IFDP Notes

February 12, 2016

Predicting Fed Forecasts

Neil R. Ericsson1

Monetary policy decisions by the Fed's Federal Open Market Committee (FOMC) have attracted considerable attention in recent years, especially with quantitative easing through large-scale asset purchases, the introduction of forward guidance, and December's "lift-off" after seven years of a near-zero federal funds rate. The FOMC's decisions are based in part on the Greenbook forecasts, which are economic forecasts produced by the Federal Reserve Board's staff and which are presented to the FOMC prior to their policy meetings. This note shows that the minutes of the FOMC meetings--and the information in those minutes about the Greenbook forecasts--provide valuable insights into the decision-making process of the FOMC.

Recent analysis by Herman Stekler and Hilary Symington lays the foundation for these results.2 Stekler and Symington constructed indexes that quantify the FOMC's views about the U.S. economy, as expressed in the minutes of the FOMC's meetings for 2006–2010.

This note compares these indexes with publicly available Greenbook forecasts, including the recently released 2010 Greenbook forecasts. The indexes very closely track the Greenbook forecasts of the current-quarter and one-quarter-ahead U.S. real GDP growth rates--particularly so for the sixteen forecasts in 2010, even though those forecasts were not available when the indexes were constructed. Stekler and Symington's indexes thus provide a proximate and relatively accurate mechanism for inferring Greenbook forecasts, well in advance of the public release of the Greenbook. The Greenbook is not released to the public until more than five years after it is presented to the FOMC, whereas the minutes of an FOMC meeting are published just three weeks after the meeting itself.

Background: Stekler and Symington's Indexes

Stekler and Symington employ a focused textual analysis of the minutes for the 40 FOMC meetings during 2006–2010, a period that spans the financial crisis and leads into the Great Recession. From their textual analysis, Stekler and Symington construct quantitative indexes that gauge the FOMC's views on the current and future strength of the U.S. economy, as expressed in the FOMC minutes themselves. The indexes are scaled such that they correspond to real GDP growth rates in percent per annum.

| Table 1: Keywords in the FOMC Minutes, Their Assessment, and the Corresponding FOMC Minutes Index. |

|---|

| Keywords | Assessment | FOMC Minutes Index (percent per annum) |

|---|---|---|

| Strong, robust, considerable, upbeat, brisk, surge | Strong growth | 4.0 |

| Normal, solid, steady | Normal growth | 3.4 |

| Modest, moderate, sustainable | Modest growth | 2.8 |

| Slow, gradual, subdued, muted | Slow growth | 2.1 |

| Unclear, mixed | Unclear | 1.5 |

| Decelerating, stabilizing, ongoing adjustment, leveling out | Decelerating growth | 0.9 |

| Continued weakness, sluggish, slack, below potential | Continued weakness | 0.3 |

| Declining, deteriorating | Decline | -0.4 |

| Recession, contraction, sharp and widespread decline | Recession | -1.0 |

Source: Stekler and Symington (2015, Tables 2 and 4).

To design their indexes, Stekler and Symington examine certain sections of the minutes that discuss:

- the current economic outlook, typically in a paragraph or paragraphs beginning "The information reviewed at the ... meeting suggested that ... "; and

- the future economic outlook, typically in a paragraph or paragraphs beginning "In their discussion of the economic situation and outlook, meeting participants ... ".

In these sets of paragraphs, Stekler and Symington search for select keywords that characterize views on the outlook. Keywords range from "strong" and "robust" for a very optimistic outlook to "recession" and "contraction" for a very pessimistic one. From the frequencies of occurrence of the keywords, Stekler and Symington create two indexes, one for the current outlook and one for the future outlook. These indexes are called FOMC Minutes Indexes (or FMIs) below. Table 1 lists the keywords, Stekler and Symington's assessment of those keywords for economic growth, and the corresponding values for the FMI.

From a broader perspective, three steps lead to the FMIs.

- Meeting of the FOMC. The FOMC meets to discuss monetary policy, with the Greenbook forecasts and certain qualitative and quantitative information in hand.

- Writing of the FOMC minutes. Minutes of the meeting are then prepared and made public.3

- Quantification of the FOMC minutes. From textual analysis of the FOMC minutes, Stekler and Symington quantify the tone of the FOMC's discussion about the current and future outlook of the U.S. economy and calibrate that quantification to forecasts of the GDP growth rate, thereby generating the FMI.4

The Greenbook forecasts are provided to the FOMC participants, prior to the FOMC meeting, and hence the FMI--through the FOMC's policymaking process--may depend on the Greenbook forecasts. This characterization applies to the FMIs for both the current outlook and the future outlook.

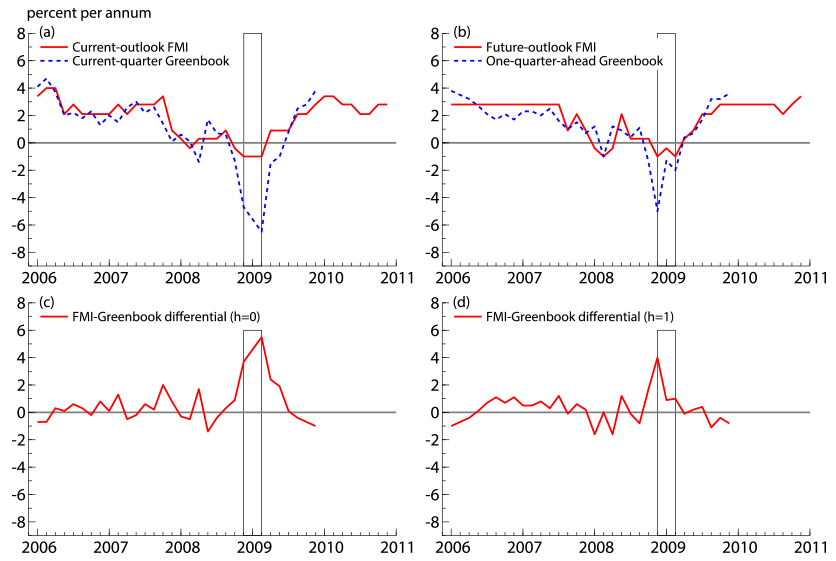

| Figure 1: The current-outlook and future-outlook FMIs, the Greenbook forecasts of the current-quarter and one-quarter-ahead U.S. real GDP growth rates, and the differentials between the FMI and Greenbook forecasts. |

|---|

|

Comparion of the FMI with the Greenbook Forecast

It is thus of interest to compare the FMI directly with the Greenbook forecast, as in Figure 1. Figure 1a plots two "nowcasts": the FMI for the current outlook, and the Greenbook forecast for the current quarter. Figure 1b plots two forecasts: the FMI for the future outlook, and the Greenbook forecast for one quarter ahead. Figure 1c plots the difference between the FMI for the current outlook and the Greenbook forecast for the current quarter; and Figure 1d plots the difference between the FMI for the future outlook and the Greenbook forecast for one quarter ahead. In Figure 1 (and likewise in Figures 2 and 3 below), the horizontal axis specifies the date of the FOMC meeting to which a Greenbook is submitted and from which an FMI is constructed. The graphs in Figure1 show that the FMI and the Greenbook forecasts are generally very close numerically, whether for the current outlook or for the future outlook.

That said, the FMI does deviate markedly from the Greenbook forecast in December 2008, January 2009, and March 2009: see the boxed-in areas in Figure 1. For these FOMC meetings, the FMI is at its minimum (= –1.0% per annum, which is the most pessimistic outlook allowed in Stekler and Symington's framework), whereas the Greenbook forecasts are typically much more negative. This discrepancy between the FMI and the Greenbook forecast arises because Stekler and Symington's FMI as constructed from Table 1 cannot be more negative than –1%, thereby truncating the distribution of the forecast implicit in the FOMC minutes. Thus, in the next section, these three meetings are treated separately from the other meetings when "predicting" the Greenbook forecasts from the FMI.5

Predicting Greenbook Forecasts

As Figure 1 implies, the FMI very closely approximates the Greenbook forecast, once accounting for the FMI's truncation in December 2008, January 2009, and March 2009. This close relationship between the FMI and the Greenbook forecast presents a special opportunity for "predicting" Greenbook forecasts, conditional on the FMI, noting that the minutes of an FOMC meeting are publicly available three weeks after the meeting, whereas the Greenbook forecasts are not released to the public until more than five years after the Greenbook itself is presented to the FOMC. When Stekler and Symington calculated FMIs for 2006–2010, they did not have the 2010 Greenbook forecasts available, so their FMIs can be used to predict the 2010 Greenbook forecasts. Moreover, with the recent release of the 2010 Greenbooks, those predictions from the FMIs can now be assessed against the actual 2010 Greenbook forecasts.6

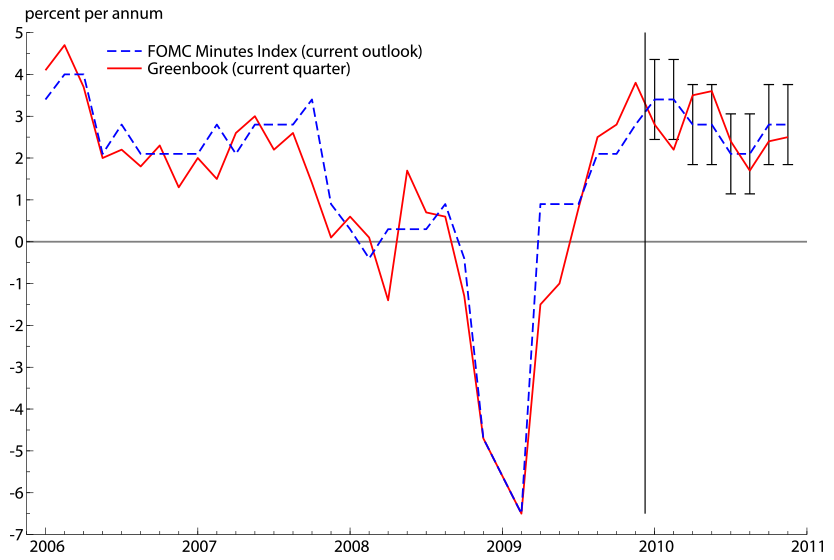

| Figure 2: The truncation-adjusted FOMC Minutes Index for the current outlook, the Greenbook forecast of the U.S. real GDP growth rate in the current quarter, and ±1 standard error bands for the FMI's predictions in 2010. |

|---|

|

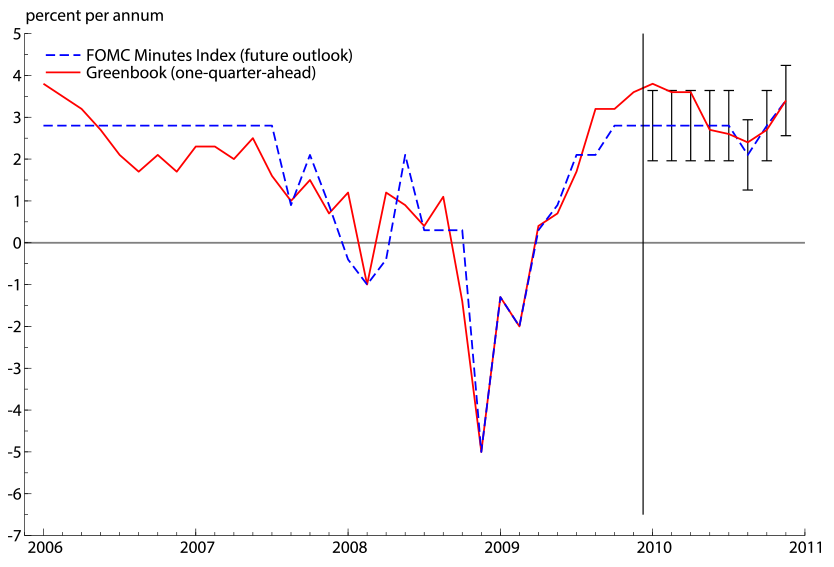

| Figure 3: The truncation-adjusted FOMC Minutes Index for the future outlook, the Greenbook forecast of the U.S. real GDP growth rate one quarter ahead, and ±1 standard error bands for the FMI's predictions in 2010. |

|---|

|

Figure 2 plots the truncation-adjusted current-outlook FMI, along with the Greenbook forecast of the current quarter's U.S. real GDP growth rate. The FMI and the Greenbook forecast are very close numerically, with deviations between them being small, typically less than 1% per annum and often less than 0.5% per annum. Figure 3 plots the truncation-adjusted future-outlook FMI and the Greenbook forecast for one quarter ahead. Their deviations are small as well.

Figures 2 and 3 also include ±1 standard error bands for the FMI in 2010, with those bands derived from the properties of the FMIs and the Greenbook forecasts over 2006–2009. For each FMI (current-outlook or future-outlook), only one of the eight Greenbook forecasts in 2010 lies outside those bands--significantly fewer outliers than the one-in-three expected for ±1 standard error bands. The 2010 predictions range between 2.1% and 3.4% for both the current outlook and the future outlook, with somewhat different dynamics for the two forecast horizons. The forecast standard error is under 1%.

| Table 2: Root mean squared errors and other summary statistics for the deviation between the Greenbook forecast of the U.S. real GDP growth rate and the FMI, for both current-quarter and one-quarter-ahead forecast horizons. |

|---|

| Forecast horizon Sample period |

RMSE | Mean | Standard deviation |

|---|---|---|---|

| Current quarter | |||

| 2006-2009 | 0.96 | -0.26 | 0.94 |

| 2010 | 0.65 | -0.14 | 0.68 |

| 2006-2010 | 0.90 | -0.23 | 0.88 |

| One quarter ahead | |||

| 2006-2009 | 0.84 | -0.09 | 0.85 |

| 2010 | 0.55 | 0.31 | 0.49 |

| 2006-2010 | 0.79 | -0.00 | 0.80 |

Note. Units are quarterly rates, in percent per annum.

In light of the discussion above, Table 2 numerically assesses the discrepancies between the FMIs and the Greenbook forecasts over three periods: 2006–2009, 2010, and 2006–2010. Root mean squared errors (RMSEs) are less than 1% per annum for all sample periods and for both forecast horizons. Notably, the one-quarter-ahead RMSEs are smaller than the current-quarter RMSEs. That is, Stekler and Symington's indexes are more accurate at inferring the one-quarter-ahead Greenbook forecast than the current-quarter Greenbook forecast. Also, both FMIs are much more accurate at inferring the Greenbook forecasts for 2010 than they are at inferring the Greenbook forecasts for 2006–2009.

Remarks

Several observations are germane. First, textual analysis--such as that employed by Stekler and Symington--is common in the literature. Similar examples include Boukus and Rosenberg (2006), who assess the roles of different themes in the FOMC's minutes; and Meade, Burk, and Josselyn (2015), who calculate the changing frequencies of different quantitative words in the FOMC's minutes to ascertain the diversity of views among the FOMC members and participants.

Second, Stekler and Symington's analysis is novel by quantifying qualitative text from the minutes on the outlook. By contrast, Meade, Burk, and Josselyn focus on the disparity of views in the minutes, rather than on some central tendency of views. Banternghansa and McCracken (2009, 2014) likewise focus on the disparity of views, albeit as measured by individual participants' economic forecasts. Yet other researchers such as Nunes (2013) have compared the Greenbook forecasts and FOMC participants' forecasts with each other, with other forecasts, and with the actual outcomes.

Third, the current-outlook FMI draws on text about the Federal Reserve Board staff's views, whereas the future-outlook FMI ostensibly reflects the views of the FOMC participants on both current conditions and future outlook. While these nuances may affect the interpretation of the FMIs when compared with the Greenbook forecasts, the similarity of the FMIs and the Greenbook forecasts suggests not.

Fourth, it may seem surprising that FOMC participants' views for the future outlook--as measured by the future-outlook FMI--are well-captured by the one-quarter-ahead Greenbook forecast, since the policy-relevant horizon may be somewhat longer than just one quarter ahead. The future-outlook FMI may thus be an even better proxy for Greenbook forecasts at longer horizons. Or, participants may down-weight Greenbook forecasts at longer horizons if they view those forecasts as being uninformative; see Chang and Hanson (2015).

Finally, indexes have yet to be constructed for 2011–2015 or for the period prior to 2006. Indexes over those periods may be more or less accurate than those over 2006–2010. The indexes also could be generated algorithmically, drawing on Table 1.

Conclusions

Stekler and Symington propose and build innovative quantitative indexes (the "FMIs") that measure the extent of optimism or pessimism expressed in the FOMC's minutes on the current and future outlook for the U.S. economy. Even though the text that Stekler and Symington examine includes little or no quantitative information, Stekler and Symington's FMIs reveal much about the thinking of the FOMC participants and about the Federal Reserve Board staff's input to the FOMC meetings.

The present note shows that these indexes can help infer the staff's Greenbook forecasts of the U.S. real GDP growth rate, years before the public release of the Greenbook. The FOMC minutes are thus highly informative about a key input to monetary policymaking.

References

Banternghansa, C., and M. W. McCracken (2009) "Forecast Disagreement Among FOMC Members", Federal Reserve Bank of St. Louis Working Paper No. 2009–059A, Research Division, Federal Reserve Bank of St. Louis, St. Louis, Missouri, December.

Banternghansa, C., and M. W. McCracken (2014) "The Effect of FOMC Forecast Disagreement on U.S. Treasuries", Presentation, International Symposium on Forecasting, Rotterdam, The Netherlands, July 1.

Boukus, E., and J. V. Rosenberg (2006) "The Information Content of FOMC Minutes", mimeo, Federal Reserve Bank of New York, New York, July.

Chang, A. C., and T. J. Hanson (2015) "The Accuracy of Forecasts Prepared for the Federal Open Market Committee", Finance and Economics Discussion Series Paper No. 2015–062, Board of Governors of the Federal Reserve System, Washington, D.C., July.

Danker, D. J., and M. M. Luecke (2005) "Background on FOMC Meeting Minutes", Federal Reserve Bulletin, 2005, Spring, 175–179.

Doornik, J. A. (2009) "Autometrics", Chapter 4 in J. L. Castle and N. Shephard (eds.) The Methodology and Practice of Econometrics: A Festschrift in Honour of David F. Hendry, Oxford University Press, Oxford, 88–121.

Doornik, J. A., and D. F. Hendry (2013) PcGive 14, Timberlake Consultants Press, London (3 volumes).

Ericsson, N. R. (2015) "Eliciting GDP Forecasts from the FOMC's Minutes Around the Financial Crisis", International Finance Discussion Paper No. 1152, Board of Governors of the Federal Reserve System, Washington, D.C., November, dx.doi.org/10.17016/IFDP.2015.1152 ![]() ; and RPF Working Paper No. 2015–003, Research Program on Forecasting, Center of Economic Research, Department of Economics, The George Washington University, Washington, D.C., November, www.gwu.edu/~forcpgm/2015-003.pdf

; and RPF Working Paper No. 2015–003, Research Program on Forecasting, Center of Economic Research, Department of Economics, The George Washington University, Washington, D.C., November, www.gwu.edu/~forcpgm/2015-003.pdf ![]() ; International Journal of Forecasting, in press.

; International Journal of Forecasting, in press.

Meade, E. E., N. A. Burk, and M. Josselyn (2015) "The FOMC Meeting Minutes: An Assessment of Counting Words and the Diversity of Views", FEDS Note, Board of Governors of the Federal Reserve System, Washington, D.C., May 26.

Nunes, R. (2013) "Do Central Banks' Forecasts Take Into Account Public Opinion and Views?", International Finance Discussion Paper No. 1080, Board of Governors of the Federal Reserve System, Washington, D.C., May.

Stekler, H. O., and H. Symington (2015) "Evaluating Qualitative Forecasts: The FOMC Minutes, 2006–2010", RPF Working Paper No. 2014–005 (September 2014; revised: February 2015), Research Program on Forecasting, Center of Economic Research, Department of Economics, The George Washington University, Washington, D.C., cer.columbian.gwu.edu/files/2014-005-2.pdf ![]() ; International Journal of Forecasting, dx.doi.org/10.1016/j.ijforecast.2015.02.003

; International Journal of Forecasting, dx.doi.org/10.1016/j.ijforecast.2015.02.003 ![]() , in press.

, in press.

1. The author is a staff economist in the Division of International Finance, Board of Governors of the Federal Reserve System, Washington, DC 20551 USA ([email protected]), and a Research Professor of Economics, Department of Economics, The George Washington University, Washington, DC 20052 USA ([email protected]). The views expressed in this paper are solely the responsibility of the author and should not be interpreted as necessarily representing or reflecting the views of the Federal Open Market Committee, its principals, the Board of Governors of the Federal Reserve System, or of any other person associated with the Federal Reserve System. This paper uses publicly available information, and only publicly available information. It does not use any internal or confidential Federal Reserve Board information, either directly or indirectly. The author is grateful to Chris Erceg, Lowell Ericsson, Nancy Ericsson, Joe Gruber, David Hendry, Lucas Husted, Matteo Iacoviello, Freja Ingelstam, Aaron Markiewitz, Jaime Marquez, Ellen Meade, J Seymour, Tara Sinclair, Herman Stekler, and Joyce Zickler for helpful discussions and comments. All numerical results were obtained using PcGive Version 14.0B3, Autometrics Version 1.5e, and Ox Professional Version 7.00 in 64-bit OxMetrics Version 7.00: see Doornik and Hendry (2013) and Doornik (2009). Return to text

2. See Stekler and Symington (2015) and Ericsson (2015) for further details. Return to text

3. See Danker and Luecke (2005) for a valuable perspective on the evolution of the FOMC's minutes. Return to text

4. In fact, Stekler and Symington's procedure itself involves two steps but, for expositional purposes, this description merges them into a single-step quantification of the FOMC minutes. Return to text

5. Ericsson (2015, Sections 2–3) describes the econometric methodology for handling these three meetings during the extenuating circumstances of the financial crisis, and it provides details of the online sources for the publicly available Greenbook forecasts and FOMC minutes. Return to text

6. Starting in 2010, the Greenbook forecasts appear in a Fed document called the Tealbook, which combines the previous Fed documents called the Greenbook and the Bluebook. For simplicity, these more recent forecasts are still referred to as "Greenbook forecasts" herein. Return to text

Please cite as:

Ericsson, Neil R. (2016). "Predicting Fed Forecasts," IFDP Notes. Washington: Board of Governors of the Federal Reserve System, February 12, 2016. https://doi.org/10.17016/2573-2129.17

Disclaimer: IFDP Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than IFDP Working Papers.