Freedom of Information Office

2012 New Currency Budget

-

Print Version (PDF)

Contents

Action

On December 12, 2011, the Board approved the 2012 new currency budget totaling $747.0 million, an increase of $89.5 million, or 13.6 percent, from 2011 estimated expenses and an increase of $70.9 million, or 10.5 percent, from the approved 2011 budget.

Discussion

Under authority delegated by the Board, the director of the Division of Reserve Bank Operations and Payment Systems (RBOPS) submits an annual print order for new currency to the director of the Bureau of Engraving and Printing (BEP).1 Upon reviewing the order, the BEP estimates printing costs for new currency during the calendar year (CY), which Board staff uses to prepare the annual budget for new currency. The Board then approves the final budget. Printing costs for Federal Reserve notes typically comprise about 95 percent of the new currency budget; certain other BEP costs, expenses for the currency education program, the currency quality assurance (CQA) program, currency transportation, and counterfeit-deterrence research, on average, represent the remaining 5 percent. Once the Board approves the new currency budget, it assesses the costs of new currency to each Federal Reserve Bank on a monthly basis through an accounting procedure similar to that used in assessing the costs of the Board's operating expenses to the Banks.

Table 1 provides details on the Board's CY 2011 budget, 2011 estimate, and 2012 budget.2

Table 1

New Currency Budget

(calendar year)

2011

Budget

(thousands)

2011

Estimate

(thousands)

2012

Budget

(thousands)

Percent Change

2011E/2011B

2012B/2011E

Print volume (number of notes)

6,787,720

6,444,800

7,956,427

-5.1

23.5

BEP Expenses

Printing Federal Reserve notesa

$632,265

$625,775

$707,231

-1.0

13.0

Currency education programb

$16,000

$4,500

N/A

-71.9

N/A

Other

$3,773

$3,466

$3,692

-8.1

6.5

Board Expenses

Currency education programb

N/A

$91

$2,800

N/A

N/A

Currency quality assurance

$1,300

$2,600

$5,200

100.0

100.0

Currency transportation

$18,318

$16,628

$22,795

-9.2

37.1

Counterfeit-deterrence research

$4,486

$4,487

$5,318

0.0

18.5

Total expenses

$676,141

$657,547

$747,036

-2.8

13.6

a. Expenses for printing Federal Reserve notes do not include costs associated with the currency education and currency quality assurance programs. These costs were included in printing costs in previous budget documents. Return to table.

b. The BEP managed the currency education program through September 30, 2011. The Board began managing this program effective October 1, 2011; therefore, 2011 estimates for BEP expenses include costs incurred by the BEP during the first three quarters, and 2011 estimates for Board expenses include costs incurred by the Board during the fourth quarter. Return to table.

2011 New Currency Expenses

Staff estimates that total expenses for new currency in 2011 will be $657.5 million, which are $18.6 million or 2.8 percent below the 2011 budget primarily because the BEP will print and the Board will ship fewer notes than we estimated when we prepared the 2011 budget. The majority of the decrease in note production and transportation is attributable to production problems associated with the new-design $100 note. The BEP did not deliver any new-design $100 notes to the Board during 2011.3 Lower-than-planned printing and transportation costs are partially offset by an increase in expenses for the CQA program.4

2011 Printing Costs

Estimated CY 2011 currency printing costs are $625.8 million, which are $6.5 million, or 1 percent, lower than the budgeted amount primarily because the BEP printed fewer notes than we estimated when we prepared the CY 2011 budget. At the time we prepared that budget, we had recently learned of a significant production problem with the new-design $100 note, caused by sporadic creasing of the paper. The BEP, however, estimated it would produce 1.3 billion new-design $100 notes during CY 2011 and based its billing rates on this production.5 The creasing problem, however, proved to be difficult to correct and the BEP was not able to deliver any new-design $100 notes to the Board during CY 2011.

Because the BEP did not deliver any new-design $100 notes, it assessed the Board surcharges totaling $97.8 million in 2011. Without these surcharges, the BEP would have been unable to generate sufficient revenue to cover all of its operating expenses and maintain its working capital fund.6

2011 Transportation Costs

The estimated CY 2011 transportation costs are $16.6 million, which are $1.7 million lower than the budgeted amount, primarily because we included funding in the 2011 budget to begin shipping new-design $100 notes to Reserve Banks before issuance. Because the issuance was delayed, we did not make any of these shipments. In addition, we budgeted for a 5 percent increase in armored carrier contract rates, but rates only increased about 2 percent.

2011 Currency Quality Assurance Program Costs

The estimated CQA costs are $2.6 million, which are $1.3 million higher than the budgeted amount. During 2011, the CQA consultants worked closely with the BEP and its paper supplier (Crane and Company), to evaluate the production and test data collected by the BEP and Crane to assess the mitigation efforts implemented to resolve the creasing of the new-design $100 note. The consultants also worked with the BEP and Crane to develop numerous production tests to identify the factors that led to the creasing, to implement process changes to stabilize production, and to evaluate the effectiveness of the crease detection system. To assess the robustness of the process changes at both the BEP and Crane, and determine the residual risks of returning to production, the CQA consultants worked with the Board and the BEP to draft and implement a production validation process for each press line that will produce the new-design $100 note. This validation process includes a production plan, employee training program, spoilage thresholds, data gathering requirements, and data evaluation.

In December, the BEP will complete the production validation plan on one production line at its Fort Worth facility. The CQA consultants will issue a report on the production validation results by year end. Preliminary results indicate that although the root cause for creasing has not been determined, appropriate mitigation steps have reduced the incidence of creasing below 1 percent and the new crease detection system significantly reduces the risk of the BEP delivering creased notes to the Board.7

In addition to the short-term work related to the production problems associated with the new-design $100 note, the long-term goals of this program are to improve the BEP's ability to produce high-quality notes consistently and reduce spoilage, as well as to increase the security and reduce the functional failures of notes in circulation.8 During 2011, the CQA consultants provided the BEP with a fully executable plan and schedule for implementing quality system improvements identified during 2010. The CQA consultants then began work with the Board and the BEP to implement the new CQA program. Specifically, the Board, the BEP, and the CQA consultants established integrated teams to address deficiencies in the areas of corrective and preventive action (CAPA); process change; management review; and design review. The CAPA team will identify and investigate the root causes of quality problems during the production process. The process change team will evaluate potential downstream effects on production before any changes are implemented. The management review team will provide management with critical forward-looking information about BEP operations, and the design review team will improve the product development process.

2012 New Currency Budget

The proposed $747.0 million 2012 new currency budget is 13.6 percent higher than the 2011 estimate and 10.5 percent higher than the 2011 budget.

2012 Printing Costs

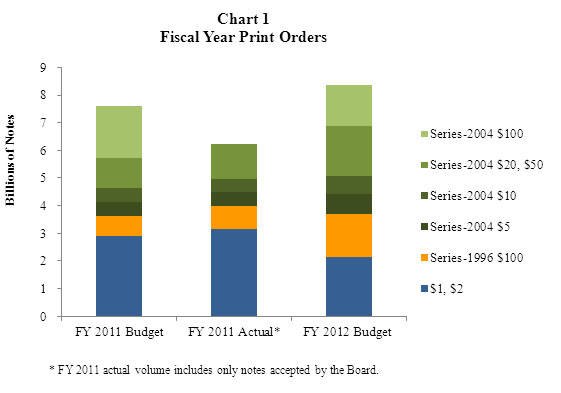

The budget includes $707.2 million in printing costs for CY 2012, which represents a 13 percent increase from the 2011 estimate. The increase is primarily attributable to a higher volume of more-expensive series-2004 notes included in the 2012 budget compared with 2011.9 As shown in chart 1, the Board's FY 2012 print order includes approximately 1.4 billion more series-2004 notes than the FY 2011 order.

Quantity and Type of Notes Ordered

Although our order for most denominations increased between FY 2011 and FY 2012, the order for $1 notes declined by 0.9 billion. The decline in the order for $1 notes reflects relatively flat payments of $1 notes to circulation and receipts of $1 notes from circulation as well as the implementation of the Reserve Banks' new policy to accept misfaced notes from and distribute misfaced notes to depository institutions.10 This decrease in the order for $1 notes, however, is more than offset by an increase of 1.7 billion notes in all other denominations, the majority of which are more-expensive series-2004 notes. The increase in all other denominations (except the new-design $100 note) is attributable to increased payments of currency to circulation and decreased receipts of currency from circulation during 2011. In addition, the FY 2012 order includes 1.5 billion new-design $100 notes to begin building inventories before issuance.

The BEP's printing costs are based on the total quantity of notes, as well as the type of notes the Board orders. In addition to a larger order in FY 2012, series-2004 notes comprise 56 percent of the order, compared with only 50 percent in FY 2011. Series-2004 notes are more expensive because they include colored backgrounds and additional security features, resulting in higher costs of paper and ink for these notes, compared with older-series notes. In addition, new-design $100 notes, the most expensive note to print, represent 32 percent of the series-2004 notes in the FY 2012 order. For budget planning purposes, the BEP provided the Board with estimates on 2012 printing costs, which are presented in table 2, by type of note.

Table 2

Calendar Year 2012 BEP Printing Costs

Note typea

Projected 2012 fixed costs (thousands of dollars)b

Projected 2012 variable costs (per thousand notes)

Projected 2012 total costs (per thousand notes)c

CY 2011 billing rates (per thousand notes)

$1, $2

$79,969

$14.73

$51.81

$55.49

Series-2004 $5

$42,732

$26.06

$84.63

$99.28

Series-2004 $10

$37,961

$26.98

$85.13

$99.18

Series-2004 $20, $50d

$114,741

$29.23

$92.47

$108.91

Series-1996 $100d

$73,573

$29.04

$77.24

$98.60

Series-2004 $100

$99,644

$60.92

$127.31

$144.80

Average cost per thousand notese

$56.39

$32.50

$88.89

$97.10

a. $1 and $2 notes do not include the security features that are in the series-1996 and series-2004 design notes; series-1996 $100 notes include a watermark and color-shifting ink; series-2004 $5 notes include two watermarks and additional security features; and series-2004 $10, $20, and $50 notes include watermarks, additional security features, and a new color-shifting ink. The series-2004 $100 note will include a watermark, a 3D security ribbon, a new color-shifting feature ("the Bell in the Inkwell"), additional security features, and a new color-shifting ink. This higher level of security for the series-2004 $100 note has significantly increased the cost for both paper and ink. Return to table.

b. The projected fixed costs are the BEP's estimates of fixed costs associated with the production of each denomination. Return to table.

c. The projected total costs per thousand notes are projected fixed costs divided by the number of notes, plus variable costs per thousand notes. Return to table.

d. The variable cost billing rates for series-1996 $100 notes and series-2004 $20 and $50 notes are comparable because a larger quantity of more-expensive color-shifting ink is used in the production of the series-1996 $100 note than is used in the production of the series-2004 $20 and $50 notes; however, the $20 and $50 notes contain additional security features. Return to table.

e. The average cost per thousand notes for 2012 is the volume-weighted average of the fixed, variable, and total costs. For 2011, the average cost per thousand notes is the total cost of printing Federal Reserve notes (including any surcharges) divided by the number of notes printed. Return to table.

BEP Fixed and Variable Costs

The 2012 print cost budget of $707.2 million is comprised of a projected $448.6 million in fixed costs and $258.6 million in variable costs Fixed costs account for 63 percent of total currency printing costs.11 Components of the BEP's fixed costs include capital investment, production staff, prepress, engraving, and fixed manufacturing overhead and support, research and development, general and administrative staff, and overtime.12 Variable costs account for 37 percent of total currency printing cost. Components of the variable costs include costs for paper, ink, and variable manufacturing overhead.

The main drivers of the $448.6 million 2012 budget for fixed costs are labor expenses (including overtime), depreciation expenses for production and inspection equipment, a new integrated security system, and a new information technology infrastructure, as well as funding to maintain a targeted level of working capital so that the BEP can make future capital expenditures.

The projected $258.6 million of variable costs is directly attributable to the volume of notes included in the Board's FY 2012 print order. The variable costs vary by denomination, as shown in table 2, and are determined primarily by costs for paper and ink. The variable costs fluctuate from $14.73 per thousand notes for $1 notes to $60.92 per thousand notes for new-design $100 notes. The $1 note is significantly less expensive to produce, whereas the new-design $100 note is the most expensive to produce because it has the most sophisticated security features. The cost for the other denominations ranges between $26 and $30 per thousand notes to produce based on levels of security features.

Based upon the projected fixed and variable costs provided by the BEP and the number of notes in the CY 2012 budget, we have calculated the total unit cost for each denomination (shown in table 2). The calculated average cost per thousand notes decreased 8.5 percent, from $97.10 in 2011 to $88.89 in 2012, because the BEP's fixed costs will be spread over a greater number of notes in 2012.

2012 Currency Quality Assurance Program Costs

The 2012 CQA budget is $5.2 million. During 2012, CQA consultants will continue to facilitate the implementation of a new quality system for the BEP. The Board, the BEP, and the CQA consultants will continue their work and will complete the CAPA program improvements. New teams will be formed to address additional improvement opportunities at the BEP. Specifically, these teams will begin to improve the materials control and equipment maintenance processes. The materials control team will review and enhance processes for inspecting incoming materials (such as paper and ink) before it is used in production. The facilities and equipment team will formalize and enhance current machine maintenance and calibration programs to ensure they are systematic and robust.

2012 Currency Education Program Costs

The 2012 currency education program budget is $2.8 million. The goal of the currency education program is to protect and maintain confidence in U.S. currency by providing information on the design and security features of Federal Reserve notes to users worldwide. To do that, the program is focused on ensuring that users of U.S. currency know what genuine Federal Reserve notes look like, are aware of the security features in each denomination, and know how to use those security features to distinguish between genuine and counterfeit notes.

On October 1, 2011, management of the currency education program transitioned from the BEP to the Board, aligning currency education with the Board's other currency-related responsibilities as the issuing authority for Federal Reserve notes. During 2012, Board staff will focus on modernizing the currency education program, while also expanding the scope of the program to make it more useful to users of U.S. currency. The currency education program budget for 2012 will fund several new initiatives, including the redesign of the currency education website to include information on all circulating designs of Federal Reserve notes, the development of a youth education initiative, and the management of international training seminars in partnership with the United States Secret Service (USSS).13

2012 Currency Transportation

The 2012 currency transportation budget is $22.8 million, which is $6.2 million or 37.1 percent higher than the 2011 estimate. This budget includes the cost of shipping new currency from the BEP to Reserve Banks, of intra-System shipments of fit and unprocessed currency, and of returning currency pallets from the Reserve Banks to the BEP. Because the Board has ordered more notes in 2012, we estimate that the Board will make approximately 500 (25 percent) more shipments than in 2011. In addition, the average cost of these shipments will be higher than in 2011 because we will ship new-design $100 notes from the BEP's Fort Worth facility (instead of its Washington D.C. facility) to the Federal Reserve Bank of New York's East Rutherford Operations Center (EROC) in preparation for issuance.14 We expect to make approximately the same number of intra-System shipments in 2012 as we made in 2011.

The Board's current two-year transportation contracts will expire at the end of the year and we are exercising a contract option to extend them into the first half of 2012. We are currently in the process of receiving new rates from armored carriers for the first six months of 2012 and we plan to enter into renegotiated contracts in July. For budget planning purposes, we have assumed a moderate increase in rates to account for increases in fuel and labor costs.

Counterfeit-Deterrence Research

The 2012 budget for counterfeit-deterrence research is $5.3 million, which includes costs associated with the Central Bank Counterfeit Deterrence Group (CBCDG) and the Reprographic Research Center (RRC). The CBCDG operates under the auspices of the G-10 central bank governors to combat digital counterfeiting and includes 32 central banks. The Board's $5.3 million share of the 2012 CBCDG budget comprises 99 percent of the Federal Reserve's counterfeit-deterrence budget.15

Other Reimbursements to the Bureau of Engraving and Printing

The 2012 budget includes $3.7 million to reimburse the BEP for expenses incurred by its Destruction Standards and Compliance Division of the Office of Compliance (OC) and Mutilated Currency Division (MCD) of the Office of Financial Management. The OC develops Reserve Bank standards for cancellation and destruction of unfit currency and for note accountability, and reviews Reserve Banks' cash operations for compliance with its standards. As a public service, the MCD also processes claims for the redemption of damaged or mutilated currency.

Appendix

Footnotes

1. By Memorandum of Understanding between the BEP and the Board, dated March 13, 1998, "[t]he Board shall provide the currency order to the BEP with denomination and Federal Reserve Bank breakdown 60 days before the beginning of the BEP's fiscal year." Return to text.

2. Because the BEP operates on a fiscal year that began October 1, 2011, and ends September 30, 2012, Board staff estimates the Board's calendar-year budget for new currency by eliminating the cost of notes that the BEP will produce in the first quarter of its fiscal year and estimating the volume and associated printing costs of notes Board staff projects the BEP will produce in the fourth quarter of the calendar year. Return to text.

3. The new-design $100 note is the last denomination to be issued as part of the series-2004 design family of notes. This design family began with the issuance of the series-2004 $20 note in October 2003, followed by the $50 note in September 2004, the $10 note in March 2006, and the $5 note in March 2008. The new-design $100 note incorporates advanced technology that makes it easier for the public to authenticate and more difficult for counterfeiters to replicate. Return to text.

4. In October 2010, the Board contracted with PRTM (which was subsequently acquired by PricewaterhouseCoopers) to conduct an assessment of the BEP's quality system for the production of Federal Reserve notes. Board staff estimates that the CQA program will take at least four years to complete. Return to text.

5. In April 2010, the Board announced that the new-design $100 note would be issued on February 10, 2011. In October 2010, the Board announced a delay in the issue date of the new-design $100 note. Return to text.

6. The BEP does not receive Federal appropriations; all operations of the BEP are financed by a revolving fund that is reimbursed through product sales, virtually all of which are sales of Federal Reserve notes to the Board to fulfill its annual print order. Customer billings are the BEP's only means of recovering the costs of operations and generating funds necessary for capital investment. Section 16 of the Federal Reserve Act requires that all costs incurred for the issuing of notes shall be paid for by the Board and included in its assessments against the Reserve Banks. Return to text.

7. Because of the dynamic and complex nature of the papermaking process and the multiple processes involved in the production of the new-design $100 note, as well as the numerous changes to production processes before the Board's CQA consultants were provided data from the BEP and Crane, the CQA consultants have not determined a root cause(s). Return to text.

8. During 2012, we estimate that the cost of spoilage, based on 2012 variable printing costs and historical spoilage rates, will be approximately $38.5 million. Return to text.

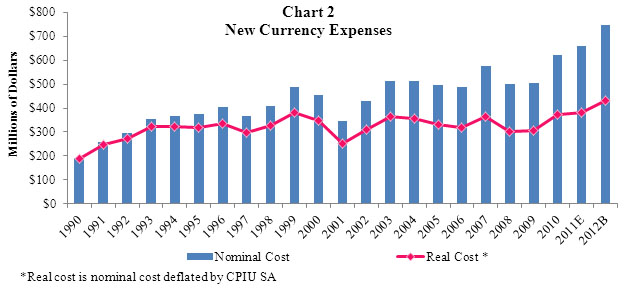

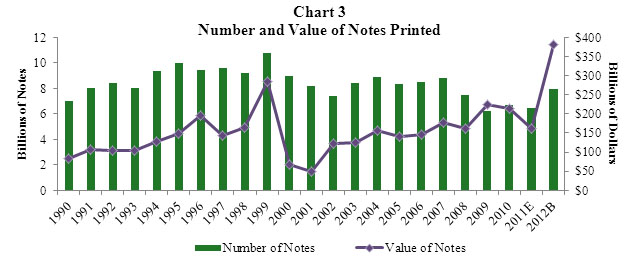

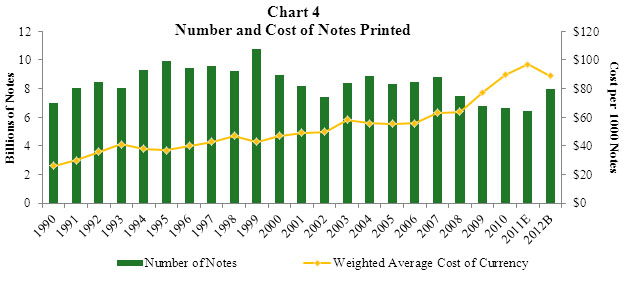

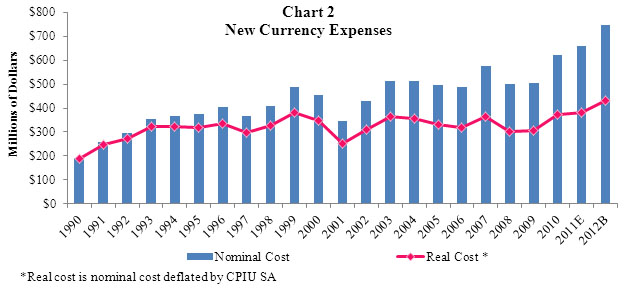

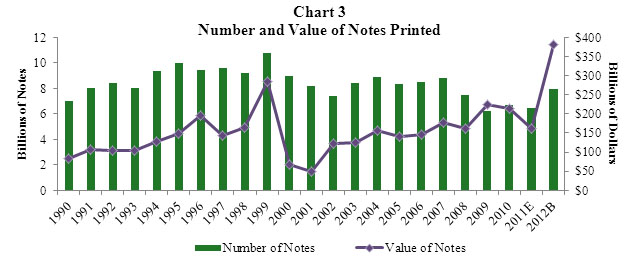

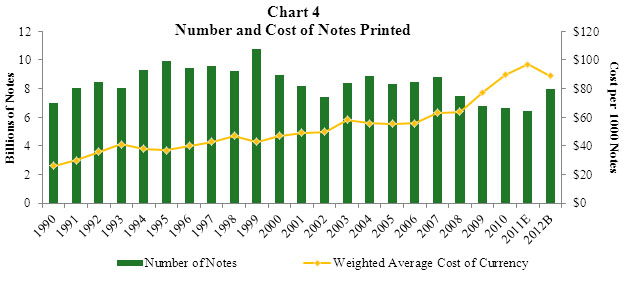

9. Charts 2-4 in the appendix show the new currency expenses, the value and number of notes printed, and the number and cost of notes printed from 1990 through the 2012 budget period. Return to text.

10. Misfaced notes are notes that are reverse-side up rather than portrait-side up. For operational reasons, misfaced notes have traditionally been destroyed during Reserve Bank processing even if they were otherwise fit for recirculation. Beginning in April 2011, Reserve Banks began to pay out "misfaced" notes ($1 - $20 notes only) to depository institutions and accept misfaced notes ($1 - $20 notes only) in deposits from depository institutions. This policy decreased the destruction rate of $1 notes by 5 percentage points and decreased the average destruction rate of $5 through $20 notes by 3 percentage points. Without these reductions, we estimate our CY 2012 print cost budget would be $14 million more. This policy change was endorsed by the Cash Customer Advisory Council, which represents the 16 largest depository institutions (by deposit volume) that are customers of the Reserve Banks. Return to text.

11. Because the BEP has been unable to fund its operations without assessing the Board surcharges during FY 2010 and FY 2011, the Board requested that the BEP change the method used to bill the Board. Currently, the BEP bills the Board monthly, based solely on the number of notes it has produced. Beginning in 2012, however, on a monthly basis, the BEP will assess the Board one-twelfth of its fixed cost budget independent of the quantity of notes produced, as well as a variable cost based on the number of notes produced. The fixed and variable cost billing method will generally allow the BEP to recover all fixed costs and maintain its working capital fund regardless of the number of notes its produces, minimizing the need for the BEP to assess the Board surcharges. The new billing method will also allow the Board to better manage the currency budget as currency expenses will be more transparent and predictable. Return to text.

12. Although production staff and overtime are traditionally classified as variable costs, the BEP includes them in fixed costs because the BEP does not adjust staffing based on the size of our print order. The BEP estimates that expenses for production staff accounts for approximately 12 percent of total fixed costs. During 2012, Board staff will work with the BEP to refine its fixed and variable cost components. Return to text.

13. Before the Board assumed the management of the currency education program, the USSS funded and managed international training seminars. Beginning in 2012, however, the Board will fund these seminars, including associated travel expenses for USSS and Board staff. Return to text.

14. Current-design $100 notes are produced only at the BEP's Washington D.C. facility (ECF), and current demand requires that the ECF dedicate all resources to producing the current-design $100 note. We expect this elevated demand to continue throughout 2012, and it is likely, therefore, that the BEP's Ft. Worth facility (WCF) will be the only facility producing new-design $100 notes in 2012. Because international customers receive currency shipments primarily from EROC, it needs the largest inventory of new-design $100 notes. Shipments from the WCF to EROC are four times more expensive than shipments from the ECF to EROC, because shipments from the WCF to EROC require air transportation, whereas shipments from the ECF to EROC are accommodated using less-expensive ground transportation. Return to text.

15. The estimated RRC payment of $41,000 represents the remaining 1 percent of the counterfeit-deterrence research budget. The RRC is a state-of-the-art facility hosted by the National Bank of Denmark for adversarial testing of banknote designs and counterfeit deterrent features for its 13 member countries. Return to text.

- Print Version (PDF)

Contents

Action

On December 12, 2011, the Board approved the 2012 new currency budget totaling $747.0 million, an increase of $89.5 million, or 13.6 percent, from 2011 estimated expenses and an increase of $70.9 million, or 10.5 percent, from the approved 2011 budget.

Discussion

Under authority delegated by the Board, the director of the Division of Reserve Bank Operations and Payment Systems (RBOPS) submits an annual print order for new currency to the director of the Bureau of Engraving and Printing (BEP).1 Upon reviewing the order, the BEP estimates printing costs for new currency during the calendar year (CY), which Board staff uses to prepare the annual budget for new currency. The Board then approves the final budget. Printing costs for Federal Reserve notes typically comprise about 95 percent of the new currency budget; certain other BEP costs, expenses for the currency education program, the currency quality assurance (CQA) program, currency transportation, and counterfeit-deterrence research, on average, represent the remaining 5 percent. Once the Board approves the new currency budget, it assesses the costs of new currency to each Federal Reserve Bank on a monthly basis through an accounting procedure similar to that used in assessing the costs of the Board's operating expenses to the Banks.

Table 1 provides details on the Board's CY 2011 budget, 2011 estimate, and 2012 budget.2

Table 1

New Currency Budget

(calendar year)

|

2011 Budget (thousands) |

2011 Estimate (thousands) |

2012 Budget (thousands) |

Percent Change | ||

|---|---|---|---|---|---|

| 2011E/2011B | 2012B/2011E | ||||

| Print volume (number of notes) | 6,787,720 | 6,444,800 | 7,956,427 | -5.1 | 23.5 |

| BEP Expenses | |||||

| Printing Federal Reserve notesa | $632,265 | $625,775 | $707,231 | -1.0 | 13.0 |

| Currency education programb | $16,000 | $4,500 | N/A | -71.9 | N/A |

| Other | $3,773 | $3,466 | $3,692 | -8.1 | 6.5 |

| Board Expenses | |||||

| Currency education programb | N/A | $91 | $2,800 | N/A | N/A |

| Currency quality assurance | $1,300 | $2,600 | $5,200 | 100.0 | 100.0 |

| Currency transportation | $18,318 | $16,628 | $22,795 | -9.2 | 37.1 |

| Counterfeit-deterrence research | $4,486 | $4,487 | $5,318 | 0.0 | 18.5 |

| Total expenses | $676,141 | $657,547 | $747,036 | -2.8 | 13.6 |

a. Expenses for printing Federal Reserve notes do not include costs associated with the currency education and currency quality assurance programs. These costs were included in printing costs in previous budget documents. Return to table.

b. The BEP managed the currency education program through September 30, 2011. The Board began managing this program effective October 1, 2011; therefore, 2011 estimates for BEP expenses include costs incurred by the BEP during the first three quarters, and 2011 estimates for Board expenses include costs incurred by the Board during the fourth quarter. Return to table.

2011 New Currency Expenses

Staff estimates that total expenses for new currency in 2011 will be $657.5 million, which are $18.6 million or 2.8 percent below the 2011 budget primarily because the BEP will print and the Board will ship fewer notes than we estimated when we prepared the 2011 budget. The majority of the decrease in note production and transportation is attributable to production problems associated with the new-design $100 note. The BEP did not deliver any new-design $100 notes to the Board during 2011.3 Lower-than-planned printing and transportation costs are partially offset by an increase in expenses for the CQA program.4

2011 Printing Costs

Estimated CY 2011 currency printing costs are $625.8 million, which are $6.5 million, or 1 percent, lower than the budgeted amount primarily because the BEP printed fewer notes than we estimated when we prepared the CY 2011 budget. At the time we prepared that budget, we had recently learned of a significant production problem with the new-design $100 note, caused by sporadic creasing of the paper. The BEP, however, estimated it would produce 1.3 billion new-design $100 notes during CY 2011 and based its billing rates on this production.5 The creasing problem, however, proved to be difficult to correct and the BEP was not able to deliver any new-design $100 notes to the Board during CY 2011.

Because the BEP did not deliver any new-design $100 notes, it assessed the Board surcharges totaling $97.8 million in 2011. Without these surcharges, the BEP would have been unable to generate sufficient revenue to cover all of its operating expenses and maintain its working capital fund.6

2011 Transportation Costs

The estimated CY 2011 transportation costs are $16.6 million, which are $1.7 million lower than the budgeted amount, primarily because we included funding in the 2011 budget to begin shipping new-design $100 notes to Reserve Banks before issuance. Because the issuance was delayed, we did not make any of these shipments. In addition, we budgeted for a 5 percent increase in armored carrier contract rates, but rates only increased about 2 percent.

2011 Currency Quality Assurance Program Costs

The estimated CQA costs are $2.6 million, which are $1.3 million higher than the budgeted amount. During 2011, the CQA consultants worked closely with the BEP and its paper supplier (Crane and Company), to evaluate the production and test data collected by the BEP and Crane to assess the mitigation efforts implemented to resolve the creasing of the new-design $100 note. The consultants also worked with the BEP and Crane to develop numerous production tests to identify the factors that led to the creasing, to implement process changes to stabilize production, and to evaluate the effectiveness of the crease detection system. To assess the robustness of the process changes at both the BEP and Crane, and determine the residual risks of returning to production, the CQA consultants worked with the Board and the BEP to draft and implement a production validation process for each press line that will produce the new-design $100 note. This validation process includes a production plan, employee training program, spoilage thresholds, data gathering requirements, and data evaluation.

In December, the BEP will complete the production validation plan on one production line at its Fort Worth facility. The CQA consultants will issue a report on the production validation results by year end. Preliminary results indicate that although the root cause for creasing has not been determined, appropriate mitigation steps have reduced the incidence of creasing below 1 percent and the new crease detection system significantly reduces the risk of the BEP delivering creased notes to the Board.7

In addition to the short-term work related to the production problems associated with the new-design $100 note, the long-term goals of this program are to improve the BEP's ability to produce high-quality notes consistently and reduce spoilage, as well as to increase the security and reduce the functional failures of notes in circulation.8 During 2011, the CQA consultants provided the BEP with a fully executable plan and schedule for implementing quality system improvements identified during 2010. The CQA consultants then began work with the Board and the BEP to implement the new CQA program. Specifically, the Board, the BEP, and the CQA consultants established integrated teams to address deficiencies in the areas of corrective and preventive action (CAPA); process change; management review; and design review. The CAPA team will identify and investigate the root causes of quality problems during the production process. The process change team will evaluate potential downstream effects on production before any changes are implemented. The management review team will provide management with critical forward-looking information about BEP operations, and the design review team will improve the product development process.

2012 New Currency Budget

The proposed $747.0 million 2012 new currency budget is 13.6 percent higher than the 2011 estimate and 10.5 percent higher than the 2011 budget.

2012 Printing Costs

The budget includes $707.2 million in printing costs for CY 2012, which represents a 13 percent increase from the 2011 estimate. The increase is primarily attributable to a higher volume of more-expensive series-2004 notes included in the 2012 budget compared with 2011.9 As shown in chart 1, the Board's FY 2012 print order includes approximately 1.4 billion more series-2004 notes than the FY 2011 order.

Quantity and Type of Notes Ordered

Although our order for most denominations increased between FY 2011 and FY 2012, the order for $1 notes declined by 0.9 billion. The decline in the order for $1 notes reflects relatively flat payments of $1 notes to circulation and receipts of $1 notes from circulation as well as the implementation of the Reserve Banks' new policy to accept misfaced notes from and distribute misfaced notes to depository institutions.10 This decrease in the order for $1 notes, however, is more than offset by an increase of 1.7 billion notes in all other denominations, the majority of which are more-expensive series-2004 notes. The increase in all other denominations (except the new-design $100 note) is attributable to increased payments of currency to circulation and decreased receipts of currency from circulation during 2011. In addition, the FY 2012 order includes 1.5 billion new-design $100 notes to begin building inventories before issuance.

The BEP's printing costs are based on the total quantity of notes, as well as the type of notes the Board orders. In addition to a larger order in FY 2012, series-2004 notes comprise 56 percent of the order, compared with only 50 percent in FY 2011. Series-2004 notes are more expensive because they include colored backgrounds and additional security features, resulting in higher costs of paper and ink for these notes, compared with older-series notes. In addition, new-design $100 notes, the most expensive note to print, represent 32 percent of the series-2004 notes in the FY 2012 order. For budget planning purposes, the BEP provided the Board with estimates on 2012 printing costs, which are presented in table 2, by type of note.

Table 2

Calendar Year 2012 BEP Printing Costs

| Note typea | Projected 2012 fixed costs (thousands of dollars)b | Projected 2012 variable costs (per thousand notes) | Projected 2012 total costs (per thousand notes)c | CY 2011 billing rates (per thousand notes) |

|---|---|---|---|---|

| $1, $2 | $79,969 | $14.73 | $51.81 | $55.49 |

| Series-2004 $5 | $42,732 | $26.06 | $84.63 | $99.28 |

| Series-2004 $10 | $37,961 | $26.98 | $85.13 | $99.18 |

| Series-2004 $20, $50d | $114,741 | $29.23 | $92.47 | $108.91 |

| Series-1996 $100d | $73,573 | $29.04 | $77.24 | $98.60 |

| Series-2004 $100 | $99,644 | $60.92 | $127.31 | $144.80 |

| Average cost per thousand notese | $56.39 | $32.50 | $88.89 | $97.10 |

a. $1 and $2 notes do not include the security features that are in the series-1996 and series-2004 design notes; series-1996 $100 notes include a watermark and color-shifting ink; series-2004 $5 notes include two watermarks and additional security features; and series-2004 $10, $20, and $50 notes include watermarks, additional security features, and a new color-shifting ink. The series-2004 $100 note will include a watermark, a 3D security ribbon, a new color-shifting feature ("the Bell in the Inkwell"), additional security features, and a new color-shifting ink. This higher level of security for the series-2004 $100 note has significantly increased the cost for both paper and ink. Return to table.

b. The projected fixed costs are the BEP's estimates of fixed costs associated with the production of each denomination. Return to table.

c. The projected total costs per thousand notes are projected fixed costs divided by the number of notes, plus variable costs per thousand notes. Return to table.

d. The variable cost billing rates for series-1996 $100 notes and series-2004 $20 and $50 notes are comparable because a larger quantity of more-expensive color-shifting ink is used in the production of the series-1996 $100 note than is used in the production of the series-2004 $20 and $50 notes; however, the $20 and $50 notes contain additional security features. Return to table.

e. The average cost per thousand notes for 2012 is the volume-weighted average of the fixed, variable, and total costs. For 2011, the average cost per thousand notes is the total cost of printing Federal Reserve notes (including any surcharges) divided by the number of notes printed. Return to table.

BEP Fixed and Variable Costs

The 2012 print cost budget of $707.2 million is comprised of a projected $448.6 million in fixed costs and $258.6 million in variable costs Fixed costs account for 63 percent of total currency printing costs.11 Components of the BEP's fixed costs include capital investment, production staff, prepress, engraving, and fixed manufacturing overhead and support, research and development, general and administrative staff, and overtime.12 Variable costs account for 37 percent of total currency printing cost. Components of the variable costs include costs for paper, ink, and variable manufacturing overhead.

The main drivers of the $448.6 million 2012 budget for fixed costs are labor expenses (including overtime), depreciation expenses for production and inspection equipment, a new integrated security system, and a new information technology infrastructure, as well as funding to maintain a targeted level of working capital so that the BEP can make future capital expenditures.

The projected $258.6 million of variable costs is directly attributable to the volume of notes included in the Board's FY 2012 print order. The variable costs vary by denomination, as shown in table 2, and are determined primarily by costs for paper and ink. The variable costs fluctuate from $14.73 per thousand notes for $1 notes to $60.92 per thousand notes for new-design $100 notes. The $1 note is significantly less expensive to produce, whereas the new-design $100 note is the most expensive to produce because it has the most sophisticated security features. The cost for the other denominations ranges between $26 and $30 per thousand notes to produce based on levels of security features.

Based upon the projected fixed and variable costs provided by the BEP and the number of notes in the CY 2012 budget, we have calculated the total unit cost for each denomination (shown in table 2). The calculated average cost per thousand notes decreased 8.5 percent, from $97.10 in 2011 to $88.89 in 2012, because the BEP's fixed costs will be spread over a greater number of notes in 2012.

2012 Currency Quality Assurance Program Costs

The 2012 CQA budget is $5.2 million. During 2012, CQA consultants will continue to facilitate the implementation of a new quality system for the BEP. The Board, the BEP, and the CQA consultants will continue their work and will complete the CAPA program improvements. New teams will be formed to address additional improvement opportunities at the BEP. Specifically, these teams will begin to improve the materials control and equipment maintenance processes. The materials control team will review and enhance processes for inspecting incoming materials (such as paper and ink) before it is used in production. The facilities and equipment team will formalize and enhance current machine maintenance and calibration programs to ensure they are systematic and robust.

2012 Currency Education Program Costs

The 2012 currency education program budget is $2.8 million. The goal of the currency education program is to protect and maintain confidence in U.S. currency by providing information on the design and security features of Federal Reserve notes to users worldwide. To do that, the program is focused on ensuring that users of U.S. currency know what genuine Federal Reserve notes look like, are aware of the security features in each denomination, and know how to use those security features to distinguish between genuine and counterfeit notes.

On October 1, 2011, management of the currency education program transitioned from the BEP to the Board, aligning currency education with the Board's other currency-related responsibilities as the issuing authority for Federal Reserve notes. During 2012, Board staff will focus on modernizing the currency education program, while also expanding the scope of the program to make it more useful to users of U.S. currency. The currency education program budget for 2012 will fund several new initiatives, including the redesign of the currency education website to include information on all circulating designs of Federal Reserve notes, the development of a youth education initiative, and the management of international training seminars in partnership with the United States Secret Service (USSS).13

2012 Currency Transportation

The 2012 currency transportation budget is $22.8 million, which is $6.2 million or 37.1 percent higher than the 2011 estimate. This budget includes the cost of shipping new currency from the BEP to Reserve Banks, of intra-System shipments of fit and unprocessed currency, and of returning currency pallets from the Reserve Banks to the BEP. Because the Board has ordered more notes in 2012, we estimate that the Board will make approximately 500 (25 percent) more shipments than in 2011. In addition, the average cost of these shipments will be higher than in 2011 because we will ship new-design $100 notes from the BEP's Fort Worth facility (instead of its Washington D.C. facility) to the Federal Reserve Bank of New York's East Rutherford Operations Center (EROC) in preparation for issuance.14 We expect to make approximately the same number of intra-System shipments in 2012 as we made in 2011.

The Board's current two-year transportation contracts will expire at the end of the year and we are exercising a contract option to extend them into the first half of 2012. We are currently in the process of receiving new rates from armored carriers for the first six months of 2012 and we plan to enter into renegotiated contracts in July. For budget planning purposes, we have assumed a moderate increase in rates to account for increases in fuel and labor costs.

Counterfeit-Deterrence Research

The 2012 budget for counterfeit-deterrence research is $5.3 million, which includes costs associated with the Central Bank Counterfeit Deterrence Group (CBCDG) and the Reprographic Research Center (RRC). The CBCDG operates under the auspices of the G-10 central bank governors to combat digital counterfeiting and includes 32 central banks. The Board's $5.3 million share of the 2012 CBCDG budget comprises 99 percent of the Federal Reserve's counterfeit-deterrence budget.15

Other Reimbursements to the Bureau of Engraving and Printing

The 2012 budget includes $3.7 million to reimburse the BEP for expenses incurred by its Destruction Standards and Compliance Division of the Office of Compliance (OC) and Mutilated Currency Division (MCD) of the Office of Financial Management. The OC develops Reserve Bank standards for cancellation and destruction of unfit currency and for note accountability, and reviews Reserve Banks' cash operations for compliance with its standards. As a public service, the MCD also processes claims for the redemption of damaged or mutilated currency.

Appendix

Footnotes

1. By Memorandum of Understanding between the BEP and the Board, dated March 13, 1998, "[t]he Board shall provide the currency order to the BEP with denomination and Federal Reserve Bank breakdown 60 days before the beginning of the BEP's fiscal year." Return to text.

2. Because the BEP operates on a fiscal year that began October 1, 2011, and ends September 30, 2012, Board staff estimates the Board's calendar-year budget for new currency by eliminating the cost of notes that the BEP will produce in the first quarter of its fiscal year and estimating the volume and associated printing costs of notes Board staff projects the BEP will produce in the fourth quarter of the calendar year. Return to text.

3. The new-design $100 note is the last denomination to be issued as part of the series-2004 design family of notes. This design family began with the issuance of the series-2004 $20 note in October 2003, followed by the $50 note in September 2004, the $10 note in March 2006, and the $5 note in March 2008. The new-design $100 note incorporates advanced technology that makes it easier for the public to authenticate and more difficult for counterfeiters to replicate. Return to text.

4. In October 2010, the Board contracted with PRTM (which was subsequently acquired by PricewaterhouseCoopers) to conduct an assessment of the BEP's quality system for the production of Federal Reserve notes. Board staff estimates that the CQA program will take at least four years to complete. Return to text.

5. In April 2010, the Board announced that the new-design $100 note would be issued on February 10, 2011. In October 2010, the Board announced a delay in the issue date of the new-design $100 note. Return to text.

6. The BEP does not receive Federal appropriations; all operations of the BEP are financed by a revolving fund that is reimbursed through product sales, virtually all of which are sales of Federal Reserve notes to the Board to fulfill its annual print order. Customer billings are the BEP's only means of recovering the costs of operations and generating funds necessary for capital investment. Section 16 of the Federal Reserve Act requires that all costs incurred for the issuing of notes shall be paid for by the Board and included in its assessments against the Reserve Banks. Return to text.

7. Because of the dynamic and complex nature of the papermaking process and the multiple processes involved in the production of the new-design $100 note, as well as the numerous changes to production processes before the Board's CQA consultants were provided data from the BEP and Crane, the CQA consultants have not determined a root cause(s). Return to text.

8. During 2012, we estimate that the cost of spoilage, based on 2012 variable printing costs and historical spoilage rates, will be approximately $38.5 million. Return to text.

9. Charts 2-4 in the appendix show the new currency expenses, the value and number of notes printed, and the number and cost of notes printed from 1990 through the 2012 budget period. Return to text.

10. Misfaced notes are notes that are reverse-side up rather than portrait-side up. For operational reasons, misfaced notes have traditionally been destroyed during Reserve Bank processing even if they were otherwise fit for recirculation. Beginning in April 2011, Reserve Banks began to pay out "misfaced" notes ($1 - $20 notes only) to depository institutions and accept misfaced notes ($1 - $20 notes only) in deposits from depository institutions. This policy decreased the destruction rate of $1 notes by 5 percentage points and decreased the average destruction rate of $5 through $20 notes by 3 percentage points. Without these reductions, we estimate our CY 2012 print cost budget would be $14 million more. This policy change was endorsed by the Cash Customer Advisory Council, which represents the 16 largest depository institutions (by deposit volume) that are customers of the Reserve Banks. Return to text.

11. Because the BEP has been unable to fund its operations without assessing the Board surcharges during FY 2010 and FY 2011, the Board requested that the BEP change the method used to bill the Board. Currently, the BEP bills the Board monthly, based solely on the number of notes it has produced. Beginning in 2012, however, on a monthly basis, the BEP will assess the Board one-twelfth of its fixed cost budget independent of the quantity of notes produced, as well as a variable cost based on the number of notes produced. The fixed and variable cost billing method will generally allow the BEP to recover all fixed costs and maintain its working capital fund regardless of the number of notes its produces, minimizing the need for the BEP to assess the Board surcharges. The new billing method will also allow the Board to better manage the currency budget as currency expenses will be more transparent and predictable. Return to text.

12. Although production staff and overtime are traditionally classified as variable costs, the BEP includes them in fixed costs because the BEP does not adjust staffing based on the size of our print order. The BEP estimates that expenses for production staff accounts for approximately 12 percent of total fixed costs. During 2012, Board staff will work with the BEP to refine its fixed and variable cost components. Return to text.

13. Before the Board assumed the management of the currency education program, the USSS funded and managed international training seminars. Beginning in 2012, however, the Board will fund these seminars, including associated travel expenses for USSS and Board staff. Return to text.

14. Current-design $100 notes are produced only at the BEP's Washington D.C. facility (ECF), and current demand requires that the ECF dedicate all resources to producing the current-design $100 note. We expect this elevated demand to continue throughout 2012, and it is likely, therefore, that the BEP's Ft. Worth facility (WCF) will be the only facility producing new-design $100 notes in 2012. Because international customers receive currency shipments primarily from EROC, it needs the largest inventory of new-design $100 notes. Shipments from the WCF to EROC are four times more expensive than shipments from the ECF to EROC, because shipments from the WCF to EROC require air transportation, whereas shipments from the ECF to EROC are accommodated using less-expensive ground transportation. Return to text.

15. The estimated RRC payment of $41,000 represents the remaining 1 percent of the counterfeit-deterrence research budget. The RRC is a state-of-the-art facility hosted by the National Bank of Denmark for adversarial testing of banknote designs and counterfeit deterrent features for its 13 member countries. Return to text.