FEDS Notes

April 20, 2015

Defined-Contribution Pension Plans for State and Local Government Employees in the Financial Accounts of the United States

Matthew Hoops, Irina Stefanescu, and Ivan Vidangos

State and local (S&L) governments have traditionally sponsored defined-benefit (DB) retirement plans for their workers. Although DB plans, which provide a fixed payment in retirement using a formula based on years of service and pay, continue to be the dominant form of pension coverage in the S&L government sector, 401(k)-style defined-contribution (DC) plans have increasingly become available to S&L government employees as well. The S&L Employee Retirement Fund sector in the Financial Accounts of the United States has historically included only the assets and liabilities of S&L DB pension plans.1 ,2 Beginning with the September 2014 release, the S&L pension sector has been expanded to include S&L DC plans. This note provides some background information on the DC pension plans available to S&L government workers, briefly discusses the methodology used to construct the estimates of assets held by S&L DC pension plans, and presents the estimates currently reported in the Financial Accounts. Finally, it discusses the impact of the introduction of S&L DC pension assets on the balance sheet of the household sector.

1. Background

DB pension plans have traditionally been, and continue to be, the dominant form of retirement pension coverage in the S&L government sector. However, DC pension plans have become increasingly available to many S&L government employees, either as supplements to or replacements for traditional DB plans. According to the Bureau of Labor Statistics, in March 2014, 75 percent of S&L workers participated in a traditional DB plan, while 16 percent participated in a DC plan (U.S. Department of Labor, Bureau of Labor Statistics, 2014).3 DC pension arrangements in the S&L government sector take a variety of forms, and are typically named after the section of the IRS Code governing the arrangement, including 401(k), 401(a), 403(b) and 457 plans. The bulk of S&L DC plan assets are held in 403(b) plans and 457 plans, which are described below.4 Currently, the estimates of S&L DC pension assets reported in the Financial Accounts are restricted to these two types of plans.

Section 403(b) plans (also called tax-sheltered annuity plans) are 401(k)-style DC plans that are typically sponsored by public education employers and 501(c)(3) tax-exempt organizations.5 These plans are typically used as a voluntary supplement to a DB plan, but in some cases they constitute the primary retirement plan--as is the case for many college and university employees (particularly at private schools). 403(b) plans are similar to private-sector 401(k) plans, in that a 403(b) plan allows employees to defer some of their pre-tax income into individual accounts, and employers may also contribute to the account on behalf of their employees. The contributions and earnings within the 403(b) plan are generally not subject to federal or state income tax until they are distributed, typically after the employee has reached age 59-1/2. Like 401(k) plans, 403(b) plans can also be offered as a Roth account, in which post-tax income is contributed but all distributions from the account are tax-exempt once the participant reaches age 59-1/2.

Section 457 plans (also called deferred compensation plans) are 401(k)-style DC plans that are typically sponsored by S&L governments for their employees. This arrangement can be offered to supplement a traditional pension plan or other DC plan(s), or as a stand-alone plan.

2. Data and Methodology

In the Financial Accounts, S&L DC plan assets are estimated as the sum of 457 and 403(b) plan assets held by S&L government sponsors. 457 plan assets are directly reported by the Investment Company Institute (ICI). S&L 403(b) plan assets are calculated by subtracting non-governmental 403(b) assets from total 403(b) assets. We estimate total 403(b) assets from multiple sources. These assets can be broken down into three categories: (a) variable annuities, (b) mutual funds and (c) unallocated insurance contracts.6 We extract total assets in variable annuities from the College Retirement Equity Fund (CREF) quarterly statements. ICI provides information on 403(b) total assets in mutual funds. Finally, we estimate the percentage of total assets invested in unallocated insurance contracts from Form 5500 micro data on non-governmental 403(b) plans.7

3. Size of S&L DC Plans

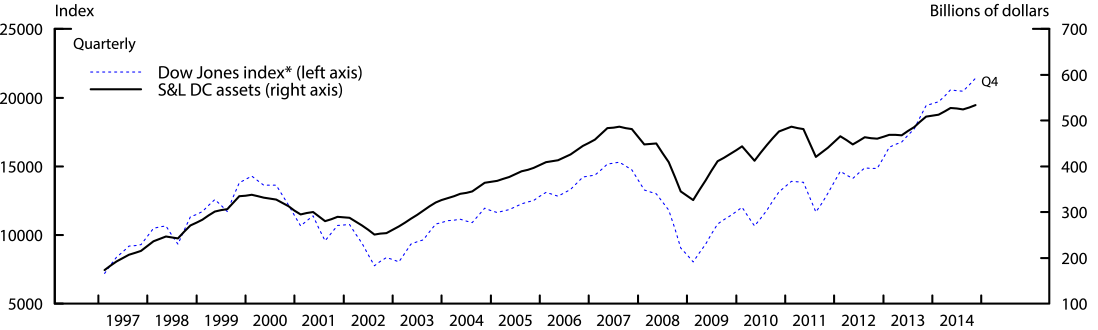

In the Financial Accounts of the United States, S&L DC plans are now reported in Table L.120.c (PDF) ("State and Local Government Employee Retirement Funds: Defined Contribution Plans").8 As shown in Figure 1, total S&L DC assets rose from about $215 billion in the fourth quarter of 1997 to around $533 billion in the fourth quarter of 2014. The figure illustrates that these assets tend to rise and fall with stock market performance, reflecting the fact that corporate equities and equity mutual funds account for a substantial share of S&L DC portfolios. As of the fourth quarter of 2014, 36 percent of S&L DC assets were invested in mutual funds, 31 percent are invested in equities, 25.8 percent are invested in unallocated insurance contracts, and 7.2 percent are invested in credit market instruments and other assets.

| Figure 1: Total S&L defined-contribution assets |

|---|

|

Source: Federal Reserve Board Statistical Release Z.1, "Financial Accounts of the United States" (March 12, 2015).

* Dow Jones U.S. total stock market index.

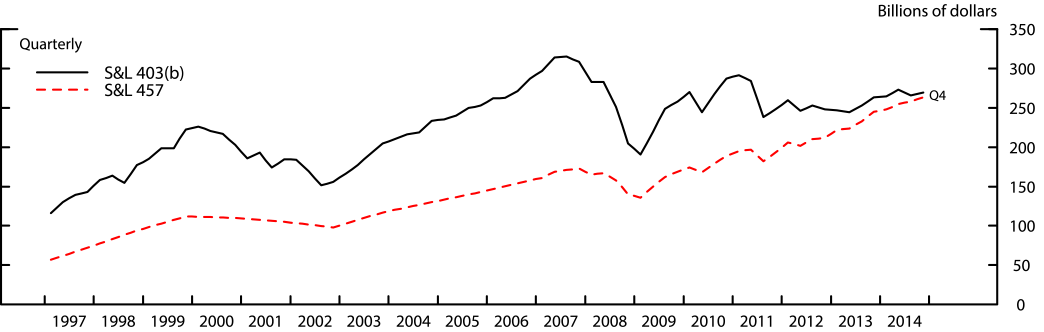

Figure 2 decomposes total S&L DC assets into assets held by 403(b) and 457 plans. Total assets of 403(b) plans (the black line) are a bit larger than those of 457 plans (the red line), although the gap seems to be narrowing and, in general, the two types are of a roughly similar magnitude, with 403(b) plans reaching $270 billion and 457 plans reaching $264 billion by the fourth quarter of 2014.

| Figure 2: S&L 403(b) plan and 457 plan assets |

|---|

|

Source: Federal Reserve Board Statistical Release Z.1, "Financial Accounts of the United States" (March 12, 2015). Investment Company Institute.

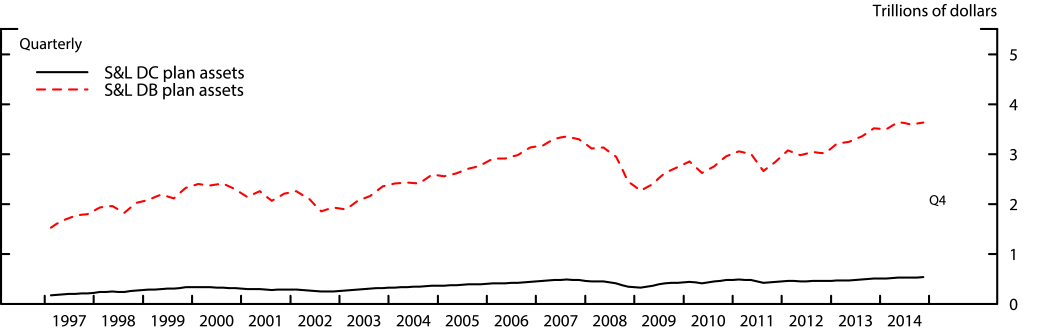

Despite their recent growth, S&L DC plans still account for only a small share of total retirement assets in S&L pension plans. As shown in Figure 3, the predominant source of funding for retirement income of S&L government workers still comes from DB plans, which held an estimated $3.6 trillion in the fourth quarter of 2014.9

| Figure 3: S&L DC and DB plan assets* |

|---|

|

Source: Federal Reserve Board Statistical Release Z.1, "Financial Accounts of the United States" (March 12, 2015).

* DB plan assets exclude unfunded claims on the sponsor.

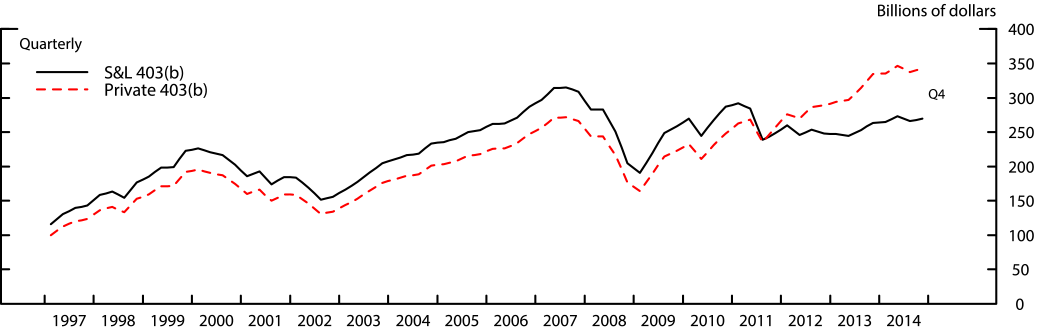

Figure 4 shows that assets in S&L 403(b) plans (the black line) are similar in magnitude to the assets of non-governmental 403(b) plans (the red line), although non-governmental 403(b) assets appear to have experienced faster growth in recent years.10 In the fourth quarter of 2014, S&L 403(b) plans held about $270 billion in assets, compared with $342 billion held by their non-governmental counterparts.11

| Figure 4: S&L and private 403(b) plan assets |

|---|

|

Source: Federal Reserve Board Statistical Release Z.1, "Financial Accounts of the United States" (March 12, 2015).

4. Impact on the Household Sector

S&L DC assets are treated as assets of the household sector in the Financial Accounts. Introducing the S&L DC sector had essentially zero net effect on the total value of household net worth (reported in Table B.101 (PDF), because S&L DC assets were already accounted for as household assets. The introduction of the S&L DC pension plans effectively reallocated these assets from direct holdings of households (e.g. in the form of mutual funds) to indirect holdings via S&L pension funds.

References:

Munnell, Alicia H. (2012). "State and Local Pensions: What Now?" Brookings Institution Press.

US Department of Labor, Bureau of Labor Statistics (2014), "National Compensation Survey: Employee Benefits in the United States, March 2014," Bulletin 2779 (September). Available at http://www.bls.gov/ncs/ebs/benefits/2014/ebbl0055.pdf.

1. The assets of S&L DC plans were included residually in the household sector. Return to text

2. The Financial Accounts of the United States are available at http://www.federalreserve.gov/releases/z1/. Return to text

3. In contrast, in 1990, 90 percent of S&L workers participated in a DB plan and only 9 percent participated in a DC plan (U.S. Department of Labor, Bureau of Labor Statistics). Return to text

4. 401(k) plans are commonly offered in the private sector but are typically not available to S&L government employees unless the plan was established prior to May 1986 (which was quite rare). 401(a) plans include profit-sharing plans and money purchase plans and are also relatively infrequent in the public sector. Return to text

5. Public education employers include public schools, state colleges, and universities. Return to text

6. Variable annuities are investment products typically offered by life insurance companies. The value of the investment varies based on the performance of the underlying investment options. Both the insurance and the tax-deferral features differentiate them from typical mutual funds. Unallocated insurance contracts are assets on the pension plan balance sheet held and managed by life insurance companies for the purpose of future purchase of annuities. Allocated insurance contracts are established when the obligation for payout is allocated to a specific individual and moved off the pension balance sheet to the life insurance company. Return to text

7. State and Local 403(b) variable annuities data (CREF) begin in 1980q1. Data for state and local 457 plans, 403(b) investments in unallocated insurance contracts and mutual funds begin in 1997q1. Return to text

8. Table L.120 (PDF) ("State and Local Government Employee Retirement Funds"), which previously reported S&L DB assets only, now reports the sum of both S&L DB and DC assets. S&L DB assets are now shown separately in Table L.120.b (PDF) ("State and Local Government Employee Retirement Funds: Defined Benefit Plans"). The corresponding flows are shown in tables F.120.c (PDF), F.120 (PDF), and F.120.b (PDF). Return to text

9. S&L DC plans are also small when compared with traditional 401(k) plans offered in the private sector, which held roughly $4.5 trillion in assets at the end of 2014q4. Return to text

10. New regulations for 403(b) plans went into effect in 2009 and non-governmental 403(b) plans are now required to file Form 5500. The new disclosures improved the information available on this particular subgroup. Return to text

11. Non-governmental 403(b) plans are included in the private pension sector in the Financial Accounts. Return to text

Please cite as:

Hoops, Matthew, Irina Stefanescu, and Ivan Vidangos (2014). "Defined-Contribution Pension Plans for State and Local Government Employees in the Financial Accounts of the United States," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, April 20, 2015. https://doi.org/10.17016/2380-7172.1519

Disclaimer: FEDS Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers.