By Topic

Frequently Asked Questions on the New Accounting Standard on Financial Instruments--Credit Losses

The Financial Accounting Standards Board (FASB) issued a new accounting standard, Accounting Standards Update (ASU) No. 2016-13, Topic 326, Financial Instruments – Credit Losses, on June 16, 2016.1 The new accounting standard introduces the current expected credit losses methodology (CECL) for estimating allowances for credit losses.

The Board of Governors of the Federal Reserve System (FRB), the Federal Deposit Insurance Corporation (FDIC), the National Credit Union Administration (NCUA), and the Office of the Comptroller of the Currency (OCC) (hereafter, the agencies) issued a Joint Statement on June 17, 2016, summarizing key elements of the new accounting standard and providing initial supervisory views with respect to measurement methods, use of vendors, portfolio segmentation, data needs, qualitative adjustments, and allowance processes.

The agencies have developed these frequently asked questions (FAQ) to assist institutions and examiners. The focus of the FAQs is on the application of CECL and related supervisory expectations. Each question identifies the date the FAQ was originally published as well as the date(s) it was updated, if applicable.2 The agencies have also made minor technical and editorial changes to previously published FAQs. In addition, the Appendix includes links to relevant resources that are available to institutions to assist with the implementation of CECL.

In November 2018, the FASB issued ASU No. 2018-19, Codification Improvements to Topic 326, Financial Instruments–Credit Losses, to mitigate transition complexity by amending the effective date of the new accounting standard for nonpublic business entities (non-PBEs)3 to fiscal years beginning after December 15, 2021, including interim periods within those fiscal years. Accordingly, responses to questions 4, 34, and 35 have been updated to reflect the new effective date for non-PBEs.

The new accounting standard applies to all banks, savings associations, credit unions, and financial institution holding companies (hereafter, institutions), regardless of size, that file regulatory reports for which the reporting requirements conform to U.S. generally accepted accounting principles (GAAP).

Further, ASU 2016-13 applies to all financial instruments carried at amortized cost (including loans held for investment (HFI) and held-to-maturity (HTM) debt securities, as well as trade receivables, reinsurance recoverables, and receivables that relate to repurchase agreements and securities lending agreements), a lessor's net investments in leases, and off-balance-sheet credit exposures not accounted for as insurance or as derivatives, including loan commitments, standby letters of credit, and financial guarantees. The new accounting standard does not apply to trading assets, loans held for sale, financial assets for which the fair value option has been elected, or loans and receivables between entities under common control. While there are differences between CECL and current U.S. GAAP, the agencies expect the new accounting standard will be scalable to institutions of all sizes. However, inputs to allowance estimation methods will need to change to properly implement CECL.

The new accounting standard also makes targeted improvements to the accounting for credit losses on available-for-sale (AFS) debt securities, including lending arrangements that meet the definition of debt securities under U.S. GAAP and are classified as AFS.

Until the new accounting standard becomes effective, institutions must continue to follow current U.S. GAAP on impairment and the allowance for loan and lease losses (ALLL). Each institution also should continue to refer to the agencies' December 2006 Interagency Policy Statement on the Allowance for Loan and Lease Losses, and the policy statements on allowance methodologies and documentation4 (collectively, the ALLL policy statements) until the effective date of ASU 2016-13 applicable to the institution.5 The agencies will not rescind existing supervisory guidance on the ALLL until CECL becomes effective for all institutions.

The agencies plan to issue proposed supervisory guidance on the allowance for credit losses under CECL before the first mandatory effective date for the new accounting standard. As noted in the response to question 46, many of the concepts, processes, and practices detailed in existing supervisory guidance will continue to be relevant under CECL. Until new guidance is issued, institutions should consider the relevant sections of existing ALLL policy statements, the 2016 Joint Statement, and these FAQs in their implementation of the new accounting standard.

The agencies will continue to assess whether other existing supervisory guidance requires updating as a result of the new accounting standard. In general, references in other existing supervisory guidance to the calculation, measurement, or reporting of the ALLL or the provision for loan and lease losses in accordance with U.S. GAAP will remain applicable. However, these references should be interpreted as meaning the allowance or provision for credit losses on loans and leases as measured under CECL following an institution's adoption of the new accounting standard. Additionally, related references to or discussion of the incurred loss model within existing supervisory guidance would no longer be applicable. Institutions should consider whether internal policies, including those referencing existing supervisory guidance, need to be updated or modified for the new accounting standard.

In November 2019, the FASB issued ASU No. 2019-10, Financial Instruments—Credit Losses (Topic 326), Derivatives and Hedging (Topic 815), and Leases (Topic 842): Effective Dates. This ASU delayed the effective date of Topic 326 to fiscal years beginning after December 15, 2022, including interim periods within those fiscal years, for all institutions, except U.S. Securities and Exchange Commission (SEC) filers, as that term is defined in U.S. generally accepted accounting principles that are not eligible to be smaller reporting companies as defined by the SEC. The responses below to the “Frequently Asked Questions” issued on April 3, 2019, have not yet been updated. Institutions should consider this delayed effective date when reviewing the responses to questions 3, 4, 28, and 34 through 36.

| Topic | FAQ Number |

|---|---|

| Applicability of New Accounting Standard | 6 |

| Background | 1-3 |

| Collateral-Dependent Financial Assets | 15, 37-38 |

| Data | 25-26, 44 |

| Debt Securities | 10-12 |

| Effective Dates | 4 |

| Implementation | 5, 19, 22, 41-42 |

| Methods | 7 |

| Off-Balance-Sheet Credit Exposures | 9 |

| Public Business Entities | 28-33 |

| Purchased Credit-Deteriorated Financial Assets | 14, 27 |

| Qualitative Factors | 24 |

| Reasonable and Supportable Forecasts | 39-40 |

| Regulatory Capital | 18 |

| Regulatory Reports | 34-36 |

| Segmentation | 8, 43 |

| Supervisory Expectations | 17, 20-21, 23, 45-46 |

| Third-Party Vendors | 16 |

| Troubled Debt Restructurings | 13 |

1. Why is the FASB changing the existing incurred loss methodology? [December 2016]

In the period leading up to the global economic crisis, institutions and financial statement users expressed concern that current U.S. GAAP restricts the ability to record credit losses that are expected, but that do not yet meet the "probable" threshold. After the crisis, various stakeholders requested that accounting standard-setters6 work to enhance standards on loan loss provisioning to incorporate forward-looking information. Standard-setters concluded that the existing approach for determining the impairment of financial assets, based on a "probable" threshold and an "incurred" notion, delayed the recognition of credit losses on loans and resulted in loan loss allowances that were "too little, too late."

2. What are some of the concerns the FASB is addressing with CECL? [December 2016]

By issuing CECL, the FASB:

- Removed the "probable" threshold and the "incurred" notion as triggers for credit loss recognition and instead adopted a standard that states that financial instruments carried at amortized cost should reflect the net amount expected to be collected.

- Broadened the range of data that is incorporated into the measurement of credit losses to include forward-looking information, such as reasonable and supportable forecasts, in assessing the collectability of financial assets.

- Introduced a single measurement objective for all financial assets carried at amortized cost.

3. What does the new accounting standard change in existing U.S. GAAP? [December 2016]

- Introduction of a new credit loss methodology.

The new accounting standard developed by the FASB has been designed to replace the existing incurred loss methodology in U.S. GAAP. Under CECL, the allowance for credit losses is an estimate of the expected credit losses on financial assets measured at amortized cost, which is measured using relevant information about past events, including historical credit loss experience on financial assets with similar risk characteristics, current conditions, and reasonable and supportable forecasts that affect the collectability of the remaining cash flows over the contractual term of the financial assets.7 In concept, an allowance will be created upon the origination or acquisition of a financial asset measured at amortized cost. The allowance will then be updated at subsequent reporting dates. The allowance for credit losses under CECL is a valuation account, measured as the difference between the financial assets' amortized cost basis and the amount expected to be collected on the financial assets (i.e., lifetime credit losses).8 - Earlier recognition of credit losses.

Today's incurred loss methodology is based on a "probable" threshold and an "incurred" notion, the effect of which is to delay the recognition of credit losses on loans, and thereby resulting in allowances that are "too little, too late." By removing the "probable" threshold and the "incurred" notion, CECL eliminates the triggers used for recognizing credit losses under existing U.S. GAAP. Under CECL, the total amount of net charge-offs on financial assets does not change, but rather the timing of credit loss provision expenses changes.

Although the measurement of credit loss allowances is changing under CECL, the FASB's new accounting standard does not address when a financial asset should be placed in nonaccrual status. In addition, the FASB retained the existing write-off guidance in U.S. GAAP, which requires an institution to write off a financial asset in the period the asset is deemed uncollectible. - Leverage of existing credit risk management practices.

Similar to today's practices under the incurred loss methodology, management will continue to incorporate qualitative and quantitative factors, including information related to underwriting practices, when estimating allowances for credit losses under CECL. However, better alignment of allowance estimation practices with existing credit risk assessment and risk management practices is likely, as the new accounting standard allows a financial institution to leverage its current internal credit risk systems as a framework for estimating expected credit losses. - Forward-looking information.

CECL is forward-looking and broadens the range of data that must be considered in the estimation of credit losses. More specifically, CECL requires consideration of not only past events and current conditions, but also reasonable and supportable forecasts that affect expected collectability. Institutions must revert to historical credit loss experience for those periods of the contractual term of financial assets beyond which the institution is able to make or obtain reasonable and supportable forecasts of expected credit losses. - Reduction in the number of credit impairment models.

Impairment measurement under existing U.S. GAAP has often been considered complex because it encompasses five credit impairment models for different financial assets.9 In contrast, CECL introduces a single measurement objective to be applied to all financial assets carried at amortized cost, including loans HFI and HTM debt securities. That said, CECL does not specify a single method for measuring expected credit losses; rather, it allows any reasonable approach, as long as the estimate of expected credit losses achieves the objective of the FASB's new accounting standard. Under today's incurred loss methodology, institutions use various methods, including historical loss rate methods, roll-rate methods, and discounted cash flow methods, to estimate credit losses. CECL allows the continued use of these methods; however, certain changes to these methods will need to be made in order to estimate lifetime expected credit losses. - Purchased credit-deteriorated (PCD) financial assets.

CECL introduces the concept of PCD financial assets, which replaces purchased credit-impaired (PCI) assets under existing U.S. GAAP. The differences in the PCD criteria compared to today's PCI criteria will result in more purchased loans HFI, HTM debt securities, and AFS debt securities being accounted for as PCD financial assets. In contrast to today's accounting for PCI assets, the new standard requires the estimate of expected credit losses embedded in the purchase price of PCD assets to be estimated and separately recognized as an allowance as of the date of acquisition. This is accomplished by grossing up the purchase price by the amount of expected credit losses at acquisition, rather than being reported as a credit loss expense. - AFS debt securities.

The new accounting standard also modifies today's accounting for impairment on AFS debt securities. Under this new standard, institutions will recognize a credit loss on an AFS debt security through an allowance for credit losses, rather than a direct write-down as is required by current U.S. GAAP. The recognized credit loss is limited to the amount by which the amortized cost of the security exceeds fair value. A write-down of an AFS debt security's amortized cost basis to fair value, with any incremental impairment reported in earnings, would be required only if the fair value of an AFS debt security is less than its amortized cost basis and either (1) the institution intends to sell the debt security, or (2) it is more likely than not that the institution will be required to sell the security before recovery of its amortized cost basis. - Vintage disclosures by PBEs in U.S. GAAP financial statements.

Under the new accounting standard, disclosures of credit quality indicators of financing receivables and net investment in leases, such as loan-to-value ratios, credit scores, and risk ratings, need to be disaggregated by vintage (i.e., year of origination) to provide users of financial statements greater transparency regarding the credit quality trends within the portfolio from period to period. This information can be used to better understand and evaluate management's prior and current estimates of credit losses.10

For PBEs,11 the disaggregation of credit quality indicators by vintage is required for a minimum of five annual reporting periods, with the balance for financing receivables and net investment in leases originated before the fifth annual reporting period shown in the aggregate. For example, assume an institution is preparing disclosures for the year ended December 31, 2020. The vintage-based disclosure should include information for financing receivables and net investment in leases originated during 2020, 2019, 2018, 2017, 2016, and prior to 2016. The standard provides transition relief for PBEs that are not U.S. Securities and Exchange Commission (SEC) filers.12 Institutions that are not PBEs have the option to make the vintage disclosures in their U.S. GAAP financial statements, but are not required to do so.

4. When does the new accounting standard take effect?13 [December 2016, updated April 2019]

The new accounting standard provides three different effective dates. The effective date applicable to an institution depends on the institution's characteristics.

- For a PBE that is an SEC filer, as both terms are defined in U.S. GAAP, the new credit losses standard is effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. Thus, for an SEC filer that has a calendar year fiscal year, the standard is effective January 1, 2020, and it must first apply the new credit losses standard in its financial statements and regulatory reports (e.g., the Call Report) for the quarter ended March 31, 2020. An SEC filer is an entity that is required to file its financial statements with the SEC under the federal securities laws or, for an insured depository institution (IDI), the appropriate federal banking agency under section 12(i) of the Securities Exchange Act of 1934.14

- For a PBE that is not an SEC filer, the credit losses standard is effective for fiscal years beginning after December 15, 2020, including interim periods within those fiscal years. Thus, for a PBE that is not an SEC filer and has a calendar year fiscal year, the standard is effective January 1, 2021, and the entity must first apply the new credit losses standard in its financial statements and regulatory reports (e.g., the Call Report) for the quarter ended March 31, 2021. A PBE that is not an SEC filer includes (1) an entity that has issued debt or equity securities that are traded, listed, or quoted on an over-the-counter (OTC) market, or (2) an entity that has issued one or more securities that are not subject to contractual restrictions on transfer and is required by law, contract, or regulation to prepare U.S. GAAP financial statements15 and make them publicly available periodically (e.g., pursuant to Section 36 of the Federal Deposit Insurance Act and Part 363 of the FDIC's regulations).

- For an entity that is not a PBE (non-PBE), the credit losses standard is effective for fiscal years beginning after December 15, 2021, including interim periods within those fiscal years. Thus, for a non-PBE with a calendar year fiscal year, the standard is effective January 1, 2022, and the entity must first apply the new accounting standard in its financial statements and regulatory reports (e.g., the Call Report) for the quarter ended March 31, 2022.

Early application of the new credit losses standard is permitted for all institutions for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years.

The following table provides a summary of the effective dates.

| New Accounting Standard Effective Dates | ||

|---|---|---|

| U.S. GAAP Effective Date | Regulatory Report Effective Date* | |

| PBEs That Are SEC Filers | Fiscal years beginning after 12/15/2019, including interim periods within those fiscal years | 3/31/2020 |

| Other PBEs (Non-SEC Filers) | Fiscal years beginning after 12/15/2020, including interim periods within those fiscal years | 3/31/2021 |

| Non-PBEs | Fiscal years beginning after 12/15/2021, including interim periods within those fiscal years | 3/31/2022 |

| Early Application | Early application permitted for fiscal years beginning after 12/15/2018, including interim periods within those fiscal years | |

*For institutions with calendar year fiscal years

5. How should an institution apply the new accounting standard upon initial adoption? [December 2016]

As of the new accounting standard's effective date, institutions will apply the standard based on the characteristics of financial assets as follows:16

- Financial assets carried at amortized cost (e.g., loans HFI and HTM debt securities) that are not PCD assets: A cumulative-effect adjustment for the changes in the allowances for credit losses will be recognized in retained earnings on the statement of financial position (balance sheet) as of the beginning of the first reporting period in which the new standard is adopted.

- Purchased credit-deteriorated assets: Financial assets classified as PCI assets prior to the effective date of the new standard will be classified as PCD assets as of the effective date. For all assets designated as PCD assets as of the effective date, an institution will be required to gross up the balance sheet amount of the financial asset by the amount of its allowance for expected credit losses as of the effective date. Subsequent changes in the allowances for credit losses on PCD assets will be recognized by charges or credits to earnings. The institution will continue to accrete the noncredit discount or premium to interest income based on the effective interest rate on the PCD assets determined after the gross-up for the CECL allowance at adoption.

- AFS and HTM debt securities: A debt security on which other-than-temporary impairment had been recognized prior to the effective date of the new standard will transition to the new guidance prospectively (i.e., with no change in the amortized cost basis of the security). The effective interest rate on such a debt security before the adoption date will be retained and locked in. Amounts previously recognized in accumulated other comprehensive income (OCI) related to cash flow improvements will continue to be accreted to interest income over the remaining life of the debt security on a level-yield basis. Recoveries of amounts previously written off relating to improvements in cash flows after the date of adoption will be recognized in income in the period received.

6. Does the new accounting standard apply to all institutions? [December 2016]

The new accounting standard applies to all banks, savings associations, credit unions, and financial institution holding companies, both public and private, regardless of size, that file regulatory reports for which the reporting requirements conform to U.S. GAAP.

7. What are some acceptable methods for estimating allowance levels under CECL? [December 2016]

CECL does not prescribe the use of specific estimation methods.17 Rather, allowances for credit losses may be determined using various methods that reasonably estimate the expected collectability of financial assets and are applied consistently over time. For example, acceptable methods include loss rate, roll-rate, vintage analysis, discounted cash flow, and probability of default/loss given default methods. Neither a vintage nor a discounted cash flow method is required for estimating expected credit losses. Additionally, an institution may apply different estimation methods to different groups of financial assets. To properly apply an acceptable estimation method, an institution's credit loss estimates must be well supported.

However, inputs will need to change in order to achieve an appropriate estimate of expected credit losses. For instance, the inputs to a loss rate method would need to reflect expected losses over the contractual term, rather than the annual loss rates commonly used under the existing incurred loss methodology. In addition, institutions would need to consider how to adjust historical loss experience not only for current conditions, as is required under the existing incurred loss methodology, but also for reasonable and supportable forecasts that affect the expected collectability of financial assets. Nevertheless, taking these factors into account, the agencies expect that smaller and less complex institutions will be able to adjust their existing allowance methods to meet the requirements of the new accounting standard without the use of costly and/or complex modeling techniques.

CECL allows institutions to apply judgment in developing estimation methods that are appropriate and practical for their circumstances. The agencies expect supervised institutions to make good faith efforts to implement the new accounting standard in a sound and reasonable manner. After the effective date of CECL, the agencies will assess the implementation of the accounting standard and consider the need to issue additional supervisory guidance to aid in the development of practices for the sound application of the standard.

8. How should institutions segment HFI loan and HTM debt security portfolios under CECL? [December 2016]

CECL requires institutions to measure expected credit losses on financial assets carried at amortized cost on a collective or pool basis when similar risk characteristics exist. Similar risk characteristics may include one or a combination of the following:18

- Internal or external (third-party) credit scores or credit ratings;

- Risk ratings or classifications;

- Financial asset type;

- Collateral type;

- Asset size;

- Effective interest rate;

- Term;

- Geographical location;

- Industry of the borrower;

- Vintage;

- Historical or expected credit loss patterns; and

- Reasonable and supportable forecast periods.

Although the new accounting standard provides examples of similar risk characteristics, smaller and less complex institutions may conclude that the segmentation practices they have used under the incurred loss methodology are also appropriate under the expected loss methodology, or they may refine those practices. In addition, institutions will need to determine how to segment their HTM debt securities portfolios.

If a financial asset does not share risk characteristics with other financial assets, the new accounting standard requires the expected credit losses on that asset to be measured on an individual asset basis. As under the incurred loss methodology, financial assets on which expected credit losses are measured on an individual basis should not also be included in a collective assessment of expected credit losses.

9. Will there be an allowance for credit losses on off-balance-sheet credit exposures under CECL?19 [December 2016]

For off-balance-sheet credit exposures, an institution will estimate expected credit losses over the contractual period in which they are exposed to credit risk. Similar to today's practices, an institution will report in net income as an expense the amount necessary to adjust the allowance for credit losses on off-balance-sheet credit exposures, which is reported as a liability, for management's current estimate of expected credit losses on these exposures. For the period of exposure, the estimate of expected credit losses should consider both the likelihood that funding will occur and the amount expected to be funded over the estimated remaining life of the commitment or other off-balance-sheet exposure.

In contrast, the FASB decided that no credit losses should be recognized for off-balance-sheet credit exposures that are unconditionally cancellable by the issuer. To illustrate, Bank A has a significant credit card portfolio, including funded balances on existing cards and unfunded commitments (i.e., available credit) on credit cards. Bank A's cardholder agreements stipulate that the available credit may be unconditionally cancelled at any time. When determining the allowance for expected credit losses, Bank A estimates the expected credit losses over the estimated remaining lives of the funded credit card loans. However, Bank A would not evaluate or record an allowance for unfunded commitments on credit cards because it has the ability to unconditionally cancel the available lines of credit.

10. How will CECL affect the HTM debt securities portfolio? [December 2016]

CECL applies to HTM securities since they are carried at amortized cost and are within the scope of the standard. Therefore, in contrast to today's accounting, institutions generally will need to establish allowances for credit losses on their HTM debt securities as of the date they adopt CECL and maintain such allowances thereafter. Because CECL requires institutions to measure expected credit losses on a collective or pool basis when similar risk characteristics exist, HTM securities that share similar risk characteristics will need to be collectively assessed for credit losses.

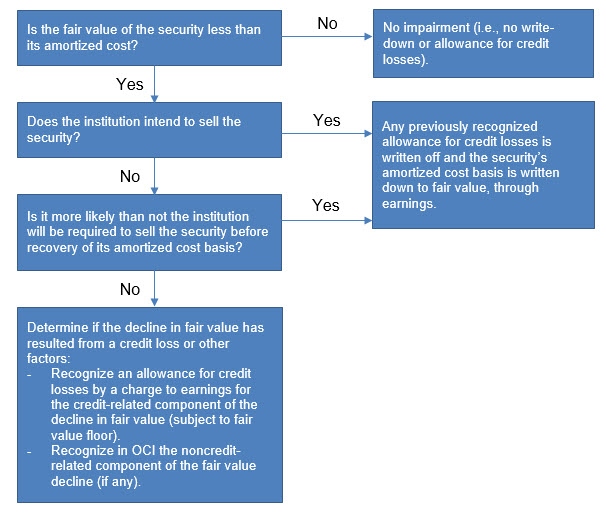

11. Does the accounting for credit losses on AFS debt securities change under the new accounting standard?20 [December 2016]

Yes. The new accounting standard makes targeted improvements to the accounting for credit losses on AFS debt securities. Under this standard, institutions will record credit losses on AFS debt securities through an allowance for credit losses rather than the current practice of write-downs of individual securities for other-than-temporary impairment.

Similar to today, at each reporting date, an institution must determine whether a decline in the fair value of an individual AFS debt security below its amortized cost basis is the result of credit factors or other factors.

Other targeted improvements to the existing impairment methodology for AFS debt securities include:

- Limiting allowances for credit losses on individual AFS debt securities to the excess of the amortized cost basis over fair value; and

- Permitting the reversal of allowance amounts in current period earnings to the extent that expected cash flows improve.

When evaluating whether a credit loss exists on an individual AFS debt security that is impaired, an entity would not be permitted to ignore whether credit losses exist simply because fair value has been less than amortized cost for only a limited period of time.

Finally, the AFS debt security impairment methodology retains today's "intend to sell" and "more-likely-than-not required to sell" guidance that requires a write-down to fair value through earnings.

The following table summarizes the differences between current U.S. GAAP and the new standard on AFS debt securities.

| Current U.S. GAAP | New Accounting Standard |

|---|---|

| Credit losses recognized through a direct write-down of the amortized cost basis. | Allowance approach. |

| Credit losses can exceed total unrealized losses. | Fair value floor for credit losses. |

| No immediate reversals of previously recognized credit losses. | Allows immediate full or partial reversals of previously recognized credit losses, as appropriate. |

The AFS impairment methodology is summarized in the following diagram:

12. Is there a difference between the AFS methodology and CECL under the new accounting standard? [December 2016]

Yes. CECL requires an institution to measure expected credit losses upon the initial recognition of financial assets carried at amortized cost (e.g., loans HFI and HTM securities) and perform the credit loss assessment on such assets on a collective (pool) basis when similar risk characteristic(s) exist. In contrast, for AFS debt securities, the new accounting standard maintains the current requirement to assess credit losses at the individual security level only when the amortized cost of an AFS debt security exceeds fair value.21 In addition, AFS impairment is required to be measured using a discounted cash flow approach, whereas CECL does not specify a measurement approach.

13. Will the accounting for a troubled debt restructuring (TDR) change? [December 2016]

Yes. Although the guidance for determining whether a modification of terms on a financial asset is a TDR will remain unchanged from today's U.S. GAAP, the new standard makes certain changes to the existing accounting for TDRs. An institution will continue to account for a modification as a TDR if the institution for economic or legal reasons related to a borrower's financial difficulties grants a concession to the borrower that it would not otherwise consider. However, the FASB determined that credit losses on TDRs should be calculated under the same expected credit loss methodology that is applied to other financial assets carried at amortized cost – in other words, under CECL. This is in contrast to current guidance, which requires that impairment on loans that are TDRs be measured using specific methods applicable to individually impaired loans (e.g., discounted cash flow and fair value of collateral).

Further, the new accounting standard requires:

- The value of concessions made by the creditor in a TDR to be incorporated into the allowance estimate; and

- The pre-modification effective interest rate to be used to measure credit losses on a TDR when applying the discounted cash flow method.

14. How should institutions account for PCD financial assets under CECL? [December 2016]

CECL introduces the concept of PCD financial assets, which replaces PCI assets under existing U.S. GAAP. For PCD assets, the new accounting standard requires institutions to estimate and record an allowance for credit losses for these assets at the time of purchase. This allowance is then added to the purchase price to establish the initial amortized cost basis of the PCD assets, rather than being reported as a credit loss expense. In contrast, for purchased financial assets within the scope of CECL that are not PCD assets, an institution is required to measure expected credit losses by a charge to the provision for credit losses (expense) in the period the non-PCD assets are acquired.

In addition, the definition of PCD assets is broader than the definition of PCI assets in current accounting standards. The new accounting standard defines "purchased financial assets with credit deterioration" as "acquired individual financial assets (or acquired groups of financial assets with similar risk characteristics) that, as of the date of acquisition, have experienced a more-than-insignificant deterioration in credit quality since origination, as determined by an acquirer's assessment."22

In practical terms, loans HFI, HTM debt securities, and AFS debt securities that qualify as PCD will reflect an allowance for credit losses and a noncredit discount (or premium) for the difference between the asset's par value (unpaid principal balance) and purchase price as of the acquisition date. This is accomplished by grossing up the purchase price by the amount of expected credit losses at acquisition. This method is less complex and more transparent compared with the requirements of today's PCI model, and creates comparability of allowances for credit losses with non-PCD purchased and originated loans and non-PCD debt securities.

For example, assume that Bank A pays $750,000 for a loan with an unpaid principal balance of $1 million.23 The loan will be HFI and measured on an amortized cost basis. At the time of purchase, Bank A estimates the allowance for credit losses on the unpaid principal balance to be $175,000.

At the purchase date, Bank A's statement of financial position would reflect an amortized cost basis for the loan of $925,000 (that is, the amount paid plus the allowance for credit losses) and an initial allowance for credit losses of $175,000 associated with the loan.

The difference between the unpaid principal balance of $1 million and the amortized cost of $925,000 at the acquisition date is a noncredit discount. This $75,000 noncredit discount would be accreted into interest income over the life of the financial asset on a level-yield basis (provided the loan appropriately remains on accrual status). The allowance for credit losses is evaluated each quarter and adjusted as necessary by a charge or credit to the provision for credit losses.

The acquisition-date journal entry is as follows:

| Account | Debit | Credit |

|---|---|---|

| Loan (HFI) - Unpaid principal balance | $1,000,000 | |

| Loan (HFI) - Noncredit discount | $75,000 | |

| Allowance for credit losses | $175,000 | |

| Cash | $750,000 |

When accounting for PCD financial assets under CECL, other changes from today's practices include:

- An entity must allocate the noncredit discount or premium resulting from the acquisition of a pool of PCD financial assets to each individual asset in the pool;

- When using a method to estimate the allowance for credit losses that discounts expected future cash flows, the discount rate used is the rate that equates the purchase price of the PCD asset with the present value of the estimated future cash flows at the acquisition date; and

- When using a method to estimate the allowance for credit losses other than one that discounts expected future cash flows, the allowance estimate is based on the unpaid principal balance (face or par value) of the PCD asset.

15. Has the "collateral-dependent" definition changed in the new accounting standard? [December 2016]

Yes. The "collateral-dependent" definition has been altered slightly. The new accounting standard defines a collateral-dependent financial asset as "a financial asset for which the repayment is expected to be provided substantially through the operation or sale of the collateral when the borrower is experiencing financial difficulty based on the entity's assessment as of the reporting date."24

The standard allows institutions to use, as a practical expedient, the fair value of the collateral to measure expected credit losses on collateral-dependent financial assets.

Similar to existing U.S. GAAP, if an institution uses the practical expedient on a collateral-dependent financial asset and repayment or satisfaction of the asset depends on the sale of the collateral, the fair value of the collateral should be adjusted for estimated costs to sell (on a discounted basis). However, the institution would not need to incorporate in the net carrying amount of the financial asset the estimated costs to sell the collateral if repayment or satisfaction of the financial asset depends only on the operation, rather than on the sale, of the collateral.

Example 6 in ASU 2016-13 illustrates one way to implement the collateral-dependent concepts.25 The example below is based on Example 6 in the standard. Assume that:

Bank F provides commercial real estate loans to developers of luxury apartment buildings. Each loan is secured by a respective luxury apartment building. Over the past two years, comparable standalone luxury housing prices have dropped significantly, while luxury apartment communities have experienced an increase in vacancy rates.

At the end of 20X7, Bank F reviews its commercial real estate loan to Developer G and observes that Developer G is experiencing financial difficulty as a result of, among other things, decreasing rental rates and increasing vacancy rates in its apartment building.

After analyzing Developer G's financial condition and the operating statements for the apartment building, Bank F believes that it is unlikely Developer G will be able to repay the loan at maturity in 20X9. Therefore, Bank F believes that repayment of the loan is expected to be substantially through the foreclosure and sale (rather than the operation) of the collateral.

As a result, in its financial statements for the period ended December 31, 20X7, Bank F utilizes the [collateral-dependent] practical expedient and uses the apartment building's fair value, less costs to sell, when developing its estimate of expected credit losses.

16. Should institutions use third-party vendors to assist in measuring expected credit losses under CECL? [December 2016]

The agencies will not require institutions to engage third-party service providers to assist management in calculating allowances for credit losses under CECL. If an institution chooses to use a third-party service provider to assist management with this process, the institution should engage in sound third-party risk management. Management should refer to the agencies' guidance on third-party service providers.26

Specifically with regard to data, to implement CECL, an institution should collect and maintain relevant data to support its estimates of lifetime expected credit losses in a way that aligns with the method or methods it will use to estimate its allowances for credit losses. As such, the agencies encourage institutions to discuss the availability of historical loss data internally and with their core loan service providers because system changes related to the collection and retention of data may be warranted. Depending on the estimation method or methods selected, institutions may need to capture additional data and retain data longer than they have in the past on loans that have been paid off or charged off to implement CECL.

17. Will the agencies establish benchmarks or floors for allowance levels? [December 2016]

No. At the time of adoption, the actual impact of CECL on an institution's allowance levels will depend on many factors. These factors include current and future expected economic conditions, the level of an institution's allowance balances, its portfolio mix, its underwriting practices, and its geographic locations and those of its borrowers. Because allowance levels depend on these institution-specific factors, the agencies cannot reasonably forecast the expected change in allowance levels across all institutions. For similar reasons, the agencies will not establish benchmark targets or ranges of allowance levels upon adoption of CECL or for allowance levels going forward.

18. Will adoption of the new accounting standard impact U.S. GAAP equity and regulatory capital? [December 2016, updated April 2019]

Yes. Upon initial adoption, the earlier recognition of credit losses under CECL will likely increase allowance levels and lower the retained earnings component of equity, thereby lowering common equity tier 1 capital for regulatory capital purposes.27

However, the actual effect of CECL upon implementation will vary by institution and depend on many factors, such as those identified in the response to question 17, and the effect of these factors on the collectability of an institution's HFI loans and HTM debt securities upon adoption.

In December 2018, the federal bank regulatory agencies approved a final rule that modifies their regulatory capital rules and provides institutions the option to phase in over a three-year period any day-one regulatory capital effects of the new accounting standard. The final rule also revises the agencies' other rules that reference credit loss allowances to reflect the new standard. Institutions that choose to early adopt the new accounting standard (e.g., in the first quarter of 2019) may adopt the final rule, including its CECL transition provision, before the effective date of the final rule.

The agencies will monitor changes to institutions' regulatory capital due to the adoption of the expected credit loss methodology.

19. Can institutions build their allowance levels in anticipation of adopting CECL? [December 2016]

No. Institutions must continue to use the existing U.S. GAAP incurred loss methodology until CECL becomes effective. It is not appropriate to begin increasing allowance levels beyond those appropriate under existing U.S. GAAP in advance of CECL's effective date.

When estimating allowance levels before CECL's effective date, the implementation of the CECL methodology is a future event. It is therefore inappropriate to treat CECL as a basis for qualitatively adjusting allowances measured under the existing incurred loss methodology.

20. How will the agencies coordinate their efforts to address the implementation of CECL? [December 2016]

Recognizing the operational impact CECL may have, particularly for smaller and less complex institutions, the agencies are working together to ensure consistent and timely communications, training, and supervisory guidance.

The agencies will develop supervisory guidance to clarify expectations, but will not provide an approved formula or mandate a single approach that institutions must follow when applying CECL.

The agencies' accounting policy staffs are cataloguing current policy statements, examination materials, reporting forms and instructions, and training programs to determine the revisions needed in response to CECL.

21. Will the agencies provide support to institutions? [December 2016]

Yes. The agencies are performing ongoing outreach to the industry and other stakeholders to understand potential implementation issues and communicate supervisory views. The agencies will use this information to determine the nature and extent of support and other assistance needed.

The agencies issued a Joint Statement on June 17, 2016, summarizing key elements of the new accounting standard and providing initial supervisory views with respect to measurement methods, use of vendors, portfolio segmentation, data needs, qualitative adjustments, and allowance processes.

The agencies have developed these FAQs to assist institutions and examiners. The agencies plan to publish additional FAQs and/or update existing FAQs periodically.

22. What should institutions do to prepare for the implementation of CECL? [December 2016]

To plan and prepare for the transition to and implementation of the new accounting standard, each institution is encouraged to:

- Become familiar with the new accounting standard and educate the board of directors and appropriate institution staff about CECL and how it differs from the incurred loss methodology;

- Determine the applicable effective date of the standard based on the PBE criteria in U.S. GAAP;

- Determine the steps and timing needed to implement the new accounting standard;

- Identify the functional areas within the institution that should participate in the implementation of the new standard;

- Discuss the new accounting standard with the board of directors, audit committee, industry peers, external auditors,28 and supervisory agencies to determine how to best implement the new standard in a manner appropriate for the institution's size and the nature, scope, and risk of its lending and debt securities investment activities;

- Review existing allowance and credit risk management practices to identify processes that can be leveraged when applying the new standard;

- Determine the allowance estimation method or methods to be used;

- Identify currently available data that should be maintained and consider whether any additional data may need to be collected or maintained to implement CECL. Examples of types of data that may be needed to implement CECL include: origination and maturity dates, origination par amount, initial and subsequent charge-off amounts and dates, and recovery amounts and dates by loan; and cumulative loss amounts for loans with similar risk characteristics;29

- Identify necessary system changes to implement the new accounting standard consistent with the new standard's requirements and the allowance estimation method or methods to be used; and

- Evaluate and plan for the potential impact of the new accounting standard on regulatory capital.

CECL is scalable to institutions of all sizes and the agencies expect smaller and less complex institutions will not need to adopt complex modeling techniques to implement the new standard.

23. What should institutions expect from their examination teams prior to the effective date of the new accounting standard? [December 2016]

During the early part of the implementation phase for the new accounting standard, examiners may begin discussing the status of an institution's implementation efforts.30 Throughout the implementation phase, examiners will tailor their expectations based on the size and complexity of the institution and the effective date of the new accounting standard applicable to the institution. In doing so, examiners will be mindful of the scope and scale of changes necessary for each institution to make a good faith effort to achieve a sound and reasonable implementation of the new accounting standard. For further information on planning and preparing for the new accounting standard, including examples of initial implementation efforts, refer to the response to question 22.

Until CECL's effective date, the agencies will continue to examine credit loss estimates and allowance balances using examination procedures applicable to determining whether the institution has implemented an incurred credit loss methodology consistent with existing U.S. GAAP and regulatory reporting instructions. The guidance in the December 2006 Interagency Policy Statement on the Allowance for Loan and Lease Losses and the agencies' policy statements on allowance methodologies and documentation remains relevant.31

24. Are qualitative factors still relevant under CECL? [September 2017]

Yes. An institution should not rely solely on past events to estimate expected credit losses. Therefore, similar to today's practices under the incurred loss methodology, an institution will continue to incorporate qualitative and quantitative factors when estimating allowances for credit losses under CECL.

Historical loss information will generally provide an appropriate starting point for an institution's assessment of expected credit losses. The new credit losses standard acknowledges that, because historical experience may not fully reflect an institution's expectations about the future, the institution should adjust historical loss information, as necessary, to reflect the current conditions and reasonable and supportable forecasts not already reflected in the historical loss information. To adjust historical credit loss information for current conditions and reasonable and supportable forecasts, the institution should continue to consider all significant factors relevant to determining the expected collectability of financial assets as of each reporting date. The new accounting standard provides examples of factors an institution may consider.32 Depending on the nature of the asset, not all of the factors may be relevant and other factors also may be relevant and should be considered. The agencies believe the qualitative or environmental factors identified in the December 2006 Interagency Policy Statement on the Allowance for Loan and Lease Losses should continue to be relevant under CECL and are covered by the examples of factors that may be considered under the new credit losses standard.

25. What data do institutions need to implement CECL? [September 2017]

An institution should collect and maintain data relevant to estimating lifetime expected credit losses33 that align with each method the institution will use to estimate its allowances for credit losses under CECL.34 The institution should begin by identifying currently available relevant data that should be maintained. The institution should then consider whether additional data may be relevant, and therefore would need to be collected and maintained for a period sufficient to implement each method it has selected.

The agencies encourage institutions to discuss the availability of historical loss data internally with lending, credit risk management, information technology, and other functional areas and with their core loan service providers. System changes and other changes related to the collection and retention of data may be warranted. For example, depending on the estimation method or methods selected to implement CECL, institutions may need to capture additional data and retain data longer than they have in the past on loans and other financial assets that have been paid off or charged off. Examples of certain other types of data that may be needed to implement CECL are identified in the response to question 22.

When developing estimates of expected credit losses on financial assets, the institution should consider available information relevant to assessing the collectability of cash flows. This information may include internal information, external information, or a combination of both relating to past events, current conditions, and reasonable and supportable forecasts.

26. Will the agencies require institutions to reconstruct data from earlier periods that are not reasonably available in order to implement CECL? [September 2017]

No. The agencies will not require institutions to undertake efforts to obtain or reconstruct data from previous periods that are not reasonably available without undue cost and effort. However, an institution may decide it would be beneficial to do so to more effectively implement CECL. An institution may find that certain data from previous periods relevant to its determination of its historical lifetime loss experience are not available or no longer accessible in the institution's loan system or from other sources. The institution should promptly begin to capture and maintain such data on a go-forward basis so it can build up a more complete set of relevant historical loss data by the effective date of the new credit losses standard or as soon thereafter as practicable.

27. For PCD financial assets, how should institutions account for changes in expected credit losses under CECL in periods after their acquisition date? [September 2017]

The allowance for credit losses on financial assets within the scope of ASC 326-20, including PCD financial assets, should be evaluated each quarter and adjusted as necessary by recognizing a credit loss expense or a reversal of credit loss expense.

For example, continuing the example in the response to question 14, Bank A paid $750,000 for a loan classified as HFI with an unpaid principal balance of $1 million. Bank A determined that the loan qualified as a PCD financial asset. At the purchase date, Bank A estimated the allowance for credit losses on the unpaid principal balance was $175,000, and the noncredit discount on the loan was $75,000.

Assume that at the end of the following quarter, Bank A reevaluates the expected credit losses on the loan and estimates that the allowance for credit losses on this PCD financial asset should be $200,000.35 Further assume this PCD financial asset does not share risk characteristics with other financial assets.

The quarter-end journal entry to record the change in the allowance is as follows:

| Account | Debit | Credit |

|---|---|---|

| Provision for credit losses | $25,000 | |

| Allowance for credit losses | $25,000 |

The change in the estimate of expected credit losses on the PCD financial asset does not affect the remaining balance of the $75,000 noncredit discount that was calculated at the purchase date. The noncredit discount is accreted into interest income over the life of the PCD financial asset on a level-yield basis (provided the loan remains on accrual status).

Now assume that at the end of the next quarter, Bank A again reevaluates the expected credit losses on the loan and estimates that the allowance for credit losses should be $190,000, a decrease of $10,000 from the allowance at the end of the previous quarter.36

The journal entry to record the change in the allowance at the end of this quarter is as follows:37

| Account | Debit | Credit |

|---|---|---|

| Allowance for credit losses | $10,000 | |

| Provision for credit losses | $10,000 |

Again, the remaining balance of the $75,000 noncredit discount, originally calculated at the purchase date, is not affected by the change in the estimate of expected credit losses on the PCD financial asset. The noncredit discount continues to be accreted into interest income over the contractual life of the PCD financial asset on a level-yield basis (provided the loan remains on accrual status).

28. What is a PBE, and how does PBE status affect implementation of the new credit losses standard? [September 2017]

A PBE is a business entity that meets any one of five criteria set forth in the "Glossary" of the new credit losses standard. The FASB originally established the PBE definition for use in specifying the scope of future financial accounting and reporting guidance through ASU No. 2013-12, Definition of a Public Business Entity, in December 2013. As it relates to the implementation of the new credit losses standard, PBE status affects the effective date applicable to the institution as discussed in the response to question 4. Additionally, the new credit losses standard requires institutions that are PBEs to disclose credit quality indicators by vintage.38

The determination of whether an institution is a PBE is the responsibility of each institution's management. Institutions are encouraged to review the responses to questions 29 through 32 in making this determination.

29. When is a PBE considered an SEC filer? [September 2017]

Although all SEC filers are considered PBEs, not all PBEs meet the definition of an SEC filer. Since the FASB set different effective dates for PBEs that meet the definition of an SEC filer and PBEs that do not meet the definition of an SEC filer, determining whether an institution is an SEC filer is an important first step in planning for implementation of the new credit losses standard.39

A PBE is considered an SEC filer if it is required to file or furnish its financial statements with either of the following:40

- The SEC.

- With respect to an entity subject to Section 12(i) of the Securities Exchange Act of 1934, as amended, the appropriate agency under that section.

Therefore, an IDI that is required to file its financial statements with the appropriate federal banking agency under Section 12(i) of the Securities Exchange Act of 1934 is considered an SEC filer.41

The inclusion of the financial statements of an institution that is not otherwise an SEC filer in a submission by another SEC filer does not cause the institution to be considered an SEC filer.42

30. Can an institution that is not an SEC filer be considered a PBE? [September 2017]

Yes, an institution that is not an SEC filer can be considered a PBE. To determine whether an institution that is not an SEC filer is a PBE, the institution must evaluate the following criteria and conclude that it meets at least one of these criteria:43

- It is not required by the SEC to file or furnish financial statements, but does file or furnish financial statements (including voluntary filers), with the SEC (including other entities whose financial statements or financial information are required to be or are included in a filing).44

- It is required to file or furnish financial statements with a foreign or domestic regulatory agency in preparation for the sale of or for purposes of issuing securities that are not subject to contractual restrictions on transfer.

- It has issued securities that are traded, listed, or quoted on an exchange or an OTC market.45

- It has one or more securities that are not subject to contractual restrictions on transfer, and it is required by law, contract, or regulation to prepare U.S. GAAP financial statements46 (including footnotes) and make them publicly available on a periodic basis (for example, interim or annual periods). An institution must meet both of these conditions to meet this criterion.

31. What is meant by "contractual restrictions on transfer" as used in the second and fourth criteria listed in the response to question 30? [September 2017]

Management preapproval of the transfer or resale of securities issued by an institution represents a contractual restriction on transfer for purposes of the PBE definition. Contractual restrictions on transfer can be either explicit or implicit.

For example, S corporation shareholder agreements commonly include restrictions that explicitly require a shareholder to obtain management preapproval of any share transfer to ensure the S corporation maintains its pass-through status for federal income tax purposes. However, the fact that an institution is an S corporation does not guarantee the existence of shareholder agreements or that such a restriction is included in any shareholder agreements. Similar restrictions that require management preapproval also may be present in shareholder agreements of closely held institutions that are not S corporations.

An explicit contractual restriction that limits transfers of an institution's securities to existing shareholders would also meet the same objective because the securities cannot be sold to new investors. However, other provisions may not lead to the same conclusion. For example, a "right of first refusal" would not represent a contractual restriction on transfer because it only gives management the right to purchase the security before it can be sold to another party. This right does not prevent the holder from transferring the security altogether.

An implicit contractual restriction on transfer is presumed to exist when an institution is wholly owned (i.e., 100 percent owned) by its parent holding company. In effect, the holding company must approve the transfer of any or all of the institution's currently outstanding securities, which constitutes an implicit contractual restriction on transfer.

Before concluding on an institution's PBE status, the institution should determine if any contractual restrictions, whether implicit or explicit, exist by reading shareholder and debt agreement(s), if any; consulting with its parent holding company, if any; reviewing the legal entity structure of its consolidated group, if any; and considering other relevant information.

32. When an institution is determining its PBE status, must it consider securities outstanding at the parent holding company level, or should the PBE determination be made individually for each entity within an organizational structure? [September 2017]

The PBE definition should be applied on an entity-by-entity basis. Here are two illustrations of this analysis:

Illustration 1: Holding Company and Bank Subsidiary Scenario

Assume the following:

- A holding company owns 100 percent of the common stock issued by its bank subsidiary.

- The bank subsidiary is not an SEC filer and does not meet the first two criteria listed in the response to question 30.

- The bank subsidiary has no other debt or equity securities outstanding that would cause it to meet the last two criteria listed in the response to question 30.

- The holding company is not an SEC filer, but has issued unrestricted common stock that trades on an OTC market.

In this case, each of the two entities will reach a different conclusion as to whether it is a PBE.

The holding company would be considered a PBE under the third criterion listed in the response to question 30 because it has issued common stock that trades on an OTC market. Therefore, the holding company's consolidated financial statements would be required to be prepared using accounting standards and effective dates applicable to PBEs.

The bank subsidiary would not be a PBE under any of the criteria because an implicit contractual restriction on transfer exists for its issued securities, which are 100 percent owned by its parent holding company. The subsidiary should not "look through" to the holding company, even if the holding company's only significant asset is its investment in the bank subsidiary. Therefore, the bank subsidiary would be able to use the effective date of the new credit losses standard for entities that are not PBEs when it prepares its regulatory reports (e.g., the Call Report) and stand-alone U.S. GAAP financial statements, if applicable. Additionally, if the bank subsidiary, as a non-PBE, prepares stand-alone U.S. GAAP financial statements, the bank subsidiary has the option to disclose credit quality indicators by vintage, but is not required to do so.47

Notwithstanding the effective date of the new credit losses standard that applies to the bank subsidiary's regulatory reports and stand-alone financial statements, if applicable, the subsidiary must provide financial information to the holding company for the purposes of the holding company's consolidated financial statements based on the standard's effective date and disclosure requirements that apply to a PBE that is not an SEC filer. Therefore, it may be advisable for the bank subsidiary to elect to early adopt the new credit losses standard for its regulatory reports and stand-alone financial statements, if applicable, at the same time that the holding company adopts the standard because the bank would need to be able to provide this information to the holding company for the holding company's consolidated financial reporting.48

Illustration 2: Unconsolidated variable interest entity (VIE)

Assume the following:

- An institution that is not an SEC filer has issued debt securities to a VIE that the institution is not required to consolidate under U.S. GAAP.

- In turn, the VIE holding the debt securities has issued unrestricted securities (for example, trust preferred securities) to third-party investors.

The institution would not be required to "look through" the VIE for the purposes of determining whether the institution is a PBE. However, the institution should evaluate whether it meets any of the criteria in the definition of a PBE listed in the response to question 30 on a stand-alone basis. For example, the debt securities issued by the institution that are owned by the VIE need to be evaluated under the fourth criterion in the response to question 30. The agencies would expect the institution to conclude that the debt securities have an implicit contractual restriction on transfer if 100 percent of the debt securities are held by the VIE that issued the trust preferred securities. In that situation, the VIE could not sell the debt securities it holds without the involvement of the management of the institution. The institution would also need to determine whether it is required to periodically prepare financial statements and make them publicly available, the second condition in the fourth criterion in the response to question 30. Both conditions must be met for the institution to be a PBE.

33. Is an insured depository institution that is subject to Section 36 of the Federal Deposit Insurance Act and Part 363 of the FDIC's regulations, "Annual Independent Audits and Reporting Requirements" (commonly referred to as the FDICIA requirement), considered a PBE? [September 2017]

The fact that an IDI is subject to the FDICIA requirement49 does not in and of itself mean the IDI is a PBE. An IDI subject to the FDICIA requirement that is not an SEC filer would need to evaluate each criterion in the definition of a PBE listed in the response to question 30 to determine whether it is a PBE. If the IDI is a subsidiary of a holding company, the IDI and the holding company should separately evaluate each of the PBE criteria to determine whether each entity is a PBE.

For example, assume an IDI subject to the FDICIA requirement is not an SEC filer and does not meet any of the first three criteria listed in the response to question 30. The final criterion in that response includes two conditions, both of which must be met for the IDI to be a PBE. These conditions are:

- The entity has one or more securities that are not subject to contractual restrictions on transfer, and

- The entity is required by law, contract, or regulation to prepare U.S. GAAP financial statements and make them publicly available on a periodic basis.

An IDI subject to Section 36 and Part 363 is required to prepare audited annual U.S. GAAP financial statements, which the IDI must include in a report that it files with the FDIC, its primary federal regulator (if other than the FDIC), and the appropriate state banking regulator (if applicable). The IDI must make this report, including the U.S. GAAP financial statements, publicly available. Thus, an IDI subject to the FDICIA requirement meets the second condition in the criterion above50 and needs to determine if it meets the first condition in that criterion to conclude whether it is a PBE.

When an IDI is subject to Section 36 and Part 363, the IDI's only securities outstanding are common stock, and the IDI is not an SEC filer, the IDI should consider whether contractual restrictions on transfer exist on its common stock. If the common stock of the IDI is wholly owned by a holding company, an implicit restriction on the transfer of the IDI's common stock is presumed to exist. Therefore, the IDI would not meet the first condition in the criterion above, and, thus, the IDI is not a PBE. If there is no holding company or the holding company owns less than 100 percent of the IDI's common stock, and the IDI determines that no contractual restrictions on transfer exist on its common stock, the IDI would be a PBE under the final criterion listed in the response to question 30, as it meets both conditions under that criterion (i.e., conditions 1 and 2 above).

The FDICIA requirement to prepare and make U.S. GAAP financial statements publicly available on a periodic basis is not part of the Securities Exchange Act of 1934 or the rules promulgated thereunder. Therefore, when an IDI is subject to the FDICIA requirement, this does not cause the IDI to be an SEC filer.

34. For an institution with a calendar fiscal year that is not a PBE and has not elected early adoption, how and when should the new credit losses standard be incorporated into the institution's Call Report? [September 2017, updated April 2019]

For an institution that is not a PBE, the new credit losses standard is effective for fiscal years beginning after December 15, 2021, including interim period financial statements within those fiscal years, unless the institution elects to early adopt the new credit losses standard.

The institution must first apply the new credit losses standard in its financial statements and regulatory reports (e.g., the Call Report) for the period ending March 31, 2022. To record the impact of initially applying the new credit losses standard as of January 1, 2022, when preparing its first quarter 2022 Call Report:

- The institution must estimate its allowances for credit losses on loans HFI, HTM debt securities, and other on-balance-sheet financial assets within the scope of ASC 326-20, and its liabilities for credit losses on off-balance-sheet credit exposures within the scope of ASC 326-20 by applying the new credit losses standard to these assets and exposures as of January 1, 2022.51

- The institution must then calculate the difference between its allowances and liabilities for credit losses measured in accordance with the new credit losses standard as of January 1, 2022, and the allowances and liabilities for these exposures reported on its Call Report balance sheet as of December 31, 2021, that were measured based on U.S. GAAP in effect on that date (i.e., the incurred loss methodology).52 The sum of these differences, net of applicable income taxes, is the "cumulative-effect adjustment" as of the effective date of the new credit losses standard.

- The cumulative-effect adjustment is recognized as an adjustment to the beginning balance of retained earnings as of January 1, 2022.53

Additionally, the institution must reflect the credit loss expenses for the first calendar quarter of 2022 measured in accordance with the new accounting standard when it prepares its first quarter 2022 Call Report:

- The institution must first estimate, in accordance with the new accounting standard, its allowances and liabilities for credit losses on financial assets and exposures within the scope of the standard as of March 31, 2022. The Call Report balance sheet for March 31, 2022, should reflect these allowances and liabilities.

- The amounts necessary to adjust the balances of the allowances and liabilities for credit losses to the March 31, 2022, estimated amounts should be reported as credit loss expenses in the Call Report income statement for March 31, 2022.54 The amounts reported as expenses should take into consideration the initially estimated balances of the allowances and liabilities as of January 1, 2022, as measured under the new accounting standard. The amounts reported as expenses should also incorporate the activity (e.g., charge-offs and recoveries) affecting the allowances and liabilities during the first calendar quarter of 2022.

35. Can you provide a numerical example illustrating the response to question 34 (i.e., for an institution with a calendar year fiscal year that is not a PBE, how and when should the new credit losses standard be incorporated into its Call Reports)? [September 2017, updated April 2019]

Included in this response for illustrative purposes is a numerical example of the response to question 34. This example considers only the impact of initially applying CECL to loans HFI and not to other financial assets and off-balance-sheet credit exposures within the scope of ASC 326-20.55

Assume the following:

- The institution recorded allowances for loan and lease losses of $150,000 as of December 31, 2021, measured in accordance with current U.S. GAAP (i.e., the incurred loss methodology).

- The institution recorded charge-offs, net of recoveries, on loans HFI of $20,000 during the first three months of 2022 (i.e., January 1, 2022, through March 31, 2022).

- The institution estimated its allowance for credit losses on loans HFI under CECL to be $200,000 as of January 1, 2022, and $235,000 as of March 31, 2022.

The institution calculates the difference between its allowance for credit losses on loans HFI under CECL as of January 1, 2022, and its allowance for loan and lease losses on these same loans under current U.S. GAAP as of December 31, 2021, to be $50,000 ($200,000 minus $150,000). The $50,000 difference, net of applicable income taxes, is recognized as an adjustment to the January 1, 2022, beginning balance of retained earnings in the first quarter 2022 Call Report. The institution then will recognize a $55,000 provision for credit losses for the first three months of 2022 as calculated under CECL56 to bring the allowance for credit losses under CECL to $235,000 as of March 31, 2022.

The following table compares the amounts reported by the institution in its Call Reports for December 31, 2021, and March 31, 2022, as a basis for illustrating the journal entries the institution would make to reflect the effects of adopting the new credit losses standard as of January 1, 2022, and applying it during the first quarter of 2022. Assume the institution records provision expense entries only as of quarter-end.

| Account | 12/31/2021 Call Report | 1/1/2022 CECL Effective Date | 3/31/2022 Call Report |

|---|---|---|---|

| Allowance for loan and lease losses (under the incurred loss methodology) | $150,000 | ||

| Allowance for credit losses on loans HFI (under CECL) | $200,000 | $235,000 | |

| Cumulative-effect adjustment to the January 1, 2022, beginning balance of retained earnings (ignoring applicable tax effect, if any) | $50,000 | ||

| Charge-offs, net of recoveries (year-to-date) | $20,000 | ||

| Provision for credit losses (year-to-date) (under CECL) | $55,000 |

Journal entry as of January 1, 2022:

| Account | Debit | Credit |

|---|---|---|

| Retained earnings | $50,000 | |

| Allowance for credit losses on loans HFI | $50,000 |

To record the cumulative-effect adjustment to retained earnings (ignoring tax effects, if any) for the change in the balance of the allowance for loan and lease losses as of December 31, 2021, to the initial balance of the allowance for credit losses on loans HFI upon adoption of CECL as of its January 1, 2022, effective date.

Journal entry as of March 31, 2022:

| Account | Debit | Credit |

|---|---|---|

| Provision for loan and lease losses on loans HFI | $55,000 | |

| Allowance for loan and lease losses on loans HFI | $55,000 |

To record the $55,000 provision for credit losses for the first three months of 2022 measured under CECL.

36. How and when must an institution that is a PBE with a non-calendar fiscal year (e.g., a September 30 fiscal year-end), but is not an SEC filer, incorporate the new credit losses standard into its regulatory reports? [September 2017]

The following example of a PBE with a September 30 fiscal year-end that is not an SEC filer is provided to illustrate how and when an institution with a non-calendar fiscal year must incorporate the new credit losses standard into its financial statements and regulatory reports (e.g., the Call Report). This example applies to an institution that has not elected to early adopt the new credit losses standard.

As stated in the response to question 4, a PBE that is not an SEC filer must apply the new credit losses standard in its financial statements and regulatory reports (e.g., the Call Report) for fiscal years beginning after December 15, 2020, including interim periods within those fiscal years. In this example of an institution that is a PBE but is not an SEC filer, the institution's fiscal year begins October 1, 2021. Thus, it must begin to apply the new credit losses standard as of that date. The institution must continue to apply current U.S. GAAP (i.e., the incurred loss methodology) in its financial statements, if applicable, and regulatory reports (e.g., the Call Report) for March 31, 2021; June 30, 2021; and September 30, 2021. This means the Call Reports for the first three calendar quarters of 2021 for a PBE with a September 30 fiscal year-end that is not an SEC filer will not reflect any adjustments for the new credit losses standard.

Such a PBE must first apply the new credit losses standard in its interim period financial statements, if applicable, and in its Call Report for the quarter ended December 31, 2021. The institution must estimate its allowances for credit losses on on-balance-sheet financial assets within the scope of ASC 326-20 and its liabilities for credit losses on off-balance-sheet credit exposures within the scope of ASC 326-20 by applying the new credit losses standard to these assets and exposures as of October 1, 2021.57 The cumulative-effect adjustment to retained earnings as of October 1, 2021, is the sum of the differences, net of applicable income taxes, between its allowances and liabilities for credit losses measured in accordance with CECL as of that date and the allowances and liabilities for these assets and exposures reported on its Call Report balance sheet as of September 30, 2021, that were measured based on U.S. GAAP in effect on that date.58 The cumulative-effect adjustment to retained earnings as of October 1, 2021, would be reported in the changes in equity capital schedule of the Call Report for December 31, 2021.