FEDS Notes

December 7, 2015

The Ins and Outs of Mortgage Debt: An Update

Neil Bhutta

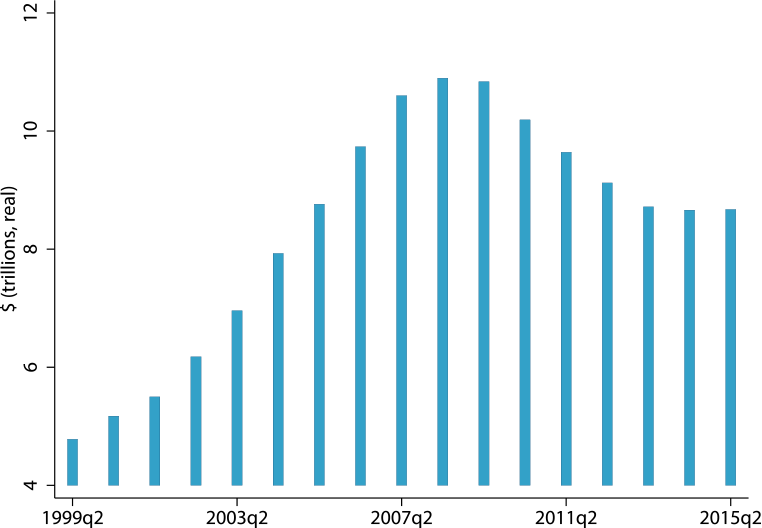

Real household mortgage debt has been flat over the past two years (figure 1). However, as described in more detail below, new data on credit flows reveal that mortgage inflows have picked up for the first time since before the financial crisis, including to individuals with lower credit scores. At the same time, outflows have contracted, largely reflecting fewer mortgage defaults. Still, because inflows remain weak, inflows and outflows have offset each other and aggregate mortgage debt has not yet begun to rise.

| Figure 1: Real Household Mortgage Debt Outstanding |

|---|

|

Source: FRBNY CCP/Equifax.

Notes: Graph shows the stock of mortgage each year as of the end of the 2nd quarter since 1999, as estimated from a five percent sample of the CCP, adjusted to avoid double-counting balances of jointly-held mortgages.

In a recent paper (Bhutta 2015), I constructed new measures of mortgage credit flows using the Federal Reserve Bank of New York's (FRBNY) Consumer Credit Panel (CCP). In this note, I update some of these mortgage flow measures through the second quarter of 2015. The CCP is a nationally representative, quarterly longitudinal dataset consisting of detailed, anonymous consumer credit report data maintained by Equifax. The CCP provides quarter-end snapshots of individuals' debt holdings, payment history, credit risk scores and geographic location down to the census block.1 Regarding personal mortgage debt, CCP coverage is comprehensive, including first and junior liens, closed- and open-end loans, loans held in a bank's portfolio or sold into mortgage-backed securities, and loans secured by principal residences, second homes or investment properties.2

Using the CCP, I measure mortgage "inflows" ("outflows") as the total change in mortgage debt among individuals who increased (reduced) such debt over a given period. Because inflows and outflows reflect changes in mortgage debt balances, they do not necessarily reflect the volume of mortgage originations. For example, years with high refinance volume will not necessarily generate large inflows, unless there is also a significant amount of "cash-out" refinance activity where borrowers increase their balances at the time of the transaction.

The individual-level details in the CCP allow inflows and outflows to be finely disaggregated into various groups of interest to better understand the sources of inflows and outflows. In this note, I only present a few disaggregations; more detailed disaggregations and additional results across geographic areas are available in Bhutta (2015) using data only through 2013:Q3.

Figure 2 presents inflation-adjusted inflows and outflows for eight two-year periods spanning 1999:Q2 through 2015:Q2, with inflows and outflows divided into six and four groups, respectively.3 In the most recent two-year period--(the end of) 2013:Q2 through 2015:Q2--total inflows were about $1.6 trillion while total outflows were slightly higher at almost $1.7 trillion, generating a slight decline in the stock of real mortgage debt of about $100 billion in the period.

| Figure 2: Inflows and Outflows, 1999:Q2-2015:Q2 |

|---|

|

Source: FRBNY CCP/Equifax.

Notes: Top and bottom panels show mortgage inflows and outflows divided into six and four mutually exclusive groups, respectively (see text for definitions) for eight two-year periods. Credit score refers to the Equifax risk score measured at the start of a given period. Low score is defined as under 680 and includes those without a credit score at the start of the period. Those entrants for whom first-time borrower status cannot be inferred are included not-first-time group.

As noted earlier, inflows expanded in the most recent period for the first time since the financial crisis, but still stand below inflows in the earliest observed period of 1999-01, and far below peak inflows in 2005-07. In contrast, despite record numbers of defaults and some indications that households have been aggressively trying to reduce debt, changes in outflows since 2005-07 have not been nearly as dramatic as the changes in inflows, and outflows in the most recent period were fairly similar to those in 2005-07.

Turning to the different categories of flows, on the inflow side, "entrants" are those going from zero to positive mortgage debt during a given period, and are further divided into four groups by credit score and first-time borrowing status. "Increasers" refers to those who add to their mortgage debt during a period, and are split into "investors" and all other increasers.4 In this analysis, the term "investor" refers to anyone inferred to have more than one mortgaged property at the end of a given period, and in many cases these investor inflows reflect purchases of an additional property such as a second home (not shown here). Other increasers have only one mortgaged property and, for example, might increase their debt by extracting home equity through a cash-out refinance.5 Overall, these data indicate that the recent rise in inflows reflects incremental increases in inflows for all groups, including lower-score (less than 680) entrants.

Two other features of the top panel of figure 2 are striking. First, during the housing boom, inflow growth was driven by investors and other increasers (shades of red), consistent with equity extraction and purchases of second homes and investment properties being key drivers of debt growth.6 In contrast, growth in inflows from entrants, including lower-score first-time borrowers, was relatively modest.

Second, since the financial crisis, inflows from lower-score entrants have declined sharply and are below the level in the 1999-01 period. For example, inflows from lower-score first-time borrowers were only about half of what they were in 1999-01, even though home prices are now considerably higher.7 The relatively sharp decline in first-time borrowing by lower-score individuals is consistent with tightened credit supply since the financial crisis, but it could also be the case that lower-score individuals' demand for owner-occupied housing (and thus mortgage debt) may have declined more than high-score individuals. Indeed, those with lower scores tend to be younger and less well educated--groups that were harder hit by the recession. However, as shown in my previous paper, a much stronger decline in first-time borrowing remains even after controlling for possibly differential effects of local unemployment shocks on lower-score individuals, as well as potential time-varying effects specific to certain demographic groups that might be correlated with time-varying credit score effects. These findings support an interpretation where the observed differential decline in first-time borrowing by credit score largely reflects tightened credit supply.

On the outflow side, "exiters" refers to those whose mortgage debt drops to zero during a given period, and are split into those with and without at least one mortgage default (defined as being at least 90 days past due) during the period. "Decreasers" refers to those whose mortgage balances decline (but remain positive) during a given period, including borrowers who simply make scheduled mortgage payments.8

Total outflows have contracted since the 2009-11 period, with outflows associated with mortgage defaults subsiding significantly (darker shades of yellow and green). As the housing crisis unfolded, outflows peaked in the 2009-11 period, and borrowers with a mortgage default accounted for an increasing share of outflows. Prior to the 2007-09 period, defaults were far less prevalent and outflows from such borrowers were only a small component of total outflows.

Finally, there is little indication of an increase in outflows in recent years due to borrowers paying down debt more aggressively. Although, as some anecdotes suggest, aversion to debt may have increased in recent years and prompted some homeowners to accelerate principal payments or payoff their mortgages, outflows other than from those with a mortgage default never expanded appreciably. In fact, despite the rise in defaults since 2007, total outflows as a share of mortgage debt outstanding have basically been flat over time (see Bhutta 2015). If many borrowers were paying down their loans at a faster rate than before the crisis, total outflows as a share of debt should have expanded significantly rather than remaining almost constant.9

In sum, new data on mortgage credit flows indicate that mortgage inflows have picked up for the first time since before the financial crisis, including to individuals with lower credit scores, while outflows have contracted as mortgage defaults have subsided. Although there has been no net change in mortgage debt over the past couple of years (outflows have offset inflows) as inflows remain weak, if the trends in inflows and outflows continue, real mortgage debt will begin to rise again in the coming quarters.

References

Bhutta, N. 2015. The Ins and Outs of Mortgage Debt during the Housing Boom and Bust. Journal of Monetary Economics, 76, pp.284-298.

Bhutta, N., Keys, B.J., forthcoming. Interest Rates and Equity Extraction during the Housing Boom. American Economic Review.

Chinco, A., Mayer, C., 2012. Distant Speculators and Asset Bubbles in the Housing Market. Working paper.

Greenspan, A., Kennedy, J., 2008. Sources and Uses of Equity Extracted from Homes, Oxford Review of Economic Policy, 24(1), pp. 120-144.

Haughwaut, A., Lee D., Tracy, J., VanderKlaauw, W., 2011. Real Estate Investors, the Leverage Cycle, and the Housing Market Crisis. Federal Reserve Bank of New York Staff Report no. 514.

Lee, D., VanderKlaauw W., 2010. An Introduction to the FRBNY Consumer Credit Panel. Federal Reserve Bank of New York Staff Report No. 479.

Mian, A., Sufi, A., 2011. House Prices, Home Equity-Based Borrowing, and the US Household Leverage Crisis. American Economic Review, 101: 2132-2156.

1. Credit scores for each individual are based on the Equifax 3.0 model, which is similar conceptually and numerically to the FICO score. The Equifax score ranges from 280 to 850, with higher scores associated with a lower expected likelihood of default. Return to text

2. For more information on the CCP, see Lee and van der Klaauw (2010). Note that all individuals in the data are anonymous: names, street addresses and social security numbers have been suppressed by Equifax. Individuals are distinguished and can be linked over time through a unique, anonymous consumer identification number assigned by Equifax. Return to text

3. Inflation is measured using price index data from the Bureau of Economic Analysis on personal consumption expenditures. Return to text

4. First-time borrowers are those with no mortgage debt at the start of the period and no record of ever having a mortgage in the past. Return to text

5. For more details on these classifications and other definitions, see Bhutta (2015). Return to text

6. See Bhutta and Keys (forthcoming) and Mian and Sufi (2011) for more on equity extraction patterns during the housing boom, and how extraction responded to interest rates and house price growth. Also see Greenspan and Kennedy (2008) for other estimates of equity extraction volume. See Chinco and Mayer (2012) and Haughwaut et al. (2011) for studies focusing on real estate investor activity during the housing boom. Return to text

7. For example, the S&P/Case-Shiller National Home Price Index, adjusted for inflation in personal consumption expenditures, was about 27 percent higher by mid-2014 relative to mid-2000. Return to text

8. Decreasers also includes those whose balances remain the same over a two-year period. Return to text

9. The bottom panel of figure 2 indicates that other-exiter outflows (i.e. not associated with any mortgage defaults) declined as the crisis unfolded, significantly offsetting the rise in outflows associated with a mortgage default. One possible interpretation of this finding is many borrowers who were observed to both exit and default in the post-crisis periods would have exited even in the absence of a mortgage default. However, it is also possible that in the absence of rising defaults, outflows as a share of debt would have declined in the post-crisis periods. More work is needed to distinguish between these alternatives. Return to text

Please cite as:

Bhutta, Neil (2015). "The Ins and Outs of Mortgage Debt: An Update," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, December 07, 2015. https://doi.org/10.17016/2380-7172.1669

Disclaimer: FEDS Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers.