FEDS Notes

February 21, 2018

Student Loan Debt and Aggregate Consumption Growth

This note was revised on March 1, 2018 to add clarification to Figure 2.

Between 2001 and 2016, the real amount of student debt owed by American households more than tripled, from about $340 billion to more than $1.3 trillion. The increase largely reflects an acceleration in student loan originations that was mainly due to a surge in college enrollment and ongoing increases in real tuition levels.1 The expansion of student loan borrowing, and the associated increase in post-college student loan debt service, has raised concerns that this borrowing is constraining consumption and economic growth. Although student debt service is undoubtedly a source of severe financial strain for some individuals, in this discussion we show that the direct effect of increased student debt service on aggregate consumption growth is likely small. We also argue that indirect--and hard-to-quantify--channels, such as the effect of student loan debt on access to credit or debt aversion, are probably small as well, but we cannot rule out that these channels could hold down consumption more meaningfully.

It is important to emphasize that as long as student loans are leading to better educational outcomes, the increase in student loan originations over the past couple of decades could be associated with a positive effect on consumption growth. Indeed, the existing literature suggests that, on average, college graduates have substantially higher incomes than high school graduates and that this income differential may be rising over time.2 Nevertheless, the average returns to education mask substantial heterogeneity, and there is a concern that the increase in student loan originations since 2001 (and especially during the Great Recession) was concentrated among students who received little value from their additional education.3 Moreover, continued increases in tuition costs since the Great Recession contributed to a rise in post-college debt payments that might have outpaced any education-related gains in income. Given these concerns, we explore an extreme scenario of what the negative effects of the loans could be had there been no positive effect of increased education on borrowers' incomes.4

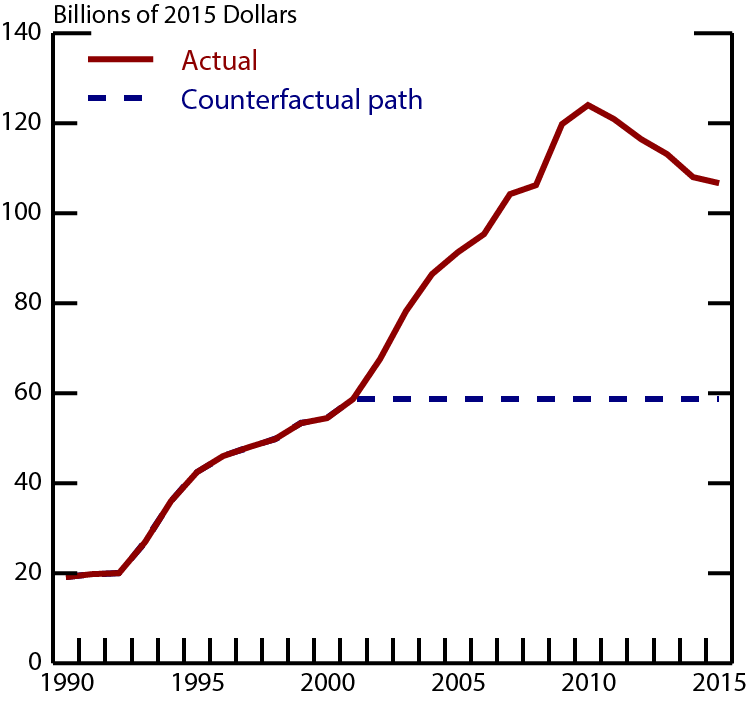

The most direct way in which increased student loan debt could hold back consumption is by increased debt service payments crowding out household spending. Had student loan originations stayed at their 2001 level of roughly $60 billion in real terms per year (the blue dotted line in Figure 1) through the end of the 2015–16 school year, we estimate that annual debt service payments would have been $50 billion lower by 2016--representing 0.3 percent of personal income.5 Even if we assume (in the spirit of our upper bound) that those debt payments held back household consumption dollar‑for‑dollar, the drag on real GDP growth would be less than 0.05 percentage point in any year since 2001.6

Source: College Board "Trends in Student Aid" Table 1.

Although increases in debt payments since 2001 appear to have had, at most, only a small direct effect on consumption, increased student loan debt could hold back consumption through other indirect channels. First, high levels of student loan debt may increase debt-to-income ratios or reduce credit scores, so some borrowers may lose access to other types of loans, such as mortgages and auto or credit card loans. Curtailed access to credit more broadly could potentially reduce aggregate consumption growth beyond the level estimated earlier. There is evidence that student loan borrowers in their mid-20s who are saddled with greater student debt delay their first home purchases, in part because of reduced access to mortgages (Mezza et al., 2016). However, homeownership by itself does not boost consumption if a household simply converts from rental to ownership in the same size and quality unit. Moreover, even if a reduced homeownership rate is associated with reduced spending on housing services and home-related durables, the small number of affected households suggests that this effect is not large in the aggregate.7 Although access to auto loans also could be curtailed by student loan debt, higher student loan debt does not appear to lower the likelihood of purchasing a vehicle (Kurz and Li, 2015). Finally, reduced access to credit card loans might hold back consumption for some borrowers, although there is no available evidence to our knowledge that we can lean on to quantify this channel.

Second, student loan borrowers with more debt are more likely to move in with their parents (Dettling and Hsu, 2014). Although this behavior is likely driven by their high debt service payments--which we already accounted for--the reduced rate of household formation may independently also trigger further reductions in consumption if householders tend to consume more, perhaps because of expenditures on home-related durables and home maintenance, than those living at home. Nevertheless, given the small stock of affected borrowers, this effect should not considerably reduce aggregate consumption.8

Third, borrowers may have psychological responses to debt that could affect consumption. In particular, if borrowers are especially averse to debt, they may choose to curtail consumption to repay their student loans more quickly. Available evidence points to the existence of debt aversion in different settings, suggesting this mechanism might play some role in reducing consumption (Loewenstein and Thaler, 1989, Thaler, 1992, Field, 2009, Palameta and Voyer, 2010, Dynan, 2012, or Mian et al., 2013).9

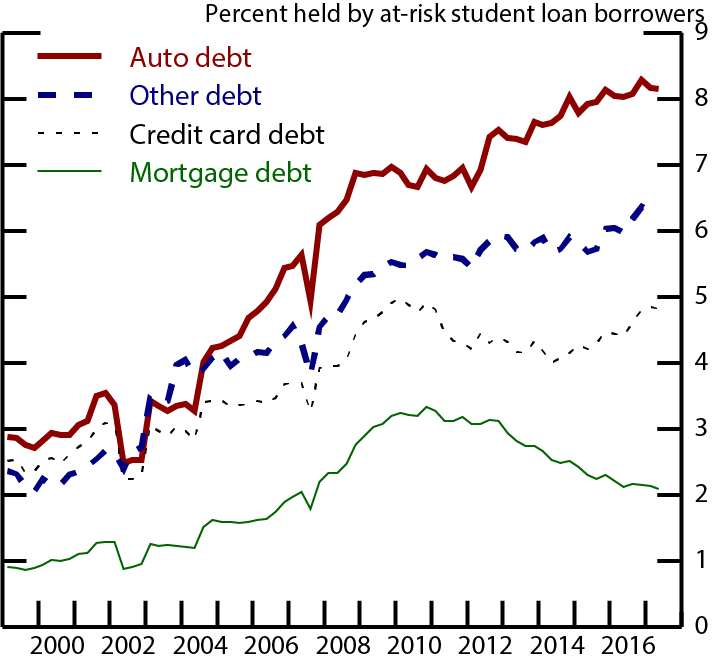

Finally, increases in student loan debt could be problematic for lenders, posing risks to financial stability. However, we currently view that outcome as unlikely. The federal government guarantees more than 90 percent of outstanding student loan debt, and, thus, financial institutions are not highly exposed to the associated direct credit risk. Moreover, the subpopulation of borrowers who have been struggling to meet their student debt obligations typically owe only small amounts on other debts. Specifically, student loan borrowers who are either subprime or distressed (i.e., those who are 90 or more days past due) owe relatively small shares of overall mortgage, auto, and credit card debt (Figure 2). Consequently, lenders do not appear to face much indirect exposure through loans to borrowers currently having trouble paying their student loans.

Note: Shares are calculated as balances held by student loan borrowers who are 90+ days past due on their student loan debt obligations or who are classified as subprime borrowers (i.e., having a riskscore lower than 620). This figure and corresponding discussion draw on analysis by Sarena Goodman, Alvaro Mezza, and Hannah Farkas.

Source: FRBNY Consumer Credit Panel, Equifax.

References:

Avery, C. and Turner, S. (2012). "Student Loans: Do College Students Borrow Too Much--Or Not Enough?" Journal of Economic Perspectives, 26(1), 165-192.

Benmelech, E., Guren, A., and Melzer, B. (2017). "Making the House a Home: The Stimulative Effect of Home Purchases on Consumption and Investment," Working paper.

Cellini, S. and Turner, N. (2016). "Gainfully Employed? Assessing the Employment and Earnings of For-Profit College Students Using Administrative Data," NBER Working Paper No. 22287.

Dettling, L. and Hsu, J. (2014). "Returning to the Nest: Debt and Parental Co-Residence Among Young Adults," Finance and Economics Discussion Series 2014-80. Board of Governors of the Federal Reserve System (U.S.).

Dynan, K. (2012). "Is a Household Debt Overhang Holding Back Consumption?" Brookings Papers on Economic Activity, Spring 2012, 299-362.

Dynarski, S. (2014). "An Economist's Perspective on Student Loans in the United States" Education Policy Initiative Working Paper 01-2014.

Field, E. (2009). "Educational Debt Burden and Career Choice: Evidence from a Financial Aid Experiment at NYU Law School". American Economic Journal: Applied Economics, 1(1), 1-21.

Kurz, C. and Li, G. (2015), "How Does Student Loan Debt Affect Light Vehicle Purchases?" FEDS Notes (Washington: Board of Governors of the Federal Reserve System, February 2).

Lang, K., and Weinstein, R. (2012). "Evaluating Student Outcomes at For-Profit Colleges," NBER Working Paper 18201.

Lochner, L. and Monge-Naranjo, A. (2014) "Student Loans and Repayment: Theory, Evidence and Policy," CIBC Working Paper Series 2014-5.

Loewenstein, G. and Thaler, R. (1989). "Anomalies and Intertemporal Choice". Journal of Economic Perspectives, 3: 181-193.

Looney, A. and Yannelis, C. (2015) "A Crisis in Student Loans? How Changes in the Characteristics of Borrowers and in the Institutions They Attended Contributed to Rising Loan Defaults". Brooking Papers on Economic Activity.

Mezza, A., Ringo, D., Sherlund, S., and Sommer, K. (2016). "Student Loans and Homeownership," Finance and Economics Discussion Series 2016-010r. Washington: Board of Governors of the Federal Reserve System.

Mezza, A. and Sommer, K. (2016). "A Trillion Dollar Question: What Predicts Student Loan Delinquencies?" Journal of Student Financial Aid, Vol. 46-3.

Mian, A., Rao, K. and Sufi, A. (2013). "Household Balance Sheets, Consumption, and the Economic Slump". Quarterly Journal of Economics, 1687-1726.

Palameta, B. and Voyer, J.P. (2010). Willingness to Pay for Post-secondary Education Among Under-represented Groups. Toronto: Higher Education Quality Council of Ontario.

Rothstein, J., and Rouse, C.E. (2011). "Constrained After College: Student Loans and Early-career Occupational Choices". Journal of Public Economics, 95, 149-163.

Thaler, R. (1992). The Winner's Curse: Paradoxes and Anomalies of Economic Life. New York: Free Press.

1. There is some debate over this latter assessment. Dynarski (2014) shows that the rise in tuitions was accompanied by a rise in grants such that the cost of attending the institutions did not contribute as much to the rise in debt. However, besides increases in enrollment and tuition, it is not well understood which other factors play a substantial role in driving borrowing up. Return to text

2. See, for example, Avery and Turner (2012) and Lochner and Monge-Naranjo (2014). Return to text

3. For instance, enrollment surged in for-profit schools, which are associated with lower returns to education (Lang and Weinstein, 2012, and Cellini and Turner, 2016), lower graduation rates, and higher rates of loan delinquencies (Looney and Yannelis, 2015, and Mezza and Sommer, 2016). Return to text

4. Student loans could also boost consumption through other channels not considered here such as an increase in education-related expenditures and higher profits for lenders or schools. Return to text

5. To estimate this effect, we assume that all student loan debt originated in a given year starts being repaid by borrowers four years later under a fixed 10-year plan with an interest rate of 6.8 percent--the maximum rate for undergraduate federal student loan borrowers from 2001 to 2016. Under these assumptions, the effect of increased originations on debt service payments builds gradually over time. Return to text

6. Our strong dollar-for-dollar assumption might be justified if the relevant households are credit constrained. If, instead, some of the households are unconstrained and forward looking, the higher debt would merely reduce their net worth, yielding a smaller effect on consumption through the standard wealth effect. Return to text

7. Estimates from Mezza et al. (2016) imply that roughly 20 percent of the decline in the homeownership rate for young adults since 2005 was due to increased student debt. This percentage accounts for less than 800,000 households. If renting has held back the total spending of each of these households by $25,000 annually--the difference in average spending between homeowners and renters in the Consumer Expenditure Survey--the total effect on aggregate consumption would be less than $20 billion. Return to text

8. Dettling and Hsu (2014) estimate that student loan debt accounts for 30% of the increase in co-parental residence since 2005, or roughly 1.3 million young adults. If each one of these adults would have otherwise been spending $3,700 annually on home-related goods--the estimate of goods spending surrounding home purchases from Benmelech, Guren, and Melzer (2017)--the total impact on consumption would be only $5 billion. Return to text

9. In contrast, for students attending a highly selective, prestigious university, Rothstein and Rouse (2011) find that the increase in post-graduation income and the decrease in the probability that students choose low-paid public interest jobs due to exogenous increases in student loans are more likely driven by capital market imperfections (i.e, credit constraints post-graduation) than by debt aversion. Return to text

Feiveson, Laura, Alvaro Mezza, and Kamila Sommer (2018). "Student Loan Debt and Aggregate Consumption Growth," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, February 21, 2018, https://doi.org/10.17016/2380-7172.2127.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.