-weighted assets. The BCBS, in the New Accord, indicated that the best estimate of the scaling factor using QIS-3 data adjusted for the EL-UL decisions was 1.06. The BCBS noted that a final determination of any scaling factor would be reconsidered prior to full implementation of the new framework. The agencies are proposing a multiplier of 1.06 at this time, consistent with the New Accord.

The agencies note that a 1.06 multiplier should be viewed as a placeholder. The BCBS is expected to revisit the determination of a scaling factor based on the results of the latest international QIS (QIS-5, which was not conducted in the United States).9 The agencies will consider the BCBS's determination, as well as other factors including the most recent QIS conducted in the United States (QIS-4, which is described below),10 in determining a multiplier for the final rule. As the agencies gain more experience with the proposed advanced approaches, the agencies will revisit the scaling factor along with other calibration issues identified during the parallel run and transitional floor periods (described below) and make changes to the rule as necessary. While a scaling factor is one way to ensure that regulatory capital is maintained at a certain level, particularly in the short- to medium-term, the agencies also may address calibration issues through modifications to the underlying IRB risk-based capital formulas.

The proposed rule also includes the AMA for determining risk-based capital requirements for operational risk. Under the proposed rule, operational risk is defined as the risk of loss resulting from inadequate or failed internal processes, people, and systems or from external events. This definition of operational risk includes legal risk - which is the risk of loss (including litigation costs, settlements, and regulatory fines) resulting from the failure of the bank to comply with laws, regulations, prudent ethical standards, and contractual obligations in any aspect of the bank's business - but excludes strategic and reputational risks.

Under the AMA, a bank would use its internal operational risk management systems and processes to assess its exposure to operational risk. Given the complexities involved in measuring operational risk, the AMA provides banks with substantial flexibility and, therefore, does not require a bank to use specific methodologies or distributional assumptions. Nevertheless, a bank using the AMA must demonstrate to the satisfaction of its primary Federal supervisor that its systems for managing and measuring operational risk meet established standards, including producing an estimate of operational risk exposure that meets a one-year, 99.9th percentile soundness standard. A bank's estimate of operational risk exposure includes both expected operational loss (EOL) and unexpected operational loss (UOL) and forms the basis of the bank's risk-based capital requirement for operational risk.

The AMA allows a bank to base its risk-based capital requirement for operational risk on UOL alone if the bank can demonstrate to the satisfaction of its primary Federal supervisor that the bank has eligible operational risk offsets, such as certain operational risk reserves, that equal or exceed the bank's EOL. To the extent that eligible operational risk offsets are less than EOL, the bank's risk-based capital requirement for operational risk must incorporate the shortfall.

The proposed rule maintains the general risk-based capital rules' minimum tier 1 risk-based capital ratio of 4.0 percent and total risk-based capital ratio of 8.0 percent. The components of tier 1 and total capital are also generally the same, with a few adjustments described in more detail below. The primary difference between the general risk-based capital rules and the proposed rule is the methodologies used for calculating risk-weighted assets. Banks applying the proposed rule generally would use their internal risk measurement systems to calculate the inputs for determining the risk-weighted asset amounts for (i) general credit risk (including wholesale and retail exposures); (ii) securitization exposures; (iii) equity exposures; and (iv) operational risk. In certain cases, however, external ratings or supervisory risk weights would be used to determine risk-weighted asset amounts. Each of these areas is discussed below.

Banks using the proposed rule also would be subject to supervisory review of their capital adequacy (Pillar 2) and certain public disclosure requirements to foster transparency and market discipline (Pillar 3). In addition, each bank using the advanced approaches would continue to be subject to the tier 1 leverage ratio requirement, and each depository institution (DI) (as defined in section 3 of the Federal Deposit Insurance Act (12 U.S.C. 1813)) using the advanced approaches would continue to be subject to the prompt corrective action (PCA) thresholds. Those banks subject to the MRA also would continue to be subject to the MRA.

Under the proposed rule, a bank must identify whether each of its on- and off-balance sheet exposures is a wholesale, retail, securitization, or equity exposure. Assets that are not defined by any exposure category (and certain immaterial portfolios of exposures) generally would be assigned risk-weighted asset amounts equal to their carrying value (for on-balance sheet exposures) or notional amount (for off-balance sheet exposures).

Wholesale exposures under the proposed rule include most credit exposures to companies and governmental entities. For each wholesale exposure, a bank would assign five quantitative risk parameters: PD (which is stated as a percentage and measures the likelihood that an obligor will default over a one-year horizon); ELGD (which is stated as a percentage and is an estimate of the economic loss rate if a default occurs); LGD (which is stated as a percentage and is an estimate of the economic loss rate if a default occurs during economic downturn conditions); EAD (which is measured in dollars and is an estimate of the amount that would be owed to the bank at the time of default); and M (which is measured in years and reflects the effective remaining maturity of the exposure). Banks would be able to factor into their risk parameter estimates the risk mitigating impact of collateral, credit derivatives, and guarantees that meet certain criteria. Banks would input the risk parameters for each wholesale exposure into an IRB risk-based capital formula to determine the risk-based capital requirement for the exposure.

Retail exposures under the proposed rule include most credit exposures to individuals and small businesses that are managed as part of a segment of exposures with similar risk characteristics, not on an individual-exposure basis. A bank would classify each of its retail exposures into one of three retail subcategories – residential mortgage exposures, qualifying revolving exposures (QREs) (for example, credit cards and overdraft lines), and other retail exposures. Within these three subcategories, the bank would group exposures into segments with similar risk characteristics. The bank would then assign the risk parameters PD, ELGD, LGD, and EAD to each retail segment. The bank would be able to take into account the risk mitigating impact of collateral and guarantees in the segmentation process and in the assignment of risk parameters to retail segments. Like wholesale exposures, the risk parameters for each retail segment would be used as inputs into an IRB risk-based capital formula to determine the risk-based capital requirement for the segment. Question 4: The agencies seek comment on the use of a segment-based approach rather than an exposure-by-exposure approach for retail exposures.

For securitization exposures, the bank would apply one of three general approaches, subject to various conditions and qualifying criteria: the Ratings-Based Approach (RBA), which uses external ratings to risk-weight exposures; an Internal Assessment Approach (IAA), which uses internal ratings to risk-weight exposures to asset-backed commercial paper programs (ABCP programs); or the Supervisory Formula Approach (SFA). Securitization exposures in the form of gain-on-sale or credit-enhancing interest-only strips (CEIOs)11 and securitization exposures that do not qualify for the RBA, the IAA, or the SFA would be deducted from regulatory capital.

Banks would be able to use an internal models approach (IMA) for determining risk-based capital requirements for equity exposures, subject to certain qualifying criteria and floors. If a bank does not have a qualifying internal model for equity exposures, or chooses not to use such a model, the bank must apply a simple risk weight approach (SRWA) in which publicly traded equity exposures would have a 300 percent risk weight and non-publicly traded equity exposures would have a 400 percent risk weight. Under both the IMA and the SRWA, equity exposures to certain entities or made pursuant to certain statutory authorities would be subject to a 0 to 100 percent risk weight.

Banks would have to develop qualifying AMA systems to determine risk-based capital requirements for operational risk. Under the AMA, a bank would use its own methodology to identify operational loss events, measure its exposure to operational risk, and assess a risk-based capital requirement for operational risk.

Under the proposed rule, a bank would calculate its risk-based capital ratios by first converting any dollar risk-based capital requirements for exposures produced by the IRB risk-based capital formulas into risk-weighted asset amounts by multiplying the capital requirements by 12.5 (the inverse of the overall 8.0 percent risk-based capital requirement). After determining the risk-weighted asset amounts for credit risk and operational risk, a bank would sum these amounts and then subtract any allocated transfer risk reserves and excess eligible credit reserves not included in tier 2 capital (defined below) to determine total risk-weighted assets. The bank would then calculate its risk-based capital ratios by dividing its tier 1 capital and total qualifying capital by the total risk-weighted assets amount.

The proposed rule contains specific public disclosure requirements to provide important information to market participants on the capital structure, risk exposures, risk assessment processes, and, hence, the capital adequacy of a bank. The public disclosure requirements would apply only to the DI or bank holding company representing the top consolidated level of the banking group that is subject to the advanced approaches. In addition, the agencies are also publishing today proposals to require certain disclosures from subsidiary DIs in the banking group through the supervisory reporting process. The agencies believe that the reporting of key risk parameter estimates for each DI applying the advanced approaches will provide the primary Federal supervisor of the DI and other relevant supervisors with important data for assessing the reasonableness and accuracy of the institution's calculation of its risk-based capital requirements under this proposal and the adequacy of the institution's capital in relation to its risks. Some of the proposed supervisory reports would be publicly available (for example, on the Call Report or Thrift Financial Report), and others would be confidential disclosures to the agencies to augment the supervisory process.

The agencies are considering implementing a comprehensive regulatory framework for the advanced approaches in which each agency would have an advanced approaches regulation or appendix that sets forth (i) the elements of tier 1 and tier 2 capital and associated adjustments to the risk-based capital ratio numerator, (ii) the qualification requirements for using the advanced approaches, and (iii) the details of the advanced approaches. For proposal purposes, the agencies are issuing a single proposed regulatory text for comment. Unless otherwise indicated, the term "bank" in the regulatory text includes banks, savings associations, and bank holding companies (BHCs). The term "[AGENCY]" in the regulatory text refers to the primary Federal supervisor of the bank applying the rule. Areas where the regulatory text would differ by agency – for example, provisions that would only apply to savings associations or to BHCs – are generally indicated in appropriate places.

In this proposed rule, the agencies are not restating the elements of tier 1 and tier 2 capital, which would generally remain the same as under the general risk-based capital rules. Adjustments to the risk-based capital ratio numerators specific to banks applying the advanced approaches are in part II of the proposed rule and explained in greater detail in section IV of this preamble. The OCC, Board, and FDIC also are proposing to incorporate their existing market risk rules by cross-reference and are proposing modifications to the market risk rules in a separate NPR issued concurrently.12 The OTS is proposing its own market risk rule, including the proposed modifications, as a part of that separate NPR. In addition, the agencies may need to make additional conforming amendments to certain of their regulations that use tier 1 or total qualifying capital or the risk-based capital ratios for various purposes.

The proposed rule is structured in eight broad parts. Part I identifies criteria for determining which banks are subject to the rule, provides key definitions, and sets forth the minimum risk-based capital ratios. Part II describes the adjustments to the numerator of the risk-based capital ratios for banks using the advanced approaches. Part III describes the qualification process and provides qualification requirements for obtaining supervisory approval for use of the advanced approaches. This part incorporates critical elements of supervisory oversight of capital adequacy (Pillar 2).

Parts IV through VII address the calculation of risk-weighted assets. Part IV provides the risk-weighted assets calculation methodologies for wholesale and retail exposures; on-balance sheet assets that do not meet the regulatory definition of a wholesale, retail, securitization, or equity exposure; and certain immaterial portfolios of credit exposures. This part also describes the risk-based capital treatment for over-the-counter (OTC) derivative contracts, repo-style transactions, and eligible margin loans. In addition, this part describes the methodology for reflecting eligible credit risk mitigation techniques in risk-weighted assets for wholesale and retail exposures. Furthermore, this part sets forth the risk-based capital requirements for failed and unsettled securities, commodities, and foreign exchange transactions.

Part V identifies operating criteria for recognizing risk transference in the securitization context and outlines the approaches for calculating risk-weighted assets for securitization exposures. Part VI describes the approaches for calculating risk-weighted assets for equity exposures. Part VII describes the calculation of risk-weighted assets for operational risk. Finally, Part VIII provides public disclosure requirements for banks employing the advanced approaches (Pillar 3).

The structure of the preamble generally follows the structure of the proposed regulatory text. Definitions, however, are discussed in the portions of the preamble where they are most relevant.

After the BCBS published the New Accord, the agencies conducted the additional quantitative impact study referenced above, QIS-4, in the fall and winter of 2004-2005, to better understand the potential impact of the proposed framework on the risk-based capital requirements for individual U.S. banks and U.S. banks as a whole. The results showed a substantial dollar-weighted average decline and variation in risk-based capital requirements across the 26 participating U.S. banks and their portfolios.13 In an April 2005 press release,14 the agencies expressed their concern about the magnitude of the drop in QIS-4 risk-based capital requirements and the dispersion of those requirements and decided to undertake further analysis.

The QIS-4 analysis indicated a dollar-weighted average reduction of 15.5 percent in risk-based capital requirements at participating banks when moving from the current Basel I-based framework to a Basel II-based framework.15 Table A provides a numerical summary of the QIS-4 results, in total and by portfolio, aggregated across all QIS-4 participants.16 The first column shows changes in dollar-weighted average minimum required capital (MRC) both by portfolio and overall, as well as in dollar-weighted average overall effective MRC. Column 2 shows the relative contribution of each portfolio to the overall dollar-weighted average decline of 12.5 percent in MRC, representing both the increase/decrease and relative size of each portfolio. The table also shows (column 3) that risk-based capital requirements declined by more than 26 percent in half the banks in the study. Most portfolios showed double-digit declines in risk-based capital requirements for over half the banks, with the exception of credit cards. It should be noted that column 3 gives every participating bank equal weight. Column 4 shows the analogous weighted median change, using total exposures as weights.

| Portfolio | Column 1: % Change in Portfolio MRC |

Column 2: % Point Contrib. to MRC Change |

Column 3: Median % Change in Port. MRC |

Column 4: Weighted Median % Change in Port. MRC |

Column 5: Share of Basel I MRC |

Column 6: Share of Basel II MRC* |

|---|---|---|---|---|---|---|

| Wholesale Credit | (24.6%) | (10.9%) | (24.5%) | (21.6%) | 44.3% | 38.2% |

|

Corporate, Bank, Sovereign

|

(21.9%) | (7.4%) | (29.7%) | (13.5%) | 33.9% | 30.3% |

|

Small Business

|

(26.6%) | (1.2%) | (27.1%) | (24.8%) | 4.6% | 3.9% |

|

High Volatility CRE

|

(33.4%) | (0.6%) | (23.2%) | (42.4%) | 1.8% | 1.3% |

|

Income Producing RE

|

(41.4%) | (1.7%) | (52.5%) | (52.4%) | 4.0% | 2.7% |

| Retail Credit | (25.6%) | (7.8%) | (49.8%) | (28.7%) | 30.6% | 26.0% |

|

Home Equity (HELOC)

|

(74.3%) | (4.6%) | (78.6%) | (76.8%) | 6.1% | 1.8% |

|

Residential Mortgage

|

(61.4%) | (6.8%) | (72.7%) | (64.4%) | 11.1% | 4.9% |

|

Credit Card (QRE)

|

66.0% | 4.0% | 62.8% | 72.2% | 6.1% | 11.6% |

|

Other Consumer

|

(6.5%) | (0.4%) | (35.2%) | (18.3%) | 6.0% | 6.4% |

|

Retail Business Exposures

|

(5.8%) | (0.1%) | (29.2%) | 11.6% | 1.2% | 1.3% |

| Equity | 6.6% | 0.1% | (24.4%) | 9.6% | 1.3% | 1.6% |

| Other assets | (11.7%) | (1.2%) | (3.2%) | (11.6%) | 10.0% | 10.1% |

| Securitization | (17.9%) | (1.4%) | (39.7%) | (45.8%) | 8.1% | 7.6% |

| Operational Risk | N/A | 9.2% | N/A | N/A | 0.0% | 10.5% |

| Trading Book | 0.0% | 0.0% | 0.0% | N/A | 5.2% | 5.9% |

| Change in MRC | (12.5%) | (12.5%) | (23.8%) | (17.1%) | 100.0% | 100.0% |

| Change in Effective MRC | (15.5%) | N/A | (26.3%) | (21.7%) | N/A | N/A |

* QIS-4

interpretation of Basel II framework as articulated in QIS-4 instructions. Return to table

Notes to the table: The first two columns of the table show the dollar-weighted

average percentage change in MRC by portfolio and the percentage point contribution

of each portfolio to the overall average percentage change (of 12.5%).

The third column shows the unweighted median percentage change in MRC

by portfolio. The fourth column shows the weighted median percentage

change in MRC by portfolio, weighting by total exposures at the portfolio

level. The next two columns show the share each portfolio contributes to MRC,

under the current framework (column 5) and the QIS-4 interpretation of

Basel II as defined in the QIS-4 instructions (column 6). Entries

in parentheses denote negative numbers. There are no percentage change numbers

for operational risk because it is not separated out as a specific risk-based

capital requirement under Basel I.

QIS-4 results (not shown in Table A) also suggested that tier 1 risk-based capital requirements under a Basel II-based framework would be lower for many banks than they are under the general risk-based capital rules, in part reflecting the move to a UL-only risk-based capital requirement. Tier 1 risk-based capital requirements declined by 22 percent in the aggregate. The unweighted median indicates that half of the participating banks reported reductions in tier 1 risk-based capital requirements of over 31 percent. The MRC calculations do not take into account the impact of the tier 1 leverage ratio requirement. Were such results produced under a fully implemented Basel II-based risk-based capital regime, the existing tier 1 leverage ratio requirement could be a more important constraint than it is currently.

Evidence from some of the follow-up analysis also illustrated that similar loan products at different banks may have resulted in very different risk-based capital requirements. Analysis determined that this dispersion in capital requirements not only reflected differences in actual risk or portfolio composition, but also reflected differences in the banks' estimated risk parameters for similar exposures.

Although concerns with dispersion might be remedied to some degree with refinements to internal bank risk measurement and management systems and through the rulemaking process, the agencies also note that some of the dispersion encountered in the QIS-4 exercise is a reflection of the flexibility in methods to quantify the risk parameters that may be allowed under implementation of the proposed framework.

The agencies intend to conduct other analyses of the impact of the Basel II framework during both the parallel run and transitional floor periods. These analyses will look at both the impact of the Basel II framework and the preparedness of banks to compute risk-based capital requirements in a manner consistent with the Basel II framework.

The ANPR stated: "The Agencies do not expect the implementation of the New Accord to result in a significant decrease in aggregate capital requirements for the U.S. banking system. Individual banking organizations may, however, face increases or decreases in their minimum risk-based capital requirements because the New Accord is more risk sensitive than the 1988 Accord and the Agencies' existing risk-based capital rules (general risk-based capital rules)."17 The ANPR was in this respect consistent with statements made by the BCBS in its series of Basel II consultative papers and its final text of the New Accord, in which the BCBS stated as an objective broad maintenance of the overall level of risk-based capital requirements while allowing some incentives for banks to adopt the advanced approaches.

The agencies remain committed to these objectives. Were the QIS-4 results just described produced under an up-and-running risk-based capital regime, the risk-based capital requirements generated under the framework would not meet the objectives described in the ANPR, and thus would be considered unacceptable.

When considering QIS-4 results and their implications, it is important to recognize that banking organizations participated in QIS-4 on a best-efforts basis. The agencies had not qualified any of the participants to use the Basel II framework and had not conducted any formal supervisory review of their progress toward meeting the Basel II qualification requirements. In addition, the risk measurement and management systems of the QIS-4 participants, as indicated by the QIS-4 exercise, did not yet meet the Basel II qualification requirements outlined in this proposed rule.

As banks work with their supervisors to refine their risk measurement and management systems, it will become easier to determine the actual quantitative impact of the advanced approaches. The agencies have decided, therefore, not to recalibrate the framework at the present time based on QIS-4 results, but to await further experience with more fully developed bank risk measurement and management systems.

If there is a material reduction in aggregate minimum regulatory capital requirements upon implementation of Basel II-based rules, the agencies will propose regulatory changes or adjustments during the transitional floor periods. In this context, materiality will depend on a number of factors, including the size, source, and nature of any reduction; the risk profiles of banks authorized to use Basel II-based rules; and other considerations relevant to the maintenance of a safe and sound banking system. In any event, the agencies will view a 10 percent or greater decline in aggregate minimum required risk-based capital (without reference to the effects of the transitional floors described in a later section of this preamble), compared to minimum required risk-based capital as determined under the existing rules, as a material reduction warranting modifications to the supervisory risk functions or other aspects of this framework.

The agencies are, in short, identifying a numerical benchmark for evaluating and responding to capital outcomes during the parallel run and transitional floor periods that do not comport with the overall capital objectives outlined in the ANPR. At the end of the transitional floor periods, the agencies would re-evaluate the consistency of the framework, as (possibly) revised during the transitional floor periods, with the capital goals outlined in the ANPR and with the maintenance of broad competitive parity between banks adopting the framework and other banks, and would be prepared to make further changes to the framework if warranted. Question 5: The agencies seek comment on this approach to ensuring that overall capital objectives are achieved.

The agencies also noted above that tier 1 capital requirements reported in QIS-4 declined substantially more than did total capital requirements. The agencies have long placed special emphasis on the importance of tier 1 capital in maintaining bank safety and soundness because of its ability to absorb losses on a going concern basis. The agencies will continue to monitor the trend in tier 1 capital requirements during the parallel run and transitional floor periods and will take appropriate action if reductions in tier 1 capital requirements are inconsistent with the agencies' overall capital goals.

Similar to the attention the agencies will give to overall risk-based capital requirements for the U.S. banking system, the agencies will carefully consider during the transitional floor periods whether dispersion in risk-based capital results across banks and portfolios appropriately reflects differences in risk. A conclusion by the agencies that dispersion in risk-based capital requirements does not appropriately reflect differences in risk could be another possible basis for proposing regulatory adjustments or refinements during the transitional floor periods.

It should also be noted that given the bifurcated regulatory capital framework that would result from the adoption of this rule, issues related to overall capital may be inextricably linked to the competitive issues discussed elsewhere in this document. The agencies indicated in the ANPR that if the competitive effects of differential capital requirements were deemed significant, "the Agencies would need to consider potential ways to address those effects while continuing to seek the objectives of the current proposal. Alternatives could potentially include modifications to the proposed approaches, as well as fundamentally different approaches."18 In this regard, the agencies view the parallel run and transitional floor periods as a trial of the new framework under controlled conditions. While the agencies hope and expect that regulatory changes proposed during those years would be in the nature of adjustments made within the framework described in this proposed rule, more fundamental changes cannot be ruled out if warranted based on future experience or comments received on this proposal.

The agencies reiterate that, especially in light of the QIS-4 results, retention of the tier 1 leverage ratio and other existing prudential safeguards (for example, PCA) is critical for the preservation of a safe and sound regulatory capital framework. In particular, the leverage ratio is a straightforward and tangible measure of solvency and serves as a needed complement to the risk-sensitive Basel II framework based on internal bank inputs.

A fundamental objective of the New Accord is to strengthen the soundness and stability of the international banking system while maintaining sufficient consistency in capital adequacy regulation to ensure that the New Accord will not be a significant source of competitive inequity among internationally active banks. The agencies support this objective and believe that it is crucial to promote continual advancement of the risk measurement and management practices of large and internationally active banks. For this reason, the agencies propose to implement only the advanced approaches of the New Accord because these approaches utilize the most sophisticated and risk-sensitive risk measurement and management techniques.

While all banks should work to enhance their risk management practices, the advanced approaches and the systems required to support their use may not be appropriate for many banks from a cost-benefit point of view. For these banks, the agencies believe that, with some modifications, the general risk-based capital rules are a reasonable alternative. As discussed in section E.2. above, this proposal's bifurcated approach to risk-based capital requirements raises difficult issues and inextricably links competitive considerations with overall capital issues. One such issue relates to concerns about competitive inequities between U.S. banks operating under different regulatory capital regimes. The ANPR cited this concern, and a number of commenters expressed their belief that in some portfolios competitive inequities would be worsened under the proposed bifurcated framework. These commenters expressed the concern that the Proposed New Accord might place community banks operating under the general risk-based capital rules at a competitive disadvantage to banks applying the advanced approaches because the IRB framework would likely result in lower risk-based capital requirements on some types of exposures, such as residential mortgage exposures, other retail exposures, and small business loans.

Some commenters asserted that the application of lower risk-based capital requirements under the Proposed New Accord would create a competitive disadvantage for banks operating under the general risk-based capital rules, which in turn may adversely affect their asset quality and cost of capital. Other commenters suggested that if the advanced approaches in the Proposed New Accord are implemented, the agencies should consider revising their general risk-based capital rules to enhance risk sensitivity and to mitigate potential competitive inequities associated with the bifurcated system.

The agencies recognize that the industry has concerns with the potential competitive inequities associated with a bifurcated risk-based capital framework. The agencies reaffirm their intention, expressed in the ANPR, to address competitive issues while continuing to pursue the objectives of the current proposal. In addition to the QIS-4 analysis discussed above, the agencies have also researched discrete topics to further understand where competitive pressures might arise. As part of their effort to develop a bifurcated risk-based capital framework that minimizes competitive inequities and is not disruptive to the banking sector, the agencies issued an Advance Notice of Proposed Rulemaking (Basel IA ANPR) considering various modifications to the general risk-based capital rules to improve risk sensitivity and to reduce potential competitive disparities between Basel II banks and non-Basel II banks.19 The comment period for the Basel IA ANPR ended on January 18, 2006, and the agencies intend to consider all comments and issue for public comment a more fully developed risk-based capital proposal for non-Basel II banks. The comment period for the non-Basel II proposal is expected to overlap that of this proposal, allowing commenters to analyze the effects of the two proposals concurrently.

In addition, some commenters expressed concern about competitive inequities arising from differences in implementation and application of the New Accord by supervisory authorities in different countries. In particular, some commenters expressed concern about the different implementation timetables of various jurisdictions, and differences in the scope of application in various jurisdictions or in the range of approaches that different jurisdictions will allow. The BCBS has established an Accord Implementation Group, comprised of supervisors from member countries, whose primary objectives are to work through implementation issues, maintain a constructive dialogue about implementation processes, and harmonize approaches as much as possible within the range of national discretion embedded in the New Accord.

While supervisory judgment will play a critical role in the evaluation of risk measurement and management practices at individual banks, supervisors are committed to developing protocols and information-sharing arrangements that should minimize burdens on banks operating in multiple countries and ensure that supervisory authorities are implementing the New Accord as consistently as possible. The New Accord identifies numerous areas where national discretion is encouraged. This design was intended to enable national supervisors to implement the methodology, or combination of methodologies, most appropriate for banks in their jurisdictions. Disparate implementation decisions are expected, particularly during the transition years. Over time, the agencies expect that industry and supervisory practices likely will converge in many areas, thus mitigating differences across countries. Competitive considerations, both internationally and domestically, will be monitored and discussed by the agencies on an ongoing basis. With regard to implementation timing concerns, the agencies believe that the transitional arrangements described in section III.A. of this preamble below provide a prudent and reasonable framework for moving to the advanced approaches. Where international implementation differences affect an individual bank, the agencies expect to work with the bank and appropriate national supervisory authorities for the bank to ensure that implementation proceeds as smoothly as possible. Question 6: The agencies seek comment on all potential competitive aspects of this proposal and on any specific aspects of the proposal that might raise competitive concerns for any bank or group of banks.

- The BCBS is a committee of banking supervisory authorities, which was established by the central bank governors of the G-10 countries in 1975. It consists of senior representatives of bank supervisory authorities and central banks from Belgium, Canada, France, Germany, Italy, Japan, Luxembourg, the Netherlands, Spain, Sweden, Switzerland, the United Kingdom, and the United States. Return to text

- The BCBS developed the Proposed New Accord to modernize its first capital Accord, which was endorsed by the G-10 governors in 1988 and implemented by the agencies in the United States in 1989. The BCBS's 1988 Accord is described in a document entitled "International Convergence of Capital Measurement and Capital Standards." This document and other documents issued by the BCBS are available through the Bank for International Settlements website at www.bis.org. The agencies' implementing regulations are available at 12 CFR part 3, Appendices A and B (national banks); 12 CFR part 208, Appendices A and E (state member banks); 12 CFR part 225, Appendices A and E (bank holding companies); 12 CFR part 325, Appendices A and C (state nonmember banks); and 12 CFR part 567 (savings associations). Return to text

- The theoretical underpinnings for the supervisory model of credit risk underlying this proposal are provided in Michael Gordy, "A Risk-Factor Model Foundation for Ratings-Based Bank Capital Rules," Journal of Financial Intermediation, July 2003. The IRB formulas are derived as an application of these results to a single-factor CreditMetrics-style model. For mathematical details on this model, see Michael Gordy, "A Comparative Anatomy of Credit Risk Models," Journal of Banking and Finance, January 2000, or H.U. Koyluogu and A. Hickman, "Reconcilable Differences," Risk, October 1998. For a less technical overview of the IRB formulas, see the BCBS's "An Explanatory Note on the Basel II Risk Weight Functions," July 2005 (Explanatory Note). The document can be found on the Bank for International Settlements website at www.bis.org. Return to text

- Banks' internal economic capital models typically focus on measures of equity capital, whereas the total regulatory capital measure underlying this proposal includes not only equity capital, but also certain debt and hybrid instruments, such as subordinated debt. Thus, the 99.9 percent nominal confidence level embodied in the IRB framework is not directly comparable to the nominal solvency standards underpinning banks' economic capital models. Return to text

- See Explanatory Note. Return to text

- See Explanatory Note, section 5.3. Return to text

- BCBS, "QIS 3: Third Quantitative Impact Study," May 2003. Return to text

- See http://www.bis.org/bcbs/qis/qis5.htm. Return to text

- See "Summary Findings of the Fourth Quantitative Impact Study," February 24, 2006. Return to text

- A CEIO is an on-balance sheet asset that (i) represents the contractual right to receive some or all of the interest and no more than a minimal amount of principal due on the underlying exposures of a securitization and (ii) exposes the holder to credit risk directly or indirectly associated with the underlying exposures that exceeds its pro rata claim on the underlying exposures whether through subordination provisions or other credit-enhancement techniques. Return to text

- See elsewhere in today's issue of the Federal Register. Return to text

- Since neither an NPR and associated supervisory guidance nor final regulations implementing a Basel II-based framework had been issued in the United States at the time of data collection, all QIS-4 results relating to the U.S. implementation of Basel II are based on the description of the framework contained in the QIS-4 instructions. These instructions differed from the framework issued by the BCBS in June 2004 in several respects. For example, the QIS-4 articulation of the Basel II framework does not include the 1.06 scaling factor. The QIS-4 instructions are available at http://www.ffiec.gov/qis4/. Return to text

- See "Banking Agencies to Perform Additional Analysis Before Issuing Notice of Proposed Rulemaking Related to Basel II," Apr. 29, 2005. Return to text

- The Basel II framework on which QIS-4 is based uses a UL-only approach (even though EL requirements were included in QIS-4). But the current Basel I risk-based capital requirements use a UL+EL approach. Therefore, in order to compare the Basel II results from QIS-4 with the current Basel I requirements, the EL requirements from QIS-4 had to be added to the UL capital requirements from QIS-4. Return to text

- In the table, "Minimum required capital" (MRC) refers to the total risk-based capital requirement before incorporating the impact of reserves. "Effective MRC" is equal to MRC adjusted for the impact of reserves. As noted above, under the Basel II framework, a shortfall in reserves generally increases the total risk-based capital requirement and a surplus in reserves generally reduces the total risk-based capital requirement, though not with equal impact. Return to text

- 68 FR 45900, 45902 (Aug. 4, 2003). Return to text

- 68 FR 45900, 45905 (August 4, 2003). Return to text

- See 70 FR 61068 (Oct. 20, 2005). Return to text