FEDS Notes

October 8, 2015

U.S. Net Wealth in the Financial Accounts of the United States1

Elizabeth Holmquist and Susan McIntosh

This note describes the measurement of U.S. net wealth in the Federal Reserve's Financial Accounts of the United States. Beginning with the September 18, 2015 publication, a new table showing the derivation of U.S. net wealth (table B.1) is included in the Financial Accounts.

U.S. net wealth is a concept that measures the total nonfinancial wealth--including both tangible wealth such as land, structures, and machines and intangible wealth such as patent rights--of the U.S. as a whole. Financial wealth is excluded in the estimation of U.S. net wealth because financial wealth represents agreements between parties regarding future payments, such that a financial asset of one party is always matched with an offsetting financial liability for another party. Thus, in an aggregate sense, financial wealth nets to zero across sectors, and aggregate U.S. wealth at a particular time can be represented as the sum of all of its nonfinancial assets. As an example, imagine a household with deposits in a bank account. The deposits are an asset of the household and a liability of the bank. But the bank, in turn, lends the money to a business to buy a machine, or to another household to buy a house or car. Now the money represents an asset of the bank and a liability of the borrower. The concept of U.S. net wealth ignores all domestic financial intermediation and just counts the value of the land, machines, houses, cars, etc., plus intangible wealth. This concept is different from the concept of household net worth, which does include the financial wealth of the household sector. However, these two concepts are closely related, because, to a large extent, households' financial wealth can be viewed as a claim on the nonfinancial wealth of the other sectors.

In estimating U.S. net wealth, we use direct measures of the value of households', nonprofits', noncorproate businesses', and governments' nonfinancial wealth. For corporate businesses, we use the market value of their outstanding equity shares to better capture the value of intangible assets, such as intellectual property. We then net out financial obligations between U.S. resident households, businesses, and government agencies and the rest of the world, because the concept of U.S. net wealth should exclude nonfinancial assets that are financed abroad rather than domestically, and include the value of nonfinancial wealth held by U.S. entities abroad. Taking all this together, we define net U.S wealth as the value of tangible assets controlled by households and nonprofits, noncorporate business, and government sectors of the U.S. economy, plus the market value of domestic nonfinancial and financial corporations, net of U.S. financial obligations to the rest of the world. More details are provided below.

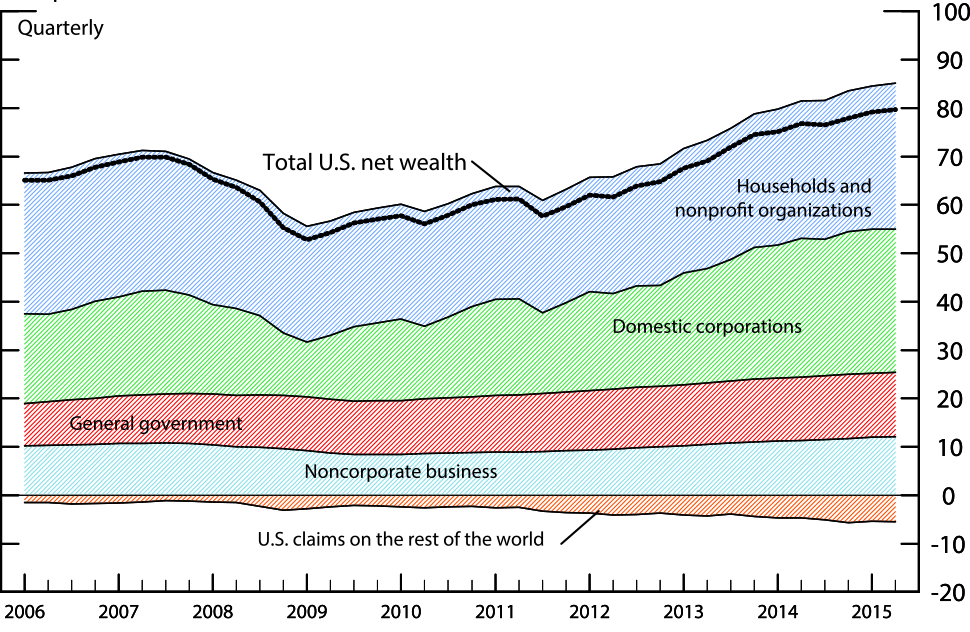

Recent Trends

As can be seen by the dotted line in the figure below, the level of net wealth in the United States has grown significantly in recent years. Prior to the most recent financial crisis, U.S. net wealth peaked at about $70 trillion in 2007:Q3. By 2009:Q1, net wealth had dropped by over $17 trillion, driven largely by collapses in the market values of housing and corporate equity. U.S. net wealth did not recover to its peak pre-recession level until mid-2013, and , subsequently, has continued to rise further, reflecting, in large part, recoveries in the real estate and stock markets. In 2015:Q2, U.S. net wealth reached its highest recorded value of almost $80 trillion, with the largest components being household nonfinancial assets and the market value of corporations.

| Chart 1: Components of U.S. Net Wealth (Trillions of dollars) |

|---|

|

Source: Financial Accounts of the United States, September 18, 2015.

Calculation of Net U.S. Wealth

In the System of National Accounts 2008 (2008 SNA), which prescribes international guidelines for national accounting, an asset is defined as "a store of value representing a benefit or series of benefits accruing to the economic owner by holding or using the entity over a period of time." 2 Nonfinancial assets are classified as either "produced assets," which we often refer to as "tangible assets" and include fixed assets, inventories, and valuables; or "nonproduced assets," which include natural resources and intangible intellectual property such as contracts, leases, and licenses, as well as purchased goodwill and marketing assets. As noted above, a key distinction between nonfinancial and financial assets is that, in a net national accounting sense, nonfinancial assets represent wealth, while financial positions net to zero across all U.S. sectors and the rest of the world.3 Therefore, as defined in the SNA, total net wealth in the U.S. can be calculated as the sum of nonfinancial assets in the domestic economy net of the U.S. financial position vis-à-vis the rest of the world.

U.S. net wealth is shown on table B.1 of the Financial Accounts. Households' and nonprofit organizations' direct holdings of nonfinancial assets (line 2) include real estate recorded at market value (line 3), nonprofit organizations' holdings of equipment (line 4) and intellectual property products (line 5) valued at replacement (current) cost, and the net stock of consumer durable goods (line 6) values at replacement cost. Real estate includes both owner-occupied real estate and commercial real estate held by nonprofit organizations.

The nonfinancial noncorporate business sector includes both sole proprietorships and partnerships, including noncorporate farms. Their nonfinancial assets (line 7) include real estate recorded at market value (line 8); and equipment (line 9), intellectual property products (line 10), and inventories (line 11) valued at replacement (current) cost. Ideally, we should include a market valuation for noncorporate businesses that reflects intangible as well as tangible assets, as we do for corporations. Unfortunately, such a comprehensive measure is not currently available, so this represents a gap between the concept of U.S. net wealth and what we are able to measure.

A small amount of nonfinancial assets held by financial noncorporate businesses (line 12) reflect proprietors' equity in noncorporate brokers and dealers. There are probably additional types of financial noncorporate businesses that we are not able to capture, so this line most likely undercounts nonfinancial assets held by financial noncorporate businesses.

As discussed above, we include the market value of domestic corporations (line 13) as a measure of the value of intangibles, such as patent rights, as well as tangible nonfinancial assets. In the Financial Accounts, the market value of corporations is estimated as the sum of the value of publicly traded shares on the exchanges, and the value of closely held companies.4 The market value of nonfinancial corporations (line 14) and financial (line 15) corporations are shown separately.

The nonfinancial assets of the federal government (line 16) and state and local governments (line 20) are measured by the value of their holdings at replacement (current) cost as reported by the Bureau of Economic Analysis (BEA). These nonfinancial assets include structures (lines 17 and 21), equipment (lines 18 and 22), and intellectual property products (lines 19 and 23). Due to data limitations, the value of land holdings and nonproduced nonfinancial assets are not included for the the government sectors and, thus, represent another potential gap between concept and measurement.5

The last step in deriving U.S. net wealth is to account for net U.S. financial claims on the rest of the world (line 24). Net U.S. financial claims on the rest of the world is measured as the difference between holdings of foreign financial instruments by U.S. residents and businesses (line 25) and holdings of U.S. financial instruments by entities in the rest of the world (line 28).

Differences between U.S. Net Wealth and Household Net Worth

Household net worth, shown as memo item B on line 34 of table B.1, is the value of net worth for the household and nonprofit organizations sector, as reported on table B.101 in the Financial Accounts. Net worth is calculated as the difference between a sector's total assets, including both financial and nonfinancial assets, and liabilities (debts owed to other sectors). Household net worth and U.S. net wealth are different concepts because they treat financial wealth differently: U.S. net wealth excludes financial wealth while household net worth includes it. Regarding this point, however, it is worth noting that the two concepts are closely related because, to a large extent, households' financial position ultimately represents a claim on the nonfinancial assets of the other sectors. Said differently, at the end of the day, households "own" all the other sectors through, for example, their holdings of equity shares or debt. So, households' financial wealth is strongly associated with the net wealth of all the other sectors.6

That said, one area where this conceptual difference manifests is in the treatment of the wealth of the government sectors. U.S. net wealth captures federal and state and local governments' wealth by including the value of governments' nonfinancial assets; the value of government debt is excluded. In constrast, government debt held by households is part of household net worth, but governments' nonfinancial assets are not.

Although U.S. net wealth and household net worth are conceptually different measures, they turn out to be close in magnitude and highly correlated over time. Nonetheless, there are differences between the two time series, particularly in the period following the financial crisis.

| Chart 2: Comparison of U.S. Net Wealth and Household Net Worth (Trillions of dollars) |

|---|

|

Note: The gray shades indicate NBER recession dates.

Source: Financial Accounts of the United States, September 18, 2015.

While it is difficult to isolate all the factors that account for the differences, there are a couple of likely contributors. As noted above, the difference in the measurement of government wealth between of U.S. net wealth and household net worth will create differences between the two series. There are also several gaps between conceptual U.S. net wealth and what we are actually able to measure--for example, we are missing measures of noncorporate intangible assets, some other financial noncorporate assets, and some nonfinancial assets of the government sector--all of which impart a downward bias to our measure of U.S. net wealth.

Another potential contributor to the gap between the two series is differences in the accounting methods used for for nonfinancial and financial assets in the Financial Accounts. For example, defined benefit (DB) pension plan entitlements, a major component of household financial assets, are measured as the present value of earned future benefits.7 The current-cost measure of government nonfinancial assets used in the calculation of U.S. net wealth does not take into account any future obligations, which, again, creates a downward bias on our measure of U.S. net wealth relative to household net worth.8

The Financial Accounts household sector's statistical discrepancy represents the difference between households' measured sources of funds and measured uses of funds. The accumulation of the household sector's statistical discrepancy over time could also affect the measurement of household net worth without affecting the calculation of U.S. net wealth.

U.S. Net Wealth versus Net Worth in the Integrated Macroeconomic Accounts

The Integrated Macroeconomic Accounts (IMAs), produced jointly by the Federal Reserve and the BEA, combine data on national income, saving, and financial holdings that is reported for seven broad sectors: households and nonprofit organizations, nonfinancial noncorporate business, nonfinancial corporate business, financial business, federal government, state and local governments, and the rest of the world. For each IMA table, sector net worth is calculated as the value of the sector's total nonfinancial and financial assets less its total liabilities. Unlike in the Financial Accounts, however, in the IMAs, the market value of a sector's corporate equity outstanding is included as a liability. Thus, the sector net worth numbers shown on table S.2.a Selected Aggregates for Total Economy and Sectors in the IMAs exclude the market value of equity, and therefore differ significantly from those reported for the sectors on table B.1. Moreover, the net worth of each sector on table S.2.a includes net financial assets, while the measure of U.S. net wealth does not. Furthermore, for the business sectors, the value of intangible assets, such as intellectual property and goodwill, are not entirely included in the IMAs, but are reflected in the market value of corporations included in U.S. net wealth. And finally, discrepancies between measured financial assets and liabilities due to inconsistencies in source data will contribute to the difference between the entries in the U.S. net wealth table B.1 and the net worth entries shown on IMA's table S.2.a.

1. The views expressed herein are those of the authors and do not necessarily reflect those of the Federal Reserve Board or its staff. We thank Marco Cagetti, Paul Smith, and Michael Palumbo for their very helpful comments. Return to text

2. See European Commission, the Organization for Economic Co-operation and Development, the International Monetary Fund, and the World Bank (2009), System of National Accounts 2008 (New York: EC, IMF, OECD, UN, and WB), chap. 10, sec. 8, p. 195, http://unstats.un.org/unsd/nationalaccount/docs/SNA2008.pdf. Return to text

3.In practice there are statistical discrepancies which are abstracted away in this calculation. Return to text

4. The value of closely held companies is estimated based on the market value of public corporations that share the industry classification and business characteristics of the closely held companies. Return to text

5. The value of stewardship land and heritage assets is also excluded.Stewardship land is federally-owned land that is set aside for the use and enjoyment of present and future generations, and land on which military bases are located. Except for military bases, this land is not used or held for use in general government operations. Heritage assets are government-owned assets that have one or more of the following characteristics: historical or natural significance; cultural, educational, or artistic importance; and/or significant architectural characteristics. The cost of heritage assets often is not determinable or relevant to their significance. Return to text

6. Households' direct or indirect claims on the rest of the world are included in the measure of household net worth. Return to text

7. For a more comprehensive discussion of the measurement of pension entitlements in the Financial Accounts of the United States, see the October 31, 2014 FEDS Note, "Introducing Actuarial Liabilities and Funding Status of Defined-Benefit Pensions in the U.S. Financial Accounts," by Irina Stefanescu and Ivan Vidangos. Return to text

8. The value of the private business sector's DB pension liabilities is reflected in the market value of those businesses in our measure of U.S. net wealth. Return to text

Please cite as:

Holmquist, Elizabeth, and Susan McIntosh (2015). "U.S. Net Wealth in the Financial Accounts of the United States," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, October 08, 2015. https://doi.org/10.17016/2380-7172.1642

Disclaimer: FEDS Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers.