FEDS Notes

April 19, 2019

Changes in Monetary Policy and Banks' Net Interest Margins: A Comparison across Four Tightening Episodes

Jared Berry, Felicia Ionescu, Robert Kurtzman, and Rebecca Zarutskie

How do banks' net interest margins (NIMs), a key measure of bank profitability, change as the Federal Open Market Committee (FOMC) raises or lowers its policy rate?2 This question is fundamental to banks' role in monetary policy transmission in a number of ways. How much and when banks pass through interest rate changes to borrowers affects how monetary policy alters borrowing and thus spending behavior. Similarly, the timing and extent of the pass-through of monetary policy rate changes to deposit rates affects savings behavior. Moreover, changes in bank profitability may affect bank risk-taking and stability, which in turn may have spillover effects on the real economy.3

In this note, we examine how U.S. banks' NIMs have varied over the most recent monetary policy tightening episode compared with the three previous monetary policy tightening episodes. We find that banks' NIMs have increased overall since the beginning of the most recent tightening episode, whereas, in the prior three tightening episodes, by the end of each, NIMs had declined overall. Moreover, holding constant the amount of increase in the target federal funds rate, we continue to find that banks' NIMs have increased significantly more in the most recent tightening episode relative to the past three episodes. The increase in NIMs during the current monetary policy tightening episode is due to both a slower increase in banks' interest expenses as a percent of their interest-bearing assets and a faster increase in banks' interest income as a percent of their interest-bearing assets relative to increases in the target federal funds rate. We discuss changes in the U.S. banking environment that can help explain the different behavior of banks' NIMs during the most recent monetary policy tightening episode, including an abundance of deposits in the banking system and as a share of banks' overall funding and compressed NIMs during the period spent at the zero lower bound.

How Have Banks' NIMs Varied with Changes in Monetary Policy?

Banks' interest income for a given level of interest-bearing assets should generally rise as the FOMC raises its policy rate, and as longer-term rates rise, because banks can pass on rate increases to borrowers through floating-rate loans and new fixed-rate loan originations. Similarly, banks' interest expenses should rise, or at least not fall, as banks may pass through higher interest rates to savers. However, the overall net effect of monetary policy rate increases on banks' NIMs is not ex-ante clear, as the relative interest rate pass-through sensitivities of banks' assets and liabilities depend on the competitive environment for deposits and loans, the composition and condition of banks' balance sheets and funding sources, and the behavior of market-based longer-term interest rates, along with other factors.

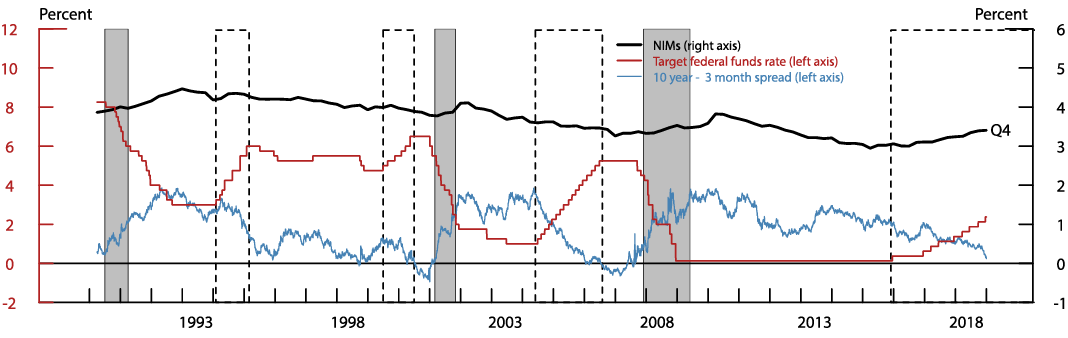

Figure 1 shows aggregate commercial bank NIMs over the past 30 years alongside the target federal funds rate and the spread between the 10-year Treasury yield and the 3-month Treasury yield, a measure of the slope of the yield curve. In aggregate, banks' NIMs, which have ranged between 3 and 4 1/2 percent, have been fairly stable over time relative to the target federal funds rate and the slope of the yield curve. Banks' NIMs have also generally been declining over the past several decades.4

Note: Net interest margins (NIMs) series are quarterly. Target federal funds rate is the midpoint of the target range for the federal funds rate. The shaded bars indicate periods of business recession as defined by the National Bureau of Economic Research: July 1990-March 1991, March 2001-November 2001, and December 2007-June 2009. The dashed boxes denote monetary policy tightening cycles: February 1994-February 1995, March 1997-May 2000, June 2004-June 2006, and December 2015-end of the sample.

Source: Consolidated Reports of Condition and Income, FFIEC 031/041, Federal Reserve Board Release on Selected Interest Rates (H.15).

The dashed boxes in figure 1 denote monetary policy tightening episodes, and the gray-shaded regions indicate recessions. During periods of monetary policy tightening, NIMs have tended to decline somewhat or remain flat, as the increase in short-term interest rates gradually increases banks' interest expenses and the generally flattening yield curve reduces the income of interest-bearing assets tied to longer rates.5 During recessions, banks' NIMs have tended to rise for a time when the monetary policy rate has declined, as banks' assets--loans and securities, some of which earn a fixed rate--have generally repriced downward more slowly than their liabilities, which mainly consist of deposits that banks are relatively quick to reprice downward in such environments.6

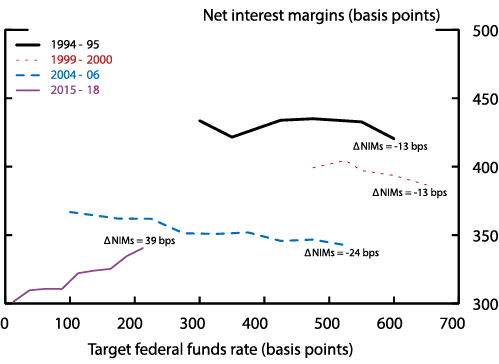

The relative insensitivity of NIMs to changes in the monetary policy rate can also be seen in figure 2, which plots aggregate bank NIMs as a function of the target federal funds rate during the four most recent monetary policy tightening episodes. In the first three tightening episodes, NIMs declined or remained flat. However, the leftmost purple line shows that NIMs have generally increased during the most recent monetary policy tightening episode, a finding that we further explore by decomposing the changes in banks' NIMs. In each successive tightening episode, the level of the NIMs is lower, reflecting the general decline in NIMs over the past several decades.

Note: Net interest margins (NIMs) are net interest income divided by the quarterly average of interest-earning assets. Text near a given line shows the total basis point change in NIMs over a given episode. While the federal funds rate (FFR) rose by a total of 225 basis points to date for the most recent tightening episode, we calculate changes in NIMs relative to a 200 basis points rise in the FFR since our data end in 2018:Q4 and the final 25 basis point increase in the FFR was announced in the December 2018 FOMC meeting. Please see the Appendix for the details behind the calculation of changes in NIMs for each tightening episode.

Source: Consolidated Reports of Condition and Income, FFIEC 031/041, and Board staff calculations.

What Is Different about the Current Monetary Policy Tightening Episode?

We decompose changes in banks' NIMs over each of the four monetary policy tightening episodes to shed light on what underlies the different behavior of NIMs in the current episode. NIMs are defined as the ratio of net interest income (NII) divided by interest-bearing assets (IBA), where net interest income is in turn defined as the difference between interest income (II) and interest expense (IE). NIMs can also be defined as the difference between the interest income divided by interest-bearing assets (II/IBA) and interest expense divided by interest-bearing assets (IE/IBA):

In table 1, we show how interest income relative to interest-bearing assets (II/IBA) and interest expense relative to interest-bearing assets (IE/IBA) change with the target federal funds rate (FFR) through each of the four tightening episodes.7 Column (1) shows the cumulative change in the target federal funds rate (FFR) over each tightening episode, and column (2) shows the cumulative change in NIMs over the episode. Column (3) divides the cumulative change in NIMs by the cumulative change in the target federal funds rate (FFR) to show how NIMs have changed with each 1 basis point change in the target federal funds rate. NIMs increased by about 0.2 basis point for each 1 basis point increase in the target federal funds rate in the current tightening episode, in contrast to the previous episodes, in which NIMs decreased overall.8 While the target federal funds rate has risen by a total of 225 basis points to date in the most recent episode, we calculate changes in NIMs relative to a 200 basis points rise in the target federal funds rate because the final 25 basis point increase in the target federal funds rate was announced following the December 2018 FOMC meeting and our data end in 2018:Q4.

Table 1: NIMs Decomposition Relative to the Federal Funds Rate

| Monetary Policy Tightening Episode | Cumulative Change in FFR in bps (1) | Cumulative Change in NIMs in bps (2) | Cumulative Change in NIMs over Cumulative Change in FFR (3) | Cumulative Change in II/IBA over Cumulative Change in FFR (4) | Cumulative Change in -IE/IBA over Cumulative Change in FFR (5) |

|---|---|---|---|---|---|

| 2015-18 | 200 | 39 | 0.2 | 0.49 | -0.3 |

| 2004-06 | 425 | -24 | -0.06 | 0.39 | -0.45 |

| 1999-2000 | 175 | -13 | -0.07 | 0.35 | -0.41 |

| 1994-95 | 300 | -13 | -0.04 | 0.34 | -0.39 |

Note: NIMs are net interest margins. FFR is target federal funds rate. II/IBA is interest income over interest-bearing assets. IE/IBA is interest expense over interest-bearing assets. NIMs at the beginning of an episode are 4-quarter trailing averages. While the FFR rose by a total of 225 basis points to date for the most recent tightening episode, we calculate changes in NIMs relative to a 200 basis points rise in the FFR since our data end in 2018:Q4 and the final 25 basis point increase in the FFR was announced in the December 2018 FOMC meeting. Please see the Appendix for the details behind the calculation of changes in NIMs for each tightening episode.

Source: Consolidated Reports of Condition and Income, FFIEC 031/041.

Columns (4) and (5) in table 1 show how the components of NIMs change with each 1 basis point change in the federal funds rate. Changes in NIMs are the sum of changes in interest income over interest-bearing assets (II/IBA) and changes in interest expenses over interest-bearing assets (IE/IBA). These additional columns show that interest expenses as a share of interest-bearing assets have increased with the federal funds rate at a slower pace than in previous episodes, while interest income as a share of interest-bearing assets has increased with the federal funds rate at a faster pace.

One possible reason for the slower increase to date in interest expenses relative to interest-bearing assets is that the degree of monetary policy tightening--viewed in terms of the magnitude of the policy rate increase--in the current episode has not yet reached the point at which competition for bank deposits and other bank funding has sufficiently intensified. To examine this possibility, we condition on the degree of the increase in the monetary policy rate; our conditional analysis can also capture, more generally, differences across the four episodes due to the degree of monetary policy tightening in each episode. Specifically, in table 2, we calculate and decompose changes in NIMs during the previous episodes after the first 175 basis points of increases in the federal funds rate. In the 2004-06 episode, NIMs decrease by a larger amount with each 1 basis point change in the federal funds rate if we focus on the first 175 basis points of increases in the policy rate. The 1999-2000 episode only had 175 basis points of rate increases, so the results for that episode do not change. In the 1994-95 episode, NIMs decrease by a lesser amount after conditioning on the first 175 basis points of tightening, going from a negative 0.04 basis point change with each 1 basis point increase in the federal funds rate to a negative 0.01 basis point relative change.

Table 2: NIMs Decomposition Relative to the Federal Funds Rate after First 175 Basis Points of Increases

| Monetary Policy Tightening Episode | Cumulative Change in FFR in bps (1) | Cumulative Change in NIMs in bps (2) | Cumulative Change in NIMs over Cumulative Change in FFR (3) | Cumulative Change in II/IBA over Cumulative Change in FFR (4) | Cumulative Change in -IE/IBA over Cumulative Change in FFR (5) |

|---|---|---|---|---|---|

| 2015-18 | 175 | 38 | 0.22 | 0.49 | -0.28 |

| 2004-06 | 175 | -16 | -0.09 | 0.28 | -0.37 |

| 1999-2000 | 175 | -13 | -0.07 | 0.35 | -0.41 |

| 1994-95 | 175 | -1 | -0.01 | 0.33 | -0.34 |

Note: NIMs are net interest margins. FFR is target federal funds rate. II/IBA is interest income over interest-bearing assets. IE/IBA is interest expense over interest-bearing assets. NIMs at the beginning of an episode are 4-quarter trailing averages. Data for the 1994-1995 period begin in 1993:Q4 and end in 1994:Q4. Data for the 1999-2000 period begin in 1999:Q2 and end in 2000:Q3. Data for the 2004-2006 period begin in 2004:Q2 and end in 2005:Q2. Data for the 2015-2018 period begin in 2015:Q4 and end in 2018:Q3.

Source: Consolidated Reports of Condition and Income, FFIEC 031/041.

The decomposition in column (5) of table 2 reveals that the drag on NIMs from interest expenses is lower in the current monetary policy tightening episode than in the three previous episodes even after conditioning on the first 175 basis points of rate increases. Likewise, the decomposition in column (4) of table 2 indicates that the increase in interest income from the first 175 basis points of rate increases is greater in the most recent tightening episode compared with the prior episodes

Changes in the banking environment since the Great Recession have likely affected banks' loan and deposit rate setting behavior and contributed to the increase in NIMs as the FOMC has raised the target federal funds rate in the most recent tightening episode. First, the extended period at the zero lower bound of the target federal funds rate has served to reduced banks' NIMs as deposit rates hit zero and interest rates on loans continued to fall (Covas, Rezende, and Vojtech, 2015). As the FOMC has gradually raised short-term interest rates, banks have likely been more reluctant to raise deposit rates, even compared with past episodes, in order to recoup their lost profitability. Second, following large-scale asset purchases by the Federal Reserve, the banking system has had a large amount of liquidity in the form of both reserves and deposit funding, and a greater share of banks' funding is now in the form of deposits.9 Moreover, new liquidity regulations encouraged banks to hold greater shares of their balance sheets in liquid assets. As a result of abundant levels of reserves and deposits, banks may not have felt the need to compete as intensively as in the past for deposits as short-term interest rates have risen. Given the greater share of deposits in banks' funding during the most recent tightening episode, even if deposit rates rose at a similar pace as in prior monetary policy tightening episodes we would expect the drag on NIMs from these higher deposit rates to be less since other types of bank funding tend to have their rates adjust even more quickly in response to rising short-term interest rates. Finally, the greater shares of banks' portfolios held in liquid assets, which are tied to shorter-term rates, has facilitated faster upward adjustment of interest income stemming from tightening monetary policy.

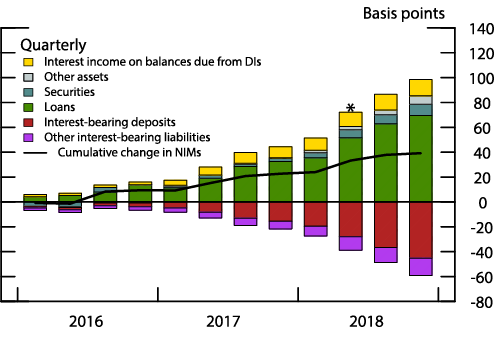

To provide insight into these changes to banks' balance sheets, we further decompose the changes in interest income relative to interest-bearing assets by asset types since the start of the current monetary tightening episode, as well as the changes in interest expense relative to interest-bearing assets by liability type. Figure 3 illustrates this decomposition, with the vertical bars representing the cumulative contributions of each asset and liability type to total changes in NIMs. The green-shaded portion of the bars indicates that loans have been the biggest positive contributors to NIMs, especially loan types such as commercial and industrial loans, which tend to have floating interest rates that adjust upward more quickly with changes in the federal funds rate than do other types of longer-term fixed rate loans such as home purchase mortgages. Figure 3 also shows that securities and excess reserves--the blue and yellow portions of the bars, respectively--have contributed positively to the cumulative change in NIMs but by far less than the contributions from loans.

Asset categories are displayed in order from top to bottom.

Note: DIs are depository institutions. NIMs are net interest margins. The symbol "*" above the bars denotes the quarter in which the federal funds rate has increased by 175 basis points relative to the beginning of the tightening cycle. Other assets includes income from trading assets, fed funds and repos, leases, and all other interest income not reported elsewhere.

Source: Consolidated Reports of Condition and Income, FFIEC 031/041, and Board staff calculations.

Furthermore, figure 3 reveals that the liabilities exerting the most downward pressure on NIMs to date have been deposits, the largest source of funding for most banks, but that the downward pressure has been less than the improvement to NIMs coming from loan interest income.

Conclusion

Given the importance of the role of banks in the transmission of monetary policy, we examined how banks' NIMs have varied over the current monetary policy tightening episode compared with the three previous monetary policy tightening episodes. We find that in contrast to the previous three episodes in the United States, banks' NIMs have increased in the current episode. The increase in NIMs does not seem to be due to the current point in the tightening episode, but rather to changes in the banking environment following an extended period at the zero lower bound and abundant amounts of deposits and liquid assets in the banking system.

If short-term interest rates were to rise further and the Federal Reserve to further reduce the size of its balance sheet with the amount of reserves in the banking system also declining, banks may eventually begin to compete more aggressively for core deposits resulting in higher interest expenses. Additionally, interest income from securities tied to short-term rates may also decline. In such a scenario, we may witness a more rapid increase in interest expenses relative to interest income as a share of interest-bearing assets, and the behavior of commercial bank NIMs in response to increases in the monetary policy rate may begin to resemble behavior witnessed in past monetary policy tightening episodes.

Appendix: Calculating and Decomposing Changes in Banks' NIMs during Monetary Policy Tightening Episodes

To examine changes in banks' NIMs, we use merger-adjusted Call Report data, which are reported on a quarterly basis.10 To calculate aggregate NIMs, we pool assets and liabilities of commercial banking units for a given top holder and weight each observation by its total amount of interest-bearing assets at the top holder level.

We study the past four monetary policy tightening episodes because we have reliable, merger-adjusted income statement data for all elements of our decomposition for the past four episodes. In our analysis, the first quarter before an increase in the target federal funds rate (the reference quarter) is always defined as the closest quarter-end to the first increase. Consequently, the February 4, 1994, rate hike has a reference quarter of 1993:Q4, while the remaining episodes all have a reference quarter during the first rate increase: 1999:Q2, 2004:Q2, and 2015:Q4. We always choose the quarter after the last rate increase in a given tightening episode as the final quarter. Thus, the final quarters for the first three episodes are 1995:Q2, 2000:Q3, and 2006:Q3. We use data until 2018:Q4 for the most recent tightening episode.

To reduce the likelihood that changes in NIMs may pick up seasonal differences in NIMs based on the starting and ending points of each tightening episode, we examine the change in NIMs at the end of the tightening episode relative to the four-quarter trailing average of NIMs at the beginning of the episode. If we set the reference level of NIMs as the level in the quarter at the beginning of the episode instead of the four-quarter trailing average level, the 1993:Q4-1995:Q2 tightening cycle witnessed a 0.01 basis point increase in NIM for each 1 basis point increase in the target federal funds rate, in comparison with the negative 0.04 basis point relative change in NIMs shown using the trailing average method. Similarly, the 1993:Q4-1995:Q2 episode shows a larger relative increase after the first 175 basis points of increases--0.10 basis point for each 1 basis point increase in the federal funds rate. These differences are the product of NIMs falling in 1993:Q4 right before the first rate hike after being relatively flat from 1993:Q1-1993:Q3. The results are quantitatively and qualitatively similar in the other three episodes no matter how the reference level of NIMs is calculated.

We follow the methodology described in Covas, Rezende, and Vojtech (2015) when decomposing changes in banks' NIMs into contributions from different asset and liability types.

References

Altavilla, Carlo, Miguel Boucinha, and Jose-Luis Peydro (2017). "Monetary Policy and Bank Profitability in a Low Interest Rate Environment," ECB Working Paper No. 2105. Frankfurt: European Central Bank, October, https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2105.en.pdf?6b8a3f70b10e04798981cbe109df411e.

Claessens, Stijn, Nicholas Coleman, and Michael Donnelly (2018). " 'Low-For-Long' Interest Rates and Banks' Interest Margins and Profitability: Cross-Country Evidence," Journal of Financial Intermediation, vol. 35, part A (July), pp. 1-16.

Committee on the Global Financial System (2018), "Financial Stability Implications of a Prolonged Period of Low Interest Rates," CGFS Papers No. 61. Basel, Switzerland: Bank for International Settlements, July, https://www.bis.org/publ/cgfs61.pdf.

Covas, Francisco B., Marcelo Rezende, and Cindy M. Vojtech (2015). "Why Are Net Interest Margins of Large Banks So Compressed?" FEDS Notes. Washington: Board of Governors of the Federal Reserve System, October 5, https://doi.org/10.17016/2380-7172.1612.

Driscoll, John C., and Ruth A. Judson (2013). "Sticky Deposit Rates," Finance and Economics Discussion Series 2013-80. Washington: Board of Governors of the Federal Reserve System, October, https://www.federalreserve.gov/pubs/feds/2013/201380/201380pap.pdf.

Drechsler, Itamar, Alexi Savov, and Philipp Schnabl (2018). "Banking on Deposits: Maturity Transformation without Interest Rate Risk," NBER Working Paper Series 24582. Cambridge, Mass.: National Bureau of Economic Research, May, https://www.nber.org/papers/w24582.pdf.

English, William B. (2002). "Interest Rate Risk and Bank Net Interest Margins," BIS Quarterly Review (December), pp. 67-82, https://www.bis.org/publ/qtrpdf/r_qt0212g.pdf.

English, William B., Skander J. Van den Heuvel, and Egon Zakrajšek (2018). "Interest Rate Risk and Bank Equity Valuations," Journal of Monetary Economics, vol. 98 (October), pp. 80-97.

Ennis, Huberto M., Helen Fessenden, and John R. Walter (2016). "Do Net Interest Margins and Interest Rates Move Together?" Economic Brief EB16-05. Richmond: Federal Reserve Bank of Richmond, May, https://www.richmondfed.org/publications/research/economic_brief/2016/eb_16-05.

1. The views in this document do not necessarily reflect those of the Federal Reserve System, its Board of Governors, or its staff. We thank Rochelle Edge and Gretchen Weinbach for comments and suggestions. Return to text

2. NIMs are defined as the difference between interest income and interest expense as a share of interest-bearing assets. Return to text

3. See English (2002) and BIS Committee on the Global Financial System (2018) for a discussion of this transmission mechanism. Return to text

4. For a further discussion of the general stability of NIMs and the general downward trend in NIMs, see English (2002); Covas, Rezende, and Vojtech (2015); Claessens, Coleman, and Donnelly (2018); and Drechsler, Savov, and Schnabl (2018). For a discussion of changes in NIMs during previous monetary policy tightening episodes, see Ennis, Fessenden, and Walter (2016). Return to text

5. Other studies have also documented the generally negative reaction of bank profits--and specifically NIMs--to tightening in monetary policy. See, for example, English, Van den Heuvel, and Zakrajsek (2018); Altavilla, Boucinha, and Peydro (2017); and Ennis, Fessenden, and Walter (2016). Return to text

6. The tendency of bank deposit rates to adjust slowly to increases in the monetary policy rate and relatively quickly to decreases in the monetary policy rate is discussed in Driscoll and Judson (2013). Return to text

7. The initial reference level of NIMs is computed as a four-quarter trailing average for this analysis. This implies a qualitative difference between the results in our tables and figure 2. While NIMs fall during the 1994-1995 episode in our tables, they remain about flat in figure 2. This can be attributable to NIMs falling in 1993:Q4 right before the rate hike after being relatively flat from 1993:Q1-1993:Q3. We provide further details in the Appendix. Return to text

8. This result holds not only for all banks, but also when decomposed into large and small banks. The results are more pronounced, however, for large banks, defined as those bank holding companies with more than $50 billion in assets (in 2015:Q4 dollars). Return to text

9. Using data from the Federal Reserve's H.8 Assets and Liabilities of Commercial Banks in the United States, we calculate that the average share of deposits to total assets at domestic commercial banks over the four monetary policy tightening episodes from the earliest to most recent. The shares for total deposits to total assets are 0.72, 0.63, 0.63, and 0.76, respectively, and the shares of non-large-time deposits (those that are likely the most "sticky", or the least rate sensitive) to total assets are 0.65, 0.54, 0.53, and 0.70, respectively, from earliest to most recent tightening episode. Return to text

10. In this note we focus exclusively on commercial bank NIMs and therefore use Call Report data, or form FFIEC 031/041, rather than consolidated data at the bank holding company, or form FR-Y9C, which would also include interest income and expense from non-commercial banking units. Return to text

Berry, Jared, Felicia Ionescu, Robert Kurtzman, and Rebecca Zarutskie (2019). "Changes in Monetary Policy and Banks' Net Interest Margins: A Comparison across Four Tightening Episodes," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, April 19, 2019, https://doi.org/10.17016/2380-7172.2352.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.