IFDP Notes

November 23, 2016

Measuring Cross Country Monetary Policy Uncertainty1 (PDF)

Lucas Husted, John Rogers, and Bo Sun

In previous work, we constructed a news-based index of U.S. monetary policy uncertainty (MPU) that captures the degree of uncertainty the public perceives about Federal Reserve policy actions and their consequences (Husted, Rogers, and Sun, 2016a). In this note, we extend that work to Canada, the Euro Area, Japan, and United Kingdom. As before, we follow a modified news-based search approach along the lines of Baker, Bloom, and Davis (2016a). We focus on the period 1999 to July 2016.

An important element of the new work is to analyze to what degree monetary policy uncertainty is correlated across countries. This echoes the vast literature on the independence of monetary policy. In general, we find that both cross-country correlations and "spillovers" are positive and significant. We also document the importance of Brexit and display some evidence of a relationship between cross-country MPU and a measure of "crash risk" in the foreign exchange market.

In the U.S.-focused note, we argued that our measure of MPU is preferable to several alternatives, at least for our sample period (containing the ZLB) and data frequency (monthly or central bank policy meeting intervals). There we showed a strong link between our index and direct measures of monetary policy uncertainty constructed using survey data. We also showed that our index closely tracks a market-based measure of monetary policy uncertainty, swaptions' implied volatility, before policy rates hit the zero bound, but that significant divergences appear afterward. There is clearly additional information embedded in our MPU index compared to measures based on survey data and market volatility. Our measure is able to be constructed for countries and during time periods when market or survey data are not available.2

The MPU Indexes

As in our U.S-focused work, the approach to constructing the MPU index is to track the frequency of newspaper articles related to monetary policy uncertainty. Using the ProQuest Newsstand and historical archives as our primary source, we construct the index by searching for keywords related to monetary policy uncertainty in major newspapers. Table 1 describes the search information for all of our country searches. Taking the Euro Area as an example, we search for articles containing the triple of (i) "uncertainty" or "uncertain," (ii) "monetary policy(ies)" or "interest rate(s)" or "policy rate" or "refinancing tender" or "EONIA rate" and (iii) "European Central Bank" or "ECB" or "Governing Council". We do this for every day's issue of the Financial Times, Wall Street Journal, and NY Times. Whenever it was feasible to work with domestic newspapers, as here for Canada and the United Kingdom, we conducted both a "domestic-based" search and a search based on the three papers listed for the Euro Area. For the United Kingdom, we report results for the index constructed from searching British newspapers Daily Telegraph, Financial Times, Guardian, Independent, and the Times of London. For Canada, similarly, we use their domestic newspapers.

Note that we control for the changing volume of total news articles over time and the possibility that some newspapers naturally cover monetary policy more than others by first dividing the raw count of identified articles by the total number of news articles mentioning the "European Central Bank" (more precisely, any of the words in category (iii) for that country) for each newspaper in a given period. The share of articles is subsequently normalized to have a unit standard deviation for each newspaper over the sample period. Each of our monetary policy uncertainty indexes is aggregated by summing the resulting series and scaling them to have a mean of 100 over the sample. Finally, we aggregate each daily index into monthly buckets.

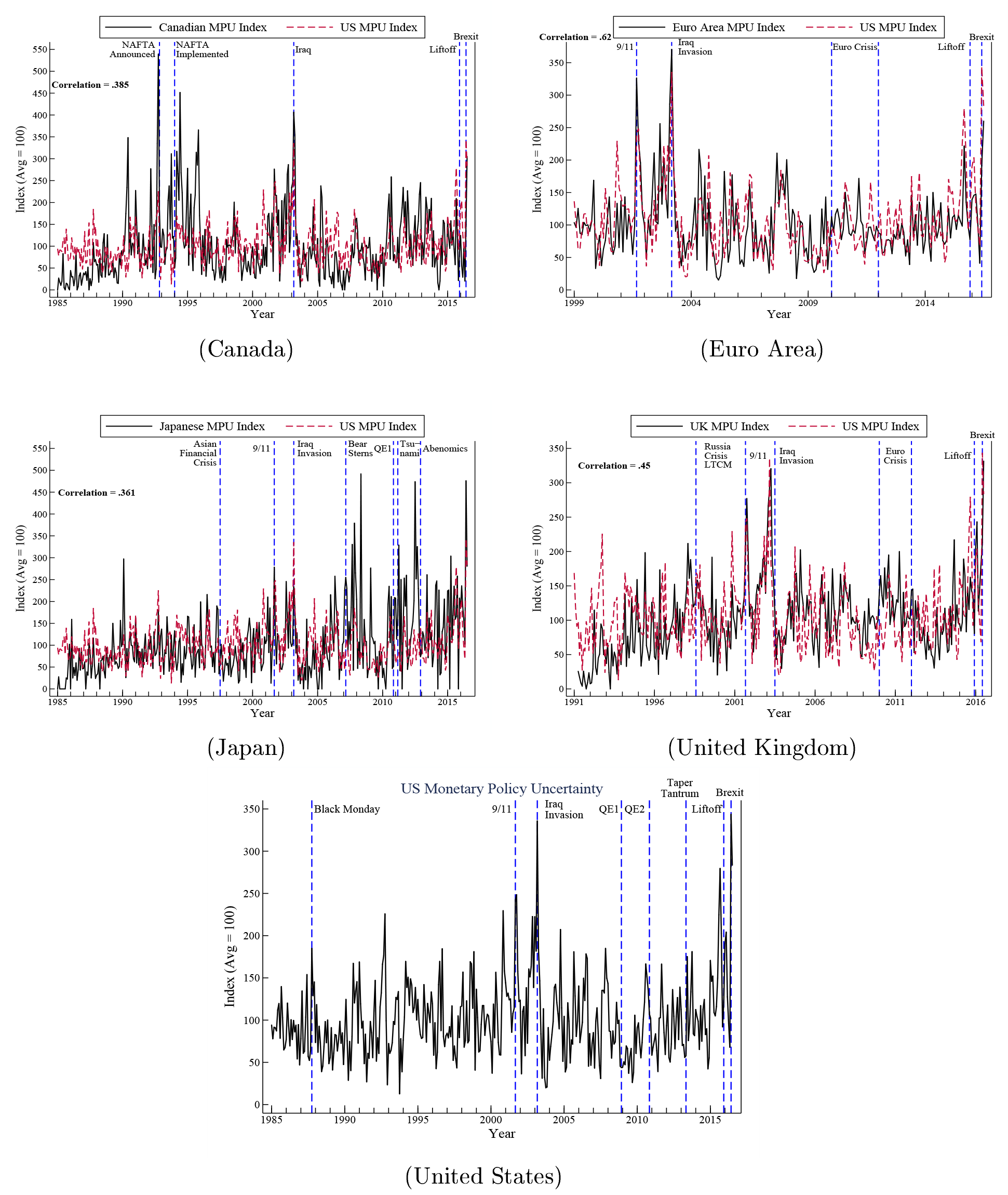

Cross country MPU, Economic Policy Uncertainty, and Brexit

We display our foreign MPU indexes in the four panels of Figure 1, together with our U.S. index. In each case, the sample ends in July 2016. The unconditional correlations between U.S. monetary policy uncertainty and that of Canada, Euro Area, Japan, and the United Kingdom are, respectively, 0.385, 0.62, 0.36, and 0.45. As has been documented for the United States, monetary policy uncertainty abroad spikes on several key dates, especially as evidenced by the large values recorded for Canada in the early 1990s (NAFTA), and in Japan at the onset of the global financial crisis, after the tsunami, and just prior to the unveiling of Abenomics. Large spikes in the Euro Area correspond quite closely to those in the United States, where the index spikes around the September 11 attacks, the March 2003 invasion of Iraq, and prior to the October 2015 FOMC meeting (in which "liftoff uncertainty" seemed to have peaked). In the case of the United Kingdom, monetary policy uncertainty also peaks around 9/11 and the Iraq invasion, but not prior to Fed liftoff. Our MPU indexes thus fluctuate substantially during the period when policy rates were at the effective "zero" lower bound: from late 2008 in the U.S. and late 2009 in the Euro Area. Finally, note the large effect of the June 23, 2016 "Brexit" vote.

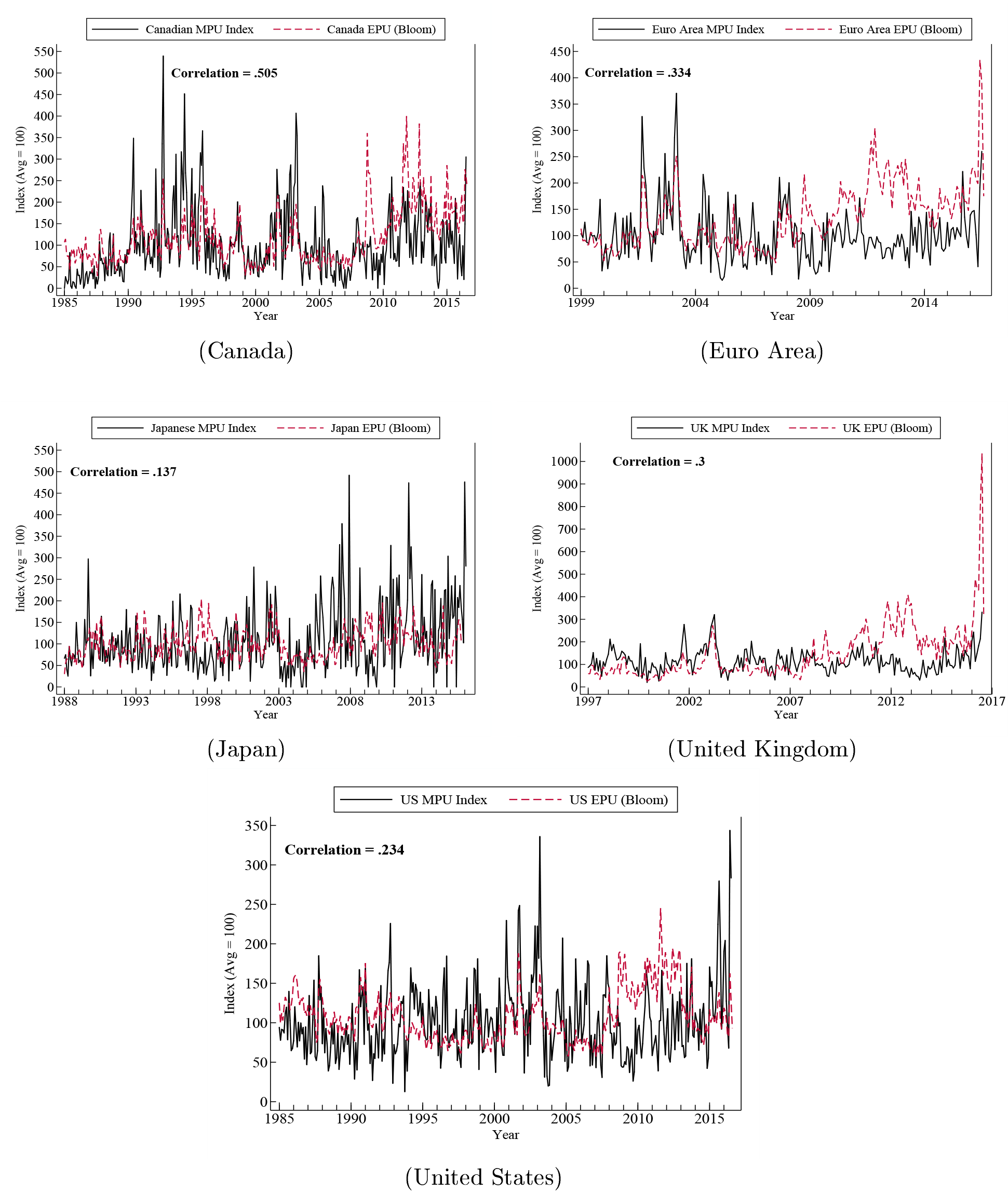

As recently noted by Baker, Bloom, and Davis (2016b), economic policy uncertainty rose dramatically globally after the Brexit vote, to historically unprecedented levels in the United Kingdom. In the five panels of Figure 2, we display our monetary policy indexes against the Baker, Bloom, and Davis (2016a) overall economic policy uncertainty index (EPU). We observe some similarities between EPU and our more narrowly-focused measure of MPU, but also many differences. For the United States, Canada, Euro Area, Japan, and United Kingdom respectively, the correlations are .23, .50, .33, .14, and .30. Note from the UK panel that, as large as MPU is at the time of Brexit, it is dwarfed by overall EPU.3

One conclusion we draw from the figures above is that at horizons of a couple of months to perhaps a year, monetary policy uncertainty comoves noticeably positively across these countries. This is especially evident with respect to large movements like in 2003 and Brexit. We turn next to investigate (1) potential implications on the foreign exchange market of these movements, and (2) sources of these comovements.

MPU, Currency Excess Returns and Risk Reversals

In Husted, Rogers, and Sun (2016b), we investigated the effect of various forms of uncertainty about the U.S. economy on excess returns and risk reversals for a panel of 20 currencies. We used daily data on U.S. and foreign interest rates $$ i_{t}$$ and $$ i^{*}_{t}$$ (3-month, annual rate Treasury bill yields) and spot exchange rates $$ s_{t}$$ (foreign currency per dollar), to calculate "Hold One Quarter" (65 business days) excess returns,

$$$$\displaystyle ER_{t} = 0.25(i^{*}_{t}-i_{t}) +s_{t+65} -s_{t}.$$$$

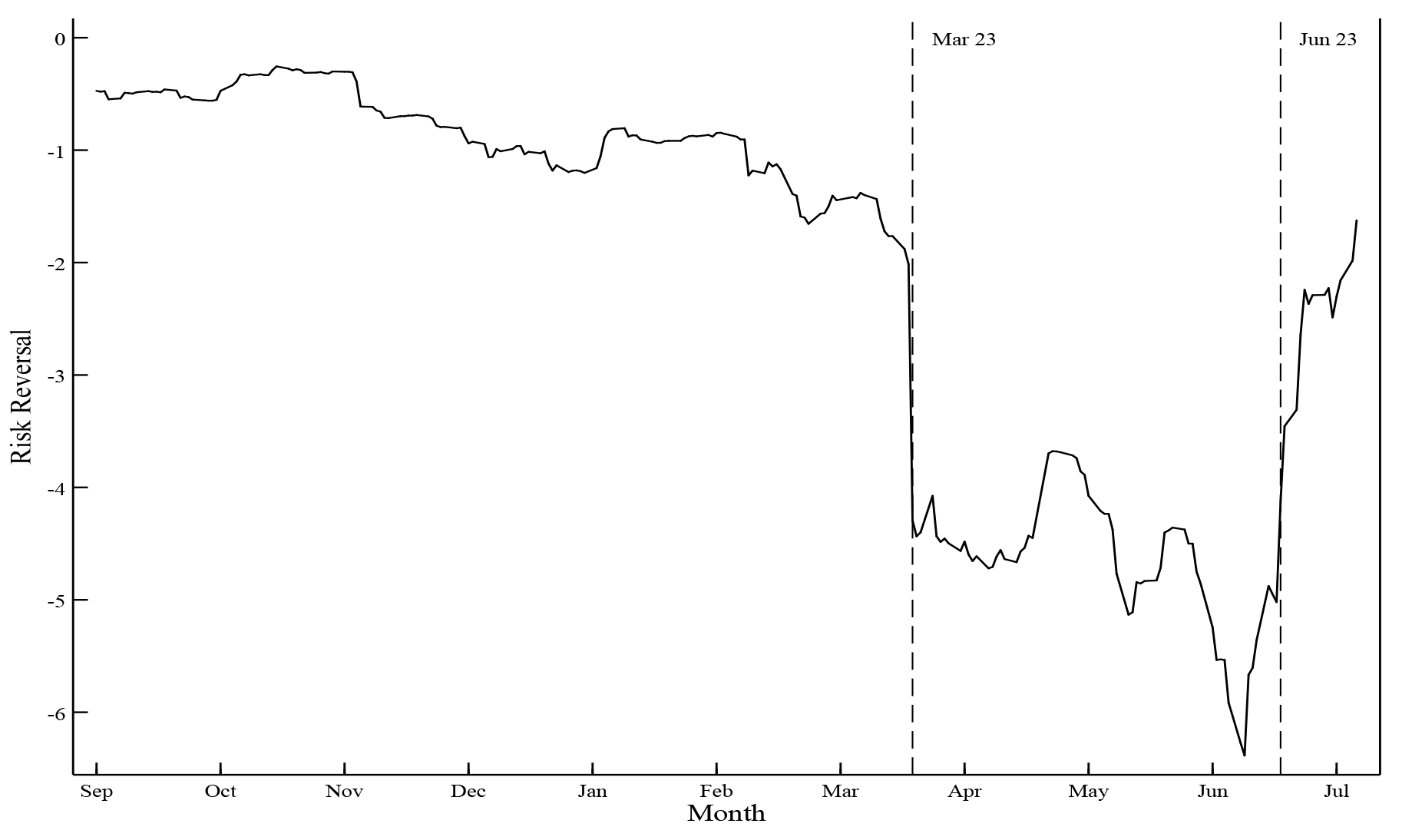

We also examined $$ 25 \Delta$$ three-month risk reversals, a measure of skewness in the foreign exchange market. A risk reversal is the difference between the implied volatility of an out-of-the-money foreign currency call option (giving the right to buy currency, at a specified price) and put option (right to sell, at a given price). Risk reversals are widely used to insure against currency depreciation, and hence are a measure of "crash risk".

By way of reference, consider in Figure 3 the daily three-month ahead dollar-pound risk reversal, in a sample that includes the June 23, 2016 referendum on Brexit. Notice the gradual decline prior to March 23, when the referendum date first comes into the three-month ahead window, and very sharp decline on that date: increased demand for protection against a crash in the pound, provided by the put options, drove the price of puts up and the risk reversal down.

In this note, we examine the effects of foreign MPU relative to U.S. MPU on excess returns and risk reversals for our (small) panel of Canada, Euro Area, Japan, and the United Kingdom. We run the monthly panel regression,

$$$$ Y_{j,t} = b_{0} + b_{1} * \text{log($\frac{\text{mpu}_{j,t}} {\text{mpu}_{t}}$)} +\epsilon $$$$

where Y is alternatively $$ ER_{j,t}$$ and $$ RR_{j,t}$$ for currency j, while $$ mpu_{j,t}$$ and $$ mpu_{t}$$ are country j foreign and U.S. monetary policy uncertainty, respectively (recall that the U.S. dollar is the benchmark currency for ER and RR). The sample period is April 2002 (January 2005) through December 2015 for excess returns (risk reversals).

As seen in Table 2, own-country heightened uncertainty relative to that in the United States has an insignificant effect on excess returns but makes risk reversals more negative. The latter result is consistent with the intuition from movements in risk reversals in Spring 2016 (which is not in the regression sample period). Heightened own-country mpu relative to that in the United States increases demand for foreign currency put options, to protect against a large crash, and lowers the risk reversal.

Evidence of Spillovers from Bivariate VARs

Next we present evidence concerning sources of cross-country comovements in MPU. Is comovement generated by uncertainty coming from the U.S., perhaps that surrounding FOMC meetings, for example? Our initial approach is to compute from bivariate estimated vector autoregressions (VARs) the impulse responses of each country's MPU to home and foreign MPU shocks. Then we display movements in the U.S. and foreign MPU indexes on the days before and after their own monetary policy meeting dates, and repeat this exercise examining movements in foreign MPU around FOMC meeting dates.

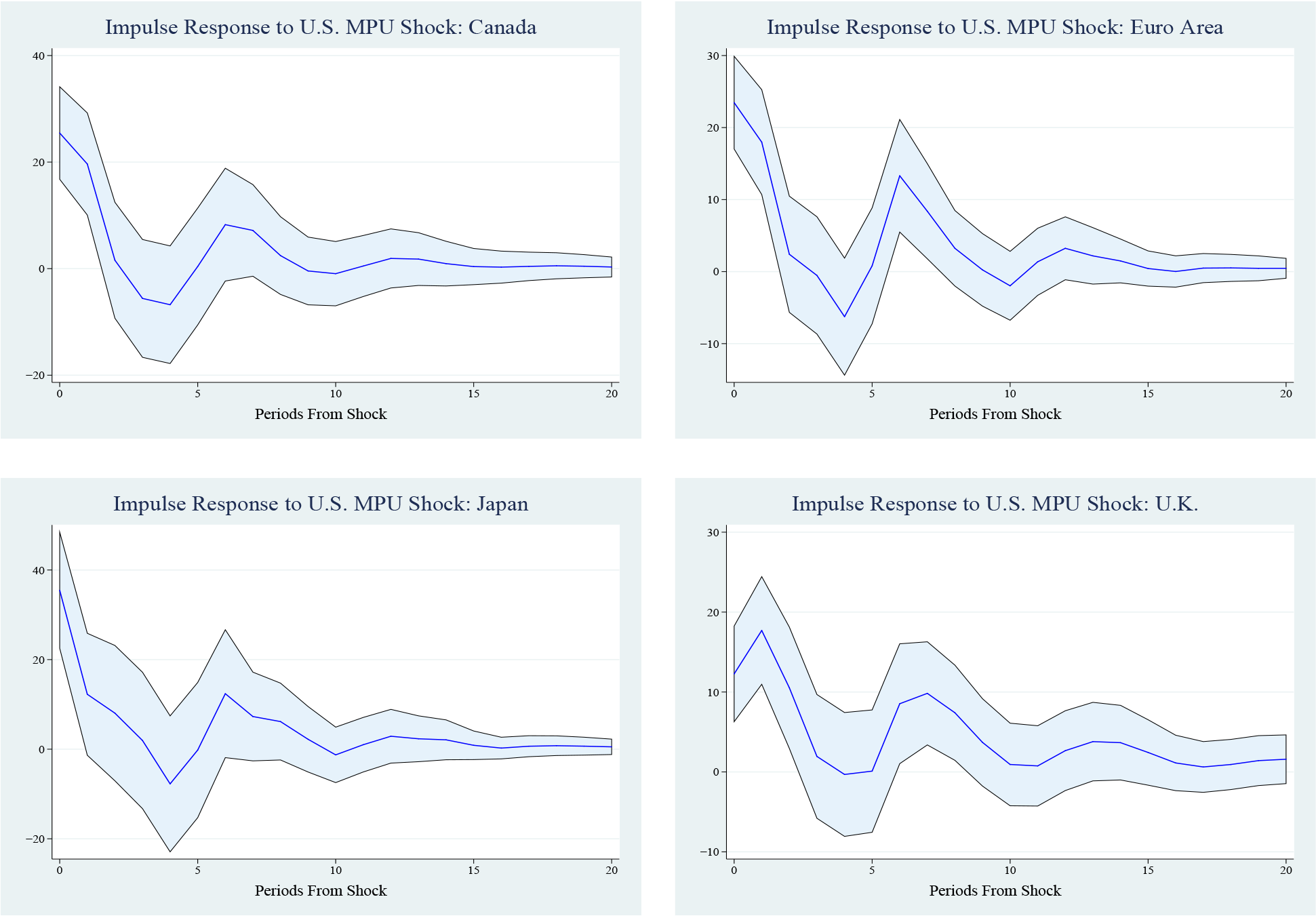

We estimate simple bivariate VARs for monthly U.S.-and-foreign MPUs and perform basic impulse response and variance decomposition analysis. By ordering U.S. MPU first, we allow foreign MPU to respond to U.S. innovations immediately while U.S. MPU can only respond with a one-period lag. We use six lags (results are insensitive to the choice).

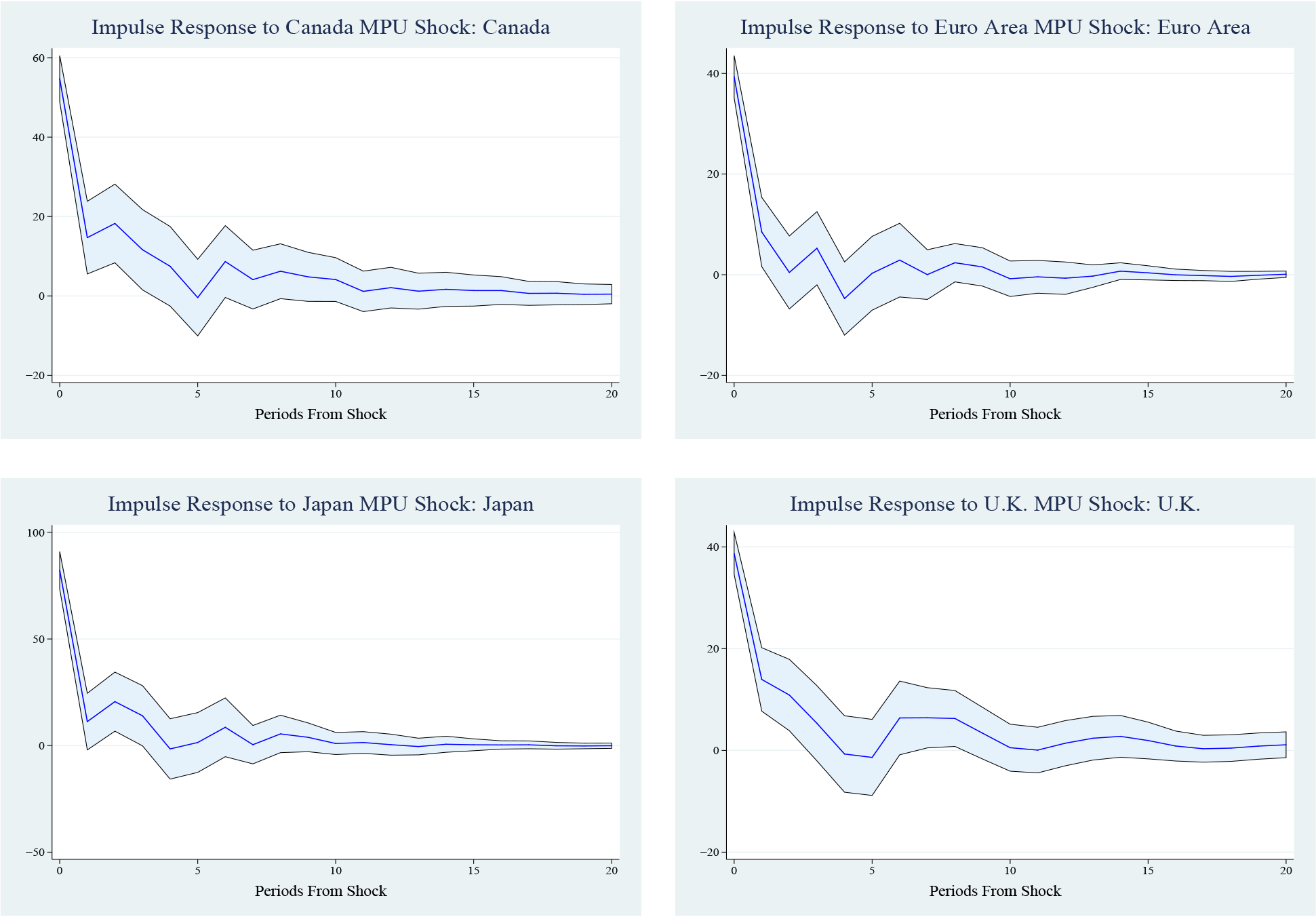

In the four panels of Figure 4 and Figure 5 we display the impulse responses, by country, to a shock to U.S. MPU and own-country MPU, respectively. In each case, foreign MPU responds positively and significantly to U.S. shocks, an effect that is insignificantly different from zero after two months. The responses to own-country MPU, shown in the four panels of Figure 5, are about twice as large and significant for about twice as many months compared to the responses to U.S. shocks.

The variance decompositions from these bivariate VARs are displayed in Table 3, where we show the contribution of U.S. shocks to foreign country MPU variability.4 On impact, U.S. shocks account for 9 percent of variation in U.K. monetary policy uncertainty and up to 26 percent for the Euro Area. At the one-year horizon, U.S. shocks explain up to 41 percent in the case of the Euro Area. Obviously, these simple specifications are silent on the precise channels through which monetary policy uncertainty is spilling over, but nonetheless are strongly suggestive that spillovers are nontrivial.

Movements in MPU Around Monetary Policy Meeting Days

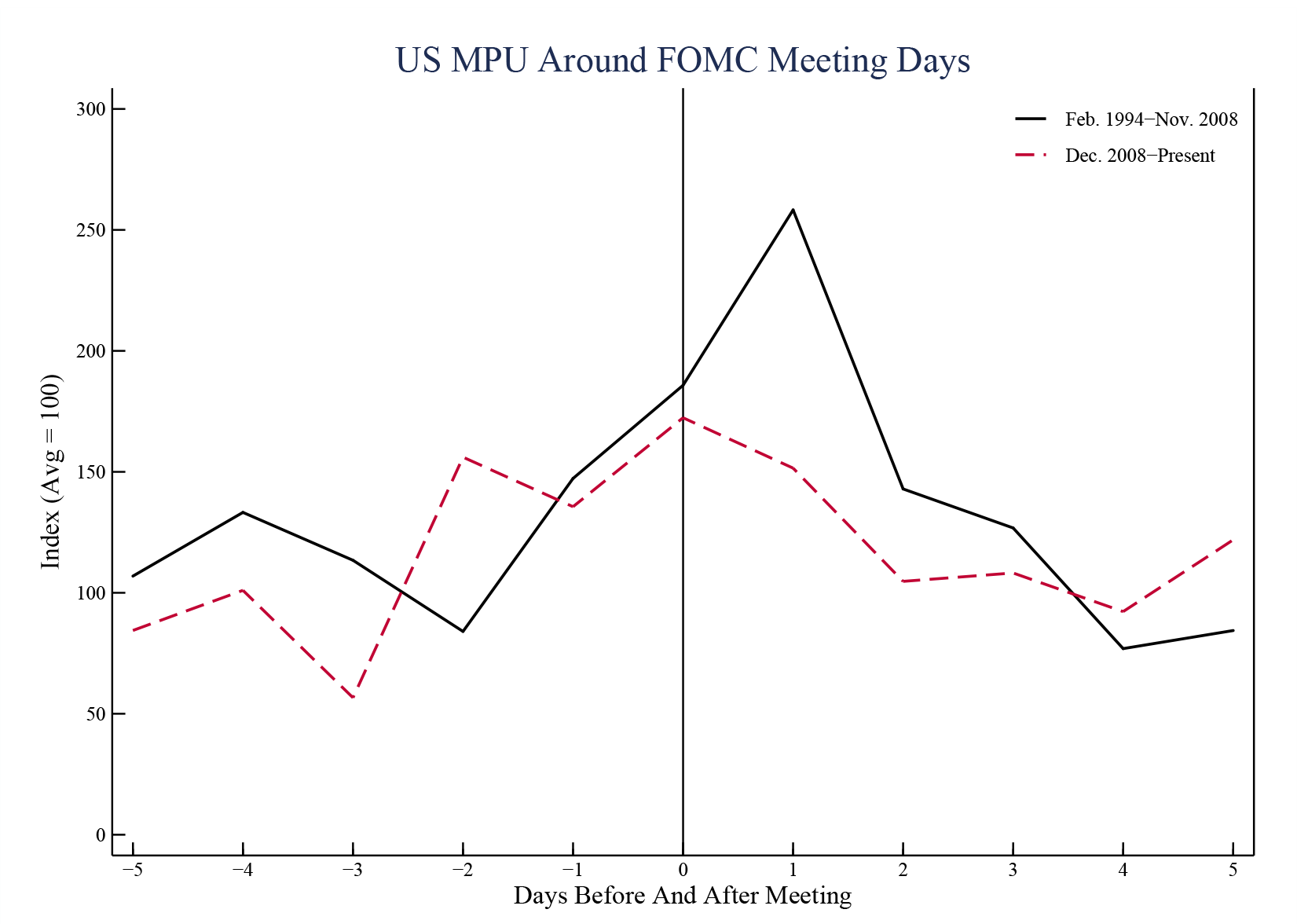

In Husted, Rogers, and Sun (2016a) we showed that there is a rise in U.S. MPU in the days prior to FOMC meetings which dissipates very quickly after the meeting. Furthermore, we showed that after the FOMC began to rely increasingly on forward guidance beginning in December 2008, the pre-meeting rise in U.S. MPU is greatly muted and peaks one day sooner, compared to the period February 1994-November 2008.5 The figure from that paper showing this is repeated here as Figure 6, where the solid line represents the sample of FOMC meetings for the sub-period up to November 2008 and the dashed line for the period Dec. 2008 to January 2016.

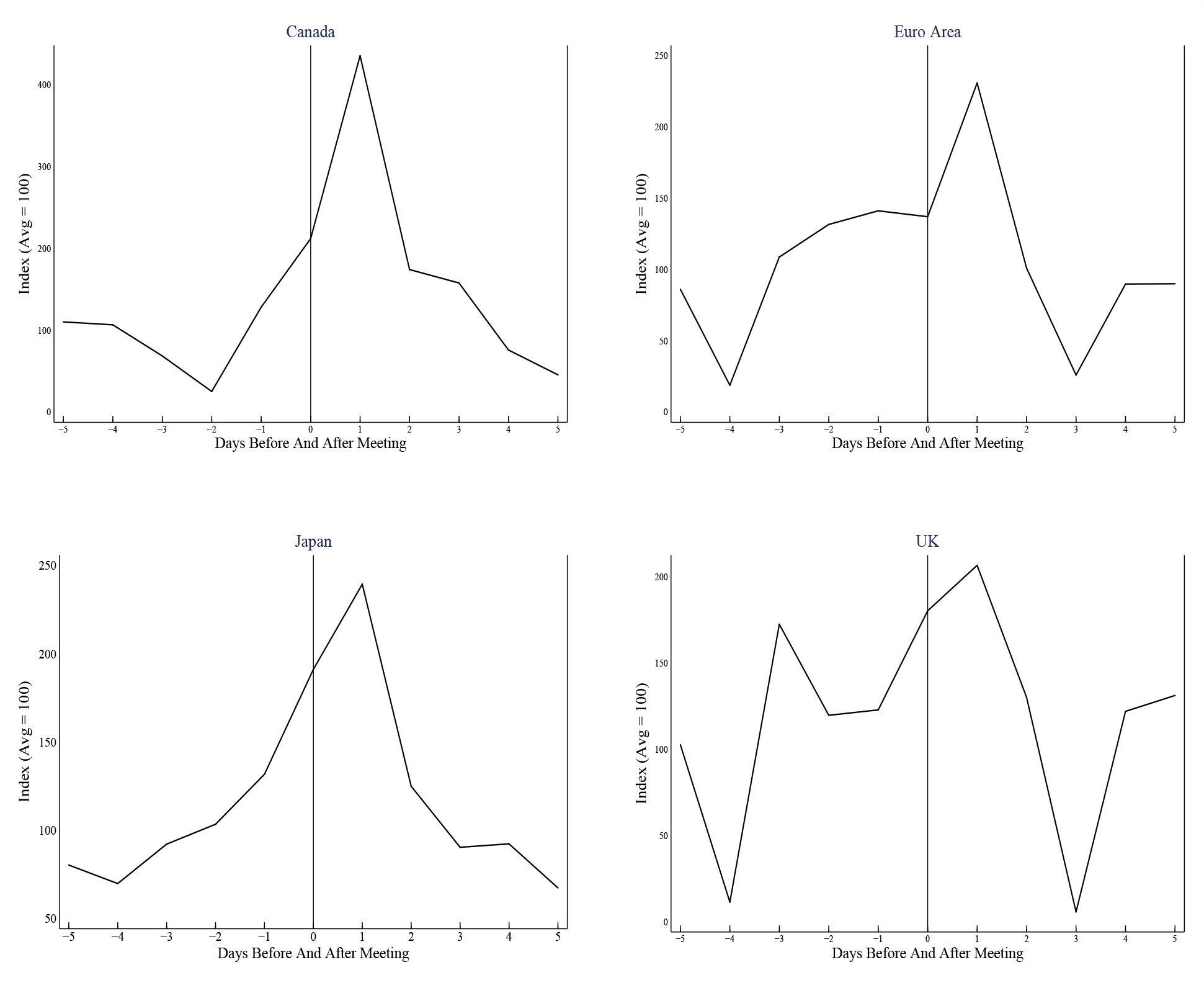

We display the movements in our foreign MPU indexes around their own monetary policy meeting days in the four panels of Figure 7. Uncertainty rises prior to policy setting meeting days, peaks on the day after the meeting, the first day of newspaper coverage, and dissipates immediately after. This pattern is especially pronounced for Canada and Japan. This is consistent with our earlier U.S. results.

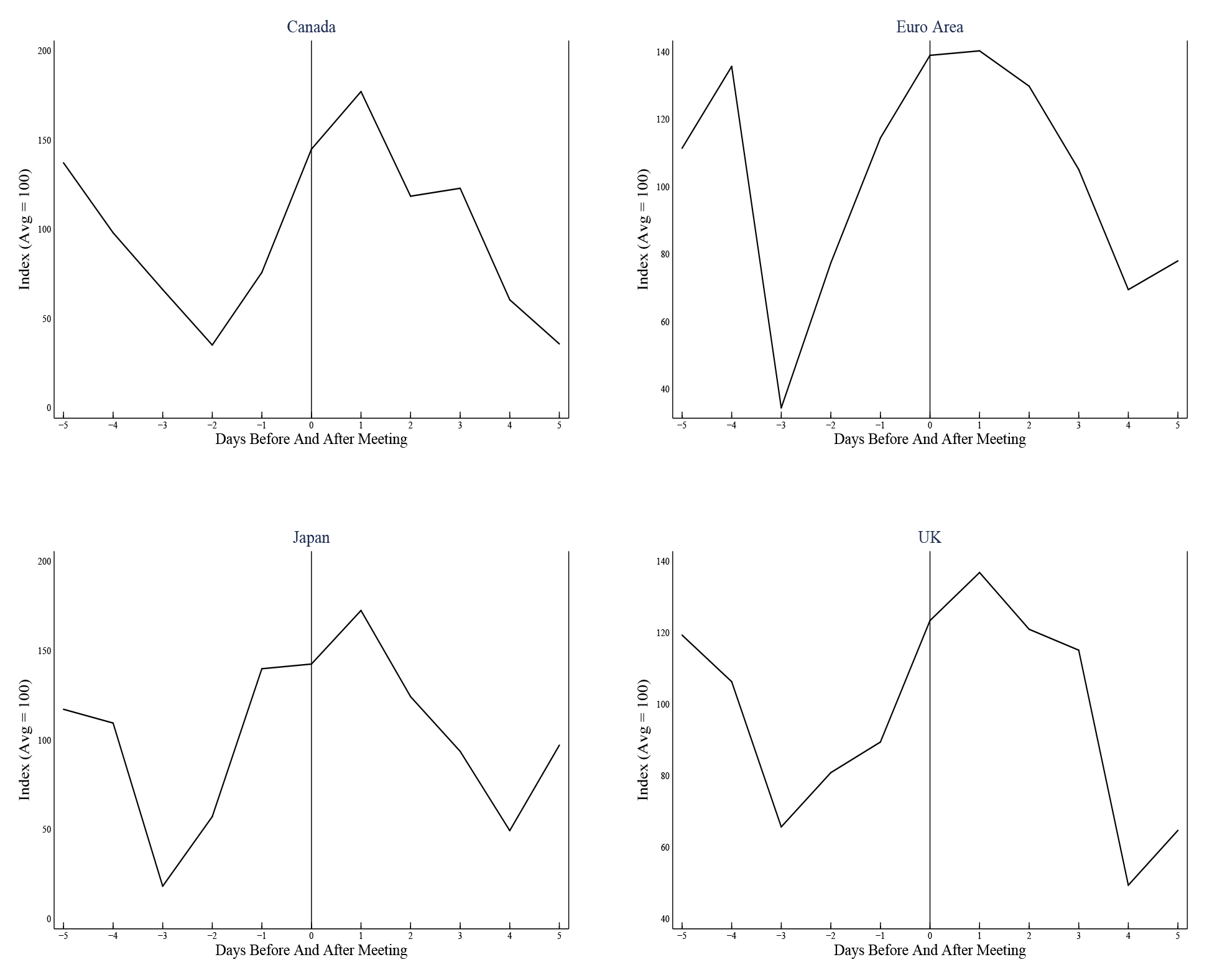

Movements in foreign MPU appear less strongly related to FOMC meetings, however, as we display in the four panels of Figure 8. For all four countries and in each sub-period, there do appear to be consistent increases in uncertainty in the days prior to FOMC meetings, as well as a quick dissipation afterward. However, this pattern is muted relative to the pattern observed prior to own central bank meeting days. The plots suggest that uncertainty arises more from country-specific factors relating to the individual countries' monetary policy setting meetings than from uncertainty that surrounds FOMC meetings, although both are relevant.

| Country | (i) | (ii) | (iii) | Newspapers |

|---|---|---|---|---|

| Canada | uncertainty uncertain |

monetary policy interest rate policy rate overnight rate overnight lending rate |

"Bank of Canada" "BOC" |

Gazette Globe and Mail Ottawa Citizen Toronto Star Vancouver Sun |

| Euro Area | uncertainty uncertain |

monetary policy interest rate policy rate refinancing tender eonia |

"European Central Bank" "ECB" |

Financial Times New York Times Wall Street Journal |

| Japan | uncertainty uncertain |

monetary policy interest rate policy rate call rate |

"Bank of Japan" "BOJ" |

Financial Times New York Times Wall Street Journal |

| United Kingdom | uncertainty uncertain |

monetary policy interest rate policy rate bank rate overnight lending rate |

"Bank of England" "BOE" "Monetary Policy Committee" "MPC" |

Daily Telegraph Financial Times Guardian Independent Times of London |

Notes: Words in quotes ae searched as exact terms. All other words searched over allow for plural forms.

| Excess Returns | Risk Reversals | |

|---|---|---|

| $$log($\text{mpu}_{j,t} / \text{mpu}_{\text{us},t})$$ |

$$2.01X10^{-3}$$ $$(1.91X10^{-3})$$ |

-0.26** (0.08) |

| Fixed Effects $$ R^{2}$$ between |

Yes .18 |

Yes .60 |

Notes:** indicates significance at the 1% level. Standard errors in parentheses. Return to text

| Horizon | Canada | Euro Area | Japan | United Kingdom |

|---|---|---|---|---|

| 1 | 18 | 26 | 16 | 09 |

| 2 | 24 | 35 | 17 | 22 |

| 4 | 22 | 35 | 16 | 24 |

| 12 | 24 | 41 | 19 | 29 |

References

Baker, Scott, Nicholas Bloom, and Steven J. Davis, 2016a. "Measuring Economic Policy Uncertainty," Quarterly Journal of Economics, forthcoming.

Baker, Scott, Nicholas Bloom, and Steven J. Davis, 2016b. "Policy Uncertainty: Trying to Estimate the Uncertainty Impact of Brexit," http://www.policyuncertainty.com/media/Brexit_Discussion.pdf

Bernanke, Ben S, 2016. "Economic Implications of Brexit," ![]() Brookings Institution, Washington, DC.

Brookings Institution, Washington, DC.

Husted, Lucas, John H. Rogers, and Bo Sun, 2016a. "Measuring Monetary Policy Uncertainty: The Federal Reserve January 1985 to January 2016," IFDP Note, Federal Reserve Board.

Husted, Lucas, John H. Rogers, and Bo Sun, 2016b. "Uncertainty and Carry Trade Excess Returns," mimeo, Federal Reserve Board.

1. We thank Shaghil Ahmed for comments and Andrew Kane for research assistance. The views expressed here are solely our own and should not be interpreted as reflecting the views of the Board of Governors of the Federal Reserve System or of any other person associated with the Federal Reserve System. Return to text

2. Conceptual differences exist between our measure and the market-based indicators. In theory, the latter reflect the average perception of individuals participating in options markets. Our news-based index reflects the average opinion of people reading newspapers (assuming that newspapers reflect the readership). Since relatively few households participate in the options markets, the prices in these markets may not be particularly representative. In addition, in market-based indicators the perceived degree of uncertainty is contaminated with time-varying risk aversion and state-dependent marginal utility. The market-based measures are presumed to reflect the price individuals are willing to pay for insurance against future policy rate fluctuations. Willingness to substitute resources from one possible future to another depends on the relative scarcity of resources in those futures. Therefore, a household may be willing to pay a lot to insure against the possibility of a rate increase even if the household sees the outcome as highly unlikely. These considerations bolster the case for using our measures of monetary policy uncertainty. Return to text

3. Consistent with this evidence, Bernanke (2016) writes of Brexit: "The vote ushers in what will be several years of tremendous uncertainty - about the rules that will govern the UK's trade with its continental neighbors, about the fates of foreign workers in Britain and British workers abroad, and about the countryâs political direction, including perhaps where its borders will ultimately lie. Such fundamental uncertainty will depress business formation, capital investment, and hiring; indeed, it had begun to do so even before the vote." Return to text

4. Own-country contributions are of course 100 minus the number displayed. Return to text

5. In that paper, we examined the effects of our computed FOMC-day MPU on carry trade excess returns using a sample of 20 countries. Return to text

Please cite as:

Husted, Lucas, John Rogers, and Bo Sun (2016). "Measuring Cross Country Monetary Policy Uncertainty," IFDP Notes. Washington: Board of Governors of the Federal Reserve System, November 23, 2016. https://doi.org/10.17016/2573-2129.26

Disclaimer: IFDP Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than IFDP Working Papers.