IFDP Notes

December 30, 2016

"Low-For-Long" Interest Rates and Portfolio Shifts in Advanced Foreign Economies (PDF)

John Ammer, Alexandra Tabova, and Caleb Wroblewski1

1. Introduction

For the past several years, interest rates in many advanced economies have been at historic lows. Although low interest rates have helped support recovery in these economies, persistently low rates have also raised concerns about increased incentives for risk-taking by investors to achieve higher yields. Specifically, households and institutional investors could seek to offset weaker profitability and lower returns on safer assets through risk-increasing shifts in their balance sheets. We examine the extent to which investors have shifted toward riskier assets in four advanced foreign economies (AFEs) with low interest rates -- the euro area, the U.K., Japan, and Canada -- while acknowledging that the effects of low rates are hard to parse from those of regulatory and other policy measures implemented recently. Overall, we find evidence of increased risk-taking by some investors, but not of sufficient magnitude to suggest any major near-term risk to financial stability.

We start by analyzing comprehensive sector-level asset allocations to broad asset classes, which are available from AFE flow-of-funds, as well as aggregate debt levels in the household and nonfinancial business sectors of these economies. These initial exercises reveal only modest shifts toward riskier assets, like equity securities, and only limited evidence of increased leverage in the private nonfinancial sector. However, because changes in risk-taking within the broad asset classes would leave no imprint on these data, we next extend the analysis using more detailed data, with a specific focus on AFEs' foreign debt investments. To this end, we draw on two sources: the geographical breakdown of the euro area external financial account and the Treasury International Capital (TIC) data for instrument-level AFE holdings of U.S. corporate debt securities. Although they cover a smaller share of overall portfolios, these more-detailed data on AFEs' foreign debt investments provide an additional window into possible risk-taking behavior.

We find some evidence suggesting some investors in these economies have been "reaching-for-yield" through their foreign debt investments. In particular, the geographical breakdown of the euro area external financial account shows that investment in foreign bonds appears to have responded to the difference between bond yields at home and in the destination countries, with a substantial pick-up in outflows from euro-area investors in 2013 and 2014, consistent with euro-area investors taking on foreign-exchange risks in return for higher yields. In addition, the TIC data on holdings of U.S. corporate bonds show that residents of some of the low-rate AFEs have recently increased exposure to duration and credit risk in their portfolios of U.S. corporate bonds.

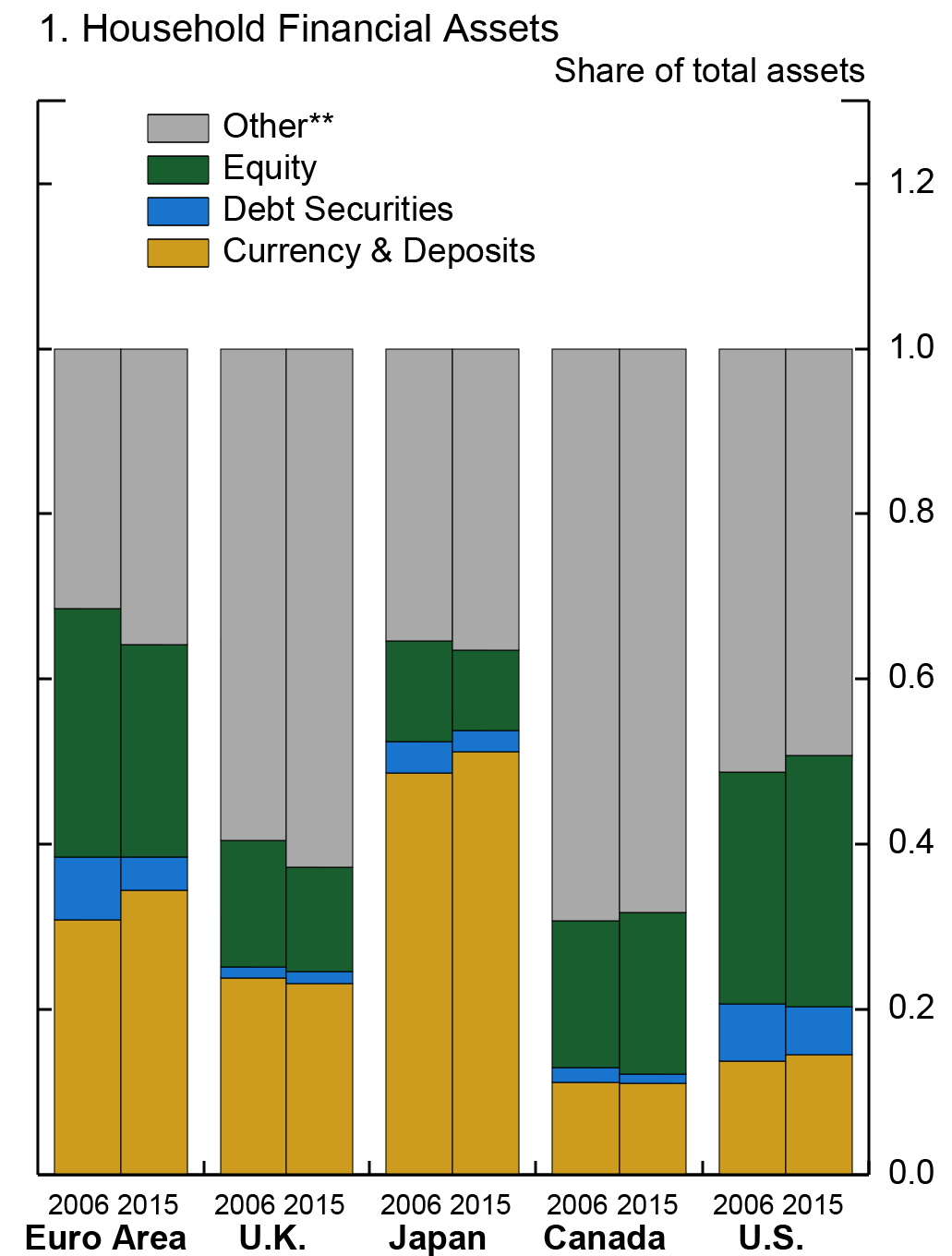

2. Broad Investment Allocations and Leverage Patterns

AFE flow-of-funds accounts provide aggregate holdings in broadly-defined categories of financial assets, such as deposits, loans, and debt and equity securities. The first panel (panel 1 of Exhibit 1), compares the 2015 readings on households' financial asset allocations to those at the end of 2006, when interest rates were higher, for the euro area, the U.K., Japan, Canada, and the United States. On the face of it, these data reveal little sign of increased risk-taking. Notably, currency and deposits (the yellow portions of the bars) continue to account for a large fraction of household financial assets in these economies, especially in Japan and the euro area, where the shares of this category actually have increased slightly since 2006. In particular, households do not seem to have sought higher returns by shifting much from cash and deposits either toward debt securities (in blue) -- which typically have longer maturities than deposits and in some cases more credit risk -- or toward equity securities (in green). In fact, the share of household portfolios in equities, the riskiest category, has declined in all of these economies except Canada.2

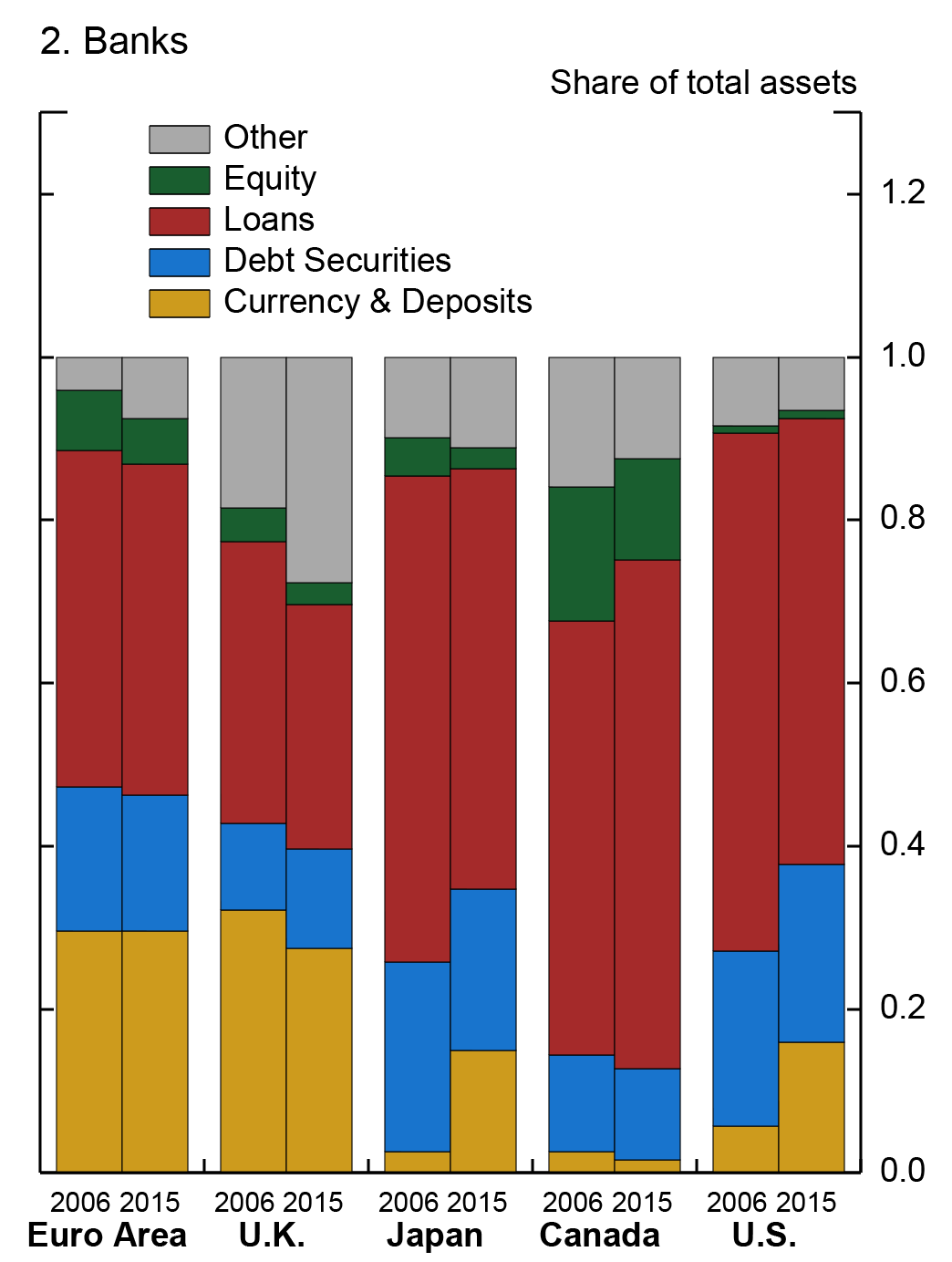

Another avenue of risk-taking could be that financial institutions take more risk, seeking to offset, to some degree, the direct adverse effects of low interest rates on their profitability and capital positions.3 Broad allocations, however, do not show much increased risk-taking by banks (panel 2 of Exhibit 1)4. Banks made modest shifts out of equity securities in all four foreign regions, while aggregate allocations to debt securities generally were little changed. Furthermore, in Japan (as in the United States), a diminishing share of loans, together with a large increase in banks' reserve balances in the context of quantitative easing, resulted in a shift toward safer assets. Besides QE-related portfolio shifts, AFE banks' portfolio shifts likely reflect regulatory changes, including the need to hold more high-quality liquid assets under the liquidity coverage ratio requirement.

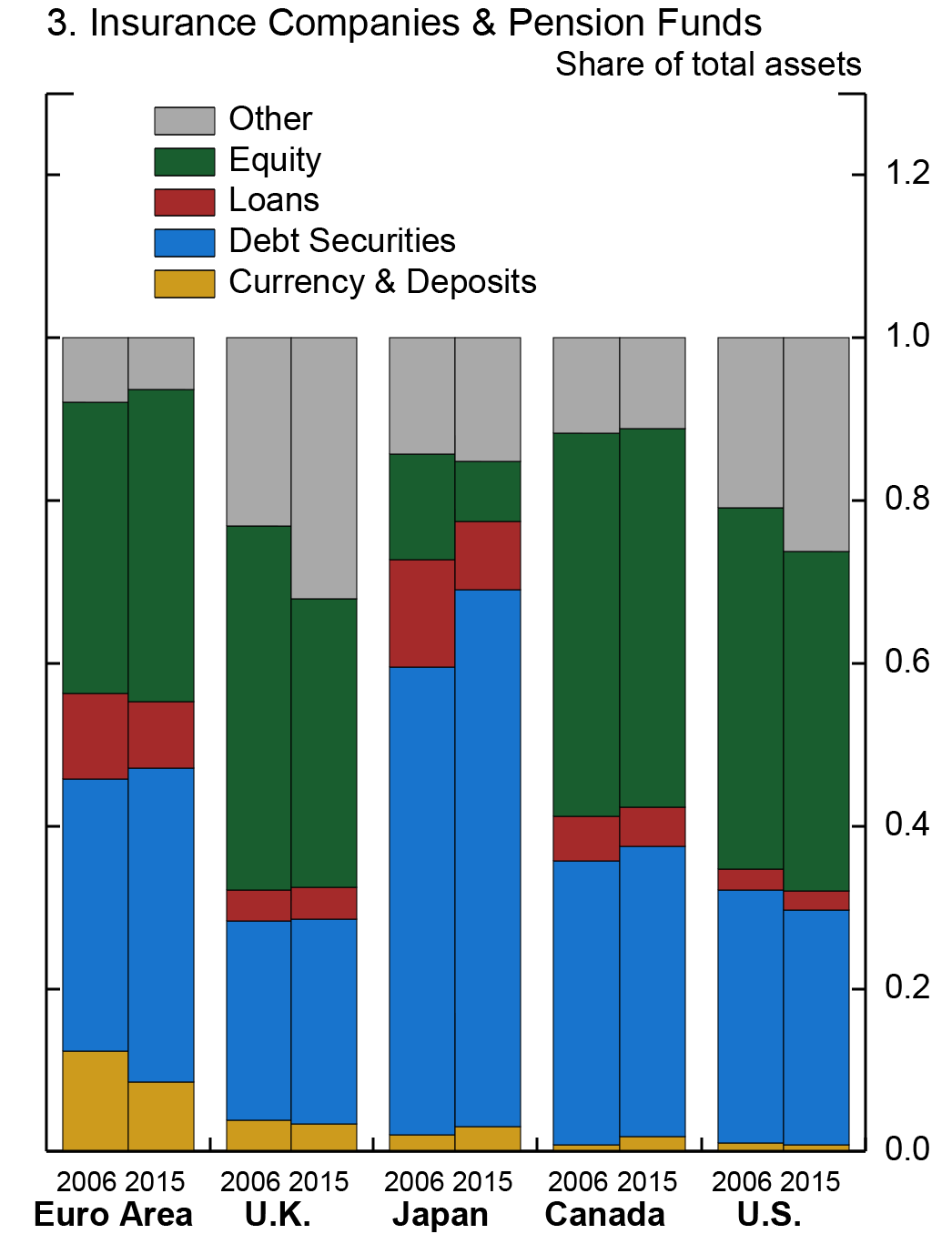

The investment allocations of insurance companies and pension funds (panel 3 of Exhibit 1) show a bit more evidence of increased risk-taking, perhaps reflecting increased pressure to meet fixed long-term obligations. First, in the euro area, the sector has shifted toward riskier equity and away from safe deposits. Furthermore, the combination of an increased allocation to debt securities and decreased allocation to loans (which are likely to be both floating-rate and of shorter-maturity than bonds) implies that these investors are taking on more interest-rate risk. In addition, Domanski, Shin, and Sushko (2015) report that German insurers have made risk-increasing shifts within their debt-security portfolios in recent years.5

Second, in Japan, where interest rates have been low for a long time, the quantitative and qualitative easing (QQE) programs initiated by the Japanese government in 2013 have put additional downward pressure on longer-term interest rates. After the start of QQE, Japanese insurers marginally added risks to their portfolios, increasing equity holdings from 5 percent in 2013 Q1 to 7 percent in 2015 Q2. Low interest rates and QQE have also increased the incentives for portfolio rebalancing among asset managers and official institutions, and Japan's largest institutional investor, the Government Pension Investment Fund, recently announced that in order to meet its long-term liabilities, it would increase investments in riskier assets, including corporate bonds, overseas assets, and domestic equities.6

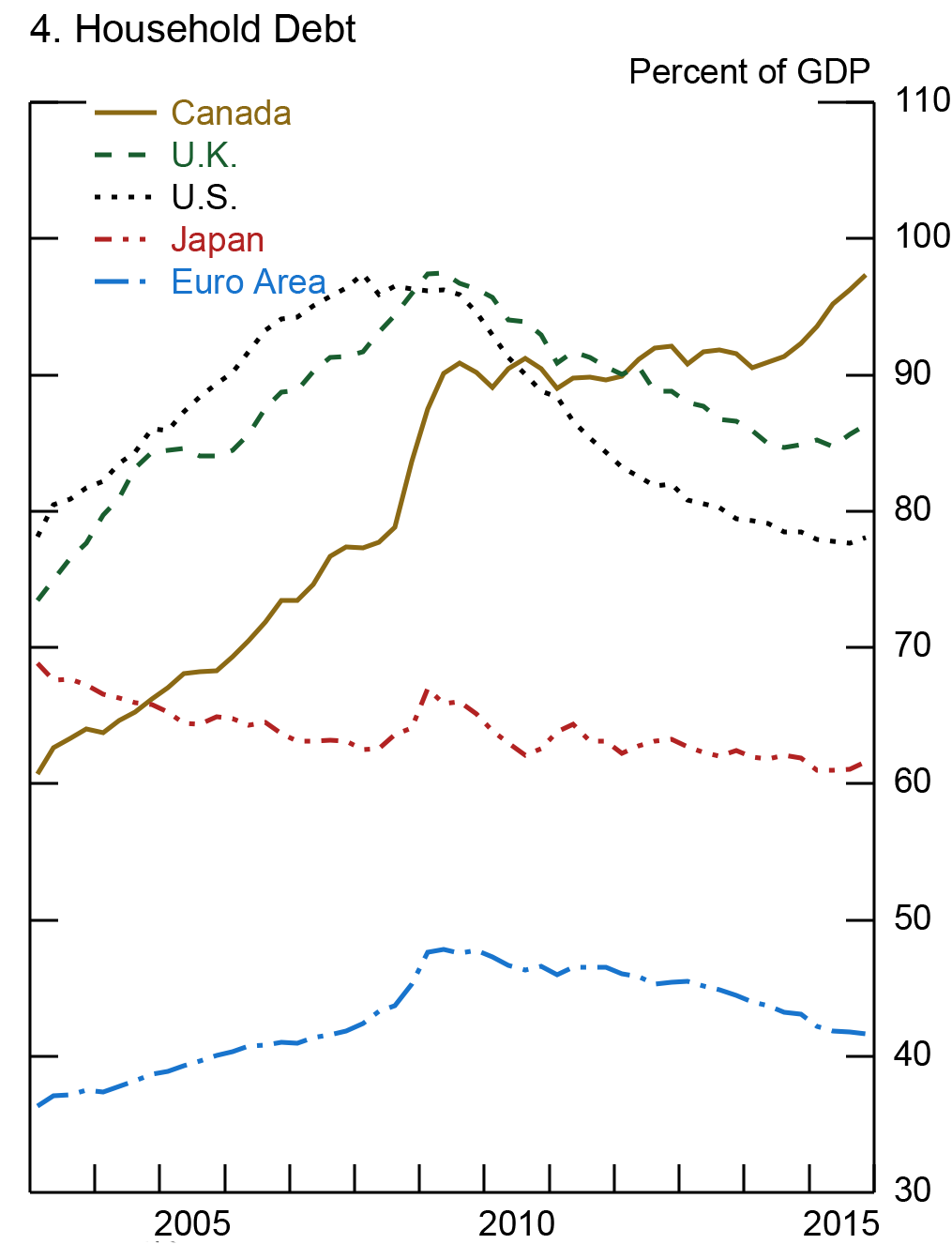

While asset compositions have not changed much, low rates could induce households and businesses to increase their liabilities and leverage. So far, aggregate household debt-to-GDP ratios (panel 4 of Exhibit 1) have been flat or declining in most AFEs since the Global Financial Crisis (GFC), suggesting that households in these economies have not been levering up to increase returns on financial investments. However, Canada is a notable exception, where high household credit growth has raised concerns about elevated house prices, and authorities are responding with macroprudential policies.

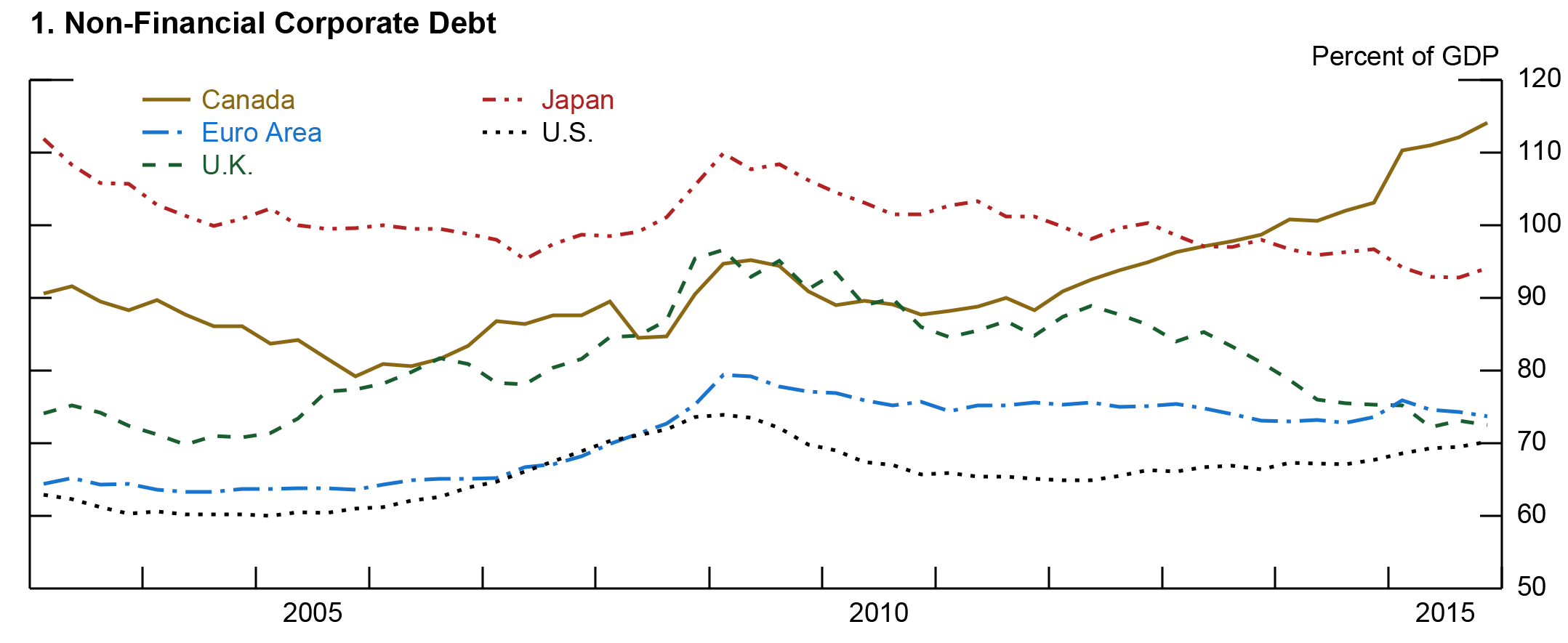

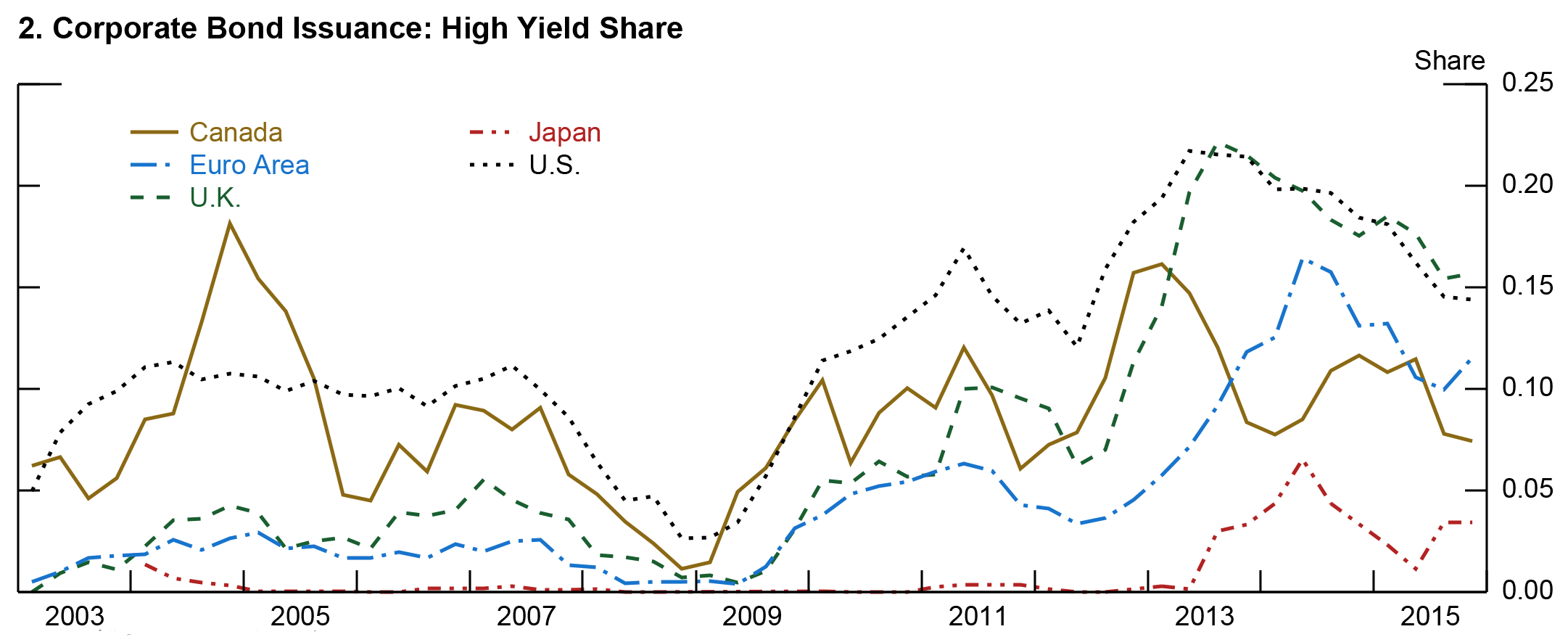

Turning to business leverage, there does not seem to be much evidence of a substantial run-up in AFEs of aggregate nonfinancial corporate debt relative to GDP (panel 1 of Exhibit 2). Of course, these aggregate data may not reveal increased leverage at some firms that could entail more risk-taking by investors in those firms. Some (indirect) evidence consistent with increased risk-taking comes from the composition of corporate bond supply. In particular, the composition of European corporate bond issuance has shifted somewhat toward riskier high-yield bonds (panel 2), suggesting that some investors are taking on more credit risk to increase prospective returns, and, as a result, helping relatively risky firms increase or at least maintain balance-sheet leverage. That said, the high-yield share of European bond finance is still well below U.S. levels.

3. Composition of Foreign Debt Investments

While the broad sector-level asset allocations available from AFE flow-of-funds data generally do not point to significant changes in risk-taking, it is plausible that risk-shifting has occurred within the broad asset categories. Below, we consider more-detailed data on AFEs' foreign debt investments (albeit covering small shares of overall portfolios) that provide an additional window into possible risk-taking behavior.

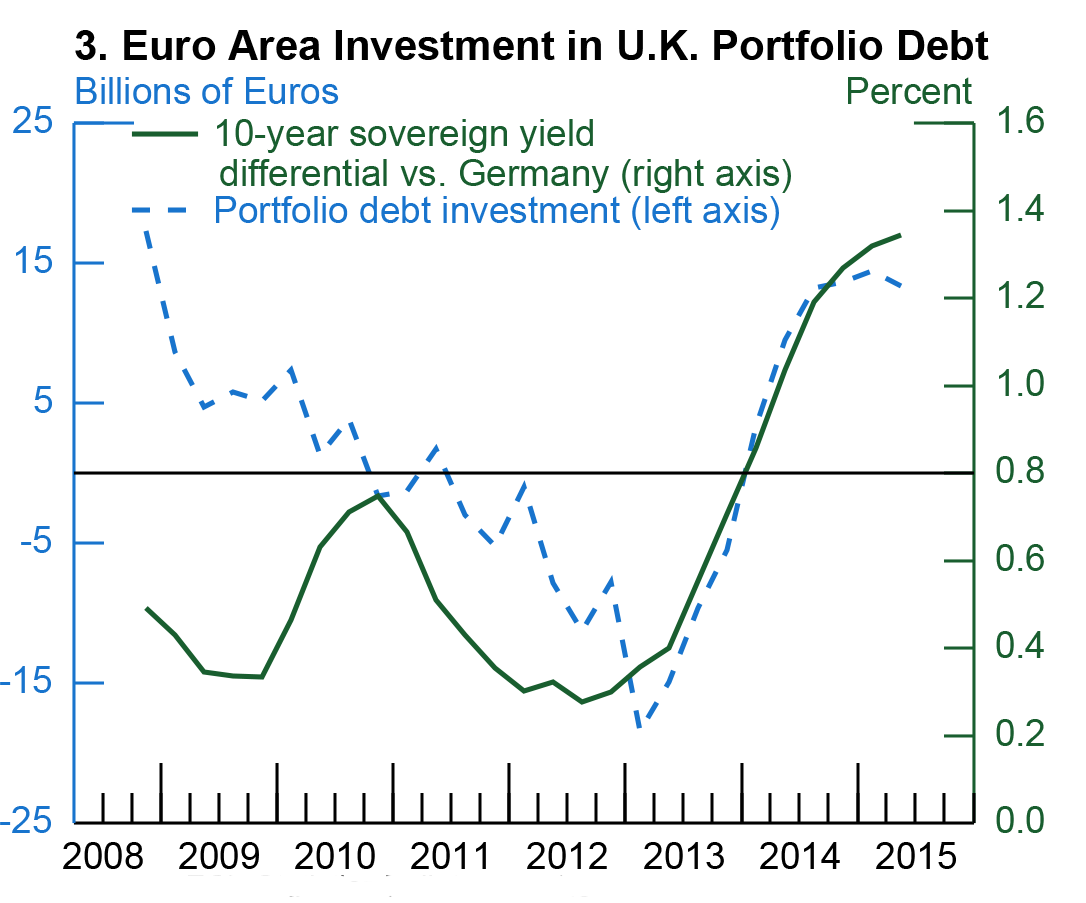

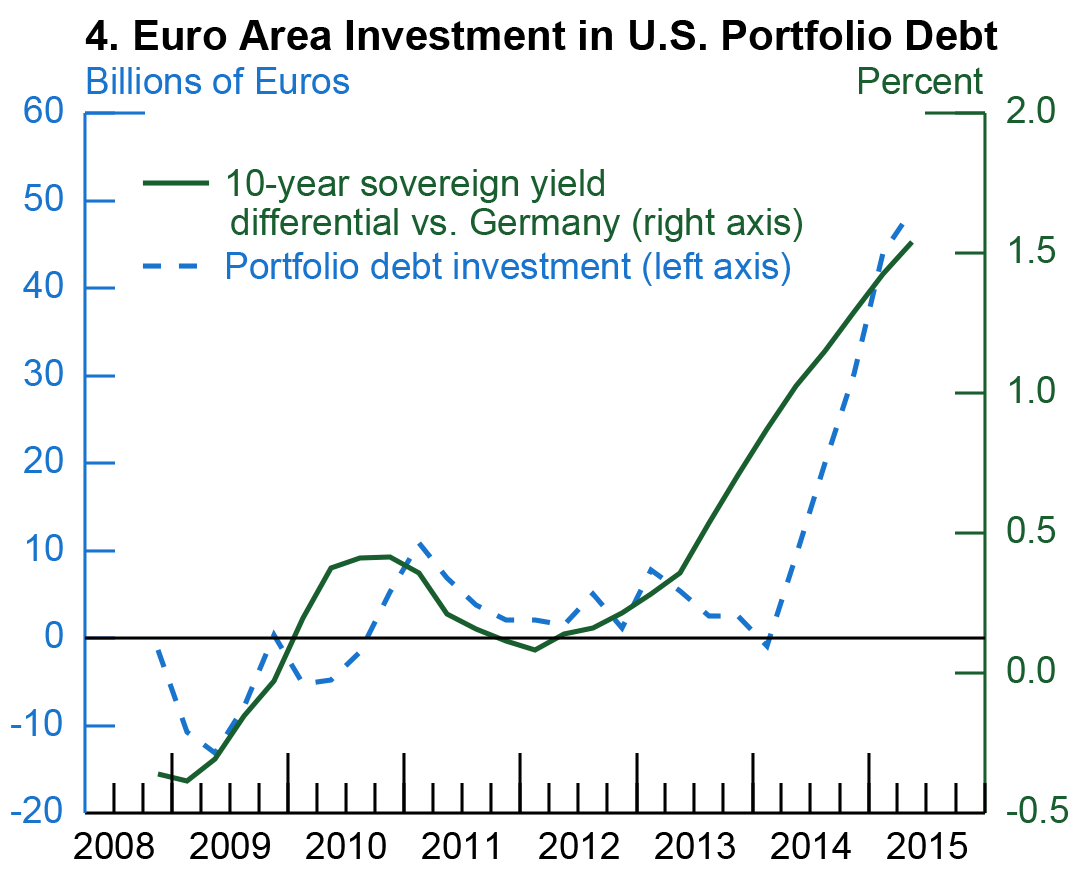

First, we turn to the geographical breakdown of the euro area external financial account.7 Panels 3 and 4 of Exhibit 2 show euro-area aggregate residents' net purchases of U.K. and U.S. debt securities (breakdowns by investor classes are not available), shown by the blue lines. In both cases, investment appears to have responded to the difference between bond yields at home and in these countries (the green lines), with a substantial pick-up in outflows from euro-area investors in 2013 and 2014, suggesting that euro-area investors may have taken on foreign-exchange risks in return for higher yields.8

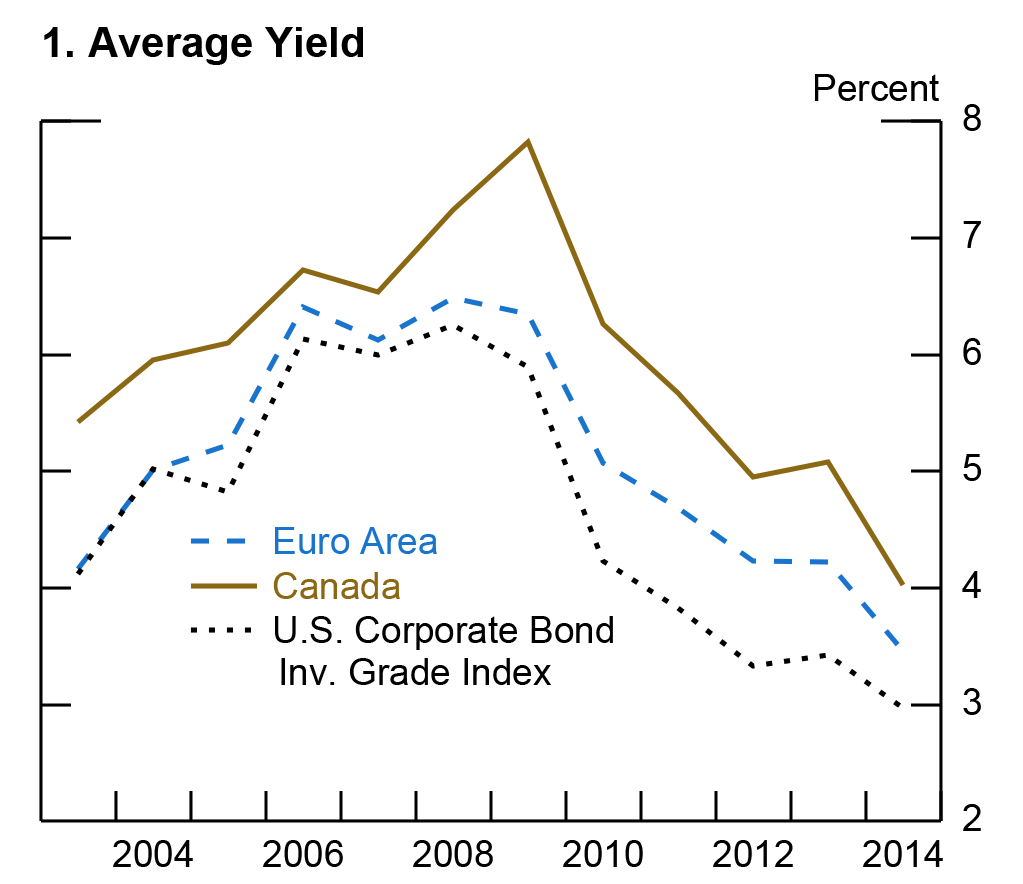

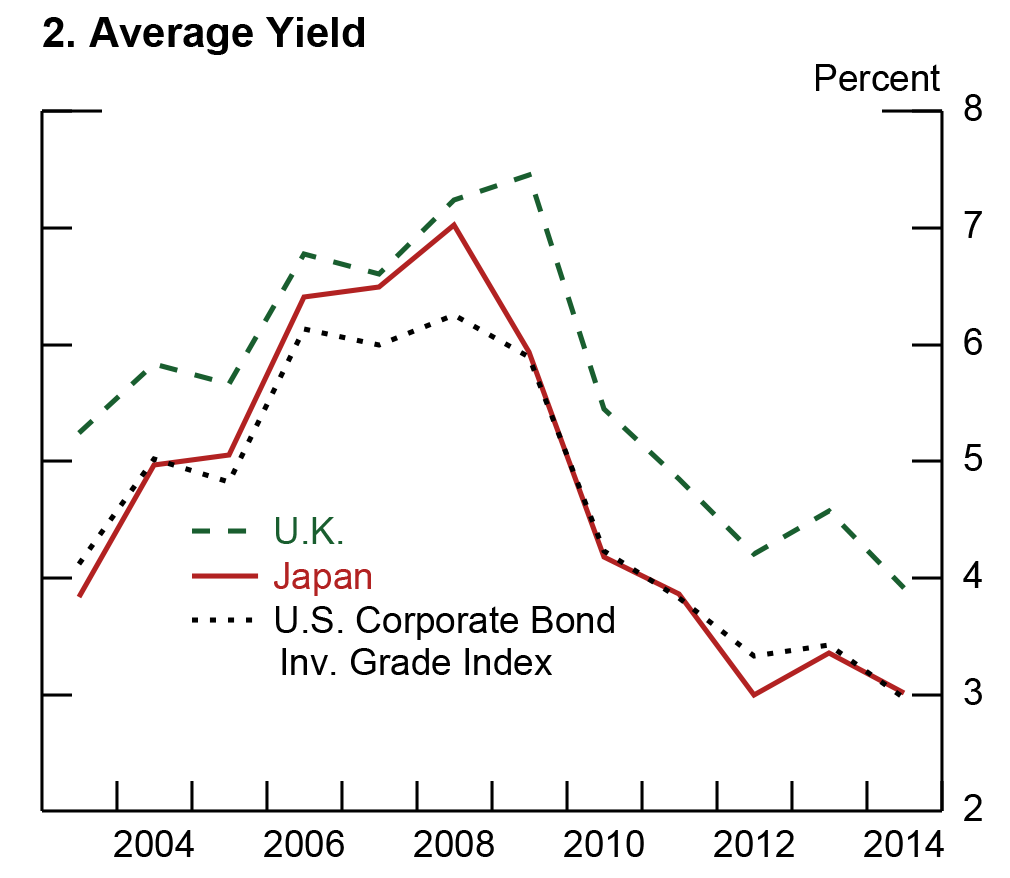

Second, using the Treasury International Capital (TIC) data for instrument-level AFE holdings of U.S. corporate debt securities, we show that investors from some of the low interest-rate AFEs have taken on more duration and credit risk as home-country rates have declined.9 As can be seen in panel 1 of Exhibit 3, until 2009, the yield of euro area holdings followed closely the BofA Merrill Lynch Investment Grade U.S. Corporate Bond Index, but it has since started to diverge and as of 2014 is 0.5 percentage points higher than the Index. Average yields observed for holdings by Canadian investors show a less pronounced divergence and U.K. investors (panel 2) show only some divergence. These relatively higher yields came with some increases in maturities and decreases in credit ratings.

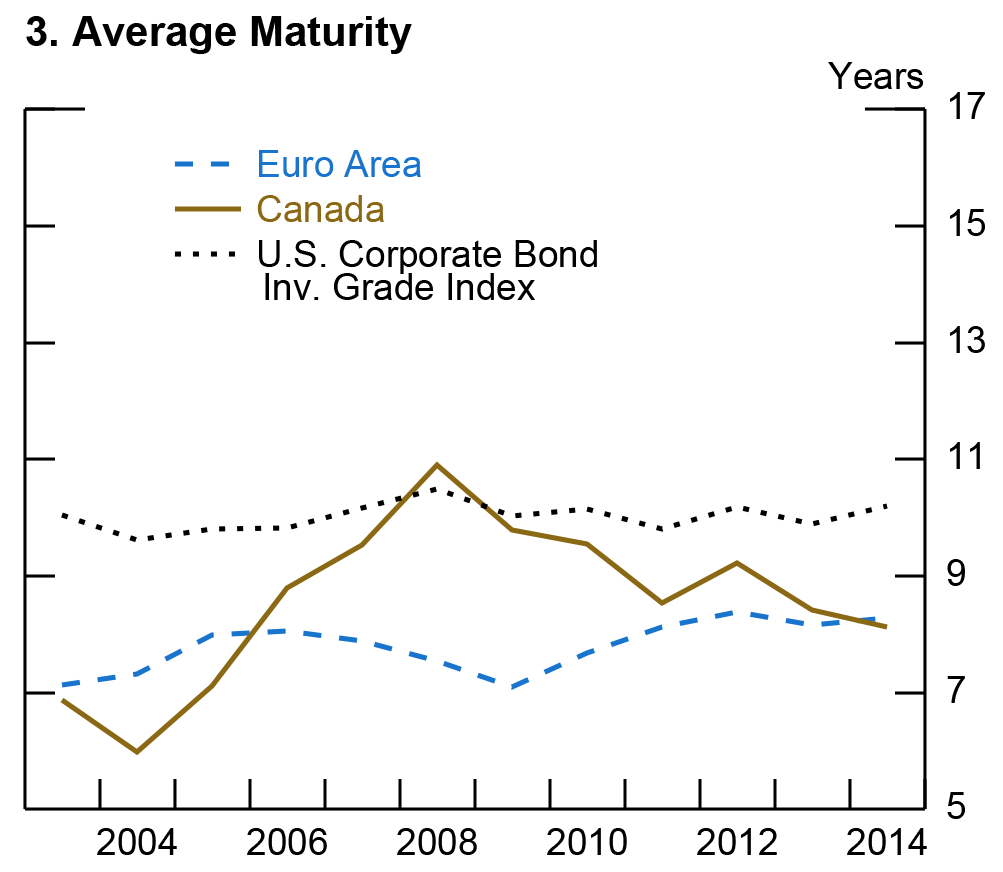

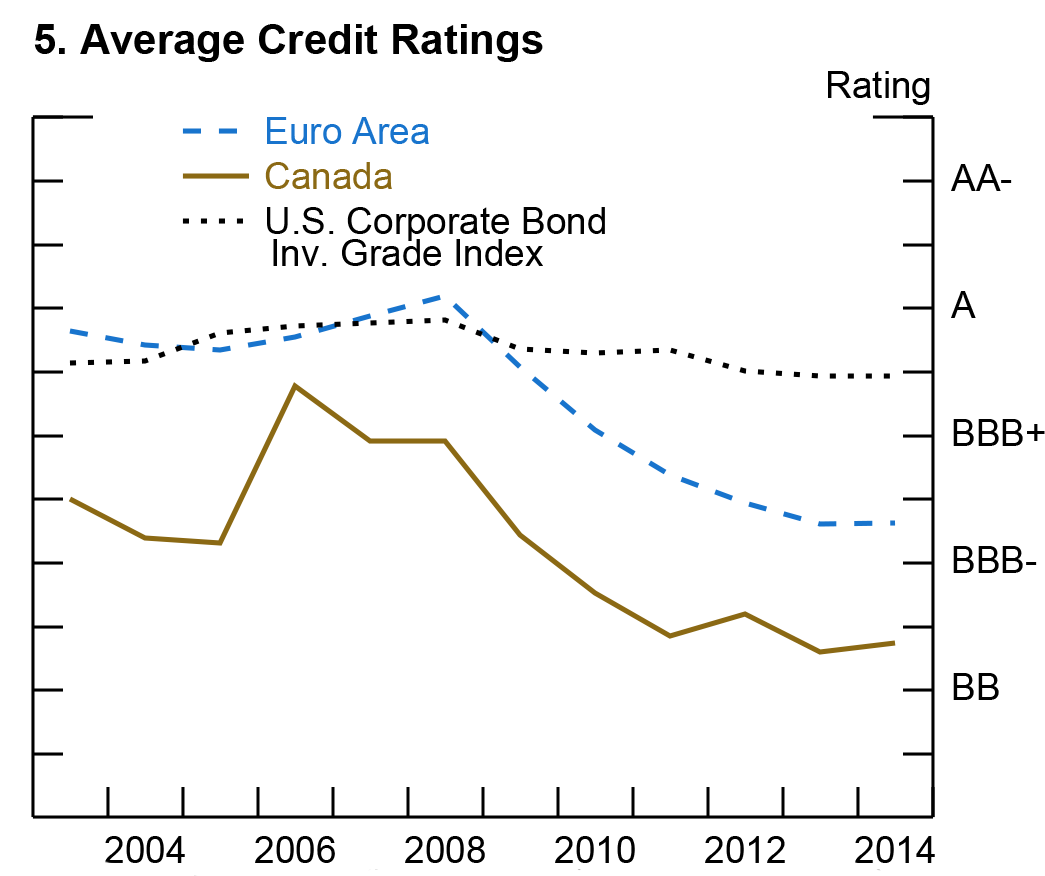

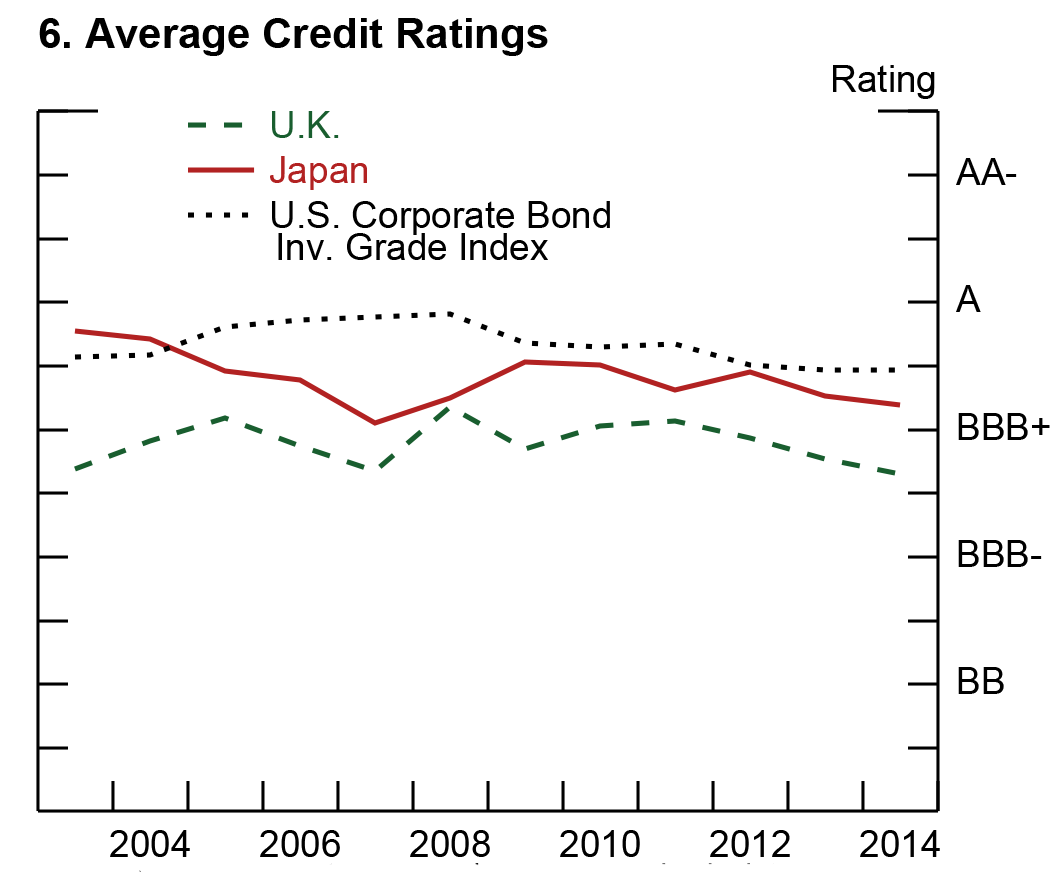

The average maturity of the euro area's portfolio of U.S. corporate bonds (panel 3) has edged up since 2009 and exceeds its peak in 2005, suggesting some reaching for yield by incurring duration risk. The maturity of Japanese holdings has also increased (panel 4). Panel 5 shows that, after following closely the Index, the average credit rating of euro area and Canadian holdings declined substantially since 2009, with the gap with the index widening over time (panel 5). For U.K. and Japanese investors there is not much of a decline in the average credit ratings of the foreign assets they hold (panel 6).

Looking forward, if risk-shifting portfolio shifts by foreign investors from low-rate AFEs become more pronounced, they could contribute to valuation pressures in U.S. corporate debt markets. A discernible impact of foreign portfolio investors on U.S. financial markets would not be unprecedented: in the run-up to the GFC, a number of foreign institutions were major investors in U.S. asset-backed securities.

**Other is mostly comprised of insurance and pension reserves. Note: Colors in key correspond with each bar segment, in order from top to bottom. |

Note: Colors in key correspond with each bar segment, in order from top to bottom. |

Note: Colors in key correspond with each bar segment, in order from top to bottom. |

Source: BIS |

* Note: Data for 2006 and 2015 represents 2006:Q4 and 2015:Q2. Return to text.

| |

Source: Thomson One. 4-quarter moving average. |

|

Source: ECB Statistics Bulletin and Bloomberg. |

|

|

|

|

|

|

|

Source: Treasury International Capital (TIC) Liabilities Survey; Bank of America Merrill Lynch U.S. Corporate Bond Indexes; authors' calculations

References

Aramonte, Sirio, Seung Jung Lee, and Viktors Stebunovs, 2015. Risk Taking and Low Longer-term Interest Rates: Evidence from the U.S. Syndicated Loan Market. FEDS #2015-068. Federal Reserve Board

Claessens, Stijn, Nicholas Coleman, and Michael Donnelly, 2016. "Low-for-long" interest rates and net interest margins of banks in Advanced Foreign Economies. IFDP Note, Federal Reserve Board, April 2016

Domanski, Dietrich, Hyun Song Shin, and Vladyslav Sushko, 2015. The Hunt for Duration: Not Waving but Drowning? BIS Working Paper #519, October 2015.

IMF, 2016. Germany: Insurance Sector Supervision – Technical Note. Financial Sector Assessment Program. June, 2016.

Morais, Bernardo, Jose-Luis Peydro, and Claudia Ruiz, 2015. The International Bank Lending Channel of Monetary Policy Rates and QE: Credit Supply, Reach-for-Yield, and Real Effects. International Finance Discussion Papers 1137.

1. All authors are at the Federal Reserve Board. The views in this paper are solely the responsibility of the authors and should not be interpreted as reflecting the views of the Board of Governors of the Federal Reserve System or any other person associated with the Federal Reserve System. Return to text

2. The data are not detailed enough to reveal shifts within the debt portfolios towards more or less risky securities. Return to text

3. Claessens, Coleman, and Donnelly (2016) find that low interest rates are contributing to weaker net interest margins of banks in AFEs, and these effects can be material for banks in some key AFEs. Return to text

4. Flow-of-funds data provide no detail on the riskiness within these broad categories, such as breakdowns by ratings or maturity. However some recent studies suggest that lower rates can lead banks to lend to riskier customers. For example, Aramonte, Lee, and Stebunovs (2015) find evidence of reach-for-yield in the U.S. loan market (including credit from foreign lenders) and Morais, Peydro, and Ruiz (2015) report similar evidence for lending in Mexico by foreign banks. Return to text

5. As interest rates declined, German insurers increased their holdings of government bonds, but entirely in the form of more non-German government bonds (IMF, 2016 and Domanski, Shin, and Sushko, 2015). Since these bonds likely had higher yields than German ones, this may have been in part a reach for yield. In addition, this portfolio reallocation towards government bonds by German insurers was accompanied by a significant increase in the duration of these bonds (Domanski, Shin, and Sushko, 2015). Return to text

6. For more details, see http://www.gpif.go.jp/en/fund/pdf/adoption_of_new_policy_asset_mix.pdf Return to text

7. The external share of the euro area non-equity financial assets is about 15 percent. Return to text

8. There is no information on the extent to which such exposures may have been hedged through derivatives. Presumably, being closely regulated, banks are largely hedged, although some may still be exposed to funding risks related to currency movements (as in case of euro area banks during the GFC). Return to text

9. The TIC liabilities survey data permits more granular cut at bond characteristics, including maturity and coupon rates, for the holdings of U.S. corporate bonds part of AFEs' foreign portfolio. For comparison, the TIC sample consists only of securities that are included in the BofA/ML indexes. Return to text

Please cite as:

Ammer, John, Alexandra Tabova, and Caleb Wroblewski (2016). "Low-For-Long" Interest Rates and Portfolio Shifts in Advanced Foreign Economies," IFDP Notes. Washington: Board of Governors of the Federal Reserve System, December 30, 2016. https://doi.org/10.17016/2573-2129.27

Disclaimer: IFDP Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than IFDP Working Papers.