FEDS Notes

Apr 2014

The FRB/US Model: A Tool for Macroeconomic Policy Analysis

Flint Brayton, Thomas Laubach, and David Reifschneider1

Introduction

The FRB/US Model: A Brief Overview

Although a detailed description of the model's equations is beyond the scope of this note, a number of resources are available on the new web page. Here we provide only an overview of the main specifications of the various agents' behavior and how they compare to other models currently used in policy analysis, and then focus on illustrating some properties of the model. Basic structure of the model

Parameterizing the model Forming expectations in the model

Comparing the design of FRB/US to the DSGE modeling approach

Two Applications of the FRB/US Model

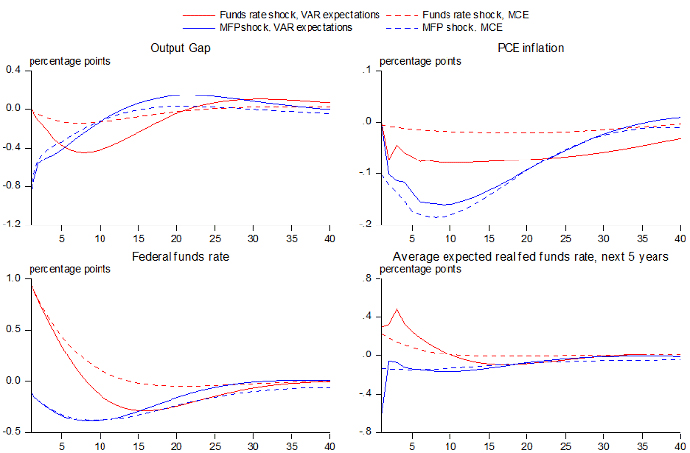

Impulse response functions to funds rate and multi-factor productivity shocks

The responses of the output gap and inflation (shown in the upper two panels) to an increase in the federal funds rate of initially 1 percentage point are qualitatively similar to results found in the VAR literature (for example, Boivin et al., 2011) and in DSGE models (for example, Smets and Wouters, 2007). The size of the FRB/US inflation response is relatively small, however, reflecting the estimation of its price-wage sector over the period of low and stable inflation since the mid-1980s. As indicated by the solid and dashed lines, the magnitude of the responses depends on the manner in which expectations are assumed to be formed. This is not surprising: Expectations are important in the structure of FRB/US, and the two expectations approaches are based on views of the relationships among macro variables that are not identical. One specific difference in this area is the degree of inertia attributed to movements in the federal funds rate. The estimated funds rate equation that is part of the VAR-based expectations mechanism has more inertia than the Taylor-type policy rule used in FRB/US itself for these simulations. As a result, the initial interest rate increase is anticipated to be more persistent under VAR-based expectations than under model-consistent expectations (lower right panel, shown in real terms). Through its effect on real long-term interest rates, this difference causes the output gap and inflation to decline substantially more in the VAR-based case.12 The responses of output and inflation to a permanent increase in multi-factor productivity (MFP) are also in general accordance with estimates from the VAR literature of the effects of technology shocks (see for example Altig et al., 2010), including the more rapid decline in inflation compared to a funds rate shock. In a model with sticky prices and wages, the level of actual output only gradually approaches the new, permanently higher level of potential output, so that the output gap initially declines. In response to the decline in the output gap and inflation, the federal funds rate temporarily falls below its baseline value. Stochastic simulations Contents of the Web Page

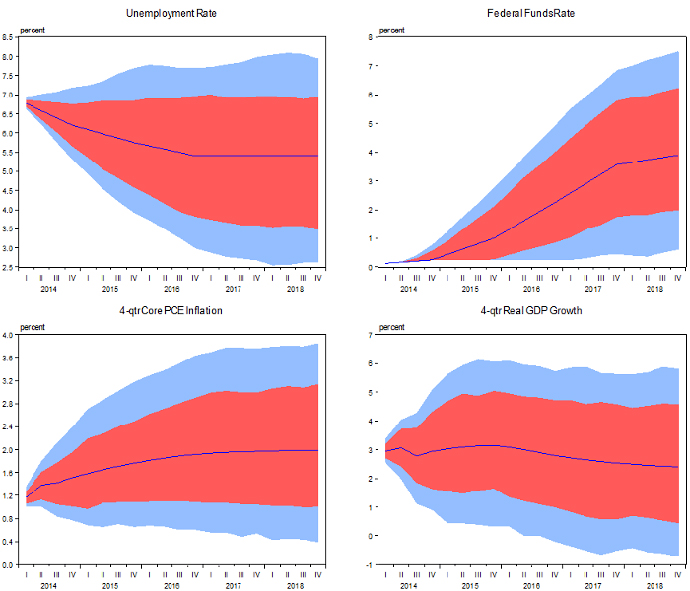

1. Flint Brayton is a contractor, Thomas Laubach is Associate Director, and David Reifschneider is Deputy Director (retired), all in the Division of Research and Statistics. The authors would like to thank Michael Palumbo, John Roberts, and David Wilcox for helpful comments. Return to text 2. The Board's website also contains a new page devoted to EDO, which is another model of the U.S. economy that is used by Board staff. Return to text 3. The general design of FRB/US shares many features with the "New Neoclassical Synthesis" class of models (Goodfriend and King, 1997). Return to text 4. Detailed documentation of the original specification of FRB/US can be found in Brayton and Tinsley (1996), and properties of early versions of the model are discussed in Brayton et al. (1997a,b) and Reifschneider et al. (1999). Since then, the model has undergone a number of changes, including modifying the price-wage sector to shift from a price index for domestic absorption and P&C hourly compensation as the main price and wage measures to the core PCE price index and ECI hourly compensation; modifying the production function in a number of ways, including the use of BLS capital services and the estimation of trend MFP as a stochastic process; the adoption of chain aggregation; multiple specification changes to the export/import equations that over time have significantly altered their short-run dynamics and long-run price/income elasticities; a more elaborate accounting of net foreign investment income and the net foreign asset position of the US; the introduction of house prices to the wealth accounting structure; and the introduction of government debt-stabilization rules. For more recent documentation of some of the model's sectors, the reader is referred to the documentation section of the web page as well as the HTML documentation of the model's individual equations that is part of the FRB/US download package. Return to text 5. FRB/US currently contains about 60 stochastic equations, 320 identities, and 125 exogenous variables. Return to text 6. The main structural price and wage equations are estimated simultaneously in the same small model. See the note "A New FRB/US Price-Wage Sector" by Brayton (2013) in the documentation section of the web page. Return to text 7. For a detailed discussion of the assumptions with which expectations are modeled in FRB/US, see Brayton et al. (1997a). Return to text 8. Recent developments of numerical algorithms have greatly increased the speed with which large-scale nonlinear MCE models can be solved. MCE simulations of FRB/US are executed in EViews using the algorithms described in Brayton (2011). More information on these algorithms is available in the "RE Solver Package" section of the FRB/US web pages. Return to text 9. SIGMA: Erceg et al. (2006). EDO: Edge et al. (2008). Return to text 10. The program pings.prg included in the FRB/US package computes impulse responses to six such shocks and plots the responses of two key variables, inflation and the output gap, to these shocks. Return to text 11. Specifically, let 12. If the expectations error about the policy rule made by agents under VAR-based expectations is eliminated by re-running both the VAR and MCE simulations using the estimated average historical funds rate rule embedded in the VAR, rather than the simple inertial rule described in footnote 11, then outcomes under MCE and VAR-based expectations become quite similar. Return to text 13. The program stochsim.prg included in the FRB/US package provides code for stochastic simulations of the model around the illustrative long baseline projection given in the database longbase.db, which is also included in the package. The baseline outlook for the unemployment rate, real GDP growth, and inflation for the years 2014 through 2016 follows the midpoints of the central tendencies of the projections of Federal Open Market Committee (FOMC) participants submitted in conjunction with the March 2014 FOMC meeting. The outlook for the federal funds rate follows the median projection of FOMC participants. All other aspects of the projections included in the database should not be construed as reflecting the views of the FOMC or any of its participants. Return to text ReferencesAltig, David, Lawrence Christiano, Martin Eichenbaum, and Jesper Linde, 2010. "Firm-Specific Capital, Nominal Rigidities and the Business Cycle." Review of Economic Dynamics 14, 225-247. Boivin, Jean, Michael Kiley, and Frederic Mishkin, 2011. "How Has the Monetary Transmission Mechanism Evolved Over Time?" In Benjamin Friedman and Michael Woodford, eds., Handbook of Monetary Economics Vol. 3 (Elsevier), pp. 369-422. Brayton, Flint, 2011. "Two Practical Algorithms for Solving Rational Expectations Models." Finance and Economics Discussion Series 2011-44, Federal Reserve Board. Brayton, Flint, and Peter Tinsley, 1996. "A Guide to FRB/US: A Macroeconomic Model of the United States." Finance and Economics Discussion Series 1996-42, Federal Reserve Board. Brayton, Flint, Eileen Mauskopf, David Reifschneider, Peter Tinsley, and John Williams, 1997a. "The Role of Expectations in the FRB/US Macroeconomic Model." Federal Reserve Bulletin, April, 227-245. Brayton, Flint, Andrew Levin, Ralph Tryon, and John Williams, 1997b. "The Evolution of Macro Models at the Federal Reserve Board." Carnegie-Rochester Conference Series on Public Policy, Vol. 47, 43-81. Carroll, Christopher A. (2001), "A Theory of the Consumption Function, With and Without Liquidity Constraints," Journal of Economic Perspectives 15(3), pp. 23-46. Cogley, Timothy, and Argia Sbordone, 2008. "Trend Inflation, Indexation, and Inflation Persistence in the New Keynesian Phillips Curve." American Economic Review 98, 2101-2126. Edge, Rochelle, Michael Kiley, and Jean-Phillipe Laforte, 2008. "Natural Rate Measures in an Estimated DSGE Model of the U.S. Economy." Journal of Economic Dynamics and Control 32, pp. 2512-2535. Erceg, Christopher, Luca Guerrieri, and Christopher Gust, 2006. "SIGMA: A New Open Economy Model for Policy Analysis." International Journal for Central Banking 2, pp. 1-50. Fleischman, Charles, and John Roberts, 2011. "From Many Series, One Cycle: Improved Estimates of the Business Cycle from a Multivariate Unobserved Components Model." Finance and Economics Discussion Series 2011-46, Federal Reserve Board. Reifschneider, David, Robert Tetlow, and John Williams, 1999. "Aggregate Disturbances, Monetary Policy, and the Macroeconomy: The FRB/US Perspective." Federal Reserve Bulletin, January, 1-19. Smets, Frank, and Rafael Wouters, 2007. "Shocks and Frictions in US Business Cycles: A Bayesian DSGE Approach." American Economic Review 97, 586-606. Taylor, John, 1999. "A Historical Analysis of Monetary Policy Rules." In John Taylor, ed., Monetary Policy Rules (Chicago: University of Chicago Press), pp. 319-41. Tinsley, Peter, 2002. "Rational Error Correction." Computational Economics 19, 197-225. Resources |

|||||

Please cite as:

Brayton, Flint, Thomas Laubach, and David Reifschneider (2014). "The FRB/US Model: A Tool for Macroeconomic Policy Analysis," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, April 03, 2014. https://doi.org/10.17016/2380-7172.0012

Disclaimer: FEDS Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers.