FEDS Notes

February 03, 2022

How global risk perceptions affect economic growth

Jón Daníelsson, Marcela Valenzuela, and Ilknur Zer1

The global crisis in 2008 reminded us of the importance of the financial sector for the macroeconomy, a lesson many had forgotten in the decades after the previous global crisis, the Great Depression. Financial risk matters. It is necessary for investment and growth, while also driving uncertainty, inefficiency, recessions, and crises.

Our interest here is in how financial risk affects economic growth, casting light on the power of monetary policy to stimulate growth, the ability of macroprudential policies to tame systemic risk, and the relative importance of the United States in driving global risk perceptions.

The relationship between financial risk and growth might seem straightforward. High risk is certainly detrimental to growth (see e.g., Ahir et al., 2019, Bloom, 2009). That leaves the question of how low risk affects growth.

We ask that very question in Danielsson, Valenzuela, and Zer (2021), where we propose a new theoretical and empirical framework for analyzing how risk interacts with the macroeconomy. We conjecture that the strength of agents' beliefs in the accuracy of their risk estimates is of key importance, driving investment decisions, capital flows, ultimately affecting future instability and growth.

How low risk affects growth

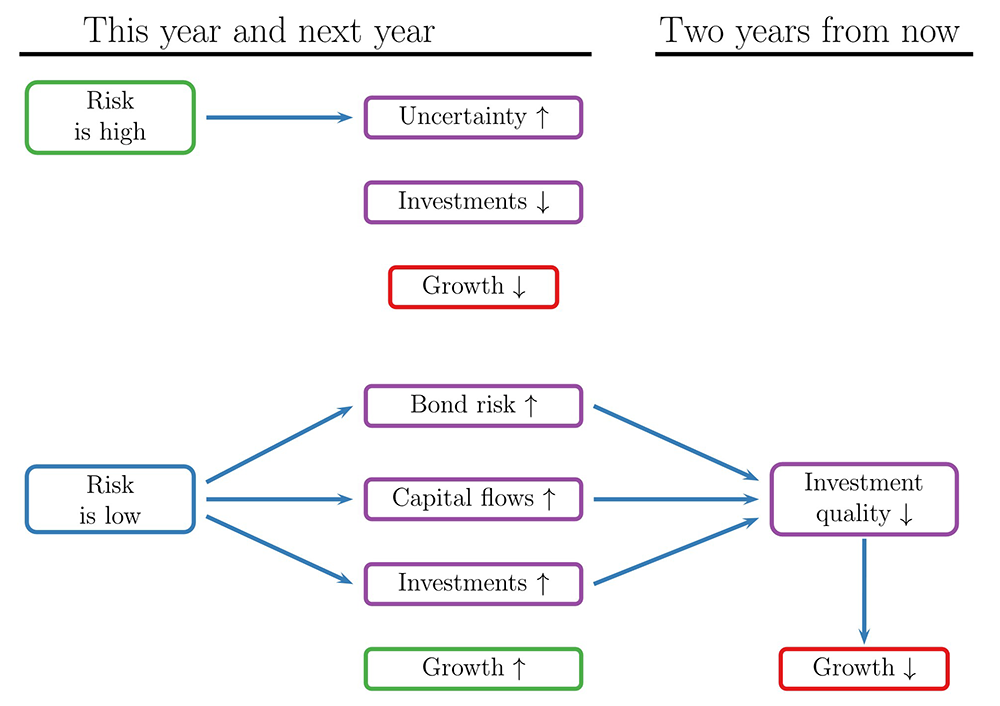

We find that the impact of low risk on the macroeconomy is very different from high risk. When economic agents perceive risk to be high, economic growth declines, while perceptions of low risk have a boom-to-bust effect: Initially positive but eventually turning negative.

The reason for the asymmetric impact of low vs. high risk has its roots in the inability to directly measure risk and the evolution of financial leverage. Risk is a latent variable, we can't directly measure it, having to use a model to infer risk from market prices.

What that means in practice is that a low-risk reading does not necessarily mean that risk is actually low. Instead, agents need repeated observations of low risk to adjust their beliefs and alter their investment decisions.

Formally, the agents have a posterior belief in the accuracy of their risk measurements, and that posterior belief is key to understanding their investment behavior. In our empirical investigation, we propose a proxy of the posterior belief — duration of low risk (DLR).

A firm belief in risk being low boosts optimism, increases agents' appetite for risk, thus driving investment. Moreover, asset prices increase in such tranquil periods (Danielsson, Shin, Zigrand 2009, Brunnermeier and Pedersen, 2009). Hence, beliefs, financial frictions, and risk-taking incentives interact: Willingness to take on more risk, increased asset prices, and easier credit conditions all drive growth — the boom in the boom-to-bust cycle.

Over time, as low risk persists, the supply of good investments falls, and the riskiness of investments increases, rendering the financial system increasingly fragile. A chain of events consistent with Minsky's dictum, "stability is destabilizing", laying the seed for a reversal — the bust in the boom-to-bust cycle.

Even then, the overall impact of perceptions of low risk on growth is positive, except when credit growth has been particularly high and/or the low-risk environment has persisted for a time. That is exactly the result we see during the global crisis in 2008, excessive credit growth coupled with robust risk appetite fueled a boom-to-bust cycle that culminated in 2008.

The global environment is particularly important. Perceptions of low global risk, global DLR, have more than twice the impact of local risk on growth. Here the United States is dominant, in line with extent results on the global nexus, accounting for about two-thirds of global risk perceptions.

The impact of global DLR on growth is achieved via three main channels: Investments, capital flows, and the riskiness of bond issuance, all of which show the same boom-to-bust response to global low risk as growth, whereas local risk has only a negligible effect.

We show the mechanism for how low and high risk affects growth in Figure 1 below.

Our theoretical and empirical approach

Our starting point is a model of financial volatility, where a Markov switching process governs high or low volatility states. While the risk state is latent, the agents can obtain a signal of it, and by using a Bayesian learning model, construct a posterior belief of risk really being low. It is that posterior belief which drives their appetite for risk.

While we don't observe the posterior, we can construct a sufficient proxy for it DLR, which increases with the number of years a country stays in a low volatility environment, at a decreasing rate.

We construct DLR by estimating annual realized volatility, calculating its trend, and using the deviation from trend to identify the volatility state — high or low — which then feeds into the calculation of DLR.

In order to estimate the relationship between risk perceptions and growth, we assembled a large panel of 73 countries spanning 1900 to 2016, with an average of 55 years of observations per country. We then calculate the annual realized volatility using 12 monthly real stock returns for each country and use deviations from a one-sided trend filter to construct the DLR. After obtaining the DLR estimates, we calculate the global DLR as the GDP weighted average across all countries with data in a particular year.

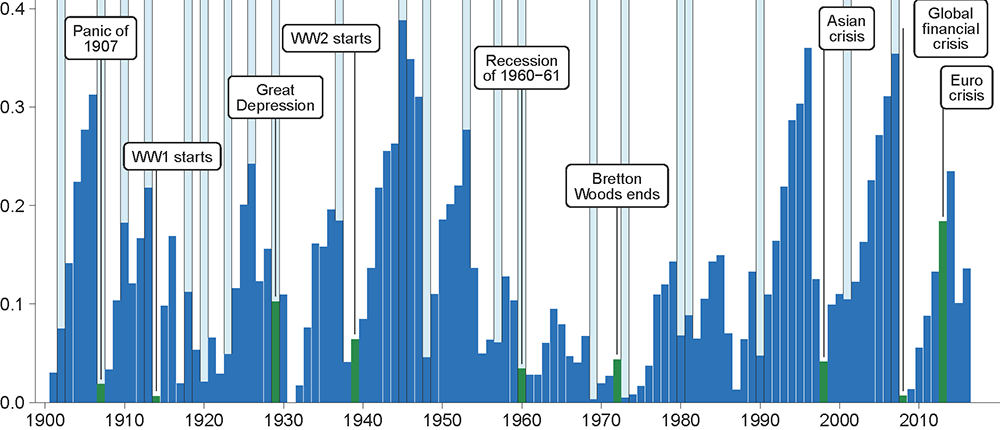

We show the global DLR in Figure 2.

Note: The global duration of low risk (G-DLR) is calculated as the gross domestic product-weighted average of country specific DLRs. DLR considers the consecutive number of years in which stock market volatility remains low for a country with decaying weights. NBER recession dates are highlighted and relevant economic events are marked in the figure.

Source: Global Financial Data, https://www.globalfinancialdata.com/gfdplatform/login.aspx.

We examine the effects of DLR on growth contemporaneously and up to five years into the future, with impulse response functions obtained from Jordà's (2005) local projection method.

DLR has a positive impact on growth contemporaneously and especially the year after, followed by a reversal in year two. The impact of global DLR on growth is much stronger than local DLR.

Finally, global DLR has a similar boom-to-bust impact on capital flows, aggregate investment, and bond market debt-issuer quality.

The main findings are robust to a range of alternative specifications and parameterizations and when the endogeneity concerned are alleviated.

Wider implications

Taken together, our results have a direct impact on several important policy debates.

Start with the importance of global risk. National policymakers concerned with growth are constrained by global financial cycles, captured by global DLR. Thus, there are limits to monetary policy independence. Even if a domestic monetary authority intends to stimulate or cool down the economy, global risk perceptions and how they drive risk-taking may override domestic monetary policy decisions.

Furthermore, after the crisis of 2008, policymakers, justifiably intent on preventing a repeat, have been actively aiming to reduce the amount of risk financial institutions can take — de-risking the financial system. While such de-risking promises to reduce the likelihood of costly crises, it also affects growth, pointing to the importance of policymakers considering the joint impact of macroprudential policies and risk perceptions on the likelihood of crises and growth.

There is a further lesson for financial authorities, as our results suggest that agents base their investment decisions on their risk perceptions, which are formed by past market outcomes. As the policy authorities cannot change such risk perceptions, they may find their attempts to stimulate or cool the economy down futile if the agents' risk perceptions point them towards different investment decisions than those desired by the authorities.

Conclusion

We investigate the relationship between financial risk and economic growth in Danielsson, Valenzuela and Zer (2021), with a focus on global risk.

We find that the global risk environment is twice as important as the local risk environment.

While perceptions of high global risk unambiguously reduce growth, the impact of low risk is more subtle, starting out as positive but then turning negative. Even then, the overall impact is positive.

The two exceptions are very long-lasting periods of low-risk periods and excessive credit growth, providing support for financial vulnerability driven economic contractions.

Furthermore, even though U.S. risk has a powerful impact on global growth, the aggregate global volatility environment exerts a much stronger impact than the US by itself.

Taken together, our results shed new light on how financial markets and the macroeconomy are related, with particular implications for policy areas such as macro-prudential regulations and monetary policy.

Bibliography

Hites Ahir, Nicholas Bloom, Davide Furceri, 11 May 2019, "The global economy hit by higher uncertainty ", https://voxeu.org/article/global-economy-hit-higher-uncertainty.

Bloom, Nicholas. "The impact of uncertainty shocks." Econometrica 77, no. 3 (2009): 623-685.

Brunnermeier, M. K. and L. H. Pedersen (2009). Market liquidity and funding liquidity. The Review of Financial Studies 22 (6), 2201–2238.

Jon Danielsson, Hyun Song Shin, Jean-Pierre Zigrand 11 March 2009, "Modelling financial turmoil through endogenous risk" https://voxeu.org/article/modelling-financial-turmoil-through-endogenous-risk.

Daníelsson, Jón and Valenzuela, Marcela and Zer, Ilknur, 2021, The impact of financial risk cycles on business cycles: a historical view https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3706143

Hodrick, R. and C. E. Prescott (1997). "Postwar US business cycles: an empirical investigation", Journal of Money Credit & Banking 29, 1–16.

Òscar Jordà. (2005). Estimation and inference of impulse responses by local projections. American economic review 95(1), 161–182.

1. The views in this column are solely those of the authors and should not be interpreted as reflecting the views of the Board of Governors of the Federal Reserve System or of any other person associated with the Federal Reserve System. Jón Daníelsson thanks Economic and Social Research Council (UK) [grant number ES/K002309/1] and the Engineering and Physical Sciences Research Council (UK) [grant number EP/P031730/1] for their support. Marcela Valenzuela thanks Fondecyt Project Nº 1190477 and Instituto Milenio ICM IS130002. Return to text

Danielsson, Jon, Marcela Valenzuela, and Ilknur Zer (2022). "How global risk perceptions affect economic growth ," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, February 03, 2022, https://doi.org/10.17016/2380-7172.3054.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.