FEDS Notes

May 11, 2016

Where do I see the Monetary Policy Normalization Tools on the Fed's Balance Sheet and Income Statement?

Christian Miller and Casey Clark1

On December 16, 2015, the Federal Open Market Committee (FOMC) determined it was appropriate to raise the effective federal funds rate from the 0 to 25 basis point range it had been set at since late 2008. This note highlights where some of the key elements of the FOMC's approach to policy normalization are reported on the Federal Reserve's website. Specifically, this note focuses on the interest on excess reserves (IOER) rate, excess reserve balances, and interest expense on excess reserves. This note also identifies where information can be found on the overnight reverse repurchase agreement (ON RRP) offering rate and the associated Federal Reserve balances and interest expense.

Background on Federal Reserve publications

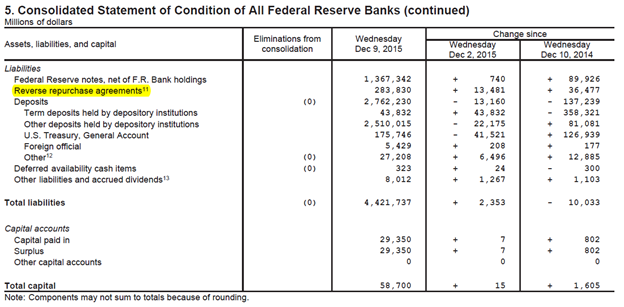

The Federal Reserve Board's Statistical Release H.4.1,"Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks," is a weekly publication that presents a balance sheet for each Federal Reserve Bank, a consolidated balance sheet for all 12 Reserve Banks, an associated statement that lists the factors affecting reserve balances of depository institutions, and several other tables presenting information on the assets, liabilities, and commitments of the Federal Reserve Banks. Table 1 presents details on the factors that supply and absorb reserve balances, as well as the level of reserve balances--that is, funds that depository institutions hold on deposit at the Federal Reserve to satisfy reserve requirements and funds held in excess of requirements.2 Table 5 presents the balance sheet of the Federal Reserve System.

Annually, the Federal Reserve System releases the combined annual financial statements for the Federal Reserve Banks (combined statements), as well as statements for the 12 individual Federal Reserve Banks, which provide a significant amount of information about the assets, liabilities, earnings, and expenses of the Reserve Banks. The financial statements are audited annually by an independent auditing firm. In addition to the annual financial statements, the Federal Reserve System releases quarterly the Federal Reserve Banks Combined Quarterly Financial Reports, which provide unaudited quarterly updates to the information presented in the annual financial statements.

IOER and reserve balances

The FOMC has stated that the IOER rate will be a primary tool during the normalization period.3 Depository institutions should be unwilling to lend to any private counterparty at a rate lower than the rate they can earn on balances maintained at the Federal Reserve. As a result, an increase in the IOER rate will put upward pressure on a range of short-term interest rates. In effect, raising the IOER rate allows the Federal Reserve to increase the value that depository institutions place on reserve balances, which will have market effects similar to those associated with a reduction in the quantity of reserves in the traditional, quantity-based mechanism for tightening the stance of monetary policy.4 The IOER rate paid on excess reserve balances can be found on the Board of Governors' "Interest on Required Balances and Excess Balances" page. Although the Federal Reserve pays interest on required reserves (IORR) in addition to IOER, the marginal return of an additional dollar of reserves to a depository institution is the IOER rate given the large amount of excess reserves in the System.

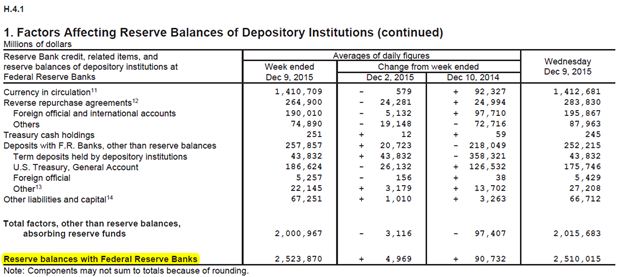

The H.4.1 reports the level of aggregate reserve balances--required and excess reserve balances together--on a weekly basis in Tables 1 and 5. Table 1 reports "Reserve balances with Federal Reserve Banks," which deducts depository institution overdrafts from overall reserve balances.

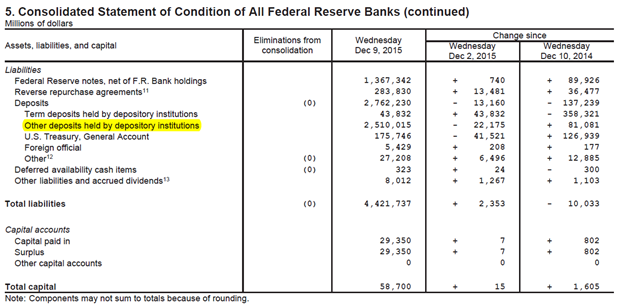

In Table 5, the line item "Other deposits held by depository institutions" reports both required and excess reserve balances, but is not reduced by any overdrafts which would be reported in the assets section of table 5. Thus, this value may not always align with "Reserve balances with Federal Reserve Banks" in Table 1.

The Statistical Release H.3, "Aggregate Reserves of Depository Institutions and the Monetary Base," reports reserve balances maintained by month and by two-week maintenance period. "Reserve balances maintained/Total" for a given two-week maintenance period on Table 1 of the H.3 is the average of the two "Reserve balances with Federal Reserve Banks" weekly averages reported in the given maintenance period in Table 1 of the H.4.1.

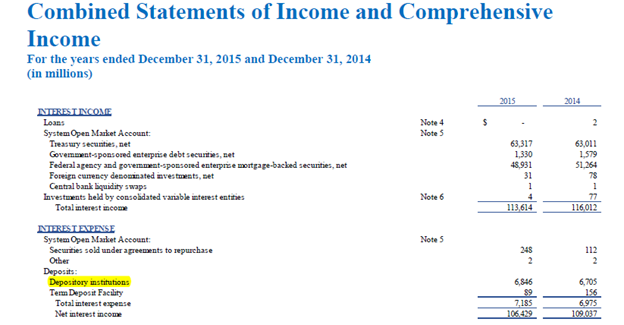

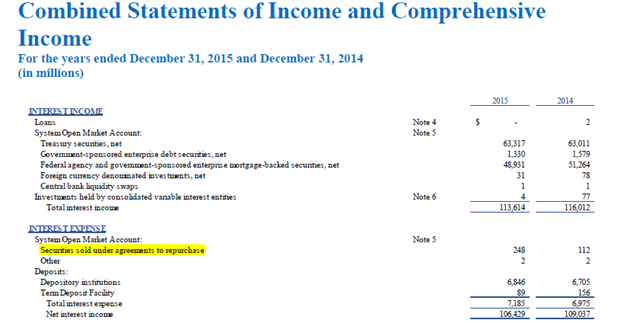

Interest expense on reserves is calculated based on balances that comprise "Other deposits held by depository institutions" reported in Table 5. Information on how interest is calculated on required and excess reserves can be found in the Reserve Maintenance Manual. Interest expense on reserves held by depository institutions is presented in the combined statements and quarterly reports. Within these reports, interest expense can be found in the Combined Statements of Income and Comprehensive Income (SOI) under the "Interest Expense: Deposits: Depository institutions" line of the statements. The expense information is presented inclusive of required and excess reserves and does not provide the interest expense related to excess reserves separately.5

ON RRP offering rate and RRPs

Another administered rate to help control the level of the effective federal funds rate is the overnight reverse repurchase program (ON RRP) offering rate. In general, any counterparty that is eligible to participate in the ON RRP facility should be unwilling to invest funds overnight with another counterparty at a rate below the ON RRP rate. Information on the ON RRP operations can be found on the Federal Reserve Bank of New York's "Temporary Open Market Operations" ![]() website.

website.

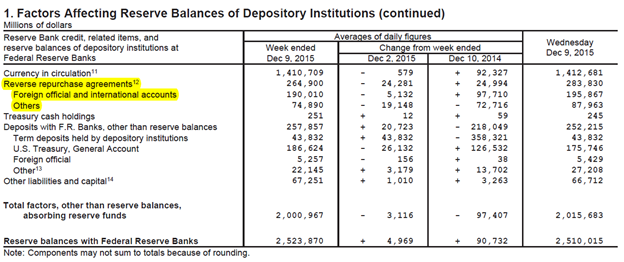

Both Table 1 and Table 5 of the H.4.1 report "Reverse repurchase agreements" under "Factors absorbing reserve balances" and "Liabilities," respectively.

As shown above, Table 1 breaks out RRPs into two categories: "Foreign official and international accounts" and "Primary Dealers and expanded counterparties." All RRPs reported in the latter category, include transactions with primary dealers and other financial counterparties who have met eligibility criteria to transact in reverse repurchase agreements that serve as an effective tool for managing money market interest rates to help support a floor on those rates.6

In the combined statements and quarterly reports, interest expense information related to RRPs is available in the "System Open Market Account: Securities sold under agreements to repurchase" line of the SOI. More detailed information on RRP balances and expense, including the break-out of RRP categories equivalent to Table 1 of the H.4.1, is presented in footnote 5 of the combined statements and tables 4 and 13 of the quarterly report.

1. The authors thank Greg Evans, Jane Ihrig, Elizabeth Klee, and Lawrence Mize for comments. Return to text

2. Table 1 is not the balance sheet, but it is derived primarily from components of the Federal Reserve's balance sheet. Hence, many of the line items reported under "Assets" in Table 5 are also reported under "Factors supplying reserve balances," and this parallelism is also evident among line items reported as "Liabilities" in Table 5 and "Factors absorbing reserve balances" in Table 1. Return to text

3. The Fed also raised the primary credit rate when it began raising short-term interest rates. The primary credit rate is the interest rate at which banks can borrow reserves overnight from the Federal Reserve. From early 2010 to late 2015, the primary credit rate was set at 75 basis points or 50 basis points above the top of the range for the target federal funds rate. Given that reserves are now superabundant and will remain so for some time, depository institutions will not need to borrow from the Federal Reserve and so are unlikely to be influenced by the level of the primary credit rate. Return to text

4. For a more detailed discussion surrounding the dynamics at play in the federal funds market, please see Ihrig, Meade, and Weinbach. 2015. "Rewriting Monetary Policy 101: What's the Fed's Preferred Post-Crisis Approach to Raising Interest Rates?" Journal of Economic Perspective 29 (4): 177-198. Return to text

5. Currently, IOER is set equal to IORR. Therefore, it is possible to approximate interest expense at a higher frequency by multiplying (IOER/365) by the level of balances maintained by depository institutions. Return to text

6. Participation in the ON RRP operations is open to the Federal Reserve's primary dealers as well as its expanded RRP counterparties, which covers a wide range of entities including 2a-7 money market funds, banks, and government-sponsored enterprises (Fannie Mae, Freddie Mac, and Federal Home Loan Banks). Return to text

Please cite this note as: Miller, Christian S. and Casey H. Clark (2016). "Where do I see the Monetary Policy Normalization Tools on the Fed's Balance Sheet and Income Statement? ," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, May 11, 2016, http://dx.doi.org/10.17016/2380-7172.1764.

Disclaimer: FEDS Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers.