FEDS Notes

May 27, 2022

A Note on the Expected Expiration of Federal Student Loan Forbearance

Hannah Case, Simona Hannon, and Alvaro Mezza1

On April 6, 2022, the Department of Education (DoEd) announced a new extension on the forbearance provision for federal student loans, which is now set to expire on August 31, 2022, almost 30 months after being set for the first time.2 These measures—originally intended for a period of 60 days—applied exclusively to federal student loans owned by the Department of Education, a little more than 80 percent of the current $1.75 trillion outstanding student loan debt.3 In this note, we use credit records from the NY Fed Equifax Consumer Credit Panel (CCP) —a nationally representative random sample of anonymized Equifax credit bureau data—to estimate potential savings among borrowers with a payment due on their student loan debt prior to the pandemic. In light of the expected expiration of this program, we describe the evolution of borrowers' financial positions over the pandemic, with particular focus on those that have not made any payments while it has been in effect. Once the provision expires, there could be a deterioration of credit risk profiles, which could infringe on this group's general access to credit.4 However, given the relatively small amount of other debt held by these borrowers, any subsequent credit risk deterioration seems unlikely to significantly disrupt consumer credit markets.

In March 2020, at the onset of the pandemic, the government announced three relief measures to help federal student loan borrowers: (1) a suspension of loan payments, (2) a zero percent interest rate on outstanding balances, and (3) the stoppage of collections on defaulted loans. According to DoEd data, these measures allowed about 20 million federal student loan borrowers that were in repayment before the pandemic to remain current even if they stopped making payments.5 As of 2019:Q4, such borrowers held about $760 billion in federal student debt.

To estimate the potential savings to these borrowers using the CCP, and match the DoEd figures as closely as possible, we first identify borrowers with a payment due before the pandemic began, that were current or in delinquency, but not in default.6 In contrast to the DoEd figures, we limit the sample to only those required to make positive payments to remain current or avoid default, as our CCP sample does not permit differentiation between those not making payments because they were in deferment due to economic hardship or forbearance—not included in the DoEd figures either—from those not making payments because of enrollment in an IDR plan with incomes low enough with respect to their debt levels—included in the DoEd figures. Defined this way, this group will necessarily include some borrowers that were not (fully) eligible for federal forbearance due to two reasons. First, our CCP sample does not permit differentiation between federal and private student loan debt. To limit the influence of these loans—which represent a little less than 10 percent of all student debt—we dropped all cosigned loans. Most private student loans are cosigned, especially those originated after the Great Recession. For example, according to MeasureOne, about 91 percent of private undergraduate loans and 64 percent of private graduate loans were cosigned in the 2020–21 academic year. Second, our CCP sample does not permit differentiation between federal loans owned by the DoEd (eligible for the provision) and Family Federal Education loans not in default/Perkins loans not held by the DoEd (not eligible for the provision). These non-eligible loans represent a little less than 10 percent of all federal loans. This all said, as noted above, a large majority of student loans are eligible for government-mandated forbearance.

In all, this group is composed of about 20 million borrowers, holding $725 billion in student loan debt, just below the $760 billion reported by the DoEd. Prior to the pandemic, this group was required to pay about $5.3 billion a month toward their student loan debt. At the borrower level, the average and median required monthly payment were about $260 and $170, respectively.

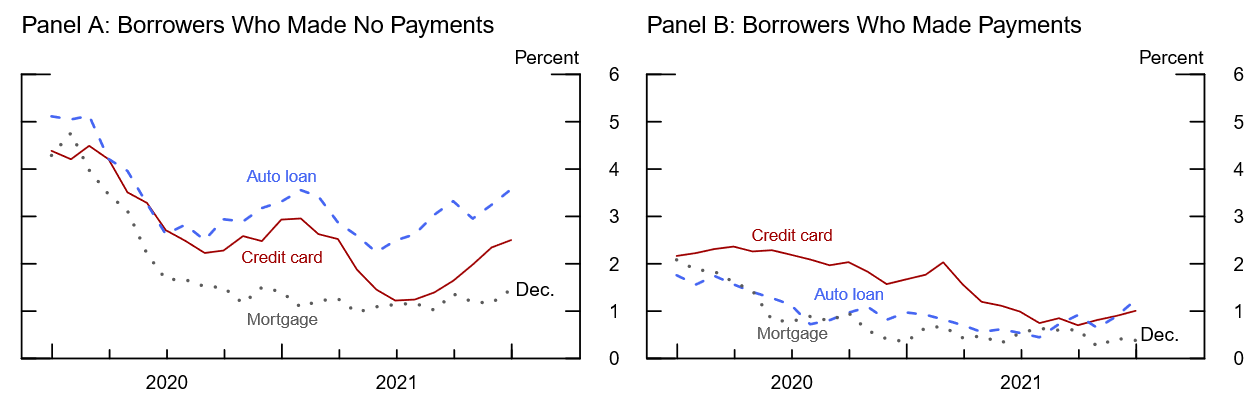

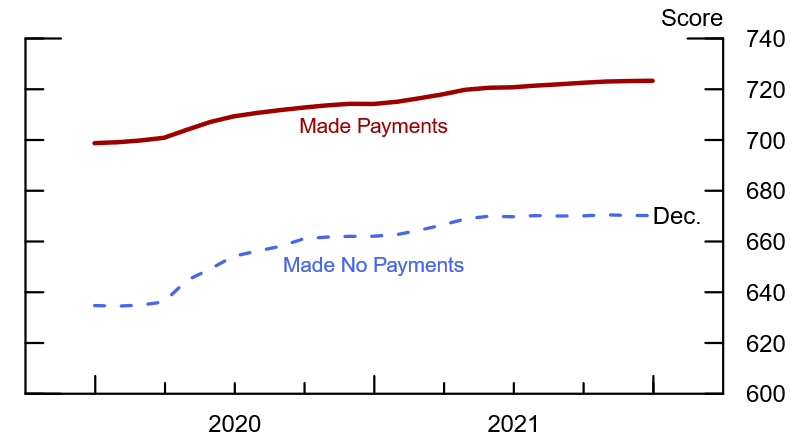

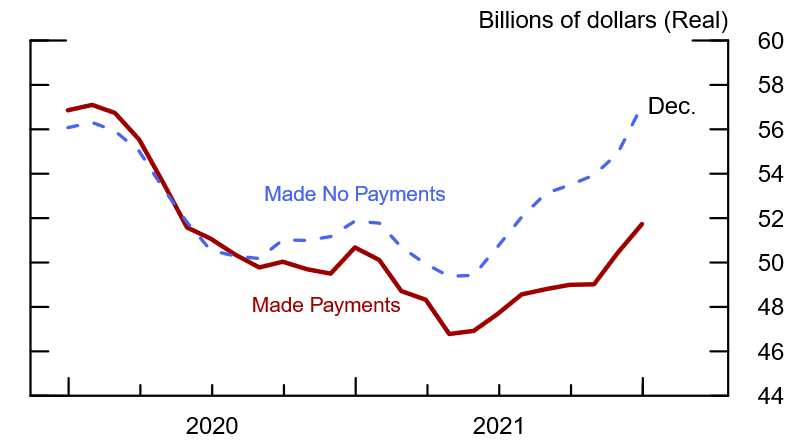

Among these borrowers, almost 60 percent (about 11.5 million) have not made any payments on their student loans from August 2020 through December 2021 , and it is possible that some of these borrowers may not be ready to resume payments once forbearance expires.7 These borrowers hold almost $400 billion in outstanding student loan debt and, prior to the pandemic, were required to pay about $2.8 billion a month toward their student loan debt. This translates into a total of $84 billion over the 30 months that the forbearance provision has been in effect. On balance, these borrowers have seen their financial positions improve during the pandemic, but there are some signs of distress. Overall, their delinquency rates on credit card, auto, and mortgage debts declined markedly throughout the pandemic (panel A of figure 1), and their average risk scores increased by 35 points to 670 through 2021:Q4, (figure 2). However, their delinquency rates started to rise during the last quarters of 2021. In addition, this group's credit card balances started to ramp up in the second half of 2021 such that their debt balances by the end of 2021 were slightly higher than their levels 2 years prior (figure 3).

Note: Delinquency measures the fraction of balances that are at least 30 days past due and excludes severe derogatory loans for auto loans and credit cards.

Source: Federal Reserve Bank of New York Consumer Credit Panel/Equifax.

Source: Federal Reserve Bank of New York Consumer Credit Panel/Equifax.

Source: Federal Reserve Bank of New York Consumer Credit Panel/Equifax.

In comparison, the remaining borrowers (about 8.8 million) made at least one payment since August 2020, and they appear much better poised for government-mandated forbearance to expire.8 For one, their payments led to a $52 billion (or roughly 15 percent) decline in their student loan outstanding balances over the two-year period ending in 2021:Q4.9 Additionally, these borrowers were able to reduce their credit card balances by about 10 percent, on net, throughout the period (figure 3) and their delinquency rates on credit card, auto, and mortgage debts, which are currently at very low levels (panel B of figure 1). Furthermore, while both groups saw increases over the pandemic, their risk scores, on average, are higher than the group of non-payers (figure 2). Although this group shows such improvements, more than 30 percent of these borrowers made payments for three or less months between August 2020 and December 2021, while slightly more than 40 percent made them for at least 12 months.

The provisions also reinstated about 3.2 million student loan borrowers from delinquent to current status, according to DoEd data.10 As one might expect, these borrowers were disproportionately more likely to be in the nonpaying group of borrowers. If the economic situation for these borrowers has not improved sufficiently over the course of the pandemic, it is possible that they will become delinquent again soon after the provisions expire, which could lead to a reversal in the upward trend of credit score changes.11 The potential decline in credit scores could affect credit access for these borrowers down the road.12

Nevertheless, existing federal student loan repayment plans that tie monthly payments to incomes could help alleviate repayment burdens for vulnerable borrowers who enroll in them. Note also that, as a group, student loan borrowers in the CCP with a payment due before the pandemic hold only a small share of the outstanding credit card, auto, and mortgage debt (about 12 percent of the total, with less than 6 percent held by the nonpaying group), which suggests that the expiration of the forbearance provisions is unlikely to disrupt lending through the broader set of consumer credit markets.

1. We thank Sarena Goodman, Geng Li, Raven Molloy, Michael Palumbo, and Kamila Sommer for useful comments and suggestions. The views presented here are those of the authors and do not necessarily reflect those of the Federal Reserve Board or its staff. Return to text

2. For the remaining loans (including private student loans), it was up to lenders' discretion to provide some type of provision to borrowers in need. Return to text

3. In March 2021, the relief measures were extended retroactively to defaulted Federal Family Education Loan Program loans that were privately held, adding almost $25 billion, according to 2021:Q3 DoEd data. Return to text

4. Counteracting this, the announcement indicated that more than 7 million borrowers in default affected by the provisions will be moved to current status once the provisions expire, which should positively impact credit records of the affected borrowers and could lead to more access to credit. Return to text

5. Data available here, https://studentaid.gov/sites/default/files/fsawg/datacenter/library/PortfoliobyLoanStatus.xls, in the "Federally Managed" sheet (data for 2020:Q1 correspond to 2019:Q4, as the DoEd reports are based on the fiscal year). All these borrowers were required to make positive monthly payments before the pandemic to remain current or avoid default, except for those not required to make payments due to having a sufficiently low income (relative to their debt) paired with enrollment in an income-driven repayment (IDR) plan. The 20 million borrower figure does not include borrowers in school or in grace period, as well as borrowers not making payments before the pandemic because of enrollment in deferment due to economic hardship, forbearance, or default, as these borrowers were already not making payments before the pandemic. Return to text

6. This differs significantly from the approach followed in Jacob Goss, Daniel Mangrum, and Joelle Scally, "Student Loan Repayment during the Pandemic Forbearance," Federal Reserve Bank of New York Liberty Street Economics, March 22, 2022, where the authors also include in their analysis some borrowers who were not required to make positive payments before the pandemic. Return to text

7. To avoid delays in credit bureau reporting, which were common during the first few months of the pandemic, we examined borrowers beginning with August 2020. Return to text

8. In aggregate, these borrowers paid at least $3.5 billion a month, on average—more than their estimated pre-pandemic required monthly payments of $2.5 billion. The group includes borrowers who decided to make payments even if in forbearance, as well as borrowers with non-cosigned private student loans or federal loans not held by the DoEd, who were required to continue making payments if lenders did not provide any type of relief or provided a shorter relief than the one provided for federal student loans held by the DoEd. Return to text

9. Note that due to the zero percent interest accrual provision, all payments made in forbearance are directed to principal repayment. Return to text

10. Additionally, while loans already in default covered by the provisions were not moved (yet) to current status, the requirements to rehabilitate defaulted loans eased during the period, which probably explains, in part, the decline in the number of borrowers in default for the federally owned portfolio by 0.6 million borrowers (to 7.1 million) between 2019:Q4 and 2021:Q3, according to DoEd data. Moreover, the announcement made on April 6, 2022, indicated that loans in default status affected by the provisions will be moved to current status once the provisions expire. This measure, which will benefit more than 7 million borrowers, could increase credit scores of those affected and potentially lead to more credit access. Return to text

11. Although borrowers who were delinquent on their student debt before the pandemic experienced improvements in credit scores and in other debt-type delinquencies, their credit profiles remain blemished. For evidence on the upward credit score migration, see Sarena Goodman, Geng Li, Alvaro Mezza, and Lucas Nathe (2021). "Developments in the Credit Score Distribution over 2020," FEDS Notes (Washington: Board of Governors of the Federal Reserve System, April 30). Return to text

12. Moreover, borrowers unaware of the expiration of the forbearance provision might fall back on payments, which would negatively affect their credit scores if they do not resume payments before becoming 90 days past due, the amount of time when servicers are required to report delinquencies on such loans to credit bureaus. Return to text

Case, Hannah, Simona Hannon, and Alvaro Mezza (2022). "A Note on the Expected Expiration of Federal Student Loan Forbearance," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, May 27, 2022, https://doi.org/10.17016/2380-7172.3090.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.