Report to the Congress on the Profitability of Credit

Card Operations of Depository Institutions

- General Discussion

- Recent Trends in Credit Card Pricing

Recent Trends in Credit Card Pricing

Aside from questions about the profitability of credit card operations, credit card pricing and how it has changed in recent years has been a focus of public attention and is consequently reviewed in this Report. Analysis of the trends in credit card pricing here focuses on credit card interest rates because they are the most important component of the pricing of credit card services. Credit card pricing, however, involves other elements, including annual fees, fees for cash advances and balance transfers, rebates, minimum finance charges, over-the-limit fees, and late payment charges.13 In addition, the length of the "interest-free" grace period, if any, can have an important influence on the amount of interest consumers pay when they use credit cards to generate revolving credit.

Over time, pricing practices in the credit card market have changed. Today card issuers offer a broad range of plans with differing rates depending on credit risk and consumer usage patterns. Risk-based pricing has become a central element of most credit card plan pricing regimes and the economic downturn and new credit card rules spurred changes in pricing in 2009 and 2010. In most plans, an issuer establishes a rate of interest for customers of a given risk profile; if the consumer borrows and pays within the terms of the plan, that rate applies. If the borrower fails to meet the plan requirements, for example, the borrower pays late or goes over their credit limit, the issuer may reprice the account reflecting the higher credit risk revealed by the new behavior. Regulations that became effective in February 2010 limit the ability of card issuers to reprice outstanding balances for cardholders that have not fallen at least 60 days behind on the payments on their accounts. Issuers may, however, reprice outstanding balances if they were extended under a variable-rate plan and the underlying index used to establish the rate of interest (such as the prime rate) changes. The new rules continue to provide issuers with considerable pricing flexibility regarding new balances.

This report relies on credit card pricing information obtained from the Quarterly Report of Credit Card Interest Rates (FR 2835a). This survey collects information from a sample of credit card issuers on (1) the average nominal interest rate and (2) the average computed interest rate. The former is the simple average interest rate posted across all accounts; the latter is the average interest rate paid by those cardholders that incur finance charges. These two measures can differ because some cardholders are convenience users who pay off their balances during the interest-free grace period and therefore do not typically incur finance charges. Together, these two interest rate series provide a measure of credit card pricing. The data are made available to the public each quarter in the Federal Reserve Statistical Release G.19 Consumer Credit.

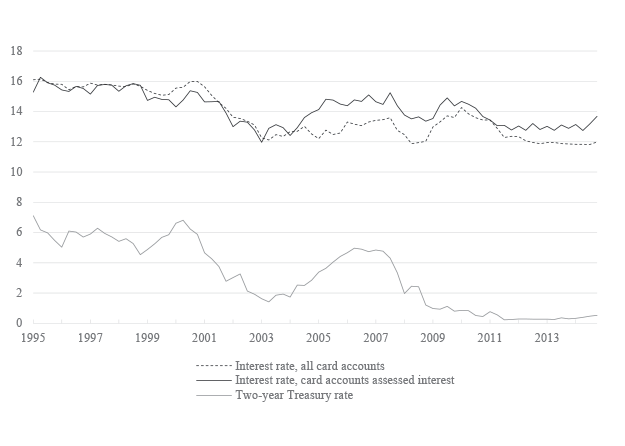

Data from the FR 2835a indicate that the average credit card interest rate across all accounts is currently at a relatively low level around 12 percent, while the two-year Treasury rate, a measure of the short-term baseline or “risk-free” rate, has been close to zero since mid-2011. (Figure 1). Average rates on accounts assessed interest are reported to be somewhat higher, at closer to 14 percent as of 2014:q4. It is important to note that while average rates paid by consumers have moved in a relatively narrow band over the past several years, interest rates charged vary considerably across credit card plans and borrowers reflecting the various features of the plans and the risk profile of the card holders served.

Source: Federal Reserve, Quarterly Report of Credit Card Interest Rates

Accessible VersionFootnotes

13. In June 1996, the Supreme Court ruled that states may not regulate the fees charged by out-of-state credit card issuers. States have not been permitted to regulate the interest rates out-of-state banks charge. In making its decision, the Court supported the position previously adopted by the Comptroller of the Currency that a wide variety of bank charges, such as late fees, membership fees, and over-the-limit fees, are to be considered interest payments for this purpose. This ruling will likely ensure that banks will continue to price credit cards in multidimensional ways rather than pricing exclusively through interest rates. Source: Valerie Block, Supreme Court Upholds Nationwide Card Charges, American Banker, June 4, 1996.

An assessment of the fees charged by credit card issuers is provided in “Credit Cards: Increased complexity in Rates and Fees Heightens Need for More Effective Disclosures to Consumers,” U.S. Government Accountability Office, Report 06-929, September 12, 2006. Refer to www.gao.gov. Return to text