FEDS Notes

February 26, 2014

Estimating the Effect of Central Clearing on Credit Derivative Exposures

Sean Campbell

Introduction

Central clearing of derivatives is a primary objective of the global financial reform effort emerging from the financial crisis. Central clearing of standardized derivatives is required by the Dodd-Frank Act, and the G-20 has also committed to increased central clearing for standardized derivatives.

Under central clearing, a central counterparty (CCP) interposes itself between the buyer and the seller of every derivative transaction, effectively standing in as the buyer to every seller and as the seller to every buyer. Importantly, CCP's impose strict margining standards upon their members, assume no net exposure to the transactions they clear, and are tightly regulated and overseen. One aspect of central clearing that has gained much attention is the requirement to post initial margin on all centrally cleared transactions to the CCP. Initial margin can be best characterized as a "performance bond" that ensures that the CCP's counterparty fulfills its derivative obligations. In the event that the counterparty cannot fulfill its obligations and defaults, the CCP uses the initial margin–which typically takes the form of cash, U.S. Treasury securities and other low-risk assets--to replace or hedge the transaction.

A key benefit of central clearing stems from the multilateral netting of derivatives positions across counterparties that is available to clearing members. As discussed below, multilateral netting reduces counterparty exposure--the chance that a counterparty will be unable to meet its obligations under the transaction. Reduced counterparty exposures reduce counterparty risk and, thus, reduce the amount of margin required to support derivative transactions. The reduction in margin requirements is potentially important as many have raised concerns that requiring initial margin to be held for centrally cleared derivative transactions that were previously conducted on a bilateral basis (often without margin) will divert large amounts of collateral from other productive uses in the economy.

In what follows, the reduction in total notional exposure resulting from central clearing in the CDS market is estimated using actual position-level data on the credit default swap (CDS) transactions of large U.S. banks and their counterparties. This estimated reduction would, all else equal, be expected to lower the total amount of initial margin required by roughly 60% relative to a situation in which all CDS transactions are cleared bilaterally. Before providing and discussing these estimates in more detail, it is useful to review how central clearing changes total notional derivative exposures through the multilateral netting of positions.

Bilateral Transactions vs. Centrally Cleared Transactions

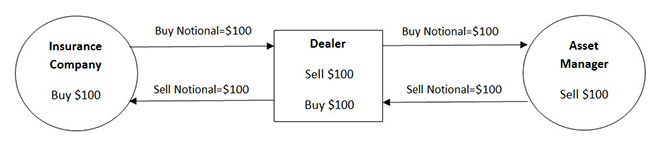

Consider two distinct, hypothetical CDS transactions. In the first transaction, a large derivatives dealer sells $100 of CDS protection, to insure against the default of a corporate bond issuer, to an insurance company. In the second transaction, the same dealer purchases $100 of CDS protection from an asset manager. Both transactions are depicted in Figure 1 below.

In the transaction depicted above, the dealer is intermediating a transaction between an insurance company and an asset manager. Importantly, however, the dealer is a direct counterparty to both CDS transactions. In terms of notional exposure, the insurance company has a $100 (buy) exposure, the asset manager has a notional (sell) exposure of $100 and the dealer has a notional (sell and buy) exposure of $200. The $200 notional exposure of the dealer reflects the fact that the dealer is on one side of both transactions. Accordingly, the total notional exposure of the combined transaction is $400 ($200=$100+$100). The total notional exposure is a simple measure of the derivative exposure of all counterparties engaged in the transaction. Importantly, the total amount of margin required from all counterparties will be related to the total notional exposure.1 If each counterparty is required to post initial margin of 1 percent, these "twin" transactions would require $4 of collateral.

A key point is that transactions resulting in smaller total notional exposures will generally create less counterparty exposure and thus require less margin than a transaction with a larger total notional exposure.

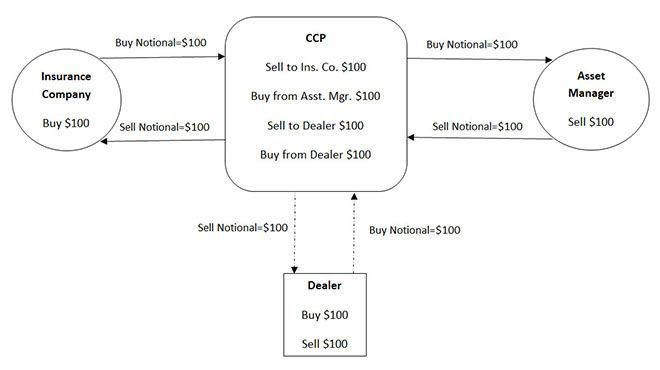

Now suppose that the two transactions described above are moved to central clearing. When this happens, a central counterparty (CCP) interposes itself between each buyer and each seller so that every counterparty engaged in the CDS transaction only faces the CCP. This situation is depicted in Figure 2.

In the centrally cleared transaction, the CCP is taking one side of every CDS transaction. Just as before, the insurance company is buying $100 of CDS protection and the asset manager is selling $100 of CDS protection. The only difference relative to the transaction depicted n Figure 1 is that the insurance company and asset manager face the CCP and not the dealer. The exposure of the dealer, however, changes relative to the transaction depicted in Figure 1. Now, the dealer is buying $100 and selling $100 of CDS protection from and to the CCP. Since the dealer is buying from and selling to the same counterparty, the CCP, these transactions offset resulting in a total net exposure of $0 for the dealer. This was not the case in the transaction depicted in Figure 1 because in that case the dealer was buying protection from the asset manager and selling protection to the insurance company. Exposures only offset when they are with the same counterparty.

Accordingly, the total notional exposure in the centrally cleared transaction is reduced to $200--a 50 percent reduction relative to the non-centrally cleared case depicted in Figure 1. The insurance company has a $100 (buy) exposure, the asset manager has a $100 (sell) exposure and the dealer has an exposure of $0 ($100+$100+$0=$200). For a 1 percent margin requirement, this framework requires only $2 of collateral be posted overall.

There are two additional characteristics of central clearing that should be noted. First, since the CCP is on one side of every transaction the net position of the CCP is identically zero (the CCP never has to post margin). This is a general feature of central clearing--CCP's take no direct exposure to the asset they are clearing. Of course, the CCP is still buying and selling CDS to several different counterparties but the purchases and sales are in perfect balance at all times.

Second, the extent to which central clearing reduces total notional exposure depends on the specific pattern of trades between all counterparties. As an example, suppose the asset manager in our example only wanted to sell $50, rather than $100, of CDS protection.

If this were the case then without central clearing the insurance company would have a notional (buy) exposure of $100 as before, the asset manager would have a notional (sell) exposure of $50 and the dealer would have a notional (sell and buy) exposure of $150. The total notional exposure would then be $300 ($100+$50+$150). If these transactions were then centrally cleared the insurance company would still have a notional (buy) exposure of $100 and the asset manager would still have a notional (sell) exposure of $50. The dealer, however, would only have a notional (sell) exposure of $50 since it would sell $100 of CDS protection to the CCP and buy $50 of CDS protection from the CCP. The total notional exposure under central clearing would then decline from $300 to $200 ($50+100+$50).

In what follows the quantitative magnitude of the reduction in CDS exposures that would result from central clearing of CDS through a single CCP is estimated using actual data on the CDS transactions of U.S. banks and their counterparties.

CDS Data

The data used in this analysis come from Depository Trust and Clearing Corporation's (DTCC's) trade information warehouse (TIW). The data cover actual CDS positions in which one of the counterparties is an institution regulated by the Federal Reserve or the underlying reference entity upon which the CDS is written is a U.S. entity. Accordingly, the data cover a significant fraction of the CDS market but are not exhaustive. Finally, all counterparties are classified as either "Dealer" or "Buyside". Dealer counterparties represent large, internationally active banks that regularly deal in derivatives. All other counterparties are identified as "Buyside" which includes asset managers, insurance companies, pension plans and other users of CDS.

The Effect of Central Clearing on Total Notional Exposure

In this section the observed network of CDS transactions in the data is analyzed to identify the extent to which total notional exposures would be reduced if all CDS transactions had been centrally cleared through a single CCP. The analysis in Table 1, below, performs the same calculations that are described in the context of Figure 1 and Figure 2. The only difference is that the calculations that appear in Table 1 have been performed on all CDS transactions in the available data rather than a hypothetical pair of transactions.

As previously discussed, the total notional exposure is a useful summary statistic that is informative about the overall size of derivative exposures as well as the amount of margin that counterparties would have to post to support their derivative transactions. Column (1) of Table 1 reports the total notional amount when CDS transactions are Not Centrally Cleared and is analogous to the calculation discussed in the context of Figure 1. Column (2) of Table 1 reports the total notional amount when CDS transactions are Centrally Cleared and is analogous to the calculation discussed in the context of Figure 2. Finally, column (3) reports the Reduction in total notional exposure that results from central clearing and is calculated as the ratio of the amounts reported in column (2) and (1).

| Table 1 |

|---|

| (1) Not Centrally Cleared ($TR) |

(2) Centrally Cleared ($TR) |

(3) Total Notional Reduction (%) |

|

|---|---|---|---|

| Buyside | 2.01 | 1.15 | 43 |

| Dealer | 9.52 | 2.86 | 69 |

| Total | 11.53 | 4.01 | 61 |

As can be seen in Table 1, Dealers dominate the activity in CDS markets with total notional amounts that are far higher than that of Buyside counterparties. The dominance of Dealers is largely a product of significant amounts of trading in CDS among dealers.

Looking at the total notional exposure calculations appearing in column (1) indicates that the total notional of all Buyside counterparties comes to roughly $2 trillion while that of Dealer counterparties comes to roughly $9.5 trillion. The total notional exposure across both Buyside and Dealer counterparties is roughly 11.5 trillion in the data used for this analysis.

Looking at the total notional calculations in column (2) indicates that multilateral netting has a large effect on the total notional amount for both Buyside and Dealer counterparties. Specifically, the total notional amount of the Buyside under central clearing declines from roughly $2 trillion to $1.2 trillion. The total notional of Dealers declines substantially more from $9.5 trillion to $2.9 trillion. This finding is consistent with a dealer network that resembles Figure 2. Dealers, to a large extent, act as intermediaries and benefit substantially from the multilateral netting offered by CCP's. Buyside counterparties benefit from multilateral netting as well but they benefit far less as more of their exposures are directional in nature (like the insurance company and asset manager depicted in Figure 1). Under central clearing, the CDS market as a whole experiences a reduction in total notional exposure from roughly $11.5 trillion to $4 trillion. Accordingly, moving CDS trading to a single CCP would, in aggregate, result in a reduction in total notional exposures of roughly 60 percent according to this analysis. The amount of initial margin required under central clearing relative to a market without central clearing would also be significantly less though the precise amount of the reduction would depend on a number of additional factors that are not considered here.

Conclusion

Central clearing of derivatives is a key financial stability objective that has been endorsed in the United States and globally by the G-20. Central clearing reduces counterparty exposure and increases the transparency of the resulting financial network. Margin requirements necessitated by central clearing have raised concerns about the liquidity impact of such requirements that might arise from "locking up" significant amounts of collateral. This analysis uses actual data on CDS positions of dealers and buyside counterparties to estimate the extent to which central clearing reduces total notional exposures. Total notional exposures are informative about overall counterparty risk and the margin that would be required to support derivative transactions. This analysis suggests that moving CDS trading to central clearing would reduce notional exposures and margin requirements by 60 roughly percent relative to a regime in which CDS are not centrally cleared but margins are required. Of course, this analysis is overly simplified in a number of ways--it considers a single market, the CDS market, and assumes that all derivatives are centrally cleared through a single CCP. It also assumes that the market activities observed during a period without central clearing and uniform margin requirements are broadly representative to activities under the central clearing regime. In reality, all of these assumptions are likely to be violated. Nonetheless, the analysis shows the potential for central clearing to conserve collateral for margining purposes and the underlying data it relies upon, in principle, allow more fine-tuned analyses to be conducted. As central clearing begins to take hold in the U.S. and globally, it will be important to use transaction-level data to track how the introduction of central clearing is affecting total derivative exposures, as well as to monitor the demand for collateral and possible adverse consequences for market liquidity.

1. In practice, the specific amount of initial margin required will typically be determined by a quantitative risk management model that relies on a number of inputs. Accordingly, while total notional exposure is a key input into such models there are other factors which would also have to be taken into account when estimating initial margin amounts. Return to text

Please cite as:

Campbell, Sean (2014). "Estimating the Effect of Central Clearing on Credit Derivative Exposures," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, February 26, 2014. https://doi.org/10.17016/2380-7172.0010

Disclaimer: FEDS Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers.