FEDS Notes

October 22, 2018

Do Marketplace Lending Platforms Offer Lower Rates to Consumers?

Over the past decade, firms using innovative technology--so-called fintech firms--have entered into various financial services markets. One particular set of entrants, marketplace lenders, have entered into consumer lending markets, using nontraditional data- and technology-intensive methods to originate loans to consumers.1 While the definition of marketplace lending has evolved over time, the basic concept has remained the same. These firms tout an easy online application, overall loan convenience, innovative underwriting, and low costs. Two of the largest marketplace lenders, Prosper and Lending Club, are often referred to as peer-to-peer (P2P) lenders, because they have added the innovation of funding loans by investors. Prosper and Lending Club have grown significantly, accounting for almost $9 billion in originations in 2017. Much of the research surrounding marketplace lenders focuses on topics such as technological innovation, big data analyses, two-sided markets, and information gathering.2 However, the potential reduction in loan rates to borrowers remains elusive and has not been well documented. This note analyzes interest rates of loans from the two largest P2P platforms, Lending Club and Prosper, to observe their potential benefits to borrowers.

A proper comparison of loan rates can be challenging, because the appropriate traditional loans, used as a base comparison, are not clearly delineated, and because loan rates vary by consumer characteristics. I argue that credit card loans are the most appropriate traditional loan to compare with the personal unsecured loans originated by Lending Club and Prosper. My analysis focuses on borrowers' credit scores as the most prominent factor that determines loan rates.

Some Research on Fintech Pricing

A nascent literature on fintech lending has broached the topic of loan pricing, but little has been done on the rates of such loans relative to other products controlling for credit risks. For example, Demyanyk and Kolliner (2014) compare Lending Club interest rates to average credit card rates. Using Lending Club internal credit ratings, they find that only the safest borrowers systematically receive lower rates relative to average credit card rates. They also find that higher credit risk borrowers do not systemically receive lower rates. However, their analysis does not account for the distribution of credit risk in credit card markets, because the average credit card rate does not account for credit rating.

The fintech pricing research that controls for risk characteristics either considers other types of credit markets or draws inferences from aggregated data. Buchak, Matvos, Piskorski, and Seru (2017) study fintech pricing in residential lending markets. They find that fintech interest rates are not significantly different from traditional lender rates. De Roure, Pelizzon, and Tasca (2016) compare interest rates between Auxmoney, a German marketplace lender, and traditional German banks. They find that marketplace interest rates are higher than bank loan rates, especially credit card and overdraft interest rates. They use state-level aggregated data in their comparison, so their analysis relies on the similarity of risk distributions. Finally, Mach, Carter, and Slattery (2014) find that rates on P2P-originated small business loans are about two times higher than rates for small business loans from traditional sources. They note that small business P2P borrowers might not qualify for bank loans.

Data

I use interest rate data from three sources. For P2P interest rates, I use loan origination data from the two largest marketplace lenders, Prosper and Lending Club. Data from both platforms provide information on borrower characteristics, including credit history and credit scores.

For credit card interest rates, I use data from Mintel Comperemedia (Mintel), which records interest rates presented in credit card mail offers extended to households. The Mintel data include credit attributes of offer recipients merged from TransUnion. These data measure various characteristics of the offer and the characteristics of the household that received the offer, including the credit score. The Mintel data only report annual percentage rate (APR) for each offer. I only consider credit card offers with no annual fees to improve the validity of interest rate comparisons.

Most borrowers on both P2P platforms state that loans are obtained to consolidate debt. For example, about 77 percent of loans originated on both platforms in 2017 are debt consolidation loans.3 While debt consolidation could arise from various other sources, such as auto or home equity lines, loans from these sources are secured and, hence, considerably different than unsecured credit.

Other information also supports the comparability between credit cards and P2P loans. Borrowers from Prosper and Lending Club have average installment loans that are greater than the average originated loan amount on both platforms. At origination, P2P borrowers hold average installment loan balances of around $35,000, while their average loan amount is about $15,000. Therefore, consumers are unlikely to be paying off their installment loans with P2P loans. P2P borrowers also have, on average, more credit cards and higher credit card utilization rates. Comparing these borrowers to borrowers in the Federal Reserve Bank of New York's Consumer Credit Panel/Equifax (FRBNY CCP), we find that P2P borrowers have, on average, eight bank cards, while FRBNY CCP borrowers have, on average, four bank cards. While not conclusive, this information points to consumers with a higher-than-average number of credit cards and higher revolving balances who are trying to refinance their credit card debt.4

A comparison of interest rates across various credit score products is problematic, because not all lenders use the same credit rating score. I create a crosswalk between the different credit scores by tying bins using these scores to their respective prime and subprime thresholds. 5 I separate the credit scores into 9 bins. Bin 1 is placed just above the subprime threshold and bin 4 starts at the prime threshold for the prospective credit score. The rest of the bins are evenly spaced across the range for each credit score system.6 In other words, bins 1–3 are evenly spaced through near-prime scores and bins 5–9 through prime scores.7

Rate Comparison

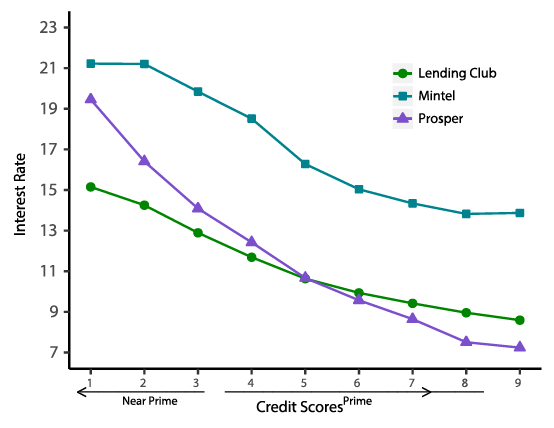

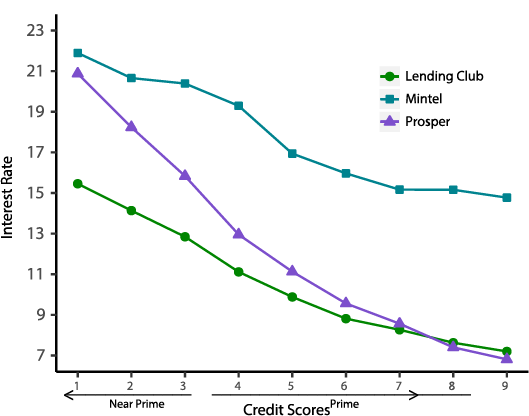

My analysis starts by looking at average interest rates across mapped credit score bins. Figures 1 and 2 show average interest rates for Lending Club and Prosper loans along with average credit card interest rates for households from Mintel for the fourth quarters of 2016 and 2017. Average rates for each platform are calculated for nine credit score bins. Mintel average rates are calculated for similar credit score bins. I consider two quarters to show the stability of loan pricing.

The teal line represents average credit card offer interest rates from Mintel. Lending Club and Prosper average rates are represented by green and purple lines, respectively. Binning the data by credit score, the data indicate that, on average, the rates that borrowers receive are lower than credit card offer rates. For all credit score bins, Lending Club and Prosper average rates are substantially lower than average credit card rates. Relative to Lending Club, Prosper tends to give somewhat higher interest rates on low credit score loans and lower interest rates on higher credit score loans.

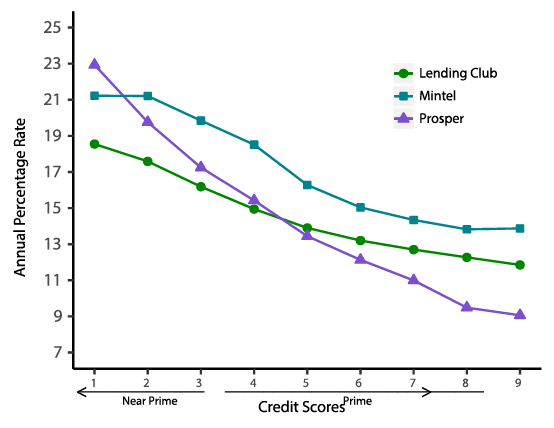

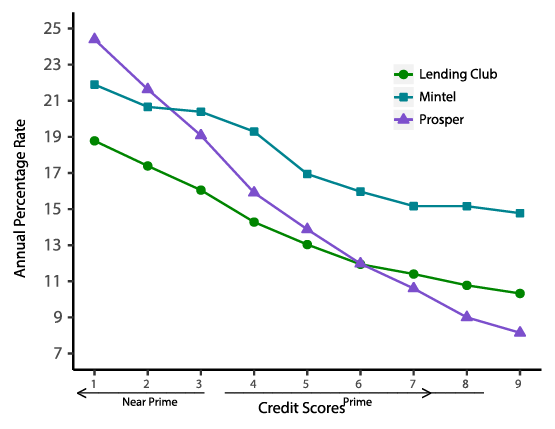

Interest rates do not capture the entire cost of the loan. APR may be a more appropriate measure of the total cost of credit. For most loans, Lending Club and Prosper assess a 5 percent origination fee. The origination fee is substantially lower for the safest borrowers. Figures 3 and 4 compare the APRs for Lending Club and Prosper to credit card interest rates for the fourth quarters of 2016 and 2017.8

The APRs indicate a similar story. As in figures 1 and 2, average APRs for Lending Club loans are lower than credit card rates for all levels of credit scores. Average APRs for Prosper loans are also lower than credit card rates for credit scores above bin 1 in 2016 and above bin 2 in 2017.

The higher average Prosper APR for lower credit score borrowers does not necessarily indicate that these borrowers are paying more for the loan or that the loan is not worthwhile. I am only comparing average rates, so I do not observe the borrower's actual choice set and interest rates.9 For example, high APR Prosper borrowers could be facing high credit card rates. Moreover, these customers may be consolidating debt from accounts that are not general purpose credit cards, such as charge cards or store cards. Borrowers may also be more concerned with cash flow than the overall cost of credit. Even though the APR is higher, monthly payments are reduced by the lower interest rate or the terms of the loan. For example, a closed-end five-year loan can result in a lower monthly payment compared to simply paying the minimum credit card payments.10 Finally, the crosswalk different credit scores is imperfect. Average credit card rates in my analysis may not reflect true averages for given credit score bins.

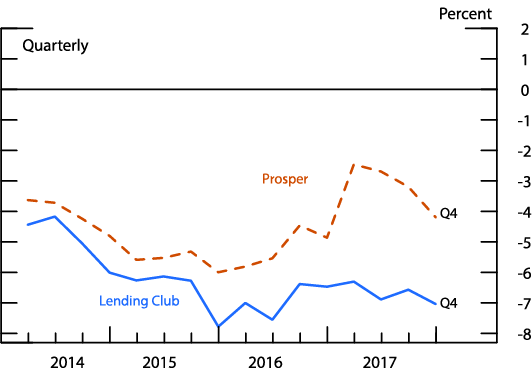

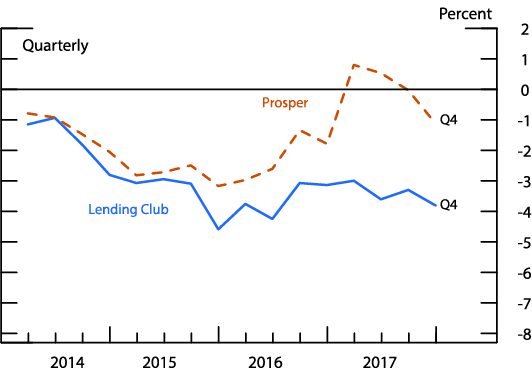

In order to get a better sense of interest rate and APR differences between credit cards and P2Ps over time, I calculate spreads for each loan relative to average credit card offer rates within credit score bins. For every loan originated by Prosper or Lending Club, I calculate a spread by using the credit card rate that matches the same credit score bin as the loan. Average spreads for each platform are calculated for each platform in each quarter. Spreads relative to APR are calculated in the same manner. Figures 5 and 6 show average quarterly interest rates and APR spreads for each platform.

Both figures show that average spreads relative to Mintel offer rates have been considerable and consistently negative over time. For Lending Club, average interest rate and APR spreads ranged from around negative 400 to negative 800 basis points and from around negative 100 to negative 450 basis points, respectively, over the past couple of years. For Prosper, average interest rate and APR spreads ranged from around negative 250 to over negative 600 basis points and from around 100 to negative 300 basis points, respectively, over the past couple of years.

Conclusion and Discussion

This note provides evidence that credit card borrowers may receive potentially significant interest rate reductions as a result of obtaining loans from online P2P platforms. Relative to credit card rates, I find considerable interest rate and APR savings from debt consolidation through P2P lenders.

Research on credit cards has explored why interest rates in credit card markets tend to be more rigid than in other lending markets. Research from Ausubel (1991), Calem and Mester (1996), and Stango (2000) consider the question of why credit card interest rates are rigid. Ausubel (1992) attributes rate rigidity to consumers not properly considering the probability that they will pay interest on their balances. Calem and Mester (1996) find search and switching costs as well as adverse selection as sources of rate rigidity. Stango (2000) points to quality competition, where consumers are less sensitive to interest rates.

More recent studies discuss changes in credit card pricing. Furletti (2003) details the evolution of credit card pricing from 1986 through 2001. He finds that credit card pricing became more complex and risk-based, moving from a single interest rate for all cards to risk-based interest rates with various fees. The prevalence of annual fees fell substantially over this time period.11

These studies all give some potential explanations as to why credit card interest rates have not adjusted to entries by P2P lenders. Ultimately, this question should focus on the degree of competition between online platforms and credit cards. Even though borrowers seem to be switching from credit cards to P2P loans, the anecdotal evidence presented in this note indicates that competition is muted. P2P lenders appear to be able to take advantage of rate rigidities to attract customers, but rate spreads need to be large enough to get borrowers to switch. More substantive evidence needs to be collected in order to conclusively determine the degree of substitution and competition.

References

Agarwal, Sumit, Souphala Chomsisengphet, Neale Mahoney, and Johannes Stroebel (2015). "Regulating Consumer Financial Products: Evidence from Credit Cards," Quarterly Journal of Economics, vol. 130 (February), pp. 111–64.

Ausubel, Lawrence M. (1991). "The Failure of Competition in the Credit Card Market," American Economic Review, vol. 81 (March), pp. 50–81.

Buchak, Greg, Gregor Matvos, Tomasz Piskorski, and Amit Seru (2017). "Fintech, Regulatory Arbitrage, and the Rise of Shadow Banks," Stanford Graduate School of Business Working Paper No. 3511. Stanford, Calif.: Stanford GSB, March.

Calem, Paul S., and Loretta J. Mester (1995). "Consumer Behavior and the Stickiness of Credit-Card Interest Rates," American Economic Review, vol. 85 (December), pp. 1327–36.

de Roure, Calebe, Loriana Pelizzon, and Paolo Tasca (2016). "How Does P2P Lending Fit into the Consumer Credit Market?" Deutsche Bundesbank Discussion Paper No. 30/2016. Frankfurt: Deutsche Bundesbank, August, https://www.bundesbank.de/Redaktion/EN/Downloads/Publications/Discussion_Paper_1/2016/2016_08_12_dkp_30.pdf%3F__blob%3DpublicationFile.

Demyanyk, Yuliya, and Daniel Kolliner (2014). "Peer-to-Peer Lending Is Poised to Grow," Economic Trends. Cleveland: Federal Reserve Bank of Cleveland, August, https://www.clevelandfed.org/newsroom-and-events/publications/economic-trends/2014-economic-trends/et-20140814-peer-to-peer-lending-is-poised-to-grow.aspx.

Elliehausen, Gregory, and Simona M. Hannon (2017). "The Credit Card Act and Consumer Finance Company Lending" Finance and Economics Discussion Series 2017-072. Washington: Board of Governors of the Federal Reserve System, June, https://doi.org/10.17016/FEDS.2017.072.

Furletti, Mark (2003). "Credit Card Pricing Developments and Their Disclosure," Payment Cards Center Discussion Paper. Philadelphia: Federal Reserve Bank of Philadelphia, January, https://www.philadelphiafed.org/-/media/consumer-finance-institute/payment-cards-center/publications/discussion-papers/2003/creditcardpricing_012003.pdf?la=en.

Jagtiani, Julapa, and Catharine Lemieux (2017). "Fintech Lending: Financial Inclusion, Risk Pricing, and Alternative Information," Working Paper No. 17-17. Philadelphia: Federal Reserve Bank of Philadelphia, July, https://www.philadelphiafed.org/-/media/research-and-data/publications/working-papers/2017/wp17-17.pdf.

Mach, Traci L., Courtney M. Carter, and Cailin R. Slattery (2014). "Peer-to-Peer Lending to Small Businesses," Finance and Economics Discussion Series 2014-10. Washington: Board of Governors of the Federal Reserve System, January, https://www.federalreserve.gov/pubs/feds/2014/201410/201410pap.pdf.

Stango, Victor (2000). "Competition and Pricing in the Credit Card Market," Review of Economics and Statistics, vol. 82 (August), pp. 499–508.

U.S. Department of the Treasury (2016). "Opportunities and Challenges in Online Marketplace Lending," white paper. Washington: Treasury Department, May, https://www.treasury.gov/connect/blog/Documents/Opportunities_and_Challenges_in_Online_Marketplace_Lending_white_paper.pdf.

1. In a broader sense, fintech firms are active in wealth management, payments, small business lending, and many other financial markets. Return to text

2. See, for example, U.S. Department of the Treasury (2016). Return to text

3. Lending Club and Prosper loan data report the purpose of the loans. Debt consolidation loans are reported as either debt consolidation or credit card loans. Return to text

4. Consumers could be refinancing auto, education, and mortgage debt, but this seems unlikely because rates for these products are secured loans or have government guarantees generally much lower than credit card rates and, hence, lower than marketplace loan rates. On a side note, commercial banks also provide unsecured personal loans. Detailed data from commercial banks are not available. However, as of September 2017, 33 of the top 100 banks advertise unsecured personal loans on their websites. Seventeen of these institutions advertise fast loan approval. The average minimum advertised interest rate for the safest borrowers is 8.44 percent. Only 5 of these commercial banks offer best rates of 6 percent of lower, comparable to the best rates from Lending Club or Prosper. Return to text

5. The Lending Club internal credit rating ranges from A to G with 5 subcategories (a total of 35 credit ratings). Prosper internal credit rating has 6 ratings. Rates and fees vary over the credit ratings, sometimes significantly. Return to text

6. Lending Club does not offer loans to subprime borrowers. I do not include Prosper loans with subprime credit scores. Return to text

7. Credit card rates from confidential regulatory data are comparable using the same credit scores. Return to text

8. The Prosper data include the APR of each loan. Lending Club APRs are approximated assuming that all loans are assessed a 5 percent origination fee (only the high credit score borrower APR is overstated in this case). Return to text

9. The same is true when comparing rates across both platforms. Return to text

10. Credit card companies have varying formulas for calculating the monthly minimum. Many institutions simply use 2 percent of outstanding balances. With this formula, payoff periods tend to be much longer and monthly payments higher. Return to text

11. Other more recent papers point to interest rate rigidities. Agarwal et al. (2015) find the regulatory limits on credit card fees from the 2009 Credit Card Accountability Responsibility and Disclosure (CARD) Act did not result in offsetting increases in interest charges. Elliehausen and Hannon (2017) note that CARD Act restrictions on risk-based pricing resulted in a significant reduction of credit cards for high-risk customers. Return to text

Adams, Robert (2018). "Do Marketplace Lending Platforms Offer Lower Rates to Consumers?," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, October 22, 2018, https://doi.org/10.17016/2380-7172.2268.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.