Freedom of Information Office

2014 Currency Budget

Action

On December 12, 2013, the Board approved the 2014 currency budget totaling $826.7 million, which represents an increase of $29.1 million, or 3.6 percent, over the approved 2013 budget.1 This increase is primarily attributable to the new currency reader program.2 Without the implementation of the reader program, the 2014 budget would have increased by only $9.7 million, or 1.2 percent, over the 2013 budget.

Discussion

Under authority delegated by the Board, the director of the Division of Reserve Bank Operations and Payment Systems (RBOPS) submits an annual fiscal year (FY) print order for new currency to the director of the Bureau of Engraving and Printing (BEP). Upon reviewing the order, the BEP estimates printing costs for new currency during the calendar year (CY), which staff uses to prepare the annual currency budget. The Board then reviews and approves the final budget. Printing costs for Federal Reserve notes constitute nearly 90 percent of the currency budget. Expenses for currency transportation, the currency reader program, the currency quality assurance (CQA) and counterfeit deterrence programs, the currency education program (CEP), and other costs to reimburse the BEP make up the remaining 10 percent.

Once the Board approves the currency budget, it assesses the costs of currency to each Federal Reserve Bank on a monthly basis. Table 1 provides details on the Board's CY 2013 budget, 2013 estimate, and 2014 budget.

Table 1

Currency Budget

(calendar year)

2013

Budget

(thousands)

2013

Estimate

(thousands)

2014

Budget

(thousands)

Percent Change

2013E/2013B

2014B/2013B

Print volume (number of notes)

8,180,705

6,352,992

7,845,067

-22.3

-4.1

BEP Expenses

$738,210

$664,210

$767,996

-10.0

4.0

Printing Federal Reserve notes

$734,775

$661,160

$745,387

-10.0

1.4

Currency reader

$0

$0

$19,384

n/a

n/a

Other

$3,435

$3,050

$3,225

-11.2

-6.1

Board Expenses

$59,391

$40,844

$58,670

-31.2

-1.2

Currency transportation

$30,697

$21,051

$33,222

-31.4

8.2

Quality assurance and counterfeit deterrence

$19,182

$16,593

$21,091

-13.5

10.0

Currency education

$9,512

$3,200

$4,357

-66.4

-54.2

Total expenses

$797,600

$705,054

$826,665

-11.6

3.6

n/a Not applicable. Return to table.

2013 Currency Expenses

Staff estimates that total currency expenses will be $705.1 million in 2013. This amount is $92.5 million, or 11.6 percent, below the 2013 budgeted amount. The reduction in expenses is primarily attributable to lower-than-budgeted expenses for printing new notes, transporting new and fit notes, and for the currency education program. These factors are discussed in more detail below.

2013 Printing Expenses

Estimated expenses for printing Federal Reserve notes in CY 2013 are $661.2 million. This amount is $73.6 million, or 10.0 percent lower, than the budgeted amount. When we prepared the 2013 budget, we were uncertain whether the Board would issue the new-design $100 note in 2013, so we included approximately 1.5 billion series-1996 (old-design) $100 notes in the budget to ensure that Reserve Banks would have sufficient quantities to meet demand during FY 2013.3 By April, however, we were satisfied that the BEP had resolved the production problems and could produce the necessary quantity of new-design $100 notes the Board needed to begin issuing in 2013; the Board announced that it would issue the new-design $100 note beginning on October 8. We no longer needed all of the old-design $100 notes that we had included in our FY 2013 print order, and thus reduced the order for old-design $100 notes by approximately 1.0 billion notes. This modification to the FY 2013 print order resulted in a decrease to the estimated expenses of nearly $26.3 million. The remainder of the budget-to-estimate difference is attributable mostly to the BEP producing fewer notes during the fourth quarter than we estimated when we prepared the 2013 budget.4

2013 Transportation Expenses

Estimated CY 2013 expenses for currency transportation are $21.1 million. This amount is $9.6 million, or 31.4 percent, lower than the budgeted amount. About $7.8 million, or more than 80 percent of the difference, is attributable to shipping fewer new-design $100 notes than we had budgeted. Rather than storing all $100 notes at the Reserve Banks, as planned, we chose to temporarily store these additional notes at the BEP. The remainder of the difference between the budget and estimate is because of the reduction in the order for old-design $100 notes and our revised projection for BEP production in the fourth quarter.

2013 Currency Quality Assurance and Counterfeit Deterrence Expenses

Estimated CY 2013 expenses for the CQA and counterfeit deterrence programs are $16.6 million. This amount is $2.6 million, or 13.5 percent, lower than the budgeted amount. The difference is due primarily to a $2.2 million underrun in the CQA program.

During 2013, the CQA program continued to make progress in implementing a new quality system for the BEP. Specifically, the CQA consultants developed, deployed, and transitioned to BEP staff several key components of the new quality system. For example, one component is a corrective action and preventative action (CAPA) system to identify, investigate, and prevent the recurrence of production issues. The CQA program also completed work on a process change procedure that allows staff to identify, submit, and evaluate opportunities for improvement in all areas of production. One suggestion resulted in a savings of about $2.0 million in ink costs in less than a year. The CQA consultants also made significant progress in defining and implementing a process to manage both technology and product development for the U.S. currency program. In addition, the BEP is making significant organizational and management changes that should result in a stronger commitment to the CQA initiative.

2013 Currency Education Program Expenses

Estimated CY 2013 expenses for the CEP are $3.2 million. This amount is $6.3 million, or 68 percent, lower than the budgeted amount. The decline is attributable to a greater-than-anticipated amount of work performed in-house. Contractor costs were further reduced through aggressive oversight and management. Additionally, the federal government shutdown in October caused some planned activities, such as international outreach and research, to be postponed until next year, shifting some expenditures from 2013 to 2014.

2014 Currency Budget

The proposed 2014 currency budget is $826.7 million, which is 3.6 percent higher than the 2013 budget.5 The increase is primarily attributable to the BEP's implementation of a program to procure and distribute currency readers. Without this expense, the budget would have increased only 1.2 percent because of minor increases in the costs to produce and transport notes, as well as in the budgeted expenses for the CQA and counterfeit-deterrence programs.

2014 Printing Budget

The currency budget includes $745.4 million in printing costs for CY 2014, which represents a 1.4 percent increase from the 2013 budget. The increase is due primarily to higher fixed costs at the BEP, offset by a decrease in variable costs. The printing cost budget includes $431.1 million (58 percent) in fixed costs and $314.3 million (42 percent) in variable costs.6

Fixed Costs: Fixed costs, which include capital, prepress and engraving, fixed manufacturing overhead and support, research and development, and general and administrative staff, are budgeted to increase by $44.2 million, primarily because of depreciation, payments to other government agencies, and staffing to support the CQA program.7 Depreciation is expected to increase significantly because the BEP has purchased and installed new equipment and software, including a new information technology platform (BEP Enterprise Network – BEN) to manage all BEP operations. Also, the BEP will pay the IRS $4.0 million for procurement services and the Treasury $2.5 million for upgrades to the BEP's communication system.8 The BEP also included $5 million in its fixed costs to on-board staff to support the CQA program.

The 2014 fixed costs also include $43.3 million in capital to fund investments ($31.2 million) and to replenish the BEP's working capital account ($12.1 million) because its capital spending in 2013 exceeded the amount it collected from the Board via monthly charges.9 We have reviewed the capital projects the BEP has classified as high priority and support including funding for these projects in the budget. We believe, however, that these proposed capital expenditures should be evaluated in the context of a comprehensive strategic capital plan, and have agreed to work with the BEP to develop such a plan in early 2014. As agreed to in the memorandum of understanding between the Board and the Treasury, the BEP must notify the director of RBOPS before committing any funds to capital projects in excess of $1 million.

Table 2

Number of Notes Produced (calendar year)a

Type of Note

2013 Budget

(thousands)

2014 Budget

(thousands)

Percent Change

2014B/2013B

$1, $2

1,991,905

2,317,867

16.4

Series-2004 $5

691,200

722,133

4.5

Series-2004 $10

452,800

451,200

-0.4

Series-2004 $20, $50

734,400

2,165,067

194.8

Series-1996 $100

1,500,800

0

-100.0

Series-2004 $100

2,809,600

2,188,800

-22.1

Total

8,180,705

7,845,067

-4.1

a. Details regarding the Board's FY 2014 order can be found on the Board's public website. Return to table.

Variable Costs: Variable costs, which include paper, ink, direct labor, and other variable manufacturing costs, are budgeted to decline by $33.6 million from the 2013 budget because of the projected lower number of $100 notes to be printed, as shown in table 2.10 This decline in variable costs largely offsets the fixed cost increases.

The average variable cost per thousand notes, which varies by denomination, remained largely unchanged from 2013 to 2014, as shown in table 3. The variable costs range from $18.98 per thousand notes for $1 notes to $66.35 per thousand notes for new-design $100 notes and are determined primarily by the cost of paper.11 For budget planning purposes, the BEP provided us with estimates of 2014 printing costs, which are presented in table 3, by type of note.

Table 3

Calendar Year BEP Printing Costs

Note typea

2014 projected

fixed costs

(thousands)b

2014 projected

variable unit costs

(per thousand notes)

2014 projected

total costs

(per thousand notes)c

2013 estimated

total costs

(per thousand notes)

$1, $2

$81,568

$18.98

$54.09

$54.46

Series-2004 $5

$37,164

$35.38

$101.37

$97.76

Series-2004 $10

$28,125

$33.99

$91.81

$89.75

Series-2004 $20, $50

$129,180

$37.69

$102.07

$97.67

Series-2004 $100

$155,095

$66.35

$130.89

$126.73

Average cost per thousand notesd

$55.40

$40.56

$95.95

$88.85

a. $1 and $2 notes do not include the security features that are in the series-2004-design notes; series-2004 $5 notes include two watermarks and additional security features, and series-2004 $10, $20, and $50 notes include watermarks, additional security features, and a new color-shifting ink. The series-2004 $100 note includes a watermark, a 3-D security ribbon, a new color-shifting feature (“the Bell in the Inkwell”), additional security features, and a new color-shifting ink. This higher level of security for the series-2004 $100 note has significantly increased the cost for both paper and ink. Return to table.

b. The projected fixed costs are the BEP's estimates of fixed costs associated with the production of each denomination. Return to table.

c. The projected total costs per thousand notes are projected fixed costs divided by the number of notes in the Board's order, plus variable costs per thousand notes. Return to table.

d. The average cost per thousand notes for 2014 is the volume-weighted average. For 2013, the unit cost per thousand notes is the volume-weighted average of the fixed and variable costs divided by the number of notes the Board included in its FY 2013 order. Return to table.

Even though average variable costs declined slightly, from $42.07 in 2013 to $40.56 in 2014, the average total cost increased about 8.0 percent, from $88.85 to $95.95. The increase in the average total cost is attributable to the increase in fixed costs discussed above. The average fixed costs per thousand notes increased from $49.74 in 2013 to $55.40 in 2014.

2014 Currency Reader Program Budget

The 2014 currency budget includes $19.4 million to fund the first year of a multiyear program to distribute currency readers to qualified individuals who are blind or visually impaired at no cost to the user. The BEP will implement a currency reader program to comply with a court order requiring the Treasury Department to provide meaningful access to individuals that are blind or visually impaired in denominating U.S. currency. During 2014, the BEP expects to award a contract to procure currency readers and to distribute the readers by mid-2014 through an interagency agreement with the Library of Congress. We agree with the BEP's approach to leverage the existing infrastructure of the Library of Congress' book reader program, which is managed by the National Library Service.

2014 Budget for Other Reimbursements to the Bureau of Engraving and Printing

The 2014 budget includes $3.2 million to reimburse the BEP for expenses incurred by its Destruction Standards and Compliance Division of the Office of Compliance (OC) and Mutilated Currency Division (MCD) of the Office of Financial Management. The OC develops standards for cancellation and destruction of unfit currency and for note accountability at the Reserve Banks, and reviews Reserve Banks' cash operations for compliance with its standards. As a public service, the MCD also processes claims for the redemption of damaged or mutilated currency.

2014 Currency Transportation Budget

The 2014 currency transportation budget is $33.2 million, which is $2.5 million, or nearly 8.2 percent, higher than the 2013 budget. This budget includes the cost of shipping new currency from the BEP to Reserve Banks, of intra-System shipments of fit and unprocessed currency, and of returning currency pallets from the Reserve Banks to the BEP. We estimate that we will ship about the same number of notes in 2014 that we shipped in 2013, because our FY 2013 and 2014 orders include a similar number of notes. The budget increase is primarily attributable to a planned 6.0 percent increase in contracted rates with armored carriers to transport currency.

2014 Currency Quality Assurance and Counterfeit-Deterrence Budget

The 2014 budget for CQA and counterfeit deterrence is $21.1 million, which is $1.9 million, or 10.0 percent, higher than the 2013 budget. This budget includes $13.9 million to fund the CQA program and $7.2 million to fund counterfeit-deterrence research and projects.

Currency Quality Assurance

The budgeted amount of $13.9 million for the CQA program is $0.5 million, or 3.7 percent higher than the 2013 budget and will allow the CQA consultants to continue facilitating the implementation of the new quality system at the BEP; to support the research, technology, and product development required for the next design family of Federal Reserve notes; and to continue providing temporary resources to the BEP to sustain critical programs that have been implemented for the quality system.

During 2014, the Board and CQA consultants will build on the foundation and successes accomplished to date. Efforts will continue to focus on several BEP operational areas, including materials, production, equipment, and facilities, with the intent to derive and sustain improvements in both quality and efficiency. The CQA consultants will continue to focus on the BEP's management processes to monitor and continuously improve the quality system. The CQA consultants will also assist the BEP in improving the banknote design process so that production quality is considered at the conceptual stage and continues through the development and testing stages of the next family of banknotes

Counterfeit Deterrence

The 2014 budget for counterfeit-deterrence research is $7.2 million, which is $1.4 million, or about 24.4 percent, higher than the 2013 budget. The budget includes $5.1 million for membership in the Central Bank Counterfeit Deterrence Group (CBCDG). The CBCDG operates under the auspices of the G-10 central bank governors to combat digital counterfeiting and includes 32 central banks. The Board's share of the 2013 CBCDG budget makes up 65 percent of the Federal Reserve's counterfeit-deterrence budget.

2014 Currency Education Program Budget

The 2014 CEP budget is $4.4 million, which is $5.2 million, or 54.2 percent, less than the 2013 budget. The CEP program is designed to protect and maintain confidence in U.S. currency worldwide by providing information on all circulating designs of Federal Reserve notes to the global public. The program works to ensure that users of U.S. currency know what genuine Federal Reserve notes look like, are aware of the security features in each denomination, and know how to use those security features to distinguish between genuine and counterfeit notes.

The 2014 budget reflects the continued increased level of activity associated with educating the global public about the new-design $100 note through the second quarter of 2014. This includes work that was postponed due to the shutdown of the government in October.12 In 2014, the CEP will continue to use in-house resources and will leverage, when possible, existing Reserve Bank, United States Secret Service, State Department, and BEP partnerships in order to minimize expenses. Tasks that cannot, or would be too resource-intensive, to be sourced internally will be contracted; these account for more than 90 percent of the 2014 CEP budget. The major expense drivers for the 2014 budget include the fulfillment of educational materials in more than 20 languages, international outreach to businesses and retailers in more than 25 countries, and hosting and developing the NewMoney.gov educational website.

Appendix: New Currency Expenses

Footnotes

1. The 2014 budget is 17.2 percent larger than the 2013 estimate, primarily because the budget includes 1.5 billion more notes than the 2013 estimate. Spending in 2013 was affected by a number a factors (such as the decision to issue the new-design $100 note and the government shutdown), as discussed below. Return to text.

2. The BEP has been working to meet the requirements of a 2008 court order requiring the Secretary of the Treasury to provide meaningful access for individuals that are blind or visually impaired to denominate U.S. currency. The court has accepted the Treasury's recommendation to continue using the large, high-contrast numeral on all redesigned notes, to develop and implement a tactile feature in the next redesign of notes, and to develop a currency reader program, whereby the BEP will make readers available to qualified blind and visually impaired persons free of charge. Return to text.

3. The BEP experienced unexpected production problems that caused the Board to delay issuance from the original date in February 2011. Return to text.

4. Because the BEP operates on a fiscal year that begins on October 1 and ends September 30, we estimate the Board's calendar-year budget for new currency by eliminating the cost of notes that the BEP will produce in the first quarter of its fiscal year and estimating the costs of notes we project the BEP will produce in the fourth quarter of the calendar year. Return to text.

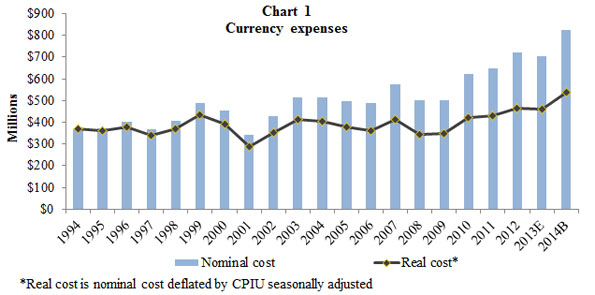

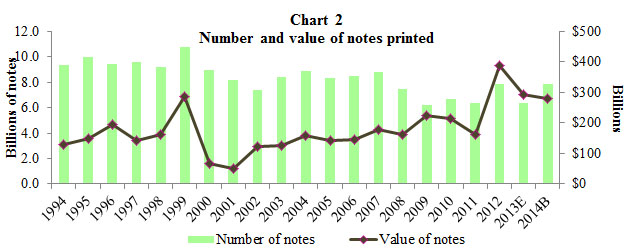

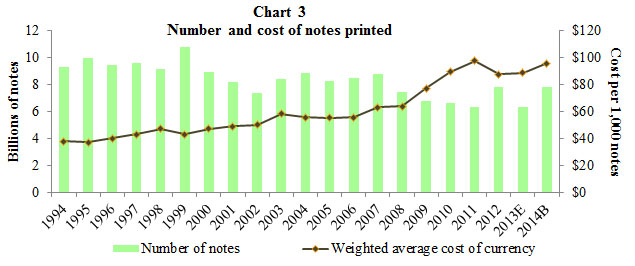

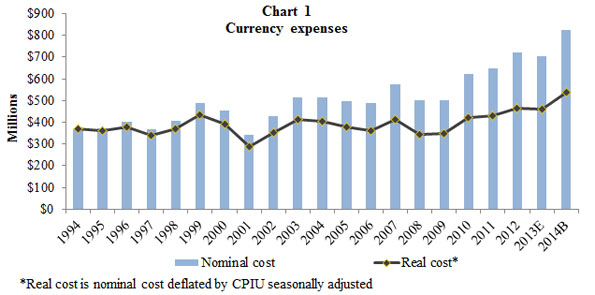

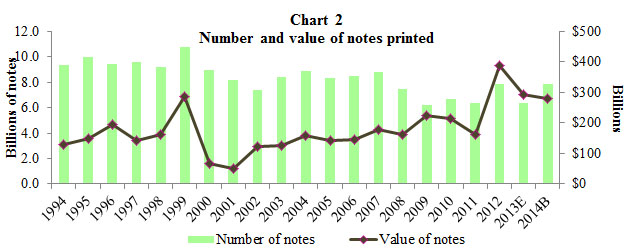

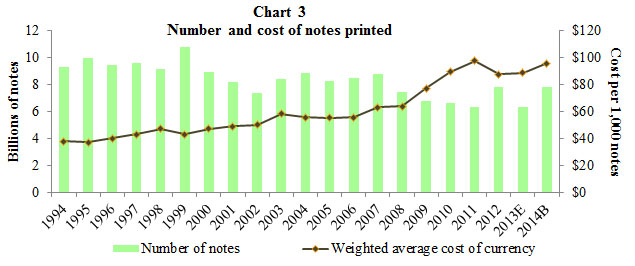

5. Charts 1-3 in attachment 1 show the new currency expenses, the value and number of notes printed, and the number and cost of notes printed from the 1994 through 2014 budget periods. Return to text.

6. The BEP does not receive federal appropriations; all operations of the BEP are financed by a revolving fund that is reimbursed through product sales, virtually all of which are sales of Federal Reserve notes to the Board to fulfill its annual print order. Customer billings are the BEP's only means of recovering the costs of operations and generating funds necessary for capital investment. Section 16 of the Federal Reserve Act requires that all costs incurred for the issuing of notes shall be paid for by the Board and included in its assessments against the Reserve Banks. Return to text.

7. The BEP is currently evaluating options for either renovating its Washington, D.C., facility or building a new facility. We support moving forward with a prospectus for a new facility as soon as possible. The timing of relocating to a modern, efficient facility affects capital planning. Return to text.

8. The BEP stated that it does not anticipate reducing its procurement staff as a result of the transfer of some procurement responsibilities to the IRS because the BEP's procurement section was understaffed when the IRS assumed these responsibilities. Return to text.

9. In 2013, the BEP included $50.9 million for capital expenses as part of its monthly fixed cost charge to the Board. In 2014, we have requested that the BEP bill the Board for capital separately from other fixed costs to increase transparency and to allow us to better track to budget and review planned capital commitments. Return to text.

10. We expect future-year budgets to include a much smaller quantity of new-design $100 notes to meet ongoing demand. Return to text.

11. The paper cost per note is at least double the costs for both ink and direct labor for each denomination. The paper cost is principally determined by the sophistication of the embedded security features within the paper and the cost and complexity of incorporating these security features into the paper. Return to text.

12. The CEP's planned international training and awareness events in October were unexpectedly cancelled due to the shutdown of the federal government. The CEP is in the process of rescheduling training seminars, and it will pursue a targeted stakeholder outreach program in countries with high dollar flows but limited media coverage regarding the circulation of a new-design $100 note. These events will occur through the second quarter of 2014. Because of this delay, the planned post-assessment research activities have been postponed until early 2014, further increasing 2014 expenses. Return to text.

Action

On December 12, 2013, the Board approved the 2014 currency budget totaling $826.7 million, which represents an increase of $29.1 million, or 3.6 percent, over the approved 2013 budget.1 This increase is primarily attributable to the new currency reader program.2 Without the implementation of the reader program, the 2014 budget would have increased by only $9.7 million, or 1.2 percent, over the 2013 budget.

Discussion

Under authority delegated by the Board, the director of the Division of Reserve Bank Operations and Payment Systems (RBOPS) submits an annual fiscal year (FY) print order for new currency to the director of the Bureau of Engraving and Printing (BEP). Upon reviewing the order, the BEP estimates printing costs for new currency during the calendar year (CY), which staff uses to prepare the annual currency budget. The Board then reviews and approves the final budget. Printing costs for Federal Reserve notes constitute nearly 90 percent of the currency budget. Expenses for currency transportation, the currency reader program, the currency quality assurance (CQA) and counterfeit deterrence programs, the currency education program (CEP), and other costs to reimburse the BEP make up the remaining 10 percent.

Once the Board approves the currency budget, it assesses the costs of currency to each Federal Reserve Bank on a monthly basis. Table 1 provides details on the Board's CY 2013 budget, 2013 estimate, and 2014 budget.

Table 1

Currency Budget

(calendar year)

|

2013 Budget (thousands) |

2013 Estimate (thousands) |

2014 Budget (thousands) |

Percent Change | ||

|---|---|---|---|---|---|

| 2013E/2013B | 2014B/2013B | ||||

| Print volume (number of notes) | 8,180,705 | 6,352,992 | 7,845,067 | -22.3 | -4.1 |

| BEP Expenses | $738,210 | $664,210 | $767,996 | -10.0 | 4.0 |

| Printing Federal Reserve notes | $734,775 | $661,160 | $745,387 | -10.0 | 1.4 |

| Currency reader | $0 | $0 | $19,384 | n/a | n/a |

| Other | $3,435 | $3,050 | $3,225 | -11.2 | -6.1 |

| Board Expenses | $59,391 | $40,844 | $58,670 | -31.2 | -1.2 |

| Currency transportation | $30,697 | $21,051 | $33,222 | -31.4 | 8.2 |

| Quality assurance and counterfeit deterrence | $19,182 | $16,593 | $21,091 | -13.5 | 10.0 |

| Currency education | $9,512 | $3,200 | $4,357 | -66.4 | -54.2 |

| Total expenses | $797,600 | $705,054 | $826,665 | -11.6 | 3.6 |

| n/a Not applicable. Return to table. | |||||

2013 Currency Expenses

Staff estimates that total currency expenses will be $705.1 million in 2013. This amount is $92.5 million, or 11.6 percent, below the 2013 budgeted amount. The reduction in expenses is primarily attributable to lower-than-budgeted expenses for printing new notes, transporting new and fit notes, and for the currency education program. These factors are discussed in more detail below.

2013 Printing Expenses

Estimated expenses for printing Federal Reserve notes in CY 2013 are $661.2 million. This amount is $73.6 million, or 10.0 percent lower, than the budgeted amount. When we prepared the 2013 budget, we were uncertain whether the Board would issue the new-design $100 note in 2013, so we included approximately 1.5 billion series-1996 (old-design) $100 notes in the budget to ensure that Reserve Banks would have sufficient quantities to meet demand during FY 2013.3 By April, however, we were satisfied that the BEP had resolved the production problems and could produce the necessary quantity of new-design $100 notes the Board needed to begin issuing in 2013; the Board announced that it would issue the new-design $100 note beginning on October 8. We no longer needed all of the old-design $100 notes that we had included in our FY 2013 print order, and thus reduced the order for old-design $100 notes by approximately 1.0 billion notes. This modification to the FY 2013 print order resulted in a decrease to the estimated expenses of nearly $26.3 million. The remainder of the budget-to-estimate difference is attributable mostly to the BEP producing fewer notes during the fourth quarter than we estimated when we prepared the 2013 budget.4

2013 Transportation Expenses

Estimated CY 2013 expenses for currency transportation are $21.1 million. This amount is $9.6 million, or 31.4 percent, lower than the budgeted amount. About $7.8 million, or more than 80 percent of the difference, is attributable to shipping fewer new-design $100 notes than we had budgeted. Rather than storing all $100 notes at the Reserve Banks, as planned, we chose to temporarily store these additional notes at the BEP. The remainder of the difference between the budget and estimate is because of the reduction in the order for old-design $100 notes and our revised projection for BEP production in the fourth quarter.

2013 Currency Quality Assurance and Counterfeit Deterrence Expenses

Estimated CY 2013 expenses for the CQA and counterfeit deterrence programs are $16.6 million. This amount is $2.6 million, or 13.5 percent, lower than the budgeted amount. The difference is due primarily to a $2.2 million underrun in the CQA program.

During 2013, the CQA program continued to make progress in implementing a new quality system for the BEP. Specifically, the CQA consultants developed, deployed, and transitioned to BEP staff several key components of the new quality system. For example, one component is a corrective action and preventative action (CAPA) system to identify, investigate, and prevent the recurrence of production issues. The CQA program also completed work on a process change procedure that allows staff to identify, submit, and evaluate opportunities for improvement in all areas of production. One suggestion resulted in a savings of about $2.0 million in ink costs in less than a year. The CQA consultants also made significant progress in defining and implementing a process to manage both technology and product development for the U.S. currency program. In addition, the BEP is making significant organizational and management changes that should result in a stronger commitment to the CQA initiative.

2013 Currency Education Program Expenses

Estimated CY 2013 expenses for the CEP are $3.2 million. This amount is $6.3 million, or 68 percent, lower than the budgeted amount. The decline is attributable to a greater-than-anticipated amount of work performed in-house. Contractor costs were further reduced through aggressive oversight and management. Additionally, the federal government shutdown in October caused some planned activities, such as international outreach and research, to be postponed until next year, shifting some expenditures from 2013 to 2014.

2014 Currency Budget

The proposed 2014 currency budget is $826.7 million, which is 3.6 percent higher than the 2013 budget.5 The increase is primarily attributable to the BEP's implementation of a program to procure and distribute currency readers. Without this expense, the budget would have increased only 1.2 percent because of minor increases in the costs to produce and transport notes, as well as in the budgeted expenses for the CQA and counterfeit-deterrence programs.

2014 Printing Budget

The currency budget includes $745.4 million in printing costs for CY 2014, which represents a 1.4 percent increase from the 2013 budget. The increase is due primarily to higher fixed costs at the BEP, offset by a decrease in variable costs. The printing cost budget includes $431.1 million (58 percent) in fixed costs and $314.3 million (42 percent) in variable costs.6

Fixed Costs: Fixed costs, which include capital, prepress and engraving, fixed manufacturing overhead and support, research and development, and general and administrative staff, are budgeted to increase by $44.2 million, primarily because of depreciation, payments to other government agencies, and staffing to support the CQA program.7 Depreciation is expected to increase significantly because the BEP has purchased and installed new equipment and software, including a new information technology platform (BEP Enterprise Network – BEN) to manage all BEP operations. Also, the BEP will pay the IRS $4.0 million for procurement services and the Treasury $2.5 million for upgrades to the BEP's communication system.8 The BEP also included $5 million in its fixed costs to on-board staff to support the CQA program.

The 2014 fixed costs also include $43.3 million in capital to fund investments ($31.2 million) and to replenish the BEP's working capital account ($12.1 million) because its capital spending in 2013 exceeded the amount it collected from the Board via monthly charges.9 We have reviewed the capital projects the BEP has classified as high priority and support including funding for these projects in the budget. We believe, however, that these proposed capital expenditures should be evaluated in the context of a comprehensive strategic capital plan, and have agreed to work with the BEP to develop such a plan in early 2014. As agreed to in the memorandum of understanding between the Board and the Treasury, the BEP must notify the director of RBOPS before committing any funds to capital projects in excess of $1 million.

Table 2

Number of Notes Produced (calendar year)a

| Type of Note |

2013 Budget (thousands) |

2014 Budget (thousands) |

Percent Change 2014B/2013B |

|---|---|---|---|

| $1, $2 | 1,991,905 | 2,317,867 | 16.4 |

| Series-2004 $5 | 691,200 | 722,133 | 4.5 |

| Series-2004 $10 | 452,800 | 451,200 | -0.4 |

| Series-2004 $20, $50 | 734,400 | 2,165,067 | 194.8 |

| Series-1996 $100 | 1,500,800 | 0 | -100.0 |

| Series-2004 $100 | 2,809,600 | 2,188,800 | -22.1 |

| Total | 8,180,705 | 7,845,067 | -4.1 |

| a. Details regarding the Board's FY 2014 order can be found on the Board's public website. Return to table. | |||

Variable Costs: Variable costs, which include paper, ink, direct labor, and other variable manufacturing costs, are budgeted to decline by $33.6 million from the 2013 budget because of the projected lower number of $100 notes to be printed, as shown in table 2.10 This decline in variable costs largely offsets the fixed cost increases.

The average variable cost per thousand notes, which varies by denomination, remained largely unchanged from 2013 to 2014, as shown in table 3. The variable costs range from $18.98 per thousand notes for $1 notes to $66.35 per thousand notes for new-design $100 notes and are determined primarily by the cost of paper.11 For budget planning purposes, the BEP provided us with estimates of 2014 printing costs, which are presented in table 3, by type of note.

Table 3

Calendar Year BEP Printing Costs

| Note typea |

2014 projected fixed costs (thousands)b |

2014 projected variable unit costs (per thousand notes) |

2014 projected total costs (per thousand notes)c |

2013 estimated total costs (per thousand notes) |

|---|---|---|---|---|

| $1, $2 | $81,568 | $18.98 | $54.09 | $54.46 |

| Series-2004 $5 | $37,164 | $35.38 | $101.37 | $97.76 |

| Series-2004 $10 | $28,125 | $33.99 | $91.81 | $89.75 |

| Series-2004 $20, $50 | $129,180 | $37.69 | $102.07 | $97.67 |

| Series-2004 $100 | $155,095 | $66.35 | $130.89 | $126.73 |

| Average cost per thousand notesd | $55.40 | $40.56 | $95.95 | $88.85 |

a. $1 and $2 notes do not include the security features that are in the series-2004-design notes; series-2004 $5 notes include two watermarks and additional security features, and series-2004 $10, $20, and $50 notes include watermarks, additional security features, and a new color-shifting ink. The series-2004 $100 note includes a watermark, a 3-D security ribbon, a new color-shifting feature (“the Bell in the Inkwell”), additional security features, and a new color-shifting ink. This higher level of security for the series-2004 $100 note has significantly increased the cost for both paper and ink. Return to table.

b. The projected fixed costs are the BEP's estimates of fixed costs associated with the production of each denomination. Return to table.

c. The projected total costs per thousand notes are projected fixed costs divided by the number of notes in the Board's order, plus variable costs per thousand notes. Return to table.

d. The average cost per thousand notes for 2014 is the volume-weighted average. For 2013, the unit cost per thousand notes is the volume-weighted average of the fixed and variable costs divided by the number of notes the Board included in its FY 2013 order. Return to table.

Even though average variable costs declined slightly, from $42.07 in 2013 to $40.56 in 2014, the average total cost increased about 8.0 percent, from $88.85 to $95.95. The increase in the average total cost is attributable to the increase in fixed costs discussed above. The average fixed costs per thousand notes increased from $49.74 in 2013 to $55.40 in 2014.

2014 Currency Reader Program Budget

The 2014 currency budget includes $19.4 million to fund the first year of a multiyear program to distribute currency readers to qualified individuals who are blind or visually impaired at no cost to the user. The BEP will implement a currency reader program to comply with a court order requiring the Treasury Department to provide meaningful access to individuals that are blind or visually impaired in denominating U.S. currency. During 2014, the BEP expects to award a contract to procure currency readers and to distribute the readers by mid-2014 through an interagency agreement with the Library of Congress. We agree with the BEP's approach to leverage the existing infrastructure of the Library of Congress' book reader program, which is managed by the National Library Service.

2014 Budget for Other Reimbursements to the Bureau of Engraving and Printing

The 2014 budget includes $3.2 million to reimburse the BEP for expenses incurred by its Destruction Standards and Compliance Division of the Office of Compliance (OC) and Mutilated Currency Division (MCD) of the Office of Financial Management. The OC develops standards for cancellation and destruction of unfit currency and for note accountability at the Reserve Banks, and reviews Reserve Banks' cash operations for compliance with its standards. As a public service, the MCD also processes claims for the redemption of damaged or mutilated currency.

2014 Currency Transportation Budget

The 2014 currency transportation budget is $33.2 million, which is $2.5 million, or nearly 8.2 percent, higher than the 2013 budget. This budget includes the cost of shipping new currency from the BEP to Reserve Banks, of intra-System shipments of fit and unprocessed currency, and of returning currency pallets from the Reserve Banks to the BEP. We estimate that we will ship about the same number of notes in 2014 that we shipped in 2013, because our FY 2013 and 2014 orders include a similar number of notes. The budget increase is primarily attributable to a planned 6.0 percent increase in contracted rates with armored carriers to transport currency.

2014 Currency Quality Assurance and Counterfeit-Deterrence Budget

The 2014 budget for CQA and counterfeit deterrence is $21.1 million, which is $1.9 million, or 10.0 percent, higher than the 2013 budget. This budget includes $13.9 million to fund the CQA program and $7.2 million to fund counterfeit-deterrence research and projects.

Currency Quality Assurance

The budgeted amount of $13.9 million for the CQA program is $0.5 million, or 3.7 percent higher than the 2013 budget and will allow the CQA consultants to continue facilitating the implementation of the new quality system at the BEP; to support the research, technology, and product development required for the next design family of Federal Reserve notes; and to continue providing temporary resources to the BEP to sustain critical programs that have been implemented for the quality system.

During 2014, the Board and CQA consultants will build on the foundation and successes accomplished to date. Efforts will continue to focus on several BEP operational areas, including materials, production, equipment, and facilities, with the intent to derive and sustain improvements in both quality and efficiency. The CQA consultants will continue to focus on the BEP's management processes to monitor and continuously improve the quality system. The CQA consultants will also assist the BEP in improving the banknote design process so that production quality is considered at the conceptual stage and continues through the development and testing stages of the next family of banknotes

Counterfeit Deterrence

The 2014 budget for counterfeit-deterrence research is $7.2 million, which is $1.4 million, or about 24.4 percent, higher than the 2013 budget. The budget includes $5.1 million for membership in the Central Bank Counterfeit Deterrence Group (CBCDG). The CBCDG operates under the auspices of the G-10 central bank governors to combat digital counterfeiting and includes 32 central banks. The Board's share of the 2013 CBCDG budget makes up 65 percent of the Federal Reserve's counterfeit-deterrence budget.

2014 Currency Education Program Budget

The 2014 CEP budget is $4.4 million, which is $5.2 million, or 54.2 percent, less than the 2013 budget. The CEP program is designed to protect and maintain confidence in U.S. currency worldwide by providing information on all circulating designs of Federal Reserve notes to the global public. The program works to ensure that users of U.S. currency know what genuine Federal Reserve notes look like, are aware of the security features in each denomination, and know how to use those security features to distinguish between genuine and counterfeit notes.

The 2014 budget reflects the continued increased level of activity associated with educating the global public about the new-design $100 note through the second quarter of 2014. This includes work that was postponed due to the shutdown of the government in October.12 In 2014, the CEP will continue to use in-house resources and will leverage, when possible, existing Reserve Bank, United States Secret Service, State Department, and BEP partnerships in order to minimize expenses. Tasks that cannot, or would be too resource-intensive, to be sourced internally will be contracted; these account for more than 90 percent of the 2014 CEP budget. The major expense drivers for the 2014 budget include the fulfillment of educational materials in more than 20 languages, international outreach to businesses and retailers in more than 25 countries, and hosting and developing the NewMoney.gov educational website.

Appendix: New Currency Expenses

Footnotes

1. The 2014 budget is 17.2 percent larger than the 2013 estimate, primarily because the budget includes 1.5 billion more notes than the 2013 estimate. Spending in 2013 was affected by a number a factors (such as the decision to issue the new-design $100 note and the government shutdown), as discussed below. Return to text.

2. The BEP has been working to meet the requirements of a 2008 court order requiring the Secretary of the Treasury to provide meaningful access for individuals that are blind or visually impaired to denominate U.S. currency. The court has accepted the Treasury's recommendation to continue using the large, high-contrast numeral on all redesigned notes, to develop and implement a tactile feature in the next redesign of notes, and to develop a currency reader program, whereby the BEP will make readers available to qualified blind and visually impaired persons free of charge. Return to text.

3. The BEP experienced unexpected production problems that caused the Board to delay issuance from the original date in February 2011. Return to text.

4. Because the BEP operates on a fiscal year that begins on October 1 and ends September 30, we estimate the Board's calendar-year budget for new currency by eliminating the cost of notes that the BEP will produce in the first quarter of its fiscal year and estimating the costs of notes we project the BEP will produce in the fourth quarter of the calendar year. Return to text.

5. Charts 1-3 in attachment 1 show the new currency expenses, the value and number of notes printed, and the number and cost of notes printed from the 1994 through 2014 budget periods. Return to text.

6. The BEP does not receive federal appropriations; all operations of the BEP are financed by a revolving fund that is reimbursed through product sales, virtually all of which are sales of Federal Reserve notes to the Board to fulfill its annual print order. Customer billings are the BEP's only means of recovering the costs of operations and generating funds necessary for capital investment. Section 16 of the Federal Reserve Act requires that all costs incurred for the issuing of notes shall be paid for by the Board and included in its assessments against the Reserve Banks. Return to text.

7. The BEP is currently evaluating options for either renovating its Washington, D.C., facility or building a new facility. We support moving forward with a prospectus for a new facility as soon as possible. The timing of relocating to a modern, efficient facility affects capital planning. Return to text.

8. The BEP stated that it does not anticipate reducing its procurement staff as a result of the transfer of some procurement responsibilities to the IRS because the BEP's procurement section was understaffed when the IRS assumed these responsibilities. Return to text.

9. In 2013, the BEP included $50.9 million for capital expenses as part of its monthly fixed cost charge to the Board. In 2014, we have requested that the BEP bill the Board for capital separately from other fixed costs to increase transparency and to allow us to better track to budget and review planned capital commitments. Return to text.

10. We expect future-year budgets to include a much smaller quantity of new-design $100 notes to meet ongoing demand. Return to text.

11. The paper cost per note is at least double the costs for both ink and direct labor for each denomination. The paper cost is principally determined by the sophistication of the embedded security features within the paper and the cost and complexity of incorporating these security features into the paper. Return to text.

12. The CEP's planned international training and awareness events in October were unexpectedly cancelled due to the shutdown of the federal government. The CEP is in the process of rescheduling training seminars, and it will pursue a targeted stakeholder outreach program in countries with high dollar flows but limited media coverage regarding the circulation of a new-design $100 note. These events will occur through the second quarter of 2014. Because of this delay, the planned post-assessment research activities have been postponed until early 2014, further increasing 2014 expenses. Return to text.