IFDP Notes

February 8, 2016

International Spillovers of Monetary Policy1

John Ammer, Michiel De Pooter, Christopher Erceg, and Steven Kamin

PowerPoint Presentation:

Cross-Border Spillovers from Monetary Policy (PDF)

I. Introduction

International monetary policy spillovers have been the subject of much economic debate since at least the early interwar period, and formal modeling of monetary policy in an open economy dates back to the pioneering analyses of Mundell (1963) and Fleming (1962).2 These spillovers received renewed attention after the global financial crisis (GFC), when interest rate differentials among different global regions widened substantially and many central banks experimented with new and unconventional forms of monetary stimulus. Notwithstanding several years of very active research, however, most important questions about monetary policy spillovers remain open. Is monetary policy stimulus, for example, "beggar-thy-neighbor" or "boost-thy-neighbor"? Do spillovers from conventional monetary policy actions differ from those of unconventional policies? Are monetary policy spillovers stabilizing or destabilizing for the global economy?

This note presents a broad-brush overview of some of the salient issues on this topic and provides our sense of the answers to some key questions. We start by sketching out a simple framework for understanding how monetary policy actions spill over to other economies. The note then describes some back-of-the-envelope estimates of how U.S. monetary policy actions are transmitted overseas that we corroborate using a large-scale policy model (SIGMA). Finally, we discuss the implications of monetary policy spillovers for global economic stability, including the challenges posed by those spillovers for some countries with multiple policy objectives.

Our main conclusions are as follows:

- International spillovers from monetary policy may be either positive or negative, depending on the relative strength of three channels of transmission: the exchange rate channel, the domestic demand channel, and the effect on foreign financial conditions.

- We estimate U.S. monetary policy actions to have positive spillovers abroad, in the sense that a policy which pushes U.S. economic activity in one direction pushes foreign activity in the same direction. In the case of a monetary policy easing, for example, the effect of a depreciation of the dollar in reducing expenditures abroad is outweighed by the expenditure-increasing effects of higher U.S. domestic demand (which raises U.S. imports) and a loosening of foreign financial conditions.

- It remains an open question whether international spillovers of conventional monetary policies differ from those of unconventional policies. However, in our own analysis, we find the effects of conventional and unconventional policies on the dollar and foreign bond yields to be remarkably similar.

- The most salient question is not whether monetary policy spillovers are positive or negative, but whether they are stabilizing for the global economy. In response to common adverse shocks such as the GFC, the positive spillovers of easing actions by the Federal Reserve and other central banks proved stabilizing for the global economy. Conversely, some years afterwards, these positive spillovers from ongoing policy accommodation were not welcomed by emerging market economies (EMEs) whose cyclical positions had much improved.

- Confronted with unwelcome spillovers from abroad, most central banks with flexible exchange rates have at their disposal a key equilibrating instrument: their own independent monetary policy.

- Even in that environment, however, responding to spillovers may be challenging if central banks have other goals for their monetary policy besides stabilizing domestic output and inflation, such as promoting exports or maintaining financial stability.

II. Channels of Monetary Policy Spillovers

We can identify three distinct channels by which monetary policy actions affect conditions in foreign economies. The first is the exchange rate channel. By way of example, we will consider an easing of monetary policy. This easing should lower the home interest rate relative to foreign rates and depreciate the home currency. This, in turn, boosts the home trade balance, and thus home GDP, while lowering the trade balances and GDP of the country's trading partners. This is a pure expenditure-shifting effect -- that is, it shifts expenditures from foreign countries to the home country. Such an effect is a key feature of the Mundell-Fleming model of international monetary policy interactions, and created the intellectual rationale for the view that monetary policy easing exerted "beggar-thy-neighbor" effects on foreign economies.3

But there are two other channels besides the exchange rate channel, and in the case of a domestic monetary easing, both of these have expenditure-increasing effects on foreign economies. The first is that when monetary policy is eased, this increases domestic demand -- that is, spending on consumption and investment -- in the home country, which increases home-country imports and thus foreign-country exports. This domestic demand channel boosts foreign GDP.

The other channel, which we refer to as the "financial spillovers" channel, arises because when monetary policy is eased, it lowers longer-term yields and raises other asset prices in the home country; this leads, through portfolio balance effects among financially interconnected economies, to capital flows to and lower yields and higher asset prices in foreign economies.4 These easier financial conditions boost domestic spending and thus GDP in foreign countries.

Is monetary policy easing in the home country a negative or a positive on net for economic activity abroad? The answer depends on whether the strength of the negative exchange rate channel is greater or smaller than the combined positive effects of the domestic demand and the financial spillovers channels. And this is fundamentally an empirical question.

III. An Estimate of Monetary Policy Spillovers for the United StatesThis section describes some back-of-the-envelope estimates of the effects on foreign real GDP of U.S. monetary policy actions. These computations are helpful both for understanding the quantitative importance of each of the channels outlined above, and also for interpreting estimates derived from large structural models (as we will show, the estimates from the SIGMA model align quite closely with our rule-of-thumb estimates). We will focus on an (hypothetical) easing of U.S. monetary policy that lowers the 10-year Treasury yield by 25 basis points.5 Our estimates are summarized in Table 1.

| Table 1: Rough Estimates of U.S. Monetary Policy Spillovers |

|---|

| Exchange Rate Channel: | Lowers Broad dollar by 1 percent Boosts real U.S. net exports by .15 percent of U.S. GDP Lowers Foreign GDP by .05 percent ( - ) |

| Domestic Demand Channel: | Boosts U.S. demand by .5 percent Raises U.S. imports by .15 percent of GDP Raises Foreign GDP by .05 percent ( + ) |

| Financial Spillovers Channel: | Reduces Foreign yields by 10 basis points Raises Foreign GDP by .25 percent ( + ) |

| "All-in" Effect: | Raises Foreign GDP by .25 percent ( + ) |

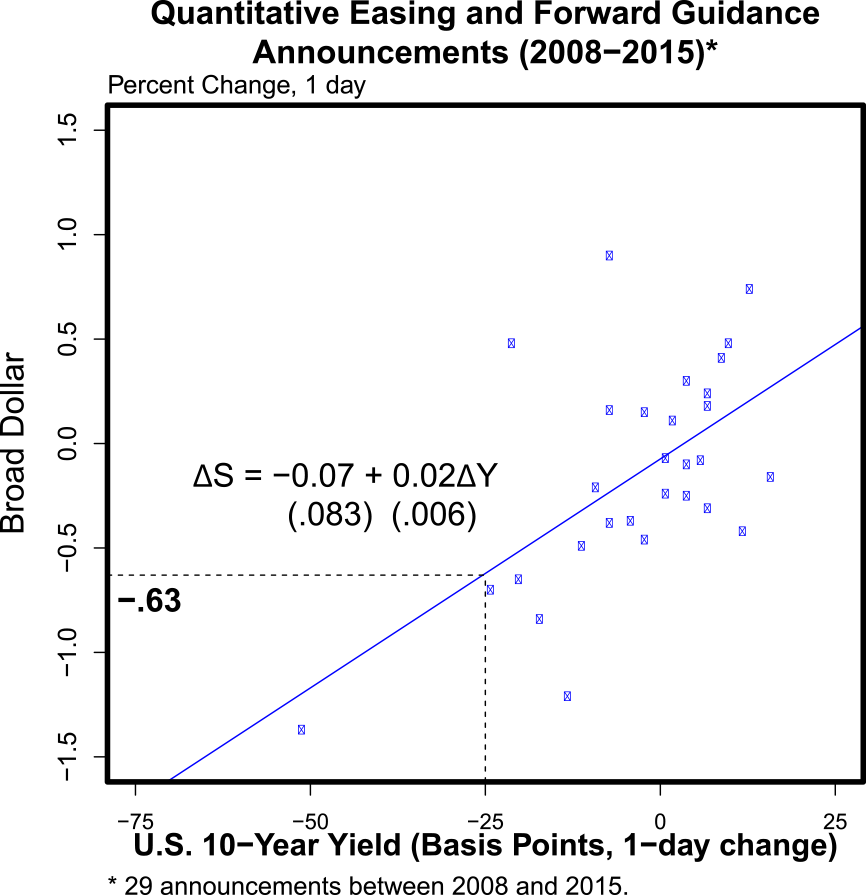

Starting with the exchange rate channel, how much does this lower the dollar? Figure 1 focuses on actual monetary policy announcements by the Federal Reserve in the years since the GFC; the x axis represents movements in 10-year Treasury yields from before to after these announcements, while the y axis shows movements in the nominal broad (or multilateral) dollar index. Announcements that lower Treasury yields by 25 basis points are associated with a decline in the dollar of a little less than 1 percent, which is broadly in line with other studies.6

Rounding up, we assume U.S. policy actions that lower the Treasury yield by 25 basis points lower the broad dollar by 1 percent. Based on fairly conventional elasticities implied by an econometric model of U.S. trade used by Federal Reserve Board staff, the decline in the dollar raises U.S. exports by 0.7 percent, lowers U.S. imports by 0.4 percent, and ultimately boosts real net exports by about .15 percent of U.S. GDP after 2-3 years.7 This causes foreign real net exports to deteriorate, pushing down foreign GDP about .05 percent after 2-3 years, a fairly small effect.

We now turn to the second spillover channel, the boost to U.S. domestic demand. Based on earlier studies of monetary policy effects, we assume a 25 basis point decline in the 10-year Treasury yield increases U.S. demand by .5 percent.8 Given that U.S. imports are highly responsive to U.S. activity -- with the elasticity typically estimated to be about 2 -- this expansion in U.S. demand is likely to raise U.S. imports by around 1 percent -- or .15 percent of GDP -- which in turn boosts foreign GDP about .05 percent.9

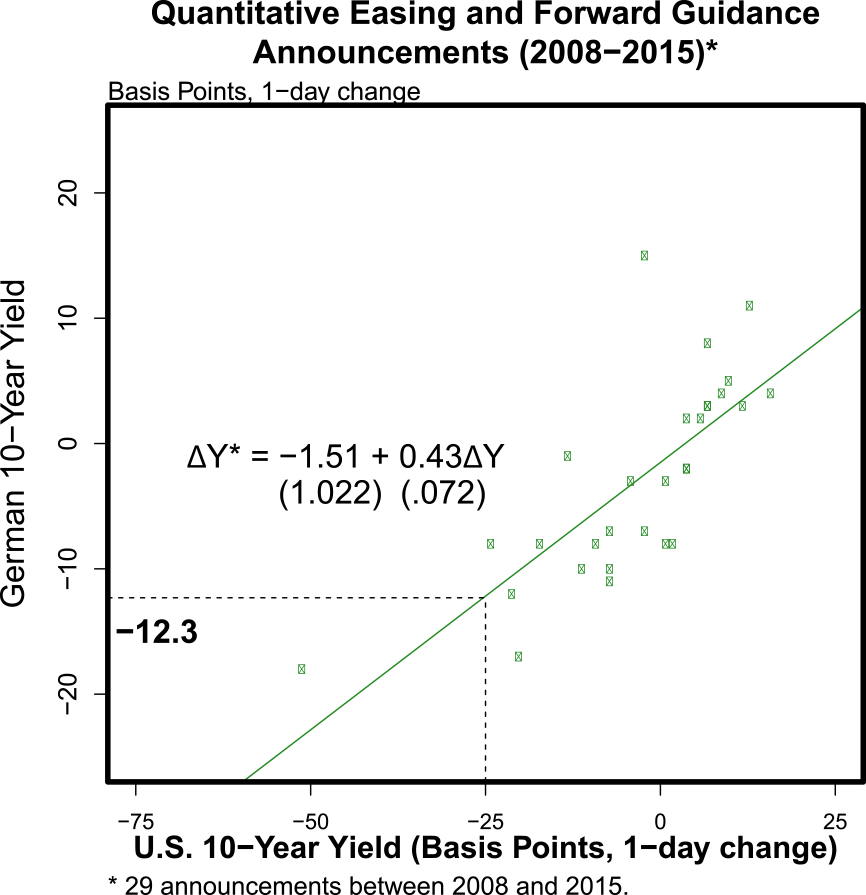

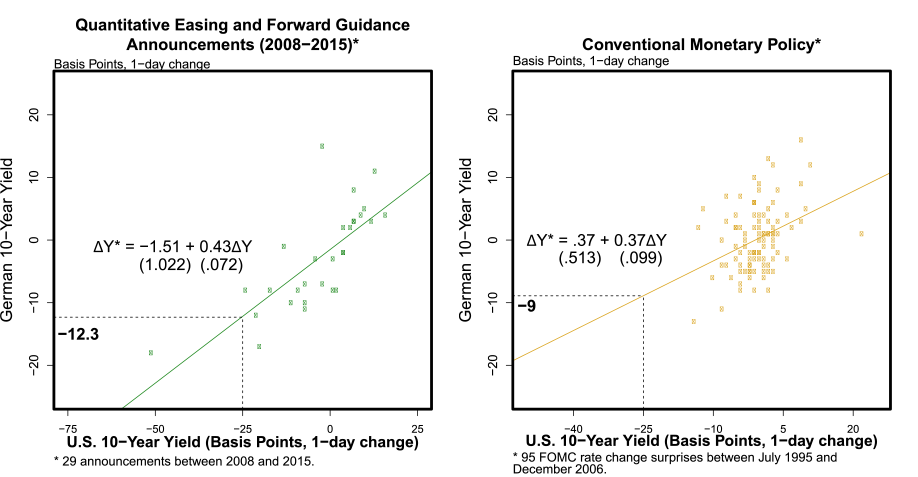

Finally, we turn to the financial spillovers channel. To help gauge plausible spillover effects, Figure 2 repeats the scatterplot of Fed policy announcements, but now plots German 10-year bund yields on the y axis. It shows that a Fed policy announcement resulting in a 25 basis point reduction in US yields is associated with a 12 basis point reduction in German yields. This estimate is in the neighborhood of estimates by Rogers, et al., (2014) for advanced economies, and by Bowman et al., (2015), for emerging market economies. Rounding this effect to 10 basis points and extrapolating from our U.S. estimates of the effects of interest rates on GDP, we estimate that this should boost foreign GDP by 1/4 percent. We believe this to be a reasonable ballpark estimate, but we caution that estimating financial spillovers remains a very active area of research, and there is no consensus on the strength of this effect.10

Table 1 pulls together the estimates of U.S. spillovers for the three distinct channels. The effects of the exchange rate and the domestic demand channels on foreign GDP are very small. Moreover, they cancel out, leaving the financial spillovers channel as the main factor leading U.S. monetary policy stimulus to boost foreign growth. But, at 1/4 percent, this effect is not very large.

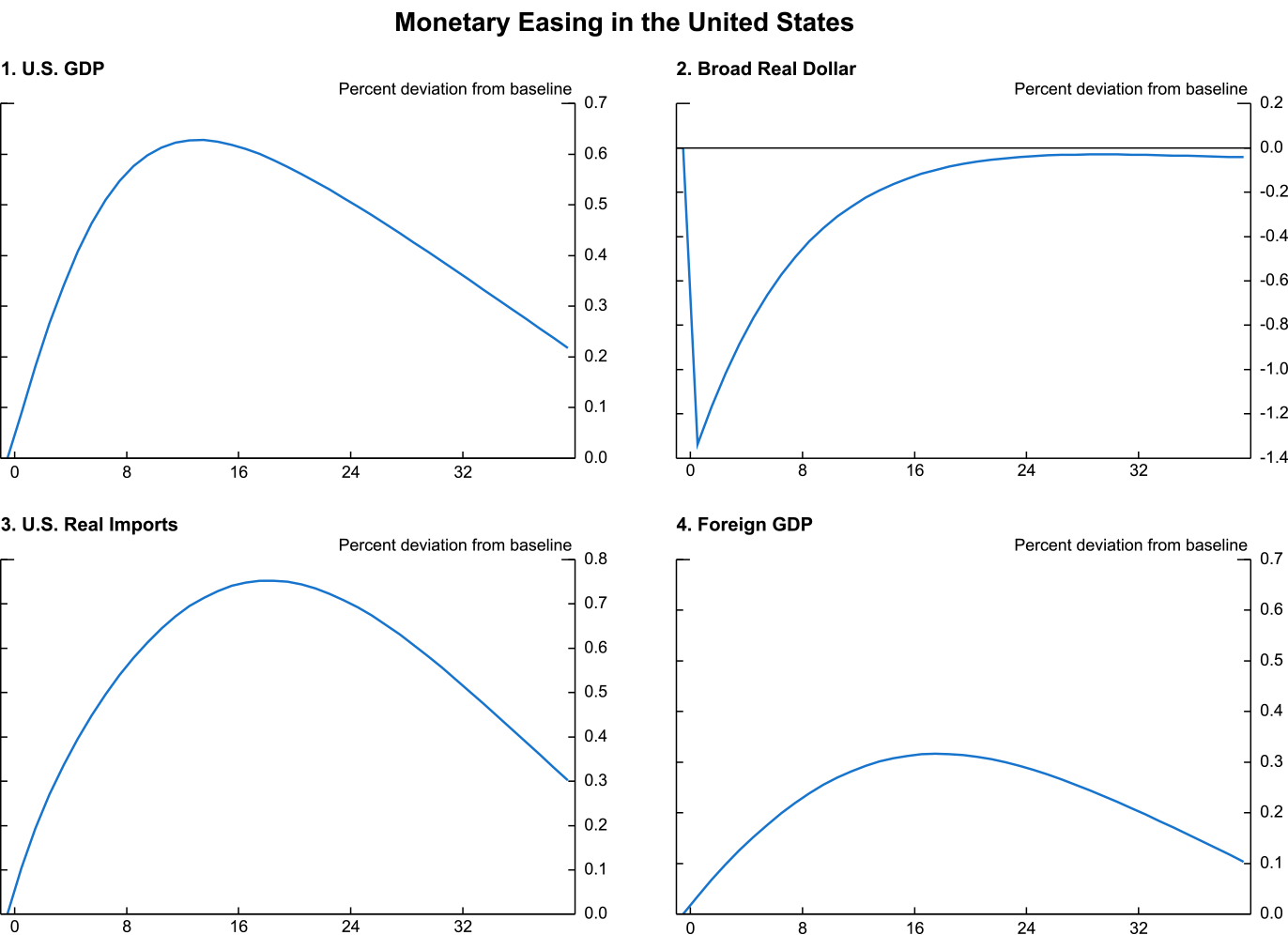

The rules of thumb summarized in Table 1 are incorporated into our large-scale open economy SIGMA model, one of the structural models used by Federal Reserve Board staff for policy simulations. (The Appendix presents an overview of the SIGMA model as well as some details of the SIGMA simulations featured in this note.) SIGMA can be used to trace out the effects of policy actions in global general equilibrium. Figure 3 shows the effects of a persistent easing of U.S. monetary policy that is scaled to reduce the nominal yield on 10-year U.S. Treasury securities by 25 basis points; while foreign monetary policy does not respond to this easing of U.S. monetary policy -- an assumption we'll relax below -- foreign long-term yields fall about 10 basis points due to favorable financial spillovers. Looking at the top left panel, the monetary policy easing raises U.S. GDP by about 0.6 percent above its baseline value (note that all variables are shown as deviations from their baseline paths). Although the dollar falls, as shown in the top right panel, higher domestic demand pushes U.S. imports up on net. All told, foreign GDP rises, as shown in the bottom right, but by roughly half of the rise in U.S. output.

Our estimate of positive spillovers abroad from U.S. policy easing is in line with a number of studies of the cross-border spillover effects of advanced economy monetary policy, but still other studies have found negative spillovers, as Table 2 indicates. This lack of consensus may not be surprising, since the net effect of monetary policy spillovers depends on the relative strength of the three channels involved. In particular, the spillover effects are likely to differ across recipient countries depending on various country-specific features, including how monetary policy reacts, the exchange rate regime, and the degree of vulnerability to external shocks.11 Monetary spillovers may also vary through time, and depend on business cycle conditions.12

| Table 2: Previous Studies of Monetary Policy Spillovers |

|---|

| Expansionary Effects: | Contractionary Effects: |

|---|---|

| Georgiadis (2015) Fukuda, Kimura, Sudo, and Ugai (2013) Chen, Filardo, He, and Zhu (2012) Bluedorn and Bowdler (2010) Kim (2001) |

Ilzetski and Jin (2013) Maćkowiak (2007) Lubik and Schorfheide (2006) Canova (2005) |

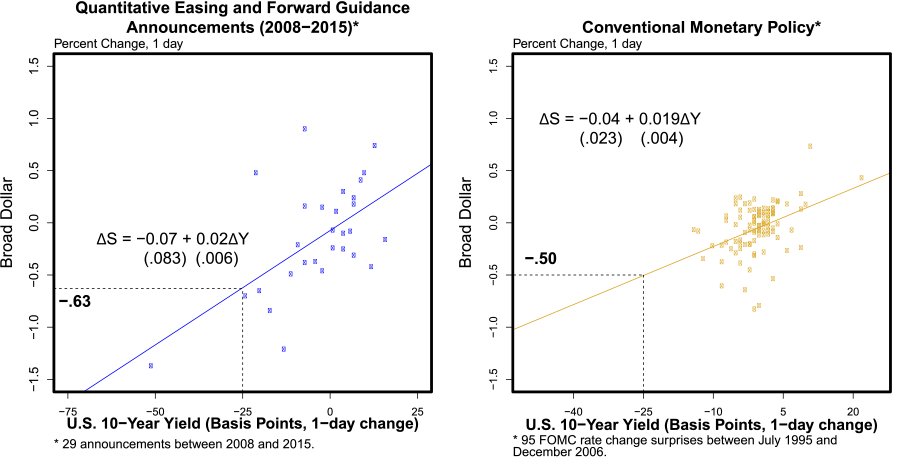

As noted above, a significant spur to the renewed interest in monetary policy spillovers of late has been the advent of unconventional monetary policies. Accordingly, much recent research has focused on whether international spillovers differ, depending on whether they stem from conventional or unconventional policy actions. Our own somewhat preliminary analysis suggests that conventional and unconventional U.S. monetary policy actions appear to have similar effects, at least on the dollar and foreign yields. Figure 4 shows that the effects of unconventional policy announcements on the U.S. dollar -- the panel on the left -- don't seem to differ materially from the effects of similar-sized announcements during the pre-crisis period -- the panel on the right. The same holds true for the effects on German bond yields, shown in Figure 5.13 But as shown in Table 3, some studies have found differences in the spillovers from conventional and unconventional policies -- at least for certain asset classes such as equities (e.g., Chen et al. 2014) -- so this issue is far from settled.

| Table 3: Unconventional vs. Conventional Policy Effects on Asset Prices |

|---|

| Rogers, Scotti, and Wright (2014): | Similar QE announcement effects on AFE asset prices (for given impact on U.S. Treasury yields) as in prior event studies on policy rate announcements (such as Hausman and Wongswan (2011)). |

| Glick and Leduc (2013): | Report similar effects on AFE dollar exchange rates for a given change in the long-term Treasury yield. |

| Glick and Leduc (2015): | Report stronger effects on AFE dollar exchange rates from the components of changes in longer-term rates that are orthogonal to the unexpected change in the current federal funds rate target. |

| Bowman, Londono, and Sapriza (2015): | Similar EME asset price responses to changes in Treasury yields. |

| Takáts and Vela (2014): | Weaker post-2007 relation between EME and U.S. policy rates but stronger in five-year yields. |

| Chen, Mancini-Griffoli, and Sahay (2014): | Stronger spillovers to EMEs from unconventional policy. |

Finally, it bears mentioning that spillovers from monetary policy are likely to differ, depending on the economy initiating the monetary policy action. All else equal, if a country's domestic demand is less responsive to monetary policy than in the United States, then the net effect on its trading partners of monetary stimulus in that country will be less positive than in the case of a U.S. monetary easing. Similarly, if monetary stimulus caused substantially greater currency depreciation than in the U.S. case, the net spillovers to trading partners would be less positive, and could well be negative. And it may also be the case that spillovers through the financial channel will differ from country to country. As indicated in Table 4, Rogers et al. find that Federal Reserve actions have larger effects on the asset prices of other economies than do the actions of other major central banks.

| Table 4: Spillovers of Monetary Policy Surprises that Lower Domestic Yields 25 BP |

|---|

| Federal Reserve | Bank of England | ECB | Bank of Japan | |

|---|---|---|---|---|

| 10-year Treasury | -0.25 | -0.03*** | -0.01 | -0.04 |

| UK Gilt | -0.13*** | -0.25 | 0.02*** | -0.03 |

| German 10-year | -0.09*** | -0.05*** | 0.05*** | -0.01 |

| 10-year JGB | -0.05*** | -0.01 | 0.00 | -0.25 |

*** Significance at the 1 percent level. Return to text.

Note: For the ECB, a monetary policy surprise is defined as a 25 bp reduction in the Italian-German bond spread. As the sample extends only to mid-2013, it does not include the ECB's quantitative easing programs initiated in 2014 and 2015.

Source: Rogers, Scotti, Wright (2014)

IV. Are Spillovers Stabilizing or Destabilizing for the Global Economy?

In this section, we move beyond the question of whether monetary policy spillovers are positive or negative and address the broader issue of whether these spillovers are stabilizing or destabilizing for the global economy. In this regard, it is critical to understand that monetary policy actions don't occur in isolation. They are usually undertaken in response to economic shocks. Depending upon the distribution of shocks throughout the global economy, as well as whether monetary policy spillovers are positive or negative, those spillovers can be either stabilizing or destabilizing.

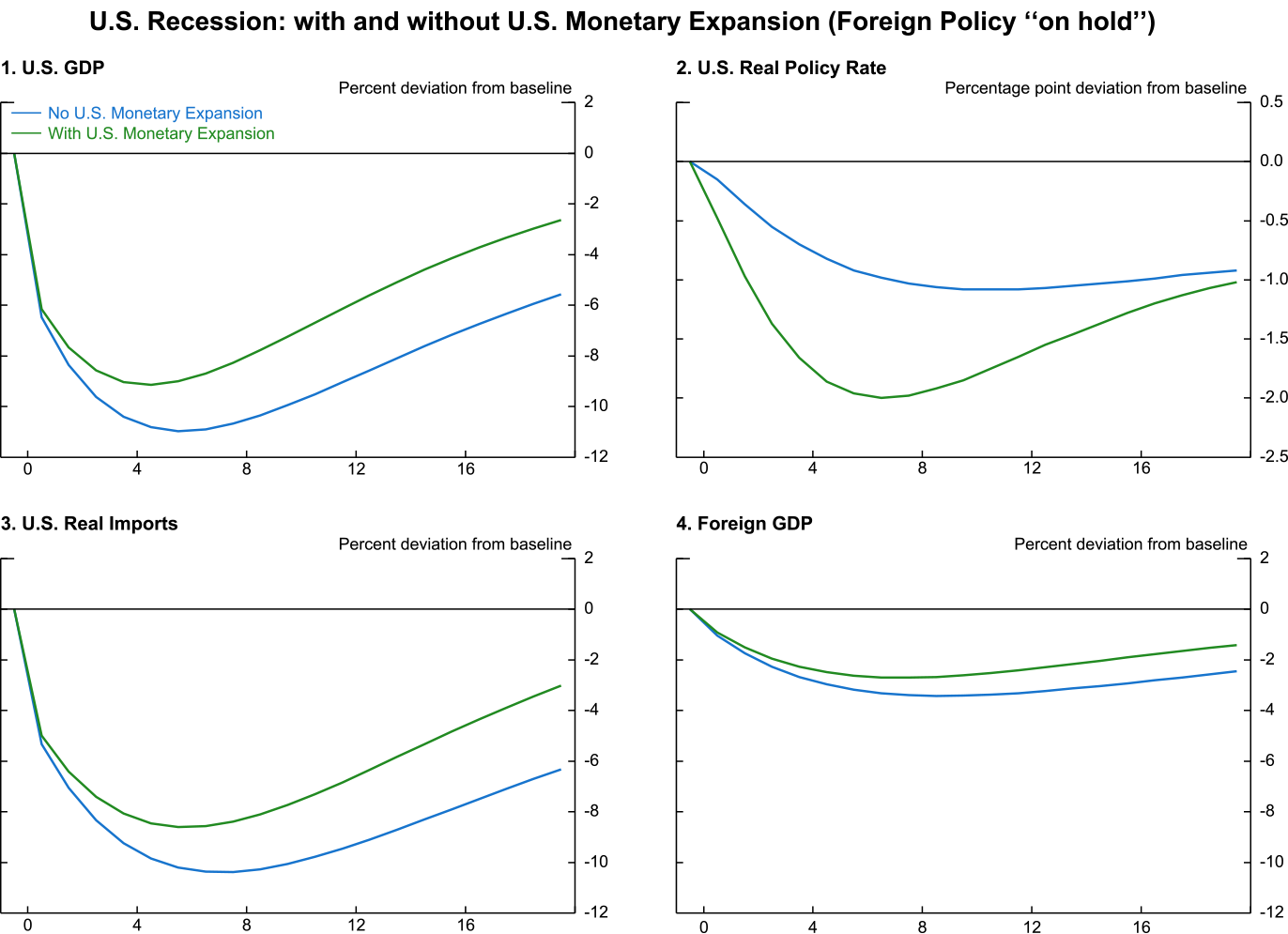

For example, consider the case where a large economy, such as the United States, has experienced a negative shock to its domestic demand, and thus real GDP. We again use simulations of the SIGMA model, shown in Figure 6, to illustrate this case. The blue lines represent a scenario where U.S. monetary policy does not respond strongly to the negative shock, and again assumes that foreign monetary policy stays essentially on hold. In this example, the resultant lower dollar and the contraction in U.S. domestic demand lowers U.S. imports, so foreign GDP, at bottom right, falls as well.14 We contrast this with a scenario in which U.S. monetary policy responds aggressively to the negative shock by lowering interest rates. In the latter scenario -- shown by the green lines -- U.S. GDP falls by less, U.S. imports fall by less, and foreign GDP falls by less as well.

In this example, the spillovers from U.S. monetary policy are clearly stabilizing for the global economy. The same would hold true in the case of a common shock that adversely affected many of the world's economies. Thus, when all economies were in recession at the height of the global financial crisis in 2008 and 2009 -- as roughly captured in Figure 6 - the easing actions by the Federal Reserve and other central banks triggered beneficial spillovers which helped to stabilize the global economy.

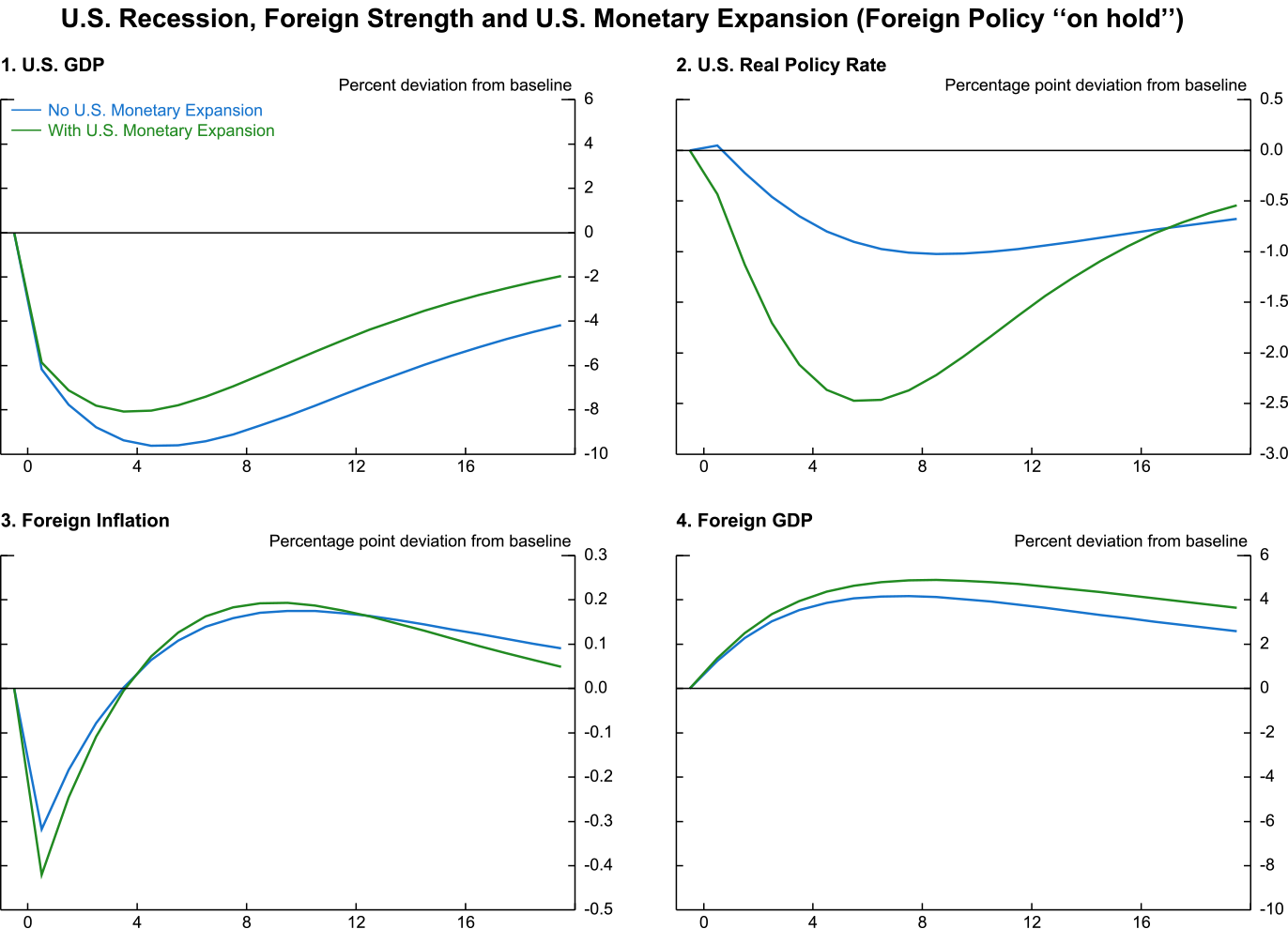

But when different economies are at very different points in their business cycles, monetary policy spillovers may not be stabilizing. For example, in 2010, when the economic recovery in the United States and other advanced economies was still languishing, growth in EMEs had rebounded, and they may not have needed additional stimulus. Figure 7 presents a SIGMA model simulation designed to provide a stylized example of such a situation. The blue lines depict a scenario where the United States, at top left, has moved into recession while the foreign economy, at bottom right, is experiencing a mild boom relative to its equilibrium path.15 When U.S. interest rates are lowered in response to the recession in the United States, as shown by the green line, this pushes foreign output and inflation even higher above equilibrium.16

V. Monetary Policy as an Equilibrating Mechanism

So, depending on the business-cycle positions of economies around the world, monetary policy spillovers may prove either stabilizing or destabilizing for the global economy. This may seem to suggest that the world economy is a highly precarious environment, but the global economic and financial system has a key equilibrating feature we have not yet discussed: the ability of central banks in floating exchange rate regimes to adjust monetary policy in response to shocks in order to keep output and inflation near their targets.17

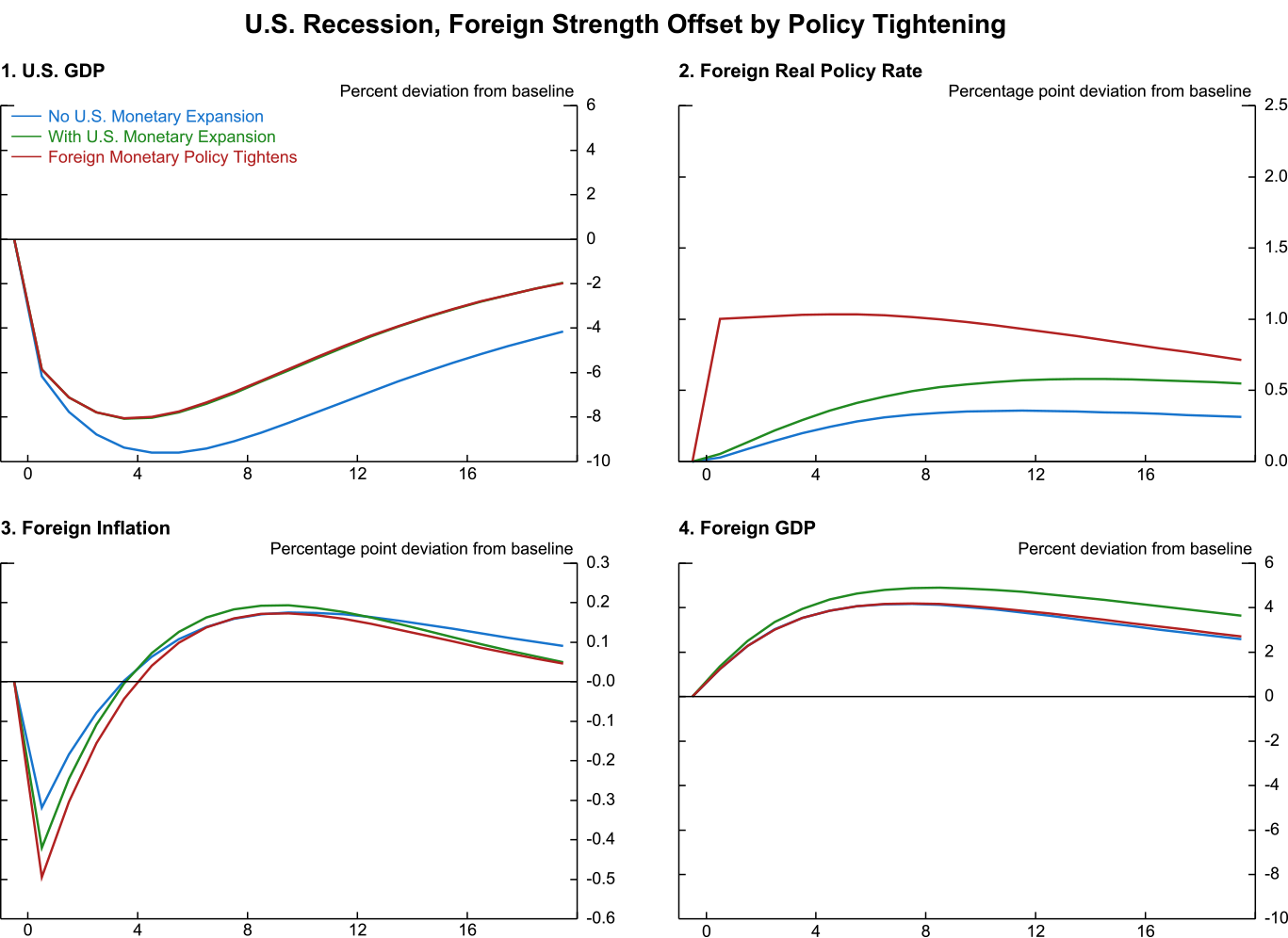

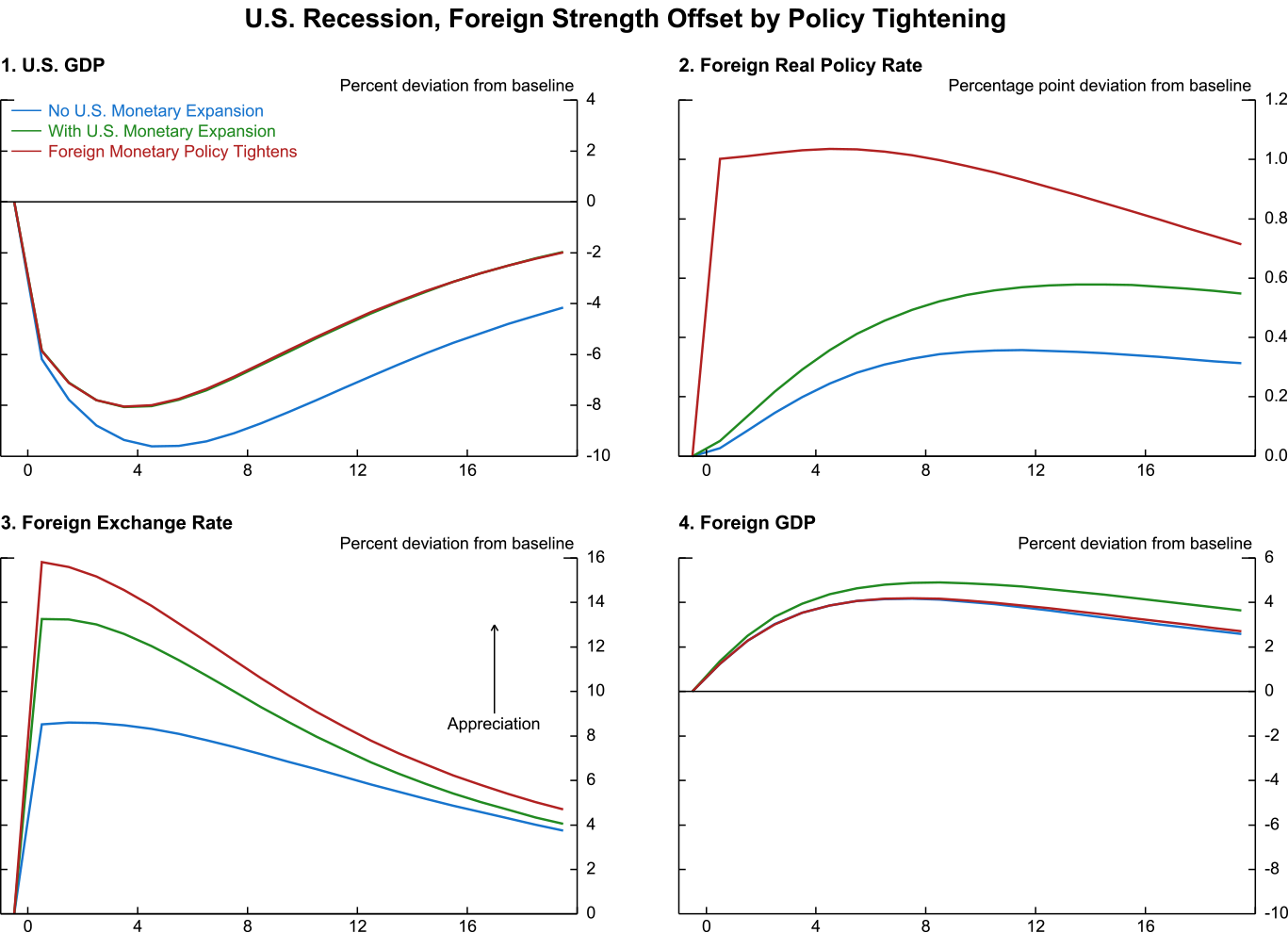

Figure 8 reproduces the simulation depicted in Figure 7. As before, and shown by the blue lines, the United States has moved into recession and the foreign economies into a boom. Also as before, the green lines show that monetary loosening by the Federal Reserve in response to the U.S. recession pushes foreign output and inflation even higher above their equilibrium paths. However, we now add a new scenario, shown by the red lines, in which foreign monetary policy tightens by enough to fully offset the additional stimulus to output and inflation coming from U.S. monetary easing. Thus, while the foreign economy continues to run "hot" -- and additional tightening would be required to close output and inflation gaps entirely -- our example illustrates that foreign policymakers should be able to help insulate domestic output and inflation from the effects of monetary actions abroad.

Over the past year or two, the cyclical situation in the United States and abroad appears to have moved into the opposite situation: the U.S. economy has been growing solidly, while growth in many foreign economies has weakened. Accordingly, concerns have been raised about the spillovers of normalization of U.S. monetary policy on the foreign economies; the Fed started this process with a small hike in the federal funds rate in December 2015, and is generally expected to raise rates gradually further, conditional on the evolution of the U.S. economy. However, all of the considerations discussed above still apply. First, as discussed earlier in this note, the effect of U.S. monetary policies on foreign activity does not seem especially large. Second, many foreign central banks have already been loosening monetary policies and could do more if their situations required. Finally, normalization of U.S. monetary policy will not represent a policy shock -- it will be predicated on continued strength in the U.S. economy, and that will support activity abroad. Notably, U.S. net exports already have been subtracting more than 1/2 of a percentage point from U.S. GDP growth in the past year or so, and this represents a shift in expenditure from the United States to the foreign economies.

VI. Limitations of Central Bank Policy

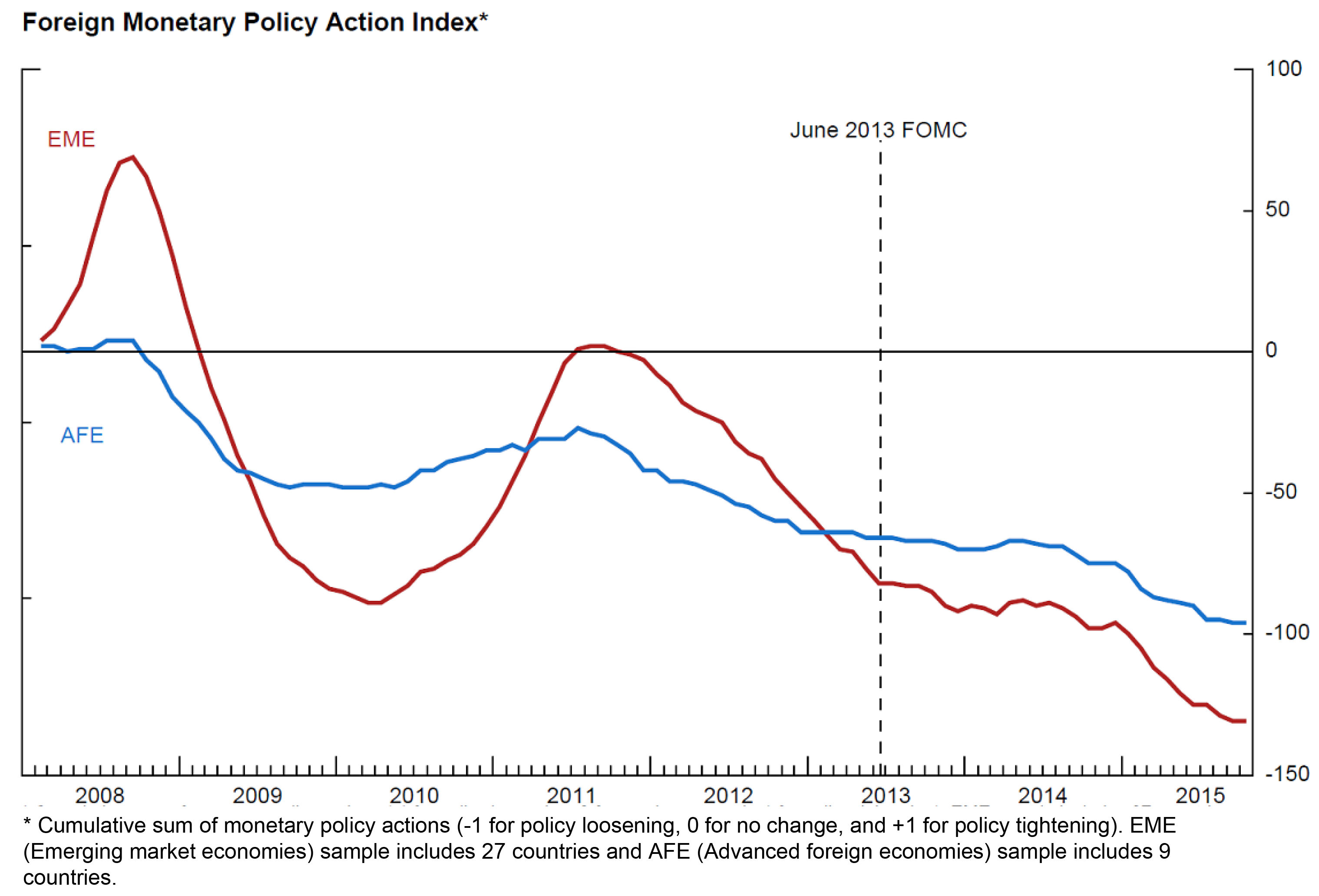

Of course, we should acknowledge that there are limits to the ability of independent central banks to offset monetary policy spillovers -- or any shock, for that matter. To begin with, lags and other frictions in the transmission process can prevent monetary policy from swiftly returning an economy to equilibrium. Second, some central banks may desire to reduce policy rates if normalization by other central banks causes adverse spillovers to their economies, but may be inhibited from doing so by the zero lower bound. Third, other central banks wanting to loosen policy to offset foreign monetary policy tightening may find it difficult to do so given a legacy of high inflation and diminished monetary policy credibility. That said, some recent research suggests that the number of central banks able to implement countercyclical policy has been rising. (Coulibaly, 2012) Indeed, as shown in Figure 9, even after the taper tantrum, many EME central banks continued to loosen policy.18

Finally, even if the authorities had the latitude to fully stabilize output and inflation, they may well have additional objectives. For example, they may want to promote an export-led development strategy (or stable exchange rates). Or they may seek to ensure that capital flows do not undermine financial stability. With multiple objectives, monetary policy responses to spillovers become more complicated.19

To see this, let's return to the example discussed earlier, reproduced in Figure 10, where the U.S. economy is hit by recession and U.S. monetary policy loosening pushes foreign GDP, the bottom right panel, above its equilibrium level -- shown by the green line. In that example, the foreign central bank raises interest rates -- the red line in the top right panel -- by enough to fully offset the effects of U.S. monetary easing on domestic output and inflation. However, as shown in the bottom left panel, the monetary tightening pushes the currency up further, which will weaken exports. If, conversely, the foreign central bank remained "passive" -- the green line -- the less appreciated exchange rate would be better for exports, but such a policy would allow more pronounced economic overheating, excessive credit growth, and exacerbate financial stability risks. So the lack of instruments in the face of multiple objectives makes addressing external spillovers all the more challenging.

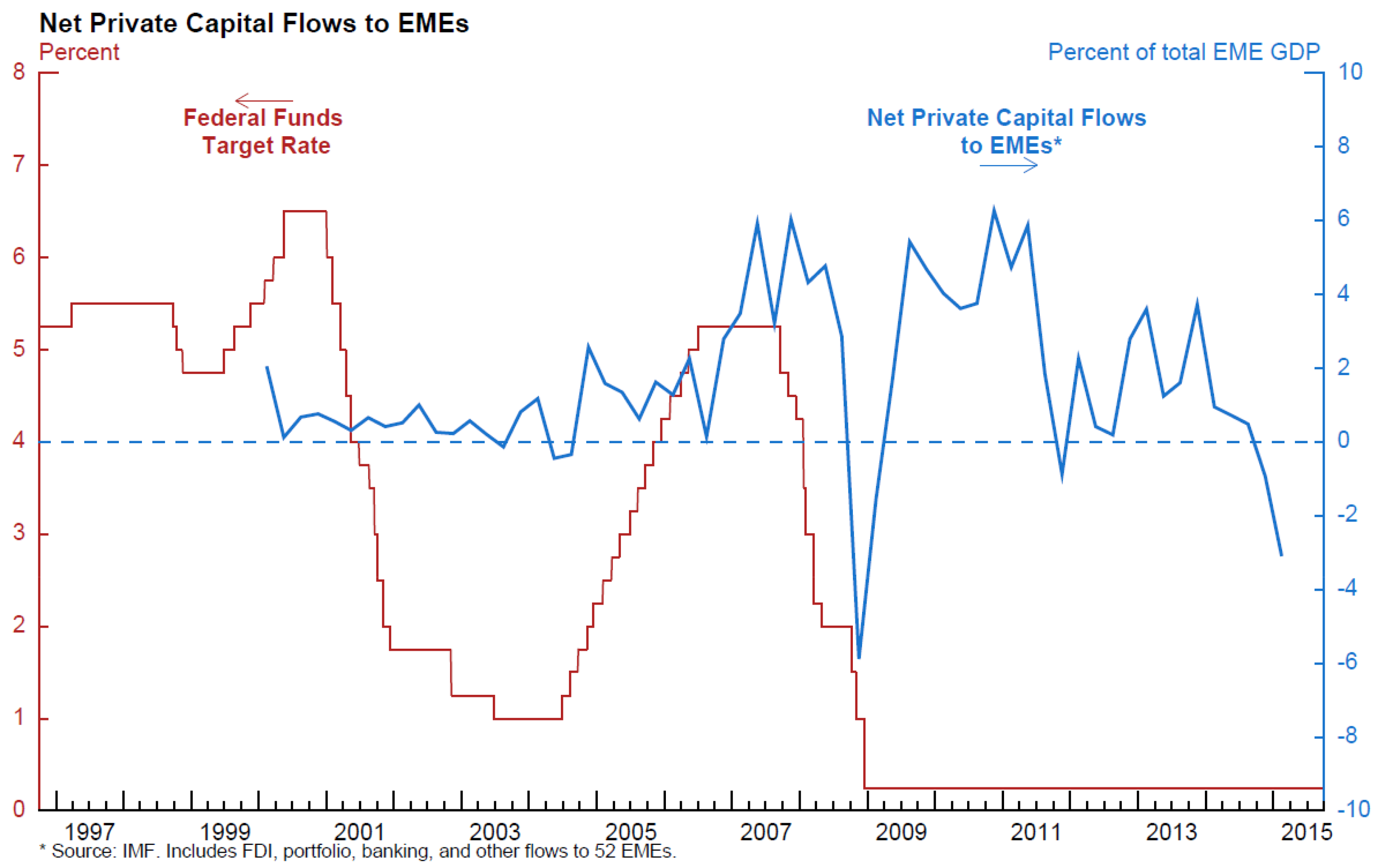

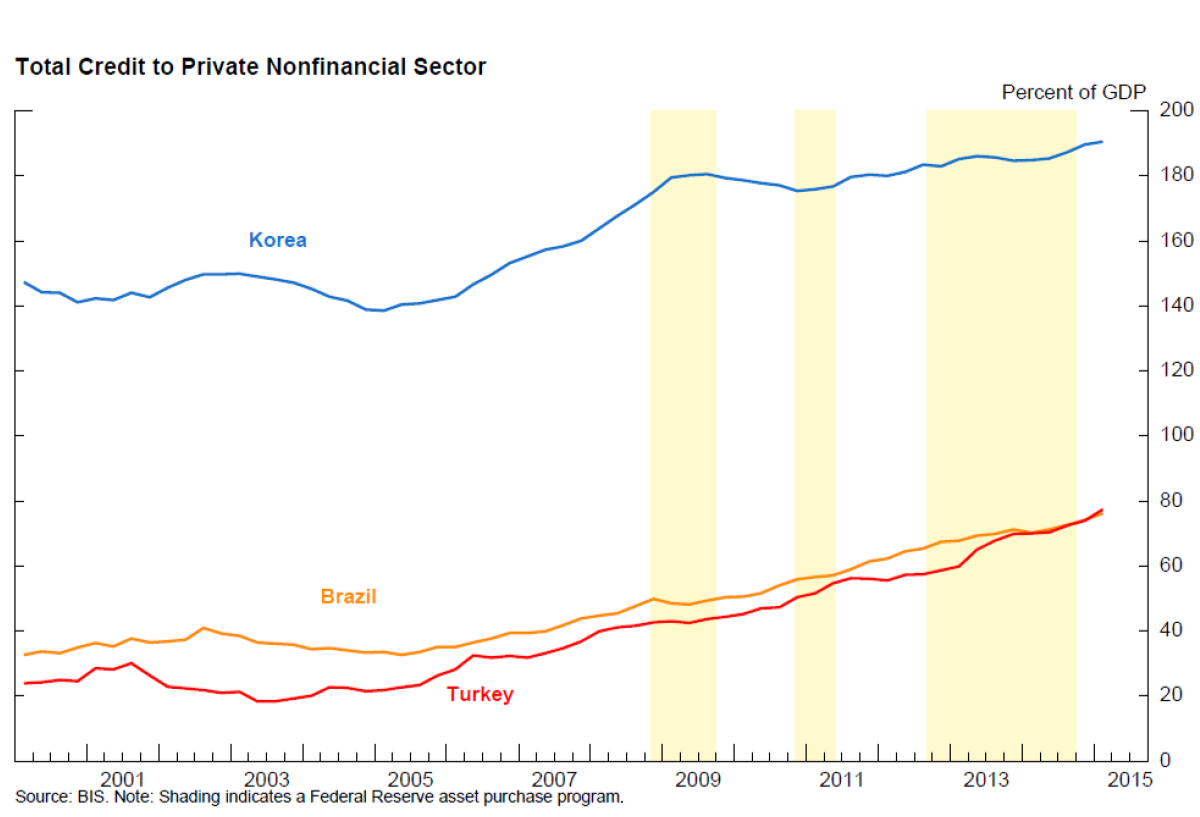

Indeed, this was the dilemma faced by EMEs after the global financial crisis, when their rebound in economic growth was accompanied by a rebound in capital inflows and credit availability as advanced economies loosened monetary policy. But, of course, advanced economy monetary policy was not the only factor at play here. First, other factors such as growth differentials likely contributed to EME capital inflows.20 Second, as indicated in Figure 11, when scaled by GDP, the post-crisis surge in capital flows to EMEs doesn't seem quite as extraordinary. Third, as shown in Figure 12, it bears mentioning that much of the run-up in credit in many EMEs was already well in train before the crisis and loosening of advanced-economy monetary policies.

References

Ahmed, Shaghil, and Andrei Zlate (2014). "Capital Flows to Emerging Market Economies: A Brave New World?" Journal of International Money and Finance, vol. 48 (November), pp. 221-28.

Avdjiev, Stefan, and Elod Takáts (2014). "Cross-Border Bank Lending during the Taper Tantrum: The Role of Emerging Market Fundamentals," BIS Quarterly Review (September), pp. 49-60, www.bis.org/publ/qtrpdf/r_qt1409g.pdf ![]() .

.

Bernanke, Ben (2013). "Monetary Policy and the Global Economy," speech delivered at the Department of Economics and STICERD (Suntory and Toyota International Centres for Economics and Related Disciplines) Public Discussion in Association with the Bank of England, London School of Economics, London, March 25.

Bernanke, Ben (2015). "Federal Reserve Policy in an International Context," Mundell-Fleming Lecture presented at the 16th Jacques Polak Annual Research Conference, International Monetary Fund, Washington, November 5. http://www.imf.org/external/np/res/seminars/2015/arc/pdf/Bernanke.pdf ![]()

Bernanke, Ben, Mark Gertler, and Simon Gilchrist (1999), "The Financial Accelerator in a Quantitative Business Cycle Framework," in John Taylor and Michael Woodford (ed), Handbook of Macroeconomics, edition 1, volume 1, chapter 21, pp. 1341-1393.

Bluedorn, John C. and Christopher Bowdler (2010). "The Open Economy Consequences of U.S. Monetary Policy," Journal of International Money and Finance, vol. 30, pp. 309-336.

Boivin, Jean, Michael Kiley, and Frederic Mishkin (2011). "How Has the Monetary Transmission Mechanism Evolved over Time?" Benjamin Friedman and Frank Hahn, editors, Handbook of Monetary Economics, volume 3 (Amsterdam: Elsevier), pp. 269-422.

Borio, Claudio, and Haibin Zhu (2012). "Capital Regulation, Risk-Taking and Monetary Policy: A Missing Link in the Transmission Mechanism?" Journal of Financial Stability, vol. 8 (December), pp. 236-51.

Bowman, David, Juan M. Londono, and Horacio Sapriza (2015). "U.S. Unconventional Monetary Policy and Transmission to Emerging Market Economies," Journal of International Money and Finance, vol. 55 (July), pp. 27-59.

Bruno, Valentina and Hyung Song Shin (2015). "Capital Flows and the Risk-Taking Channel of Monetary Policy," Journal of Monetary Economics, vol. 71, pp. 119-32.

Canova, Fabio (2005). "The Transmission of U.S. Shocks to Latin America," Journal of Applied Econometrics, vol. 20, pp. 229-251.

Chen, Jiaqian, Tommaso Mancini-Griffoli, and Ratna Sahay (2014). "Spillovers from United States Monetary Policy on Emerging Markets: Different This Time?," IMF Working Paper Series WP/14/240. Washington: International Monetary Fund (December), www.imf.org/external/pubs/ft/wp/2014/wp14240.pdf ![]() .

.

Chen, Qianying, Andrew Filardo, Dong He, and Feng Zhu (2012). "International Spillovers of Central Bank Balance Sheet Policies," BIS Papers Series 66p. Basel, Switzerland: Bank for International Settlements (October), www.bis.org/publ/bppdf/bispap66p.pdf ![]() .

.

Christiano, Lawrence, Martin Eichenbaum, and Charles Evans (2005). "Nominal Rigidities and the Dynamic Effects of a Shock to Monetary Policy," Journal of Political Economy, vol. 113 (1), pp. 1-45.

Chung, Hess, Jean-Philippe Laforte, David Reifschneider, and John C. Williams (2012). "Have We Underestimated the Likelihood and Severity of Zero Lower Bound Events?"Journal of Money, Credit and Banking, 44 (February), pp. 47-82.

Clarida, Richard, Jordi Gali, and Mark Gertler (2002). "A Simple Framework for International Monetary Policy Analysis," Journal of Monetary Economics, vol. 49 (September), pp. 879-904.

Corsetti, Giancarlo, Paolo Pesenti, Nouriel Roubini and Cedric Tille (2000). "Competitive Devaluations: Toward a Welfare-Based Approach," Journal of International Economics, vol. 51 (June), pp. 217-41.

Coulibaly, Brahima (2012). "Monetary Policy in Emerging Market Economies: What Lessons from the Global Financial Crisis?" International Finance Discussion Papers 1042. Washington: Board of Governors of the Federal Reserve System (February), www.federalreserve.gov/pubs/ifdp/2012/1042/ifdp1042.pdf.

Engen, Eric, Thomas Laubach, and David Reifschneider (2015). "The Macroeconomic Effects of the Federal Reserve's Unconventional Policies," Finance and Economic Discussion Papers 2015-05. Washington: Board of Governors of the Federal Reserve System (January), www.federalreserve.gov/econresdata/feds/2015/files/2015005pap.pdf

Erceg, Christopher, Luca Guerrieri, and Christopher Gust (2006). "SIGMA: A New Open Economy Model for Policy Analysis." International Journal of Central Banking, vol. 2 (March), pp. 1-50.

Fleming, J. Marcus (1962). "Domestic Financial Policies under Fixed and under Floating Exchange Rates," International Monetary Fund Staff Papers, vol. 9 (November), pp. 369-80.

Fratzscher, Marcel (2012). "Capital Flows, Push versus Pull Factors and the Global Financial Crisis," Journal of International Economics, vol. 88 (November), pp. 341-56.

Fratzscher, Marcel, Marco Lo Duca, and Roland Straub (2013). "On the International Spillovers of U.S. Quantitative Easing," Working Paper Series 1557. Frankfurt: European Central Bank (June), www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1557.pdf ![]() .

.

Fukuda, Yoshiyuki, Yuki Kimura, Nao Sudo, and Hiroshi Ugai (2013). "Cross-Country Transmission Effect of the U.S. Monetary Shock Under Global Integration." Bank of Japan Working Paper Series, No. 13-E-16, www.boj.or.jp/en/research/wps_rev/wps_2013/data/wp13e16.pdf ![]()

Furceri, Davide, Stephanie Guichard, and Elena Rusticelli (2011). "Medium-Term Determinants of International Investment Positions: The Role of Structural Policies," OECD Economics Department Working Paper Series 863. Paris: Organisation for Economic Co-operation and Development (May), www.oecd-ilibrary.org/economics/medium-term-determinants-of-international-investment-positions_5kgc9kzsm19x-en?crawler=true ![]() .

.

Georgiadis, Georgios (2015). "Determinants of Global Spillovers from U.S. Monetary Policy." ECB Working Paper Series No. 1854, www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1854.en.pdf ![]()

Glick, Reuven, and Sylvain Leduc (2013). "The Effects of Unconventional and Conventional U.S. Monetary Policy on the Dollar," Working Paper Series 2013-11. San Francisco: Federal Reserve Bank of San Francisco (May), www.frbsf.org/economic-research/files/wp2013-11.pdf ![]() .

.

Glick, Reuven, and Sylvain Leduc (2015). "Unconventional Monetary Policy and the Dollar: Conventional Signs, Unconventional Magnitudes," Working Paper Series 2015-18. San Francisco: Federal Reserve Bank of San Francisco (November), http://www.frbsf.org/economic-research/files/wp2015-18.pdf ![]() .

.

Gruber, McCallum, and Vigfusson (2016). "The Dollar in the U.S. International Transactions (USIT) Model," IFDP Note: Board of Governors of the Federal Reserve System, forthcoming.

Gust, Christopher, Sylvain LeDuc, and Nathan Sheets (2009). "The Adjustment of Global External Balances: Does Partial Exchange-Rate Pass-Through to Trade Prices Matter?" Journal of International Economics, vol. 79 (November), pp. 173-185.

Hausman, Joshua, and Jon Wongswan (2011). "Global Asset Prices and FOMC Announcements," Journal of International Money and Finance, vol. 30 (April), pp. 547-71.

Hanson, Samuel, and Jeremy Stein (2015). "Monetary Policy and Long-Term Real Rates," Journal of Financial Economics, vol. 115, pp. 429-48.

Hofmann, Boris, Ilhyock Shim, and Hyung Song Shin (2015). "The Risk-Taking Channel of Currency Appreciation," Bank for International Settlements.

Hooper, Peter, Karen Johnson, and Jaime Marquez (2000). "Trade Elasticities for the G-7 Countries," Princeton Studies in International Economics no. 87.

Hume, David (1742). "Of Interest," Political Discourses, essay IV, in Eugene F. Miller, ed., Essays, Moral, Political, and Literary. Indianapolis: Liberty Fund, Inc. (1987), www.econlib.org/library/LFBooks/Hume/hmMPL27.html ![]() .

.

Ilzetski, Ethan and Keyu Jin (2013). "The Puzzling Change in the International Transmission of U.S. Macroeconomic Policy Shocks." Working Paper. London School of Economics, https://personal.lse.ac.uk/jink/transmission.pdf ![]()

Kiley, Michael (2014). "The Aggregate Demand Effects of Short and Long-Term Interest Rates," International Journal of Central Banking, vol. 10 (December), pp. 69-104.

Kim, Soyoung (2001). "International Transmission of U.S. Monetary Policy Shocks: Evidence from VARs," Journal of Monetary Economics, vol 48, pp. 339-372.

Lubik, Thomas and Frank Schorfheide (2006). "A Bayesian Look at New Open Macroeconomics," NBER Macroeconomics Annual 2005, vol. 20, pp. 313-382.

Luca, Oana, and Nikola Spatafora (2012). "Capital Inflows, Financial Development, and Domestic Investment: Determinants and Inter-Relationships," IMF Working Paper Series WP/12/120. Washington: International Monetary Fund, May, www.imf.org/external/pubs/ft/wp/2012/wp12120.pdf ![]() .

.

Mackowiak, Bartosz (2007). "External Shocks, U.S. Monetary Policy and Macroeconomic Fluctuations in Emerging Markets," Journal of Monetary Economics, vol. 54, pp.2512-2520.

Morris, Stephen, and Hyun Song Shin (2014). "Risk-Taking Channel of Monetary Policy: A Global Game Approach," working paper, Princeton University, January, www.princeton.edu/~hsshin/www/risk_taking_channel_lbh.pdf ![]() .

.

Mundell, Robert A. (1963). "Capital Mobility and Stabilization Policy under Fixed and Flexible Exchange Rates," Canadian Journal of Economic and Political Science, vol. 29 (November), pp. 475-85.

Neely, Christopher J. (2015). "Unconventional Monetary Policy Had Large International Effects," Journal of Banking and Finance, vol. 52 (March), pp. 101-111.

Obstfeld, Maurice and Kenneth Rogoff (2002). "Global Implications of Self-Oriented National Monetary Rules," Quarterly Journal of Economics, vol. 117 (May), pp. 503-35.

Rey, Hélčne (2013). "Dilemma Not Trilemma: The Global Financial Cycle and Monetary Policy Independence," paper presented at "Global Dimensions of Unconventional Monetary Policy," a symposium sponsored by the Federal Reserve Bank of Kansas City, held in Jackson Hole, Wyo., August 22-24, www.kc.frb.org/publicat/sympos/2013/2013Rey.pdf ![]() .

.

Rogers, John H., Chiara Scotti, and Jonathan H. Wright (2014). "Evaluating Asset-Market Effects of Unconventional Monetary Policy: A Multi-Country Review," Economic Policy, vol. 29 (October), pp. 749-99.

Sahay, Ratna, Vivek Arora, Thanos Arvanitis, Hamid Faruqee, Papa N'Diaye, Tommaso Mancini-Griffoli, and an IMF Team. (2014). "Emerging Market Volatility: Lessons from the Taper Tantrum," IMF Staff Discussion Note SDN/14/09. Washington: International Monetary Fund, September, www.imf.org/external/pubs/ft/sdn/2014/sdn1409.pdf ![]() .

.

Smets, Frank, and Rafael Wouters (2007). "Shocks and Frictions in US Business Cycles: A Bayesian DSGE Approach," American Economic Review, 97(3): 586-606.

Takáts, Elod, and Abraham Vela (2014). "International Monetary Policy Transmission," BIS Papers Series 78. Basel, Switzerland: Bank for International Settlements, August, www.bis.org/publ/bppdf/bispap78b_rh.pdf ![]() .

.

Taylor, John (1993). "Discretion vs. Policy Rules in Practice." Carnegie -Rochester Conference Series on Public Policy 39, pp. 195- 214.

Appendix: SIGMA Description and Simulations

Overview of SIGMA

SIGMA is a model developed and used by Federal Reserve Board staff for simulation analysis. The simulations in this note are implemented in a two country block version of the SIGMA model with a "U.S. block" and "foreign" block. SIGMA is a dynamic general equilibrium (DSGE) model that incorporates an array of nominal and real rigidities designed to help the model yield empirically-plausible implications across a broad set of shocks. Abstracting from its open economy features, the specification of each country block builds heavily on the estimated models of Christiano, Eichenbaum, and Evans (CER, 2005) and Smets and Wouters (SW, 2007). While many of the key features of SIGMA are described in Erceg, Guerrieri, and Gust (2006), the model used in the simulations includes some additional features mentioned below (notably, allowing for incomplete passthrough of exchange rate changes to import prices).

On the aggregate supply side, SIGMA incorporates sluggish nominal price adjustment by assuming that monopolistically competitive firms set prices according to Calvo-style staggered contracts. Because the model allows for dynamic indexation, lagged inflation enters the "price Phillips Curve" (as well as expected inflation and marginal cost). Similarly, SIGMA incorporates wage stickiness by positing that households are monopolistic suppliers of labor services and set wages in Calvo-style staggered contracts indexed to lagged wage inflation.

On the aggregate demand side, SIGMA includes habit persistence in consumption and adjustment costs on investment -- features that imply a gradual adjustment of domestic demand to real interest rates. Our model extends CER and SW by assuming that half of households are "Keynesian" and simply consume their current after-tax income, and by allowing for financial frictions that drive a wedge between the policy rate and the interest rate faced by private households and firms. While our model in fact incorporates a financial accelerator on investment spending following the basic approach of Bernanke, Gertler, and Gilchrist (1999), our simulations assume that these financial wedges are simply exogenous for simplicity. Government purchases are assumed to be exogenous and have no direct effect on the utility of households. The government is assumed to finance its purchases and transfers through adjusting the tax rate on labor income; this tax rate varies with the stock of government debt to ensure long-run fiscal solvency.

The open economy features of SIGMA also build on an extensive open economy DSGE literature. Import (and export) demand varies directly with domestic absorption, and inversely with the relative price of imported goods, with the responsiveness to relative price changes damped in the near-term due to adjustment costs. To account for incomplete passthrough of exchange rate changes to import prices, SIGMA adopts a preference specification over imports which implies non-constant demand elasticities as in Gust, Sheets, and LeDuc (2009); this feature implies that the desired markup of firms varies with the import share of the economy.

Monetary policy is assumed to follow a Taylor-style rule, so that the nominal interest rate simply responds to the deviation of consumer price inflation from the central bank's inflation target and to the output gap. However, our benchmark calibration of the rule assumes that the response to the output gap is very small -- only 0.25, which is half that of the Taylor (1993) rule, and far smaller than estimates in Engen, Laubach, and Reifschneider (2015) suggest would be consistent with the Federal Reserve's behavior in recent years. We also assume that the coefficient on inflation is only slightly above unity in the foreign sector (rather that 1.5 in the standard Taylor rule, which is also the calibration for the United States) to capture the notion that monetary policy abroad reacts "passively" to U.S. monetary policy stimulus.

Some Details on the Simulations

Figure 3: 25 Basis Point Reduction in 10-year Treasury yield

This simulation assumes that U.S. monetary policy is eased enough to depress the 10-year nominal Treasury yield by 25 basis points. The fall in nominal yields is achieved through a combination of a fall in the term premium on Treasury securities and an exogenous shift in the intercept of the U.S. policy reaction function. The simulation assumes modest financial spillovers to the foreign economy, so that foreign long-term bond yields fall around 10 basis points. In the absence of these financial spillovers, foreign GDP would be virtually unchanged in response to the U.S. policy easing.

Figure 6: U.S. Recession, with and without U.S. Monetary Expansion

In the baseline case with "no monetary expansion," large adverse aggregate demand shocks in the United States depress U.S. GDP substantially. Given the magnitude and persistence of the shock, real policy interest rates fall somewhat even though nominal policy rates are constrained to respond little to their Taylor-rule determinants, output and inflation; the decline in real interest rates causes the broad real dollar to depreciate about 5 percent. Foreign GDP falls modestly due to spillovers from the U.S. downturn, and because of (much smaller) adverse demand shocks.

In the "U.S" monetary expansion case, we assume that the U.S. shifts to a much more aggressive policy reaction function as soon as the adverse demand shock materializes, and moreover, asset purchases cause a fall in the term premium on long-term Treasuries. The more accommodative reaction function cushions the GDP decline, and causes the broad real dollar to depreciate much more sharply. The foreign monetary policy reaction function remains unchanged (foreign policy rates are "on hold," constrained to show little responsiveness to their Taylor-rule determinants), with foreign GDP rising relative to the "no monetary expansion" scenario due to positive financial spillovers from the fall in U.S. rates.

Figure 7: U.S. Recession, Foreign Strength

This scenario is identical to the previous one, except that the baseline embeds a positive foreign demand shock so that foreign GDP is noticeably above its long-run steady state value. Accordingly, while the U.S. monetary expansion has the same effects as in the previous scenario, the stronger initial conditions imply some "foreign overheating" insofar as output rises further above steady state, and inflation eventually exceeds its target.

Figure 8, 10: U.S. Recession, Foreign Strength Offset by Policy Tightening

This first two scenarios ("No U.S. Monetary Expansion," "With U.S. Monetary Expansion") are identical to those shown in Figure 7. In the third scenario, "Foreign Monetary Policy Tightens," we assume that the foreign central bank raises interest rates by considerably more than implied by the baseline (passive) Taylor rule. In our scenario, this is achieved by adjusting the intercept term of the policy reaction function.

1. This note is based on the presentation by Steven Kamin at the conference, "Spillovers of Unconventional Monetary Policy," Peterson Institute for International Economics, October 15, 2015. The authors thank Andrew Rys and Alexander Mechanick for providing excellent research assistance, and Stijn Claessens and participants in the International Financial Division workshop and Peterson Institute conference for helpful comments. Return to text

2. The literature on monetary policy spillovers dates at least to Hume (1742). Recent treatments include Corsetti et al. (2000), Clarida, Gali, and Gertler (2002), and Rey (2013). Return to text

3. Fleming (1962), in particular, appeals to the balance of payments to argue that the capital outflows induced by lower home interest rates must be offset by an improvement in the home country's trade balance. Return to text

4. The financial spillovers channel has been the subject of particularly active research in recent years, including Borio and Zhu (2012), Rey (2013), Morris and Shin (2014), Bruno and Shin (2015), Neely (2015), and Hanson and Stein (2015). While portfolio balance channels are an important source of spillovers, the literature has highlighted how financial spillovers may occur through a number of channels. For example, Hofmann, Shim, and Shin (2015) argue that the decline in EME yields resulting from an easing of U.S. monetary policy partly reflects that foreign currencies appreciate vis-ŕ-vis the dollar, which improves EME corporate and sovereign balance sheets. Return to text

5. The monetary policy easing in our analysis is achieved through both a reduction in policy rates and an increase in asset purchases. While our simulations below assume that monetary policy is not constrained by the zero lower bound, a similar-sized reduction in the 10-year Treasury yield could be achieved through forward guidance and asset purchases if the zero lower bound were binding. Return to text

6. We estimate a slightly larger response coefficient to U.S. yields when substituting a narrower dollar index that excludes emerging-market currencies. The results with this narrower index are broadly in line with Glick and LeDuc (2013). Return to text

7. The U.S. International Transactions (USIT) model and the rules of thumb that underlie this calculation were discussed in a speech by Vice Chairman Fischer entitled "The Transmission of Exchange Rate Changes to Output and Inflation" on November 12, 2015, and are described in more detail in a forthcoming IFDP note by Gruber, McCallum, and Vigfusson (2016). Return to text

8. Our assumed interest elasticity of U.S. demand is in line with the implications of the FRB/US model used in the analysis of Chung, LaForte, Reifschneider, and Williams (2012), and is also fairly close to the estimates of Kiley (2014) that are based on both an optimization-based model and a semi-structural model. It also seems consistent with the large empirical literature assessing the effects of a "shock" to the federal funds rate under plausible assumptions about the response of long nominal yields to the policy rate (e.g., see Boivin, Kiley, and Mishkin (2011)). Return to text

9. Our assumed income elasticity of U.S. imports of 2 is consistent with that implied by the USIT model discussed in Gruber, McCallum, and Vigfusson (2016), as well as with a longstanding literature (see, for example, Hooper, Johnson, and Marquez (2000)). Return to text

10. Among other things, our streamlined analysis does not take into account spillovers to other asset prices abroad, such as stock prices or corporate bond yields. It also does not take into account effects on financial stability abroad, such as when rises in the dollar interact with dollar-denominated corporate debt and create financial difficulties for some foreign firms. Return to text

11. Using various empirical proxies for vulnerabilities of emerging market economies, Bowman et al. (2015) find that domestic interest rates respond more to U.S. interest rates in more vulnerable economies. Return to text

12. For example, Fratzscher, Lo Duca, and Straub (2013) compare the Fed's first two QE programs and report that a given dollar amount of asset purchases appeared to have substantially different effects on asset prices and capital flows during the two periods. Return to text

13. We also find that conventional- and unconventional-period yield responses are roughly the same for Japanese, Canadian, and U.K. bond yields, respectively. Return to text

14. In order to highlight the key features of this scenario, we also assume a small negative shock to foreign domestic demand. Return to text

15. As discussed in the Appendix, we assume that the policy rate in the foreign economy follows a Taylor rule in which the real policy rate shows very little sensitivity to the output gap or inflation gap -- which is the sense in which foreign policy rates may be regarded as roughly "on hold." Similarly, the U.S. policy reaction function is considerably less aggressive than the standard Taylor rule (1993) in the "no monetary expansion" scenario. Nevertheless, U.S. real interest rates still fall somewhat (panel 2) in response to the very large adverse shock, the broad dollar depreciates. Return to text

16. Foreign inflation declines initially because the foreign currency appreciates in response to the fall in U.S. demand and associated decline in U.S. real interest rates. The larger foreign currency appreciation in the U.S. monetary expansion scenario causes a comparatively bigger initial fall in foreign inflation. Return to text

17. One key implication of the Mundell-Fleming framework is that a central bank cannot freely adjust policy rates to stabilize domestic output while also maintaining a fixed exchange rate and open capital account -- thus presenting a tradeoff that often referred to as the "macroeconomic policy trilemma" (see Obstfeld and Rogoff, 2002). More recently, Rey (2013) has argued that even floating exchange rates will not suffice to insulate domestic financial conditions from foreign shocks, at least without restrictions on capital mobility; however, there is nothing in Rey's analysis that precludes a central bank with floating exchange rates from taking independent actions to offset the undesired effects on domestic financial conditions of foreign shocks. Return to text

18. The authors kindly thank Brahima Coulibaly for providing us with this figure. Return to text

19. See Bernanke (2015) for a discussion of how an objective for export-performance may affect the conduct of monetary policy. One way that EMEs have addressed the problem of multiple objectives, though not analyzed here, is to supplement monetary policies with macroprudential policies and capital controls. Return to text

20. See, for example, Ahmed and Zlate (2014). Studies using panel data typically have found that country-specific factors help explain cross-sectional differences in international investment and capital flows. See, for example, Furceri, Guichard, and Rusticelli (2011); Fratzscher (2012); Luca and Spatafora (2012); Avdjiev and Takáts (2014); and Sahay et al. (2014). Return to text

Please cite as:

Ammer, John, Michiel De Pooter, Christopher Erceg, and Steven Kamin (2016). "International Spillovers of Monetary Policy," IFDP Notes. Washington: Board of Governors of the Federal Reserve System, February 08, 2016. https://doi.org/10.17016/2573-2129.15

Disclaimer: IFDP Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than IFDP Working Papers.