FEDS Notes

October 15, 2021

Lessons from the History of the U.S. Regulatory Perimeter

Alexandros Vardoulakis, Asad Kudiya, Byoung Hwa Hwang, Courtney Demartini, Dan McGonegle, Gavin Smith, Jess Cheng, Katherine E. Di Lucido, Kathy Wilson, Jeffery Y. Zhang, Joseph Cox, Mary L. Watkins, Meg Donovan, Nicholas K. Tabor, Nick Ehlert, and Stacey L. Schreft1

Banking organizations in the United States have long been subject to two broad categories of regulatory standards. The first is permissive: a "positive" grant of rights and privileges, typically via a charter for a corporate entity, to engage in the business of banking.2 The second is restrictive: a "negative" set of conditions on those rights and privileges, limiting conduct and imposing a program of oversight and enforcement, by which the holder of that charter must abide.3

Together, these requirements form a legal cordon, or "regulatory perimeter," around the U.S. banking sector. Inside that perimeter are firms, or other legal persons, that can legally conduct a set of banking activities, subject to various forms of regulation and supervision. Outside that perimeter are firms conducting other financial and non-financial activity, under the broad heading of "commerce"—subject to other laws and restrictions, but not to the specific combination of positive grants and negative restrictions of the perimeter. A range of firms lie close to the boundary, blurring the distinctions between the two.

Today's regulatory perimeter faces a variety of challenges and pressures—from the "unbundling" and "re-bundling" of the traditional banking business; to the growth of stablecoins, stored-value platforms, and other new technologies; to the entry of commercial firms into the financial services space; to the advent of new financial services charters, with new uses for old ones. These developments are the topic of substantial current scholarship.4

A recent paper in the Finance and Economics Discussion Series (FEDS) attempts to situate these challenges within the broader history of federal banking law and, in so doing, to reveal new insights about the nature of the U.S. regulatory perimeter.5 This FEDS Note describes a handful of lessons that history holds for the perimeter challenges of today.

Lesson 1: The United States has always had a legal perimeter separating "banking" from "commerce." That perimeter has rarely been clear; it has always been porous; and it has never been static.

The early American perimeter derived from banks' public purpose—not just as legislatively chartered entities, but as a source of economic rents and fiscal support. The goal of this separation was not to protect banking from commerce, but to ensure that banking served commerce adequately, providing financing for public infrastructure and other preferred projects. As such, governments placed these early banks on one side of a porous perimeter, with a close relationship to commercial activity.

This direct fiscal role has faded over time, but the permeable, shifting nature of the perimeter has not. The territory between "banking" and "commerce" has always been large and contested, with the areas under financial regulators' jurisdiction changing with the politics and law of the time. Over time, Congress has also recognized other benefits associated with separating banking and commerce, including protection against concentration of economic power and conflicts of interest. The particulars differ, but the debates seeking to define and capture these benefits are as old as the nation itself. Perimeter changes are natural, and there is helpful, clarifying precedent for even the most novel, idiosyncratic challenges. To understand those challenges, it is important to understand what's old about them, not just what's new.

Lesson 2: Challenges to the perimeter often follow a common pattern—starting with outside-in pressure, and frequently culminating in crisis.

Disputes about the scope of federal banking regulation are historically specific. However, a typical pattern has emerged of push and pull, between institutions and the agencies and jurisdictions that regulate them. When the perimeter buckles, it typically starts with pressure from less well-regulated firms—that is, from the outside in.

Outside-in pressure. Firms outside the regulatory perimeter (sometimes, but not always, with a commercial presence) enter into increasingly direct competition with firms inside it, offering the services of a regulated bank while avoiding most or all of its requirements. In effect, these firms can cross the perimeter—offering products that mimic the functionality of core banking products, like deposits and loans, without the costs that regulation and supervision impose or the safeguards they provide. Such regulatory arbitrage does more than just increase the ties between banking and commerce; it creates a commercial advantage for firms outside the perimeter and adds a new grade to a previously level playing field.

Inside-out pressure. Firms inside the regulatory perimeter typically respond to this pressure by advocating regulation of their non-bank competitors and straining at the fetters on their own conduct. Regulated firms form new partnerships, create new products, convert to new charters, or lobby for changes to disadvantageous regulatory requirements. They find allies in commercial firms, as well as in competing regulators and jurisdictions. They argue that restrictions are arbitrary, restraining innovation and unnecessarily marking certain acceptable activities as unsafe; or, if not, that they push conduct beyond the reach of regulation, making it less safe. In either case, they argue these restrictions place regulated firms at a disadvantage, imperiling their safety and soundness, the integrity of the financial system, and overall economic growth. Accounts of changing technology have figured in much of this discourse.

Reform and expansion—by devil or disaster. Pressure on the perimeter can often culminate in action, either by crisis, scandal, or both. Regulators, legislators, and industry act to tailor the perimeter—often while letting existing institutions operate under legacy treatment—or increase permissible activities in exchange for increased regulation. In turn, this can lead to political action to redefine the perimeter, move it, or repair its holes. The actors involved can vary, from Congress, to banks, to regulators themselves. With few exceptions, the effect is to push the perimeter outward, extending it to at least some set of firms and activities not previously within regulators' jurisdiction. A consistent set of arguments often recur during a perimeter expansion: that unregulated or under-regulated activities pose a threat to the core banking sector, financial stability, and the public purse; that uneven regulation is inequitable; or that a flimsy perimeter fosters monopoly, giving large commercial firms an unfair economic advantage.

Lesson 3: The core architecture of the U.S. perimeter is simpler than some current debates suggest.

Contemporary discussions often draw a distinction between "entity-based" and "activity-based" approaches to financial regulation. In an entity-based system, regulators have jurisdiction over certain categories of legal persons—a chartered bank, for example, or a registered investment adviser. In an activity-based system, regulators have jurisdiction based on what a legal person does, like making loans or dealing in securities. Throughout history, however, this distinction has obscured more than it has clarified. In the U.S. context, it is largely a red herring.

Congress often confers regulatory jurisdiction, and defines positive grants and negative restrictions, by creating a set of categories (e.g., "bank," "credit union," "Federal Reserve member," "deposit broker"). Those categories might be based on a mix of entity- and activity-based factors. They can capture a wide range of legal persons and arrangements, both formal and informal—and very often, they can require that an activity take place only within a particular type of organizational structure. For example, an institution might be a "depository institution" because it holds a certain type of "bank" charter.6 It might hold that charter, in turn, because of the specific business it conducts or hopes to conduct, such as taking deposits.7 It might conduct that business, in turn, because it is closely related to another aspect of its business, like lending.8

A rough and ready rule captures this relationship, which fits much of the last 150 years of federal financial law: Because you do, you are; and because you are, you do.

Lesson 4: Nearly 40 years ago, Congress made an important and enduring shift in regulatory design. Over time, this shift has made the perimeter significantly more complex.

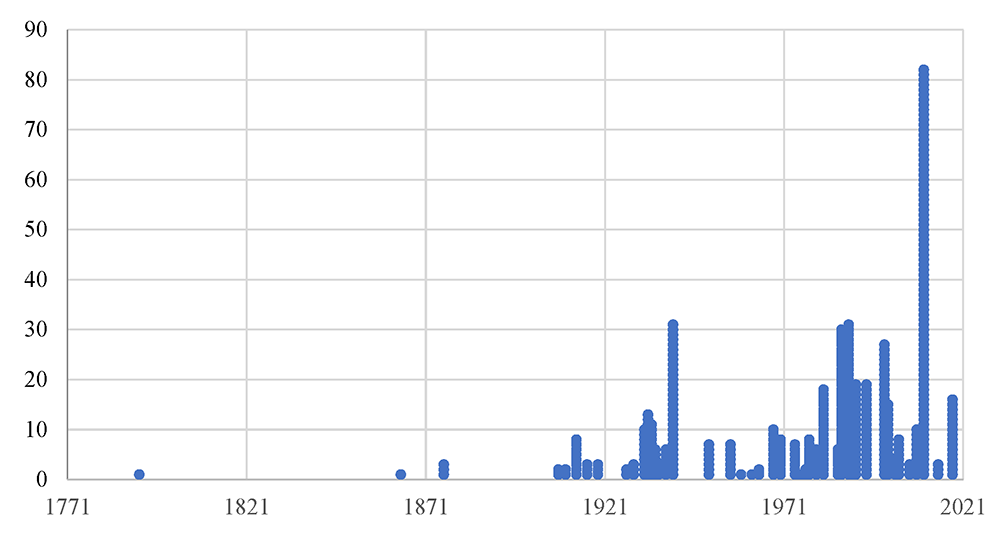

The federal perimeter began to take shape in 1791, with the introduction of the term "bank" in the organic statute of the Bank of the United States.9 Over the next 230 years, as Fig. 1 shows, Congress extended the perimeter, by adding new regulatory categories that defined new rights and responsibilities. Each change was typically a response to a specific challenge, like a new product or service, a new legal entity structure, or a new cross-jurisdictional or cross-border issue. Their cumulative effect was to make the perimeter more complex—as agencies formed and dissolved, new categories incorporated or supplanted others, and the boundaries between core "prudential" supervision and more "functional" approaches emerged and blurred.

However, this pattern has not been static. Instead, a significant shift occurred almost 40 years ago—to a new approach to regulatory design, and a different allocation of responsibility between Congress and the regulatory agencies. This new approach did not diminish the perimeter's mounting complexity; it accelerated it.

Figure 1. The Federal Financial Regulatory Perimeter, 1791-2021 (click to expand)10

Before the 1980s, debates about the placement and shape of the perimeter typically focused on the meaning and scope of existing regulatory categories—for example, which activities should define the "business of banking," which entities should qualify as "banks" (or "bank holding companies"), or what should qualify as a "deposit." In this earlier era, those broad terms set the rough outer bounds of regulators' jurisdiction, within relatively concise statutes.11 Within those bounds, agencies had substantial discretion to oversee the conduct of supervised institutions, subject to public input through measures like notice-and-comment rulemaking. This approach made the perimeter more responsive and resilient to changing industry practices.

Over the course of the 1980s, however, Congress's approach to the perimeter changed. By the decade's end, financial regulatory legislation typically maintained the existing statutory definitions of "banking," "deposits," "securities," and other key terms. Instead, reform legislation most often created new, sometimes overlapping sets of regulatory categories—extending federal oversight, not just to new institutions, but also to new categories of institutions, charters, and activities. At the same time, Congress reduced agencies' discretion in the exercise of such oversight.12 Reform legislation described the restrictions each type of institution should and should not face, in extensive and unprecedented statutory detail.

This trend is visible in the animation above, as well as in Fig. 2. It arguably began to crest with the Gramm-Leach-Bliley Act in 1999 (which introduced roughly 30 new regulatory categories), but it persisted in both the Dodd-Frank Act (which incorporated more than 50 existing categories without amendment and introduced over 80 new ones) and the Economic Growth, Regulatory Relief and Consumer Protection Act (which introduced 18 more categories, repealing none).

Figure 2. Regulatory Categories by Year of Introduction13

The U.S. has embraced this "categorization" approach through several turns of the credit cycle, in periods of both deregulation and re-regulation. During that time, it has experienced (arguably) four financial crises, attributable to factors both internal and external to the financial system. In each case, important firms, activities, and other sources of the stress were outside the regulatory perimeter, compounding fragility inside it. In each case, regulators lacked clear, well-resourced, plenary authority to oversee those firms and activities. In each case, a period of reform followed, aimed at restoring or improving the perimeter's integrity. And in each case, the reforms followed the same broad approach as the time before.

Today, the resulting federal financial regulatory perimeter is broader, more complex, and arguably more permeable than at any point in its history. It contains several hundred statutory categories, each conferring its own mix of rights and obligations—some requiring the formation of a specific legal entity, others requiring public registration, disclosure, or supervision, still others requiring some form of chartering with prior government consent. Almost any entity or legal person offering financial services typically falls under one or several of these categories, triggering at least some kind of public oversight. Conversely, however, by tailoring the scope of its activities and its legal form, a careful firm can choose some forms of regulation over others. And critically, while the current regulatory perimeter keeps firms inside it from "venturing outside" to engage in commercial activity, it lacks the same ability to keep firms outside the perimeter from "venturing in"—to engage in bank-like activity, without bank-like regulation and supervision.

1. Board of Governors of the Federal Reserve System. The authors have benefitted from the comments and contributions of a number of Federal Reserve colleagues and particularly wish to thank Mark Carlson for his time and feedback. We also wish to thank Aurite Werman, Charles Gray, David Mills, David Palmer, Jacy Su, Justin Warner, Kavita Jain, Kelley O'Mara, Matthew Malloy, Molly Mahar, Ryan Rossner, and Stephanie Martin. The views expressed in this article are the authors' alone and do not indicate concurrence by other members of the Federal Reserve System staff, the Board of Governors, or the United States government. Return to text

2. Positive requirements in this context also fall under the umbrella of "entry restrictions." See, e.g., Morgan Ricks, Entry Restriction, Shadow Banking, and the Structure of Monetary Institutions, 2(2) J. Fin. Reg. 291 (2015). Return to text

3. See Francesco Parisi, Norbert Schulz, & Jonathan Klick, Two Dimensions of Regulatory Competition, 26 Int'l. Rev. L. Econ. 56 (2006) (providing a model of regulatory competition in multi-body administrative settings). Return to text

4. See, e.g., Howell Jackson & Morgan Ricks, "Locating Stablecoins within the Regulatory Perimeter," Harvard Law School Forum on Corporate Governance (Aug. 5, 2021); Agustín Carstens, Stijn Classens, Fenando Restoy, & Hyun Song Shin, "Regulating big techs in finance," BIS Bulletin No. 45 (Aug. 2, 2021); Gary B. Gorton & Jeffery Y. Zhang, Taming Wildcat Stablecoins, SSRN working paper (Jul. 19, 2021); Dan Awrey, Unbundling Banking, Money, and Payments, European Corporate Governance Institute Law Working Paper No. 565 (2021); Markus K. Brunnermeier, Harold James, & Jean-Pierre Landau, The Digitalization of Money, NBER Working Paper No. 26300 (Sep. 2019). Return to text

5. Nicholas K. Tabor, Katherine E. Di Lucido, & Jeffery Y. Zhang, A Brief History of the U.S. Regulatory Perimeter, Finance and Economics Discussion Series (FEDS) No. 2021-051, Board of Governors of the Federal Reserve System (Aug. 2, 2021). Return to text

6. See, e.g., 12 U.S.C. § 461(b)(1)(A)(i) (defining "depository institution" to include "insured bank"). Return to text

7. See, e.g., 12 U.S.C. § 1813(h) (defining "insured bank" by reference to "bank"), 1813(a)(1) (defining "bank" to include "State bank"), 1813(a)(2) (defining "State bank" to include "any bank . . . which is engaged in the business of receiving deposits . . . ."). Return to text

8. See, e.g., 12 U.S.C. 378(a)(2) (prohibiting receipt of deposits, unless a person is (i) specifically authorized to do so under federal or state law and (ii) subject to examination and regulation). Return to text

9. An Act to incorporate the subscribers to the Bank of the United States, Ch. 1-10 (Feb. 25, 1791). Return to text

10. For full references, see supra note 5. Return to text

11. We are not the first to note this shift away from statutory concision. See, e.g., Morgan Ricks, The Money Problem: Rethinking Financial Regulation (2016), at 250. Return to text

12. This point echoes work on the shifting role of supervision and its relationship to monetary policy. See Lev Menand, Why Supervise Banks? The Foundations of American Monetary Settlement, 74 Vand. L. Rev. (forthcoming). Return to text

13. For full references, see supra note 5. Return to text

Vardoulakis, Alexandros, Asad Kudiya, Byoung Hwa Hwang, Courtney Demartini, Dan McGonegle, Gavin Smith, Jess Cheng, Katherine E. Di Lucido, Kathy Wilson, Jeffery Y. Zhang, Joseph Cox, Mary L. Watkins, Meg Donovan, Nicholas K. Tabor, Nick Ehlert, and Stacey L. Schreft. Corresponding Authors: Nicholas K. Tabor, Jeffery Y. Zhang, and Katherine E. Di Lucido. (2021). "Lessons from the History of the U.S. Regulatory Perimeter," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, October 15, 2021, https://doi.org/10.17016/2380-7172.3007.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.