FEDS Notes

October 15, 2021

Bank Lending Conditions during the Pandemic

David Bodovski, Hannah Firestone, Seung Jung Lee, and Viktors Stebunovs1

Introduction

The COVID-19 pandemic has been a large shock to economies and financial systems around the world. In the beginning, as governments introduced unprecedented measures to contain the quickly spreading virus and households hunkered down to socially distance from one another, output plummeted, unemployment skyrocketed, and significant financial stress materialized. At the same time, governments around the world implemented substantial measures to support households and firms, including measures designed to facilitate the provision of bank credit.

Globally, banks play a significant role in providing credit to both households and firms. In this note, we use bank lending surveys for 11 economies to investigate the evolution of bank lending conditions during the first year of the pandemic. We find that, at the height of the pandemic, lending standards did not tighten to the extent observed during the Global Financial Crisis (GFC), when banks were the source of distress and government support to households and firms was not as large. We also find that the type of government interventions mattered. Countries that rely more on bank-based financing tended to introduce larger support measures that targeted bank lending—in particular, in the form of loan guarantee programs, which are a type of contingent government liabilities—and less on fiscal spending. In turn, countries that provided more substantial loan guarantee measures saw lending standards tighten less than countries that had more modest guarantee programs. The difference in the evolution of lending standards across loan types highlight further that the supporting role of loan guarantee programs. As loan guarantee programs predominantly covered loans to firms, the relationship between larger loan guarantee programs and less tight lending standards manifests itself mostly for loans to firms rather than for loans to households.

The rest of this note is organized as follows. First, we describe bank lending surveys from around the world and compare the evolution of bank lending conditions through time and across countries. Next, we describe various government policies, with an emphasis on fiscal measures, that helped support the economies and financial systems globally. Then, we show that economies that rely more on bank financing introduced more substantial contingent liabilities measures, such as government loan guarantee programs, and that these measures supported bank lending conditions. Finally, in light of our findings and risks that new virus variants may pose, we caution against a premature withdrawal of government support measures.

Bank Lending Conditions around the World

In most countries, bank lending is the largest source of financing for the private nonfinancial sector. To gauge ease of access to bank lending, many central banks survey commercial banks about lending conditions on a quarterly basis. Such surveys typically include questions about lending standards and terms and conditions of loans. Lending standards are internal criteria that banks set to guide their decisions to lend to households and firms, which may be hard to quantify. To further manage the credit risk that they take, banks set terms and conditions. The terms and conditions of loans refer to loan contract terms, such as the interest rate, loan size and maturity, collateral requirements, and so on. Banks change lending standards and terms and conditions over time in response to many factors, including changes in the economic outlook and in risk tolerance. For example, households and firms face more challenging bank lending conditions around recessions, when borrowers of lower credit quality find it harder to get a loan; loan interest rates increase relative to a reference interest rate; collateral requirements become more stringent; and so on.

In our analysis, we use lending surveys from 11 countries and focus on the evolution of bank lending conditions over the pandemic. To keep things comparable across the countries, we examine only lending standards for households and firms.2

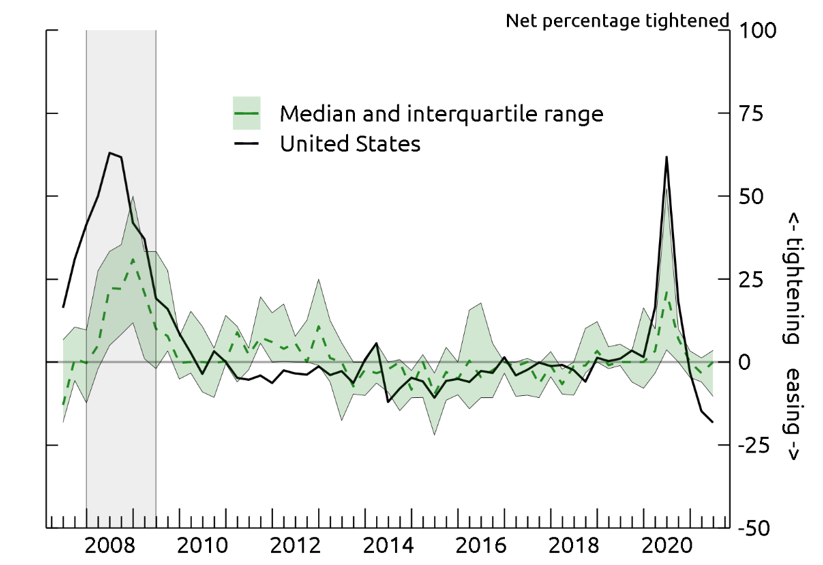

Lending standards for households tightened considerably in most countries during the pandemic (figure 1). The degree of tightening was generally comparable to that observed during the GFC. This time, though, the pace of tightening was materially faster, and the duration of tightening was shorter.

Notes: The sample range is the interquartile range of lending standards for France, Germany, Italy, Japan, Netherlands, Poland, South Korea, Spain, United States, and United Kingdom. The shaded area denotes the GFC.

Source: Bank of England, Bank of Japan, Bank of Korea, European Central Bank, Federal Reserve Board, and National Bank of Poland.

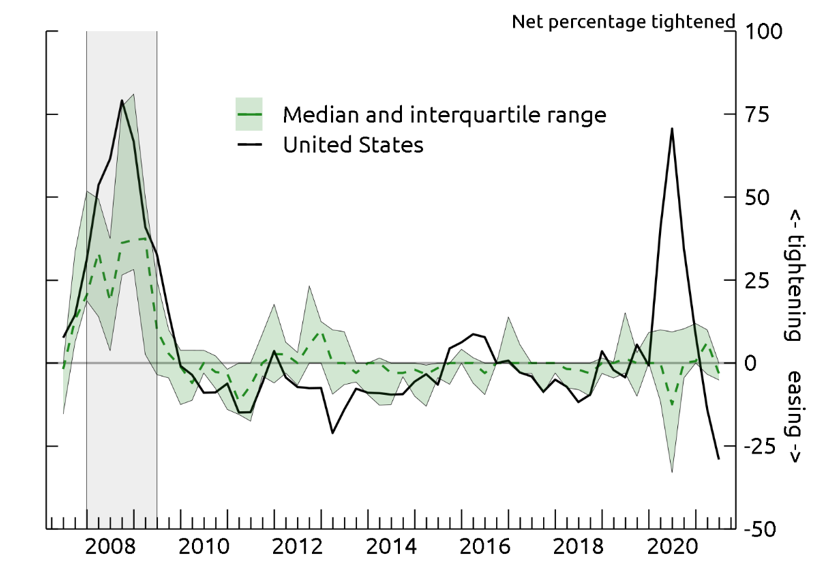

In contrast to lending standards for households, lending standards for firms generally eased (see the median in figure 2). It is highly atypical for lending standards for firms to ease in a recession. It is also very unusual for lending standard for firms to ease when lending standards for household tighten. After all, creditworthiness of both households and firms falls in recessions, and the pandemic-induced recessions around the world were not much different.

Notes: The sample range is the interquartile range of lending standards for France, Germany, Italy, Japan, Netherlands, Poland, South Korea, Spain, United States, and United Kingdom. The shaded area denotes the GFC.

Source: Bank of Canada, Bank of England, Bank of Japan, Bank of Korea, European Central Bank, Federal Reserve Board, National Bank of Poland.

Banks' capital positions, much improved since the GFC, may not have been the dominant factor explaining the differences in the changes in lending standards in 2020.3 For instance, if improved capital were the main reason, banks would not have eased lending standards for firms, but tightened those for households. In addition, a far higher percentage of banks in the United States reported tighter lending standards for firms than in other regions, even though U.S. banks were generally better capitalized than their foreign peers.

Instead, we investigate whether the introduction of government loan guarantee programs that predominantly targeted lending to firms may have facilitated the easing of lending standards for firms during the pandemic. This, in turn, may have prevented a more material weakening in the supply of credit than otherwise. We exploit a significant variation in the magnitude of government loan guarantee programs and in changes in lending standards across countries to support our conjecture. But first, we look at a variety of government intervention measures over the pandemic, specifically those with fiscal implications.

COVID-19 and Government Fiscal Policies

Just as the types and intensities of government efforts to contain the virus varied across countries, so did government economic policies to alleviate the negative effect of the pandemic and such efforts. While some countries introduced mostly traditional fiscal stimulus, others relied more on monetary policy or contingent measures to support the financial system. In this section, we focus on a subset of the former that had fiscal implications. Many of these policies targeted easier access to bank credit with loan guarantee programs.

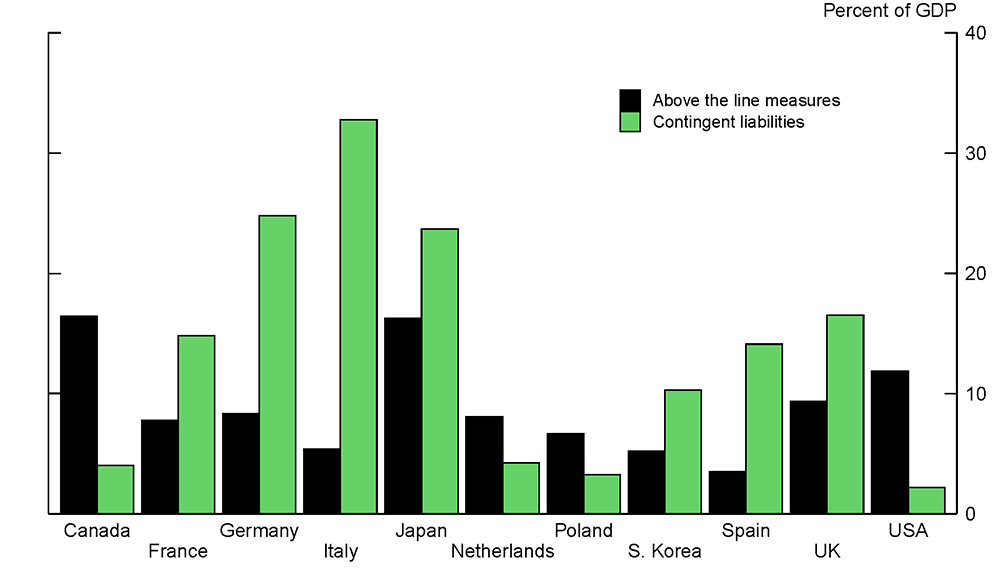

As figure 3 shows, the magnitudes of various fiscal support policies were substantial and varied greatly across different countries. Governments relied on direct fiscal policies ("above the line measures"), comprising additional spending, forgone revenue (such as a temporary decrease in taxes), and other, less significant, measures.4 Such measures exceeded 10 percent of GDP in a few countries, for example Canada and the United States. Governments also introduced contingent support measures ("contingent liabilities"), mostly in the form of loan guarantee programs—for example, the Coronavirus Business Interruption Loan Scheme in the United Kingdom or the Paycheck Protection Program in the United States.5 Contingent measures surpassed 20 percent of GDP in a few countries such as Germany and Italy. We note that these percentages represent the maximum that the support measures could reach. Because the usage of such support measures as loan guarantee programs was borrower-driven, their actual size could be lower.6

Notes: Above the line measures include additional spending (or forgone revenue) and accelerated spending (or deferred revenues). Contingent liabilities include loan guarantees and quasi-fiscal operations. Below the line measures such as equity injections, loans, asset purchases, are not included. Data are as of 2020:Q3.

Source: International Monetary Fund.

In general, the countries appeared to choose between larger traditional fiscal spending and larger contingent liability measures. For example, some countries that relied more on additional spending or forgone revenue, such as Canada and the United States, implemented far more modest contingent policies. At the other extreme, countries like Italy and Spain introduced larger contingent liabilities policies but smaller additional fiscal spending.

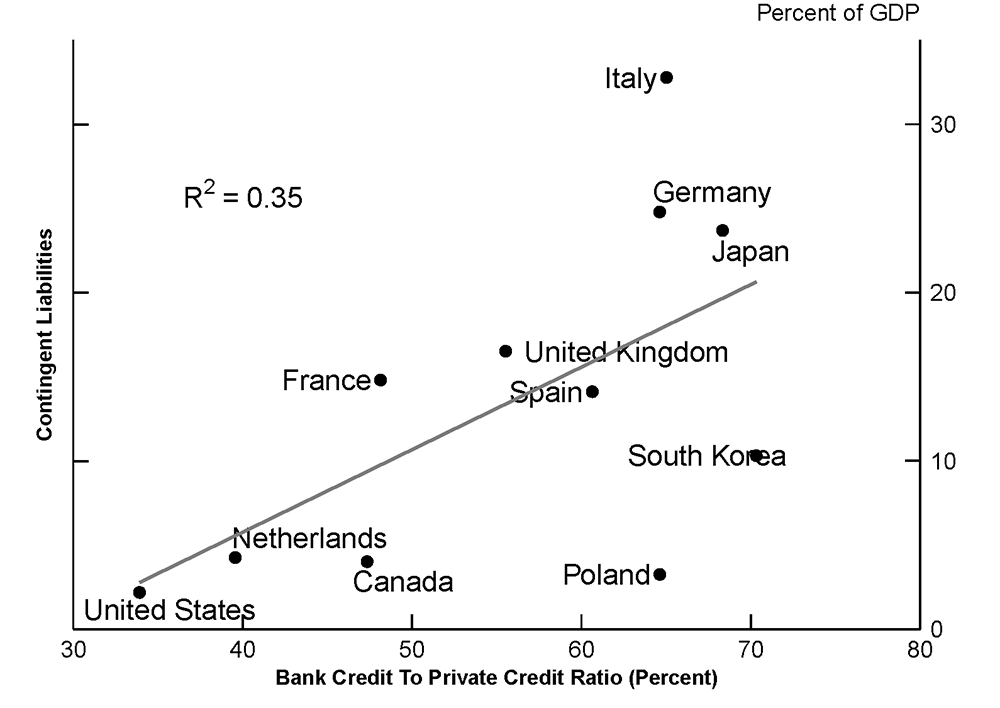

Among potential reasons behind the countries' policy choices, we consider the importance of bank credit as a source of funding for households and firms.7 As figure 4 shows, the countries where the private nonfinancial sectors are more reliant on bank credit introduced larger contingent fiscal measures, again much of which was in the form of loan guarantee programs. For example, Germany, Italy, and Japan, where bank credit to total private credit exceeded 60 percent prior to the pandemic, ended up implementing significant contingent measures, exceeding 20 percent of GDP in 2020. In contrast, in the Netherlands and the United States, where bank credit to total private credit was lower than 40 percent, contingent measures were only a few percent of GDP. The positive relationship between the importance of bank credit and the magnitude of contingent relationship appears to be rather strong (the R-squared is 0.35).

Figure 4. Ratio of Credit Held by Banks to Total Outstanding Private Credit and Contingent Liabilities

Notes: The ratio of bank credit to private credit refers to the percentage of all private credit in the economy that is held by banks, as of 2019:Q4. The ratio is calculated by taking total private nonfinancial credit minus such credit provided by banks, divided by total private nonfinancial credit. Contingent liabilities are as of 2020:Q3 and they include guarantee programs and quasi-fiscal operations.

Source: Bank for International Settlements and International Monetary Fund.

Loan Guarantees and Changes in Lending Standards for Business Loans

Loan guarantee programs may have an easing effect on lending standards because they reduce, in some cases eliminate, credit risk that banks bear when making guaranteed loans. More generous loan guarantee programs may have larger easing effects on lending standards.

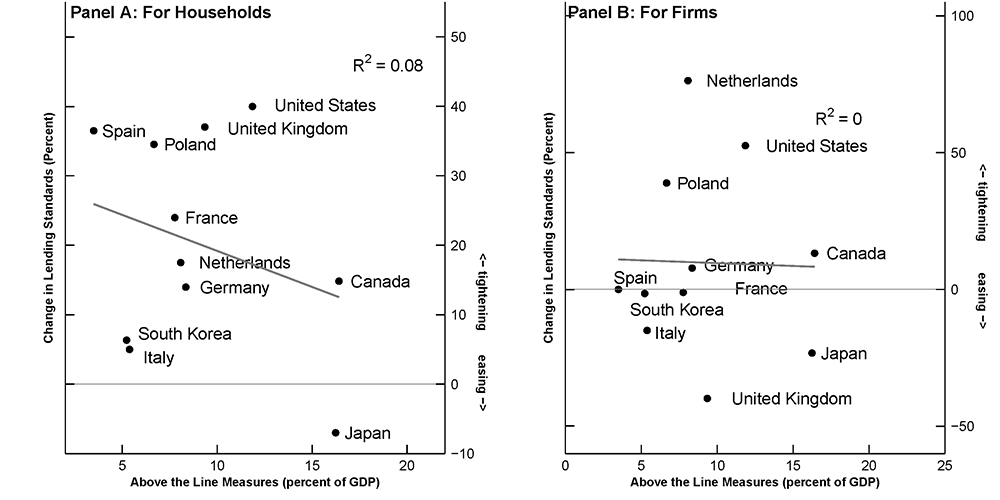

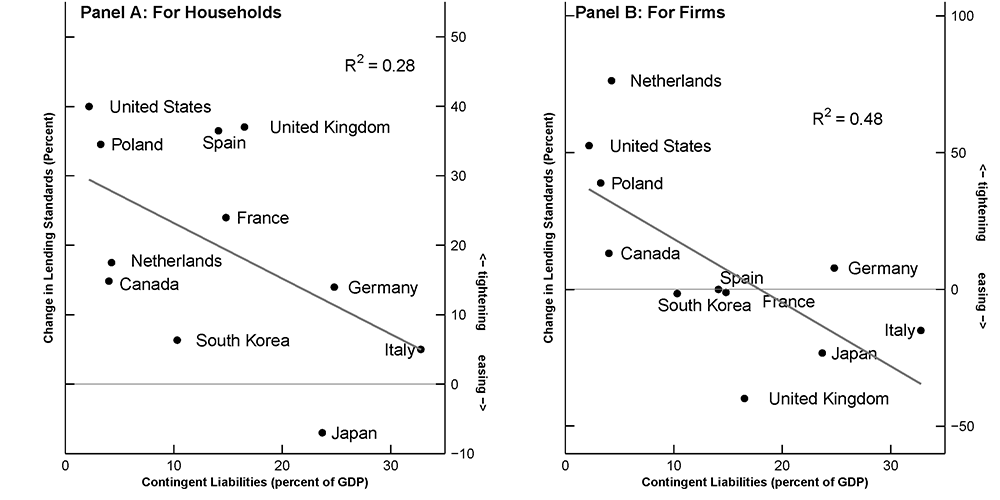

The evidence in figures 5 and 6 for the early stages of the pandemic supports this conjecture, in part by contrasting the effects of traditional fiscal spending and contingent liabilities measures on lending standards for households and those for firms. Comparing panels A and B in figure 5 shows that the relationship between above-the-line measures and lending standards is present (though very weak) for households but not for firms. These findings may be consistent with the bulk of above-the-line measures more directly supporting households and employment.8 In contrast, as figure 6 shows, the relationship between contingent liabilities measures and changes in lending standards is material and positive for both households and firms. The linear relationship is significantly stronger for firms (the R-squared for firms, at 0.48, is nearly twice as high as that for households). This stronger relationship for firms than for households is consistent with government loan guarantees mostly targeting lending to firms rather than lending to households. The figure also suggests that government loan guarantee programs that target lending to firms might have had supportive spillovers on lending standards for households. Because loans to firms that are guaranteed by government carry very low risk weights, guarantee programs essentially free up bank capital that can be deployed elsewhere—for example, easing lending standards for households and, thus, taking on more credit risk.

Notes: Tightening Credit Standards refers to the net percentage of banks reporting a tightening of credit standards over 2020:Q2-Q3. Above the line measures include additional spending (or forgone revenue) and accelerated spending (or deferred revenues).

Source: Bank of Canada, Bank of England, Bank of Japan, Bank of Korea, European Central Bank, Federal Reserve Board, National Bank of Poland, International Monetary Fund.

Notes: Tightening Credit Standards refers to the net percentage of banks reporting a tightening of credit standards over 2020:Q2-Q3. Contingent liabilities include loan guarantee measures and quasi-fiscal operations and are as of 2020:Q3.

Source: Bank of Canada, Bank of England, Bank of Japan, Bank of Korea, European Central Bank, Federal Reserve Board, National Bank of Poland, International Monetary Fund.

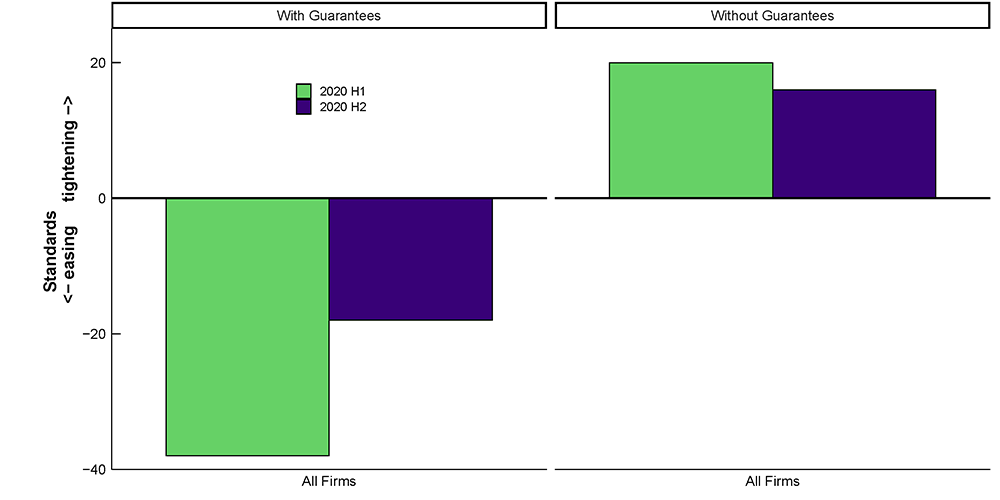

For the euro-area countries, we have direct evidence that links larger loan guarantees and looser lending standards for firms. In a recent ECB bank lending survey, lenders reported that government loan guarantees had an easing effect on lending standards to firms in 2020 (figure 7).9 In contrast to lending standards for loans to firms without government guarantees, those to firms with government guarantees eased substantially in the first half of the year, as the bulk of guarantee programs became operational in the second quarter. Similarly, in the second half, lending standards for loans to for firms with government guarantees continued to ease, albeit to a materially smaller extent, and those for firms without government guarantees continued to tighten.

Notes: Tightening Credit Standards refers to the net percentage of banks reporting a tightening of credit standards.

Source: European Central Bank.

The ECB survey also pointed out that banks expected any further easing effect of government guarantees on their lending standards to be limited, if not to dissipate. There may be multiple reasons for the easing effects to be only transient as the guarantee programs' initial effect wears off. One of the likely reasons is that the pool of new borrowers that qualify for guarantees and still seek liquidity shrinks as the programs mature. Indeed, as Bruegel's data show, the utilization of euro-area guarantee programs surged on their introduction in the second quarter of 2020.10 However, growth in the utilization stalled in the following quarter and, at the same, the mitigating effect of guarantee programs on lending standards began to dissipate. Consistently, banks reported a very strong increase in demand for loans with government guarantees in the first half of 2020 and only a marginal increase in the second half.

Changes in Lending Standards and Loan Growth

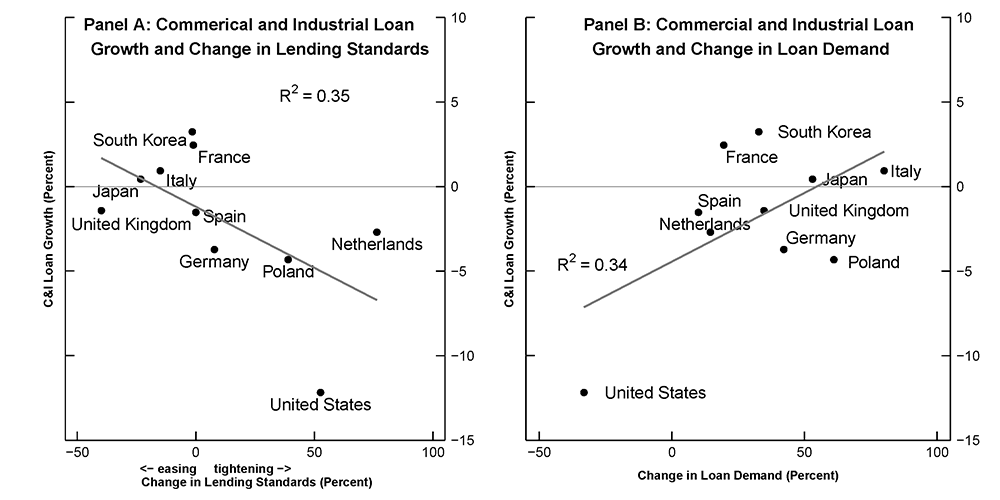

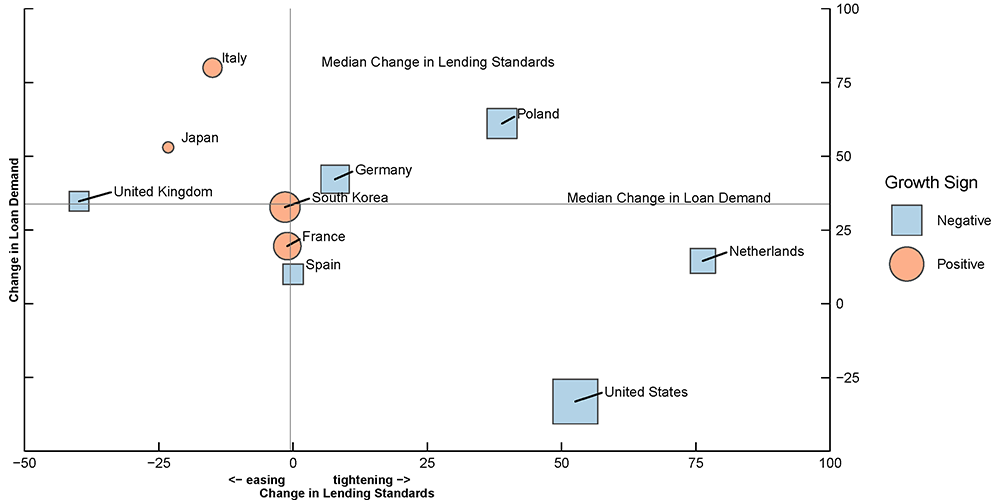

Having demonstrated that government loan guarantee programs had an easing effect on lending standards for firms, we examine whether the introduction of the programs and changes in lending standards affected loan growth with a lag (see Bassett, Chosak, Driscoll, and Zakrajsek (2014)). As panel A in figure 8 shows, easier lending standards over 2020:Q2-Q3 correlated with higher loan growth over 2020:Q3-Q4 during over the height of the pandemic. For example, the United States and Poland saw a significant tightening of lending standards for firms and negative growth in loans to firms (which we proxy by commercial and industrial loans).11 However, in the countries where lending standards for firms eased, growth in loans to firms was positive. Of course, observed loan growth reflects the strength of loan demand too.

Fortunately, lending surveys also provide information about changes in loan demand. As panel B in figure 8 shows, there is a positive correlation between loan demand and loan growth. For the euro area and possibly for other countries, the overall strength of demand partly reflects the strength of demand for loans with guarantees.12

Notes: Tightening Credit Standards refers to the net percentage of banks reporting a tightening of credit standards over 2020:Q2-Q3. Increase in Loan Demand refers to the net percentage of banks reporting an increase in the demand for loans over 2020:Q2-Q3. C&I loan growth refers to the increase in outstanding commercial and industrial loans over 2020:Q3-Q4.

Source: Bank of England, Bank of Japan, Bank of Korea, European Central Bank, Federal Reserve Board, National Bank of Poland.

We conduct further analysis to discern whether loan supply or loan demand was a more important factor in determining loan growth over the height of the pandemic. Figure 9 plots changes in lending standards and loan demand over 2020:Q2-Q3. Blue squares represent negative growth in C&I loans over 2020:Q3-Q4 and orange circles positive growth, with the size of the shapes representing the strength of loan growth in absolute terms. We divide the figure into quadrants that are based on the cross-country medians of tightening in lending standards and of increase in loan demand. For example, Italy falls into the upper left quadrant because it saw both lending standards ease more than the median easing and demand for loans to firms increase more than the median change in demand. In addition, the circle for Italy is orange and moderately sized because the country's C&I loan growth was moderately positive. In absence of credit supply constraints, captured by tightness of lending standards, higher loan demand would be associated with higher C&I loan growth. However, the figure shows that lending to firms generally contracted in the countries with relatively tighter lending standards, regardless of the changes in loan demand (for example, compare the locations of the circles for Poland and Germany against those for the Netherland and the United States). In contrast, lending to firms expanded in the countries with relatively looser lending standards, regardless of the changes in loan demand (compare the locations of the circles for Italy and Japan and those for France and South Korea). All in all, the cross-section of the countries in the figure suggests that, over the height of the pandemic, loan supply appears to have been a more important determinant of loan growth.

Notes: Tightening Credit Standards refers to the net percentage of banks reporting a tightening of credit standards. Increase in Loan Demand refers to the net percentage of banks reporting an increase in the demand for loans over 2020:Q2-Q3. C&I loan growth refers to growth in outstanding commercial and industrial loans over 2020:Q3-Q4. Countries with blue squares experienced a decline in outstanding C&I loans, while those with orange circles saw an increase in C&I loans. Larger shapes indicate larger growth in absolute terms in C&I loans.

Source: Bank of England, Bank of Japan, Bank of Korea, European Central Bank, Federal Reserve Board, National Bank of Poland.

Near-Term Risks to the Recovery from the Pandemic

In sum, we presented international evidence that fiscal contingent liabilities measures, specifically, government loan guarantee programs, had an easing effect on bank lending standards for firms at the height of the pandemic. These loan guarantee programs were more substantial in countries where the private nonfinancial sectors are more reliant on bank credit as a source of financing. These countries experienced a more significant easing in lending standards for firms. In turn, easier lending standards appeared to be key to supporting growth in lending to firms. As the economic outlook improves and banks' balance sheets remain resilient, lending conditions may improve markedly on their own. However, as the pandemic still rages, unwinding government support measures such as loan guarantees in countries that rely more on bank credit for firm financing too soon or too quickly could still slow down if not halt the improvements in lending conditions and have a dampening effect on loan growth. Therefore, a delicate balancing act may be required by governments if the uncertainty surrounding the impact of virus variants become more prominent.

References

Bassett, W. F., M. B. Chosak, J. C. Driscoll, and E. Zakrajsek, "Changes in bank lending standards and the macroeconomy," Journal of Monetary Economics, vol. 62, March 2014, pp. 23-40.

Euro-area bank lending survey, European Central Bank, Frankfurt, Germany, January 2021.

Haltenhof S., S. J. Lee, and V. Stebunovs, "The credit crunch and fall in employment during the Great Recession," Journal of Economic Dynamics and Control, vol. 43, June 2014, pp. 31-57.

IMF Fiscal Monitor, International Monetary Fund, Washington, DC., April 2021.

Lown C., D. P. Morgan, and S. Rohatgi, "Listening to loan officers: The impact of commercial credit standards on lending and output", Federal Reserve Bank of New York Policy Review, July 2000, pp. 1-16.

1. David Bodovski ([email protected]) is at the Pennsylvania State University; Hannah Firestone ([email protected]) is at the Stanford Graduate School of Business; Seung Jung Lee ([email protected]) and Viktors Stebunovs ([email protected]) are in the Division of International Finance of the Federal Reserve Board of Governors. We thank Isabel Kitschelt, Mariya Pominova, and Chris Webster for research assistance. The note reflects the views of the authors and should not be interpreted as reflecting the views of the Board of Governors of the Federal Reserve System. Return to text

2. While lending surveys usually capture changes in lending standards rather than the levels of lending standards, they are still informative about the state of bank credit conditions and about future economic activity. For example, in the U.S. context, see Lown, Morgan, and Rohatgi (2000) and Haltenhof, Lee, and Stebunovs (2014). Return to text

3. Another potential factor may have been the differences in regulatory guidance on loans under moratoria and non-performing loan recognition. For example, such guidance in some countries allowed banks for a limited time not to classify loans under moratoria as non-performing loans, encourage increase loss provision against them, and increase risk weights on their loan portfolios. In theory, such guidance may free up bank capital, which may have an easing effect on lending standards. However, in a severe recession with a highly uncertain economic outlook, out of precaution, banks may rather preserve than deploy capital. Return to text

4. The IMF Fiscal Monitor defines as above-the-line measures as those that involve revenue raising and government expenditure, which affect the overall fiscal balance and government debt. Return to text

5. The IMF Fiscal Monitor defines contingent liabilities as obligations that are not explicitly recorded on government balance sheets and that arise only in the event of a particular discrete situation, such as a crisis. Government guarantees provide coverage on the potential losses of the liabilities incurred by banks, firms, or households. They typically have no immediate upfront cost in the form of deficit or debt unless the expected cost is budgeted, but they create a contingent liability, with the government exposed to future calls on guarantees and fiscal risks. Return to text

6. Governments also implemented other types of support measures, such as equity injections into and direct loans to firms, but they were not as significant. Return to text

7. Other factors such as COVID cases, deaths attributed to COVID, or COVID-related changes in mobility were not associated with the relative magnitudes of the contingent measures. Return to text

8. Among G20 advanced economies, support to firms accounted for only 10 percent of the total above-the-line support, but employment protection and household income support represented about half (see the IMF's April 2021 Fiscal Monitor). Return to text

9. See the ECB's January 2021 euro-area bank lending survey. Return to text

10. See Bruegel's dataset on loan guarantees and other national credit-support programs in the wake of COVID-19, as of April 9, 2021. Return to text

11. A significant factor that contributed to a sharp contraction in loans to firms in the United States over the last three quarters of 2020 was a payback of credit lines that firms drew on in the first quarter, in part of precaution as the pandemic began. However, similar behavior was also observed in other countries. Return to text

12. See the ECB's January 2021 bank lending survey. Return to text

Bodovski, David, Hannah Firestone, Seung Jung Lee, and Viktors Stebunovs (2021). "Bank Lending Conditions during the Pandemic ," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, October 15, 2021, https://doi.org/10.17016/2380-7172.3000.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.