Freedom of Information Office

2011 New Currency Budget

Action

On December 10, 2010, the Board approved the 2011 new currency budget totaling $676.1 million, an increase of $52.6 million, or 8.4 percent, from 2010 estimated expenses and a decrease of $26.8 million, or 3.8 percent, from the approved 2010 budget.

Discussion

Under authority delegated by the Board, the director of the Division of Reserve Bank Operations and Payment Systems (RBOPS) submits an annual print order for new currency to the director of the Bureau of Engraving and Printing (BEP).1 Upon reviewing the order, the BEP establishes calendar-year billing rates for new currency, which Board staff uses to prepare the annual budget for new currency. The Board then approves the final budget. Printing costs for Federal Reserve notes typically comprise more than 95 percent of the new currency budget; expenses for currency transportation, counterfeit-deterrence research, and costs to reimburse the BEPís Finance Directorate, on average, represent the remaining 5 percent. Once the Board approves the new currency budget, it assesses the costs of new currency to each Federal Reserve Bank on a monthly basis through an accounting procedure similar to that used in assessing the costs of the Boardís operating expenses to the Banks.

Table 1 provides details on the Boardís calendar-year (CY) 2010 budget, 2010 estimate, and 2011 budget.2

Table 1

New Currency Budget

(calendar year)

2010 Budget (thousands)

2010 Estimate (thousands)

2011 Budget (thousands)

Percent Change 2010E/2010B

Percent Change 2011B/2010E

Print volume (number of notes)

7,616,733

6,701,824

6,787,720

-12.0

1.3

Printing costs for FR notes

$677,613

$599,822

$649,565

-11.5

8.3

Currency transportation costs

$17,446

$16,003

$18,318

-8.3

14.5

Counterfeit-deterrence research

$4,208

$4,207

$4,486

0.0

6.6

BEP's Finance Directorate

$3,650

$3,548

$3,773

-2.8

6.3

Total Expenses

$702,918

$623,579

$676,141

-11.3

8.4

2010 New Currency Expenses

Staff estimates that total expenses for new currency in 2010 will be $623.6 million, which is $79.3 million or 11.3 percent, under the 2010 budget primarily because the BEP will print fewer notes than we estimated when we prepared the 2010 budget. The majority of the decrease in note production is a result of the significant production problems the BEP experienced in 2010 with the new-design $100 note.3 The lower printing costs represent about 98 percent of the total new currency budget underrun for 2010. Lower-than-planned currency transportation expenses represent the remaining 2 percent of the difference between the 2010 budget and estimate.

2010 Printing Costs

Estimated CY 2010 currency printing costs are $599.8 million, which are $77.8 million or 11.5 percent, lower than the budgeted amount, primarily because the BEP printed fewer notes than we estimated when we prepared the CY 2010 budget in November 2009. When we prepared the budget, we assumed that the Board would begin issuing the new-design $100 note in late 2010 and estimated that the BEP would produce 2.75 billion new-design $100 notes during the calendar year. The BEP experienced numerous production problems during the year, however, which resulted in the Board modifying the original fiscal-year (FY) 2010 print order three times to remove 1.2 billion notes from the order.4 Even after the three modifications, production difficulties continued and the BEP was unable to meet the Boardís final FY 2010 print order for new-design $100 notes, which caused the Board to announce an indefinite delay in the issue date for the new-design $100 note.5

Because the BEP produced fewer notes than the Board ordered in its initial FY 2010 print order, the BEP assessed the Board two surcharges to cover its operating costs. The first surcharge compensated the BEP for the revenue that it did not generate as a result of the Board modifying the print order three times and reducing the number of notes ordered. The BEP established its billing rates based on the number of notes in the Boardís initial FY 2010 print order (see table 2 for billing rates). Because of the significant reduction in volume, however, the BEP would have been unable to generate sufficient revenue to cover all of its operating expenses and maintain its working capital fund without a second surcharge.6 The second surcharge covered production costs of new-design $100 notes that the Board did not accept, because the BEP cannot verify that the notes meet established quality standards.7 Before the BEP discovered the quality problem, however, it had produced approximately 1.1 billion new-design $100 notes.8

The 2010 printing costs also included funding to establish a production quality assessment review of the BEP. In October, Board staff engaged a management-consulting firm to conduct a comprehensive quality review of the BEPís operations and suppliers.

2010 Transportation Costs

The estimated CY 2010 transportation costs are $16.0 million, which is $1.4 million lower than the budgeted amount, primarily because armored carrier contract rates were lower than expected and there were fewer shipments than budgeted.

2011 New Currency Budget

The proposed $676.1 million 2011 new currency budget is 8.4 percent higher than the 2010 estimate and 3.8 percent lower than the 2010 budget. Printing costs for Federal Reserve notes represent nearly 96 percent of this new currency budget, and expenses for currency transportation, counterfeit-deterrence research, and costs to reimburse the BEPís Finance Directorate account for the remaining 4 percent.

2011 Printing Costs

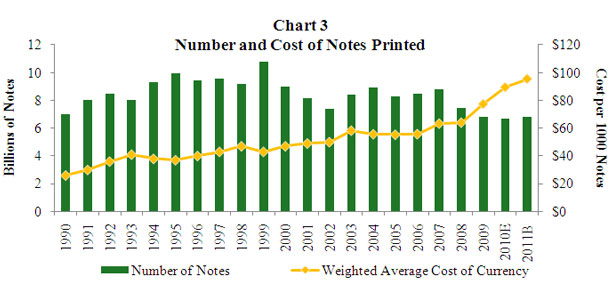

The budget includes $649.6 million in printing costs for CY 2011, which represents an 8.3 percent increase from the 2010 estimate.9 As shown in table 2, the average cost per thousand notes increased 6.7 percent, from $89.48 in 2010 to $95.51 in 2011, primarily because high fixed costs at the BEP are allocated among fewer notes in FY 2011 than in FY 2010.

In addition, the 2011 printing costs include funding for the ongoing production quality assessment review of the BEP. During 2011, the contractor will continue its review and recommend a course of action to improve quality control at the BEP for all denominations and, if appropriate, recommend any further actions the Board should take to enhance quality assurance.

Table 2

BEP Billing Rates

Note typea

CY 2010 billing rates per thousand notes

CY 2011 billing rates per thousand notes

Percent change in CY billing rates

FY 2010 print order (millions)

FY 2011 print order (millions)b

Pre-1996 $1, $2c

$48.07

$55.49

15.4

1,862.4

2,918.4

Series 1996 $100

$85.35

$98.60

15.5

771.2

499.2

Series 2004 $5

$77.57

$99.28

28.0

627.2

486.4

Series 2004 $10

$78.85

$99.18

25.8

83.2

499.2

Series 2004 $20, $50

$85.11

$108.91

28.0

2,291.2

1,081.6

Series 2004 $100

$117.98

$144.80

22.7

2,400.0

1,331.2

Total

8,035.2

6,816.0

Average Cost per Thousand Notesd

CY 2010

CY 2011

Percent change

CY 2011/CY 2010

$89.48

$95.51

6.7

a $1 and $2 notes do not include the security features that are in the Series 1996 and Series 2004 design notes; Series 1996 $100 notes include a watermark and color-shifting ink; Series 2004 $5 notes include two watermarks and additional security features; and Series 2004 $10, $20, and $50 notes include watermarks, additional security features, and a new color-shifting ink. The Series 2004 $100 note will include a watermark, a 3D security ribbon, a new color-shifting feature ("the Bell in the Inkwell"), additional security features, and a new color-shifting ink. This higher level of security for the Series 2004 $100 note has significantly increased the cost for both paper and ink. Return to table.

b Although the Board ordered 7.6 billion notes in FY 2011, the BEP has assumed (and based pricing on) annual production of 6.8 billion notes. The 771.2 million note difference is attributable to new-design $100 note production volume. Specifically, the BEPís billing rates assume that the BEP will produce 1.3 billion new-design $100 notes during FY 2011 and reclaim 771.2 million of the 1.1 billion new-design $100 notes produced during FY 2010 and held for quality concerns. Return to table.

c The FY 2010 and 2011 print orders do not include $2 notes because Reserve Banks have sufficient inventories to meet estimated public demand until FY 2012, at which time we expect to place another order. Return to table.

d The average cost is the printing costs (including any surcharges) divided by the number of notes printed. Return to table.

The primary cost components of the billing rates for new currency are currency production, production support, capital investment, and public education.10 Figure 1 shows the percentage contribution of these factors to the total printing cost of currency.

Currency Production Costs

Currency production costs comprise 47.6 percent of total currency printing costs. These costs reflect a decrease of $65.0 million, or 18.1 percent, from the 2010 budget. This decrease is primarily attributable to the 15 percent decrease in the number of notes the BEP assumes it will produce in FY 2011. Specifically, the lower volume of notes the BEP expects to produce in FY 2011 will reduce overtime in the manufacturing, engraving, and support areas.

Production Support Costs

The production support budget comprises 42.1 percent of total currency printing costs. These costs reflect a decrease of $9.7 million, or 3.6 percent, from the 2010 budget. This decrease is largely attributable to a decrease in manufacturing support costs because of the lower volume of notes budgeted, a decrease in staffing, and lower utility costs because of investments in energy efficiency.

Capital Investment Costs

The BEPís capital improvement costs are approximately 7.8 percent of the 2011 total currency printing costs and decreased $3.9 million, or 7.6 percent, from 2010 budget because of an anticipated reduction in outlays for capital equipment in 2011.

Public Education Costs

The BEPís public education costs represent approximately 2.6 percent of total currency printing costs and increased $9.0 million, or 128.6 percent, from the 2010 budget because of ongoing expenses related to the delay in issuance of the new-design $100 note. The public education program associated with the new-design $100 note will continue to incur costs during the delay in the issuance of the new-design $100 note because of the need to continue to distribute hard-copy materials, announce a new issuance date, and plan and implement day-of-issue events. These activities require ongoing work from the contractor for the public education program, including media monitoring and response, social media engagement, and basic program management and administration.11

2011 Currency Transportation

The 2011 currency transportation budget is $18.3 million, which is 5.0 percent higher than the 2010 budget and 14.5 percent higher than the 2010 estimate. This budget includes the cost of shipping new currency from the BEP to Reserve Banks, of intra-System shipments of fit and unprocessed currency, and of returning currency pallets from the Reserve Banks to the BEP. The 2011 budget is higher than the 2010 budget and estimate primarily because we project that armored carrier contract rates will increase 5.0 percent in 2011 and we included funding to begin shipping new-design $100 notes from the BEP to every Reserve Bank to build sufficient inventories before issuance.

Counterfeit-Deterrence Research

The 2011 budget for counterfeit-deterrence research is $4.5 million, which includes costs associated with the Central Bank Counterfeit Deterrence Group (CBCDG) and the Reprographic Research Center (RRC). The CBCDG operates under the auspices of the G-10 central bank governors to combat digital counterfeiting and includes 32 central banks. The Boardís $4.5 million share of the 2011 CBCDG budget comprises 99 percent of the Federal Reserveís counterfeit-deterrence budget and is $225 thousand higher than the 2010 estimate.12

Bureau of Engraving and Printing's Finance Directorate

The 2011 budget includes $3.8 million to reimburse the BEP for expenses incurred by its Destruction Standards and Compliance Division of the Office of Compliance (OC) and Mutilated Currency Division of the Office of Financial Management (OFM). The OC develops Reserve Bank standards for cancellation and destruction of unfit currency and for note accountability, and reviews Reserve Banksí cash operations for compliance with its standards. As a public service, the OFM processes claims for the redemption of damaged or mutilated currency.

Data for Chart 1

YEAR

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010E

2011B

Nominal Cost in millions of dollars

190

260

295

355

368

373

403

367

408

487

456

344

430

514

514

497

489

576

500

503

624

676

Real Costch1 (CPI Adjusted) in millions of dollars

190

249

275

321

324

320

336

299

327

382

346

254

312

365

356

333

317

363

304

306

374

404

ch1 Real cost is nominal cost deflated by CPI--All Urban items, seasonally adjusted. Return to table.

Data for Chart 2

YEAR

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010E

2011B

Billions of notes

7.00

8.02

8.45

8.03

9.33

9.96

9.44

9.58

9.20

10.80

8.97

8.18

7.39

8.39

8.88

8.30

8.50

8.80

7.5

6.2

7.3

6.8

Value of Notes in billions of dollars

84.47

107.96

103.19

104.89

128.82

148.24

194.64

142.23

163.26

285.49

67.46

50.20

123.30

126.20

157.00

140.8

146.1

178.1

160.3

224.2

217.6

258.6

Data for Chart 3

YEAR

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010E

2011B

Billions of notes

7.00

8.02

8.45

8.03

9.33

9.96

9.44

9.58

9.20

10.8

8.97

8.18

7.39

8.39

8.89

8.29

8.46

8.8

7.5

6.8

6.7

6.8

Weighted Average Cost of Currency per 1000 notes

$26.00

$30.00

$36.00

$41.00

$38.00

$37.00

$40.00

$43.00

$47.00

$43.00

$47.00

$49.00

$50.00

$58.25

$55.67

$55.32

$55.74

$63.30

$63.99

$77.42

$89.48

$95.51

1 By Memorandum of Understanding between the BEP and the Board, dated March 13, 1998, "[t]he Board shall provide the currency order to the BEP with denomination and Federal Reserve Bank breakdown 60 days before the beginning of the BEPís fiscal year." Return to text.

2 Because the BEP operates on a fiscal year that began October 1, 2010, and ends September 30, 2011, Board staff estimates the Boardís calendar-year budget for new currency by eliminating the cost of notes that the BEP will produce in the first quarter of its fiscal year and estimating the volume and associated printing costs of notes Board staff projects the BEP will produce in the fourth quarter of the calendar year. Return to text.

3 The new-design $100 note is the last denomination to be issued as part of the Series 2004 design family of notes. This design family, which incorporates new color backgrounds, began with the issuance of the Series 2004 $20 note in October 2003, followed by the $50 note in September 2004, the $10 note in March 2006, and the $5 note in March 2008. The new-design $100 note incorporates advanced technology that makes it easier for the public to authenticate and more difficult for counterfeiters to replicate. Return to text.

4 The three modifications were initiated by the BEP in response to production and quality challenges encountered with several denominations, but most notably with the production of the new-design $100 note. Specifically, the Board removed 32.0 million $5 notes, 83.2 million $10 notes, and 1.1 billion new-design $100 notes from the FY 2010 order. Return to text.

5 In April, the Board announced that the new-design $100 note would be issued on February 10, 2011. In October, however, the Board announced a delay in the issue date of the new-design $100 note. Return to text.

6 The BEP does not receive Federal appropriations; all operations of the BEP are financed by a revolving fund that is reimbursed through product sales, most notably sales of Federal Reserve notes to the Board to fulfill the annual print order. Customer billings are the BEPís only means of recovering the costs of operations and generating funds necessary for capital investment. Section 16 of the Federal Reserve Act requires that all costs incurred for the issuing of notes shall be paid for by the Board and included in its assessments against the Reserve Banks. Return to text.

7 The Board, the BEP, and the U.S. Secret Service jointly established quality standards that notes must meet before the Board will accept and pay for the notes. Return to text.

8 The BEP is currently researching options that may be used to identify and separate notes that meet quality standards from those that do not. The BEP will not charge the Board for any reclaimed notes in 2011 because the surcharge already covered the cost of production. In addition, the BEP will not issue a credit for any notes that do not meet quality standards. Return to text.

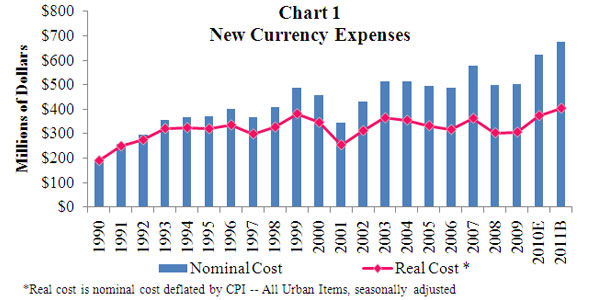

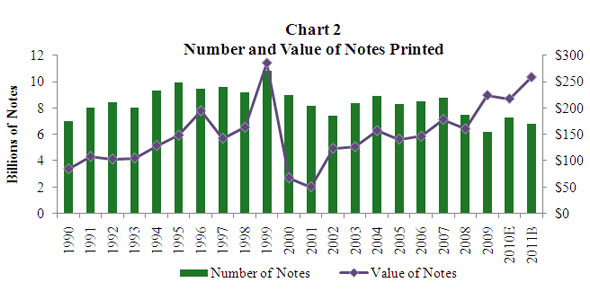

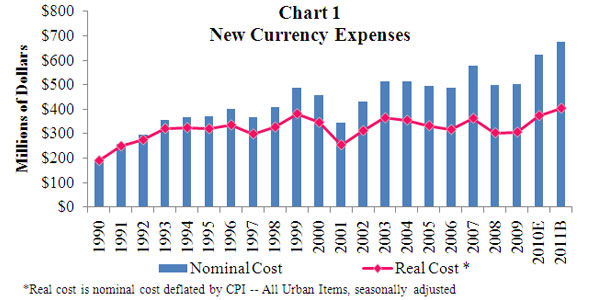

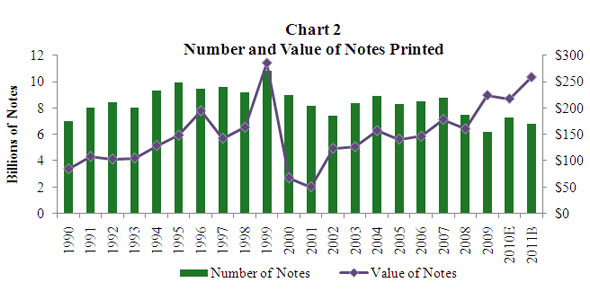

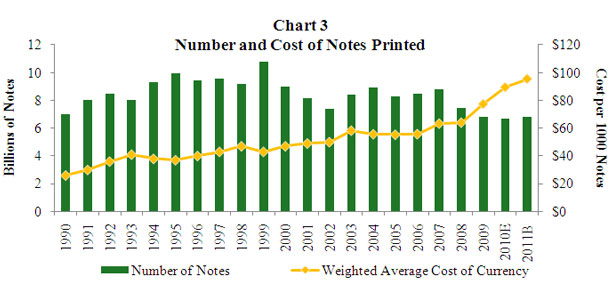

9 Charts 1-3 in the attachment show the new currency expenses, the value and number of notes printed, and the number and cost of notes printed from 1990 through the 2011 budget period. Return to text.

10 Currency production costs include costs for paper, ink, direct labor, and variable and fixed overhead costs. Production support costs include costs incurred for manufacturing support, prepress and engraving, research and development, and general and administrative staff and activities. Return to text.

11 In 2007, the BEP awarded a $36 million multiyear contract following a competitive bidding process, to develop a public education program in support of the Series 2004 $5 and $100 notes. This contract was amended in 2009 to $43.7 million for additional work performed during the delay in issuance of the new-design $100 note. In August 2010, the contract was amended to $54.2 million, a step necessitated for the most part by ongoing, unanticipated fulfillment costs. These costs are being generated by stronger-than-expected demand for hard-copy materials, higher customs, duties, value-added-tax fees, new customs regulations, and modified shipping arrangements in key international markets. Return to text.

12 The estimated RRC payment of $32,200 represents the remaining 1 percent of the counterfeit-deterrence research budget. The RRC is a state-of-the-art facility hosted by the National Bank of Denmark for adversarial testing of banknote designs and counterfeit deterrent features for its 13 member countries. Return to text.

On December 10, 2010, the Board approved the 2011 new currency budget totaling $676.1 million, an increase of $52.6 million, or 8.4 percent, from 2010 estimated expenses and a decrease of $26.8 million, or 3.8 percent, from the approved 2010 budget.

Discussion

Under authority delegated by the Board, the director of the Division of Reserve Bank Operations and Payment Systems (RBOPS) submits an annual print order for new currency to the director of the Bureau of Engraving and Printing (BEP).1 Upon reviewing the order, the BEP establishes calendar-year billing rates for new currency, which Board staff uses to prepare the annual budget for new currency. The Board then approves the final budget. Printing costs for Federal Reserve notes typically comprise more than 95 percent of the new currency budget; expenses for currency transportation, counterfeit-deterrence research, and costs to reimburse the BEPís Finance Directorate, on average, represent the remaining 5 percent. Once the Board approves the new currency budget, it assesses the costs of new currency to each Federal Reserve Bank on a monthly basis through an accounting procedure similar to that used in assessing the costs of the Boardís operating expenses to the Banks.

Table 1 provides details on the Boardís calendar-year (CY) 2010 budget, 2010 estimate, and 2011 budget.2

| 2010 Budget (thousands) | 2010 Estimate (thousands) | 2011 Budget (thousands) | Percent Change 2010E/2010B | Percent Change 2011B/2010E | |

|---|---|---|---|---|---|

|

Print volume (number of notes) |

7,616,733 |

6,701,824 |

6,787,720 |

-12.0 |

1.3 |

| Printing costs for FR notes | $677,613 | $599,822 | $649,565 | -11.5 | 8.3 |

| Currency transportation costs | $17,446 | $16,003 | $18,318 | -8.3 | 14.5 |

| Counterfeit-deterrence research | $4,208 | $4,207 | $4,486 | 0.0 | 6.6 |

| BEP's Finance Directorate | $3,650 | $3,548 | $3,773 | -2.8 | 6.3 |

| Total Expenses | $702,918 | $623,579 | $676,141 | -11.3 | 8.4 |

2010 New Currency Expenses

Staff estimates that total expenses for new currency in 2010 will be $623.6 million, which is $79.3 million or 11.3 percent, under the 2010 budget primarily because the BEP will print fewer notes than we estimated when we prepared the 2010 budget. The majority of the decrease in note production is a result of the significant production problems the BEP experienced in 2010 with the new-design $100 note.3 The lower printing costs represent about 98 percent of the total new currency budget underrun for 2010. Lower-than-planned currency transportation expenses represent the remaining 2 percent of the difference between the 2010 budget and estimate.

2010 Printing Costs

Estimated CY 2010 currency printing costs are $599.8 million, which are $77.8 million or 11.5 percent, lower than the budgeted amount, primarily because the BEP printed fewer notes than we estimated when we prepared the CY 2010 budget in November 2009. When we prepared the budget, we assumed that the Board would begin issuing the new-design $100 note in late 2010 and estimated that the BEP would produce 2.75 billion new-design $100 notes during the calendar year. The BEP experienced numerous production problems during the year, however, which resulted in the Board modifying the original fiscal-year (FY) 2010 print order three times to remove 1.2 billion notes from the order.4 Even after the three modifications, production difficulties continued and the BEP was unable to meet the Boardís final FY 2010 print order for new-design $100 notes, which caused the Board to announce an indefinite delay in the issue date for the new-design $100 note.5

Because the BEP produced fewer notes than the Board ordered in its initial FY 2010 print order, the BEP assessed the Board two surcharges to cover its operating costs. The first surcharge compensated the BEP for the revenue that it did not generate as a result of the Board modifying the print order three times and reducing the number of notes ordered. The BEP established its billing rates based on the number of notes in the Boardís initial FY 2010 print order (see table 2 for billing rates). Because of the significant reduction in volume, however, the BEP would have been unable to generate sufficient revenue to cover all of its operating expenses and maintain its working capital fund without a second surcharge.6 The second surcharge covered production costs of new-design $100 notes that the Board did not accept, because the BEP cannot verify that the notes meet established quality standards.7 Before the BEP discovered the quality problem, however, it had produced approximately 1.1 billion new-design $100 notes.8

The 2010 printing costs also included funding to establish a production quality assessment review of the BEP. In October, Board staff engaged a management-consulting firm to conduct a comprehensive quality review of the BEPís operations and suppliers.

2010 Transportation Costs

The estimated CY 2010 transportation costs are $16.0 million, which is $1.4 million lower than the budgeted amount, primarily because armored carrier contract rates were lower than expected and there were fewer shipments than budgeted.

2011 New Currency Budget

The proposed $676.1 million 2011 new currency budget is 8.4 percent higher than the 2010 estimate and 3.8 percent lower than the 2010 budget. Printing costs for Federal Reserve notes represent nearly 96 percent of this new currency budget, and expenses for currency transportation, counterfeit-deterrence research, and costs to reimburse the BEPís Finance Directorate account for the remaining 4 percent.

2011 Printing Costs

The budget includes $649.6 million in printing costs for CY 2011, which represents an 8.3 percent increase from the 2010 estimate.9 As shown in table 2, the average cost per thousand notes increased 6.7 percent, from $89.48 in 2010 to $95.51 in 2011, primarily because high fixed costs at the BEP are allocated among fewer notes in FY 2011 than in FY 2010.

In addition, the 2011 printing costs include funding for the ongoing production quality assessment review of the BEP. During 2011, the contractor will continue its review and recommend a course of action to improve quality control at the BEP for all denominations and, if appropriate, recommend any further actions the Board should take to enhance quality assurance.

| Note typea | CY 2010 billing rates per thousand notes | CY 2011 billing rates per thousand notes | Percent change in CY billing rates | FY 2010 print order (millions) | FY 2011 print order (millions)b |

|---|---|---|---|---|---|

| Pre-1996 $1, $2c | $48.07 | $55.49 | 15.4 | 1,862.4 | 2,918.4 |

| Series 1996 $100 | $85.35 | $98.60 | 15.5 | 771.2 | 499.2 |

| Series 2004 $5 | $77.57 | $99.28 | 28.0 | 627.2 | 486.4 |

| Series 2004 $10 | $78.85 | $99.18 | 25.8 | 83.2 | 499.2 |

| Series 2004 $20, $50 | $85.11 | $108.91 | 28.0 | 2,291.2 | 1,081.6 |

| Series 2004 $100 | $117.98 | $144.80 | 22.7 | 2,400.0 | 1,331.2 |

| Total | 8,035.2 | 6,816.0 |

| CY 2010 | CY 2011 |

Percent change CY 2011/CY 2010 |

|---|---|---|

| $89.48 | $95.51 | 6.7 |

a $1 and $2 notes do not include the security features that are in the Series 1996 and Series 2004 design notes; Series 1996 $100 notes include a watermark and color-shifting ink; Series 2004 $5 notes include two watermarks and additional security features; and Series 2004 $10, $20, and $50 notes include watermarks, additional security features, and a new color-shifting ink. The Series 2004 $100 note will include a watermark, a 3D security ribbon, a new color-shifting feature ("the Bell in the Inkwell"), additional security features, and a new color-shifting ink. This higher level of security for the Series 2004 $100 note has significantly increased the cost for both paper and ink. Return to table.

b Although the Board ordered 7.6 billion notes in FY 2011, the BEP has assumed (and based pricing on) annual production of 6.8 billion notes. The 771.2 million note difference is attributable to new-design $100 note production volume. Specifically, the BEPís billing rates assume that the BEP will produce 1.3 billion new-design $100 notes during FY 2011 and reclaim 771.2 million of the 1.1 billion new-design $100 notes produced during FY 2010 and held for quality concerns. Return to table.

c The FY 2010 and 2011 print orders do not include $2 notes because Reserve Banks have sufficient inventories to meet estimated public demand until FY 2012, at which time we expect to place another order. Return to table.

d The average cost is the printing costs (including any surcharges) divided by the number of notes printed. Return to table.

The primary cost components of the billing rates for new currency are currency production, production support, capital investment, and public education.10 Figure 1 shows the percentage contribution of these factors to the total printing cost of currency.

Currency Production Costs

Currency production costs comprise 47.6 percent of total currency printing costs. These costs reflect a decrease of $65.0 million, or 18.1 percent, from the 2010 budget. This decrease is primarily attributable to the 15 percent decrease in the number of notes the BEP assumes it will produce in FY 2011. Specifically, the lower volume of notes the BEP expects to produce in FY 2011 will reduce overtime in the manufacturing, engraving, and support areas.

Production Support Costs

The production support budget comprises 42.1 percent of total currency printing costs. These costs reflect a decrease of $9.7 million, or 3.6 percent, from the 2010 budget. This decrease is largely attributable to a decrease in manufacturing support costs because of the lower volume of notes budgeted, a decrease in staffing, and lower utility costs because of investments in energy efficiency.

Capital Investment Costs

The BEPís capital improvement costs are approximately 7.8 percent of the 2011 total currency printing costs and decreased $3.9 million, or 7.6 percent, from 2010 budget because of an anticipated reduction in outlays for capital equipment in 2011.

Public Education Costs

The BEPís public education costs represent approximately 2.6 percent of total currency printing costs and increased $9.0 million, or 128.6 percent, from the 2010 budget because of ongoing expenses related to the delay in issuance of the new-design $100 note. The public education program associated with the new-design $100 note will continue to incur costs during the delay in the issuance of the new-design $100 note because of the need to continue to distribute hard-copy materials, announce a new issuance date, and plan and implement day-of-issue events. These activities require ongoing work from the contractor for the public education program, including media monitoring and response, social media engagement, and basic program management and administration.11

2011 Currency Transportation

The 2011 currency transportation budget is $18.3 million, which is 5.0 percent higher than the 2010 budget and 14.5 percent higher than the 2010 estimate. This budget includes the cost of shipping new currency from the BEP to Reserve Banks, of intra-System shipments of fit and unprocessed currency, and of returning currency pallets from the Reserve Banks to the BEP. The 2011 budget is higher than the 2010 budget and estimate primarily because we project that armored carrier contract rates will increase 5.0 percent in 2011 and we included funding to begin shipping new-design $100 notes from the BEP to every Reserve Bank to build sufficient inventories before issuance.

Counterfeit-Deterrence Research

The 2011 budget for counterfeit-deterrence research is $4.5 million, which includes costs associated with the Central Bank Counterfeit Deterrence Group (CBCDG) and the Reprographic Research Center (RRC). The CBCDG operates under the auspices of the G-10 central bank governors to combat digital counterfeiting and includes 32 central banks. The Boardís $4.5 million share of the 2011 CBCDG budget comprises 99 percent of the Federal Reserveís counterfeit-deterrence budget and is $225 thousand higher than the 2010 estimate.12

Bureau of Engraving and Printing's Finance Directorate

The 2011 budget includes $3.8 million to reimburse the BEP for expenses incurred by its Destruction Standards and Compliance Division of the Office of Compliance (OC) and Mutilated Currency Division of the Office of Financial Management (OFM). The OC develops Reserve Bank standards for cancellation and destruction of unfit currency and for note accountability, and reviews Reserve Banksí cash operations for compliance with its standards. As a public service, the OFM processes claims for the redemption of damaged or mutilated currency.

| YEAR | 1990 | 1991 | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010E | 2011B |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Nominal Cost in millions of dollars | 190 | 260 | 295 | 355 | 368 | 373 | 403 | 367 | 408 | 487 | 456 | 344 | 430 | 514 | 514 | 497 | 489 | 576 | 500 | 503 | 624 | 676 |

| Real Costch1 (CPI Adjusted) in millions of dollars | 190 | 249 | 275 | 321 | 324 | 320 | 336 | 299 | 327 | 382 | 346 | 254 | 312 | 365 | 356 | 333 | 317 | 363 | 304 | 306 | 374 | 404 |

ch1 Real cost is nominal cost deflated by CPI--All Urban items, seasonally adjusted. Return to table.

| YEAR | 1990 | 1991 | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010E | 2011B |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Billions of notes | 7.00 | 8.02 | 8.45 | 8.03 | 9.33 | 9.96 | 9.44 | 9.58 | 9.20 | 10.80 | 8.97 | 8.18 | 7.39 | 8.39 | 8.88 | 8.30 | 8.50 | 8.80 | 7.5 | 6.2 | 7.3 | 6.8 |

| Value of Notes in billions of dollars | 84.47 | 107.96 | 103.19 | 104.89 | 128.82 | 148.24 | 194.64 | 142.23 | 163.26 | 285.49 | 67.46 | 50.20 | 123.30 | 126.20 | 157.00 | 140.8 | 146.1 | 178.1 | 160.3 | 224.2 | 217.6 | 258.6 |

| YEAR | 1990 | 1991 | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010E | 2011B |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Billions of notes | 7.00 | 8.02 | 8.45 | 8.03 | 9.33 | 9.96 | 9.44 | 9.58 | 9.20 | 10.8 | 8.97 | 8.18 | 7.39 | 8.39 | 8.89 | 8.29 | 8.46 | 8.8 | 7.5 | 6.8 | 6.7 | 6.8 |

| Weighted Average Cost of Currency per 1000 notes | $26.00 | $30.00 | $36.00 | $41.00 | $38.00 | $37.00 | $40.00 | $43.00 | $47.00 | $43.00 | $47.00 | $49.00 | $50.00 | $58.25 | $55.67 | $55.32 | $55.74 | $63.30 | $63.99 | $77.42 | $89.48 | $95.51 |

1 By Memorandum of Understanding between the BEP and the Board, dated March 13, 1998, "[t]he Board shall provide the currency order to the BEP with denomination and Federal Reserve Bank breakdown 60 days before the beginning of the BEPís fiscal year." Return to text.

2 Because the BEP operates on a fiscal year that began October 1, 2010, and ends September 30, 2011, Board staff estimates the Boardís calendar-year budget for new currency by eliminating the cost of notes that the BEP will produce in the first quarter of its fiscal year and estimating the volume and associated printing costs of notes Board staff projects the BEP will produce in the fourth quarter of the calendar year. Return to text.

3 The new-design $100 note is the last denomination to be issued as part of the Series 2004 design family of notes. This design family, which incorporates new color backgrounds, began with the issuance of the Series 2004 $20 note in October 2003, followed by the $50 note in September 2004, the $10 note in March 2006, and the $5 note in March 2008. The new-design $100 note incorporates advanced technology that makes it easier for the public to authenticate and more difficult for counterfeiters to replicate. Return to text.

4 The three modifications were initiated by the BEP in response to production and quality challenges encountered with several denominations, but most notably with the production of the new-design $100 note. Specifically, the Board removed 32.0 million $5 notes, 83.2 million $10 notes, and 1.1 billion new-design $100 notes from the FY 2010 order. Return to text.

5 In April, the Board announced that the new-design $100 note would be issued on February 10, 2011. In October, however, the Board announced a delay in the issue date of the new-design $100 note. Return to text.

6 The BEP does not receive Federal appropriations; all operations of the BEP are financed by a revolving fund that is reimbursed through product sales, most notably sales of Federal Reserve notes to the Board to fulfill the annual print order. Customer billings are the BEPís only means of recovering the costs of operations and generating funds necessary for capital investment. Section 16 of the Federal Reserve Act requires that all costs incurred for the issuing of notes shall be paid for by the Board and included in its assessments against the Reserve Banks. Return to text.

7 The Board, the BEP, and the U.S. Secret Service jointly established quality standards that notes must meet before the Board will accept and pay for the notes. Return to text.

8 The BEP is currently researching options that may be used to identify and separate notes that meet quality standards from those that do not. The BEP will not charge the Board for any reclaimed notes in 2011 because the surcharge already covered the cost of production. In addition, the BEP will not issue a credit for any notes that do not meet quality standards. Return to text.

9 Charts 1-3 in the attachment show the new currency expenses, the value and number of notes printed, and the number and cost of notes printed from 1990 through the 2011 budget period. Return to text.

10 Currency production costs include costs for paper, ink, direct labor, and variable and fixed overhead costs. Production support costs include costs incurred for manufacturing support, prepress and engraving, research and development, and general and administrative staff and activities. Return to text.

11 In 2007, the BEP awarded a $36 million multiyear contract following a competitive bidding process, to develop a public education program in support of the Series 2004 $5 and $100 notes. This contract was amended in 2009 to $43.7 million for additional work performed during the delay in issuance of the new-design $100 note. In August 2010, the contract was amended to $54.2 million, a step necessitated for the most part by ongoing, unanticipated fulfillment costs. These costs are being generated by stronger-than-expected demand for hard-copy materials, higher customs, duties, value-added-tax fees, new customs regulations, and modified shipping arrangements in key international markets. Return to text.

12 The estimated RRC payment of $32,200 represents the remaining 1 percent of the counterfeit-deterrence research budget. The RRC is a state-of-the-art facility hosted by the National Bank of Denmark for adversarial testing of banknote designs and counterfeit deterrent features for its 13 member countries. Return to text.