FEDS Notes

February 12, 2016

The Federal Reserve's New Approach to Raising Interest Rates

Jane Ihrig, Ellen Meade, and Gretchen Weinbach, with Melanie Josselyn

At its December 2015 meeting, the Federal Open Market Committee (FOMC)--the Federal Reserve's monetary policy committee--raised its target range for the federal funds rate by 25 basis points, marking the end of an extraordinary seven-year period during which the federal funds target range was held near zero to support the recovery of the U.S. economy from the worst financial crisis and recession since the Great Depression. As it raised its policy target, the Federal Reserve began using a new framework for implementing monetary policy that differs from the approach that it used prior to the global financial crisis. Here we discuss the new approach the Fed has taken to implement monetary policy and how that approach has changed, review the main tools that the Fed is using to implement policy, and describe the effects of the FOMC's December decision on market interest rates. (Our papers Rewriting Monetary Policy 101 ![]() and Monetary Policy 101: A Primer (PDF) describe in greater depth the issues explored here.)

and Monetary Policy 101: A Primer (PDF) describe in greater depth the issues explored here.)

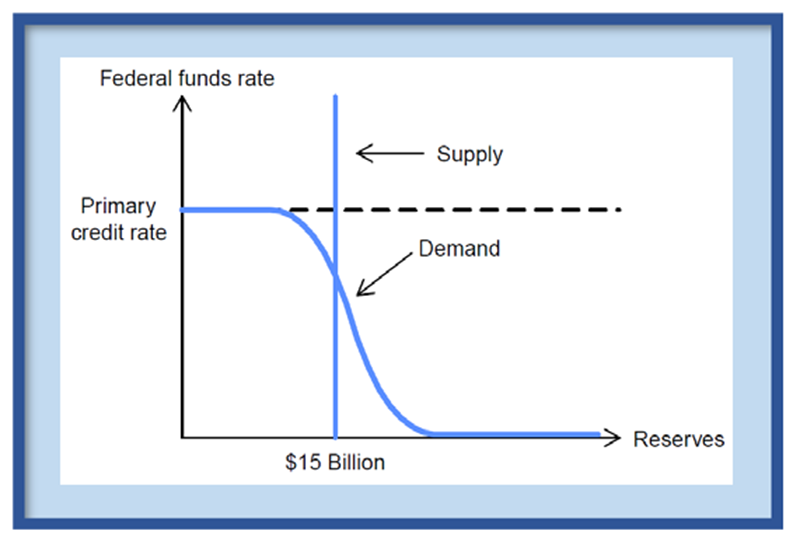

The Federal Reserve has traditionally implemented monetary policy by conducting open market operations to influence conditions in the federal funds market, an interbank market for overnight borrowing and lending. Participants in the federal funds market include depository institutions or "banks" (that is, commercial banks, savings banks, thrift institutions, credit unions, and U.S. branches and agencies of foreign banks) and government-sponsored enterprises; these institutions hold funds--known as reserve balances--in accounts at the Fed. Before the global financial crisis, the FOMC announced its target for the federal funds rate and the Open Market Desk at the Federal Reserve Bank of New York (the "Desk") achieved it by shifting the supply of reserves through open market operations.1 In particular, and as shown in figure 1, for a given estimate of the demand for reserve balances, the Desk would adjust the quantity of reserve balances in order to hit the FOMC's target federal funds rate. The federal funds rate has historically been highly correlated with other short-term interest rates, and so a change in the FOMC's federal funds rate target would pass through to other short-term market interest rates, and thereby also affect longer-term financial conditions and the real economy.

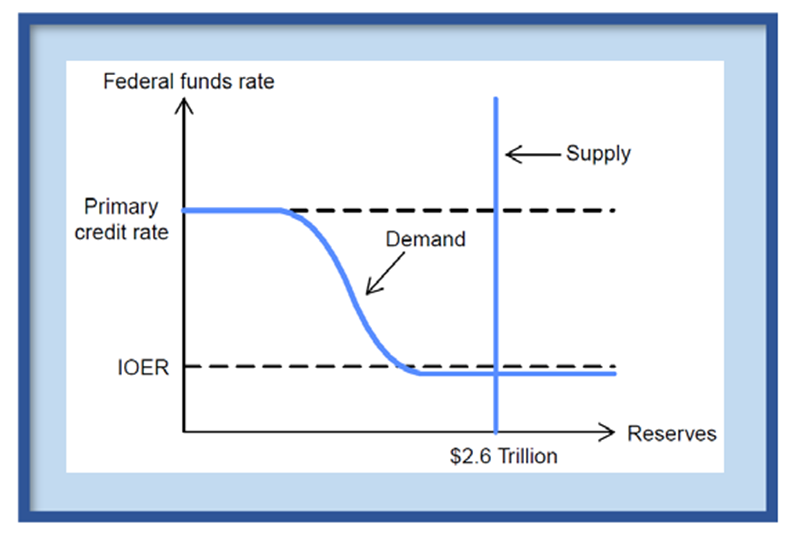

During and in the aftermath of the global financial crisis, the FOMC reduced the target range to 0 to 25 basis points, and then undertook a series of large-scale asset purchase programs to put downward pressure on longer-term interest rates. These purchases increased banks' reserve balances and the size of the Fed's balance sheet. Reserve balances have exceeded $2.6 trillion in recent months, up from nearly $15 billion just prior to the onset of the crisis in August 2007.

As a result, as shown in Figure 2, the reserve supply curve now sits significantly to the right of its pre-crisis position, intersecting the demand curve on the flat portion of that curve. With reserve balances so large, the Fed can no longer rely on small shifts in the supply of reserves to achieve a given change in the FOMC's target range for the federal funds rate.

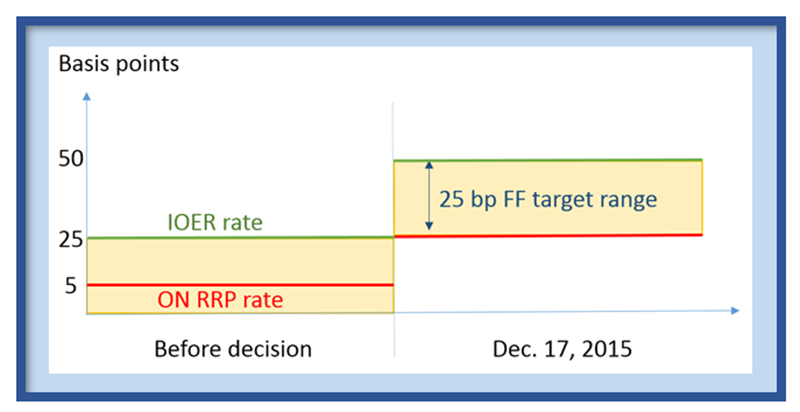

So how did the Fed implement the FOMC's increase in the target range in December? Instead of adjusting the quantity of reserves, the new framework that the Fed is using to implement the FOMC's monetary policy primarily involves adjusting prices--that is, interest rates. The Fed now sets two administered rates--the interest on excess reserves (IOER) rate and the offering rate on overnight reverse repurchase agreements (ON RRPs). The Fed uses the IOER rate as its primary policy tool; this rate is earned by banks on their reserve balances, and the rate puts upward pressure on short-term interest rates because banks have little incentive to lend funds below this rate. ON RRPs are offered at a lower rate to a broader set of financial institutions than banks, including many of the most active firms in overnight funding markets;2 the ON RRP rate helps to support short-term interest rates because eligible nonbank institutions have little incentive to lend funds below the rate at which the Fed offers ON RRPs. Each rate encourages arbitrage in money markets; each acts as a reservation rate. Together, these two administered rates--the IOER and ON RRP rates--are the main levers that the Fed currently adjusts to implement a change in the stance of monetary policy.

Figure 3 provides a graphical representation of the new framework. As shown in the region on the left, the target range for the federal funds rate prior to the FOMC's December decision was 0 to 25 basis points (the shaded region), with the IOER rate set to 25 basis points (the green line) and the ON RRP offering rate set to 5 basis points (the red line). Effective December 17, 2015, the target range was increased to 25 to 50 basis points (the shaded region on the right), and the IOER and the ON RRP rates were raised to 50 and 25 basis points, respectively. In addition, to support effective monetary policy implementation and in keeping with its previous communications, the FOMC made a very large amount of ON RRPs available to ensure that the ON RRP offering rate was effective in supporting interest rates.3

So what has happened to short-term market interest rates since mid-December? In short, the Fed's new operating framework has been successful in bringing about an increase in money market rates. As shown in Figure 4, the increases in the two administered rates acted to raise the market federal funds rate along with other short-term market interest rates. Excluding year-end, when these rates were affected by transitory calendar effects, the federal funds rate has averaged about 22 basis points higher than it was before the policy change. The volume-weighted average overnight Eurodollar rate and the market Treasury repo rate moved up in line with the federal funds rate. In addition, the variability of interest rates and trading volumes in money markets have remained similar to what they were before the Fed's policy change.

Overall, the severity of the recent global financial crisis led some major central banks around the world to use quantitative easing policies that have resulted in large central bank balance sheets. The Fed's success in raising interest rates with a large balance sheet reflects the adaptation of its policy implementation framework to the current financial environment. The FOMC has indicated that it will continue to assess its implementation framework and policy implementation tools and their settings, and will make adjustments as appropriate for controlling short term interest rates.

1. The Desk typically used temporary open market operations known as repurchase agreements or "repos." For a description of repurchase agreements in the context of implementing monetary policy, see our paper Monetary Policy 101: A Primer (PDF). Return to text

2. The Federal Reserve Bank of New York publishes a list of the Fed's ON RRP counterparties ![]() on its website. Return to text

on its website. Return to text

3. The specific operational settings of each policy tool were announced in an implementation note that accompanied the FOMC's postmeeting statement. Return to text

Please cite this note as:

Ihrig, Jane E., Ellen E. Meade, and Gretchen C. Weinbach (2016). "The Federal Reserve's New Approach to Raising Interest Rates," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, February 12, http://dx.doi.org/10.17016/2380-7172.1706.

Disclaimer: FEDS Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers.