Quarterly Report on Federal Reserve

Balance Sheet Developments

| Abbreviations | Overview | Monetary Policy Tools |

Overview

Recent Developments

The Overview section of this report highlights recent developments in the operations of the Federal Reserve's monetary policy tools and presents data describing changes in the assets, liabilities, and total capital of the Federal Reserve System as of December 31, 2014.

Federal Reserve Board Publishes Annual Financial Statements

- On March 20, 2015, the Federal Reserve System released the 2014 audited financial statements for the combined Federal Reserve Banks, the 12 individual Reserve Banks, Maiden Lane Limited Liability Company (LLC), and the Board of Governors. Total Reserve Bank assets as of December 31, 2014, were $4.5 trillion, which is an increase of $0.5 trillion over the balance on December 31, 2013. The Federal Reserve Banks' 2014 earnings, inclusive of other comprehensive income, were $99.7 billion. The Reserve Banks provided for remittances to the U.S. Treasury of $96.9 billion. Interest income on securities acquired through open market operations--U.S. Treasury securities, government-sponsored enterprise (GSE) debt securities, and federal agency and GSE mortgage-backed securities (MBS)--totaled $115.9 billion, an increase of $25.5 billion over the previous year. Earnings attributable to the consolidated variable interest entities (VIEs) were $110 million, $71 million less than 2013. Interest expense on depository institutions' reserve balances during the year was $6.7 billion, losses from the daily revaluation of foreign currency denominated asset holdings were $2.9 billion, and Reserve Bank operating expenses were $6.1 billion, including assessments of $1.9 billion for Board expenses, currency costs, and the Consumer Financial Protection Bureau. The Federal Reserve System financial statements are available on the Federal Reserve Board's website at www.federalreserve.gov/monetarypolicy/bst_fedfinancials.htm.

Federal Reserve Dissolves Three LLCs Associated with Crisis Lending Programs

- In October and November 2014, the Federal Reserve terminated the legal existence of three LLCs--Maiden Lane II LLC, Maiden Lane III LLC, and TALF LLC--that were created as part of the Federal Reserve's response to the financial crisis. Maiden Lane II LLC and Maiden Lane III LLC were created in 2008 as a part of a restructuring of the U.S. Government's financial support to American International Group, Inc. (AIG). In late 2008, the Federal Reserve Bank of New York (FRBNY) lent approximately $19.5 billion and $24.3 billion, respectively, to Maiden Lane II LLC and Maiden Lane III LLC to fund the purchase of certain assets from AIG and certain AIG counterparties. These loans were repaid in full, with interest, in 2012. Additional information on Maiden Lane II LLC and Maiden Lane III LLC is available at www.newyorkfed.org/markets/maidenlane.html. TALF LLC was created in 2009 to manage any collateral or other assets surrendered to the FRBNY by borrowers from the Term Asset-Backed Securities Lending Facility (TALF). As all TALF loans were repaid in full, with interest, TALF LLC acquired no such assets during its existence. The last TALF loan was repaid in October 2014. Information on the TALF and TALF LLC is available in previous editions of this report and at www.newyorkfed.org/markets/talf.html.

FRBNY Extends Overnight Fixed-Rate Reverse Repurchase Agreement Exercise

- At the December 2014 Federal Open Market Committee (FOMC) meeting, the FRBNY was authorized by the FOMC to continue conducting a series of overnight reverse repurchase agreement (RRP) operations involving U.S. government securities for the purpose of further assessing the appropriate structure of such operations in supporting the implementation of monetary policy during normalization. These operations were authorized for one additional year beyond the previously authorized end date--that is, through January 29, 2016. These operations do not represent a change in the stance of monetary policy, and no inference should be drawn about the timing of any change in the stance of monetary policy in the future. Additional details and the results of these operations are available on the FRBNY's website at www.federalreserve.gov/monetarypolicy/fomcminutes20141217.htm and www.newyorkfed.org/markets/omo/dmm/temp.cfm.

FRBNY Announces Additional Term Reverse Repo Operations

- On January 28, 2015, the FRBNY announced that it would conduct a series of term RRP operations from mid-February through early March, as well as a series of term RRP operations that cross the March 2015 quarter-end. These exercises were intended to continue to enhance operational readiness and to increase understanding of how term RRP operations might work as an additional supplementary tool to help control the federal funds rate. The FRBNY conducted four one-week operations in February and early March; these operations matured no later than March 12, 2015. The operations that cross March 2015 quarter-end have been or will be offered via auction at various times in late March and will mature on several dates in early April. The operations are open to all eligible RRP counterparties and use Treasury collateral. These exercises do not represent a change in the stance of monetary policy, and no inference should be drawn about the timing of any change in the stance of monetary policy in the future. Additional information is available at www.newyorkfed.org/markets/opolicy/operating_policy_150128.html.

Federal Reserve Conducts TDF Test Operations with Early Withdrawal Feature and Same-Day Settlement

- On February 2, 2015, the Federal Reserve announced that it would conduct a series of three weekly term deposit operations that offer 21-day term deposits with an early withdrawal feature. Term deposits in this series settled on the same day the operation was executed, eliminating the three-day lag between the execution of an operation and settlement in previous tests. The operations are designed to ensure the operational readiness of the Term Deposit Facility (TDF) and to provide eligible institutions with an opportunity to gain familiarity with term deposit procedures. The development of the TDF and the ongoing TDF test operations are a matter of prudent planning and have no implications for the near-term conduct of monetary policy. Results of the operations and technical details regarding the early withdrawal feature are available at www.frbservices.org/centralbank/term_deposit_facility.html.

FRBNY Announces Another Expansion of Counterparties for Reverse Repo Transactions

- On November 12, 2014, the FRBNY began accepting applications from firms interested in becoming a counterparty eligible to participate in RRP transactions with the FRBNY. The eligibility criteria were substantially the same as those used in the previous counterparty expansion announced on August 16, 2012. It is anticipated that this was the last wave of expanded reverse repo counterparties, and the FRBNY does not anticipate further expansion. On January 16, 2015 the FRBNY announced the additional counterparties accepted; more details are available at www.newyorkfed.org/markets/expanded_counterparties.html. The program to expand counterparties for the conduct of RRP transactions is a matter of prudent advance planning, and no inference should be drawn about the timing of any prospective monetary policy operation. Additional information is available at www.newyorkfed.org/markets/opolicy/operating_policy_141112.html.

Federal Reserve System Selected Assets, Liabilities, and Total Capital

Table 1 reports selected assets and liabilities and total capital of the Federal Reserve System and presents the change in these components over selected intervals. The Federal Reserve publishes its complete balance sheet each week in the H.4.1 statistical release, "Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks," available at www.federalreserve.gov/releases/h41/.

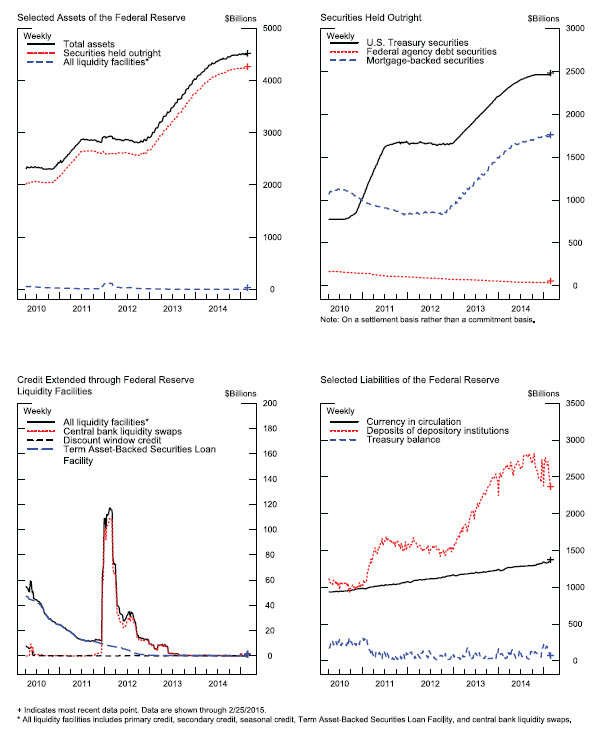

Figure 1 displays the levels of selected Federal Reserve assets and liabilities, securities holdings, and credit extended through liquidity facilities since April 2010.

Table 1. Assets, liabilities, and capital of the Federal Reserve System

Billions of dollars

| Item |

Current February 25, 2015 |

Change from October 29, 2014 |

Change from February 26, 2014 |

|---|---|---|---|

| Total assets | 4,487 | -* | +327 |

| Selected assets | |||

| Securities held outright | 4,237 | +18 | +338 |

| U.S. Treasury securities 1 | 2,460 | -1 | +182 |

| Federal agency debt securities1 | 37 | -3 | -15 |

| Mortgage-backed securities 2 | 1,740 | +22 | +170 |

| Memo: Overnight securities lending 3 | 13 | +4 | +2 |

| Memo: Net commitments to purchase mortgage-backed securities 4 | 24 | -22 | -23 |

| Unamortized premiums on securities held outright 5 | 205 | -5 | -5 |

| Unamortized discounts on securities held outright5 | -18 | +1 | -3 |

| Lending to depository institutions 6 | * | -* | +* |

| Central bank liquidity swaps 7 | * | +* | -* |

| Lending through the Term Asset-Backed Securities Loan Facility (TALF) 8 | 0 | 0 | -* |

| Net portfolio holdings of TALF LLC 9 | 0 | -* | -* |

| Support for specific institutions 10 | 2 | +* | +* |

| Net portfolio holdings of Maiden Lane LLC10 | 2 | +* | +* |

| Net portfolio holdings of Maiden Lane II LLC10 | 0 | -* | -* |

| Net portfolio holdings of Maiden Lane III LLC10 | 0 | -* | -* |

| Foreign currency denominated assets 11 | 20 | -2 | -4 |

| Total liabilities | 4,429 | -1 | +325 |

| Selected liabilities | |||

| Federal Reserve notes in circulation | 1,307 | +52 | +99 |

| Reverse repurchase agreements 12 | 306 | +69 | +73 |

| Foreign official and international accounts12 | 126 | +24 | +24 |

| Others12 | 180 | +45 | +50 |

| Term deposits held by depository institutions | 404 | +232 | +404 |

| Other deposits held by depository institutions | 2,347 | -280 | -264 |

| U.S. Treasury, general account | 47 | -72 | +19 |

| Other deposits 13 | 6 | -2 | -5 |

| Total capital | 58 | +1 | +2 |

Note: Unaudited. Components may not sum to totals because of rounding.

* Less than $500 million.

1. Face value. Return to table

2. Guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. The current face value shown is the remaining principal balance of the securities. Return to table

3. Securities loans under the overnight facility are off-balance-sheet transactions. These loans are shown here as a memo item to indicate the portion of securities held outright that have been lent through this program. Return to table

4. Current face value. Includes commitments associated with outright purchases, dollar rolls, and coupon swaps. Return to table

5. Reflects the premium or discount, which is the difference between the purchase price and the face value of the securities that has not been amortized. For U.S. Treasury and Federal agency debt securities, amortization is on a straight-line basis. For mortgage-backed securities, amortization is on an effective-interest basis. Return to table

6. Total of primary, secondary, and seasonal credit. Return to table

7. Dollar value of the foreign currency held under these agreements valued at the exchange rate to be used when the foreign currency is returned to the foreign central bank. This exchange rate equals the market exchange rate used when the foreign currency was acquired from the foreign central bank. Return to table

8. Book value. Return to table

9. TALF LLC purchased no assets from the Federal Reserve Bank of New York. Return to table

10. Fair value, reflecting values as of December 31, 2014. Fair value reflects an estimate of the price that would be received upon selling an asset if the transaction were to be conducted in an orderly market on the measurement date. Fair values are updated quarterly. Return to table

11. Revalued daily at current foreign currency exchange rates. Return to table

12. Cash value of agreements, which are collateralized by U.S. Treasury securities, federal agency debt securities, and mortgage-backed securities. Return to table

13. Includes deposits held at the Reserve Banks by international and multilateral organizations, government-sponsored enterprises, and designated financial market utilities. Return to table

Figure 1. Credit and liquidity programs and the Federal Reserve's balance sheet