FEDS Notes

April 12, 2016

Government-Backed Mortgage Insurance Promoted a Speedier Recovery from the Great Recession

Wayne Passmore and Shane M. Sherlund 1

The United Sates government has a long history of involvement in mortgage finance. During the 1930s, the government created the Federal Home Loan Banks (FHLB), the Federal Housing Administration (FHA), and the Federal National Mortgage Association (Fannie Mae). Since then, these programs grown in size and scope, and the government has introduced additional programs including the Federal Home Loan Mortgage Corporation (Freddie Mac) and the Government National Mortgage Association (Ginnie Mae).

During the most recent financial crisis, most of the government focus concerning mortgage finance was on mortgage debt relief and mortgage refinancing for households that had experienced large declines in house values. The housing programs created during the Great Depression were taken as background fixtures during the Great Recession. As a result, the Great Recession provides an opportunity to empirically assess the impacts of the Great Depression housing programs during significant economic downturns. Most of these programs were created with the objective of limiting the damage to households during the Great Depression and speeding the economic recovery. We address the empirical question: Did they perform this role during the Great Recession?

This note outlines some results from our recent FEDS paper, "Government-Backed Mortgage Insurance, Financial Crisis, and the Recovery from the Great Recession." Here, we establish the substantial impacts of government mortgage insurance programs during the financial crisis and economic recovery.

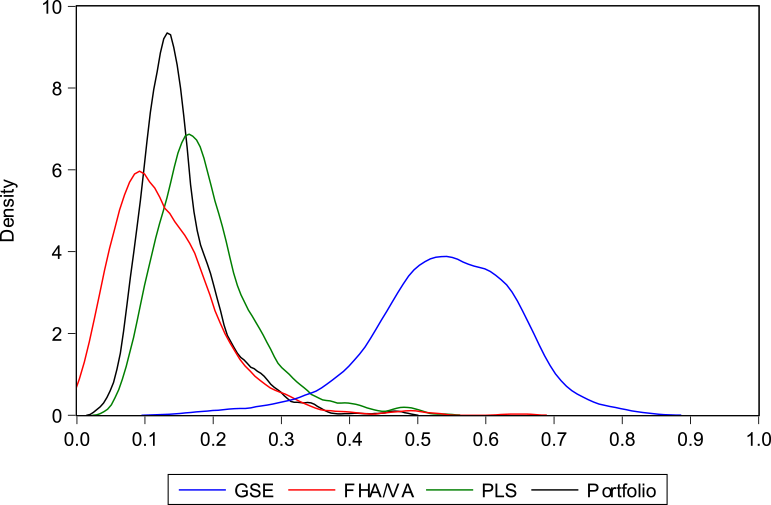

We characterize the mortgage market structure of a county via four mortgage origination channels: the proportion of mortgages that flow into bank portfolios (portfolio share), the proportion that flow into private-label securities (PLS share), the proportion that are securitized by Fannie Mae or Freddie Mac (GSE share), and the proportion that are insured by the FHA or VA (FHA/VA share).

The frequency distributions shown in figure 1 demonstrate the significant variation in the county distributions of government program use prior to the financial crisis. GSE securitization ranged from nearly 25 percent to over 75 percent of the proportion of originations in a county, where use of the FHA was much lower, ranging from close to zero to over 35 percent (top two panels). The share of mortgage originations flowing into bank portfolios ranged from 6 percent to 33 percent (bottom left). PLS, even at their heyday prior to the financial crisis, accounted for a relatively smaller proportion of the flow of mortgage originations from a county, ranging from 8 percent to just under 45 percent (bottom right).

| Figure 1: Mortgage Market Share Density Functions |

|---|

|

Source: Calculations based on data provided by McDash Analytics, LLC, a wholly owned subsidiary of Lender Processing Services, Inc., and data provided by CoreLogic.

In this note, we estimate how the intensity of GSE, FHA, PLS, and portfolio exposures influence the state of the real economy across counties. However, the use of such securitization outlets and the prevalent of bank portfolio alternatives may not be independent from the same conditions that create relatively high economic performance in a county. Thus, we control for the "propensity" of particular counties to use or select into various mortgage financing alternatives, conditional on economic fundamentals such as average incomes, house prices, and unemployment rates. By controlling for counties' propensities to select into GSE, FHA, PLS, and portfolio treatments, we can directly estimate the effect of financing alternatives on economic activity within a county.

Our identification strategy relies on the variation in government involvement in mortgage markets across counties. Counties with significant government involvement are subject to underwriting and credit risk pricing standards that are set at a national level. In contrast, counties with little government involvement are subject to underwriting and credit risk pricing standards set more by local banks, thrifts, mortgage banks, and private-sector mortgage securitization conduits (whose underwriting standards may or may not be set at the national level, and whose underwriting standards are likely more varied and responsive to current market conditions).

We envision each county containing a set of mortgage financing structures that changes only slowly over time and reflects the economic characteristics of the population that lives in those counties. As the securitization outlets are provided by national entities, their relative usage in a county reflects the underlying county characteristics. Thus, we model the extent of banks' participation in securitization outlets on the basis of observed census characteristics that are unrelated to the availability of the securitization outlets.

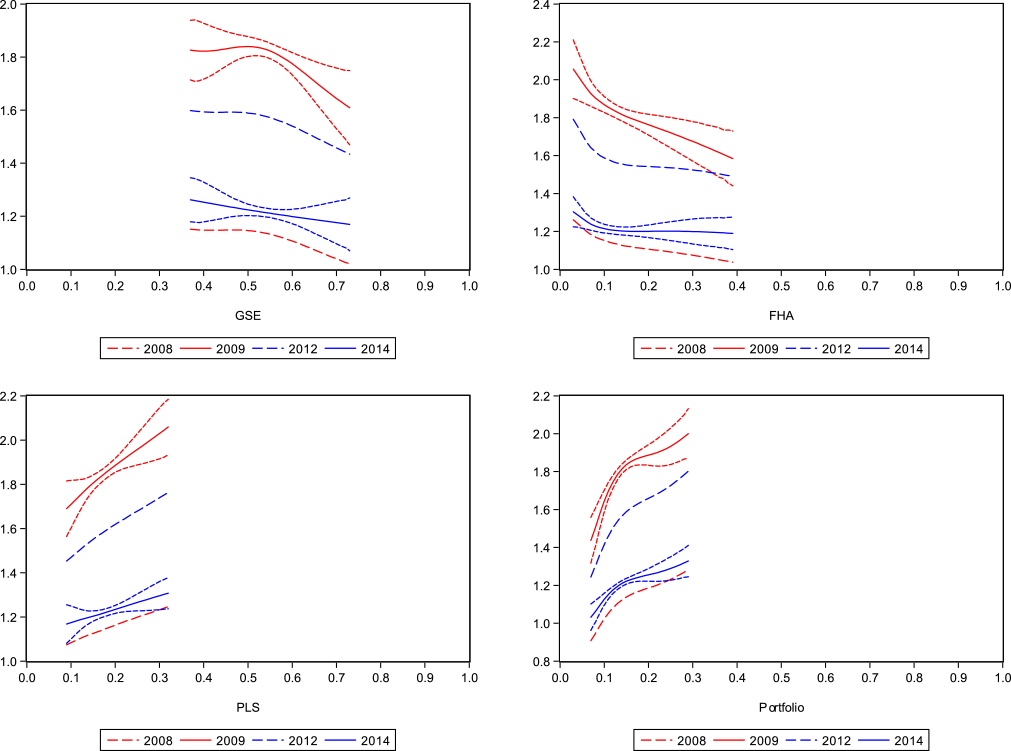

As shown in Figure 2, we see a clear downward trend in how much unemployment rates changed, relative to 2005, for counties with higher levels of GSE securitization for both the crisis and post-crisis periods. Similarly, there is a distinct downward trend for counties that made more use of the FHA. By the end of 2008, unemployment rates had increased by 26 percent in counties that had low FHA shares in 2005, relative to a 4 percent increase in unemployment rates in counties that had high FHA shares in 2005. By the end of 2009, unemployment rates had increased by 106 and 58 percent for the same groups of counties. What is clear is that the financial crisis was a substantial negative shock which influenced all counties, but the effects were much larger in counties with lower government mortgage use prior to the financial crisis. By the end of 2012, unemployment rates had fallen across the board, but remained 79 percent higher in low FHA-share counties--and 49 percent higher in high FHA-share counties. By the end of 2014, unemployment rates retraced further, but remained 30 and 19 percent higher than in 2005 for the same groups of counties.2 Here, it is evident that the effects of the financial crisis still remain, and that those effects are larger for lower FHA- and GSE-share counties---i.e., counties with low government involvement.

In contrast, counties that were more reliant on either PLS or bank portfolios in 2004-2007 experienced much larger increases in their unemployment rates. By the end of 2008, unemployment rates had increased by 7 percent in counties that had low PLS shares in 2005, relative to a 25 percent increase in unemployment rates in counties that had high PLS shares. By the end of 2009, unemployment rates had increased by 69 and 106 percent for the same groups of counties. Again, the financial crisis had adverse effects in all counties, but had the effects were larger in counties with higher private funding use prior to the financial crisis. By the end of 2012, unemployment rates had fallen across the board, but remained 45 percent higher in low PLS-share counties--and 76 percent higher in high PLS-share counties--relative to before the crisis. By the end of 2014, unemployment rates remained 17 and 31 percent higher than in 2005 for the same groups of counties. The effects of the financial crisis are still apparent across counties, but the effects remained larger for higher PLS- and portfolio-share counties--i.e., counties with low government involvement.

We find similar results for other housing indicators. Greater exposure to GSE or FHA activity prior to the financial crisis tended to be associated with smaller declines in home sales and house prices both during and after the financial crisis. In contrast, greater exposure to PLS or portfolio lending tended to be associated with larger declines in home sales and house prices. Delinquency rates and foreclosure completions tended to rise the most in counties with high exposure to PLS or portfolio lending and/or low exposure to GSE or FHA lending.

Overall, our results suggest that counties more reliant on some form of government funding for mortgages were more insulated from the financial crisis. These effects were still apparent in 2014, though the effects of the financial crisis had decayed substantially. The persistence of better outcomes with government programs is consistent with a view that less pro-cyclical government underwriting and credit risk pricing standards can create additional economic activity during and after a financial crisis.

1. Wayne Passmore is a Senior Advisor and Shane M. Sherlund is an Assistant Director in the Division of Research and Statistics at the Board of Governors of the Federal Reserve System. The views expressed are the authors' and should not be interpreted as representing the views of the FOMC, its principals, the Board of Governors of the Federal Reserve System, or any other person associated with the Federal Reserve System. We thank Della Cummings…. Wayne Passmore's contact information is: Mail Stop 66, Federal Reserve Board, Washington, DC 20551, phone: (202) 452-6432, e-mail: [email protected]. Shane Sherlund's contact information is: Mail Stop 93, Federal Reserve Board, Washington, DC 20551, phone: (202) 452-3589, e-mail: [email protected]. Return to text

2. If we showed our charts in levels, rather than benchmarked relative to 2005, the interpretation of our results might be even stronger. The results for GSE, PLS and portfolio channels are similar, but for FHA, the effects are more dramatic. Prior to the crisis, counties with higher FHA shares tended to also have higher unemployment rates. During the crisis, however, this relationship flipped: Counties with higher pre-crisis FHA shares tended to have lower unemployment rates. By 2014, counties with higher pre-crisis FHA shares again tended to have higher unemployment rates, restoring the pre-crisis relationship. Return to text

Please cite this note as:

Passmore, Wayne, and Shane M. Sherlund (2016). "Government-Backed Mortgage Insurance Promoted a Speedier Recovery from the Great Recession," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, April 12, 2016, http://dx.doi.org/10.17016/2380-7172.1742

Disclaimer: FEDS Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers.