FEDS Notes

January 28, 2022

Foreign Demand for U.S. Treasury Securities during the Pandemic1

Foreign investors hold a sizable amount of U.S. Treasury securities—$7.5 trillion or about 35 percent of the total outstanding—so net purchases by foreign investors receive significant attention from a variety of sources, including academic researchers, finance professionals, and journalists. During the pandemic, foreign demand for U.S. Treasury securities has received scrutiny for a variety of reasons, including the contribution of foreign investors to the massive selloff in March 2020 (Duffie, 2020; Vissing-Jorgensen, forthcoming) and the ability of foreign investors to absorb additional Treasury securities as the Federal Reserve prepares to taper its asset purchases (Duguid and Rennison, 2021). More broadly, some have raised the question of whether the large sales of U.S. Treasury securities at the onset of the pandemic are an early warning sign of a loss of safe-haven status for U.S. Treasury securities (He and Krishnamurthy, 2020).

This note reviews monthly net purchases of Treasury securities by foreign investors since March 2020 using data from the Treasury International Capital (TIC) system—the most reliable estimates of foreign investor flows—and finds little evidence of a persistent change in the pattern of foreign purchases (outside of the selloff in spring 2020) relative to the years before the pandemic.2 I compare the COVID-19 crisis to an expanded set of financial stress episodes—including the Global Financial Crisis (GFC)—and find that where differences in the pattern of foreign Treasury purchases emerge, they largely reflect the global nature and severity of the COVID-19 shock.3 As a result, there is little evidence to suggest that U.S. Treasury securities have lost their safe-haven status among foreign investors.

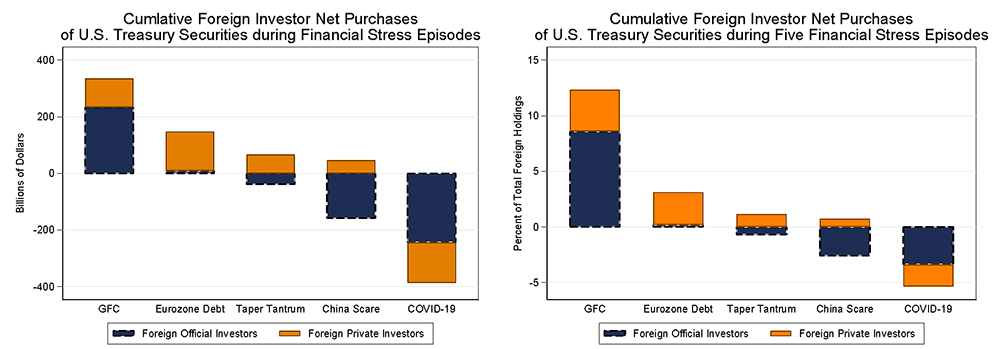

Foreign investor sales of U.S. Treasury securities during financial stress are not unique to COVID-19

Foreign investors—both official (governments, central banks, and sovereign wealth funds) and private-sector investors—were significant contributors to the broad selloff in U.S. Treasury securities in March 2020 with $417 billion of net sales, a marked contrast to foreign investors' net buying at the peak of the GFC.4 However, comparing cumulative foreign net purchases over the three peak months of the COVID-19 financial turmoil (March through May 2020) to the same for an expanded set of financial stress episodes—the European debt crisis in 2011, the taper tantrum in 2013, and the China scare in 2015—figure 1 shows some similarities across crises.5 First, while the magnitude of sales in 2020 was unprecedented, the COVID-19 crisis was not the first stress episode to feature net sales by foreign investors. Net sales by foreign official investors are particularly common, especially in stress episodes with more direct effects on emerging market economies (EMEs). In fact, the GFC is the only episode that features large net purchases by foreign official investors, and I discuss reasons for these purchases below. Finally, given China's large holdings of U.S. Treasury securities, it is likely no coincidence that the largest sales of U.S. Treasury securities by foreign official investors have come during the two crises that directly affected China (the China scare and COVID-19).6

Note: GFC months are September-November 2008, Eurozone Debt crisis months are August-October 2011, Taper Tantrum months are June-August 2013, China Scare months are July-September 2015, COVID-19 crisis months are March-May 2020.

Source: Staff estimates using Treasury International Capital data

The nature of the COVID-19 crisis prompted sales by official investors

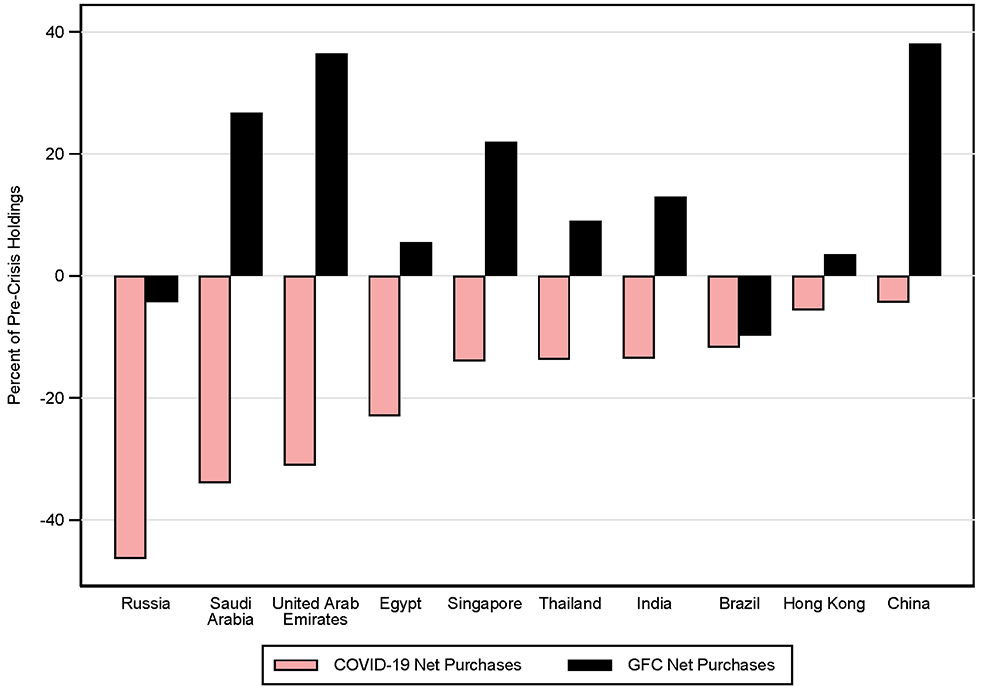

The different nature of the COVID-19 shock compared to the height of the GFC can be seen by comparing net purchases of U.S. Treasury securities by EMEs across the two crises, as is done in figure 2. The figure plots net purchases of U.S. Treasury securities (as a percent of pre-crisis holdings) during March and April 2020 for the top 10 EME net sellers next to their net purchases of U.S. Treasury securities at the peak of the GFC (September through November 2008, purchases again measured as a percent of pre-crisis holdings). Table 1 lists their net purchases during these two periods in dollar amounts, with these 10 EMEs selling $240 billion of Treasury securities, on net, in March and April 2020 (EMEs as a whole sold $283 billion during these months). While these figures include net purchases by both foreign private and foreign official investors, the vast majority of these net purchases are likely by foreign official investors.7 Eight of the 10 largest EME net sellers in March and April 2020 actually purchased U.S. Treasury securities, on net, during the GFC, and their combined net purchases account for nearly three-fourths of net purchases from September to November 2008.

Notes: COVID-19 months are March and April 2020; GFC months are September-November 2008.

Table 1: Major EME Sellers of U.S. Treasury Securities, Spring 2020

| Country | COVID-19 Net Purchases | GFC Net Purchases |

|---|---|---|

| (Billions of $) | (Billions of $) | |

| Saudi Arabia | -62.59 | 13.38 |

| China | -47.75 | 220.6 |

| Brazil | -33.23 | -15.08 |

| India | -24 | 2.71 |

| Singapore | -23.09 | 7.1 |

| Hong Kong | -15.13 | 2.55 |

| Thailand | -12.54 | 2.72 |

| United Arab Emirates | -11.58 | 7.12 |

| Russia | -5.84 | -4.83 |

| Egypt | -5.6 | 0.74 |

Among these eight sellers, two distinct groups stand out: Middle East oil exporters (Saudi Arabia, United Arab Emirates, Egypt) and east Asian countries (China, Hong Kong, Singapore, Thailand). The former group of countries benefitted from historically high oil prices in the run-up to the GFC that created large current account surpluses. By contrast, oil exporters suffered in spring 2020, as oil prices collapsed to levels not reached in nearly 20 years and current account surpluses were significantly smaller heading into the COVID-19 crisis compared to the GFC. Additionally, other Middle East oil exporters like Kuwait, Oman, and Qatar also purchased U.S. Treasury securities during the GFC but sold in spring 2020. While the east Asian countries avoided severe financial stress during the GFC through the then-limited exposure to securitized products and bank loans—the epicenter of stress—their increased exposure to U.S. dollar funding markets over the past decade and extreme uncertainty surrounding the severity of the COVID-19 shock likely necessitated sales of U.S. Treasury securities, if even just to hold precautionary dollar liquidity (Goldstein and Xie, 2009; EMEAP, 2020).

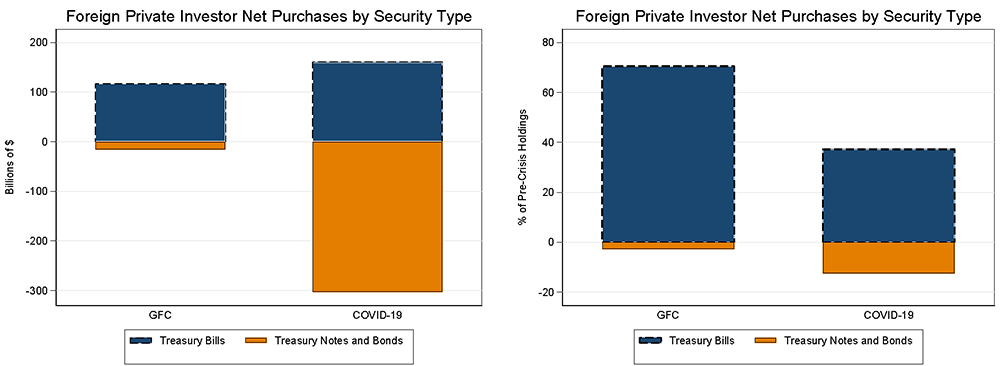

Foreign private investors only sold longer-term U.S. Treasury securities during dash for cash

The net sales by foreign private investors in March and April 2020 likely also reflected the extreme severity of the COVID-19 crisis, which created a strong demand for very liquid assets (the so-called "dash for cash") rather than a loss of safe-haven status for U.S. Treasury securities. Indeed, the turmoil in U.S. Treasury markets was generally concentrated in longer-term Treasury notes and bonds (He, Nagel, and Song, forthcoming). Consistent with this argument, figure 3 shows that foreign private investors continued purchasing U.S. Treasury bills in spring 2020 but sold very large amounts of U.S. Treasury notes and bonds at the same time. Figure 3 also shows that this pattern is not unique to the COVID-19 crisis, as foreign private investors also sold U.S. Treasury notes and bonds at the height of the GFC while purchasing U.S. Treasury bills. The reasons why foreign sales of U.S. Treasury notes and bonds were so much larger during the COVID-19 crisis are explored in-depth in Vissing-Jorgensen (forthcoming) and Board of Governors (2021). In short, two prominent reasons for the large sales are the unwind of the Treasury basis trade by hedge funds (including foreign-domiciled funds) and the sudden, massive investor outflows from mutual funds that caused these funds to sell their most liquid assets, U.S. Treasury securities, to meet these redemptions.8

Notes: GFC months are September-November 2008; COVID-19 months are March-April 2020.

Source: Staff estimates using Treasury International Capital data

Foreign purchases promptly resumed after the easing of financial strains

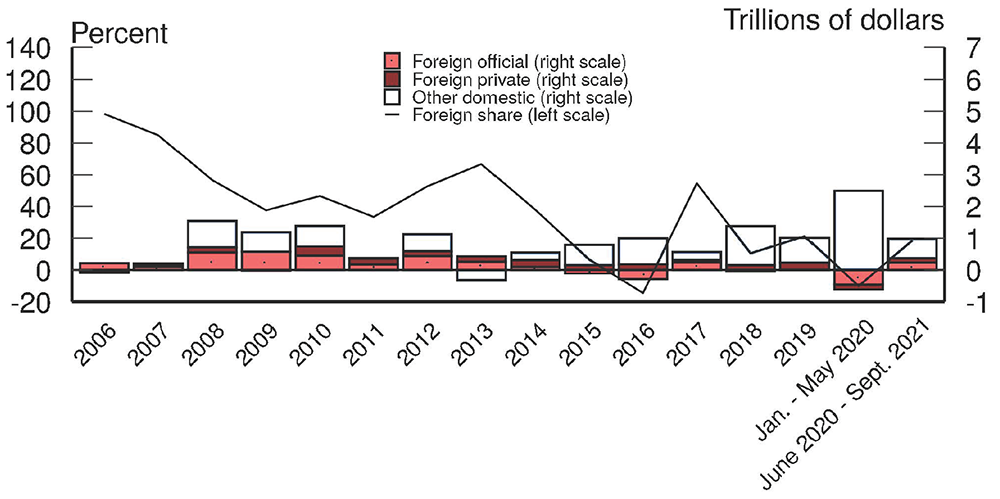

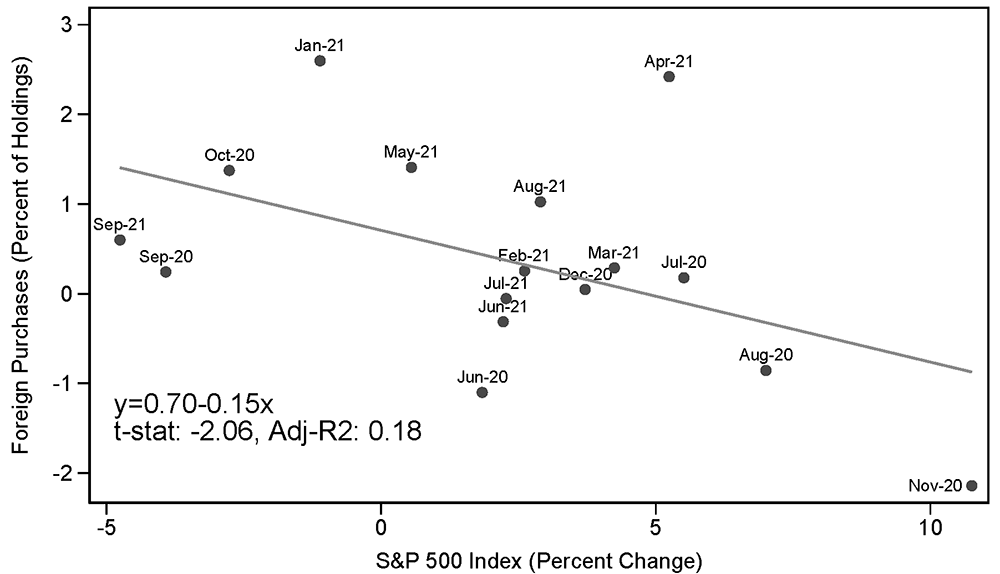

The massive foreign sales of U.S. Treasury securities proved temporary, as net foreign purchases resumed in the second half of 2020 and continued into 2021, as shown by the red bars in figure 4. About 65 percent of foreign net purchases since June 2020 have gone to foreign official investors. Foreign official purchases since June 2020 reflect the rebuilding of foreign exchange reserves following the large drawdown in March and April 2020, with the depreciation of the U.S. dollar during the second half of 2020 likely adding further incentive for EMEs to accumulate foreign exchange reserves and lean against appreciation of their currencies. Foreign private purchases have picked up following the increase in long-term interest rates in the U.S. in early 2021, accounting for around 60 percent of foreign net purchases in 2021, with U.S. Treasury securities a relatively attractive investment on a currency-hedged basis. At the same time, monthly foreign private purchases of U.S. Treasury notes and bonds have displayed a negative correlation with gains in the S&P 500 index since spring 2020, as shown in figure 5, consistent with their continued role as a "negative beta" or safe-haven asset for foreign investors.9

Source: Staff estimates using data from Treasury International Capital and the Department of the Treasury.

Figure 5. Foreign Private Investor Purchases of U.S. Treasury Notes and Bonds and Stock Market Values

Notes: Figure plots monthly foreign private investor purchases of U.S. Treasury notes and bonds (as a percent of previous month’s holdings) against the percent change in the S&P 500 index from the previous month’s value.

Source: Staff estimates using Treasury International Capital data and Bloomberg

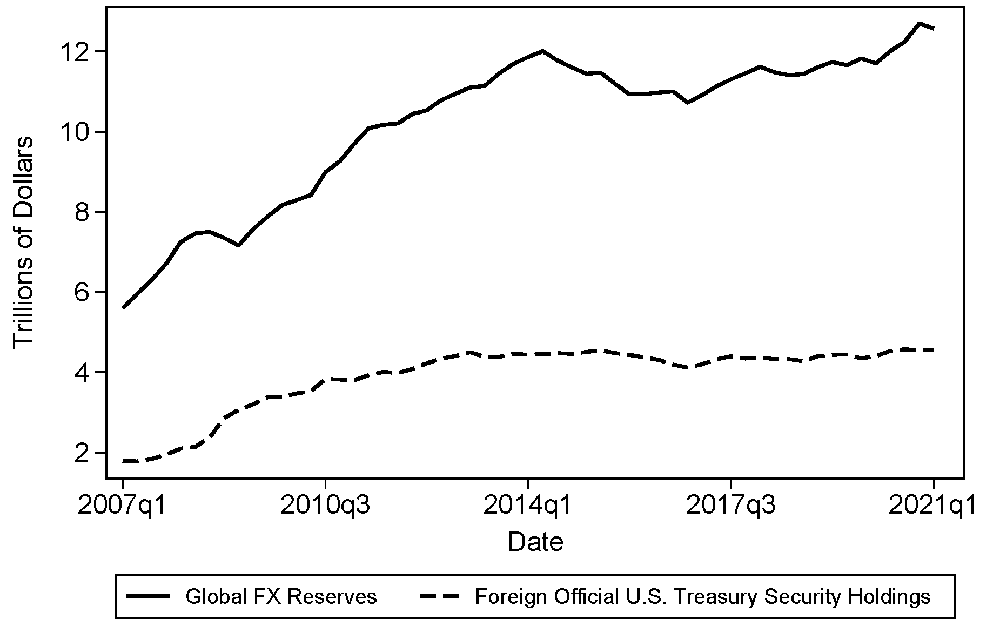

Further evidence that foreign demand for U.S. Treasury securities has returned to its pre-COVID trend can be seen in the share of Treasury net issuance absorbed by foreign investors (the black line in figure 4). In the five years before the pandemic, foreign investors absorbed around 15 percent of Treasury net issuance on average. Since June 2020, foreign investors have again absorbed a similar amount. While the share absorbed by foreign investors has fallen in recent years when compared to the period following the GFC, this is not the result of a major shift by foreign investors away from U.S. Treasury securities toward other assets. Instead, it coincides with a leveling off in foreign official holdings of U.S. Treasury securities that is mirrored by a plateau in global foreign exchange reserves, as seen in figure 6. Notably, the U.S. dollar share of foreign exchange reserves has remained around 60 percent during this time, suggesting no loss of prestige for U.S. Treasury securities, a point echoed for the U.S. dollar more broadly in Bertaut, von Beschwitz, and Curcuru (2021).

Source: Staff estimates using Treasury International Capital data and IMF COFER

References

Bertaut, Carol, Bastian von Beschwitz, and Stephanie Curcuru (2021). "The International Role of the U.S. Dollar," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, October 6, https://doi.org/10.17016/2380-7172.2998.

Bertaut, Carol, and Ruth Judson (2014). "Estimating U.S. Cross-Border Securities Positions: New Data and New Methods," International Finance Discussion Papers 1113. Washington: Board of Governors of the Federal Reserve System, August, https://www.federalreserve.gov/econres/ifdp/estimating-us-cross-border-securities-positions-new-data-and-new-methods.htm.

Bloomberg Finance LP. Bloomberg Terminals (Open, Anywhere, and Disaster Recovery Licenses).

Board of Governors of the Federal Reserve System (2021). Financial Stability Report. Washington: Board of Governors, November, https://www.federalreserve.gov/publications/files/financial-stability-report-20211108.pdf.

Duffie, Darrell. (2020). "Still the World's Safe Haven? Redesigning the U.S. Treasury Market after the COVID-19 Crisis," Hutchins Center Working Paper #62. Washington: Brookings Institute, June, https://www.brookings.edu/research/still-the-worlds-safe-haven.

Duguid, Kate, and Joe Rennison (2021). "Foreign Investors Help Prop up Treasury Market as Fed Prepares Retreat," Financial Times, September 21.

Executives' Meeting of East Asia-Pacific Central Banks (2020). "Study on U.S. Dollar Liquidity and Funding Dynamics in the EMEAP Region," EMEAP Working Group on Financial Markets.

Goldstein, Morris, and Daniel Xie (2009). "The Impact of the Financial Crisis on Emerging Asia," Working Paper 09-11. Washington: Peterson Institute for International Economics, November.

He, Zhiguo, and Arvind Krishnamurthy (2020). "Are U.S. Treasury Bonds Still a Safe Haven?" NBER Reporter No. 3 (October). Cambridge, Mass.: National Bureau of Economic Research, https://www.nber.org/reporter/2020number3/are-us-treasury-bonds-still-safe-haven.

He, Zhiguo, Stefan Nagel, and Zhaogang Song (forthcoming). "Treasury Inconvenience Yields during the COVID-19 Crisis," Journal of Financial Economics.

Tabova, Alexandra, and Francis Warnock (2021). "Foreign Investors and U.S. Treasuries," NBER Working Paper No. 29313. Cambridge, Mass.: National Bureau of Economic Research, September, https://www.nber.org/papers/w29313.

U.S. Dept. of the Treasury. Treasury International Capital (TIC) Data, https://www.treasury.gov/resource-center/data-chart-center/tic/Pages/ticsec.aspx.

Vissing-Jorgensen, Annette (forthcoming). "The Treasury Market in Spring 2020 and the Response of the Federal Reserve," Journal of Monetary Economics.

1. I thank Daniel Beltran, Carol Bertaut, Alexandra Tabova, and Jason Wu for helpful comments and suggestions. Return to text

2. The TIC data inform the official quarterly balance of payments statistics published by the Bureau of Economic Analysis. The estimated flows are essentially constructed using changes in foreign holdings of U.S. Treasury securities adjusted for valuation effects as discussed in Bertaut and Judson (2014). Tabova and Warnock (2021) assess the different sources available for measuring foreign transactions in U.S. Treasury securities and support the use of holdings-based estimates of flows. Return to text

3. He, Nagel, and Song (forthcoming) and Vissing-Jorgensen (forthcoming) are examples of research comparing COVID-19 to the GFC in U.S. Treasury markets. Vissing-Jorgensen (forthcoming) similarly argues for the unique nature of the COVID-19 shock. Return to text

4. The specific drivers of foreign selling in spring 2020 are covered in detail in Vissing-Jorgensen (forthcoming) and the box "The Role of Foreign Investors in the March 2020 Turmoil in the U.S. Treasury Market" in Board of Governors (2021), so I do not cover this issue in detail here. Return to text

5. The peak months of the GFC are September through November 2008, beginning with the Lehman Brothers crisis. The peak months of the European debt crisis are August through October 2011, coinciding with the credit ratings downgrade for several sovereign states in the euro area. The peak months of the taper tantrum are June through August 2013 and follow the announcement in Congressional testimony by Federal Reserve Chair Ben Bernanke on May 22, 2013, regarding plans for tapering of the Federal Reserve's asset purchases at some future date. The peak months of the China scare are July through September 2015 and correspond with the fallout from the crash in Chinese stock markets beginning in late June. Return to text

6. While China's sales in 2020 were not particularly large as a share of its holdings, in dollar amounts they were quite large given the size of China's foreign exchange reserve holdings. Return to text

7. Vissing-Jorgensen (forthcoming) discusses economic reasons why demand for U.S. Treasury securities by foreign official investors differed across the two crises, suggesting that the scale of liquidity needs was much larger in spring 2020 and showing that U.S. Treasury securities had a much larger weight in foreign official investor portfolios before COVID-19 relative to before the GFC. Finally, there was a stronger preference for cash relative to U.S. Treasury bills during COVID-19, as foreign official investors purchased more currencies and deposits in spring 2020 relative to the GFC. Return to text

8. See Vissing-Jorgensen (forthcoming) for an explanation of the basis trade. These channels were much less important during the GFC because the Treasury basis trade grew in popularity starting in 2018 and mutual funds' holdings of U.S. Treasury securities have increased significantly since the GFC (Vissing-Jorgensen, forthcoming). Return to text

9. He, Nagel, and Song (forthcoming) note the negative beta property of long-term U.S. Treasury securities as the negative correlation of their prices with equity prices in the decades leading up to the COVID-19 crisis. Between 2011 and 2019, foreign private investor purchases of U.S. Treasury notes and bonds were also negatively correlated with changes in the S&P 500 index. Return to text

Weiss, Colin R. (2022). "Foreign Demand for U.S. Treasury Securities during the Pandemic," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, January 28, 2022, https://doi.org/10.17016/2380-7172.3046.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.