Vacants to Value: Baltimore’s Market-Based Approach to Vacant Property Redevelopment

Baltimore City has 16,000 vacant and abandoned buildings.1 These properties are a highly visible and potent symbol of disinvestment, and they represent one of the worst drags on Baltimore's social and economic vitality. Redeveloping these properties in a way that targets scarce resources and investment to build on local market strengths has become a critical aspect of Baltimore's efforts to stabilize and revitalize its neighborhoods.

Last winter--despite a depressed homeownership market, declining public subsidy, and limited capital availability--more than 600 people packed a Baltimore auditorium to hear about a new, market-based approach to redeveloping vacant and uninhabitable buildings in the city. Mayor Stephanie Rawlings-Blake, Housing Commissioner Paul Graziano, and senior housing officials had expected to introduce their new initiative--Vacants to Value (V2V)--to a small group of developers and community partners. Instead, they met with an overflow audience that responded to their plans with optimism and a sense of readiness.

This article discusses Baltimore's new initiative, which relies heavily on targeted housing code enforcement to foster redevelopment of vacant properties in areas where there is private investment interest in housing and uses streamlined disposition processes to transfer properties to private developers. It also examines the city's creation and use of a data infrastructure that makes possible a nuanced but ambitious approach to vacant property redevelopment. This approach requires accurate, real-time assessments of the condition of and market for individual houses and their surrounding properties.

Baltimore's Prior Efforts to Address Vacant Properties

Over the last 50 years, Baltimore has lost nearly one-third of its population.2 The exodus has left the city with roughly 16,000 vacant buildings, about 25 percent of which are city-owned.3

Vacant and abandoned buildings are a blight on neighborhoods that invite crime, pose risks to public health and safety, and, of course, reduce property values. In short, these properties hurt the stability and vitality of neighborhoods, and their presence can make neighborhoods that are already struggling less appealing to prospective homeowners and investors.

Baltimore has tried various approaches over the years to address vacant properties and, in the process, has developed some critical data tools (see box 1) to inform its strategies. But like other cities, Baltimore--and the state of Maryland--had focused local, state, federal, and private resources on the city's lowest-income communities.

Box 1. Early Data Tools in Baltimore's Fight Against Vacant Properties

Over the years, Baltimore has made significant strides in its efforts to understand the scope of the vacancy problem. Early on, it recognized the need for data to inform its approach to redeveloping vacant and abandoned properties, and two data tools provided critical resources that helped the city develop a strong data infrastructure.

The Vacant House File

Since the 1970s, the number and geographic location of Baltimore's vacant houses have been tracked using the city's "Vacant House File," a database ancillary to the city's real property database. This file was an inventory of every vacant property identified by the city's Code Enforcement office.

The data was maintained on a mainframe computer and informed city planning and redevelopment efforts. A single data programmer manipulated the data for analysis and use by other city staff. By the late 1980s, Vacant House File data could be downloaded to disks and was more readily and widely available to city agencies. However, information was not real-time--the file was updated monthly but relied on the paper records of the Code Enforcement office.4

CityStat

In 1999, newly elected Mayor Martin O'Malley brought ComStat to Baltimore. ComStat is an innovative crime-analysis system pioneered in New York City. Baltimore's mayor quickly recognized that it could be used to profile virtually every city dynamic that demands a response from government--from the dumping of bulk trash to housing conditions. He named his entire framework CityStat.

CityStat made collecting and analyzing data a citywide priority. City agencies were compelled to quickly identify sources of existing data or collect new data, quantify their services, measure results, and track trends.5

CityStat moved Baltimore forward in its use of data to inform policy and program decisions. Because agencies relied largely on internal data sources and the city's existing Geographic Information Systems (GIS) capacity, costs were minimal. CityStat has now been used by three mayors. It has evolved from a tool that forced a new way of doing business on public agencies to a tool for interagency collaboration and tracking complex issues and city services now and over time.6

1. Steve Janes (assistant commissioner, Research and Compliance, Baltimore Department of Housing and Community Development), interview, August 27, 2011. Return to text

2. Bill Ballard (president, LocationAge LLC), interview, August 4, 2011. Return to text

3. Ballard interview, August 4, 2011. Return to text

Although the city had achieved some impressive successes, particularly with respect to the redevelopment of public housing and the creation of hundreds of new homes for very low-income renters and homeowners, those results had come at an enormous cost in taxpayers' dollars. Moreover, these approaches could not be replicated at a scale needed to address the city's thousands of vacant houses. And, because they were targeted to areas where there was ongoing population loss and steeply declining housing values, the achievements of these approaches were eclipsed by ongoing housing abandonment. Thus, despite the use of federal and state tools to leverage private investment, the income-restricted, project-based approach had failed to stimulate new residential markets.

The Move toward Market-Based Redevelopment

Increasingly, public and private community development advocates and funders began to turn their attention to "transitional," mixed-income communities where, it seemed, with modest public investment, housing and commercial markets could be stabilized and private funds could and would sustain redevelopment activity. Market-driven redevelopment yielded impressive results in several neighborhoods. It seemed clear to advocates that different neighborhoods--whose residential markets could vary block by block--needed different reinvestment tools to maximize their potential.

The city had data that could be used to assess residential market conditions, but it lacked both a framework for aggregating and applying the data and an analytic tool to compare conditions in neighborhoods across the city.7 City housing and planning staff worked with The Reinvestment Fund (TRF), which had developed an analytic and spatial residential-market profile in Philadelphia (TRF's Market Value Analysis approach is detailed elsewhere in this compilation in the article by Goldstein).

Creation of a Neighborhood Typology

Baltimore's work with TRF resulted in the city's "Neighborhood Typology"--a categorization of city residential markets at the census block-group level--in 2005. This typology defined five market categories: competitive, emerging, stable, transitional, and distressed. A second, updated typology was completed in 2008, and a third is expected to be finished in 2011.

The third typology will define similar market categories and be based on the same area characteristics as the previous iteration: house sales, foreclosures, concentrations of subsidized housing, percentage of commercial land, single family homes, homeownership rates, vacant homes, and vacant lots.

Typology and the Market-Based Approach

The typology enables the city to distinguish market conditions and investment potential by neighborhood, and even block by block. By mapping vacant properties across the typology, the city can assess the capacity of a given vacant property or group of properties to attract private investment. The city then uses this assessment to determine if and how V2V might restore the property to active use.

The Vacants to Value Initiative

Jump to:

V2V presents a blueprint for redeveloping the many thousands of vacant properties located in areas the city has determined have viable real estate markets that, with limited public activity, can attract private investment, be rehabbed, and re-occupied. In these areas, the city expects a private property owner to be able either to sell his property unimproved or, after investing to make it habitable, be able to rent or sell it.8

V2V also emphasizes using private market forces, rather than public capital, to target approximately 700 vacant properties located in weak market areas. Investments in these areas will be on a large enough scale--encompassing at least a city block--to catalyze additional private investment. These projects will incorporate mixed-income housing development. V2V acknowledges that it cannot rid Baltimore of all its vacant houses. Instead, it targets investment to clusters of vacant property near functioning markets or seeks to leverage substantial resources that will lead to sustainable improvements.

The idea is that by targeting a reasonable amount of investment to real estate markets that have some existing strengths, the city might be more likely to restore healthy market conditions than by following a "worst-first" approach that simply allocates resources to the areas with the highest vacant property rates (for a fuller discussion of this concept, see the Pettit and Kingsley article in this publication as well as the Goldstein article).

Targeted, Citation-Based Code Enforcement

V2V's central strategy is the use of targeted code enforcement in areas of the city identified as having relatively strong investment markets. Efforts to negotiate with property owners to achieve housing code compliance are followed by the issuance of rapidly escalating citations for noncompliance. The initiative uses citations to compel owners of vacant properties in these areas to make them habitable or sell them to buyers who will do so.9

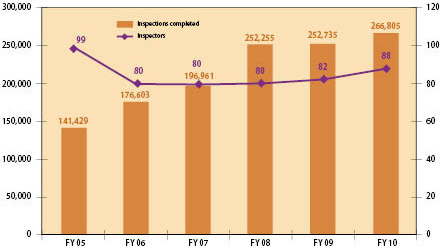

By switching code enforcement in areas with market strength from a litigious to a citation-based process, V2V expects more immediate action from noncompliant property owners. With a litigation model, to correct a violation as simple as peeling paint could take several months, and in the interim, a nuisance property would continue to contribute to neighborhood decay. With targeted citation, coupled with automated systems and new performance-based personnel practices, Baltimore Housing's Code Enforcement Division has dramatically increased the number of citations it issues and expedited owner actions to address long-vacant, blighted properties (see figure 1). Because code enforcement is most aggressive in areas with functioning housing markets, owners should be able to support the cost of property improvements, and in cases when they cannot, the markets are stable enough to support the sale of the property.10

Source: Baltimore Department of Housing and Community Development, Code Enforcement Division, 2011.

Redevelopment Strategies Based on Property and Market Traits

Depending on the characteristics of a property or parcel and the market strength of the area--whether the market comprises a city block or an entire neighborhood--V2V deploys one or more of the following redevelopment strategies:11

- Using new code enforcement processes to trigger rehabilitation where there are small numbers of vacant properties and abandonment is minimal

- Facilitating "development clusters" and "whole block" solutions by coordinating city investment and services for committed, capitalized developers in areas with market strength

- Targeting homebuyer and developer incentives

- Supporting large-scale development in distressed areas

- Maintaining, demolishing, holding, and promoting non-housing uses for properties unlikely to be redeveloped in the near-term

Streamlined Processes for Property Disposition

One key barrier that has plagued past city efforts to redevelop vacant properties has been a slow and cumbersome property-disposition process. To overcome this hurdle, the city streamlined the process of disposing of vacant properties. It also strengthened its efforts to market vacant properties, which now include use of a dedicated website and Facebook page.12

Components of V2V's Data Infrastructure

Jump to:

The salient aspects of the V2V initiative--real-time tracking of vacant properties, categorization of markets, establishment of new city policies and procedures, and identification of specific investment activity at a block or neighborhood level--all depend on a constant flow of data from a wide range of sources, ongoing data analysis, and the management resources and technology necessary to organize, maintain, and use the data. Accurate, up-to-date, and usable data give the city an important tool to redevelop vacant, uninhabitable properties using strategies nimble enough to respond to the discrete geographies and markets of individual properties. Baltimore uses a variety of data and imaging resources to make V2V possible.

Code Enforcement Database

In Baltimore, housing code inspectors are the first to officially identify and record vacant properties. Once they deem a property "vacant and uninhabitable," they record it in the housing department's code enforcement database. Each of the city's approximately 8,000 blocks is numbered, as is each parcel on every block. The blocklot number is the property's unique identifier and provides a simple way to integrate and map data from many sources.13

The Code Enforcement Division's internally created Computerized Housing Inspection Process (CHIP) thoroughly documents the status of a vacant house and includes inspection dates, descriptions of the building's condition, photographs, citations, and ownership information.14

Real Property File

The Real Property File is the backbone of Baltimore's vacant property data system.15 The Real Property File is not a file per se but a massive compilation of multiple databases, largely related to the management of property taxation--the largest single source of city revenue. The Real Property File contains comprehensive information about a specific property parcel, ranging from where the property tax bill is sent to the square footage of the lot. Because it underlies the city's property tax system, it is well-maintained and up-to-date. Its data come from disparate sources and include the legal, geographical, zoning, assessment, and tax-billing characteristics of each parcel.16

Land Acquisition Database

Created to manage the city's purchase of vacant properties, the City of Baltimore Land Asset Manager (CoBLAM) organizes the elements of property acquisition and disposition processes and exports them to Excel spreadsheets, which helps make analyzing and using the data easier. Some elements of CoBLAM are autopopulated from the Real Property File, which increases the standardization of information. CoBLAM tracks the several thousand properties the city owns as well as those it is likely to acquire through condemnation, tax sale foreclosure, or for future development. It also generates and populates legal documents needed to acquire or dispose of property.17

GIS: HousingView and CityView

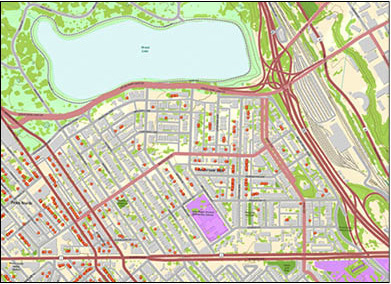

City government has assembled two GIS-based management tools that allow a user a look at a wide array of variables on any city block. HousingView is posted on the city's intranet and includes tenancy status, assessments, house sales, public or private ownership, inspection districts, and other housing-related attributes for every property parcel in the city (for example, see figure 2, which plots the location of vacant buildings in the city's Reservoir Hill neighborhood). It is used often to look at block and neighborhood development conditions and opportunities.18

Source: Baltimore City Enterprise Geographic Information Services.

CityView is modeled after a tool developed in Boston and has both an internal and public version. Like HousingView, it stores a great deal of information that can be easily accessed at the parcel, block, and neighborhood levels. Using web-based mapping, Baltimore employees can access housing-related information on the city's intranet, as well as information from myriad city agencies pertaining to city services and local assets.

The public version of CityView is available via the city's government website at http://cityview.baltimorecity.gov/CityView ![]() . Although not as comprehensive as the internal version, the public CityView provides easy access to city information for residents, visitors, researchers, and individuals doing business in Baltimore.19

. Although not as comprehensive as the internal version, the public CityView provides easy access to city information for residents, visitors, researchers, and individuals doing business in Baltimore.19

Aerial Photography

City staff frequently use aerial photography to complement and verify data and other property characteristics. The city has purchased Pictometry, which provides oblique imagery--showing building faces and sides as well as roofs and footprints--and supplements its visual images with key information, including parcel measurements. Pictometry's multiple dimensions are especially useful for vacant property acquisition and disposition decisions because they allow staff to see the current conditions of properties from their offices, eliminating the need for lengthy trips to the field. City staff also use free web-based aerial photography sources as a supplemental way to verify information.20

Census Data

Like their counterparts across the United States, Baltimore's Housing and Planning agencies make frequent use of census data--especially to map demographic and economic data at the block group and tract levels. The challenge of using census data is often the disconnect between tract and block group boundaries and the boundaries a city relies upon--such as neighborhoods, natural boundaries, and councilmanic districts--to organize and disseminate data. To improve the usability of the 2000 census, the city and other local institutions contracted with the Census Bureau to provide a wide range of census indices corresponding to the boundaries of Baltimore's 272 neighborhoods.21

Data Reconciliation

In a large city like Baltimore, the vacant house inventory changes every day, and achieving real-time data requires concerted effort. In addition, the use of a single, comprehensive database--versus using multiple, loosely connected databases--decreases the likelihood of inaccuracies.

Baltimore Housing's research staff have found a variety of tools to test their data and to resolve discrepancies across disparate data sources. They rely heavily on creative ways of using quantitative data that the city already has access to via water bills and tax mailings, as well as qualitative on-the-ground knowledge of city staff. For example, staff have estimated a threshold of water use below which a property is deemed unoccupied, and they check the city's quarterly water bills over two quarters to help confirm long-term vacancies.22 Pictometry and other aerial photography are also used to confirm what data indicate.23

Data Creators and Managers: The Foundation for a Sound Infrastructure

Baltimore has not quantified the costs of creating its data infrastructure, but staff and contractors alike agree it has been far lower than the cost of paying for the development of new software or hardware. In fact, beyond an early investment in GIS, the city has made only limited investment in technology, and, aside from the information provided by aerial photography, nearly all data collected already existed in a city database or file. The cost of developing the neighborhood typology framework was less than $150,000.24 A small group of consultants provides most of the additional technical expertise the city needs.

The city has built its infrastructure on data and information that all cities maintain in some form. What sets Baltimore apart with respect to the use of data to wrestle with vacant properties is the work its staff have done to

- determine the barriers to widespread vacant house redevelopment;

- recognize the information needed to support widespread redevelopment;

- identify useable, practical information sources;

- develop new frameworks to gather, aggregate, organize, and manage disparate information; and

- dedicate efforts to assure information is up-to-date and accurate.

Baltimore has assembled a remarkable team of staff and contractors who have brought exceptional professionalism, discipline, and resourcefulness to the task of mitigating the city's vacant house problem. They work at various levels and in various units of the city bureaucracy. They have legal, planning, and other professional expertise; years of experience with urban housing issues; and many have a long tenure with the city. They know Baltimore well--from its administrative, policy, and development processes to the essential characteristics of every city neighborhood. V2V is undergirded by market-based principles and a well-utilized data infrastructure, but its success depends on the people who created and will maintain it.

About the Authors

Ellen Janes is the Federal Reserve Bank of Richmond's senior manager for community development. She works with public and private partners to increase opportunity and investment in low- and moderate-income communities throughout the Federal Reserve's Fifth District. Before joining the Richmond Fed in 2008, Janes worked as state director to U.S. Senator Barbara Mikulski and as assistant secretary for neighborhood revitalization for Maryland's Department of Housing and Community Development. She lives in Baltimore with her husband and two children.

Sandra Davis is an outreach intern for the Community Development Department at the Federal Reserve Bank of Richmond, where she assists the senior manager for community development with a variety of work including research, writing, and event planning. Davis is a graduate student at the University of Maryland and will complete her Masters of Community Planning in May 2012. She hopes to pursue a career in community development upon graduation.

1. Baltimore City is an independent city, distinctly separate from the surrounding Baltimore County; data from Baltimore City Vacant Property File, September 2011. Return to text

2. 1960 and 2010 U.S. Census. Return to text

3. Baltimore City (2010), "Mayor Announces 'Vacants to Value' Plan to Reduce Blight," press release, November 3, www.baltimorecity.gov/OfficeoftheMayor/NewsPressReleases/tabid/66/ID/691/Mayor_Announces_Vacants_to_Value_Plan_to_Reduce_Blight.aspx. ![]() Return to text

Return to text

4. Steve Janes (assistant commissioner, Research and Compliance, Baltimore Department of Housing and Community Development), interview, August 27, 2011. Return to text

5. Bill Ballard (president, LocationAge LLC), interview, August 4, 2011. Return to text

6. Ballard interview, August 4, 2011. Return to text

7. Bill Ballard (president, LocationAge LLC), interview, August 4, 2011. Return to text

8. Michael Braverman (deputy commissioner, Code Enforcement, Baltimore Department of Housing and Community Development), interview, September 8, 2011. Return to text

9. Braverman interview, September 8, 2011. Return to text

10. Braverman interview, September 8, 2011. Return to text

11. See "Nuts and Bolts of V2V" at http://static.baltimorehousing.org/pdf/V2VNutsBolts1.pdf. ![]() Return to text

Return to text

12. Julia Day (deputy commissioner, Land Resources, Baltimore Department of Housing and Community Development), interview, August 10, 2011. The website and Facebook page can be found at www.baltimorehousing.org/vacants_to_value ![]() and www.facebook.com/pages/Baltimore-Housing-Vacants-to-Value-Initiative/174594812563039

and www.facebook.com/pages/Baltimore-Housing-Vacants-to-Value-Initiative/174594812563039 ![]() , respectively. Return to text

, respectively. Return to text

13. Braverman interview, September 8, 2011. Return to text

14. Braverman interview, September 8, 2011. Return to text

15. Steve Janes (assistant commissioner, Research and Compliance, Baltimore Department of Housing and Community Development), interview, August 27, 2011. Return to text

16. Ballard interview, August 4, 2011. Return to text

17. Day interview, August 10, 2011. Return to text

18. Day interview, August 10, 2011. Return to text

19. Day interview, August 10, 2011. Return to text

20. Brenda Davies (social policy and program analyst, Baltimore Department of Housing and Community Development), interview, August 3, 2011. Return to text

21. Davies interview, August 3, 2011; and Steve Janes, interview, August 3, 2011. Return to text

22. Davies interview, August 3, 2011. Return to text

23. Davies interview, August 3, 2011. Return to text

24. 21 Janes interview, August 27, 2011. Return to text