Average Debit Card Interchange Fee by Payment Card Network

Background

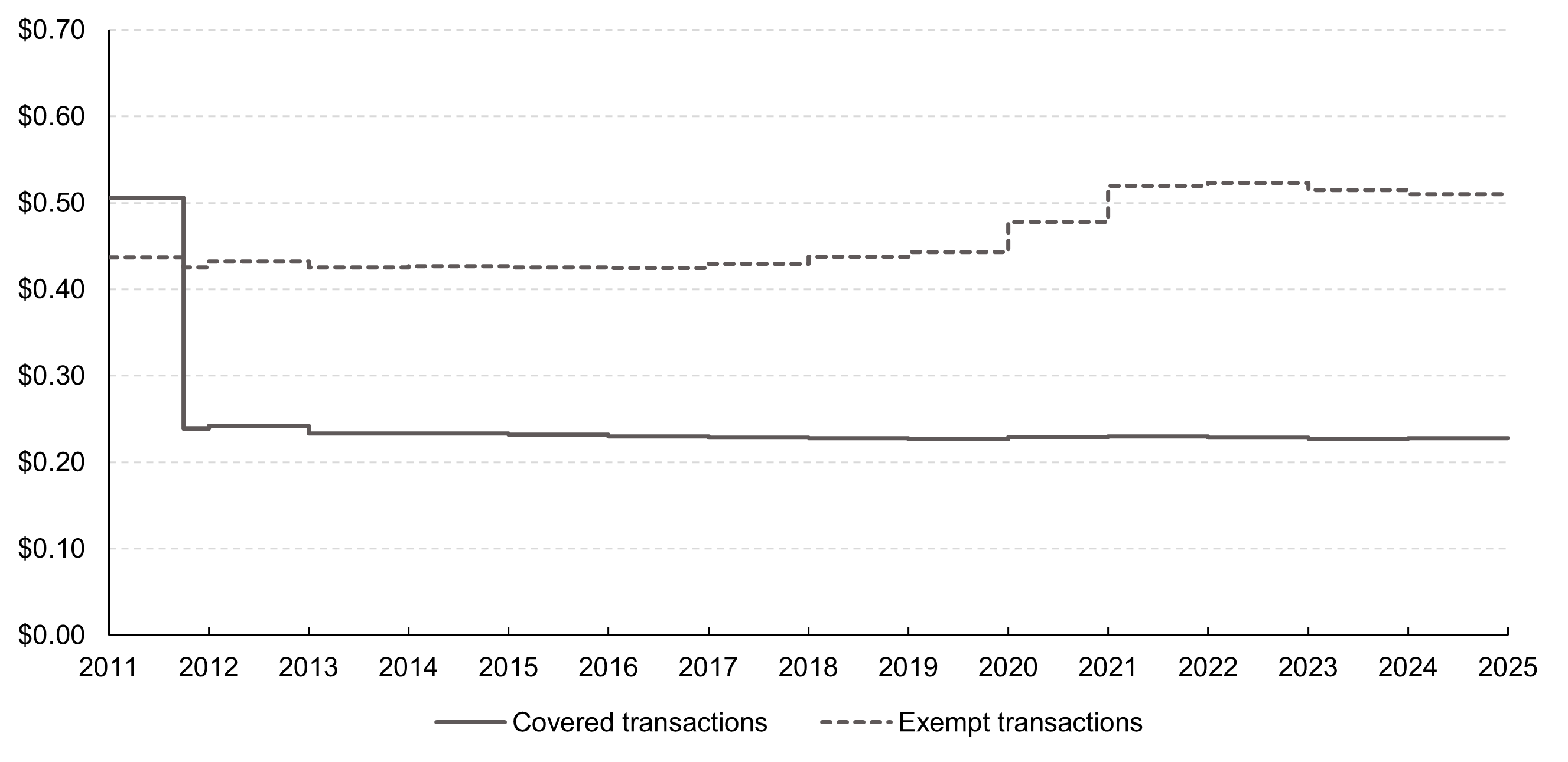

The Board’s Regulation II provides that an issuer subject to the interchange fee standard (a covered issuer) may not receive, for any electronic debit transaction, an interchange fee that exceeds $0.21 plus 0.05 percent multiplied by the value of the transaction, plus a $0.01 fraud-prevention adjustment, if eligible. Transactions made using certain reloadable general-use prepaid cards and debit cards issued pursuant to government-administered payment programs are exempt from the interchange fee standard, even if the card is issued by a covered issuer.

As used below, “covered transactions” are transactions made using debit cards issued by covered issuers, excluding transactions made using prepaid or government program cards that are exempt from the interchange fee standard. All other transactions are referred to as “exempt transactions.”

Average Debit Card Interchange Fee, by Transaction Status

Average Debit Card Interchange Fee, by Transaction Status and Network Type

| Network1 | 2024 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Exempt transactions2 | Covered transactions3 | All transactions (exempt and covered transactions)4 |

|||||||||||

| % of total number of transactions5 |

% of total value of transactions6 |

Average transaction value7 |

Average interchange fee per transaction8 |

Interchange fee as % of average transaction value9 |

% of total number of transactions5 |

% of total value of transactions6 |

Average transaction value7 |

Average interchange fee per transaction8 |

Interchange fee as % of average transaction value9 |

Average transaction value7 |

Average interchange fee per transaction8 |

Interchange fee as % of average transaction value9 |

|

| Dual-message10 | 38.8% | 35.7% | $43.41 | $0.61 | 1.41% | 61.2% | 64.3% | $49.68 | $0.22 | 0.45% | $47.24 | $0.37 | 0.79% |

| Discover | 100.0% | 100.0% | $68.57 | $0.83 | 1.22% | 0.0% | 0.0% | $32.56 | $0.23 | 0.72% | $68.57 | $0.83 | 1.22% |

| MasterCard | 48.1% | 47.9% | $48.57 | $0.63 | 1.30% | 51.9% | 52.1% | $49.00 | $0.24 | 0.49% | $48.79 | $0.43 | 0.88% |

| Visa | 36.1% | 31.9% | $41.35 | $0.60 | 1.46% | 63.9% | 68.1% | $49.83 | $0.22 | 0.44% | $46.77 | $0.36 | 0.76% |

| Visa dual‑message | 34.6% | 30.4% | $41.15 | $0.62 | 1.50% | 65.4% | 69.6% | $49.84 | $0.22 | 0.44% | $46.83 | $0.36 | 0.76% |

| Visa single‑message11 | 75.5% | 73.2% | $43.79 | $0.40 | 0.91% | 24.5% | 26.8% | $49.50 | $0.24 | 0.49% | $45.19 | $0.36 | 0.80% |

| Single‑message12 | 40.6% | 36.5% | $39.45 | $0.26 | 0.67% | 59.4% | 63.5% | $47.01 | $0.24 | 0.51% | $43.94 | $0.25 | 0.57% |

| ACCEL | 74.9% | 73.4% | $45.53 | $0.25 | 0.54% | 25.1% | 26.6% | $49.09 | $0.24 | 0.49% | $46.43 | $0.25 | 0.53% |

| AFFN | 97.9% | 97.0% | $40.13 | $0.23 | 0.57% | 2.1% | 3.0% | $58.13 | $0.20 | 0.34% | $40.50 | $0.23 | 0.56% |

| ATH | 19.4% | 19.4% | $33.82 | $0.24 | 0.70% | 80.6% | 80.6% | $33.82 | $0.20 | 0.60% | $33.82 | $0.21 | 0.62% |

| Culiance | 100.0% | 100.0% | $44.40 | $0.23 | 0.52% | 0.0% | 0.0% | NA | NA | NA | $44.40 | $0.23 | 0.52% |

| Interlink | 23.9% | 16.2% | $31.07 | $0.35 | 1.13% | 76.1% | 83.8% | $50.78 | $0.25 | 0.48% | $46.06 | $0.27 | 0.59% |

| Jeanie | 1.7% | 7.3% | $90.96 | $0.21 | 0.23% | 98.3% | 92.7% | $20.00 | $0.17 | 0.83% | $21.22 | $0.17 | 0.79% |

| Maestro | 25.1% | 23.1% | $39.24 | $0.21 | 0.54% | 74.9% | 76.9% | $43.75 | $0.24 | 0.55% | $42.62 | $0.23 | 0.55% |

| NYCE | 72.2% | 68.4% | $41.40 | $0.28 | 0.67% | 27.8% | 31.6% | $49.74 | $0.24 | 0.48% | $43.72 | $0.27 | 0.61% |

| PULSE | 55.8% | 50.6% | $39.11 | $0.29 | 0.75% | 44.2% | 49.4% | $48.31 | $0.24 | 0.51% | $43.17 | $0.27 | 0.63% |

| SHAZAM | 91.1% | 88.3% | $35.72 | $0.23 | 0.65% | 8.9% | 11.7% | $48.53 | $0.21 | 0.43% | $36.86 | $0.23 | 0.63% |

| STAR | 47.3% | 44.4% | $41.87 | $0.21 | 0.51% | 52.7% | 55.6% | $47.15 | $0.24 | 0.51% | $44.65 | $0.23 | 0.51% |

| UnionPay | 0.0% | 0.0% | NA | NA | NA | 100.0% | 100.0% | $23.30 | $0.23 | 0.99% | $23.30 | $0.23 | 0.99% |

| All networks | 39.3% | 35.9% | $42.27 | $0.51 | 1.21% | 60.7% | 64.10% | $48.95 | $0.23 | 0.47% | $46.32 | $0.34 | 0.73% |

Note: Networks may offer multiple pricing programs to issuers. This table reflects each network's average interchange fee across all of its transactions and does not reflect what a particular issuer will earn by participating in a particular network or combination of networks.

Note: Previous years' data are subject to minor changes based on revisions to underlying data.

1. Networks listed are defined as payment card networks under the Board's Regulation II. Presto!, by the network's policy, is accessible exclusively through one merchant, which is affiliated with the network. Presto! statistics are included in the "Single-message” statistics and the "All networks" statistics but are not listed individually. Statistics for the "Dual-message," "Single-message," and "All networks" rows are weighted averages based on each network's number or value of transactions. Return to table.

2. Exempt transactions: Transactions processed by issuers exempt from the interchange fee standard, as well as transactions processed by issuers otherwise covered by the interchange fee standard that qualify for another exemption from the standard. Exempt issuers have total worldwide banking and nonbanking assets (including assets of affiliates), other than trust assets under management, of less than $10 billion as of December 31 of the previous year. Exempt transactions for covered issuers are transactions made with certain debit cards provided pursuant to government-administered payment programs and certain reloadable general-use prepaid cards. Return to table.

3. Covered transactions: Transactions processed by issuers subject to the interchange fee standard that do not qualify for another exemption from the standard. Return to table.

4. All transactions: Exempt transactions and covered transactions. Return to table.

5. % of total number of transactions: The percentage of settled purchase transactions made with cards that are exempt from, or covered by, the interchange fee standard. Return to table.

6. % of total value of transactions: The percentage of the value of settled purchase transactions made with cards that are exempt from, or covered by, the interchange fee standard. Note: Certain transactions for issuers covered by the standard are exempt from the standard. Return to table.

7. Average transaction value: The value of settled purchase transactions divided by the number of settled purchase transactions. Return to table.

8. Average interchange fee per transaction: Total interchange fees divided by the number of settled purchase transactions. Return to table.

9. Interchange fee as % of average transaction value: Total interchange fees divided by the value of settled purchase transactions. Return to table.

10. Dual-message network: A payment card network that typically uses separate messages to authorize and clear a transaction. These networks have traditionally processed signature-authenticated transactions, although some transactions may not require a signature. In some instances, a dual-message network may use a single message to authorize and clear a given transaction and may require the entry of a PIN for cardholder authentication in that transaction. As applicable, the totals for a particular dual-message network include information on any single-message transactions performed on that network. Return to table.

11. Single-message transactions processed over Visa, a dual-message network. For data prior to 2018, single message and dual-message transactions over Visa are not reported separately. Return to table.

12. Single-message network: A payment card network that typically uses a single message to authorize and clear a transaction. These networks normally process PIN-authenticated transactions, although some transactions, such as small-value purchases, may not require any authentication (PIN-less) or may use signature authentication. In some instances, a network that typically uses a single message to authorize and clear and transaction may use separate messages to authorize and clear a given transaction. As applicable, the totals for a particular single-message network include information on any dual-message transactions performed on that network. Return to table.

Data for Previous Years

Data revised as of June 10, 2025

Previous years' data are subject to minor changes based on revisions to underlying data.