Large Institution Supervision Coordinating Committee

The Federal Reserve Board (the Board) established the Large Institution Supervision Coordinating Committee (LISCC) Program in 2010 based on lessons learned from the 2007–09 global financial crisis that revealed deficiencies in how large, systemically important firms had been supervised. These lessons underscored the need for the supervision of the largest firms to be more forward-looking, consistent, and informed by analysis from multiple perspectives and disciplines, including experts on payments, financial markets, consumer protection, and financial stability. The LISCC Program coordinates the Federal Reserve's supervision of large financial institutions that pose the greatest risk to U.S. financial stability.

Key elements of the LISCC Program include

- focus on U.S. financial stability as well as individual firm safety and soundness;

- incorporation of Federal Reserve Systemwide, multidisciplinary perspectives in determining supervisory priorities and execution of the supervisory program;

- use of both firm-specific and "horizontal" examinations focusing on similar firms in all core areas of the supervisory program;

- forward-looking assessments of firms' resiliency through stress testing; and

- integration of multiple sources of data and information to identify and explore risks and trends in the portfolio.

While the core business of supervision is common across all firms, the size, complexity, and systemic nature of firms supervised by the LISCC Program require a centralized, coordinated, and unified approach to the LISCC supervisory program. Consistent with the Consolidated Supervision Framework for Large Financial Institutions (LFI), the LISCC Program was created to fulfill three primary objectives:

- enhance the resiliency of LISCC firms to lower the probability of their failure or inability to serve as a financial intermediary;

- reduce the impact on the financial system and the broader economy in the event of a LISCC firm's failure or material weakness; and

- provide information to Federal Reserve decisionmakers about issues and vulnerabilities at LISCC firms that could have an adverse impact on the broader financial system and economy.1

To meet these objectives, the LISCC Program, under the oversight of the Vice Chair for Supervision

- develops and implements a supervisory plan informed by the financial and economic environment as well as firm-specific circumstances;

- conducts horizontal and firm-specific examinations and monitoring;

- assigns supervisory ratings;

- makes recommendations to the Board regarding enforcement actions; and

- makes recommendations related to each LISCC firm's resolution plan and advises other supervisory portfolios on resolution and recovery matters.2

Currently, eight U.S. bank holding companies are included in the LISCC Program:3

- Bank of America Corporation

- The Bank of New York Mellon Corporation

- Citigroup Inc.

- The Goldman Sachs Group, Inc.

- JP Morgan Chase & Co.

- Morgan Stanley

- State Street Corporation

- Wells Fargo & Company

This list of firms subject to the LISCC Program will be updated if it changes.

LISCC Program Structure and Governance

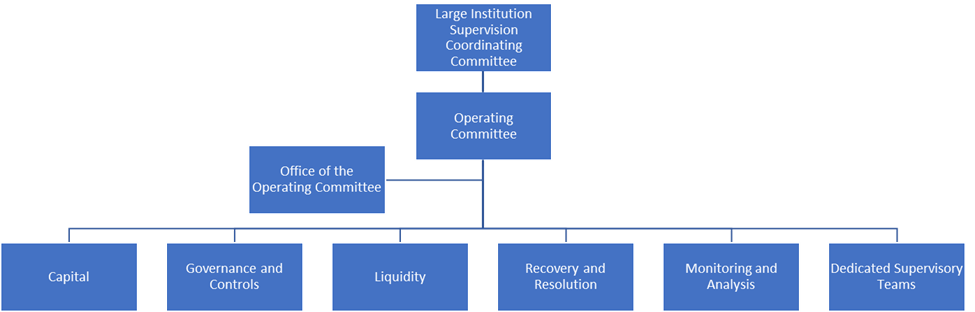

The LISCC Program consists of the LISCC, the LISCC Operating Committee, five portfolio programs (Capital, Governance and Controls, Liquidity, Recovery and Resolution, and Monitoring and Analysis), a Dedicated Supervisory Team (DST) for each supervised firm, and the Office of the Operating Committee (OOC). The LISCC Program structure is depicted in figure 1.

The LISCC Program is a Federal Reserve Systemwide program, staffed by individuals from multiple Federal Reserve Banks and the Board. Day-to-day supervision of LISCC firms is carried out by the DSTs and the LISCC portfolio programs. Given the size, complexity, and systemic nature of LISCC firms, the LISCC Program incorporates multiple perspectives, including disciplines such as payments, financial stability, and consumer affairs.

Large Institution Supervision Coordinating Committee

The LISCC is a multidisciplinary body that oversees the LISCC Program. It is composed of the Vice Chair for Supervision; senior officers from across the Federal Reserve System, including several Reserve Bank heads of supervision; and numerous division directors at the Board. The Director of the Division of Supervision and Regulation (S&R) at the Board serves as LISCC chair in close collaboration with the Vice Chair for Supervision to lead the LISCC.

LISCC Operating Committee

The LISCC Operating Committee (OC), in consultation with the LISCC and the Vice Chair for Supervision, is responsible for setting priorities for and overseeing the execution of the LISCC supervisory program. These responsibilities include but are not limited to (1) setting the strategic direction of the LISCC Program; (2) recommending ratings and enforcement actions; (3) overseeing the effectiveness of the DSTs and LISCC portfolio programs; (4) ensuring that the LISCC Program has sufficient and well-allocated resources, and efficient and controlled processes; and (5) promoting a culture that enables the LISCC Program to be effective.

The OC is multidisciplinary and composed of senior officers from several Reserve Banks and the Board, which helps ensure that a diverse set of perspectives are factored into supervisory assessments for LISCC firms. The OC chair is appointed by the S&R Director at the Board and is a senior officer in the Division of Supervision and Regulation at the Board. The OC chair is accountable for decisions made by the OC.

Programs

The LISCC Program is organized around five portfolio programs:

- Capital

- Governance and Controls

- Liquidity

- Recovery and Resolution

- Monitoring and Analysis

Capital, Governance and Controls, and Liquidity are aligned with the three components of the LFI supervisory rating framework. These three areas determine whether a banking organization has sufficient strength and resilience to maintain safe and sound operations through a range of conditions. There is also a distinct program for Recovery and Resolution Preparedness and a non-assessment program focused on Monitoring and Analysis.

Each LISCC portfolio program is overseen by a steering committee, which is led by co-chairs from a Reserve Bank and the Board. Steering committees are responsible for (1) making recommendations to the OC regarding ratings, supervisory planning, enforcement actions, emerging risks, and resource allocation; (2) directing and overseeing day-to-day supervisory activities; and (3) quality control of processes, products, and outcomes; and (4) overseeing performance management of Program staff. Steering committees are multidisciplinary and composed of officers from across the Federal Reserve System which helps ensure that a diverse set of perspectives are factored into supervisory assessments for LISCC firms.

Staff within the LISCC portfolio programs and on DSTs are responsible for maintaining detailed knowledge of the activities and risk-management practices that pertain to their area of risk. LISCC portfolio program staff leverage supervisors' expertise and cross-firm knowledge to assess individual LISCC firms and identify emerging trends across the industry. LISCC portfolio program staff execute horizontal examinations and monitoring work and participate in firm-specific examinations, while maintaining a cross-firm understanding of their area of focus.

The Capital Program assesses the effectiveness of each LISCC firm's capital planning processes and the sufficiency of its capital positions through horizontal and firm-specific examinations and monitoring activities. The primary horizontal examination, the Comprehensive Capital Analysis and Review (CCAR), focuses on firms' capital planning practices, including assessing the reliability of each firm's stressed capital projections, the controls around those projections, and the governance of each firm's internal capital adequacy assessments. CCAR and other examinations are tailored to the most material risks that could affect the capital of each LISCC firm (e.g., credit, market, and all financial risks other than liquidity) and aim to support a complete assessment of the effectiveness of each firm's capital planning practices and risk management. The Capital Program Steering Committee oversees the issuing and closing of capital-related supervisory findings for a given firm and initially vets each LISCC firm's capital ratings and findings communicated in supervisory letters to firms.4 Conducted at least annually, the assessment of the holding company Capital Planning and Positions rating is primarily based on Capital Program supervisory work as well as examination findings of other prudential regulators, as appropriate.

The Governance and Controls (G&C) Program conducts horizontal and firm-specific exams and monitoring activities that support the effective functioning of a firm's board of directors, management of business lines, and independent risk management and controls. Examinations with respect to management of business lines, independent risk management and controls, and internal audit focus on how well risk is identified, measured, monitored, and controlled. Non-financial risks, such as compliance, operational resilience, cybersecurity, and information technology, are also covered by the G&C Program. The G&C Program Steering Committee oversees the issuing and closing of governance and controls-related supervisory findings and initially vets each LISCC firm's governance and controls rating and findings communicated in supervisory letters to firms. Conducted at least annually, the assessment of the holding company governance and controls rating is based on G&C Program supervisory work, related work undertaken in the Capital, Liquidity, and Recovery and Resolution Preparedness Programs as well as examination findings of other regulators, as appropriate.

The Liquidity Program assesses the effectiveness of each LISCC firm's liquidity risk-management practices and the sufficiency of its liquidity positions through horizontal and firm-specific examinations and monitoring activities. The Comprehensive Liquidity Analysis and Review is the body of horizontal examination work conducted each year that focuses on assessing each firm's internal liquidity stress tests and certain liquidity risk management capabilities. The Liquidity Program also conducts independent quantitative analyses of the sufficiency of each firm's liquidity positions as well as firm-specific examinations. The Liquidity Program Steering Committee oversees the issuing and closing of liquidity-related supervisory findings and initially vets each LISCC firm's liquidity rating and findings communicated in supervisory letters to firms. Conducted at least annually, the assessment of the holding company's Liquidity Risk Management and Positions rating is primarily based on Liquidity Program supervisory work as well as examination findings of other prudential regulators, as appropriate.

The Recovery and Resolution Preparedness (RRP) Program assesses the effectiveness of each LISCC firm's preparedness for recovering from a severe stress and for being resolved upon failure in an orderly manner without threatening financial stability. RRP coordinates the Federal Reserve's horizontal review of the resolution plans that the LISCC firms are required to submit under title I of the Dodd-Frank Act, which culminates in joint determinations by the Board and the Federal Deposit Insurance Corporation (FDIC). RRP also coordinates with other prudential and resolution authorities. The work of the program is overseen by the RRP Steering Committee.

The Monitoring and Analysis Program (MAP) leverages a wide network of resources and information to identify and explore new issues and emerging risks affecting LISCC firms. The results of these efforts inform supervisory planning, prioritization, and policymaking, and facilitate risk awareness across the other LISCC portfolio programs and the dedicated supervisory teams. MAP also coordinates in-depth explorations and analyses of select topics raised through the risk identification process. In contrast to the other LISCC portfolio programs, MAP does not conduct assessments of firms, vet ratings, or issue supervisory findings. The MAP Steering Committee directs and oversees the research and sharing of information gathered by the program.

Dedicated Supervisory Team (DST)

The LISCC Program maintains a DST for each LISCC firm. The DSTs assist on horizontal examinations involving their firms, execute firm-specific examinations, and conduct monitoring in coordination with the LISCC portfolio programs. The DSTs maintain a broad understanding of the safety and soundness of their assigned firm, and recommend supervisory plans, ratings, and enforcement actions. The position of LISCC DST lead is periodically rotated to support examiner independence and provide for breadth of experience.5

Each DST examines, monitors, and assesses the safety and soundness of a given LISCC firm from a firm-specific perspective. The DSTs maintain deep knowledge of each LISCC firm’s strategy, risk profile, governance, and risk-management and control functions. They work closely with the LISCC portfolio programs and are responsible for developing and bringing an integrated firm-specific perspective to supervisory planning, assessments, monitoring, and discussions. Each DST serves as the primary Federal Reserve supervisory contact for the firm and communicates supervisory messages, including supervisory ratings and assessments.

Each DST works closely with its counterparts at other supervisory agencies, including the Office of the Comptroller of the Currency (OCC), the FDIC, the Consumer Financial Protection Bureau (CFPB), the Securities and Exchange Commission (SEC), relevant state supervisors, and foreign supervisors. The DSTs chair supervisory colleges to help coordinate global supervision of the LISCC firms (see the Coordination and Continuing Education section for the description of supervisory colleges).

The DSTs are overseen by a committee of Reserve Bank senior officers, who are responsible for overseeing the DSTs in each Federal Reserve district where a LISCC firm is headquartered. This committee helps to ensure that the DSTs maintain a well-supported, holistic view of their firms. The committee also provides oversight and direction to the DSTs related to supervisory ratings, supervisory planning, examination and monitoring output, hiring, and succession planning.

Office of the Operating Committee (OOC)

The OOC provides support for the LISCC Program as well as operational direction and guidance to promote the program's effectiveness, efficiency, quality, consistency, and compliance with Federal Reserve standards. The OOC is composed of functional areas covering communications, human resources, technology and reporting, operations, quality control, and a secretariat function. The OOC is led by the LISCC Program's Chief Operating Officer.

Quality Management

The LISCC Program has high operating standards and strives for continuous improvement. To help ensure that the program is meeting those standards, it is subject to multiple quality management processes:

- Quality Control (QC) is embedded in the LISCC Program to promote consistency between processes and operational expectations.

- The Quality Assurance (QA) function conducts independent reviews designed to ensure that all aspects of the LISCC Program are following established quality standards and processes. Unlike quality control activities, QA is performed after supervisory activities have been completed and final reports and other products have been issued. The QA function is independent of the LISCC Program.

- The LISCC Oversight Section (LOS) provides an independent annual assessment of the efficacy of the LISCC Program to the Board S&R Director based on reviews conducted throughout the year. The LOS reports up through the Board S&R Deputy Director of Operations.

LISCC Program Manual

The Large Institution Supervision Coordinating Committee Program Manual describes the structure, governance, supervisory process, and communication methods the Board of Governors of the Federal Reserve System undertakes when supervising large, systemically important firms.

Supervision and Regulation Report

The Supervision and Regulation Report summarizes banking conditions and the Federal Reserve's supervisory and regulatory activities, in conjunction with semiannual testimony before Congress by the Vice Chair for Supervision. For examples of LISCC exam work in the report, see:

"LISCC Contingency Funding Plan Review"

"Cybersecurity remains a high priority."

"The Archegos Default: Addressing Gaps in Risk Management"

1. See SR 12-17/CA 12-14, "Consolidated Supervision Framework for Large Financial Institutions," at https://www.federalreserve.gov/supervisionreg/srletters/sr1217.htm. Return to text

2. See 12 C.F.R. pt. 243, Resolution Plans (Regulation QQ), which applies to each firm subject to the LISCC Program and establishes rules and requirements regarding the submission and content of a resolution plan, as well as procedures for review by the Board and the Federal Deposit Insurance Corporation (FDIC) of a resolution plan, at https://www.ecfr.gov/current/title-12/chapter-II/subchapter-A/part-243. Return to text

3. See SR 20-30, "Financial Institutions Subject to the LISCC Supervisory Program," at https://www.federalreserve.gov/supervisionreg/srletters/sr2030.htm for a full definition of the categories of financial institutions that are subject to the LISCC Program. The above list of firms will be updated as appropriate with any changes. Return to text

4. See SR 13-13/CA 13-10, "Supervisory Considerations for the Communication of Supervisory Findings," at https://www.federalreserve.gov/supervisionreg/srletters/sr1313.htm. This SR letter applies to all supervisory findings wherever described. Return to text

5. To support supervisory independence, a DST lead's term is generally limited to five years or less. Return to text