FEDS Notes

November 22, 2016

The Tools and Transmission of Federal Reserve Monetary Policy in the 1920s

Mark Carlson and Burcu Duygan-Bump 1

This note describes the tools used by the Federal Reserve (Fed) to implement monetary policy in the 1920s and the degree to which changes in these tools were transmitted to private money markets. In doing so, we hope to provide some historical perspective to the renewed debate around monetary policy frameworks and toolkits.

The monetary policy toolkit in the 1920s is particularly interesting because the Federal Reserve had three policy instruments at its disposal, each of which affected financial conditions through a slightly different channel; use of these tools also resulted in a substantial portion of the Fed's balance sheet consisting of private credit instruments. The first tool was the discount window through which the Fed rediscounted private securities as a means to directly provide funding to banks at a particular interest rate and thus influenced banks' marginal cost of funds. The second tool was purchases of bankers' acceptances; the Fed set a price at which it would buy these private money market securities, essentially setting a ceiling on the market rate for acceptances and influencing related money markets. The third tool was open market operations in government securities which impacted money markets by changing the availability of reserve balances.

After describing the three policy instruments, we examine their effectiveness between the years 1922 and 1929--a period after distortions from war finance needs had diminished and preceding the financial distress of the Great Depression. In particular, we look at how private money market rates in New York City--where the largest and most important money markets in the U.S. were located --were impacted by changes in the discount rate of the Federal Reserve Bank of New York (FRBNY), by changes in FRBNY's acceptance rate, and changes in the System's holding of government bonds. We find that all three policy instruments were effective in influencing private money market rates. We estimate that changes in the discount rate and acceptance rate had similarly sized effects, and that it took noticeable, but not exceptionally large, changes in the holdings of government securities to affect private money market rates.

The note proceeds as follows. Section 1 describes the Fed's monetary policy toolkit and discusses the implications of the use of these tools for the Fed's balance sheet. Section 2 describes the major private money markets of the 1920s and presents our analysis of the transmission of changes in monetary policy to private money market rates.

Section 1. Monetary Policy Toolkit

In this section, we discuss the three main tools the Fed used to implement monetary policy in the 1920s: the discount window, purchases of bankers' acceptances, and purchases of government securities. We also briefly describe the implications of the use of these tools for the Fed's balance sheet as well as the role the Fed played in these markets.

The Discount Window

In the 1920s, the Federal Reserve relied importantly on the discount window and the rate charged for discounting bills was the primary policy tool to manage credit conditions in the economy. The goal was to accommodate commerce and business, without allowing speculative excesses to create instability. Specifically, the Federal Reserve Banks would advance (increase) their discount rates when they viewed credit growth as excessive, and they would cut their discount rates when industry and trade were in need of support.2

During the 1920s, the ability of the Federal Reserve to provide credit through the discount window was more limited than it is currently. In particular, the Federal Reserve could only (re)discount short-term commercial, agricultural, or industrial paper from member banks that was used to produce, purchase, carry, or market goods but it could not discount promissory notes, such as corporate bonds, short-term corporate paper, or commercial and industrial loans.3 The Fed could also rediscount government paper. When rediscounting paper, the Federal Reserve would take ownership of the paper and provide the member banks funds against the amount the paper promised to pay at maturity. The amount the Federal Reserve provided the bank was less than the promised payment at maturity by the discount rate. When the paper matured, the Federal Reserve would return the paper to the bank for collection; the bank would pay the Fed with the proceeds from the loan repayment or from its own resources.4 In addition to discounting private paper, the Federal Reserve could also make loans (advances) to banks for up to 15 days backed by either paper eligible for discount or by U.S. government obligations. In general, during the 1920s, advances tended to be secured by government securities while rediscounts tended to be of private paper. The Federal Reserve could require additional collateral for both discounts and loans.

Even with the restrictions on the paper it could discount or make advances upon, many member banks accessed the discount window and the rate that the Fed charged on its rediscounts and advances had an important effect on banks' marginal cost of funding. There was notably less stigma associated with borrowing from the discount window in the 1920s and borrowing was fairly widespread with about one-third of all member banks borrowing in any given month (roughly 3,000 borrowers out of 9,000 member banks). We estimate that, at the end of 1926, funding provided to member banks through the discount window (either through advances or rediscounts) represented 1.7 percent of the total liabilities of member banks. Alternatively, rediscounts and advances against private (non-government) collateral equaled about 1.5 percent of the loans of member banks.

Table 1 shows the holdings of securities acquired through discount window and open market operations as of the end of the year 1926--a year which seems fairly representative of the period we are interested in. This table confirms that advances and discounting of bills were indeed the primary operational tool accounting for just under half of the securities on the Federal Balance sheet linked to the three monetary policy tools. Advances secured by US government obligations were more common than discounts of paper and accounted for about a third of the holdings of securities related to the three monetary policy tools. Discounts were typically of commercial and agricultural paper and these accounted for an additional 13 percent of securities holdings.

Purchases of bankers' acceptances in open market

The Federal Reserve had the authority to purchase bankers' acceptances in the open market as part of its open market authority. Bankers' acceptances are a money market instrument used to finance trade, especially international trade.5 When an exporter ships goods abroad, they typically must wait to be paid until the goods have reached the market and been sold. Especially in international trade, this may take some time. Rather than wait, the exporter can bring a bill indicating the shipment to his bank and receive a loan against that bill. The bank may finance this loan by endorsing the bill and bringing it to a larger bank, usually in a money center. The money center bank "accepts" the bill and provides money to the exporter's bank. The money center bank then may choose to hold that bill and treat the payment to the exporter's bank as a loan, or it could sell it into the market as a bankers' acceptance. The acceptance is guaranteed by the payment the exporter expects to receive, the promise of the exporter's bank to make good on the paper if the exporter fails, and the promise of the money center bank to make good on the paper if the exporter's bank fails. Triply secured, the bankers' acceptance was low risk and short term, perfect as an instrument for money market investors.6

This type of instrument was little used in the United States prior to the Federal Reserve. Indeed, banks with National charters were forbidden to issue such securities. As many prominent European money markets, such as London, had large bankers' acceptance markets and the fact that these securities backed "real transactions," the founders of the Federal Reserve were keen to develop this market.7 After its founding, several Federal Reserve officials (in particular Paul Warburg at the Board and Benjamin Strong at the FRBNY) sought to build a market in the United States that would resemble the ones that worked in Europe.

Bankers' Acceptances were one of the few types of securities that the Federal Reserve was able to purchase.8 The Federal Reserve banks would set rates at which they would buy acceptances of particular maturities and take all eligible acceptances that were delivered to them. By changing the rate at which it would purchase acceptances, the Federal Reserve could affect the cost of this type of intermediation. Thus the acceptance rate provided the Federal Reserve with another monetary policy tool. Eligibility rules covered issues such as the types of goods associated with the underlying transaction and the maturity of the loans being provided; interestingly, whether any of the banks involved in the transaction were Federal Reserve member banks did not affect eligibility. The Federal Reserve preferred to purchase acceptances on the secondary market, consistent with the notion that a strong secondary market was key to the long run health of this market, but would occasionally buy acceptances directly from the accepting money center banks.

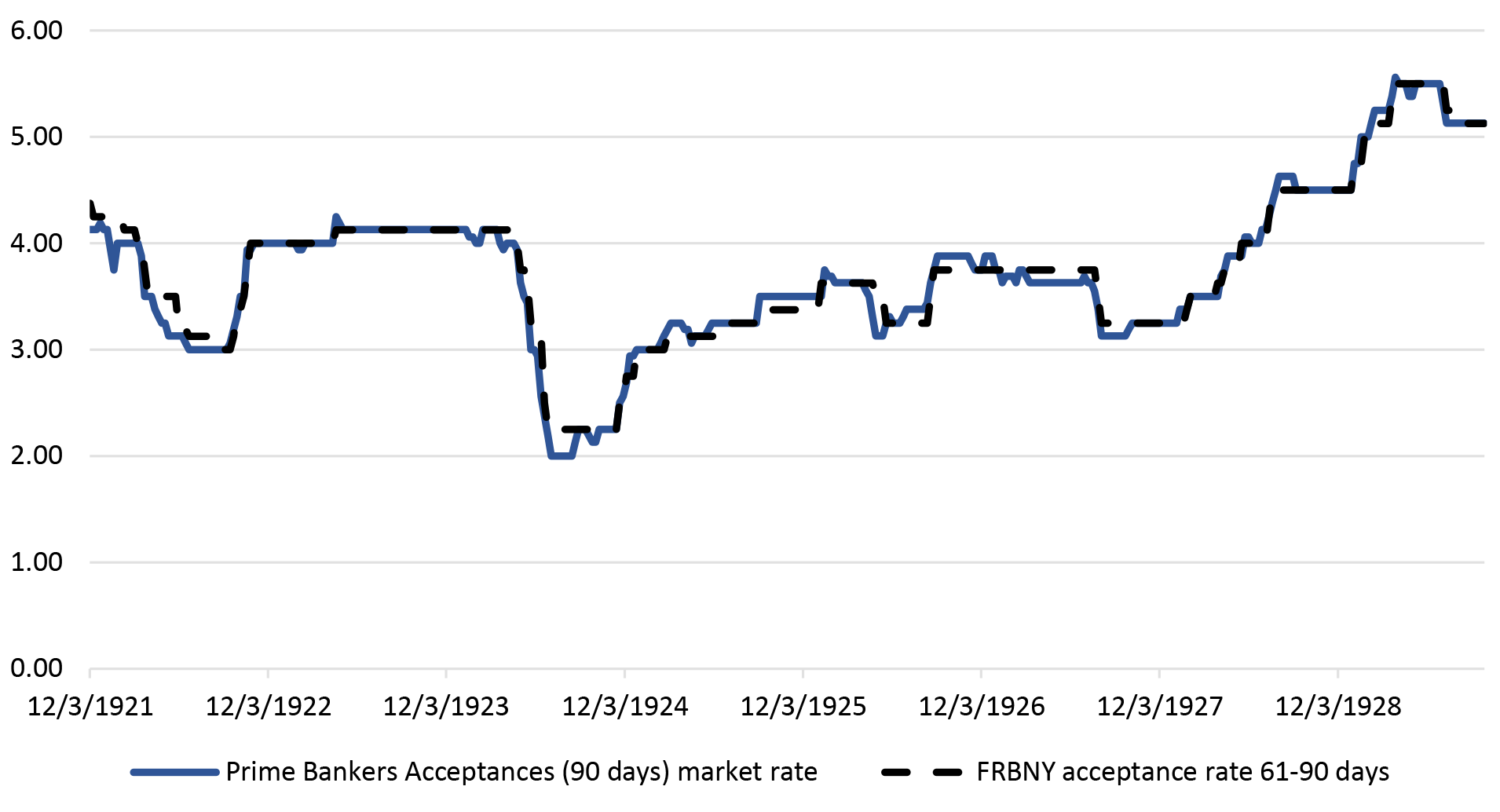

Fed purchases of bankers' acceptances securities were substantial and accounted for nearly 30 percent of the securities obtained through its monetary policy operations, as shown in Table 1. (Most of these were purchased outright, although the Federal Reserve also purchased some acceptances under agreements to resell them [repo agreements].) Specifically, the Federal Reserve held nearly $380 million of these securities at the end of the year 1926, most of which were bankers' acceptances for imports or exports. These totals meant that the Federal Reserve held nearly 40 percent of outstanding acceptances at any one time. Consistent with its substantial share of the market, the rate at which the Fed was willing to buy acceptances heavily influenced the market price. As shown in Figure 1, the market rate in New York and the rate at which FRBNY offered to purchase the securities were almost identical.

|

|

Source: Federal Reserve, Banking and Monetary Statistics, 1943.

Purchases of government securities in open market

The Federal Reserve also had the authority to purchase government obligations in the open market. Until 1923, each Federal Reserve Bank conducted open market operations in government securities independently, which at times led to challenges that underscored the need for better coordination. Efforts to coordinate purchases across the System eventually resulted in the creation of the Open Market Investment Committee in 1923. Around this time, open market operations in government securities began to be seen as a tool that could be used to manage the aggregate quantity of credit, and support the discount policy without accompanying changes in the discount rate. Specifically, purchases and sales of government securities were seen as a way of affecting the availability of funds for banks and the banks' needs to access the discount window as a source of funds: "the purchase of securities in the open market by a reserve bank places funds in the hands of member banks which these banks may use in the repayment of borrowings from the reserve banks; the sale of securities, on the other hand, by withdrawing funds from the market may lead to additional borrowing from the reserve banks."9

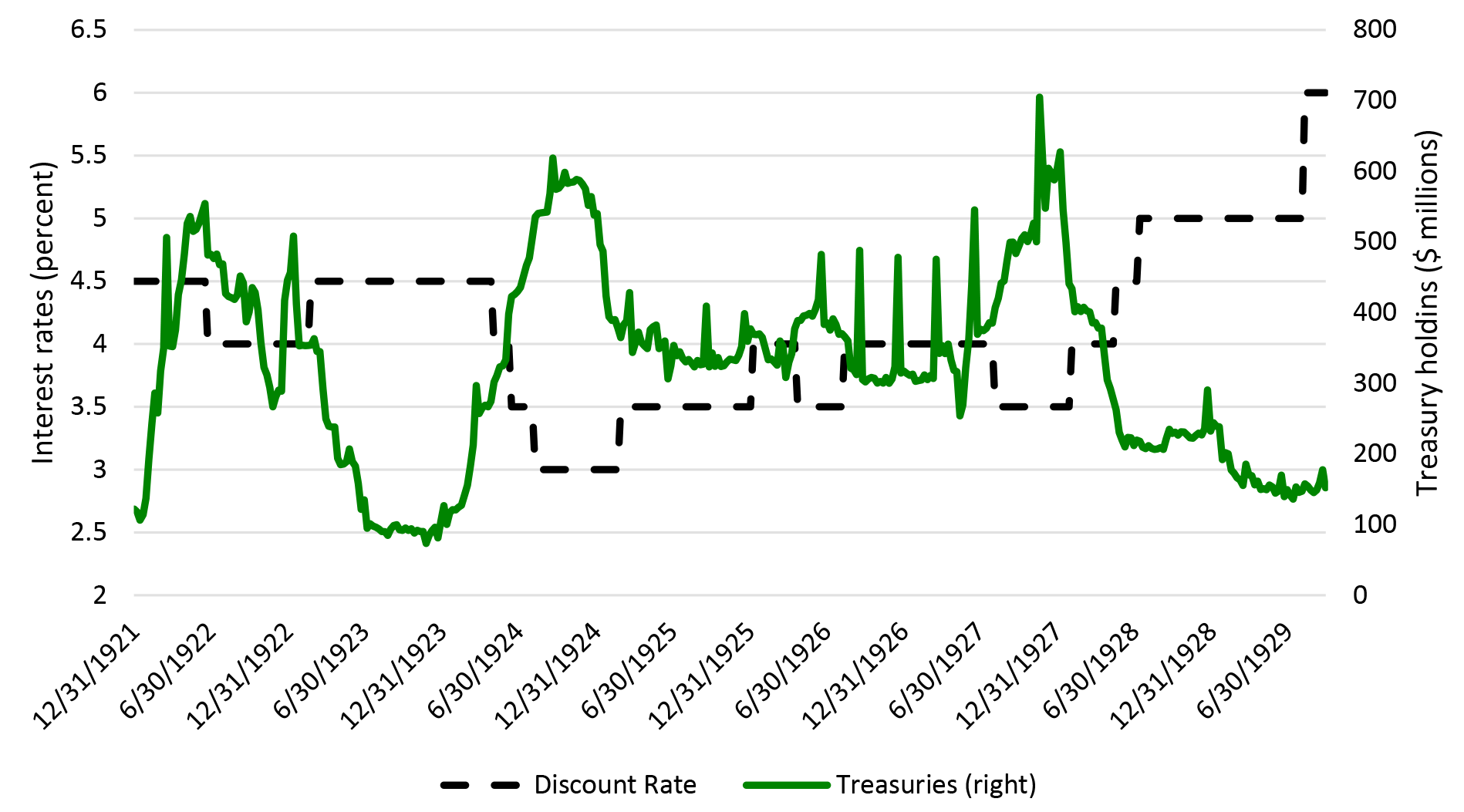

The interaction between the open market operations and the discount policy can also be seem in Figure 2. In general, policy instruments seem to have moved in the same direction. Holdings of Treasury securities tended to increase around the time that policy rates were lowered and vice versa. It is also clear that the holdings of Treasury securities was continually changing while the discount rate moved more infrequently.

|

|

Source: Federal Reserve, Banking and Monetary Statistics, 1943.

Table 1 shows the Federal Reserve holdings of Treasury securities purchased in the open market as of the end of year 1926. (As with acceptances, most securities were held out right, but some were bought under repo agreements.) At about $315 million dollars, they amounted to about less than a quarter of holdings across the three classes of operations, corresponding to about 1.7 percent of all interest-bearing Treasury securities. Certificates of indebtedness seem to have comprised the bigger share of these holdings, which suggests that they tended to hold shorter-term government securities.10

| Holdings (in thousands of dollars) | % total (all classes) | |

|---|---|---|

| Bills discounted for member banks, total | 636,628.00 | 47.80% |

| Rediscounted bills | ||

| Commercial and agricultural paper | 170,639.00 | 12.80% |

| Demand and sight drafts | 322 | 0.00% |

| Bankers' acceptances | … | … |

| Trade acceptances | 2,812.00 | 0.20% |

| Secured by US Government obligations | 1,111.00 | 0.10% |

| Member bank collateral notes (Advances) | ||

| Secured by US Government obligations | 364,169.00 | 27.30% |

| Otherwise secured | 97,575.00 | 7.30% |

| Bills bought in open market, total | 380,986.00 | 28.60% |

| Bills payable in dollars | ||

| Bankers' acceptances for imports or exports | 252,242.00 | 18.90% |

| Bankers' acceptances for domestic trade | 77,698.00 | 5.80% |

| Bankers' acceptances, other | 47,599.00 | 3.60% |

| Trade acceptances | 1,258.00 | 0.10% |

| Bills payable in foreign currencies | 2,189.00 | 0.20% |

| United States securities purchased in open market, total | 314,820.10 | 23.60% |

| Bonds | 47,962.56 | 3.60% |

| Treasury notes | 87,359.60 | 6.60% |

| Certificates of indebtedness | 179,498.00 | 13.50% |

| Total, all classes | 1,332,434.10 | 100.00% |

Source: 1926 Annual Report of the Federal Reserve Board.

Balance sheet of the Federal Reserve

An abbreviated balance sheet of the Federal Reserve between 1922 and 1929 is shown in Table 2. From this table, it is clear that the major asset of the Federal Reserve System was gold, which is consistent with the U.S. being on the gold standard. It is also apparent that, during this period, the direct exposure of the Federal Reserve to the condition of the commercial banking sector was fairly substantial. Private credit, consisting of bills of acceptance purchased in the open market, paper rediscounted, or advances to member banks on acceptable collateral (often government securities), constituted about 20 percent of the Federal Reserve System's assets. Holdings of government securities were a smaller share of the balance sheet in this period, averaging about 7 percent of total assets.

| Gold, gold certificates, due from Treasury | Rediscounts | Advances | Bills of acceptances purchased | Treasury Securities | Other assets | Total assets | Share private credit | |

|---|---|---|---|---|---|---|---|---|

| 1922 | 2,993 | 280 | 338 | 272 | 436 | 933 | 5,252 | 16.9 |

| 1923 | 3,021 | 367 | 356 | 355 | 134 | 834 | 5,066 | 21.3 |

| 1924 | 2,895 | 113 | 207 | 386 | 540 | 955 | 5,096 | 13.9 |

| 1925 | 2,647 | 190 | 453 | 373 | 375 | 1,071 | 5,109 | 19.9 |

| 1926 | 2,752 | 175 | 462 | 379 | 315 | 1,068 | 5,150 | 19.7 |

| 1927 | 2,676 | 90 | 492 | 391 | 617 | 1,080 | 5,346 | 18.2 |

| 1928 | 2,506 | 218 | 839 | 488 | 228 | 1,073 | 5,352 | 28.9 |

| 1929 | 2,784 | 174 | 458 | 391 | 454 | 1,197 | 5,458 | 18.7 |

Source: Federal Reserve, Banking and Monetary Statistics, 1943.

Note. Dollar millions. As of year-end. Private credit is the share of the balance sheet that consisted of rediscounts, advances, and bills of acceptances.

Holdings of all instruments related to monetary policy--rediscounts, advances, acceptances, and Treasury securities--accounted for between 24 percent and 33 percent of the balance sheet. Fluctuations in this share, particularly in holdings of Treasury securities, reflected shifts in monetary policy.

Section 2. Transmission of changes in monetary policy to private money rates

In this section, we examine how private money market rates changed in response to changes in the monetary policy tools and whether particular policy tools produced larger or smaller reactions in private money rates. First however, we briefly describe the private money markets where we will look for an impact of monetary policy: the call/broker's loan market and the commercial paper market.11

Call loan market12

The largest money market in the 1920s was the market for broker's loans, where short-term loans could be extended to New York City stock brokers and brokerage houses backed by equity securities traded on the New York Stock Exchange.13 A large portion of the loans were demand loans and could be "called" by the lender at any time which gave rise to the name of the market. The market was seen as a place where liquid funds could be placed and was sufficiently deep that, should a loan be called, the borrower was easily able to find another lender and repay the first lender. A modest share (30 percent) of loans to brokers were made on a time basis, while not available at call, these loans were considered part of the call loan market as they were to the same borrowers and secured by the same collateral.

This market was chiefly used by brokers to finance their own accounts and the accounts of their clients. Lenders included domestic and foreign banks, corporations, and investment trusts. The domestic banks included both small banks across the country and the major banks in New York. The latter group provided clearing and securities custody services to the brokers and might lend to the brokers directly; the New York banks were also in regular contact with the money desk at the New York stock exchange and the money brokers, the institutions where the call loans were arranged.

Interest rates for the "on demand" portion of the market were set at the New York stock exchange as the managers at the money post there tried to balance demand and supply of money. Money brokers also arranged on demand call loans but reportedly took their pricing cues from the stock exchange; money brokers were exclusively the group that intermediated the time portion of the market and set the rates to clear this market.

Prime commercial paper market

This was a market in which moderately sized firms could borrow on an unsecured basis (larger firms would typically issue long-term bonds). The small firms would issue short-term notes which would be purchased by a commercial paper house, often an institution affiliated with a large financial institution that might also be a securities broker or underwriter. That house would arrange to distribute the paper around the country. The houses would verify the quality of the commercial paper they were buying and selling; the houses would not endorse the paper they sold but there were reputational consequences to selling paper that subsequently went bad. The most common buyers of commercial paper were banks which would use this as a place to put funds on a short-term basis. Given the structure of the market, while the borrower might refinance maturing commercial paper and the same commercial paper house might buy and distribute that paper, the purchasers of one issue were not commonly the purchasers of the refinancing issue. Banks might buy this paper directly or through their correspondent, typically located in New York City. This market was strong for much of the 1920s, but started to fade by the end of that period.

Interest rates on this paper were determined by the quality of the firm issuing the paper. "Prime" commercial paper reflected the paper considered by the National Credit Office (a private firm affiliated with the R. G. Dun credit rating agency) to be of the highest quality and the interest rates on that paper were used to construct the prime commercial paper rate. As the investors in this market were banks, the interest rate was dependent on banks' own costs of funding.

The impact of changes in monetary policy tools on money market rates

We are interested in how changes in the rates the Federal Reserve controlled and the holdings of Treasury securities affected private money market rates.14 Figure 3 plots two policy rates and two private money market rates at a weekly frequency. The two policy rates are the Federal Reserve Bank of New York's discount rate and rate for purchases of acceptances with a maturity of 90-120 days. The private rates are the interest rate on time call loans (90 days) and on 90 day commercial paper.15

|

|

Source: Federal Reserve, Banking and Monetary Statistics, 1943.

The figure suggests that, in general, policy instruments seem to have moved in the same direction though they were not adjusted at exactly the same time (and from Figure 2 we know that holdings of Treasury securities tended to move inversely with these rates). Using the tools in combination during a shift in policy was intentional.16 The Fed could supply needed reserves to the banking system either by purchasing securities through open market operations or lending to banks through the discount window. The discount window was a relatively expensive source of financing. Thus, the Fed could tighten policy both by selling securities and forcing banks to turn more to the discount window and also by raising the discount rate to make such borrowing more expensive.

Figure 2 also indicates that the private market rates did follow fairly closely the movements in the policy rates and the changes in holdings of Treasury securities. To more formally test whether private rates move in response to changes in policy instruments, we regress changes in the private rates on lagged changes in the policy rates and lagged percent change in the holdings of Treasury securities. The time period we analyze is from January 1922 to September 1929 (just prior to the stock market crash). There are particularly sharp spikes in Treasury holdings in 1926 and 1927, which are observable in Figure 2, driven by the Treasury issuance calendar. We omit these weeks from the analysis; including them marginally affects the economic and statistical significance of the coefficients on the impact of changes in holdings of Treasury securities.

The regression results are reported in Table 3. We find that changes in all three policy instruments are followed by changes in market interest rates during the following week. Changes in the discount window rate appear to have large effects; an increase in the discount window rate by 25 basis points is associated with an increase in the prime commercial paper rate and the time call loan rate by about 7 basis points over the next two weeks. An increase in the acceptance rate by 25 basis points is associated with an increase in the private rates by about 5 basis points during the next week. Purchases of Treasury securities seem to have also influenced private rates. To increase private rates by 5 basis points, we find that Treasury holdings would have had to decrease by about 2 standard deviations over a week (a move observed from time to time, but rarely). This effect appears to be a bit smaller than for changes in the various policy rates. However, changes in Treasury holdings tended to either build or diminish over more extended periods of time. Alternative analysis looking at effects of changes in holdings of Treasury securities over longer time horizons than one week suggests that the cumulative effects of changes in holdings of Treasury securities over several weeks were fairly sizeable.

Dependent variable: change in the private money market rates

| Prime CP | Broker's loans on Time | |||

|---|---|---|---|---|

| Coefficient | SE | Coefficient | SE | |

| Change in the discount rate | ||||

| Contemporaneous | .09*** | (.04) | .14** | (.07) |

| Lagged one week | .17*** | (.04) | .17** | (.07) |

| Change in the acceptance rate | ||||

| Contemporaneous | .04 | (.05) | -.01 | (.1) |

| Lagged one week | .17** | (.05) | .18* | (.1) |

| Percent change in Treasury holdings | ||||

| Lagged one week | -.07* | (.04) | -.26*** | (.09) |

| Lagged two weeks | -.03 | (.04) | .05 | (.08) |

| Intercept | .001 | (.004) | .014 | (.007) |

| Observations | 381 | 381 | ||

| Adjusted R2 | .13 | .05 | ||

Note. The symbols * and ** indicate statistical significance at the 5 and 1 percent levels respectively. Standard errors in parentheses. Regressions adjust for first-order autocorrelation in the error terms (and we find no evidence of second order serial correlation).

Section 3. Conclusion

In this note, we provide an overview of the three primary tools used by the Fed to implement monetary policy in the 1920s--the discount window, purchases of bankers' acceptances, and purchases of government securities in the open market. We then show that the Fed was able to influence the private money market rates fairly effectively with each of these tools. More work is needed to better understand the monetary policy framework, interactions between the three tools, and the mechanism behind the transmission of monetary policy to the market rates.

1. We thank Jim Clouse, Barry Eichengreen, Kenneth Garbade, Elizabeth Klee, Jonathan Rose, and David Wheelock for valuable comments. Return to text

2. Annual Report of the Federal Reserve System, 1923, p.10. During the period analyzed here, the United States was on the gold standard and Federal Reserve had a gold reserve requirement, however, the Federal Reserve's gold stock was above the minimum requirement and the Fed was not meaningfully constrained in the use of its policy instruments to pursue these macroeconomic goals. Return to text

3. Short-term was 90 days for commercial and industrial paper and 9 months for agricultural paper. Such restrictions grew out of the idea that the Federal Reserve should finance "Real Bills". Temporary expansions of the Federal Reserve's ability to lend were made in 1932 and made permanent in 1935. Return to text

4. For details of this transaction see Hackley, Howard (1961) A History of the Lending Function of the Federal Reserve Banks, Washington DC: Board of Governors of the Federal Reserve System When discounting paper or receiving an advance, the bank incurred a liability to the Federal Reserve which would increase the bank's leverage. Thus, these transactions had indirect costs to the banks that open market operations in either acceptances or government securities did not have. Return to text

5. This section draws substantially from Beckhart, Benjamin (1932) The New York Money Market, Volume III: Uses of Funds, New York: Columbia University Press. Return to text

6. It is not clear what the maturity structure of these instruments at origination was, but at particular points in time, roughly 40 percent of the holdings of the Federal Reserve had maturities of less than 15 days, 20 percent had a remaining maturity of between 16 and 30 days, 25 percent had a remaining maturity of 31 to 60 days. Return to text

7. See Eichengreen, Barry and Marc Flandreau (2012), "The Federal Reserve, the Bank of England, and the Rise of the Dollar as an International Currency, 1914-1939." Open Econ Review 23: 57, doi: 10.1007/s11079-011-9217-1. Return to text

8. Open markets operations in bankers' acceptances and the use of repurchase agreements on bankers' acceptances to manage reserves were ceased in 1977 and 1984, respectively. For more detail, see Small, David H. and James Clouse (2005), "The Scope of Monetary Policy Actions Authorized under the Federal Reserve Act," Topics in Macroeconomics 5: 1. Return to text

9. Annual Report of the Federal Reserve Board, 1923, p. 13. Return to text

10. Certificates of indebtedness were coupon-bearing securities that matured in a year or less. Return to text

11. To give a sense of size, in 1926 the average monthly outstanding volumes of the different money market instruments were Bankers' acceptances: $691 million; commercial paper: $627 million, brokers' loans on call $2,288 million, and brokers' loans on time $825 million. There was an emerging federal funds market, but that was very small. There was also a repo market involving a variety of collateral, including bankers' acceptances, but the size of this market is unknown. Return to text

12. This section draws substantially from Beckhart, Benjamin (1932) The New York Money Market, Volume III: Uses of Funds, New York: Columbia University Press. Return to text

13. There were smaller, less formal markets for providing funds to brokers on the regional stock exchanges or the New York "curb" market. Return to text

14. For now, we leave aside any analysis of why the Fed was adjusting its policy rates or what intermediate policy targets it might have had. In this note, we are simply interested in whether or not private markets responded when the Fed adjusted its tools. (For discussions of Fed policy targets see Burgess, W. Randolph (1936), The Reserve Banks and the Money Market, New York: Harper and Brothers Publishers and Wheelock, David (1991), The Strategy and Consistency of Federal Reserve Monetary Policy, 1924-1933, Cambridge: Cambridge University Press.) The Fed was reportedly attentive to whether its policy rates were out of alignment with market rates. Thus, there is some possibility of reverse causality in that changes in market rates could have caused the Fed to adjust its policies. However, it seems likely that any policy response would have been in reaction to more sustained changes in market rates rather than the week to week fluctuations analyzed here. Return to text

15. The private rate on acceptances is almost identical to the rate paid by the Federal Reserve. Return to text

16. See Burgess, W. Randolph (1936). The Reserve Banks and the Money Market, New York: Harper & Brothers Publishers. Return to text

Please cite as:

Carlson, Mark, and Burcu Duygan-Bump (2016). "The Tools and Transmission of Federal Reserve Monetary Policy in the 1920s," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, November 22, 2016, https://doi.org/10.17016/2380-7172.1871.

Disclaimer: FEDS Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers.