FEDS Notes

July 30, 2021

The Pandemic's Impact on Credit Risk: Averted or Delayed?

SungJe Byun, Aaron Game, Alexander Jiron, Pavel Kapinos, Kelly Klemme, Bert Loudis1

Introduction

The COVID-19 recession resulted in historic unemployment and a significant shock to much of the service sector. Despite these macroeconomic challenges, banks' risk-based capital buffers remain high and the number of bank failures remains low. Government relief programs, including the Coronavirus Aid, Relief, and Economic Security (CARES) Act, both directly and indirectly helped stabilize bank balance sheets during the crisis.2 Banks will face new challenges as these programs begin to taper off and forbearance reported on balance sheets evolves. This note highlights potential lingering risks from the COVID-19 recession, most notably for small banks with relatively high exposure to commercial real estate (CRE).

Prior to the introduction of Section 4013 of the CARES Act, firms that granted loan concessions or modifications meeting specific conditions specified in accordance with Generally Accepted Account Principles (GAAP) were required to classify these loans as Troubled Debt Restructuring (TDR). This designation carries additional operational burden for banks, as they need to identify and disclose TDR. Section 4013 of the CARES Act provided operational relief to financial institutions by giving them the option to not classify and account for certain COVID-19 modified loans as TDRs.3

Section 4013 also provides capital relief, as banks are not required to hold additional capital associated with past due loans. For example, a residential mortgage exposure that is 90 days past due is subject to a 150 percent risk-based capital requirement (compared to the typical 0 to 50 percent requirement).4 Banks must still set aside an allowance for loan and lease losses, however, even when a loan falls under Section 4013 classification.5 To not do so would be to overstate a firm's earnings.

The window for Section 4013 modification is open until the earlier of 60 days after the pandemic emergency end date or the end of 2021, with no stated limit to the length of accommodation. The true delinquency status and credit quality of modified loans remain somewhat opaque and are subject to additional bank classification and discretion. It is therefore difficult for regulators to determine the extent of 'evergreening' (delaying of adverse credit impacts) on bank balance sheets.

Historically, high CRE concentrations have been associated with relatively higher bank risk. We use Call Report data to study recent CRE concentration dynamics and investigate their relationship with Section 4013 loan modifications.6 We first document the recent increase in the CRE concentration and the simultaneous decrease in underlying loan quality. Next, we place the Section 4013 loan modifications and different measures of loan quality in their historical context and note the rapid increase in loan modifications during the COVID-19 recession. Since the Call Report data only provide aggregate Section 4013 loan modification not broken out by loan type, in the following section, we present model results that show banks' CRE concentrations are positively associated with loan modifications. Furthermore, we find high levels of Commercial Mortgage Backed Security (CMBS) delinquencies and rising allowance levels for CRE as the U.S. economy exits the COVID-19 Recession. These risk factors could be early indicators of future increased credit losses and possible bank stress. Finally, we conclude this note with a brief overview of the key results that establish the policy relevance of the Section 4013 loan modifications.

Commercial Real Estate Concentration Risk

The focus on the linkage between Section 4013 loan modification and commercial real estate (CRE) concentration is motivated by findings in the academic literature that CRE lending can pose heightened risk for banks relative to other loan types. Cole and Gunther (1995) found that CRE concentration was one of the key predictors of bank failure during the S&L Crisis of the late 1980s—early 1990s.7 DeYoung and Torna (2013) find a similar result during the Global Financial Crisis (GFC) of 2008-2009.8 Audrino et al. (2019) also use the GFC data and find CRE concentration to be a useful predictor of bank failure at longer horizons of six to eight quarters, highlighting the role of this risk factor in early warning models of emerging bank risk. Rezende (2014) uses the data from 1993-2012 to show that high CRE concentrations are a useful predictor of CAMELS rating downgrades and are generally associated with worse CAMELS ratings.9 In this section, we document the recent increase in CRE concentration and accompanying deterioration in CRE loan quality. These developments pose risks to firms with high CRE concentration.

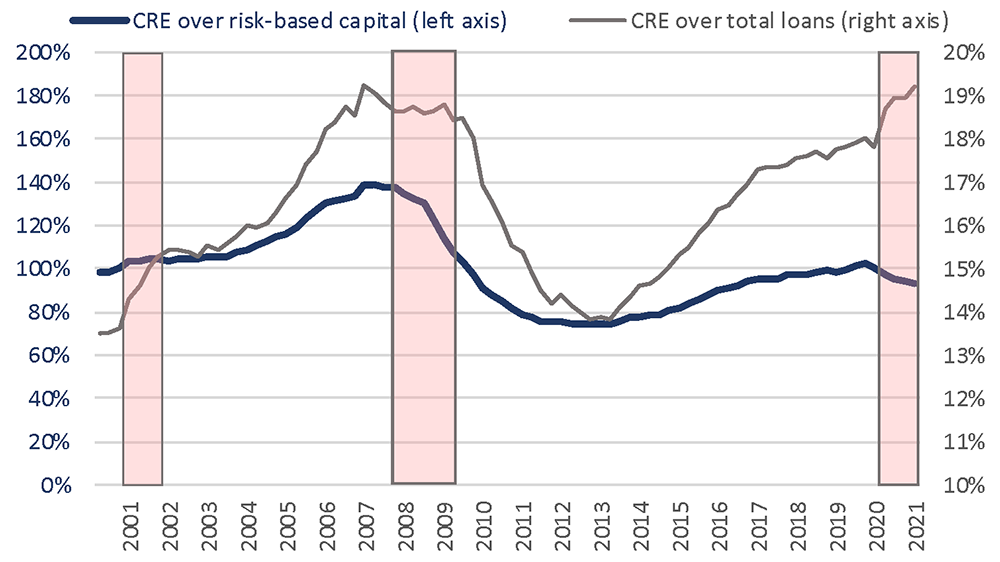

CRE concentrations have increased materially during the past six years. Our analysis measures CRE loans relative to total loans (a metric for exposure) and relative to total capital (a supervisory metric). CRE loans relative to total capital provides a useful metric for measuring commercial banks' vulnerability to potential losses on CRE loans.10

Figure 1a shows that aggregate CRE exposures relative to risk-based capital and total loans are down from their 2007 peak during financial crisis but have reverted higher since their post-crisis trough. In 2006, interagency guidance was issued in response to growing concerns over CRE concentration.11 Market conditions resulting from the Great Financial Crisis fostered the drop in concentration metrics between 2008-2013. However, in 2013 this trend reversed, and the aggregate share of CRE loans relative to total loans is now near its historical peak in our sample period. Had risk-based capital not increased substantially during the post-crisis period, CRE relative to risk-based capital would be closer to historic highs.

Note: Recessions are shaded in light red. Risk-based capital is defined as Tier 1 capital plus allowances for loan losses, as it is a measure of total capital that can be calculated historically. For consistency, we use the revised definition of the capital denominator (here, "risk-based capital") issued in a 2020 interagency guidance for calculating the CRE concentration ratio for the entire sample. Furthermore, prior to Q1 2008, owner-occupied CRE loans were included in the CRE concentration calculation due to a data limitation on the Call Reports. Post-2008 data excludes owner-occupied CRE. We apply a simple scaling adjustment prior to Q1 2008 to mitigate the structural break in the time-series. Total loan data excludes Payment Protection Program (PPP) loans.

Source: FFIEC 031, 041, and 051. All reporting firms.

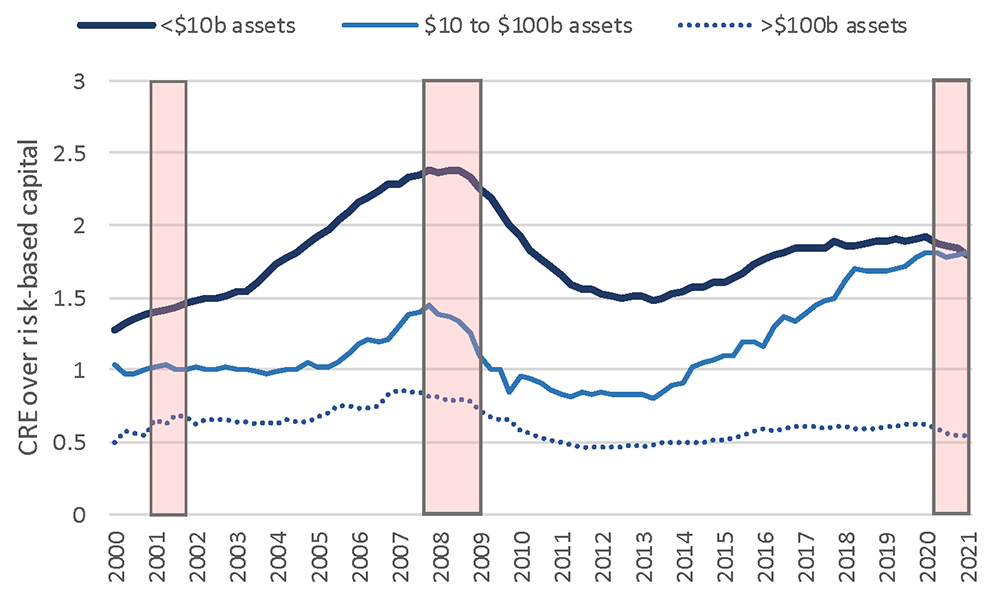

Figure 1b shows that growth in CRE concentration is largely driven by smaller banks, most notably banks with assets between $10 and $100 billion. Calculating based on median, rather than the weighted average shown in this visual, produces consistent conclusions. At the start of the COVID-19 recession, CRE concentrations at the $10 to $100 billion asset firms were larger than at the start of the 2007-2009 Great Recession.

Note: See Figure 1a for a comprehensive description of the inputs shown above.

Source: FFIEC 031, 041, and 051. All reporting firms.

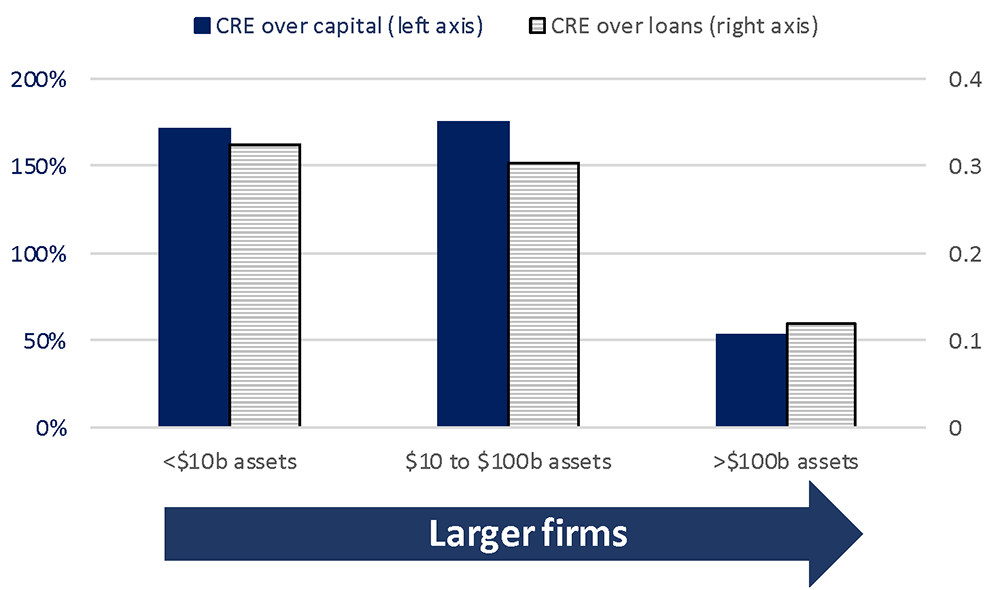

Figure 2 shows CRE exposures normalized by regulatory capital and total loans. Smaller firms generally have greater relative concentration in CRE compared with their larger peers. On average, CRE comprises around 175 percent of risk-based capital for small firms, compared to roughly 55 percent at large firms.

Note: Bars and lines represent weighted average CRE exposure. See Figure 1a for a comprehensive description of the inputs shown above.

Source: Q1 2021 FFIEC Call Reports

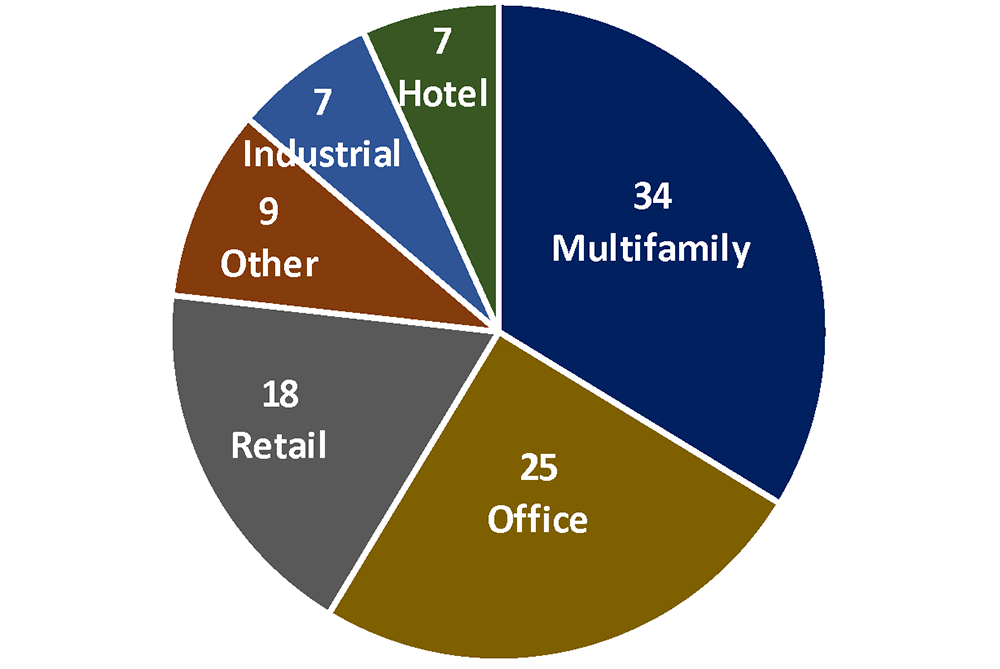

According to Flow of Funds data, banks hold half of all commercial and multifamily mortgage debt outstanding. During prior downturns, high CRE losses contributed to bank failures and constrained bank intermediation.12 Regional and community banks may be vulnerable to abrupt loan quality deterioration once the CARES Act emergency provisions expire, as their lending activity is more concentrated in CRE compared to larger, more diversified banks. For most banks, regulatory reports do not provide detailed CRE exposures at the sector level. However, Trepp's Anonymized Loan Level Repository (T-ALLR) provides additional granularity for the sample of reporting banks' CRE loans. These data suggest that banks' exposures are concentrated in multifamily, office and retail.

Figure 3 provides the breakdown for different CRE property segments as of Q4 2020, the latest quarter for which the data are available as of the writing of this note. Multifamily, office, and retail segments are by far the largest, with 34, 25, and 18 percent of all CRE loans respectively.

Source: Q4 2020 Trepp ALLR.

Loss rates among CRE loan categories are likely asymmetrically distributed. Pandemic-related retail and hotel stresses are well-known, but risks of future deterioration in office and even multifamily segments due to more work-at-home, combined with sizable regional and community bank exposures to these sectors, could lead to credit losses. While banks' CRE loan losses have risen only marginally during the pandemic, deterioration in the private label commercial mortgage backed securities (CMBS) market has been more significant. According to Trepp, the delinquency rate on loans in CMBS securitizations rose from just 2 percent prior to COVID to a peak of 10.3 percent in June 2020 and was still at an elevated 6.5 percent in April 2021. Loans in CMBS securitizations on watch lists and transferred into special servicing also remain elevated at 25.7 percent and 9.0 percent, respectively, compared to pre-COVID levels of 8.5 and 2.7 percent, respectively. Historically, banks' CRE loan losses tend to lag the credit performance of CMBS securities.

The Relationship Between Commercial Real Estate and Loan Modification Usage

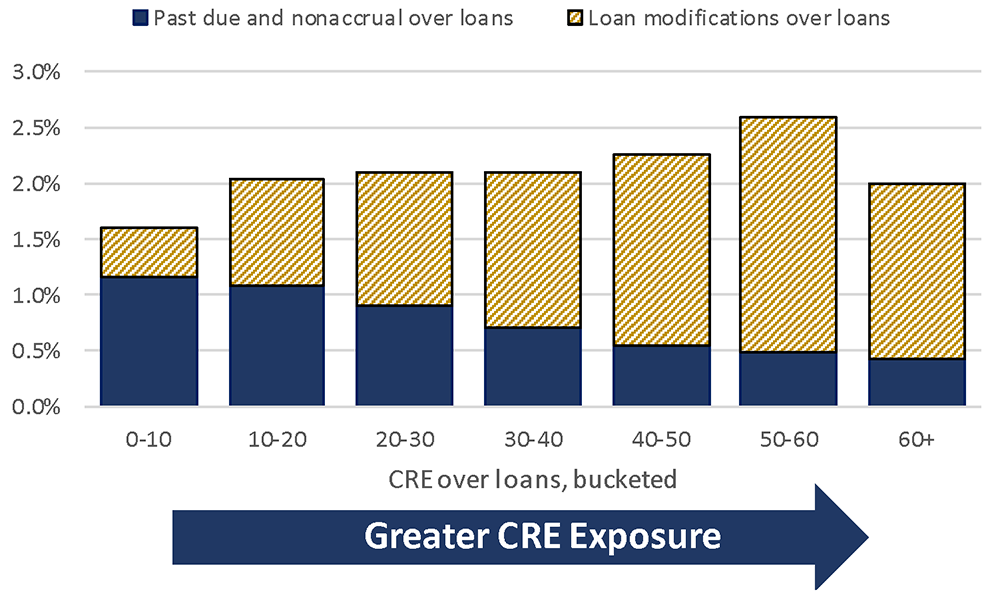

Using the Q1 2021 Call reports, we find that banks with higher CRE concentrations tend to report more loan modifications. Figure 4 shows median delinquent loans (past due and nonaccrual) and loan modifications grouped by CRE concentration (CRE over loans). For example, the first bar shows median delinquent and modified loans for banks with 0 to 10 percent of their total loans in CRE. Banks with greater CRE exposure are reporting modestly fewer delinquencies but materially greater Section 4013 loan modification usage. The typical (median) bank with high CRE concentration (greater than 60 percent of loans) reports that 1.6 percent of loans are modified. This is notably higher than the 0.4 percent of modified loans reported by banks with low (0 to 10 percent of loans) CRE concentration.

Note: Loan data excludes Payment Protection Program (PPP) loans. Key identifies bar chart in order from bottom to top.

Sources: Q1 2021 FFIEC Call Reports. Banks <$100b assets.

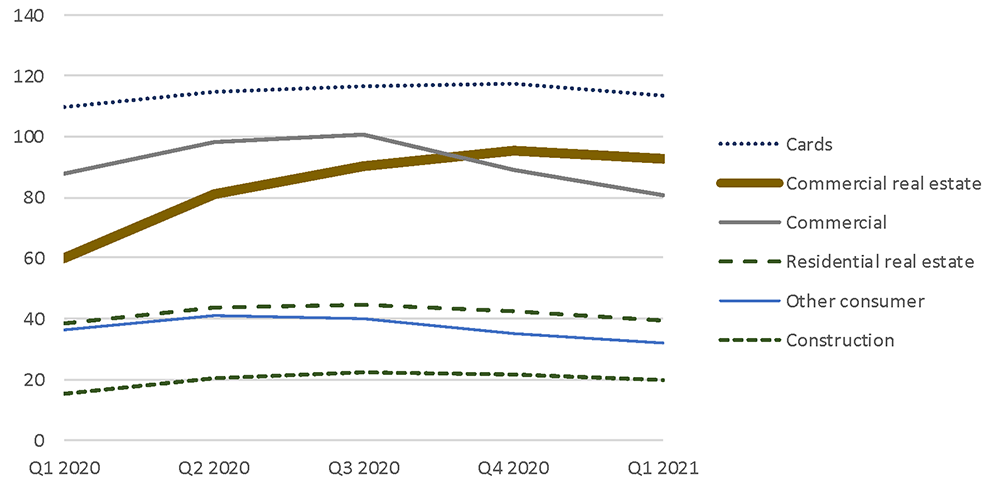

Bank Allowances

Allowances for loan and lease losses are held by banks to cover future expected charge-offs. Importantly, these loss projections and allowances were required to be estimated even for Section 4013 modified loans. Figure 5 shows aggregate allowance levels for small and mid-sized banks during the COVID-19 Recession, by loan category. In Q4 2020, banks' aggregate allowances for Commercial Real Estate (CRE) grew by 5 percent, while allowances for all other loan categories declined by 6 percent in aggregate. This divergence in allowances provides some evidence that banks expect higher future losses from CRE. One other potential explanation for the allowance dynamics could have been the adoption of the new Current Expected Credit Loss (CECL) accounting methodology. Three percent of firms representing 40 percent of the total assets in this sample are using the new Current Expected Credit Loss (CECL) accounting methodology. The conclusions of Figure 5 hold when median is used in place of aggregate values. This shows that the results are not only being driven by the largest CECL banks in the sample. In Q1 2021, aggregate CRE allowances declined by 3 percent, compared to a decline of 7 percent for all other loan categories.

Source: FFIEC Call Reports. Aggregate of banks between $1b and $100b assets.

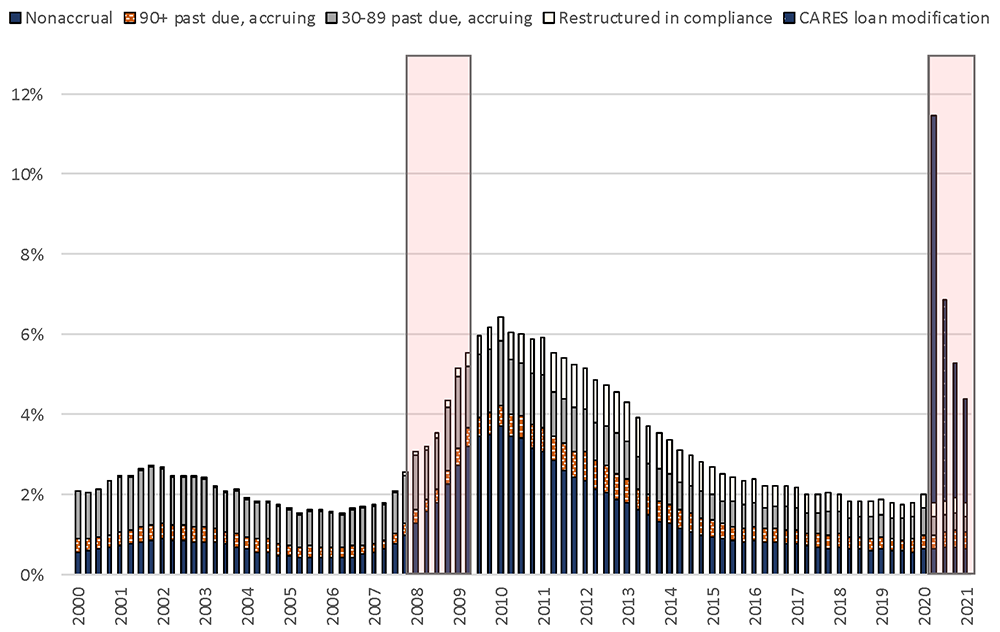

Loan Delinquency and Modification Dynamics

The initial surge in CARES Act loan modifications was driven by a sudden reduction in local economic activity and distress in the labor market related to the COVID-19 pandemic. Figure 6 describes the dynamics of loan modifications and delinquencies over the last two business cycles for banks with assets between $1 billion and $100 billion. Several aspects of these modifications relative to the experience during the Great Recession are noteworthy. First, the scale is unprecedented: In Q2 2020, loan modifications for banks in our sample were roughly 10% of total loans, exceeding the previous high by about a factor of ten. Second, banks have been much more proactive in implementing modifications and policymakers have been more proactive in issuing accommodative guidance. In the previous downturn, loan modifications generally followed loan delinquencies, whereas during the COVID-19 recession modifications may have prevented a deterioration in loan quality. Third, since Q2 2020, loan modification ratios have fallen quickly, mimicking the improvements in the U.S. labor market. Modification ratios reached approximately 3% of total loans in Q1 2021, though some individual banks have much higher shares of modified loans.

Notes: Recessions are shaded in light red. Key identifies bar chart in order from bottom to top.

Source: Aggregate FFIEC Call Report filing institutions with assets less than $100b and NBER.

When the window for Section 4013 modifications expires, loans will not automatically enter Troubled Debt Restructuring (TDR) status. We expect banks would generally seek to gradually migrate modifications to TDR on their balance sheets in order to avoid cliff effects. This presumes proper due diligence is done by banks to assess loan performance during the modification window.

An Empirical Model of the Effect of CRE Concentration on Loan Modifications

Section 4013 loan modification data do not contain information on the type of loan modified. Therefore, we investigate the potential relationship between loan modifications and banks' CRE exposures in two ways. First, we examine whether a bank's CRE exposure explains its decisions to grant loan modifications. For this purpose, we run a logistic regression with a binary indicator variable for loan modifications ('LM indicator'), which equals to 1 if a bank reports Section 4013 loan mods, and 0 otherwise. Second, we examine whether banks' CRE exposures explain differences in the relative size of loan modifications across banks by running cross-sectional regressions where the dependent variable is the ratio of loan modifications to total loans ('LM Ratio').13 Third, noting increased loan modifications for about 19 percent of banks from Q2 2020 to Q1 2021, we investigate the potential determinants of increases in loan modification ratios by running a logistic regression where the dependent variable is a binary indicator ('LMI Indicator'), which equals to 1 if a bank's loan modifications have increased between Q2 2020 and Q1 2021. Fourth, we run a cross-sectional regression using changes in loan modification ratios during the same period ('Chg. LM Ratio') as the dependent variable.

We use a large number of regressors to control for differences in banks' profiles.14 Our analysis below focuses on the CRE concentration ('CRE share') and the change in the bank-specific unemployment rate, i.e., the unemployment rate in the bank's deposit footprint, ('Chg in UER') from Q4 2019 to Q2 2020 for Columns (1) and (4), from Q4 2019 to Q1 2021 for Columns (2) and (5) and from Q2 2020 to Q1 2021 for Columns (2) and (6). When examining changes in loan modifications, we include a variable that potentially captures differences in banks' decisions due to differences in the regulatory stance of their primary supervisor. Specifically, we include a binary variable ('Non-FRS Bank'), that equals to 1 if a bank's supervisory agency is not the Federal Reserve System and 0 otherwise.15

Table 1: Quantitative Analysis on Section 4013 Loan Modifications

| Model Dependant Period | Logit | OLS | ||||

|---|---|---|---|---|---|---|

| LM indicator | LM indicator | LMI Indicator | LM Ratio | LM Ratio | Chg. LM Ratio | |

| Q2 2020 | Q1 2021 | Q2'20-Q1'21 | Q2 2020 | Q1 2021 | Q2'20-Q1'21 | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

| CRE share | 0.028*** | 0.02*** | 0.014*** | 0.294*** | 0.073*** | 0.007 |

| (0.003) | (0.003) | (0.004) | (0.015) | (0.01) | (0.009) | |

| Chg in UER | 0.034** | -0.041 | 0.026 | 0.162** | -0.075 | -0.002 |

| (0.014) | (0.027) | (0.046) | (0.08) | (0.105) | (0.094) | |

| LM Ratio as of Q2'20 | -0.151*** | -0.825*** | ||||

| (0.01) | (0.012) | |||||

| Non FRS Bank | 0.300** | 0.672** | ||||

| (0.148) | (0.293) | |||||

| Goodness of fit | 0.199 | 0.222 | 0.154 | 0.194 | 0.038 | 0.708 |

| No. Obs | 4396 | 4310 | 2548 | 2317 | 2124 | 2548 |

Note: For empirical analysis, we restrict the sample as banks whose total assets as of Q4 2019 are less than $100 billion. For empirical analysis associated with change in loan mods between Q2 and Q4 2020, we further narrow down the sample as banks that have existed for three consecutive quarters from Q2 2020 to Q4 2020 and banks with changes in 4013 loan mods either in terms of balance or number during the same period. Goodness of fit statistics are pseudo R-square for the logit model and adjusted R-square for OLS. Asterisks designate statistical significance at the 1% (***), 5% (**), and 10% (*) levels.

Columns (1) and (4) in Table 1 report estimation results for Q2 2020 loan modifications. Banks with higher CRE concentrations were more likely to have loan modifications (Column (1)) and, conditional on granting them, were likely to have larger loan modification ratios (Column (4)). Changes in the unemployment rate also has a positive and statistically significant effect on these outcomes, suggesting a pronounced impact of the unprecedented labor market disruptions that occurred in March-April 2020.

Columns (2) and (5) provide a similar set of estimation results for Q1 2021. CRE concentration continues to be an important determinant of loan modifications, albeit the magnitude of this effect is lower, especially for determining the size of loan modification ratios in Column (5). Changes in the unemployment rate becomes insignificant, suggesting that loan modifications in the later stages of the COVID-19 recession may have been driven by lingering effects of earlier labor market disruptions.

Finally, Columns (3) and (6) report estimation results for models of changes in loan modifications between Q2 2020 and Q1 2021. CRE concentration was an important determinant for the increase in the magnitude of banks' loan modifications (Column (3)). However, it did not have a statistically significant effect on increasing loan modification ratios (Column (6)). Changes in the unemployment rate did not have a significant effect on either of these outcomes. Instead, their primary determinants appear to be the loan modification ratio in Q2 2020 and the non-FRS bank indicator. The negative and statistically significant coefficient on the former suggests that banks with large initial loan modifications were unlikely to experience further increases in modifications by the first quarter 2021, whereas the positive and statistically significant coefficient on the latter implies that the banks supervised by the FDIC and OCC were more likely to increase their loan modification exposure later in the pandemic.

Conclusion

The onset of the COVID-19 recession with an unprecedented spike in unemployment was a grave cause for concern for both the country and banks. Unprecedented policy support, coupled with loan modifications, provided a bridge to many borrowers as economic activity stalled and then restarted. As the pandemic wanes and policy support, including the window for Section 4013 loan modifications, ends, a key question remains: was the pandemic's impact on credit and, in turn, bank health averted or merely delayed?

Historically, CRE loan concentrations have been associated with elevated risk of bank failure. Hotel and retail as well as office and multi-family face structural headwinds in the post-pandemic environment. The performance of CRE loans backing CMBS show evidence of credit strain. While the data do not allow to disentangle the proportion of banks' CRE loans modified, we note that during 2020 allowances for losses on CRE loans have increased by the largest amount among all loan types. Furthermore, we find that loan modifications are strongly correlated with CRE concentrations across banks. While the rate of loan modifications has been decreasing following an abrupt surge in Q2 2020, the allowance dynamics in the CRE portfolios suggest that this loan category continues to be a source of elevated bank risk, warranting continued close monitoring of banks with CRE concentrations and high or growing levels of loan modifications.

1. We thank Jill Cetina, Christopher Finger, David Lynch, Anlon Panzarella, Allan Perraud, and Helen Xu for helpful feedback. The views expressed in this paper are solely those of the authors and should not be interpreted as reflecting the views of the Board of Governors or the staff of the Federal Reserve System. Return to text

2. Relief programs include (date of being signed into law): the Coronavirus Aid, Relief, and Economic Security (CARES) Act (March 27, 2020); the Paycheck Protection Program and Health Care Enhancement (PPPHCE) Act (April 24, 2020); Paycheck Protection Program Flexibility Act of 2020 (June 5, 2020); Public Law No: 116-147 (July 3, 2020); the Consolidated Appropriations Act of 2021 (December 27, 2020); the PPP Extension Act of 2021 (March 26, 2021). Return to text

3. Interagency Statement on Loan Modifications and Reporting for Financial Institutions Working with Customers Affected by the Coronavirus (Revised)(PDF) (April 7, 2020). Return to text

4. 12 CFR § 217.32 - General risk weights Return to text

5. https://www.federalreserve.gov/supervisionreg/srletters/sr1317a1.pdf. Return to text

6. In 2006, U.S. banking regulatory agencies issued guidance on Commercial Real Estate concentration risk (Board of Governors of the Federal Reserve System, Office of the Comptroller of the Currency, and Federal Deposit Insurance Corporation "Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices"). This guidance included the following quantitative criteria for identifying institutions who may have Commercial Real Estate concentration, and therefore, warrant further supervisory analysis: Construction & Development (C&D) loans / total risk-based capital > 100% OR Total CRE loans / total risk-based capital > 300% AND 36-month CRE loan growth > 50%. Return to text

7. Cole, R.A., Gunther, J.W. (1995). "Separating the likelihood and timing of bank failure". Journal of Banking and Finance, 19, 1073-1089. Return to text

8. DeYoung, R., Torna, G. (2013). "Nontraditional banking activities and bank failures during the financial crisis". Journal of Financial Intermediation, 22, 397-421. Return to text

9. Rezende, Marcel (2014). "The Effects of Bank Charter Switching on Supervisory Ratings." Finance and Economics Discussion Series Working Paper 2014-20. Return to text

10. In 2006, U.S. banking regulatory agencies issued guidance on CRE concentration risk (Board of Governors of the Federal Reserve System, Office of the Comptroller of the Currency, and Federal Deposit Insurance Corporation "Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices"). This guidance included the following quantitative criteria for identifying institutions who may have Commercial Real Estate concentration, and therefore, warrant further supervisory analysis: Construction & Development (C&D) loans / total risk-based capital > 100% OR Total CRE loans / total risk-based capital > 300% AND 36-month CRE loan growth > 50%. Our analysis excludes owner-occupied CRE, consistent with regulatory guidance. Return to text

11. Commercial Real Estate Lending Joint Guidance (December 12, 2006). Return to text

12. Friend, K., Glenos, H., Nichols, J.B. (2013) "An Analysis of the Impact of the Commercial Real Estate Concentration Guidance" (PDF). Federal Reserve Board and Office of the Comptroller of the Currency. Return to text

13. While a large majority of banks have participated in the Small Business Administration (SBA) Paycheck Protection Program (PPP), PPP loans are not subject to Section 4013 loan modifications. Accordingly, we subtract outstanding SBA PPP loan amounts from total loans when constructing the dependent variable – loan modification ratio. Return to text

14. The full list of regressors includes common equity Tier 1 ratio, allowance ratio, return on assets, logarithm of total assets, and delinquency ratio as of Q4 2019. Given county-level unemployment rates provided by the U.S. Bureau of Labor Statistics, we construct commuting zone-level unemployment rates using the latest USDA Economic Research Service (ERS) delineations maintained by Fowler and Jensen (2020). Bank-level unemployment rates are calculated as weighted averages of unemployment rates, with branch deposits provided by the FDIC Summary of Deposits as of June 30, 2019 as corresponding weights. We include loan mods ratio in Q2 2020 and change in unemployment rates from Q2 2020 to Q4 2020 when estimating the models under specifications (3) and (6). Similarly, we construct bank-specific exposures to COVID-19 cases to control for exposure to the pandemic. Return to text

15. We also include loan modification ratio in Q2 2020 to control for initial impact. Return to text

Byun, SungJe, Aaron Game, Alexander Jiron, Pavel Kapinos, Kelly Klemme, and Bert Loudis (2021). "The Pandemic's Impact on Credit Risk: Averted or Delayed?," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, July 30, 2021, https://doi.org/10.17016/2380-7172.2957.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.