FEDS Notes

February 04, 2022

A Lawyer's Perspective on U.S. Payment System Evolution and Money in the Digital Age

Jess Cheng and Joseph Torregrossa1

Introduction

Take a close look at something that is widely used by the general public as "money" — a Federal Reserve note, a deposit with a bank, a balance with a nonbank payment company (such as PayPal or Venmo), or perhaps even a cryptocurrency — and ask what it means to use it as a store of value and a medium of exchange. That question is, in essence, a legal one. Who (if anyone) stands behind the associated commitments and what rules (if any) govern it? For a Federal Reserve note, the associated obligations are undertaken by a trusted party, with the arrangement governed by reliable and time-tested rules. On the opposite end of the spectrum are certain stablecoins and other cryptocurrencies for which the legal rights and obligations are unpredictable, obfuscated, or idiosyncratic, with untested rules. Market frictions and consumer harm can emerge from these uncertainties, particularly with respect to credit exposure and from underappreciated risks.

This Note analyzes current frictions and opportunities for evolution in the U.S. payment system, by viewing the legal underpinnings of money through the lens of "network effects" and "interoperability." First, it begins with a discussion of the current structure of the U.S. payment system, with a focus on network effects. The concept of network effects for a given system generally means that a user's benefit increases as the number of other users on the system grows.2 A sound legal framework is an important foundation for network effects within the payment system. It can bring certainty and clarity to a payment arrangement, resulting in greater consistency and predictability to the parties' payments activity; this, in turn, removes inefficiencies and provides an incentive for more parties to join the system. The ability of different arrangements to interoperate, including from a legal standpoint — that is, for users to smoothly and efficiently choose between arrangements subject to different legal frameworks, while being confident the arrangement will, like money, serve as a way to make a payment — could bring further efficiencies to users.

Second, this Note also gives a lawyer's perspective on the role of the Federal Reserve in the U.S. payment system. Specifically, this note analyzes the Federal Reserve's role in promoting the system's safety and efficiency, currently by serving as a "network hub" that connects some, but not all, of the system's forms of money. More recently, there have been calls to expand the Federal Reserve "network" further — for the Federal Reserve to go beyond merely providing to financial institutions the foundations for safe and efficient payments as it does today, and to offer new services such as a general-purpose central bank digital currency (CBDC), directly to the public or indirectly through existing banking channels.3

Finally, this Note discusses the evolving structure of the U.S. payment system. The U.S. payment system is composed of a multiplicity of issuers of money and payment arrangements. It continues to change today, particularly with the growth of payment services offered by nonbank companies. These changes are further fueled by the increased use of electronic payments, the convergence of payments and data, and a turning point in the nature of market competition with the entrance of big technology companies into payment services. Yet this diversity and innovation in money would not serve the public well if new services and products are poorly understood and poorly constructed, and do not "interoperate" well with other forms of money, including from a legal standpoint. In a fast-changing and increasingly complex world with regulatory and commercial structures built around traditional business models, how should policymakers and, more broadly, the industry respond? To provide a starting point, this Note analyzes the core tenets of efficiency and safety inherent in the U.S. payment system's current design — in particular, the legal foundations for the critical tenet that "one dollar" has a singular meaning of "one dollar" in whatever form it takes.

The Modern Tiered U.S. Payment System

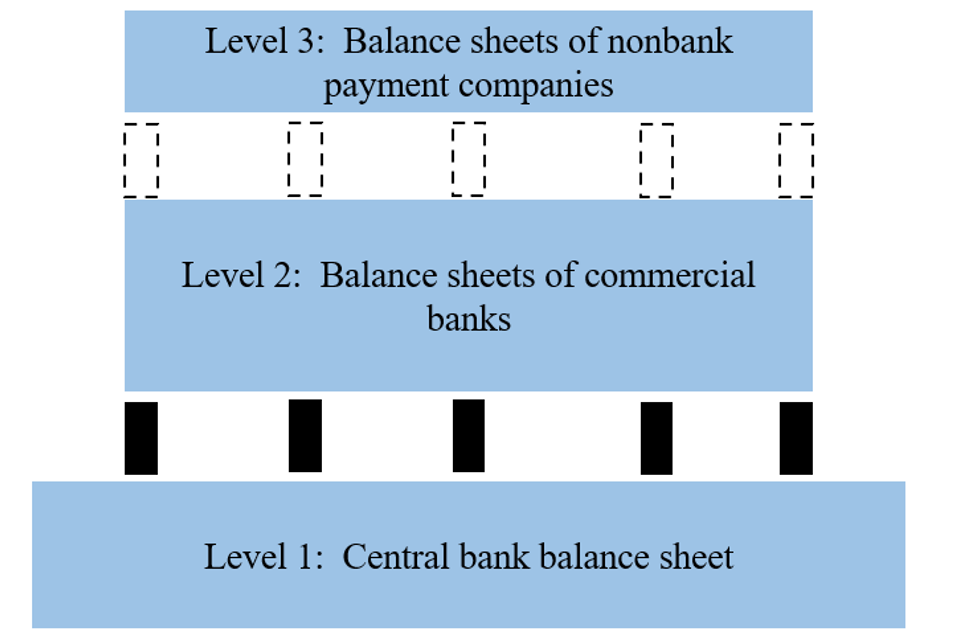

Today, the Federal Reserve plays a key role in the U.S. payment system. The Federal Reserve provides accounts and services to commercial banks and other financial institutions. They, in turn, provide financial services to consumers and businesses. Figure 1 below illustrates this tiered structure of the various forms of "money" widely used by the general public.

Level 1 consists of the central bank balance sheet, which serves as a foundation of safety and confidence. Level 2 consists of the balance sheets of commercial banks, with supporting pillars of federal regulation and supervision and federal deposit insurance coverage. In recent years, there has been a growth in nonbank payment companies, in Level 3. The discussion below explores the three levels, their legal underpinnings, and their interconnections within the U.S. payment system, starting with Federal Reserve notes that comprise a part of the central bank balance sheet.

From a legal standpoint, what is a Federal Reserve note?

A Federal Reserve note, such as a dollar bill, essentially represents the promise of the Federal Reserve to provide the bearer with . . . one dollar. A Federal Reserve note is a "note" in the sense that it represents a promise by the United States to pay the stated face amount of the note to the bearer on demand in "lawful money." This promise to pay is formalized in section 16 of the Federal Reserve Act.4 "Lawful money" includes the classes of money that are declared by the law of the United States to be "legal tender." Federal Reserve notes are "legal tender" as a matter of law.5

The 1974 case Milam v. U.S., 524 F.2d 629 (9th Cir. 1974), illustrates how this plays out in practice. An individual, Milam, sought to require the Federal Reserve Board to redeem a $50 Federal Reserve note in gold or silver. The Ninth Circuit, noting that this matter had been put to rest by the U.S. Supreme Court nearly a century before (in Juilliard v. Greenman, 110 U.S. 421 (1884)), disagreed with Milam's contentions. The court stated: "While we agree that golden eagles, double eagles and silver dollars were lovely to look at and delightful to hold, we must at the same time recognize that time marches on. . . . [Milam] is entitled to redeem his [Federal Reserve] note, but not in precious metal." In other words, a holder of a Federal Reserve note who presents it for redemption in lawful money is likely to receive in exchange lawful money in the form of another Federal Reserve note.

How does this legal concept of a Federal Reserve note translate to the economic functions of money?

Historically, federal statutes had specified a formal gold or silver content for the dollar, but these statutes were rendered obsolete when the United States abandoned the domestic gold standard with the passage of the Gold Reserve Act of 1934 and demonetized silver in the 1960s. Although the dollar as a standard unit of value has been defined in the past in terms of a gold or silver content, today there is no requirement that the monetary system of the United States consist of gold and silver coin or of currency backed by gold or silver. Rather, a Federal Reserve note is readily able to be exchanged for goods and services because, as a legal matter, it is an obligation of the United States and backed by the full faith and credit of the U.S. government. This confidence is reinforced by the Federal Reserve Act's prescription that whenever currency is issued by the Federal Reserve, the issuing Federal Reserve Bank (Reserve Bank) posts collateral equal to 100 per cent of the value of the notes issued.6

The stability and uniformity in the legal treatment of various denominations of U.S. currency also leads to efficiencies and a type of network effect. If a merchant accepts a $100 bill today from a customer, it does not need to assess whether that $100 bill will need to be converted to some other form, possibly at some discounted rate, when it tries to use it to, say, pay wages to its employees tomorrow. Nor does the merchant face the risk that its holdings of Federal Reserve notes would be greater or less depending on the exact type of note it holds (a hundred $1 bills or a single $100 bill). Each U.S. dollar is "money good" in the literal sense, so payments in physical dollars happen without friction.

However, this network can meaningfully function only if parties can effectively manage their payment activities in physical currency. Besides the Federal Reserve notes and U.S. coins in the pockets and purses of the public, there are other kinds of money in wide usage, such as deposit accounts at commercial banks (Level 2 in figure 1).

From a legal standpoint, what is a balance in a bank account?

A deposit with a bank is a liability of that bank. If a depositor has an account with a bank, that means the depositor has a right to assert a claim against the bank for the value of the deposit. If the bank decides not to pay the claim, then the depositor has the right to go to court and obtain a judgment against the bank for damages. What the depositor does not have, however, is any property right to specific bank assets; rather, it is a contract right, in essence, a promise to pay from the bank to the depositor.

The law treats a bank deposit (Level 2 in figure 1) differently from a Federal Reserve note (Level 1 in figure 1). A Federal Reserve note is payable in its face amount to the bearer on demand, which means that an individual lawfully in possession of the note may be regarded as the owner of the note. Like other bearer instruments, an individual who loses a Federal Reserve note or has it stolen may suffer financial loss. The Federal Reserve will not replace it; if currency is stolen, the individual's recourse is generally limited to pursuing a civil or criminal action against the thief. In contrast, a bank deposit is a contractual relationship that a depositor has with their bank. For individuals, this relationship carries certain legal protections, like the consumer protections against errors and fraud under the Electronic Fund Transfer Act. If a payor were to wire money through its bank to a payee who maintains an account with a different bank, what happens is not a transfer of property from the hands of payor to payee, as it would be in a payment of Federal Reserve notes. Rather, it is a shifting of bank liabilities: the payor's claim against its bank decreases and the payee's claim against its bank increases, in the amount of the payment (how banks accomplish this is discussed further below).

From a lawyer's perspective, these bank deposits could be viewed as a type of "system" of money that is separate from Federal Reserve notes and other items on the Federal Reserve's balance sheet. The amount of deposits a commercial bank maintains will not equal the amount of Federal Reserve notes and U.S. coins it has on hand, nor are banks required to hold deposits at the Reserve Banks equal to the amount of deposit liabilities on their books. Rather, banks are able to affect the total stock of money through lending activities that credit the accounts of borrowers.

At the same time, the ability of commercial banks to create money in this way also exposes their balance sheet to risk. Thus, depositors are exposed to some risk that their bank does not pay the full or correct amount on a deposit obligation. However, in practice the public relies on these bank deposits and transacts in them as a form of money through payment mechanisms such as checks, ACH transactions, credit and debit card transactions, and wire transfers.

How is it that in practice a deposit claim against a bank is essentially viewed as amounting to having money in hand?

Commercial banks are a special type of institution. They are subject to regulation and supervision for safety and soundness and are supported by federal deposit insurance coverage. Moreover, unlike investors, depositors do not take on investment risk because the value of their claims against their banks will not fluctuate based on the banks' performance as would a share of corporate stock. Additionally, bank liabilities are also distinct from the debt of other commercial institutions in that one dollar in currency and one dollar in deposits at a commercial bank are freely convertible between each other (Levels 1 and 2, respectively, in figure 1). Viewed through the lens of "network effects" and "interoperability," deposit claims against banks and Federal Reserve notes could be viewed as distinct "systems" of money, subject to different legal frameworks, but that "interoperate" such that both function as money to a generally equal degree in practice. This is in large part because the Federal Reserve, through commercial banks, helps enable the public to convert bank deposits into cash, and vice versa. When individuals or businesses want cash, they obtain it by drawing on their deposits at commercial banks. The banks, in turn, can obtain their cash from the Federal Reserve, at which banks may maintain their own deposit accounts known as "master accounts."7 When individuals or businesses no longer want the cash they have on hand, they can deposit the excess in banks, and the banks can subsequently deposit any excess with the Federal Reserve. This "elasticity" of the currency supply was a primary objective of the Congress when it passed the Federal Reserve Act in 1913.

How is it that in practice a transfer of bank deposits is essentially viewed as amounting to money changing hands?

For example, suppose a payor that maintains an account at Alpha Bank seeks to wire money to a payee at Beta Bank. The end result would be that Alpha Bank decreases its deposit obligation to the payor (that is, the payor has a lower balance with its bank), and Beta Bank increases its deposit obligation to the payee (that is, the payee has a higher balance with its bank). Yet there is a link missing: How does Alpha Bank communicate and settle with Beta Bank?

Viewed through the lens of "network effects" and "interoperability," the liabilities of different banks could be viewed as separate "systems" of money, so to speak. In the example above, all customers that have accounts at Alpha Bank could be viewed as users of the Alpha Bank "system," whereas all customers that have accounts at Beta Bank are users of the Beta Bank "system," with each bank capable of executing transfers on its own books between its customers. But what of transfers between customers of different banks? The accounts and payment services that the Federal Reserve provides help to bridge these individual bank "systems" and allow them to "interoperate" (that is, help maintain the integrity and efficiency of payments that flow between commercial banks in Level 2 in figure 1). Alpha Bank would pay Beta Bank through the Federal Reserve, which would typically process a transaction by receiving instructions from Alpha Bank, delivering instructions to Beta Bank, and settling the amount of a transaction by effecting changes to the banks' master account balances (that is, decrease the Reserve Bank liability to Alpha Bank as reflected in its master account balance and increase to the Reserve Bank lability to Beta Bank as reflect in its master account balance). Different forms of electronic interbank transfers (for example, an ACH payment or a wire transfer) may have different underlying legal bases and may be conducted in different ways from an operational standpoint, but each is in essence a shift in bank liabilities and corresponding interbank settlement based on instructions communicated between banks, allowing banks like Alpha Bank and Beta Bank to pay each other.

Taken together, the Federal Reserve's bridging role enables customers of different bank systems to efficiently make payments to each other.8 In this way, the Federal Reserve serves as a "hub," connecting banks and other financial institutions. The scope of its reach has changed over time. It initially covered state member banks and national banks, both forms of federally supervised institutions, and over time Congress has reconsidered the scope, driven not only by efficiency but also by safety and at times other policy considerations, as illustrated in Table 1.

Table 1: Legislative expansion of the Federal Reserve network

| Year | Description |

|---|---|

| 1913 | Congress created the Federal Reserve System, giving the Reserve Banks the authority to establish deposit accounts for Reserve Bank members and a nationwide check-clearing system (as well as to issue Federal Reserve notes, as discussed further above). In doing so, Congress put the Reserve Banks at the center of what was then a fractured payment system, in order to, among other things, improve its functioning to make the system more efficient and eliminate interbank settlement risk to make the system more stable. |

| 1917 | Congress amended the Federal Reserve Act to authorize the Reserve Banks, for collection purposes, to accept deposits of cash and checks from any bank or trust company, regardless of whether the institutions were members of the Federal Reserve System. This amendment in essence served to create deeper reach for the “network” with respect to the Reserve Banks’ check-collection service, helping to meet Congress’s goal of universal par clearing of checks. |

| 1978 | Congress added U.S. branches and agencies of foreign banks to the list of institutions that expressly could access Reserve Bank accounts and services, in connection with the policy goal of treating branches and agencies of foreign banks like their domestic counterparts. This expansion of the network also came with expanded oversight of the activities of these branches and agencies by the federal banking agencies. |

| 1980 | Congress again reconsidered the scope of the “network,” in connection with the revisions to the Federal Reserve’s monetary policy authorities. With the passage of the Monetary Control Act of 1980, Congress expressly made all depository institutions — entities that are almost all subject to federal oversight — eligible to access Reserve Bank master accounts, payment services, and the discount window. In a balancing of various policy tradeoffs (including giving thrifts and credit unions direct access to the Federal Reserve automated clearinghouse (ACH) network, without having to rely on commercial correspondent banks), these same institutions also became subject to Federal Reserve authority to set reserve requirements, a critical monetary policy tool at the time. |

| 2010 | The “network” was expanded further, with the policy goal of promoting financial stability. In connection with the financial crisis and the adoption of the Dodd-Frank Wall Street Reform and Consumer Protection Act, Congress further expanded the scope of the “network” to designated financial market utilities, which would also become subject to federal oversight when so designated by the Financial Stability Oversight Council. |

Yet throughout the course of these gradual changes, the division of labor, as reflected in the levels of the modern tiered payment system, has remained the same: The Federal Reserve provides services to commercial banks, and these banks in turn serve as the customer-facing tier of the system, providing financial services to the general public. Also constant are the core tenets of efficiency and safety inherent in the U.S. payment system's design. The end result of this structure is that, in practice, the general public views Federal Reserve notes and bank deposits alike as safe assets that can be widely used as a means of payment. They are effectively the same "money."

The Evolving Payments Landscape

The more significant developments in the payments landscape tend to come from nonbank payment service companies (Level 3 in figure 1). These companies seek to offer payment services that are faster, more convenient, and lower cost, using different business models that often leverage technological innovation. Some products seek to improve end-user experience by providing more-convenient ways to initiate payments over legacy payment systems. From a legal standpoint, a new communication channel or interface for an existing bank-offered payment mechanism, such as a smart phone connection to the debit card or credit card system, generally does not result in changes to the basic consumer rights or to a bank's responsibility to ensure the security of that communication channel under federal law.9 In contrast, other products use wholly new settlement and clearing arrangements that stand apart from traditional banking systems (for example, the ability to pay someone with cryptocurrencies using a distributed ledger).

From a legal standpoint, how do nonbank payment companies fit into the payment system?

At their core, payment services offered by nonbank companies tend to involve money moving to or from bank accounts in some way. That is, even if a payment initially is charged to a balance with a nonbank company (for example, PayPal or Venmo) or made using a cryptocurrency issued by a nonbank company (for example, stablecoins such as USD Coin), a commercial bank is often involved. A customer can add funds to or withdraw their balance with the payment company by a transfer of funds to or from their bank account (that is, moving between Level 3 and Level 2 in figure 1), typically using traditional payment methods such as ACH or a card network. Payments over these existing systems are subject to the statutes, rules, or procedures that are already in place and fairly established today.

It could be a different matter, however, in the case of activity occurring within the systems of nonbank payment companies (that is, activity wholly within Level 3 in figure 1).10 Nonbank payment companies may be subject to a less rigorous regulatory and supervisory regime than banks, and users of the service may be subject to contractual rules and procedures that are not buttressed by federal statutory or regulatory standards, resulting in fewer of the protections afforded to bank customers.

Additionally, making payments through complex arrangements and nontraditional business models can exacerbate the risks these products pose. Certain stablecoin arrangements, for example, rely on a legally complex organizational and technical model under which the issuer and various third parties play different roles, such as receiving customer funds, managing assets, and processing transactions. These arrangements might pose underappreciated operational risks, without clear lines of accountability or transparency to users. Moreover, from a legal standpoint such an arrangement might inadvertently expose users to risks similar to those inherent in bearer note (for example, a Federal Reserve note discussed above): If an infrastructure fails to properly account for a cryptocurrency because of a coding or other operational error, has a consumer holder simply "lost" their cryptocurrency holdings? More generally, if the general public were to shift toward these various forms of cryptocurrencies as a form of money, there would be greater diversity in the legal underpinnings of "money" in the United States. Yet the general public may not fully appreciate the resulting distinctions in their rights, risk exposure, and avenues for recourse.

Could balances or cryptocurrencies associated with this sort of nonbank payment company be viewed as fulfilling the economic functions of money?

Typically, as a legal matter, a customer's balance with a nonbank payment company represents an unsecured promise of the company to pay the customer that amount, subject to its terms and conditions. A customer may view these balances as the equivalent of a bank deposit, but they are not subject to the same level of federal regulatory protections or supervisory scrutiny.

Even still, given the wide variety of business models and arrangements, broad generalizations about the legal treatment of balances with a given company are difficult to make. The wide range of nonbank companies and business models in this tier of the payment system (Level 3 in figure 1) means that each nonbank payment company needs to develop bespoke legal and operational underpinnings for its particular product. Different nonbank payment companies may even take different approaches across their product offerings.

Under one approach, a nonbank payment company might offer a product that tries to leverage protections that are inherent in the banking system indirectly (that is, at Level 2 in figure 1). For example, a company might offer services with features that make use of the benefits of "pass-through" federal deposit insurance. In these arrangements, a company would hold customer funds under a special "fiduciary" relationship (for example, as their agent or custodian) at an insured commercial bank. If the commercial bank holding this custodial account were to fail, federal deposit insurance could "pass through" the company to each of the company's customers, subject to applicable requirements and limits. In this way, this arrangement uses some of the general characteristics and protections of commercial banks. However, the introduction of a nonbank payment company brings with it a layer of complexity and uncertainty that can make the product riskier to the end customer than a typical bank deposit. For one thing, such deposit insurance coverage is contingent upon the nonbank payment company maintaining accurate records, as well as both the company and the commercial bank complying with applicable deposit insurance requirements. More generally, each additional level on top of the foundational central bank balance sheet (Level 1) is an opportunity for new risk exposures to be introduced.

A different approach would be one in which a nonbank payment company designs products that seek to mimic the characteristics of deposits (that is, balances at commercial banks). A stablecoin issuer, for example, might structure a stablecoin in a way that strives to achieve one-for-one convertibility with dollars, with the intention that the market would view its stablecoin as the functional equivalent of money. In a simple model, it might also try to do so by "backing" its stablecoin with a mix of deposits with a commercial bank and liquid securities.

This is not a new concept. Centuries ago, state banks issued private currencies backed by, among other things, liquid or ostensibly liquid securities, and they were redeemable in coin. In this free banking era in U.S. history, the bank note system existed in a vacuum devoid of federal intervention. While not wholly unworkable, a number of significant flaws and a degree of market uncertainty emerged. Some banks engaged in speculative activities totally unrelated to banking (for example, building hotels, roads, railroads, and canals), a multiplicity of banks issued notes of varying and unpredictable quality, and notes were not typically redeemable for other notes at face value.11 For example, if a merchant from one small Midwestern town traveled to the South and wished to spend notes issued by his local bank, he might have had to exchange them for local notes or coin. A broker might provide the exchange, for a fee, after having consulted a banknote reporter (a private publication that listed current information on market rates for notes of different banks based on creditworthiness, reputation, and location). Beyond incurring these transaction costs simply in order to make a payment, some holders also took catastrophic credit and fraud losses. These products on the whole were not always safe, and the variations among them likely disrupted even the possibility of achieving network effects.

In response, Congress took steps to shore up and unify the nation's currency with the passage of the National Bank Act of 1864. The federal scheme created uniformity, stability, and widespread adoption, though possibility at the expense of flexibility. Even still, lessons learned from the free banking era seem to have been forgotten today. Some of the flaws and inefficiencies that were present in the multiplicity of state bank notes are resurfacing in digital form with today's stablecoin arrangements, along with a series of additional legal uncertainties that had long been removed from the banking system. What type of claim does a holder of a given stablecoin have, if any? Against whom may the holder make a claim, exactly? How might one collect on assets that back the stablecoin, if that is possible at all? Can an innocent transferee receive a stablecoin without worry of a third party asserting an adverse claim against it? What happens in the bankruptcy or insolvency of the issuer (and is there an issuer at all)? More generally, is a market where these kinds of arrangements could flourish outside federal financial regulation, with all these legal questions handled in a profusion of unclear and incompatible ways, progress for the U.S. payment system?

Conclusion

This Note has discussed money, the U.S. payment system, and their legal underpinnings through the lens of "network effects" and "interoperability," noting both safety and efficiency as core tenets, to explain where we sit today and how we came to this point. As this Note illustrates, the U.S. payment system is composed of a growing multiplicity of issuers of money and payment arrangements. Diversity and responsible innovation in the payment system traditionally have served consumer and business needs well, enabling competition and reflecting market preferences for holding and using different forms of money for different types of transactions.

Though complex, the system is able to function smoothly and safely largely because of the Federal Reserve's role as a network hub that supports efficient interoperation of the system's component parts and because of the unique stability of settlement on the Federal Reserve's balance sheet. From a legal perspective, although different legal bases underpin different arrangements, U.S. payments law as a whole (commercial law, the regulatory regime, and the supervisory framework) aims to provide certainty and predictability that "one dollar" has a singular meaning in whatever form it takes.

This legal framework has evolved, built on the U.S. payment system's core tenets of efficiency and safety. Today, the U.S. payment system continues to change, particularly among payment services offered by nonbank companies. Risks emerging today include a lack of user understanding of rights with respect to new payment arrangements, a lack of clarity about the applicability of regulatory protections, and system inefficiencies that result. Innovation would not serve the U.S. payment system well if it results in new services and products that are poorly understood and poorly constructed, and that do not "interoperate" well with other forms of money from a legal standpoint. The law has a critical part to play in continuing to ensure confidence in money and that the system's various forms continue to have a singular meaning of "one dollar."

References and Further Reading

Bank for International Settlements (BIS) (2019), "Big tech in finance: opportunities and risks", BIS Annual Economic Report, Chapter III, June.

Brainard, Lael (2020), "The Digitalization of Payments and Currency: Some Issues for Consideration," remarks at the Symposium on the Future of Payments, Stanford, California, February 5.

Cheng, Jess (2020), "How to Build a Stablecoin: Certainty, Finality, and Stability Through Commercial Law Principles," Berkeley Business Law Journal, Vol 17:2.

Cheng, Jess, Alaina Gimbert, and Joseph Torregrossa (2017), "Does It Matter How I Pay?", Business Law Today, American Bar Association, May.

Cheng, Jess, Angela Lawson, and Paul Wong (2021), "Preconditions for a General-purpose Central Bank Digital Currency," FEDS Notes, Washington: Board of Governors of the Federal Reserve System, February 24, 2021.

Committee on Payments and Market Infrastructures and Markets Committee (2018), "Central Bank Digital Currencies (PDF)," Basel: Bank for International Settlements, March.

Committee on Payment and Settlement Systems (2003), "The Role of Central Bank Money in Payment Systems (PDF)," Basel: Bank for International Settlements, August.

Dwyer, Gerald P. Jr. (1996), "Wildcat Banking, Banking Panics, and Free Banking in the United States (PDF)," Economic Review, Atlanta: Federal Reserve Bank of Atlanta, Vol. 81, Issue December, 1-20.

Federal Reserve (2016), "The Federal Reserve System Purposes & Functions: 6. Fostering Payment and Settlement System Safety and Efficiency," Washington: Board of Governors of the Federal Reserve System.

Friedman, Milton and Anna Jacobson Schwartz (1963), A Monetary History of the United States, 1867-1960, Princeton: Princeton University Press.

Held, Michael (2019), "U.S. Regulations and Approaches to Cryptocurrencies (PDF)," remarks at the BIS Central Bank Legal Experts' Meeting, Basel, Switzerland, December 3.

Hendrickson, Jill M. (2011), Regulation and Instability in U.S. Commercial Banking: A History of Crises.

Kuprianov, Anatoli (1985), "The Monetary Control Act and the Role of the Federal Reserve in the Interbank Clearing Market (PDF)," Economic Review, Richmond: Federal Reserve Bank of Richmond.

Powell, Jerome (2020), "Cross-Border Payments—A Vision for the Future," remarks at the International Monetary Fund and World Bank Group Annual Meetings 2020, Washington, October 19.

Sommer, Joseph (1998), "Where is a Bank Account?," Maryland Law Review, Vol. 57:1.

1. The views expressed in this Note are solely those of the authors and should not be interpreted as reflecting the views of the Board of Governors, any Federal Reserve Bank, the staff of the Federal Reserve System, or the United States. Any errors or omissions are the responsibility of the authors. The authors would like to thank Antoine Martin and Hampton Finer (Federal Reserve Bank of New York) and Melissa Leistra, Stephanie Martin, David Mills, Kirsten Wells, Kathy Wilson, Paul Wong, and Sarah Wright (Federal Reserve Board) for their contributions to and assistance with this Note. Return to text

2. At the same time, users of a system may pose risk to each other; therefore, safety considerations in addition to efficiency are also important. This is particularly true for money, in its various forms. Return to text

3. A CBDC would be a new type of central bank liability issued in digital form. Various structures and technologies might underpin a CBDC, with the aim of usage by the general public. Return to text

4. Section 16 of the Federal Reserve Act (12 U.S.C. §411) states that Federal Reserve notes "shall be redeemed in lawful money on demand . . . ." The Federal Reserve Act does not define the term "lawful money," although the term is used in the Federal Reserve Act and other federal legislation. Return to text

5. Specifically, in 1933, Congress made all coins and currencies (including Federal Reserve notes), regardless of when issued, legal tender for all purposes. This is codified at 31 U.S.C. § 5103, the "legal tender statute," which states: "United States coins and currency (including Federal reserve notes and circulating notes of Federal reserve banks and national banks) are legal tender for all debts, public charges, taxes and dues. Foreign gold or silver coins are not legal tender for debts." Return to text

6. A statement showing the amount of notes outstanding to each Reserve Bank, the notes requiring collateralization, and the various assets pledged as collateral security is published weekly in the Board's H.4.1 release. See Federal Reserve H.4.1 Statistical Release, Table 6 (Statement of Condition of Each Federal Reserve Bank) and Table 7 (Collateral Held against Federal Reserve Notes: Federal Reserve Agents' Accounts), available at https://www.federalreserve.gov/releases/h41/current/. Return to text

7. A master account is a record of financial rights and obligations of an account holder and the Reserve Bank maintaining the account with respect to one another, where opening, intraday, and closing balances are determined. See Federal Reserve Banks, Operating Circular 1, Account Relationships, § 2.2(e), available at https://www.frbservices.org/binaries/content/assets/crsocms/resources/rules-regulations/081621-operating-circular-1.pdf (PDF). Return to text

8. It is important to note that other private-sector payment systems can play a similar bridging role. Even still, to help ensure that they function safely and efficiently, these systems may rely on prefunded Reserve Bank balances to back or effect interbank settlement. The reliance of these private-sector arrangements on the Federal Reserve underscores the important and unique role the central bank plays in the U.S. payment system: It brings network efficiencies as well as safety, in the form of settlement on the central bank's balance sheet. At the same time, central bank money does not stifle responsible innovation by crowding out or supplanting private-sector institutions that offer their own advantages in meeting customer needs. Return to text

9. With respect to consumer protection, for example, electronic debits or credits to certain consumer asset accounts would generally be covered by the error-resolution, disclosure, and other provisions of the Electronic Fund Transfer Act. The application of this law and most other federal consumer laws is subject to the rulemaking and interpretive authority of the Consumer Financial Protection Bureau (CFPB).

Alternatively, a bank might use a nonbank payment processor to offer its customers, for example, a more convenient way to initiate payments from mobile phones; however, the bank would be responsible for ensuring that its agent, the nonbank service company, complies with the laws and rules, as well as the supervisory process, applicable to the bank. 12 U.S.C. §§ 1863-4, 7. Return to text

10. From a legal standpoint, these differences exist even if a nonbank company has a simple business model of holding and transferring prefunded balances in ways that are similar to bank transfers and hard to distinguish from deposits. The question of whether such a nonbank payment company may potentially be engaging in deposit-taking activity without a banking license or charter required to do so is outside the scope of this Note. Return to text

11. Note, however, that there were examples of solutions to this problem, such as the Suffolk Banking System, which emerged among a number of New England banks. At the center of the arrangement was the Suffolk Bank, in Boston, which began a practice of redeeming banknotes of certain other banks (those that had sufficient balances with Suffolk Bank) and served to ensure that bank notes would trade near par value. Return to text

Cheng, Jess, and Joseph Torregrossa (2022). "A Lawyer's Perspective on U.S. Payment System Evolution and Money in the Digital Age," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, February 04, 2022, https://doi.org/10.17016/2380-7172.2964.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.