FEDS Notes

January 6, 2017

College or the Stock Market, or College and the Stock Market?

Kartik Athreya, Felicia Ionescu, and Urvi Neelakantan

Human capital and stocks both provide rewards to those who invest in them, the former through higher future earnings and the latter through appreciation or dividends. The decision to invest in them depends on the relative rewards each asset offers. Investment in stocks requires financial resources, while investment in human capital also requires foregoing earnings from the time required for its acquisition. As a result, human capital is best invested in when one's outside earnings capabilities are low, and when one's horizon is long. This means that, in general, it is those who are both young and unskilled whom we expect to invest most in human capital.

What about investment in stocks? While older individuals and households who have completed their education can finance stock purchases with their earnings, the situation faced by the young is different. Because the young -- especially those engaged in heavy human capital investment -- have low earnings, they will need to borrow to finance any investment in stocks. However, even access to inexpensive credit may not be sufficient to induce them to borrow to finance stock purchases. This is because human capital investments steepen the path of future earnings, motivating individuals to bring forward some of these rewards by consuming more than they earn when young, rather than investing borrowed funds in stocks. These decisions made early in life will matter later as well, as individuals seek to channel human capital returns (earnings) into financial assets to prepare for retirement.

Investments in stocks and human capital also differ in an important way. Unlike stock returns, which do not vary across individuals, the returns to human capital depend on the characteristics of the investor, including their learning ability (which may be thought of as preparedness for learning arising from all forms of innate and environmental sources). Thus the relative reward -- and therefore the decision to invest in each form of wealth -- will vary across individuals.

It is plausible to expect that individuals' financial and human capital choices (i) vary inversely over their life-cycle, and (ii) vary across individuals, both of different ages and of any given age. Is this the case in the data, and can we explain the data as arising from the logic above? In this note, we document facts about the relationship between stock market participation and a predominant form of human capital investment -- formal higher education. We examine, using the Survey of Consumer Finances (SCF), the relationship between stock market participation and college enrollment and completion, with attention to the presence or absence of student loan debt. As to whether we can understand these facts, we conjecture that the data likely arise from the tradeoffs described above, and argue for a model that utilizes the standard theory of financial investment over the life-cycle but, importantly, allows for human capital investment opportunities reflective of the features of college.

The SCF is a survey of a cross-section of U.S. families conducted every three years by the Federal Reserve Board. It includes information about families' finances as well as their demographic characteristics. While the SCF provides rich detail about household finances, it is not a panel, so it does not enable us to directly observe the evolution of household portfolios over the life cycle. We therefore follow a methodology similar to [4] to create life-cycle profiles of participation in the stock market using cohort-level data. We label a household as participating in the stock market not only if their portfolio includes directly held stocks but also if their investments in mutual funds, IRAs/Keoghs, thrift-type retirement accounts and other managed assets include a positive amount of equity.

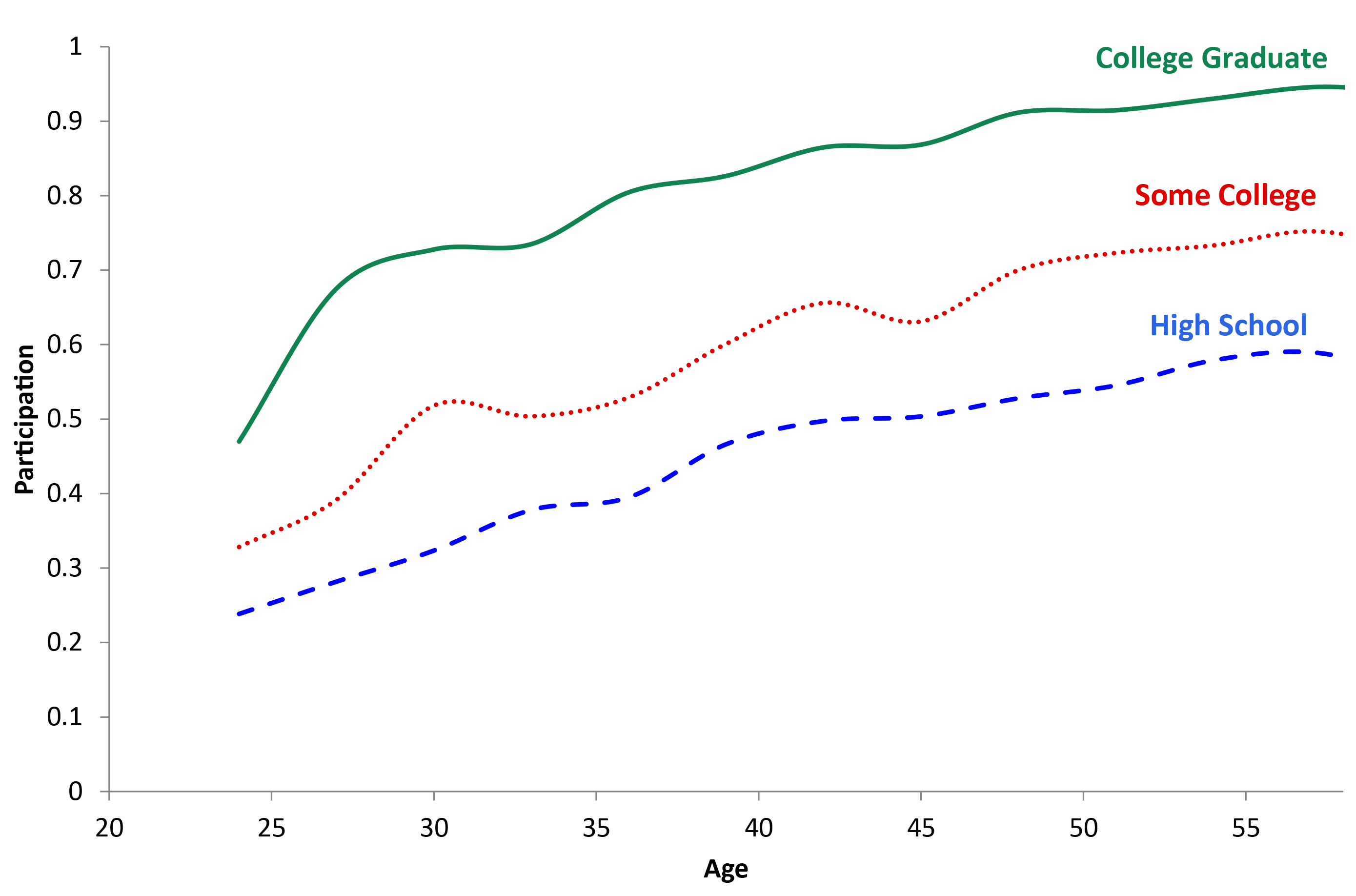

We divide our sample into three groups based on their highest level of educational attainment: those with only a high-school degree, those with some college education but no college degree, and those with a college degree. We run standard probit regressions as in [4] separately for each education group and use the resulting coefficients to construct our estimates of the life-cycle profile of stock-market participation for each group. The results are reported in Figure 1 for the 1973–1975 birth cohort. Participation rates increase with age and are quite distinct by educational attainment.

|

|

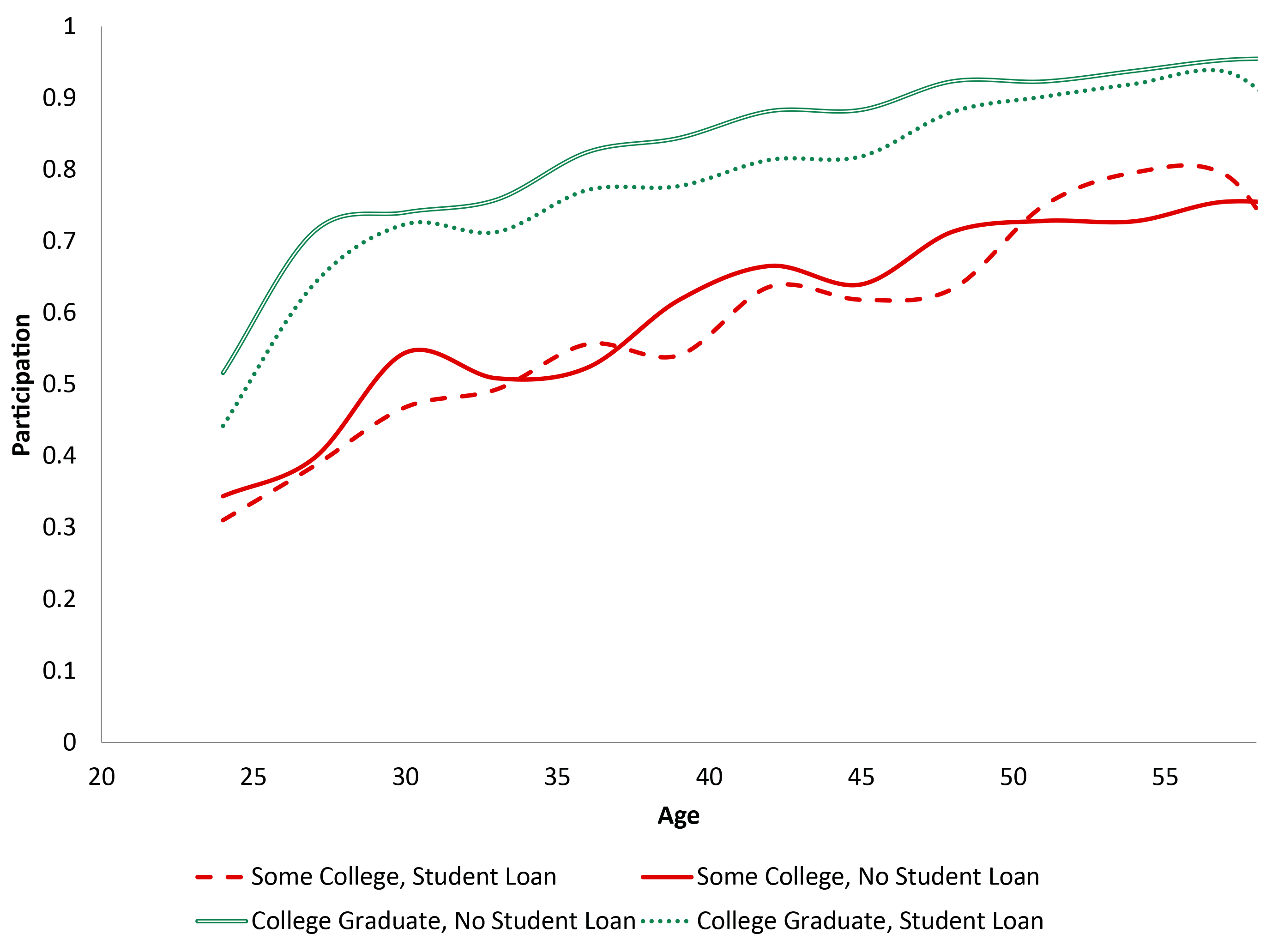

Next, we study the relationship between student loans and stock market participation. We restrict attention to individuals with some college experience, i.e., college graduates and individuals with some college education but no degree. We divide each of these two groups by student loan status. Individuals with student loans are those who report having a positive student loan balance. We create life-cycle profiles of stock market participation by educational attainment and student loan status by running probit regressions as described earlier for each of these sub-groups. Figure 2 presents the results for the 1973-1975 birth cohort. Among college graduates, those without student loans participate at consistently higher rates than those with student loans, although the difference is not large. Among those with some college but no degree, participation rates by student loan status overlap.

|

|

To summarize, our data analysis reveals two clear facts regarding the relationship between college investment and stock-market participation over the life cycle:

- There is a direct relationship between educational attainment and stock-market participation -- at every age, stock market participation is higher among those with higher educational attainment. In addition, those with higher educational attainment increase their stock market participation at a faster rate, especially early in life.

- College graduates without student loans participate in the stock market at slightly higher rates over the life cycle than those who have student loans. Interestingly, there is no difference in participation rates by student loan status for those with some college education but no degree.

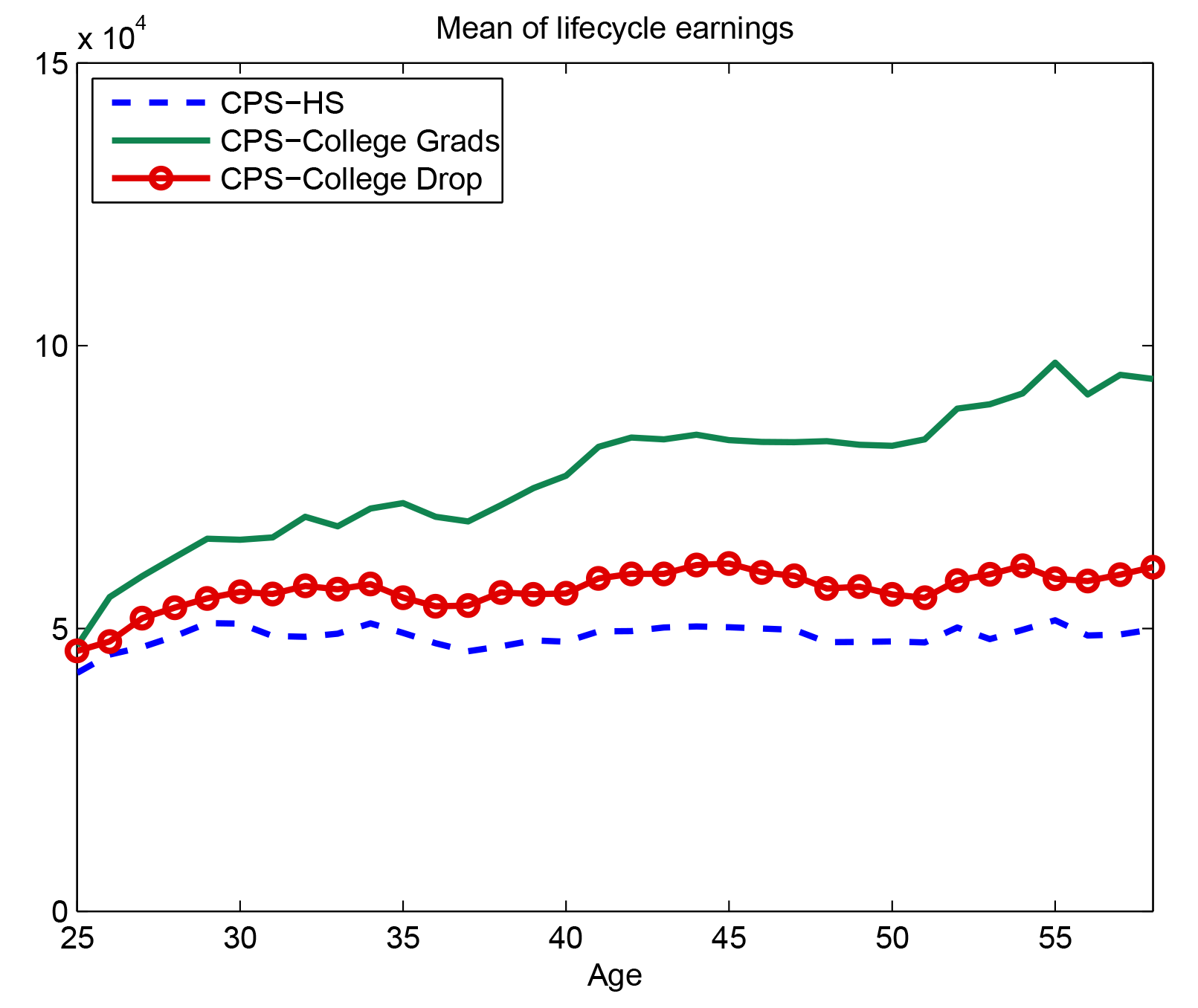

We will now flesh out why a standard theory of human capital and financial portfolio investment can explain the patterns described above, at least qualitatively. Our argument relies on the premise that human capital investment both increased and steepened the path of earnings over the life cycle. While well-documented elsewhere, Figure 3 demonstrates that this is indeed a fact in the data we employ. To construct this figure, we use the Current Population Survey (CPS) and adopt a synthetic cohort approach. That is, we compute mean earnings for those who were age 25 in 1969, age 26 in 1970 and so on till 2002 for each of the three education groups: high school (those with 12 years of schooling), some college (those with at least 12 years but less than 16 years of completed schooling) and college graduates (those with at least 16 years of completed schooling). Observe that college graduates have higher levels of earnings and steeper profiles over the life cycle than individuals with some college and high-school graduates.

Notice the parallels between earnings and stock market participation. The levels and slopes of both profiles are higher for college graduates than for the other two education groups. We now turn to the intuition from standard theory that is consistent with these patterns.

3 Intuition from a model of human capital investment and household portfolio choice

As suggested in the introduction, human capital and financial investment decisions likely "crowd each other out" and thus occur at different times in the life-cycle, varying both over the life cycle of any given individual and across individuals of any given age. A formalization of this intuition -- though not in a model capable of addressing the observed relationship between financial investment, college enrollment, and student loans -- comes from a standard model of household portfolio choice, augmented to include a human capital investment decision modeled as in [3]. In the model, developed in [1], households choose how to allocate any savings they accumulate between a risky asset (stocks) and a risk-free asset (bonds). The risk-free asset can also be used to borrow. In addition, households choose to divide their time between working (earning) and human capital accumulation (learning). The latter has an opportunity cost in terms of foregone current earnings, but leads to higher expected future earnings. Agents differ in their learning ability, initial endowment of human capital, and initial wealth.

In this setting, human capital is valued in the labor market and the returns to human capital accumulation are decreasing. Thus, those with low human capital (the young) have a low opportunity cost and high marginal returns to investing time in learning. The young also have a longer time horizon over which to recoup the returns on this investment in the form of higher earnings in the future. As a result, young households choose to spend time investing in human capital rather than working. Therefore, their current earnings are low and they anticipate higher earnings in the future. If such gains are sure enough, most will seek to improve their well-being in the near term, in anticipation of future earnings. This is the standard notion of "consumption smoothing" and will lead most who do borrow to use the proceeds to finance consumption rather than to finance stock purchases early in life. As households age, they then spend "less time learning and more time earning" and eventually begin saving (for retirement, bequests, and rainy days, e.g.), including in stocks. This explains both why stock market participation is low early in life, and why it increases over the life cycle. However, as noted at the outset, households almost certainly vary in their incentives to invest in human capital, and therefore in their incentives to participate in the stock market. This heterogeneity likely underlies the varied decisions to pursue higher education after high school and to invest in stock markets later in life across even apparently similar individuals.

In examining the connection between human capital investment via college and financial investment behavior, we note first that those who accumulate sufficient human capital while in college successfully graduate while those who do not drop out. This has implications for the path of earnings for the three levels of educational attainment as illustrated in Figure 3. As a consequence of their high learning ability and accumulated human capital, college graduates have the steepest and highest path of earnings. Conversely, by the same reasoning, those who have completed no more than high school, and college non-completers have flatter and lower earnings because they may have not accumulated as much human capital.

The logic of our model suggests that these differences in human capital investment incentives and earnings across education groups have direct implications for stock market participation by educational attainment, as illustrated in Figure 1. College graduates, anticipating a steeper path of earnings over the life cycle, have a steeper profile for stock market participation. This follows from the consumption smoothing argument described earlier. The other two education groups, having not accumulated sufficient human capital early in life, continue investing in human capital for a relatively longer period over the life cycle. This is a standard feature of models such as ours; see, for example, [2]. As a result, their stock market profiles remain relatively low and flat.

Having argued that human capital investment depresses stock market participation, we now examine whether the presence of student loans exacerbates this effect. As seen in Figure 2, for those who have completed college, this is indeed the case: stock market participation rates are slightly lower for those with student loans than for those without. There is a more puzzling pattern, at least at first glance, for college non-completers: the presence or absence of student loans is not a primary factor influencing participation. This could be an artefact of the data, but it is also plausible that the relatively low levels of human capital accumulation and an expected path of low and flat earnings dissuade participation irrespective of whether debt levels are high. This, taken together with the observation that participation rates for college graduates (both with and without student loans) are far higher than the rates for college non-completers, suggests that any effect of student loans is secondary to the effect of human capital investment on stock market participation.

To conclude, our analysis suggests that human capital investment, especially when that investment takes the form of formal education, may have important effects on financial portfolios throughout life. Our future research analyzes these issues in a model that includes a rich characterization of formal education financed using student loan debt.

References

[1] Kartik Athreya, Felicia Ionescu, Urvi Neelakantan: "Stock Market Investment: The Role of Human Capital", Federal Reserve Bank of Richmond Working Paper WP 15-07R, 2015.

[2] Felicia Ionescu: "The Federal Student Loan Program: Quantitative Implications for College Enrollment and Default Rates", Review of Economic Dynamics, pp 205-231, January 2009, Vol. 12, http://dx.doi.org/10.1016/j.red.2008.09.004.

[3] Y. Ben-Porath: "The Production of Human Capital and the Life-cycle of Earnings", Journal of Political Economy, pp. 352-365, 1967.

[4] James M Poterba, Andrew A Samwick: "Household portfolio allocation over the life cycle", National Bureau of Economic Research, 1997.

Please cite as:

Athreya, Kartik, Felicia Ionescu, and Urvi Neelakantan (2017). "College or the Stock Market, or College and the Stock Market?," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, January 6, 2017, https://doi.org/10.17016/2380-7172.1900.

Disclaimer: FEDS Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers.