FEDS Notes

February 27, 2017

The Cleared Bilateral Repo Market and Proposed Repo Benchmark Rates

David Bowman, Joshua Louria, Matthew McCormick, and Mary-Frances Styczynski*

Overview

As described in a recent statement ![]() and blog post

and blog post ![]() , the Federal Reserve Bank of New York (FRBNY), in cooperation with the Office of Financial Research (OFR), is considering the publication of several new benchmark rates for overnight Treasury general collateral repurchase agreement (repo) transactions in order to enhance market transparency and efficiency by improving the quality and breadth of repo market information available to the public. The statement proposed publishing three rates that would be based upon transaction-level data from various segments of the repo market, including the tri-party repo market, the Fixed Income Clearing Corporation's (FICC's) General Collateral Finance Repo Service, or GCF Repo® market (GCF), and the Federal Reserve's repo-based open market operations.1

, the Federal Reserve Bank of New York (FRBNY), in cooperation with the Office of Financial Research (OFR), is considering the publication of several new benchmark rates for overnight Treasury general collateral repurchase agreement (repo) transactions in order to enhance market transparency and efficiency by improving the quality and breadth of repo market information available to the public. The statement proposed publishing three rates that would be based upon transaction-level data from various segments of the repo market, including the tri-party repo market, the Fixed Income Clearing Corporation's (FICC's) General Collateral Finance Repo Service, or GCF Repo® market (GCF), and the Federal Reserve's repo-based open market operations.1

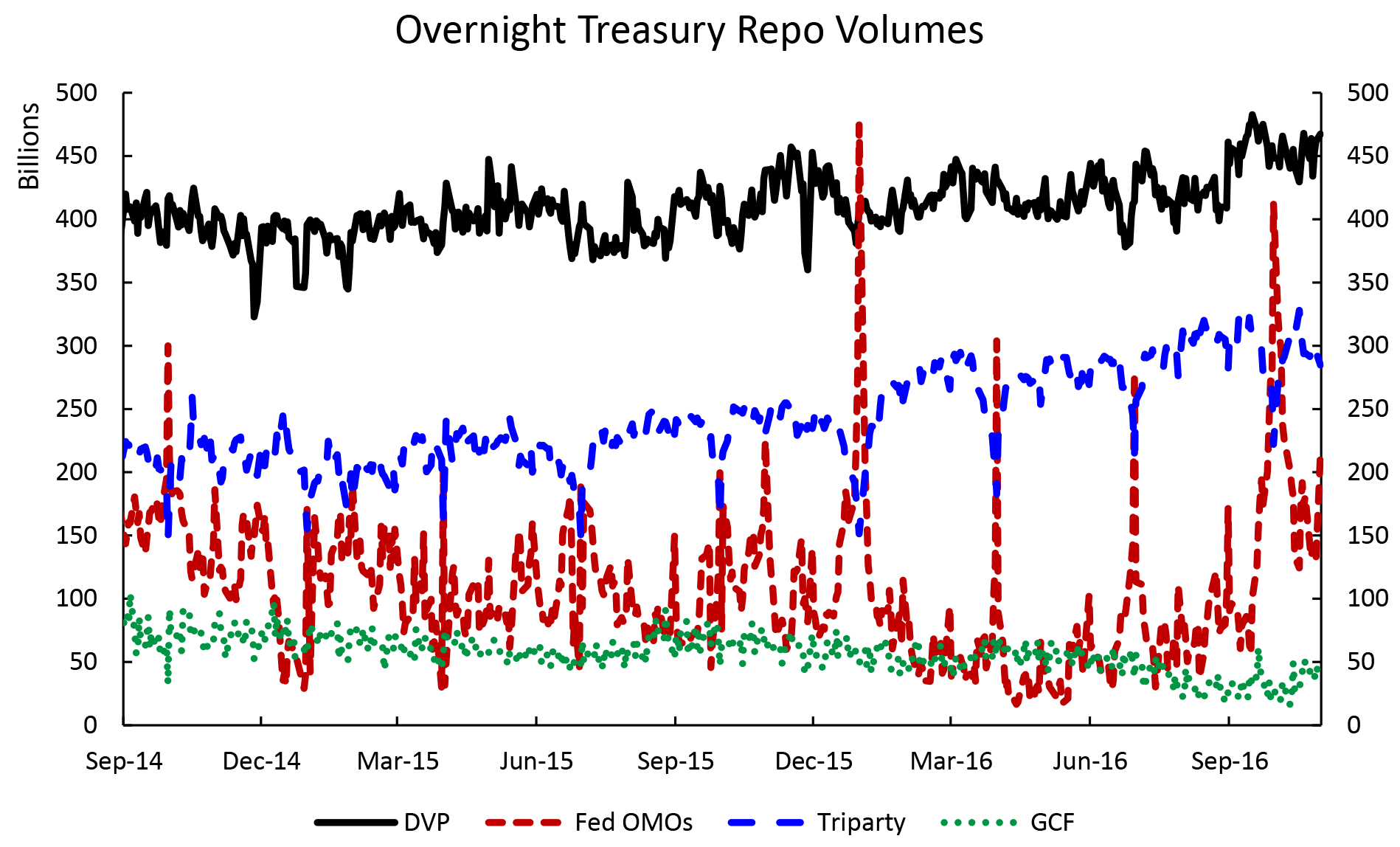

This note sheds light on another important segment of the overnight repo market – the segment of the bilateral repo market cleared by FICC – based on an anonymized sample of data made available to the Board of Governors. Each day, FICC processes about $400 billion in same-day settling overnight bilateral repo transactions collateralized with U.S. Treasury securities through its Delivery-versus-Payment (DVP) repo service, and FICC has provided anonymized data on all these trades from August 2014 through October 2016. This note describes the FICC-cleared bilateral repo segment and presents some preliminary analysis based on the newly available sample data.

Contrasting the Tri-party and Bilateral Repo Markets

The tri-party repo market is based on clearing and settlement infrastructure provided by the Bank of New York Mellon and JPMorgan Chase.2 These two clearing banks provide collateral valuation, margining, and management services to facilitate tri-party trading. A key feature of the tri-party infrastructure is the collateral allocation system, which automatically selects securities from a cash borrower's inventory to collateralize transactions. Repo transactions facilitated by the tri-party infrastructure fall into two segments: Tri-party ex-GCF, which are tri-party transactions not cleared through FICC, and GCF, which are cleared through FICC's GCF repo service. The tri-party ex-GCF segment is predominantly characterized by institutional investors – such as money market funds – lending cash to broker-dealers. The GCF segment is largely an inter-dealer market where cash raised from institutional investors is reallocated among broker-dealers. GCF repos are traded in a blind-brokered market and trades are novated to FICC, which serves as a central counterparty.3

As with tri-party repo, bilateral repo transactions also fall into two segments: bilateral repo cleared through FICC's DVP repo service and un-cleared bilateral repo. FICC's GCF Repo and DVP repo services are similar in that they both allow for clearing in interdealer repo markets. Both services novate transactions to FICC, however, GCF repos are exclusively blind brokered, while DVP repos can be blind brokered or directly negotiated.4 Un-cleared bilateral repo transactions are conducted entirely outside the services offered by FICC and the tri-party clearing banks, and detailed information about that segment is not currently available except through a pilot study of the bilateral repo market conducted by the OFR and the Federal Reserve with input from the Securities and Exchange Commission (SEC), though the OFR has stated that it plans to pursue a permanent collection of bilateral repo data.5

While several factors distinguish the tri-party and bilateral repo markets, one of the key distinguishing features is that the triparty infrastructure is explicitly a platform for general collateral (GC) repo transactions. The term "general collateral" means that the cash lender is not seeking a specific security as collateral, but is willing to receive any securities that fall within a broad class, such as Treasury securities. In a tri-party repo transaction an investor lends cash and receives securities allocated – typically via an automated algorithm – from a broad schedule of acceptable collateral for the duration of the loan. In the bilateral market, repo participants must agree on the specific securities used as collateral even if the cash lender is indifferent to the securities allocated to the trade. While bilateral repo transactions should trade at rates similar to other comparable GC rates if the counterparties are largely indifferent to the specific collateral used, the bilateral repo market is also used when cash lenders are actively seeking to obtain specific securities. Cash lenders in the bilateral market may seek to receive particular securities for many reasons, including improved collateral management, because they require securities with certain liquidity, or because they must deliver certain securities in another transaction. In some cases, these transactions trade "special," meaning that the underlying collateral is so desired that the cash-lending rate is significantly lower than a GC rate. But because all bilateral transactions specify the collateral securities, it is not possible to separately identify GC transactions from other types of bilateral trades.

Further Background on FICC Bilateral DVP Repo

FICC's DVP repo service is available to members of its Government Securities Division (GSD).6 As of December 2016, there are over 100 GSD members, made up largely of broker-dealers, but also including banks and government sponsored enterprises.7 The DVP repo service includes a sponsored members program, whereby registered investment companies can transact in DVP repo by submitting trades through a sponsoring member.8 Members and sponsored members are required to submit all eligible bilateral repo trades with other GSD members to FICC's DVP repo service.

In a same-day settling FICC DVP repo transaction, participants negotiate bilateral repos directly or through a broker, submit details of the trade to FICC, and settle transactions outside of FICC via Fedwire or on the books of the participants' designated clearing banks. In a FICC DVP repo trade the cash borrower must transfer the security specified in the trade ticket to the cash lender on the start leg of the repo; FICC is only involved in the exchange of cash and securities when the trade is unwound the following day. Overnight, FICC calculates each transaction participant's net delivery and receive obligations by security across all DVP repo transactions and other purchases and sales of Treasury securities. When the repo trade is unwound, each participant settles their net obligations directly with FICC.

The DVP Repo Market in Context

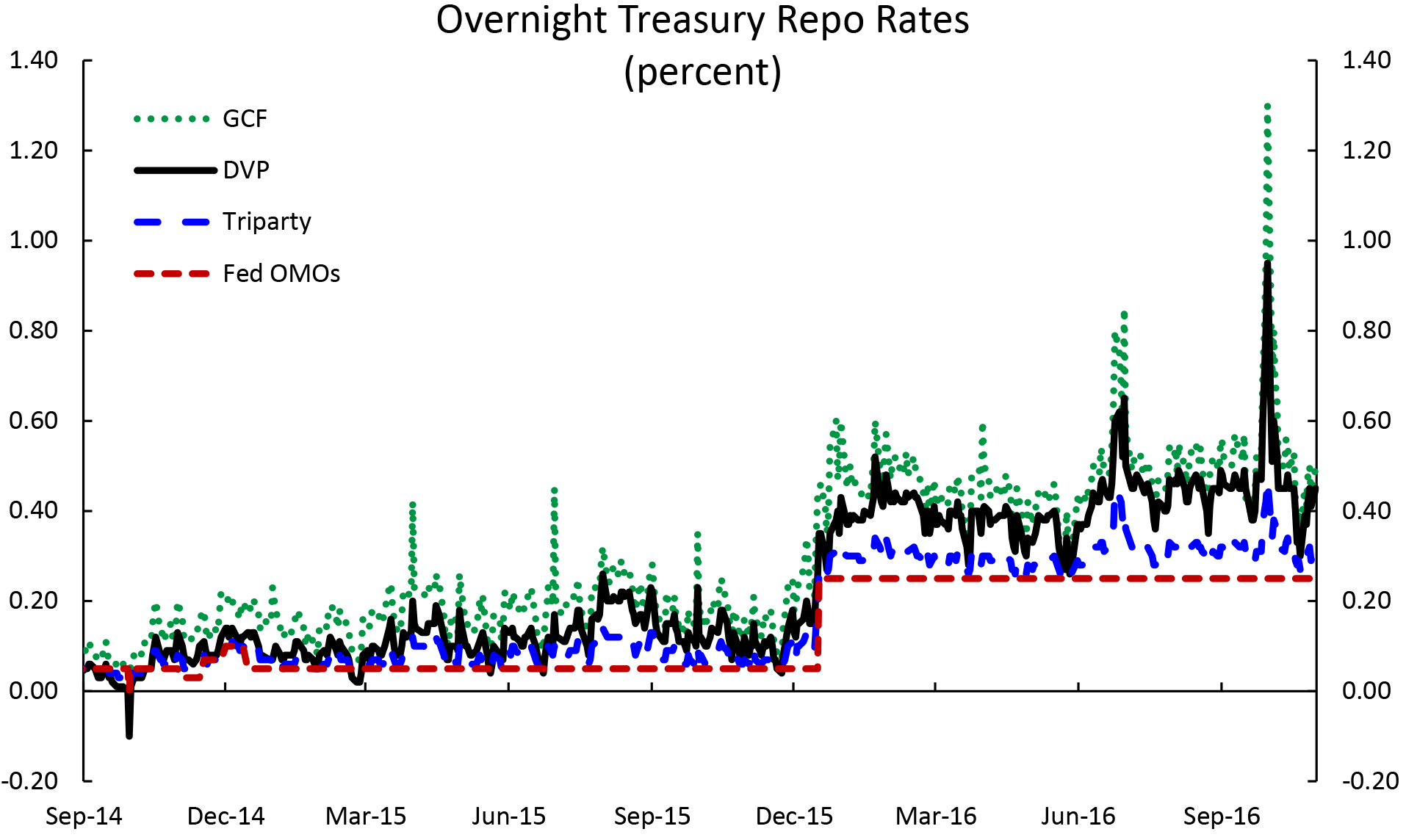

Figures 1 and 2 show the volume and volume-weighted median rate for same-day settling overnight FICC DVP repo transactions collateralized with Treasury securities (DVP repo) alongside the GC repo segments included in the rates that FRBNY and OFR have proposed publishing.9 Over the entire sample period, the average daily volume of DVP repo was $409 billion, compared to $406 billion across the other segments. The volume-weighted median DVP rate tends to be higher than the median tri-party ex GCF rate, and below the median GCF rate. Over the period in which the FOMC set the federal funds target range at ¼ to ½ percent (the period from December 17, 2015 to October 31, 2016 in our sample), the median DVP repo rate averaged 42 basis points, which is 11 basis points above the median tri-party rate and 6 basis points below the median GCF rate.

As noted above, DVP repo includes trades where the cash lender will accept any Treasury collateral (GC trades), as well as trades where the cash lender is seeking specific securities, and it is not possible to accurately separate GC repo trades from specials or other trades. At any time, a given Treasury security may trade special, however certain securities are more likely to trade special with greater frequency. In general, repo collateralized by on-the-run or first-off-the-run securities are less likely to represent GC activity, because the underlying collateral is actively traded in the Treasury cash market. These securities are often highly desired because they are so liquid, and they frequently trade "special" in the repo market, meaning that the cash lender is willing to receive a lower rate on lent cash in order to obtain a specific security, frequently for shorting, hedging, or for delivery to customers for other purposes.

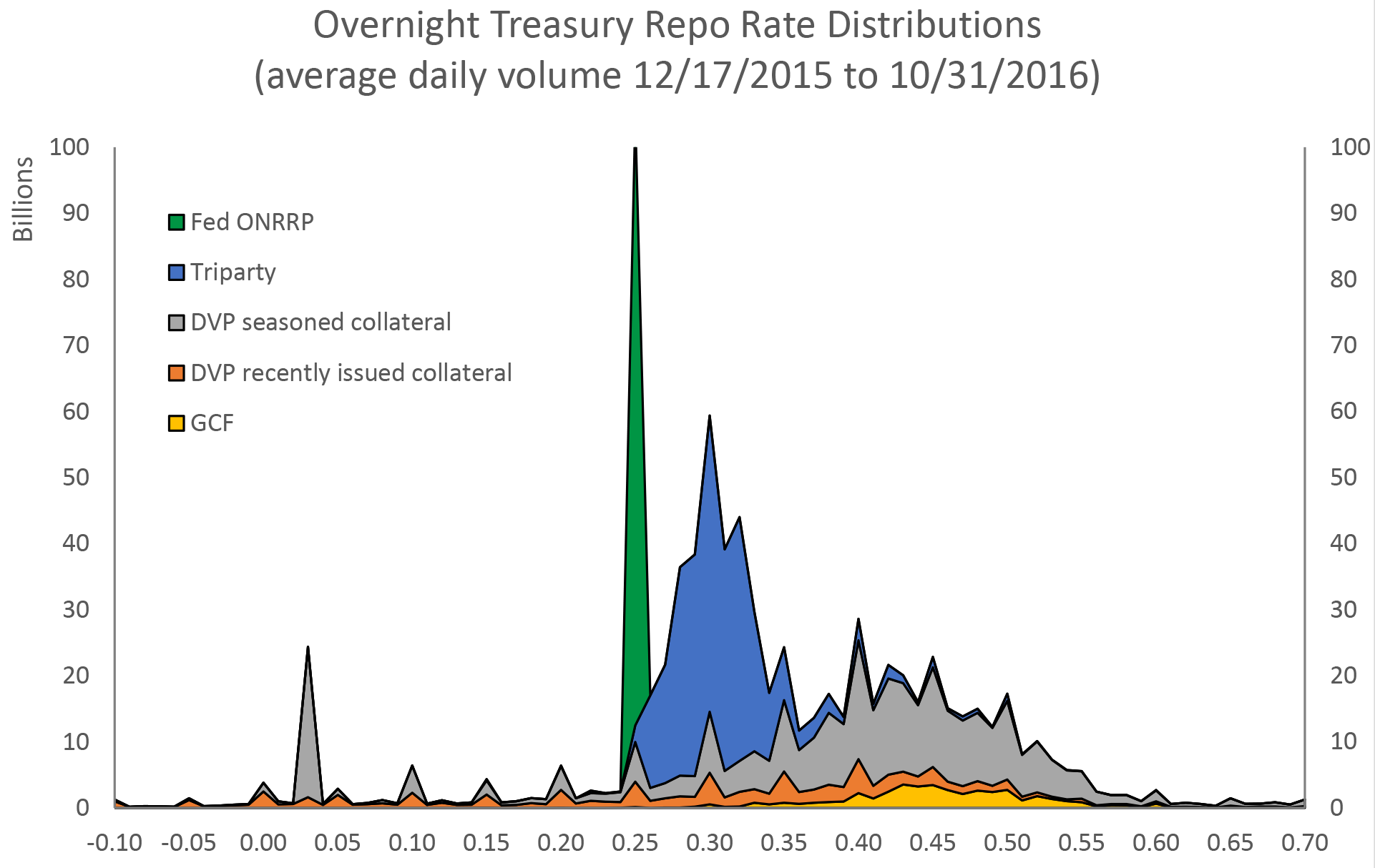

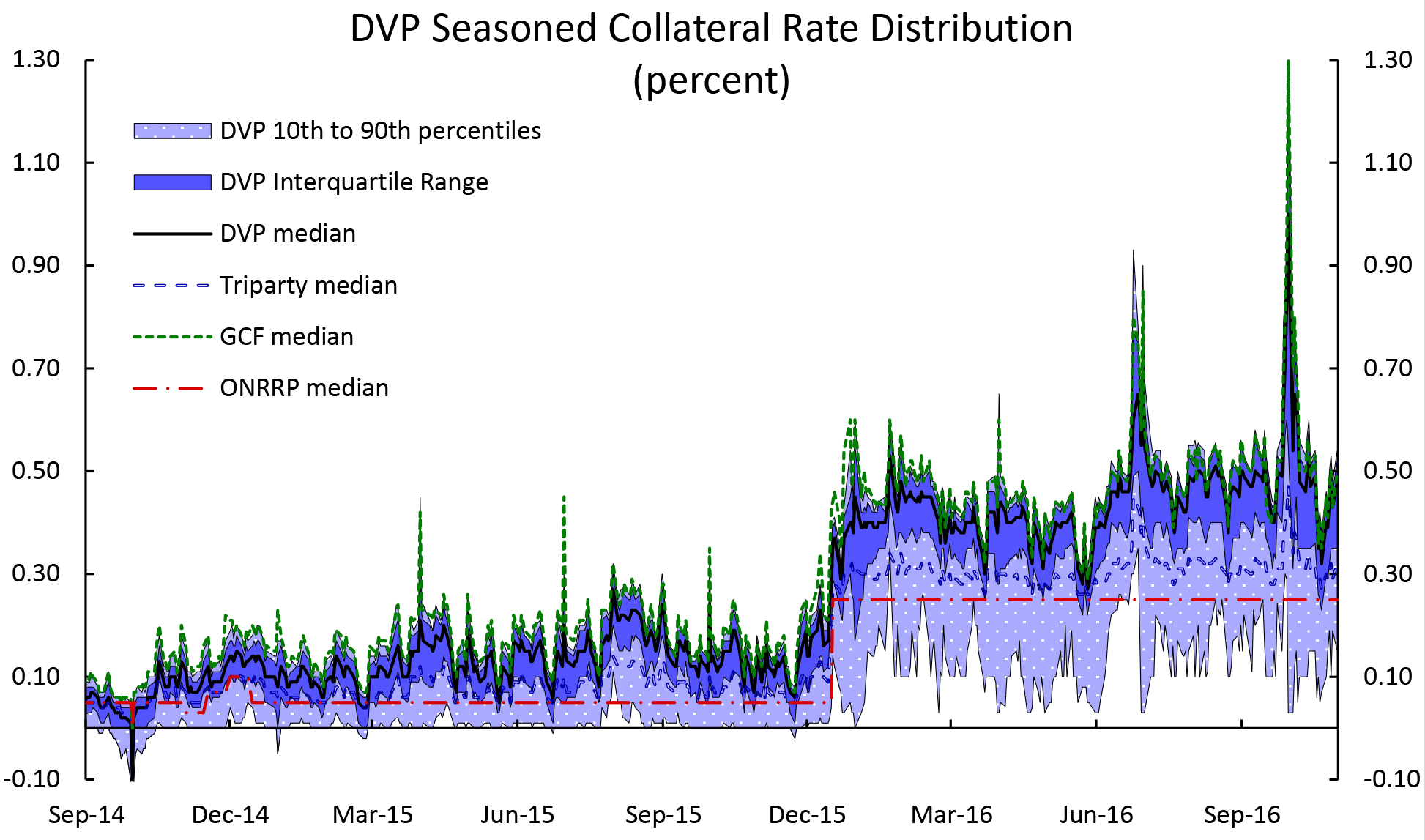

As specials do not reflect the prevailing cost of funding at a general collateral rate, it may be desirable to attempt to partially filter them out. Table 1 shows that simple filters such as removing on-the run and first off-the-run securities from the DVP data may be able to eliminate some specials trades, but by no means all such trades. The table shows summary statistics for DVP repo collateralized by both recently-issued (here defined as transactions collateralized by the on-the-run and first off-the-run Treasury securities) and seasoned Treasuries (defined as DVP trades collateralized by Treasury securities other than the on-the-run and first off-the run), alongside statistics for tri-party, GCF, and repos with the Federal Reserve. In terms of transaction volumes, seasoned DVP repo is the largest segment, followed by the tri-party ex. GCF segment. The seasoned DVP median rate is closest to the GCF median rate, but is slightly lower and less volatile. The similarity of the GCF and seasoned DVP repo rates is likely due to the fact that both GCF and DVP are largely inter-dealer markets where pricing is driven by the intermediation costs borne by dealers in facilitating transactions for other institutional investors in the repo market. DVP repo against recently-issued securities generally trades at lower rates than repo against seasoned securities. It also exhibits a larger share of trades below the Federal Reserve's offering rate on the overnight reverse repurchase program (ONRRP), which likely represents repo for securities that are in particularly high demand. (The Federal Reserve's ONRRP, which offered GC collateral against cash at a rate of 25 basis points during this time period, generally functions as a floor under GC repo rates). However, seasoned DVP repo also has a significant left tail, with many trades well below the ONRRP rate. This can be seen in Figure 3, which depicts the average rate distribution across all five segments of the repo market over this sample period. The proportion of trades at rates below the ONRRP rate also fluctuates substantially from day to day, as can be seen in figure 4 which shows the distribution of seasoned DVP rates over time.

(Average daily values Dec 17, 2015 to Oct 31, 2016)

| FICC DVP | Tri-party ex. GCF | GCF | Federal Reserve Trades | |||

|---|---|---|---|---|---|---|

| All | Recently Issued* | Seasoned* | ||||

| volume ($ billions) | $424 | $103 | $320 | $278 | $46 | $92 |

| standard deviation ($ billions) | $22 | $10 | $19 | $30 | $13 | $71 |

| median rate (basis points) | 42 | 27 | 44 | 31 | 48 | 25 |

| standard deviation (basis points) | 8 | 12 | 8 | 3 | 11 | |

| share above Federal Reserve ONRRP rate | 79% | 60% | 85% | 99.7% | 99.7% | |

* Recently issued includes DVP transactions using on-the-run and first-off-the-run collateral, while seasoned includes all other transactions. Return to table.

How inclusion of DVP repo could affect the proposed published rates

The statement ![]() announcing the proposed publication of three benchmark repo rates by the FRBNY in cooperation with OFR also noted that additional sources of data, such as information on bilateral repo transactions, could be incorporated into one or more of the rates over time. The overall volume of transactions in the proposed benchmarks would increase substantially by including the FICC-cleared DVP repo data. However, as currently designed, the benchmarks proposed by the FRBNY and OFR would measure the overnight Treasury GC repo market, and because the bilateral data include trades collateralized by specials, a reference rate that included them would no longer be just based on GC repo transactions. Excluding the on-the-run and first-off-the-run collateral trades eliminates some specials activity in the FICC DVP data, but it would be impossible to accurately filter out all of them and a significant volume of specific-issue trading would remain. That said, including cleared DVP repo data could create a more holistic view of the overall (triparty and bilateral) repo market, and could also prove helpful if repo activity were to move away from the triparty or GCF segments toward greater bilateral trading.

announcing the proposed publication of three benchmark repo rates by the FRBNY in cooperation with OFR also noted that additional sources of data, such as information on bilateral repo transactions, could be incorporated into one or more of the rates over time. The overall volume of transactions in the proposed benchmarks would increase substantially by including the FICC-cleared DVP repo data. However, as currently designed, the benchmarks proposed by the FRBNY and OFR would measure the overnight Treasury GC repo market, and because the bilateral data include trades collateralized by specials, a reference rate that included them would no longer be just based on GC repo transactions. Excluding the on-the-run and first-off-the-run collateral trades eliminates some specials activity in the FICC DVP data, but it would be impossible to accurately filter out all of them and a significant volume of specific-issue trading would remain. That said, including cleared DVP repo data could create a more holistic view of the overall (triparty and bilateral) repo market, and could also prove helpful if repo activity were to move away from the triparty or GCF segments toward greater bilateral trading.

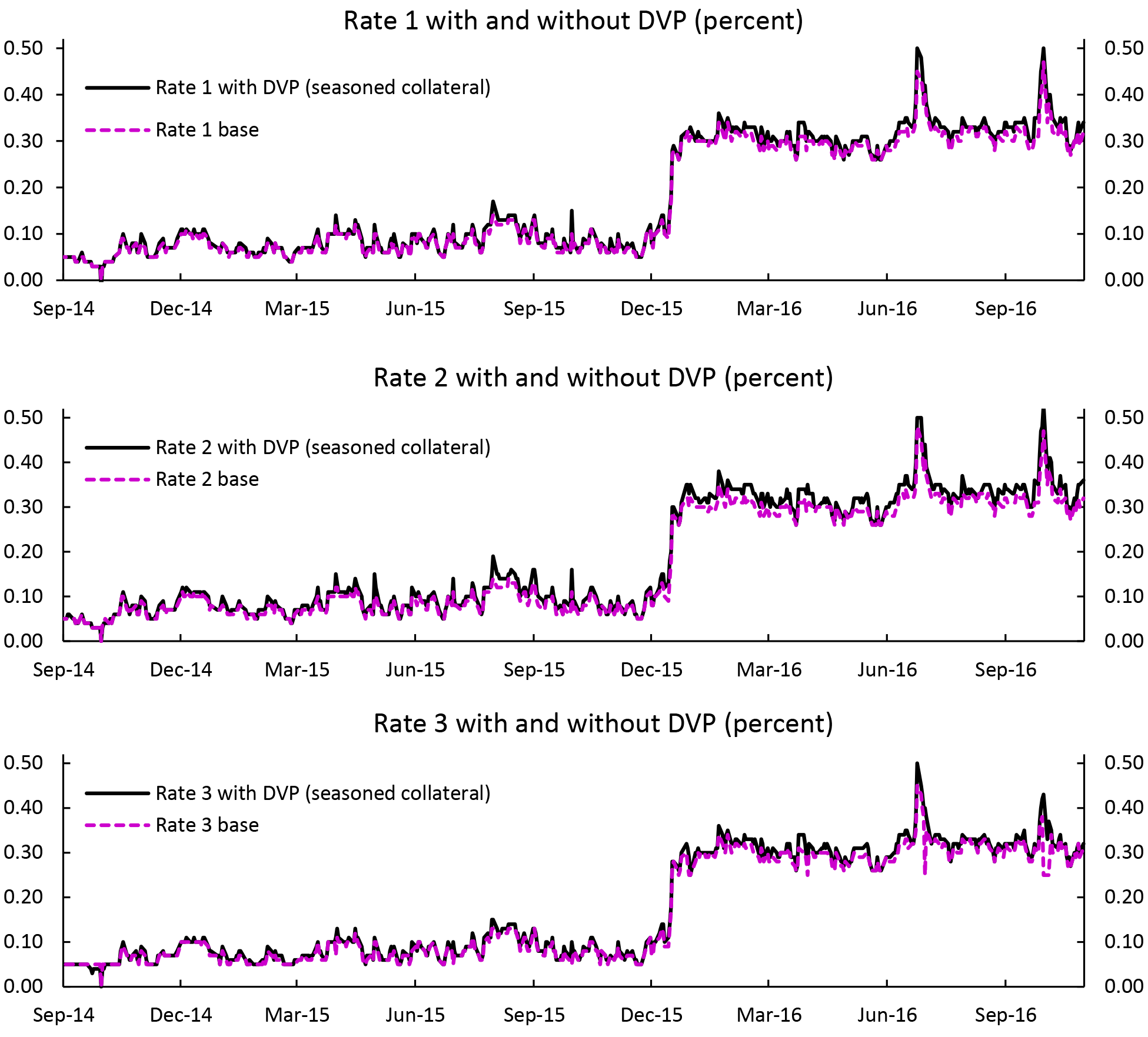

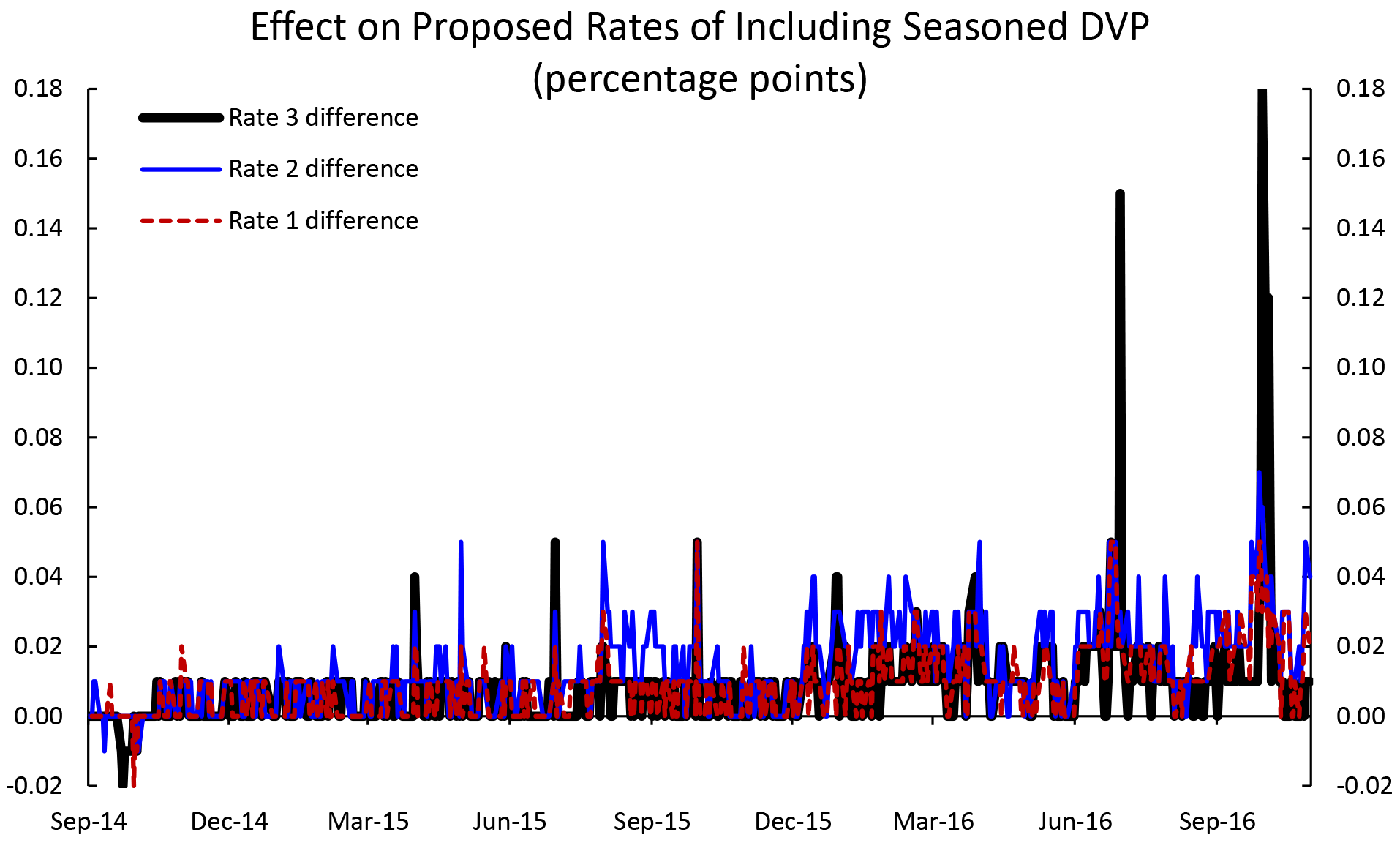

The proposed rates were, respectively, a rate based on the tri-party ex. GCF segment omitting any trades with the Federal Reserve (which we will call Rate 1), a rate based on tri-party trades, including GCF, but excluding trades with the Federal Reserve (Rate 2), and a rate including all triparty trades and trades with the Federal Reserve (Rate 3). Figure 5 plots these three proposed rates both including and excluding seasoned DVP repo (all rates are calculated as volume-weighted medians, as proposed in the FRBNY statement). As shown in Table 2, on average, the inclusion of seasoned DVP repo increases the proposed rates by 1 to 2 basis points over the sample period. The volatility of rates 1 and 2 increase slightly when DVP repo is included, while the volatility of rate 3 is about unchanged.

Figure 6 provides a closer look at how the rates change when seasoned DVP is included.10 The share of inter-dealer transactions trading at higher rates generally increases on quarter ends, and the inclusion of seasoned DVP repo tends to push up the proposed repo rates by 2-5 basis points. June 30 and September 30, 2016 were occasions when the inclusion of seasoned DVP repo trades caused a significant deviation in rate 3, the rate that includes trades with the Federal Reserve. On those dates, the rate 3 median fell to 25 basis points due to very large take up of the ONRRP. When seasoned DVP repo is included, the additional volume of DVP repos at higher rates prevented the overall median rate from falling by as much, providing some counterbalance to the large increase in trades with the Federal Reserve.

(Dec 17, 2015 to Oct 31, 2016)

| Rate 1 (Tri-party ex. GCF) |

Rate 2 (Tri-party including GCF) |

Rate 3 (Tri-party including GCF and Fed trades) |

||||

|---|---|---|---|---|---|---|

| Base rate | With seasoned DVP | Base rate | With seasoned DVP | Base rate | With seasoned DVP | |

| average volume ($ billions) | $278 | $598 | $324 | $644 | $416 | $736 |

| standard deviation of volume ($ billions) | $30 | $40 | $25 | $33 | $59 | $72 |

| volume-weighted median rate (basis points) | 31 | 32 | 31 | 33 | 30 | 31 |

| standard deviation of the median rate (basis points) | 3 | 4 | 3 | 4 | 3 | 3 |

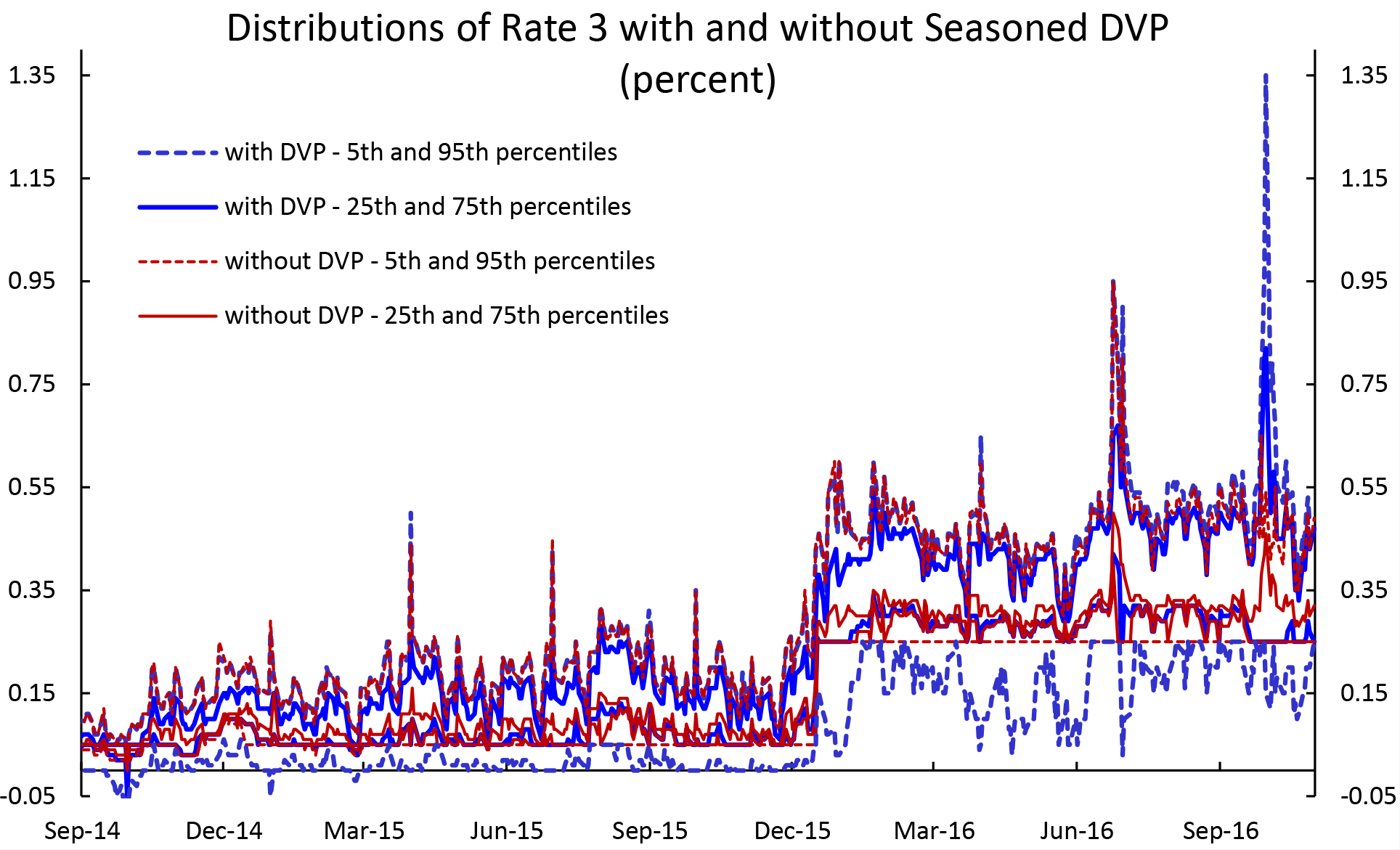

Although the inclusion of seasoned DVP data seems to introduce fairly small changes in the three proposed rates, given the greater dispersion in that data, it should be cautioned that this finding applies to the specific two-year sample obtained. The overall distribution of the DVP data is considerably more dispersed and volatile than the triparty data and could change over time. Figure 7 shows the evolution of the interquartile range and 5th and 95th percentiles of rate 3 over time when seasoned DVP data is excluded and included. Including the DVP data significantly increases the interquartile range and the range and volatility of the lower tail of the rate distribution. In an environment in which the proportion of specials trades increased, the impacts of including DVP data could be greater. The behavior of the rates could also depend on the filter used to exclude specials; the filter used here, excluding recently issued Treasury securities as collateral is far from perfect, but as noted above, it is unlikely that specials could ever be fully removed from the bilateral data. Finally, as was shown in Figure 3, including DVP would add to the complexity of the rate distributions. While the triparty ex GCF data are typically unimodal, adding bilateral data results in a distribution that is bimodal (or if ONRRP are also included, then potentially trimodal). This greater complexity could add to the overall volatility of the rates.11

*. We thank Laurie Krmpotich for excellent research assistance. Return to text

1. GCF Repo is a registered service mark of the Fixed Income Clearing Corporation. Return to text

2. JPMorgan Chase announced on July 21, 2016 that it would end its business as a clearing bank for broker-dealer government security services by the end of 2018. Return to text

3. Participants utilize tri-party accounts to allocate securities and cash to meet their GCF obligations. Return to text

4. GCF transactions are settled on the clearing banks' triparty platforms, where DVP repo can be settled on the clearing banks books, or through Fedwire Securities. To participate in FICC's GCF Repo service, participants must open a tri-party account at one of the clearing banks. Return to text

5. See "The U.S. Bilateral Repo Market: Lessons from a New Survey (PDF)," by Viktoria Baklanova, Cecilia Caglio, Marco Cipriani, and Adam Copeland, Office of Financial Research Brief Series 16-01, January 2016. Following the work of the pilot study, the OFR has stated that it intends to issue a data collection rule establishing a permanent collection of bilateral repurchase agreements and certain securities lending activity data (see the Minutes of the Financial Stability Oversight Council (PDF), September 22, 2016.). Return to text

6. See FICC's website for more information on the DVP repo service: https://www.dtcclearning.com/products-and-services/fixed-income-clearing/government-securities-division-gsd/dvp-service/dvp-repo-transactions.html Return to text

7. Registered investment companies such as mutual funds and money market funds have been eligible to become GSD members since 2014 with the adoption, after SEC approval, of a Tier Two Netting membership type for these firms. The Tier Two Netting membership provides a way for these firms to participate in central clearing without exposure to loss mutualization. Registered investment companies are prohibited from using GSD's GCF Repo Service. Return to text

8. The data we analyze in this note do not include these transactions. Return to text

9. For brokered DVP trades where the submitted buy- and sell-side repo rates where different as a result of brokers' fees, the midpoint is used in all rate calculations. Return to text

10. Although not shown, the inclusion of recently issued DVP along with seasoned DVP appears to have only minimal impacts on the volume-weighted median rates over this sample period, affecting the average and standard deviation of each rate by 1-2 tenths of a basis point. Return to text

11. For example, it may cause greater volatility in the median rate if small changes in trading activity caused the median to shift between modal points in the distribution. While in some cases use of trimmed mean might be preferable in such circumstances, use of a trimmed mean does not appear to have much impact on the rate calculation over this sample period. For example, use of trimmed mean rather than the median for rate 3 increases the calculated rate by 2-3 basis points and slightly raises its volatility. This may be because the bilateral data has a much shallower mode than the tri-party data over this period. Return to text

Please cite as:

Bowman, David, Joshua Louria, Matthew McCormick, and Mary-Frances Styczynski (2017). "The Cleared Bilateral Repo Market and Proposed Repo Benchmark Rates," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, February 27, 2017, https://doi.org/10.17016/2380-7172.1940.

Disclaimer: FEDS Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers.