FEDS Notes

September 29, 2016

Changing FHA Mortgage Insurance Premiums and the Effects on Lending

Neil Bhutta and Daniel Ringo

To what extent can the cost of credit affect home buying and mortgage borrowing activity? This note explores the effect of changes in Federal Housing Administration (FHA) mortgage insurance premiums (MIP) on mortgage borrowing activity. Reacting to changing conditions in the mortgage market as well as the state of its own balance sheet, the FHA has adjusted its pricing rules a number of times in the wake of the financial crisis. We first show that abrupt changes in FHA's MIPs have been associated with abrupt changes in the share of FHA-insured home purchase loans, indicating a close link between FHA pricing and market share. Second, focusing on the most recent MIP reduction in January 2015, we provide evidence that the resulting rise in FHA market share reflects, in part, an increase in the overall volume of lending, as opposed to simply a shift from private insurance into FHA insurance. We suspect that the immediate increase in lending occurred because the MIP reduction improved applicants' debt payment to income ratios and thus their chances of credit approval.

Background on the FHA

Potential homebuyers with little money for a down payment -- many first time homebuyers, for example -- may have difficulty obtaining a mortgage to buy a home. Lenders and secondary-market investors are concerned about potential losses if such borrowers have trouble making loan payments. To get approved, applicants with low down payments often need to pay for mortgage insurance, which helps protect creditors against losses in the event of borrower default.1

The Federal Housing Administration (FHA), a Federal agency within the Department of Housing and Urban Development (HUD), is one important provider of mortgage insurance. Since 2012, 20-30 percent of home purchase originations for 1-4 family owner-occupied properties have carried FHA insurance. FHA-insured loans require a down payment as low as 3.5 percent of the property value, which eases the transition into homeownership for first time homebuyers with little in the way of accumulated assets. In 2014, more than 80 percent of FHA-insured home purchase loans went to first-time homebuyers, and over three-quarters of FHA-insured loans had down payments of less than 5 percent (HUD, 2015). FHA mortgage insurance premiums can also be substantially lower than those from private mortgage insurance companies for many borrowers, particularly those with lower credit scores.2

Mortgage Insurance Premiums

The FHA charges a one-time upfront premium, set as a percentage of the original loan amount, as well as an annual premium, set each year during the life of the loan as a percentage of the expected average outstanding balance during the year. The premium rates are generally the same for all borrowers, regardless of credit risk.3 The upfront premium can be financed and rolled into the loan.

From the year 2000 to 2008, the upfront MIP for most FHA loans was 150 basis points, and the annual MIP was 50 basis points.4 As delinquency rates rose through the crisis and subsequent recession, FHA began a series of premium increases, reflecting the riskier loan environment and heavy losses it was incurring. From October 2008 to April 2013, the annual premium more than doubled to 135 basis points, implying an increase in the first-year premium payment of about $1,700 for a $200,000 loan. Most recently, in January 2015, FHA announced a sharp reduction in the annual premium to 85 basis points. The changes to upfront and annual premiums are summarized in Table 1. The rightmost column provides an approximation of the total MIP payments a typical borrower would make in the first year of an FHA loan, assuming a $200,000 loan, 4 percent interest rate, and financing the upfront MIP.

| Date of Change | New Mortgage Insurance Premium | Typical First Year Payment (dollars) | |

|---|---|---|---|

| Upfront | Annual | ||

| 1-Jan-01 | 150 | 50 | 1,160 |

| 1-Oct-08 | 175 | 55 | 1,290 |

| 5-Apr-10 | 225 | 55 | 1,350 |

| 4-Oct-10 | 100 | 90 | 1,900 |

| 18-Apr-11 | 100 | 115 | 2,390 |

| 9-Apr-12 | 175 | 125 | 2,680 |

| 1-Apr-13 | 175 | 135 | 2,880 |

| 26-Jan-15 | 175 | 85 | 1,890 |

Note: Premiums apply to home purchase loans for $625,000 or less with an LTV ratio greater than 95 percent and a loan term longer than 15 years.

Source: HUD Mortgagee letters 00-38, 08-22, 10-02, 11-10, 12-04, 13-05 and 15-01.

In addition to the changes in the levels of premiums, a 2013 policy change by the FHA included an extension of the period over which they must be paid. Previously, insurance premiums cancelled automatically when the outstanding balance of the loan reached 78 percent of the purchase price if the borrower is not delinquent, similar to the rules for private mortgage insurance (PMI). However for loans with a case assignment date on or after June 3, 2013, the annual insurance premium is generally assessed over the life of the loan.5 Homeowners borrowing after this date must refinance into a non-FHA loan to eliminate their mortgage insurance.

Response of FHA Market Share to Premium Changes

Some borrowers seeking a high-LTV loan may have a choice between private mortgage insurance (PMI) and FHA mortgage insurance.6 Increases to the FHA premiums may drive these borrowers to the PMI market; conversely, premium reductions may pull them back to FHA loans. In addition, some potential borrowers' willingness or ability to get a loan at all may depend directly on the premiums the FHA charges. Both of these factors can impact the FHA's market share of loan originations.

To document how the FHA share of the home purchase loan market has varied with FHA premiums since 2008, we use data collected under the Home Mortgage Disclosure Act (HMDA). HMDA directs the vast majority of mortgage lenders to annually report detailed information on every mortgage application received, including FHA status, the dates of application and origination, loan purpose (home purchase, refinance or home improvement), property type, occupancy status, lien status and application outcome (originated, denied, withdrawn by applicant, etc.). 7

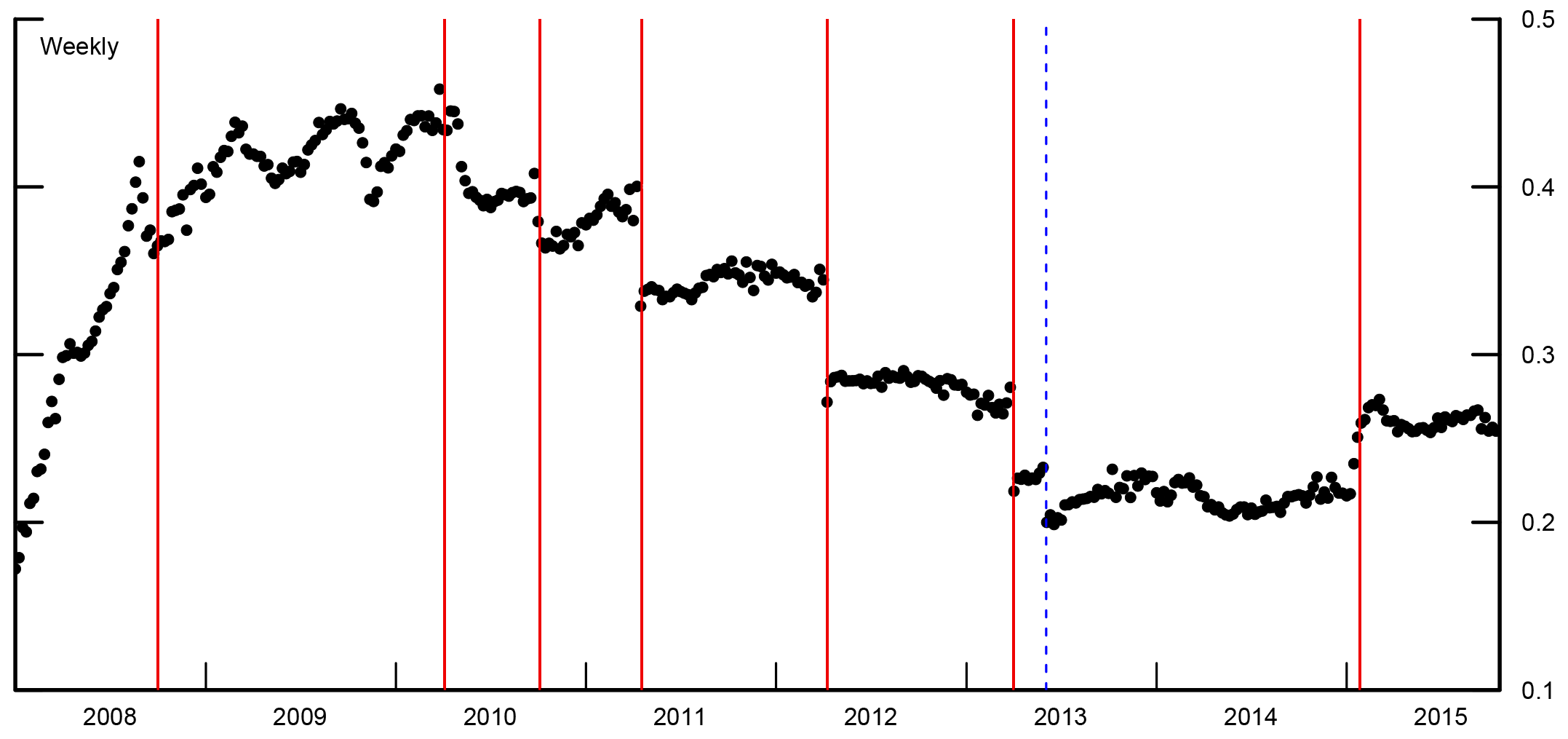

Figure 1 displays the share of first-lien owner-occupied home purchase loans that carried FHA insurance by the week of application. The vertical lines represent dates at which FHA premiums changed. The actual premium faced by a borrower depends on their case number assignment date, not the application date, but in practice case number assignments are typically made soon after application so the week of application provides a good proxy for the relevant pricing regime.

FHA market share appears quite sensitive to the premiums. For example, the recent reduction in the annual premium from 1.35 percent to 0.85 percent -- about $1,000 for a $200,000 loan in the first year -- in January, 2015 was associated with a 5 percentage point increase in FHA market share from approximately 22 percent to about 27 percent.

|

|

Note: Solid vertical lines mark dates of FHA MIP changes referenced in Table 1. The dashed vertical line marks the extension of annual insurance premiums over the life of the loan.

Source: Data reported under HMDA.

The Effect of the 2015 MIP Decline on the Level of Borrowing

Beyond affecting the choice of PMI or FHA insurance, the FHA premium changes may also have affected the choice or ability of many households to buy a home at all. This could occur through two channels. First, homeownership becomes more (less) appealing when the cost of credit falls (rises). Potential buyers for whom FHA loans are the most economical option (i.e. first-time homebuyers or others with little cash on hand, those with lower credit scores) are therefore directly incentivized to buy when premiums drop.

Second, monthly payments may determine whether a particular application gets approved for credit or denied. Among other underwriting criteria, lenders use the applicant's monthly debt service payments as a fraction of their monthly income (DTI) to determine whether to originate a loan. For FHA applicants, a reduction in premiums will reduce their DTI ratios and may improve their chances of acceptance. DTI based denials are common: in the 2014 HMDA data, over 30 percent of denied FHA home purchase applications that reported at least one reason for denial cited DTI ratio.

We investigate the response of total home purchase borrowing to changing FHA premiums by focusing on the largest and most recent such change: the 50 basis point decrease in annual premiums on January 26, 2015. Home purchase mortgage originations exhibit pronounced seasonality, typically with a rapid rise through the first several months of each year. For this reason, it is not easy to tell if the premium decrease caused more lending by comparing total levels just before and just after January 26, 2015. Instead, we divide borrowers into "treatment" and "control" groups. The treatment group consists of borrowers with FICO scores below 680 seeking loans with LTV ratios above 80 percent. These lower score, low down payment borrowers are heavily reliant on FHA loans (85 percent of them use FHA loans in our data set, described below) and so the decrease in premiums directly affects their monthly payments. The control group, all other borrowers, uses FHA loans more rarely (17 percent in our data) and thus the premium changes have little effect on the prices they pay. Observing an increase in lending to the treatment group relative to the control group right around January 26 would indicate that decreasing FHA premiums increased total lending (not merely switching borrowers between different forms of insurance).

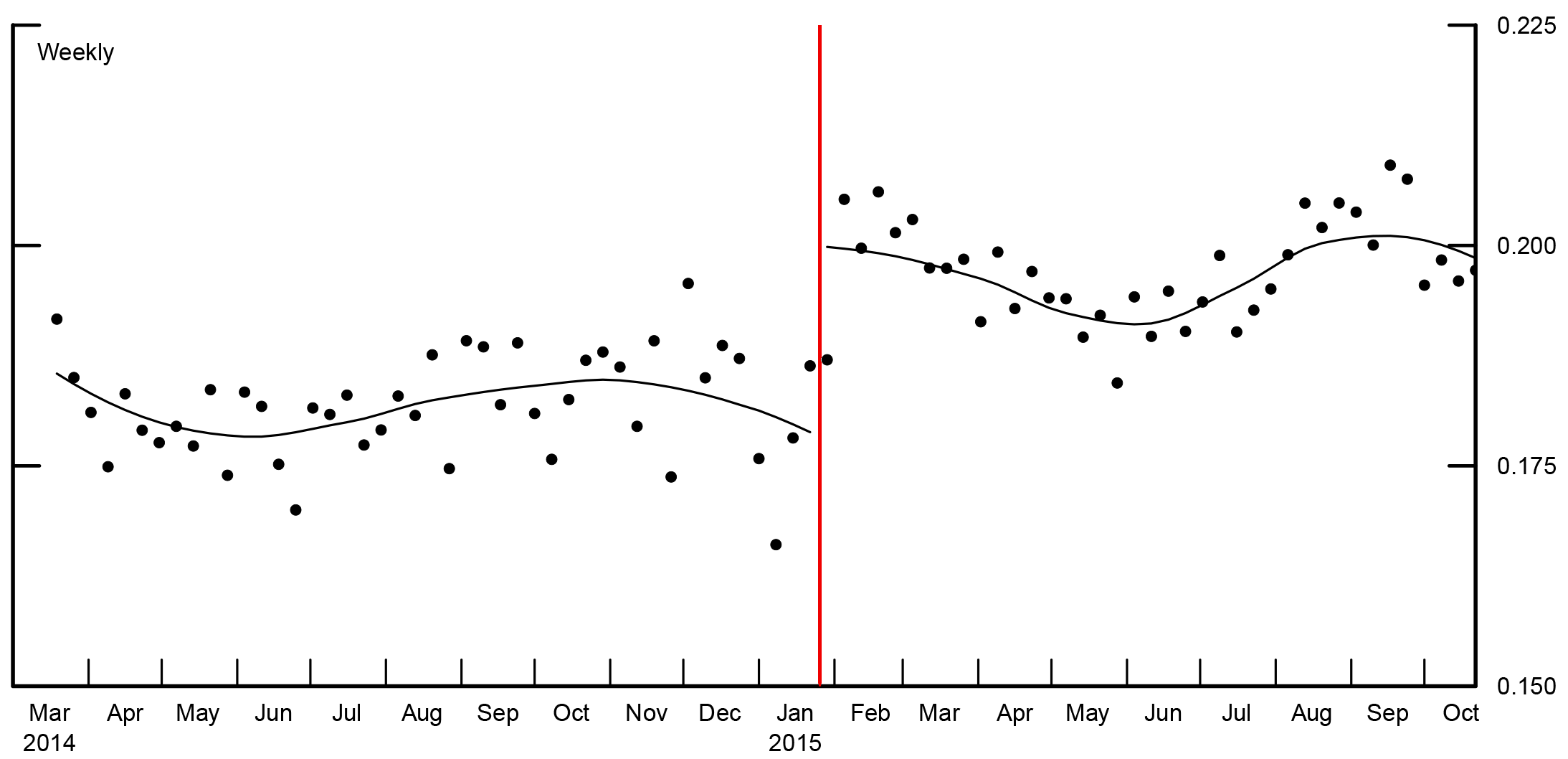

To test for the presence of such a jump, we use mortgage rate lock data from a large proprietary database of mortgage applications provided by Optimal Blue. These data cover roughly one quarter of home purchase applications in the United States from 2013 to the present. Unlike the HMDA data, they include the applicant's FICO score and LTV ratio which we use to define our treatment and control groups. In Figure 2, we plot the fraction of home purchase loans going to treatment group borrowers by week of mortgage rate lock, with a vertical line at January 26, 2015. The date of rate lock serves as an inexact proxy for the case number assignment date.

There appears to be an immediate leap in the treatment group's share of home purchase loans after January 26, rising approximately 2 percentage points. This pattern indicates that the reduced premiums did lead to a net increase in the number of home purchase loans, in addition to causing many borrowers to choose FHA loans over private insurance. Formal tests (not shown) confirm that the discontinuity is statistically significant. The immediacy of the response also suggests to us that a reduction in DTI based denials may be a key channel through which lower premiums lead to increased lending. Another possible channel—an increase in the number of home purchase loans demanded caused by a drop in the cost of credit—would almost certainly take longer than a week or two to be realized. Buying a house is a lengthy process, and consumer knowledge about FHA premiums likely spreads slowly.8

Conclusion

The volume of FHA home purchase loans is apparently quite sensitive to MIP changes. We find that lowering the annual MIP in 2015 substantially increased the number of loans to lower credit score, high LTV borrowers -- who as a group rely heavily on FHA insurance. In future work, we will further explore the evidence suggesting DTI-based denials are the primary source of this response, and how the results may extrapolate more generally to the sensitivity of home purchase borrowing to changes in monthly payments.

|

|

Note: The vertical line marks January 26, 2015, the date of the decrease in annual FHA MIP referenced in Table 1.

Estimated curve of best fit overlaid on weekly data.

Source: Optimal Blue.

References

Bhutta, Neil and Daniel Ringo. 2016. "Residential Mortgage Lending from 2004 to 2015: Evidence from the Home Mortgage Disclosure Act Data," Federal Reserve Bulletin, vol. 102.

Goodman, Laurie, Alanna McCargo, Ellen Seidman, Jim Parrott, Sheryl Pardo, Jun Zhu, Wei Li, Bing Bai, Karan Kaul, Maia Woluchem and Alison Rincon. 2016. "Housing Finance at a Glance: A Monthly Chartbook, June 2016," Urban Institute, http://www.urban.org/ ![]()

U.S. Department of Housing and Urban Development (HUD), Mortgagee Letters 00-38, 10-02, 11-10, 12-04, 13-05, and 15-01, http://portal.hud.gov/hudportal/HUD?src=/program_offices/administration/hudclips/letters/mortgagee; and HUD, Inactive Mortgagee Letter 08-22, http://portal.hud.gov/hudportal/HUD?src=/program_offices/administration/hudclips/letters/mortgagee/inactive.

2. See the June 2016 Housing Finance at a Glance ![]() monthly chartbook published by the Urban Institute. Over half of FHA-insured mortgages in 2014 went to borrowers with credit scores under 680 (HUD, 2015) Return to text

monthly chartbook published by the Urban Institute. Over half of FHA-insured mortgages in 2014 went to borrowers with credit scores under 680 (HUD, 2015) Return to text

3. Under current pricing rules, annual insurance premiums differ if the loan amount exceeds $625,000, the loan to value (LTV) ratio at origination is less than or equal to 95 percent, or the loan term is less than or equal to 15 years. However, the substantial majority of FHA purchase loans do not meet any of these criteria. Return to text

4. See HUD Mortgagee Letter 00-38 Return to text

5. See HUD Mortgagee Letter 13-04 Return to text

6. Veterans and those living in rural areas may have additional options, including loans guaranteed by the Department of Veterans Affairs or the Rural Housing Service. Return to text

7. The public version of the HMDA data does not include application and origination dates. See Bhutta and Ringo (2016) for more details on the information available in the HMDA data. Return to text

8. HUD Mortgagee Letter 15-01 announcing the reduction in premiums was published on January 9, 2015, less than three weeks before the effective date. Return to text

Please cite as: Bhutta, Neil, and Daniel Ringo (2016). "Changing FHA Mortgage Insurance Premiums and the Effects on Lending," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, September 29, 2016, http://dx.doi.org/10.17016/2380-7172.1843.

Disclaimer: FEDS Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers.