FEDS Notes

August 27, 2015

Credibility of Optimal Forward Guidance at the Interest Rate Lower Bound

Taisuke Nakata

1. Introduction

Market participants and other analysts generally expect that the federal funds rate will rise from its effective lower bound (ELB) later this year.1 However,

the ELB could again become a binding constraint on monetary policy in the future.2 The ELB constraint prevents central banks from further stimulating the

economy through conventional means, making the economic conditions worse than they would otherwise be. Accordingly, developing an effective strategy to address the adverse consequences of the lower bound constraint remains an important task for economists and policymakers.

In this note, I first describe the effectiveness of a particular form of forward guidance policy--optimal commitment policy--in mitigating the adverse consequences of the ELB. I then describe a key criticism against adopting this policy in reality--namely, that the policy is potentially not credible. Finally, I discuss my research, Nakata (2014), that investigates how the central bank's concern for reputation can overcome the credibility problem of the commitment policy.

2. Optimal Commitment Policy: A Strong Form of Forward Guidance

In many macroeconomic models, optimal commitment policy is very effective in mitigating the adverse consequences of the lower bound constraint. Under this policy, the central bank commits to keeping its policy rate at the ELB for an extended period, with the explicit goal of temporarily leading

inflation and the output gap to overshoot their longer-run targets. In economies where households and price-setters are forward looking, the temporary overheating of the economy tempers the declines in inflation and output during the period when the lower bound is a constraint through improved

expectations. This policy can be thought of as a particularly strong form of forward guidance policy and has been analyzed by many economists.3 In particular,

Michael Woodford of Columbia University made the case for optimal commitment policy as a practical policy tool in a Jackson Hole presentation in 2012.4

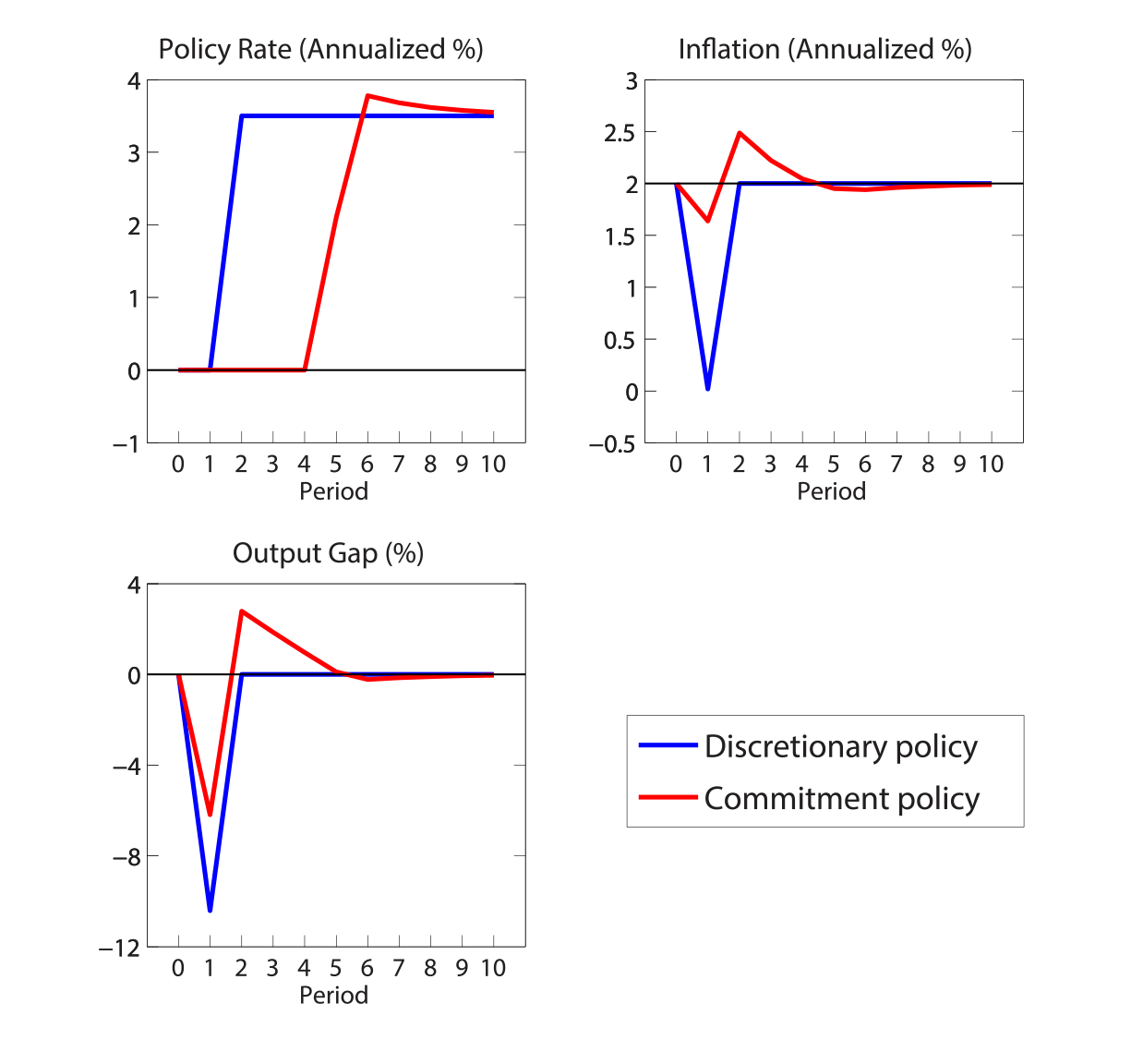

Figure 2 illustrates how this commitment policy works in the stylized macroeconomic model I use in Nakata (2014). In these simulations, there is a one-period crisis shock that hits the economy at period one and disappears at period two. The blue and red lines show the dynamics of the federal funds rate, inflation, and the output gap under optimal discretionary policy and under optimal commitment policy, respectively.5 Under the discretionary policy, the policy rate is kept at the lower bound while the crisis shock lasts but returns to the steady state as soon as the crisis shock disappears. Inflation and the output gap decline by 2 percentage points and 10 percentage points at period one, respectively. At period two, inflation is back to target and the output gap is zero.

Under the commitment policy, the central bank keeps the policy rate at the ELB until period four. This policy generates an overshooting of inflation and output at period two and beyond. Because price-setting is forward looking in this model, the higher expected inflation after the crisis leads to higher actual inflation in the period of the crisis through the expectations term in the Phillips curve of the model. Similarly, because households are forward looking, the higher expected output gap and lower expected real rate associated with higher inflation mitigate the decline in the output gap in the crisis period through the expectations terms in the aggregate demand equation. Inflation and the output gap thus decline only 0.3 and 6 percentage points respectively at period one.

3. A Case against the Commitment Policy: Lack of Credibility

While the commitment policy is effective in mitigating the adverse effects of the lower bound constraint, there is an important caveat: Commitment may not be credible. That is, when the central bank announces this policy at the onset of the crisis, the private sector may not believe that the

central bank will stick to its commitment in the future. This tension arises because the central bank will have an incentive to renege on the commitment. While the central bank wants to promise an extended period of low policy rates at the onset of the crisis, once the crisis is over, the central

bank is better off raising the policy rate and eliminating the overshooting of inflation and output because such overshooting is undesirable ex post. In the academic literature, when the government ex post has an incentive to renege on its promised policy action and thus the private sector does not

believe in the government's promise, the policy is said to be time-inconsistent. The credibility problem just described is a particular example of time-inconsistency.6

This time-inconsistency problem of optimal commitment policy is not a mere theoretical curiosity. This problem has been cited by policymakers as a factor limiting the effectiveness of stimulating the economy through announcements about future policy actions. For example, John Williams, president of the Federal Reserve Bank of San Francisco, stated:

The optimal forward guidance policy is not time-consistent. According to the theory, for this policy to have the desired effects, the central bank must commit to two things: keeping the short-term policy rate lower than it otherwise would in the future, and allowing inflation to rise higher than it otherwise would. However, when the time comes for the central bank to fulfill this commitment, it may not want to do so. It might find it hard to resist the temptation to raise rates earlier than promised to avoid the rise in inflation. [Williams (2012)]

James Bullard, president of the Federal Reserve Bank of St. Louis, also acknowledges the difficulty of credibly committing to keeping the policy rate low for long and permitting inflation to overshoot:

The "Woodford period" approach to forward guidance [i.e., optimal commitment policy] relies on a credible announcement made today that future monetary policy will deviate from normal. The central bank does not actually behave differently today. One might argue that such an announcement is unlikely to be believed. Why should future monetary policy deviate from normal once the economy is growing and inflation is rising? But if the announcement is not credible, then the private sector will not react with more consumption and investment today. That is, any effects would be minimal. [Bullard (2013)]

Similarly, Mark Carney, former governor of the Bank of Canada and current governor of the Bank of England, stated:

Today, to achieve a better path for the economy over time, a central bank may need to commit credibly to maintaining highly accommodative policy even after the economy and, potentially, inflation picks up. Market participants may doubt the willingness of an inflation-targeting central bank to respect this commitment if inflation goes temporarily above target. These doubts reduce the effective stimulus of the commitment and delay the recovery. [Carney (2012)]

Some policymakers see this time-inconsistency problem as a key factor that makes central banks reluctant to adopt this commitment policy in practice. According to Benoît Cœuré, board member at the European Central Bank,

The main challenge of such guidance [i.e., optimal commitment policy] is its inherent inconsistency over time and thus lack of credibility. ... This is a possible explanation why, in practice, central banks have refrained from using forward guidance in a way that implies a major change in strategy. Therefore, central banks' forward guidance has rather aimed at providing greater clarity on the reaction function and the assessment of future economic conditions. [Cœuré (2013)]

These quotes are only a few of many instances in which central bank officials have expressed their concern about the credibility problem of the commitment policy, suggesting that concerns about credibility are an important consideration for many policymakers.7

4. Reputation as a Way to Overcome the Credibility Problem

In my research, I study whether the central bank's concern for reputation can make the commitment policy credible. My model combines a theory of reputation from the game theory literature with a standard sticky-price macroeconomic model. In my model, if the central bank reneges on its promise to

keep the policy rate low for an extended period, it can eliminate overshooting of inflation and output in the short run but it loses its reputation and the private sector will not believe similar promises in future recessions. Instead, the private sector believes that the central bank will follow

the discretionary policy, and the central bank loses its ability to conduct the commitment policy. As just described, the discretionary policy would entail worse outcomes for inflation and the output gap than the commitment policy. Thus, a concern for reputation creates an incentive for the central

bank to fulfill its promises.8

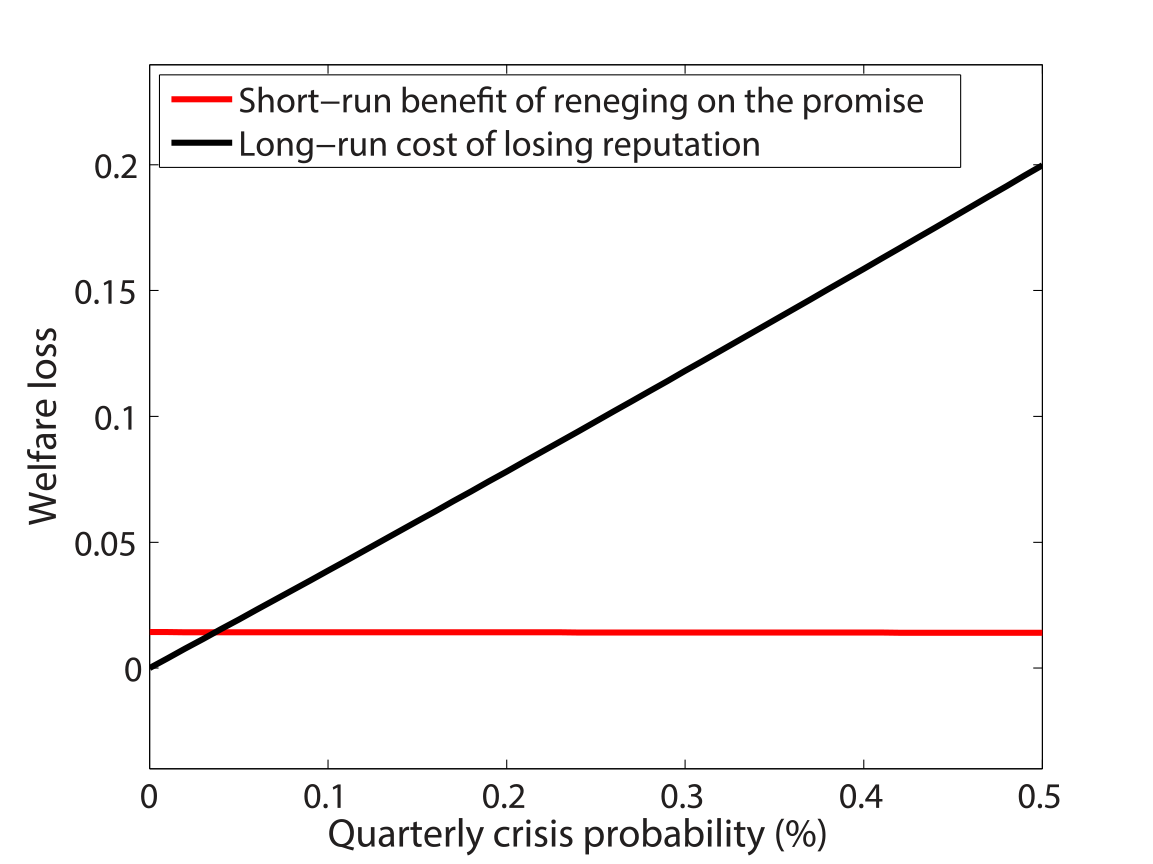

However, certain criteria must be met for the reputational mechanism to work. One key condition is that the crisis shock hits the economy sufficiently frequently. To illustrate this point, Figure 2 shows how the crisis probability affects the short-run benefit and the long-run cost of reneging on the promise of keeping the policy rate at the lower bound in the period after the crisis shock disappears. Here, the short-run benefit of reneging on the promise, shown by the red line, is how much the central bank gains by eliminating the overshooting of inflation and the output gap. This short-run benefit does not depend on the crisis probability, hence this line is flat. The long-run cost, shown by the black line, is the cost to the central bank of losing its reputation and thus its ability to conduct the commitment policy in the future. Because the benefits of the commitment policy accrue during crises, this long-run cost increases with the crisis probability. Thus, the commitment policy is credible only if the crisis probability is sufficiently high. In the example presented, the threshold crisis probability above which the commitment policy is credible is very small, less than 0.1 percent per quarter. In the U.S., a naïve estimate of this crisis probability over the past one hundred years would be about 0.5 percent per quarter, as there were two large shocks (the Great Depression and the Great Recession) in which the Federal Reserve lowered the federal funds rate to its ELB in the 100 years since the creation of the Federal Reserve (0.005=2/(4*100)).

I find that even a very small crisis probability is enough to make the commitment policy credible under many alternative assumptions about the structure of the economy. This is true even when I modify the model to allow the chair at the central bank to change over time so that loss of reputation is temporary. Thus, taken at face value, my results suggest that, if a central bank were to engage in this commitment policy, reputational forces are likely to be strong enough to make it credible.

5. Conclusion

Optimal commitment policy has recently attracted a lot of attention among economists and policymakers as a potentially effective approach to stimulating the economy when the short-term policy rate is constrained at the ELB. Despite its effectiveness in many macroeconomic models, a number of

central bank officials have expressed reservations about adopting such policies. One key reason policymakers have reservations is this policy's time-inconsistency. My results suggest that a central bank's concern for its reputation can make commitment policy time-consistent, potentially alleviating

such concerns.

My framework permits the analysis of one key issue policymakers may want to consider for adopting the optimal commitment policy--credibility. However, the validity of various assumptions responsible for making this optimal commitment policy effective would need to be examined carefully if a central bank were to adopt this policy. For example, one key assumption of this theory is that households and price-setters are forward looking and have rational expectations. Another is that the private sector correctly understands that the overshooting of inflation from its longer-run target is temporary, and that long-run inflation expectations remain anchored at the central bank's target.

Finally, while I have focused on the credibility of optimal commitment policy, my analysis is also useful in thinking about the credibility of certain policy rules that share key aspects of the commitment policy, such as price-level targeting and nominal-income targeting rules. Like the commitment policy, these rules also imply that the policy rate is kept at the lower bound for an extended period and that inflation and the output gap overshoot their targets. My research suggests that, like the optimal commitment policy, a concern for reputation would make these rules credible should a central bank choose to adopt them.

References

Adam, K., and R. Billi (2006): "Optimal Monetary Policy Under Commitment with a Zero Bound on Nominal Interest Rates," Journal of Money, Credit, and Banking, 38(7), 1877–1905.

Ball, L. M. (2013): "The Case for Four Percent Inflation," Central Bank Review, 13, 17–31.

Barro, R., and D. Gordon (1983): "Rules, Discretion, and Reputation in a Model of Monetary Policy," Journal of Monetary Economics, 12, 101–121.

Bean, C. (2013): "Global Aspects of Unconventional Monetary Policies," Remarks at the Federal Reserve Bank of Kansas City Economic Policy Symposium, Jackson Hole, Wyoming.

Bullard, J. (2013): "Monetary Policy in a Low Policy Rate Environment," OMFIF Golden Series Lecture, London, United Kingdom.

Carney, M. (2012): "Guidance," Remarks at the CFA Society Toronto, Toronto, Ontario.

Cœuré, B. (2013): "The Usefulness of Forward Guidance," Remarks at the Money Marketeers Club of New York, New York City, New York.

Dudley, W. (2013): "Remarks at the Central Bank Independence Conference: Progress and Challenges in Mexico," Remarks at the Central Bank Independence Conference: Progress and Challenges in Mexico, Mexico City, Mexico.

Eggertsson, G., and M. Woodford (2003): "The Zero Bound on Interest Rates and Optimal Monetary Policy," Brookings Papers on Economic Activity, 34(1), 139–235.

Jung, T., Y. Teranishi, and T. Watanabe (2005): "Optimal Monetary Policy at the Zero-Interest- Rate Bound," Journal of Money, Credit, and Banking, 35(7), 813–35.

Kydland, F., and E. C. Prescott (1977): "Rules Rather than Discretion: The Inconsistency of Optimal Plans," Journal of Political Economy, 85(3), 473–493.

Lacker, J. (2013): "Monetary Policy in the United States: The Risks Associated With Unconventional Policies," Remarks at the Swedbank Economic Outlook Seminar, Stockholm, Sweden.

Nakata, T. (2014): "Reputation and Liquidity Traps," Finance and Economics Discussion Series 2014-50, Board of Governors of the Federal Reserve System (U.S.).

Nakov, A. (2008): "Optimal and Simple Monetary Policy Rules with Zero Floor on the Nominal Interest Rate," International Journal of Central Banking, 4(2), 73–127.

Plosser, C. (2013): "Forward Guidance," Remarks at Stanford Institute for Economic Policy Re- searchs (SIEPR) Associates Meeting, Stanford, California.

Rogoff, K. (1987): "Reputational Constraints on Monetary Policy," Carnegie-Rochester Conference Series on Public Policy, 26, 141–182.

Werning, I. (2012): "Managing a Liquidity Trap: Monetary and Fiscal Policy," Working Paper.

Williams, J. C. (2011): "Unconventional Monetary Policy: Lessons from the Past Three Years," FRBSF Economic Letter, 2011-31 (October 3).

----(2012): "The Federal Reserve's Unconventional Policies," FRBSF Economic Letter, 2012-34 (November 13).

Woodford, M. (2012): "Methods of Policy Accommodation at the Interest-Rate Lower Bound," Presented at the 2012 Jackson Hole Symposium, Federal Reserve Bank of Kansas City, Jackson Hole, Wyoming.

* I would like to thank Stephanie Aaronson, Eric Engen, David Lebow, Matthias Paustian, John Roberts, Gisela Rua, Robert Tetlow, and Bill Wascher for their thoughtful comments. Timothy Hills and Paul Yoo provided excellent research assistance. The views expressed in this note, and all errors and omissions, should be regarded as those solely of the author, and do not necessarily reflect those of the Federal Reserve Board of Governors or the Federal Reserve System.

** Division of Research and Statistics, Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue N.W., Washington, D.C. 20551; Email: [email protected].

1. In the 2015 June Survey of Primary Dealers, respondents on average put about 80 percent probability to the event that the federal funds rate will rise from the ELB by the end of 2015. Return to text

2. For example, Ball (2013) argues that "the lower bound on interest rates is likely to constrain monetary policy in a large fraction of recessions'' in the United States. Return to text

3. See Adam & Billi (2006); Eggertsson & Woodford (2003); Jung et al. (2005); Nakov (2008); and Werning (2012). Return to text

4. See Woodford (2012). Return to text

5. Under the discretionary policy, the central bank optimizes its strategy every period based on the economic conditions that prevail at that time. Under the commitment policy, the central bank optimally designs its strategy at period one and commits to implementing that strategy afterward. Return to text

6. Time-inconsistency of optimal commitment policy was first noticed by Kydland & Prescott (1977). The problem of time-inconsistency arises in many other contexts when private-sector agents are forward looking. Return to text

7. See Bean (2013), Dudley (2013), Lacker (2013), Plosser (2013), and Williams (2011) for other examples. Return to text

8. The idea of making commitment policies credible by introducing reputational forces has a long history. Most famously, Barro & Gordon (1983) and Rogoff (1987) used the same idea to ask whether a central bank can credibly commit to low inflation in the model where the central bank has short-run incentives to create surprise inflation. Return to text

Please cite as:

Nakata, Taisuke (2015). "Credibility of Optimal Forward Guidance at the Interest Rate Lower Bound," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, August 27, 2015. https://doi.org/10.17016/2380-7172.1577

Disclaimer: FEDS Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers.