FEDS Notes

October 16, 2019

Foreign Portfolio Investment When the United States was an Emerging Market

Julio Monge and Colin Weiss1

- Introduction

Concerns about foreign indebtedness in the United States occur throughout history. Long before modern-day politicians worried whether China's ownership of U.S. Treasury bonds represented a national security threat, politicians in the 19th century feared intrusion in U.S. politics from abroad as a result of extensive foreign holdings of the debts of U.S. state governments (Wilkins, 1989). In light of these concerns, the federal government conducted surveys on occasion to estimate the aggregate indebtedness of the U.S. economy to foreigners. Two of the earliest surveys occurred in 1853 and 1869.

In this note, we analyze these two surveys and compare the patterns of foreign ownership then to foreign portfolio investment in the present-day United States. Undertaken before the U.S surpassed Great Britain as the world's economic leader, these surveys provide a unique opportunity to compare the motivations for portfolio investment in the same country at different stages of economic development. Interestingly, in all cases, across both eras, government debt is the asset class with the highest share of foreign investment.

However, despite this surface similarity, foreigners purchased U.S. government debt for vastly different reasons in the 19th century relative to today. We support this hypothesis with two pieces of evidence. First, U.S. federal debt in 1869 did not have the same perceived safety then as it does today. Second, foreign ownership of state government debts remained high in 1853 despite a debt crisis in the 1840s. These facts suggest that foreign investors in the mid-19th century sought a balance between risk and return by holding U.S. government securities, which provided greater yields than government bonds in more developed European markets, but were nonetheless safer than other investment opportunities at the time. Therefore, U.S. government debt in the 19th century reflected more of a "reach for yield" for foreigners when compared to the "safe haven" they represent today with the dollar as the world's dominant reserve currency.

- Background: The U.S. Capital Account and Financial Markets in the Mid-19th Century

This section reviews the trends in the U.S. capital account in the decades prior to each of the Treasury surveys in 1853 and 1869, as well as the structure of the financial markets available to foreign investors at the time.

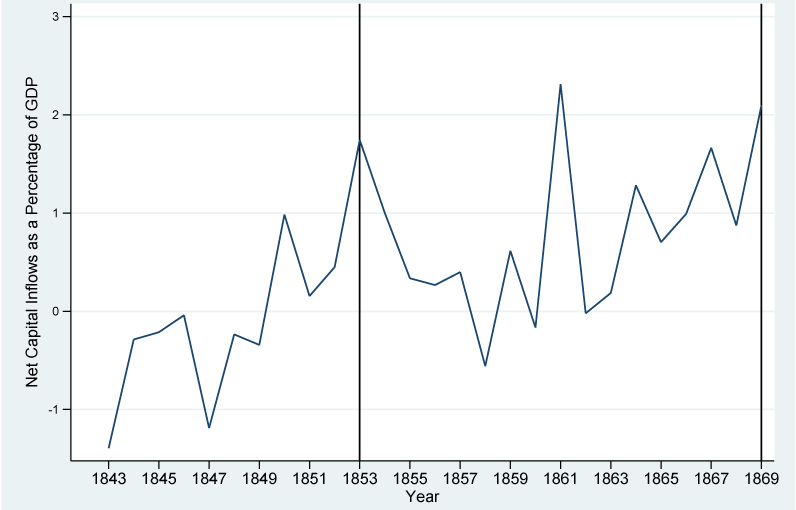

Prior to each survey year, the U.S. experienced a period of sustained capital inflows. Figure 1 uses data from North (1960), Simon (1960), and Johnston and Williamson (2019) to plot the annual net capital inflow as a share of GDP between 1843 and 1869. The vertical lines mark the survey years. The broad trend in the decade before each survey is for net outflows or very small inflows to gradually increase to net inflows equal to two percent of GDP by the survey, justifying the concerns about growing foreign investment that motivated the 1853 and 1869 surveys. The events leading to this pattern in each case are reviewed below.

Foreign capital flowed out of the U.S as many state governments defaulted on their debt in the early 1840s. Revolutions across Europe in 1848 initiated a new wave of foreign demand for U.S. securities, as investors in the affected countries sought the relative safety and high return that American assets offered. Even as the revolutionary tide subsided, a booming U.S. economy after the 1849 California gold discoveries and the resumption of interest payments by a majority of the defaulting states continued to attract foreign investment (Wilkins, 1989). A broad anti-foreign sentiment emerged in the 1850s in the U.S., likely helping to trigger the 1853 Treasury survey (Adler, 1970).

The years leading up to the 1869 survey follow a similar trend. Foreign investment dropped in the early years of the Civil War (1861 and 1862), before foreigners began purchasing much of the growing federal debt. After the end of the Civil War in 1865, construction on railroads--halted by the war--boomed, attracting additional foreign capital. The 1869 survey specifically lists the growing foreign indebtedness as a main threat to national economic development (United States Congress, 1869).

Who were the foreign investors? While the surveys do not distinguish the different nationalities, estimates from later years and the historical record around this time suggest that the largest group of foreign investors in the U.S. was from Great Britain (Wilkins, 1989). The British foreign portfolio was relatively large at the time of the surveys, with the best estimates suggesting it was worth around $2.8 billion in 1870 (Platt, 1980). The 1869 survey estimates total foreign investment in the U.S. of $1.47 billion, or 18.5 percent of U.S. GDP that year (Johnston and Williamson, 2019).

What other opportunities did the British have for foreign investment? A look at issues of the Economist from that time reveals where else British investors placed their money. Sovereign bonds from around the globe traded on the London Stock Exchange and dominated the foreign options; they were primarily of countries in Latin America and continental Europe, though the British colonies also had bonds traded in London. Stocks and bond of railway companies represented the other major foreign securities for British investors. In addition, the British had considerable domestic investment opportunities as well, with total paid-in capital for railways in 1874 estimated to be $3.3 billion at face value, and total government debt equal to $5.15 billion, or a combined 115 percent of U.K. GDP at the time (Platt, 1980; Bank of England, 2019; Thomas and Williamson, 2019).

Within the United States, foreign investors could allocate their capital among a variety of securities. Most of these represented long-term instruments. One possibility was the debt of the federal government. The federal government issued debt to finance military spending above and beyond their revenues from tariffs and public land sales. Thus, federal debt typically grew in times of war and economic distress and subsequently shrank as the economy boomed.

The other U.S. securities available at the time typically funded large-scale infrastructure projects. This is true for both the debts of state and municipal governments as well as the equity and debts of private corporations. State governments led the first wave of infrastructure borrowing, issuing bonds for the construction of canals and early railroads. Additionally, at the time, many southern states chartered banks and used the proceeds of bond sales as paid-in capital for these banks. After the default crisis of the 1840s, states reduced their borrowing for infrastructure. Instead, private corporations took over the building of transportation networks. Corporate securities in the mid-19th century were primarily railroad company obligations, followed by, to a much smaller extent, debt and equity of canal and navigation companies. Towards the end of the 1860s, cities and counties also undertook borrowing for infrastructure, but this grew mostly in the 1870s. One final opportunity for foreign investors was bank equity, though this was a minute portion of the foreign portfolio of U.S. assets.

- Foreign Ownership of U.S. Securities in the mid-19th Century vis-à-vis 2018

This section compares foreign portfolio investment in the United States in 1853 and 1869 with that in 2018, highlighting how safe asset demand now alters the risk and return tradeoffs for foreign investors now relative to those in the 19th century. Details on the data sources used for these comparisons can be found in the Appendix below.

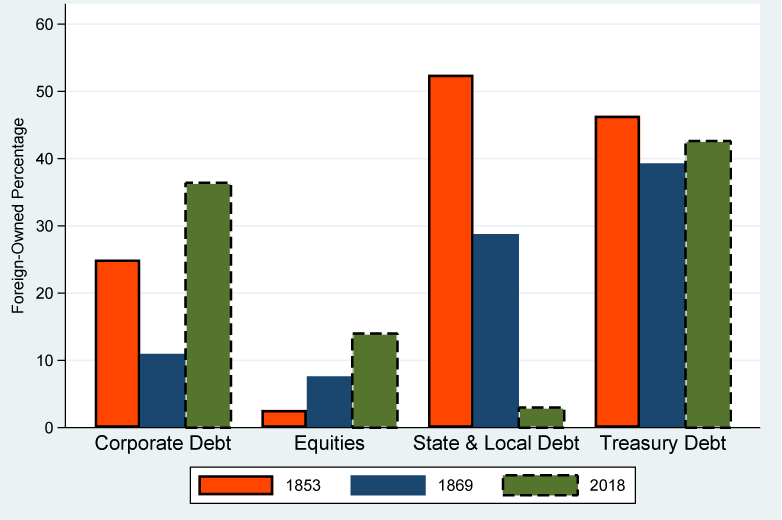

Across all three surveys, U.S. government debt has the highest share of foreign holdings relative to market size. Figure 2 plots the percentage of U.S. corporate debt, equities, municipal debt, and Treasury debt held by foreigners in 1853, 1869, and 2018, showing just how important foreign investment is for U.S. government debt in all three years. Foreigners held sizable shares of both municipal bonds and Treasury bonds in 1853 and 1869, but only the proportion of Treasury bonds has been relatively consistent in all three surveys.2

The reasons foreigners purchased U.S. government debt were far different back then from what they are now, however. Investing in U.S. Treasury debt was far riskier in the mid-19th century than in recent years. Nowadays, foreign investment in Treasuries is driven primarily by two factors: the role of the dollar as the primary reserve currency and the relative safety of Treasuries that prompts foreigners to hold them during flights to quality. In 1869, Treasury debt did not have this advantage. A mere four years before, the U.S. had concluded a costly civil war, and an arduous period of reconstruction followed thereafter. During the war, the U.S. alarmed foreign investors by making government paper legal tender in February 1862, and there were concerns among foreign investors about the possibility of the U.S. repudiating its debt (Platt, 1984). Despite this, foreign investors chose to allocate some of their capital to Treasury debt over safer securities in Western Europe, implying a different motivation for foreign investment in Treasury debt in the mid-19th century--a desire for higher returns.

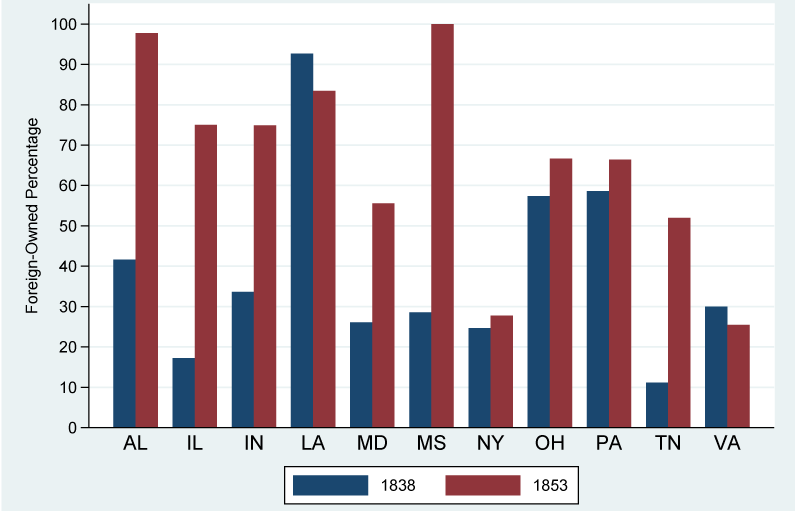

This risk-tolerant behavior by foreign investors not only applied to Treasury bonds in the late 1860s, but also apparently to state bonds in the 1850s. While usually considered safe investments nowadays, state bonds in the mid-19th were risky securities to own. In fact, during the 1840s, a total eight states and one territory defaulted on their debt: Arkansas, Illinois, Indiana, Louisiana, Maryland, Michigan, Mississippi, Pennsylvania, and the territory of Florida (Wilkins, 1989). In spite of the numerous state defaults in the 1840s, the percentage of state bonds owned by foreigners remained high in 1853, in some cases higher than it had even been in 1838, as shown in Figure 3.

Many states did try to settle with bondholders, and even implemented restrictions on the legislature's ability to borrow and prohibiting state investment in private corporations (Beach, 2014). Nevertheless, even in cases where states did not implement constitutional reforms concerning debt, foreigners held a large percentage of state bonds. For example, although Arkansas defaulted in the 1840s, and failed to implement constitutional reforms, foreign investors held about 68 percent of its debt in 1853 (Beach, 2014). Once again, the evidence suggests that higher returns enticed foreign investors to choose risky U.S. Treasuries and state bonds over safer investments closer to home.

Just how lucrative could investing in U.S. government securities be for foreign investors? As an example, in September 1853, an investor could purchase a five-year U.S. Treasury bond with a 6 percent coupon, with a slightly lower yield based on London prices (Wetenhall, 1853). That same year, an investor would have been able to purchase a 3 percent British Consol at a yield of slightly over 3 percent and 2.5 percent perpetual bond from the Netherlands at a yield of just under 4 percent (Homer and Sylla, 2005).

While there were clear risks involved in holding U.S. government securities, they did provide an opportunity for foreign investors to pursue higher returns and at the same time diversify their portfolios by holding assets potentially uncorrelated with European securities. Furthermore, U.S. government securities were relatively safe compared to other investments in the U.S. and other emerging markets at the time. Investments in U.S. corporate debt and equities in the mid-19th century were considered to be little more than highly speculative ventures suffering from rampant information asymmetry.3 There was greater access to information on U.S. federal and state governments than individual companies in the periodicals, and these governments had the authority to tax and were therefore likelier to generate returns. Unsurprisingly, the Treasury surveys reveal that the proportion of private sector securities outstanding held by foreign investors in the mid-19th century was far lower than in 2018.

Appendix: Data Sources

Data on total market capitalization are included in the 1853 survey but not the 1869 survey. We obtain market sizes for 1869 from two sources: the U.S. Public Debt Issues, 1775-1976 database, compiled by Frank Noll, provides information on federal bonds outstanding, while information on state and local bonds outstanding in 1870 and railroad securities outstanding in 1871 come from the 1872 and 1874 editions of Henry V. Poor's Manual of the Railroads of the United States. The 2018 data on foreign portfolio investment in the U.S. largely come from "Foreign Portfolio Holdings of U.S. Securities as of June 29, 2018" published by the Treasury Department, the Federal Reserve Bank of New York, and the Federal Reserve Board. We obtain data on U.S. municipal (both state and local governments) bonds outstanding in 2018Q2 from the Federal Reserve Board's "Z.1 Financial Accounts of the United States: Flow of Funds, Balance Sheets, and Integrated Macroeconomic Accounts: Fourth Quarter 2018."

The 1838 state debt data--showing foreign ownership of state bonds prior to the defaults, are from the July 21, 1838 edition of Niles' National Register, which provides foreign holdings of state bonds, and from the book American State Debts by B.U. Ratchford, which provides total state debt outstanding. The 1853 state debt data---showing foreign ownership of state bonds after the defaults--are from the 1853 Treasury survey.

Bibliography

Adler, Dorothy R (1970) British Investment in American Railways, 1834-1898, Charlottesville: The University Press of Virginia.

Bank of England (2019) Public Sector Debt Outstanding in the United Kingdom [PSDOUKA], retrieved from FRED, Federal Reserve Bank of St. Louis, https://fred.stlouisfed.org/series/PSDOUKA

Beach, Brian (2014) "Do Markets Reward Constitutional Reform? Lessons from America's State Debt Crisis," SSRN. http://dx.doi.org/10.2139/ssrn.2477525

Board of Governors of the Federal Reserve System (2019) "Z.1 Financial Accounts of the United States: Flow of Funds, Balance Sheets, and Integrated Macroeconomic Accounts: Fourth Quarter 2018," Washington: Board of Governors of the Federal Reserve System.

Board of Governors of the Federal Reserve System, Federal Reserve Bank of New York, U.S. Department of the Treasury (2019) "Foreign Portfolio Holdings of U.S. Securities as of June 29, 2018," Washington: Department of the Treasury.

"Estimate of American stocks held abroad, principally in England" (1838), in Niles' National Register, fifth series vol. 4 no. 21, Washington: William Ogden Niles. https://babel.hathitrust.org/cgi/pt?id=osu.32435063588115;view=1up;seq=332

Homer, Sidney and Richard Sylla (2005) A History of Interest Rates Fourth Edition, Hoboken: John Wiley & Sons, Inc.

Johnston, Louis and Samuel H. Williamson (2019) "What Was the U.S. GDP Then?" MeasuringWorth. http://www.measuringworth.org/usgdp/

Noll, Frank, U.S. Public Debt Issues, 1775-1976, Economic History Association. http://eh.net/database/u-s-public-debt-issues-1775-1976/

North, Douglass (1960) "U.S. Balance of Payments 1790-1860," in Trends in the American Economy in the Nineteenth Century, Princeton: Princeton University Press, pp. 573-628.

Platt, D. C. M. (1980) "British Portfolio Investment Overseas before 1870: Some Doubts," The Economic History Review, vol. 33 no. 1, pp. 1-16. https://www.jstor.org/stable/2595540

Platt, D. C. M. (1984) Foreign Finance in Continental Europe and the United States, 1815-1870: Quantities, Origins, Functions and Distribution. London: George Allen & Unwin.

Poor, Henry V. (1872) Manual of the Railroads of the United States, for 1872-73, Showing their Mileage, Stocks, Bonds, Cost, Traffic, Earnings, Expenses, and Organizations: with a Sketch of their Rise, Progress, Influence, etc. Together with an Appendix, Containing a Full Analysis of the Debts of the United States, and of the Several States. New York: H. V. & H. W. Poor.

Poor, Henry V. (1874) Manual of the Railroads of the United States, for 1874-75, Showing their Mileage, Stocks, Bonds, Cost, Traffic, Earnings, Expenses, and Organizations: with a Sketch of their Rise, Progress, Influence, etc. Together with an Appendix, Containing a Full Analysis of the Debts of the United States, and of the Several States. New York: H. V. & H. W. Poor.

Ratchford, B.U. (1941) American State Debts. Durham: Duke University Press.

Simon, Matthew (1960) "The United States Balance of Payments, 1861-1900," in Trends in the American Economy in the Nineteenth Century, Princeton: Princeton University Press, pp. 629-716.

Thomas, Ryland and Samuel H. Williamson (2019) "What Was the U.K. GDP Then?" MeasuringWorth. http://measuringworth.com/ukgdp/

U.S. Congress, Senate (1854) Report of the Secretary of the Treasury, in answer, to a resolution of the Senate calling for the amount of American securities held in Europe and other foreign countries, on the 30th June, 1853, Ex. Doc. No. 42, 33d Congress 1st Session, Washington: Beverley Tucker, Senate Printer.

U.S. Congress, House (1869) The Report of the Special Commissioner of the Revenue upon the Industry, Trade, Commerce, &c., of the United States for the Year 1869, report prepared for the Committee of Ways and Means by the Special Commissioner of the Revenue, U.S. Department of the Treasury, Ex. Doc. 27, 41st Congress 2nd session, Washington: Government Printing Office.

Wetenhall, James B. (1853), "Public Securities of the United States of America," in Course of the Exchange: Prices of Shares in Canals, Railways, Dock Stocks, Assurance Companies, No. 14,071 September 20, 1853, London: Committee of the Stock Exchange.

Wilkins, Mira (1989) The History of Foreign Investment in the United States to 1914. Cambridge: Harvard University Press.

1. Julio Monge, [email protected], Federal Reserve Bank of New York; Colin Weiss, [email protected], Division of International Finance, Federal Reserve Board of Governors. We thank Daniel Beltran, Carol Bertaut, and Shaghil Ahmed for helpful comments. The views expressed in this paper are those of the authors and should not be interpreted as representing the view of the Federal Reserve Board, the Federal Reserve Bank of New York, or any other person associated with the Federal Reserve System. Corresponding author: [email protected]. Return to text

2. By contrast, it is likely that relatively little municipal debt is held by foreigner investors nowadays since foreign investors do not get the tax advantages that U.S. residents do when holding these securities. Return to text

3. Wilkins (1989) mentions the concerns that many foreigners had about the riskiness of U.S. private sector securities. Among their concerns were the reliability of information presented to them about American companies, the honesty of American companies' management, and the perceived speculative or even fraudulent nature of these investments. Return to text

Monge, Julio and Colin Weiss (2019). "Foreign Portfolio Investment When the United States was an Emerging Market," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, October 16, 2019, https://doi.org/10.17016/2380-7172.2461.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.