FEDS Notes

August 30, 2023

Recent Developments in Hedge Funds’ Treasury Futures and Repo Positions: is the Basis Trade “Back"?

Daniel Barth, R. Jay Kahn and Robert Mann1

In short, the answer is "probably", at least to some degree. This note summarizes recent developments in hedge funds' Treasury futures and repo positions derived from the Commodities Futures and Trading Commission's (CFTC's) Traders in Financial Futures data and the Office of Financial Research's ("OFR") Cleared Repo Collection. Trends in these two data sources are consistent with hedge funds increasing their positions in the Treasury cash-futures basis trade. As Table 1 shows, hedge fund repo borrowing in the sponsored segment rose by $120 billion between October 4th, 2022 and May 9th, 2023, and was higher as of May 9th, 2023 than it was at its previous peak in 2019. Hedge fund short futures positions in the 2-year, 5-year, and 10-year contracts rose by $411 billion over the same period. Consistent with these empirical trends, spreads on the trade suggest it has been profitable at several points in recent months, without considering the value of options embedded in the trade (and whose value has likely increased as measures of Treasury market uncertainty have risen).

Table 1. Hedge Fund Repo Borrowing

| As of date | |||

|---|---|---|---|

| 31-Jan-19 | 4-Oct-22 | 9-May-23 | |

| Levered fund Treasury shorts | |||

| 2-, 5- and 10-year | 631.17 | 304.03 | 714.92 |

| Total | 745.52 | 433.77 | 860.26 |

| Hedge fund sponsored repo | |||

| Borrowing | 234.85 | 113.59 | 233.23 |

| Lending | 16.16 | 30.84 | 38.74 |

Note: Futures positions are in contract notional dollars.

Source: OFR Cleared Repo Collection and CFTC Traders in Financial Futures Data

The cash-futures basis trade is an arbitrage trade that involves a short Treasury futures position, a long Treasury cash position, and borrowing in the repo market to finance the trade and provide leverage.2 This trade presents a financial stability vulnerability because the trade is generally highly leveraged and is exposed to both changes in futures margins and changes in repo spreads (see Schrimpf, Shin and Sushko (2020) and Barth and Kahn (2023)). Hedge funds unwinding the cash-futures basis trade likely contributed to the March 2020 Treasury market instability (see Schrimpf, Shin and Sushko (2020), Vissing-Jorgensen (2021), Barth and Kahn (2023), and Kruttli et al (2021)).

The evidence initially presented by Barth and Kahn (2023) and Kruttli et al (2021) for the size and growth of hedge fund basis trading in 2018 and 2019 was based on three sources of data:

- Rising sponsored repo borrowing by relative-value hedge funds from the OFR's Cleared Repo collection;

- A dramatic rise in short futures positions of leveraged investors (hedge funds) from the CFTC's Traders in Financial Futures reports;

- Substantial growth in matched long and short Treasury exposures and a divergence of repo borrowing and lending from SEC's Form PF.

In this note, we show that the first two sources provide similar patterns to what prevailed in 2019, however, relevant data on Treasury exposures of hedge funds as well as their repo market activity is currently unavailable because of the lag involved in quarterly hedge fund reporting through Form PF. Moreover, the micro-evidence from sponsored repo is suggestive but not conclusive, as we review below. Our findings should therefore be interpreted with these caveats in mind.

Sponsored repo borrowing by hedge funds

Hedge funds borrow in repo almost exclusively through two venues: FICC's sponsored DVP repo service (a centrally cleared bilateral market) and the non-centrally cleared bilateral repo market.3 While the non-centrally cleared bilateral market is a larger source of funding for hedge funds than sponsored repo, sponsored repo serves an important role because it allows dealers to net their lending to one entity against borrowing from another for calculating certain regulatory ratios.

During 2018 and 2019, when hedge fund cash-futures basis trades positions were large, sponsored repo borrowing likely constituted a small percentage of total basis trade repo borrowing, with the majority being conducted in the non-centrally cleared bilateral repo market. Nonetheless, increases in sponsored borrowing volumes may be indicative of increases in basis trade positions because of the trade's reliance on net repo borrowing. As discussed in Barth and Kahn (2023) and Kruttli et al (2021), the basis trade is one of the few canonical relative value trades that involves net repo borrowing – only the cash Treasury position needs to be financed in repo because the short futures position requires no initial cash (aside from margin). For other relative value trades, for instance the classic on-the-run/off-the-run Treasury arbitrage trade, since repo and reverse-repo are naturally matched, dealers can provide funding through the non-centrally cleared bilateral repo market without increasing the size of their balance sheet (see Hempel et al (2023)). For such trades, we would not necessarily expect increased arbitrage activity to associate with any increase in sponsored repo demand. But for the basis trade, the presence of net repo borrowing may make sponsored repo an attractive venue, since dealers are able to net the lending to basis traders against borrowing from money market funds and other cash providers, as the nominal counterparty to both trades is FICC. However, this incentive to move to FICC would also hold for other trades that involve net repo borrowing.

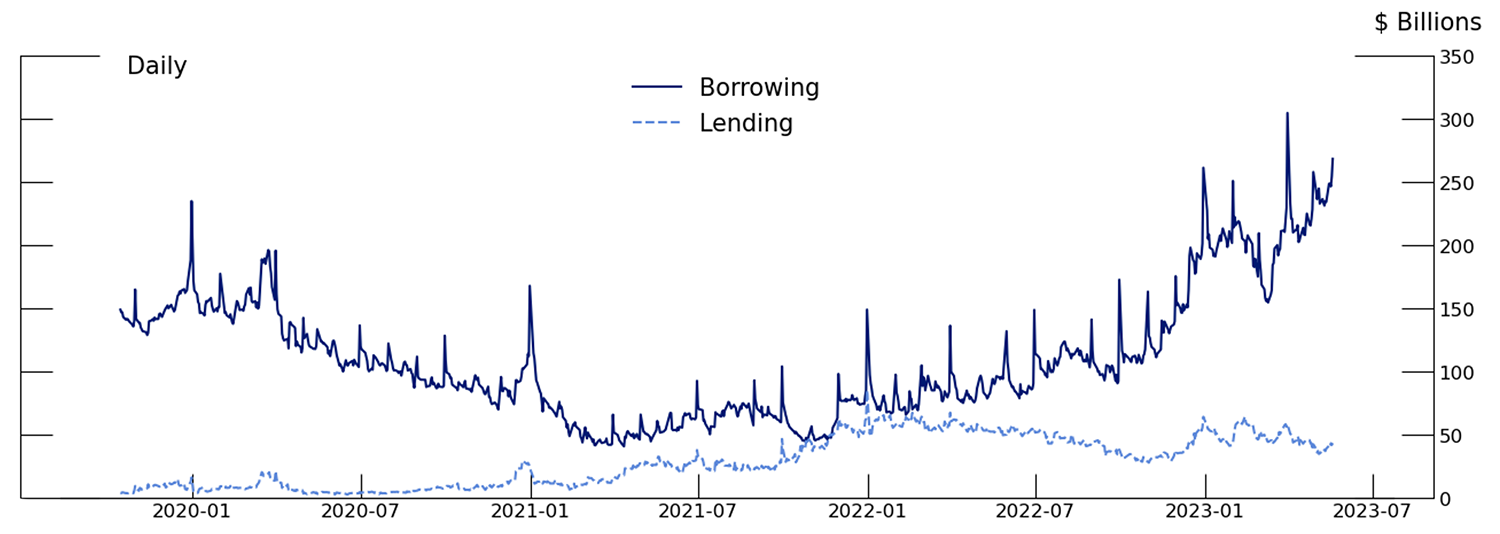

This means rising hedge fund borrowing in sponsored repo should correlate with rising hedge fund net repo demand due to increasing basis trade positions. Between the beginning of October 4, 2022, and May 9th, 2023, sponsored repo borrowing from hedge funds increased by $119 billion, from $114 billion to $233 billion. This rise has sent hedge fund borrowing through sponsored repo to its maximum level observed in the OFR's data, which covers the period from October 2019 to the present, and may be a record value for the sponsored service overall. Meanwhile, sponsored lending by hedge funds has remained essentially constant, rising only slightly from $31 billion to $39 billion over the same period. Sponsored repo borrowing and lending by hedge funds is shown in Figure 1.

Source: OFR Cleared Repo Collection

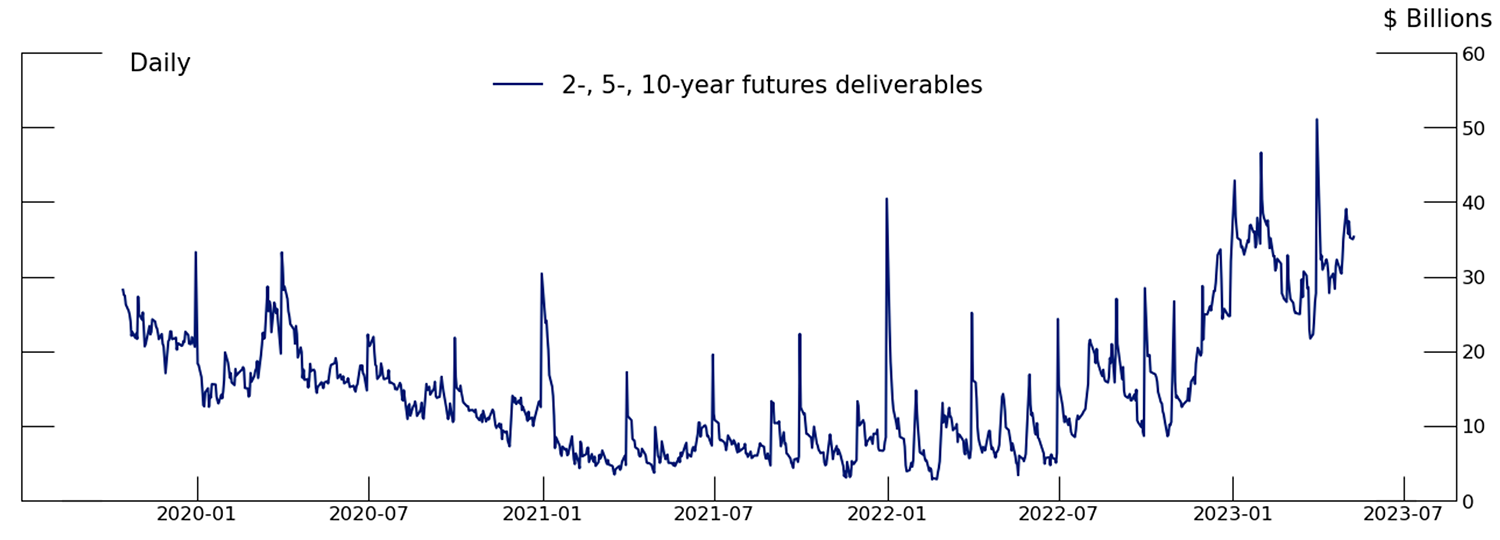

Additional evidence from sponsored repo for hedge fund basis trades comes from the collateral posted. Borrowing for the basis trade is likely to be concentrated in Treasuries that are deliverable into the Treasury futures. In Figure 2, we show borrowing by hedge funds against the 1st, 2nd, and 3rd cheapest to deliver Treasuries for the 1st and 2nd to deliver contracts in the 2-year, 5-year, and 10-year Treasury futures.4 As the figure shows, sponsored repo borrowing against these Treasuries has been increasing, rising from $19 billion at the beginning of October 2022 to $39 billion at the beginning of May. Borrowing against this set of deliverable Treasuries makes up only 16% of total hedge fund borrowing in sponsored repo as of May 1st, 2023.

Note: Series includes total borrowing in the 1st-3rd CTD Treasuries for the 1st and 2nd to deliver contracts.

Source: OFR Cleared Repo Collection

It is important to emphasize that while DVP sponsored repo collateral is informative about trends in hedge fund repo positions, this $20 billion increase is almost surely dramatically lower than total basis trade activity. Only around 10% of total hedge fund repo is conducted in the sponsored market (See Hempel et al (2022), and while sponsored repo may be an attractive venue for dealers looking to net hedge fund repo borrowing associated with basis trades, it likely still represents only a small portion of total basis trade repo positions. Second, collateral may not be proportionately allocated between the sponsored and non-centrally cleared bilateral markets. In fact, FICC's portfolio margining procedures may create an incentive to diversify the mix of collateral delivered through the sponsored segment. Therefore, sponsored borrowing against CTD collateral is likely a poor estimate for the aggregate size of the trade. Nevertheless, changes in hedge fund DVP activity are likely a good indicator of changes in basis trade demand. As show in Barth and Kahn (2023), sponsored repo borrowing with CTD collateral was elevated in 2019, during the period the cash-futures basis trade was most popular among hedge funds. Further, when hedge funds partially wound down that trade in 2020, DVP sponsored repo borrowing also fell, as shown in Figure 1. Trends in hedge fund DVP sponsored repo also match the trends in short futures positions described below. Together, the evidence from DVP repo is suggestive that hedge fund basis trade repo demand has significantly grown.

While most of the funds whose sponsored borrowing has increased appear to be large relative value hedge funds, they do not appear to be the same funds who made up the greatest share of likely basis trades in the previous episode. Examining individual positions, we find only a moderate increase in borrowing by hedge funds classified as large basis traders by Barth and Kahn (2023), which is based on Form-PF data from 2019. However, we note that many of the funds with notable borrowing in sponsored repo, but which are not classified as large basis traders, have the same adviser as one or more Barth and Kahn (2023) large basis traders. It is possible that funds that were not previously involved in the basis trade have reallocated into the trade, that new funds are opening to take on the trade, or that these funds are running distinct trades.

Futures positions of hedge funds

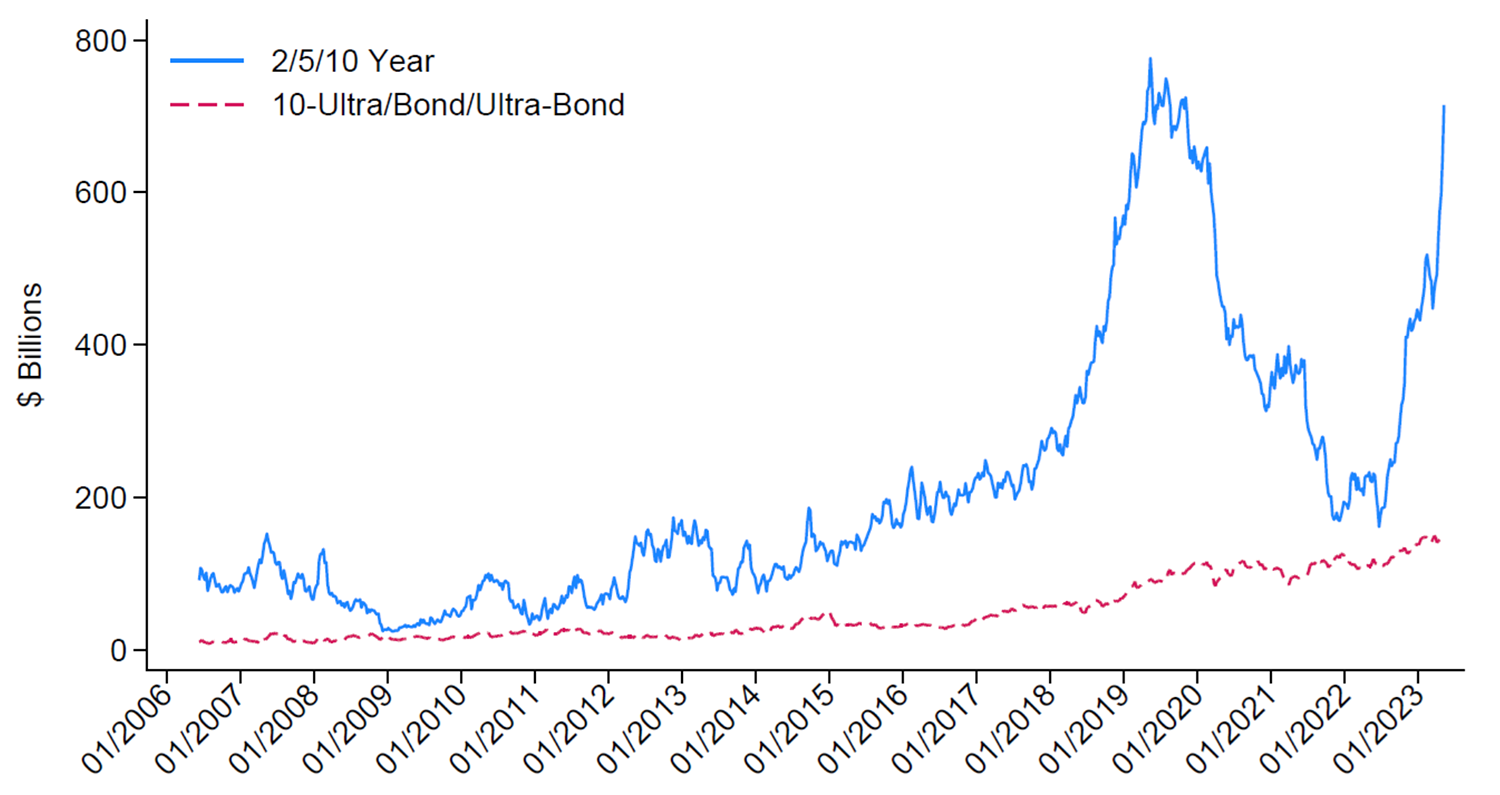

Another measure of hedge funds' potential basis trade positions comes from the futures market. One hallmark of hedge funds' basis trade positions in 2018 and 2019 involved substantial short positions in Treasury futures contracts. Treasury futures are generally categorized by the approximate maturity of the notes or bonds that are eligible to be delivered into the contract.5 There are six Treasury futures contracts that constitute the vast majority of outstanding volumes, each associated with the approximate maturity of the securities eligible for delivery, with naming conventions given by: 2-year, 5-year, 10-year, 10-year ultra, bond, and ultra-bond. Securities are deliverable into futures contracts at any point during the delivery months of March, June, September, and December. Figure 3 below shows that hedge funds' short futures positions in the 2-year, 5-year, and 10-year contracts have increased by $411 billion between October 4th, 2022 and May 9th, 2023, reaching a total of nearly $715 billion, only $35 billion shy of the previous high of $750 billion in July 2019. Hedge fund short futures positions in the other maturity baskets – the ultra-10 year, bond, and ultra-bond – have also risen modestly, but display nowhere near the variation or magnitude of the shorter-maturity contracts.

Source: CFTC Traders in Financial Futures data.

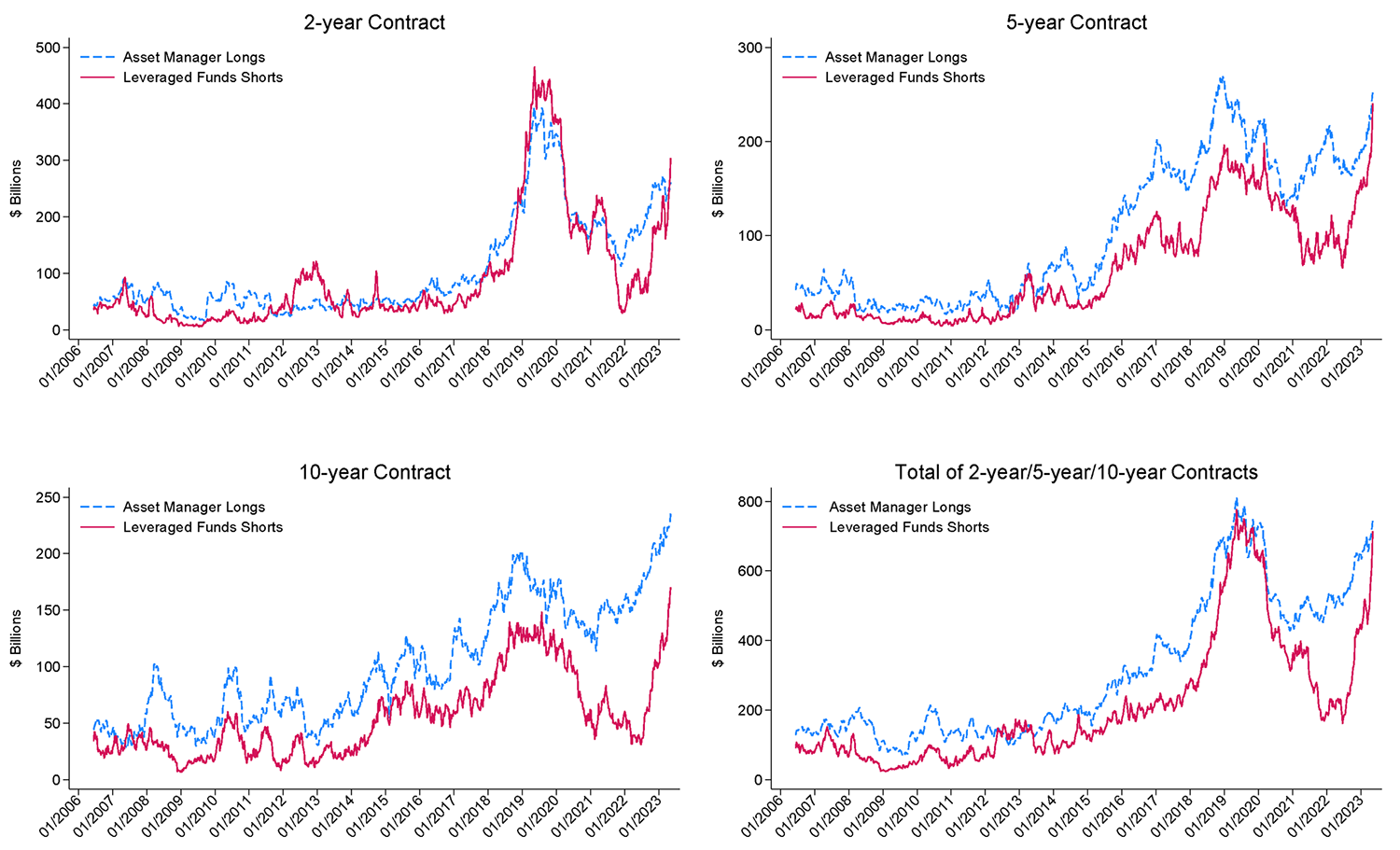

One notable difference between the current rise in short futures and the 2018–2019 period is the much larger growth in the 10-year contract, and comparatively lower growth in the 2-year contract (although as discussed in the conclusion, the most recent data suggests 2-year short futures have also risen dramatically). Figure 4 shows the rise in hedge fund short futures positions separately for the 2-year, 5-year, and 10-year contracts, alongside the growth in long futures positions held by asset managers.

Source: CFTC Traders in Financial Futures data.

2-year short futures owned by leveraged funds reached a peak of $465 billion in May 2019 and remained above $400 billion until mid-November; as of May 2023, hedge fund short futures in the 2-year contract stood at $304 billion, significantly lower than their all-time high, although they had increased by more than $200 billion since the beginning of October 2022. Comparatively, in the 5-year contract, hedge fund short Treasury futures were $240 billion as of May 9th, 2023, roughly $43 billion above their previous high in early 2019. In the 10-year contract, hedge fund short Treasury futures positions were $170 billion, roughly $22 billion above their all-time high.

As in the 2018 and 2019 episode, the significant increase in hedge fund short Treasury futures appears to be paired with corresponding increases in asset manager long Treasury futures positions. This is shown in Figure 4 above. In the aftermath of the March 2020 disruptions, hedge fund short Treasury futures fell comparatively more than asset managers' long Treasury futures and took longer to recover. Beginning in late 2020, asset manager long futures began to increase steadily. For hedge funds, growth in short Treasury futures didn't begin until mid-2022 and was much more rapid. As of June 1st, 2022, asset manager long Treasury futures in the 2-year, 5-year, and 10-year contracts were $338 billion larger than hedge fund short futures. As of the second week of May 2023, this difference had fallen to just $34 billion.

Conclusion

This note provides evidence that hedge fund futures and repo positions are consistent with increased trading in the cash-futures basis. We emphasize these developments are not enough to conclusively determine the scale of hedge fund basis trade activity. However, we note that conditions are similar to those that prevailed in 2018 and 2019, when hedge fund basis trades grew rapidly. Specifically, increases in interest rates away from the zero lower bound may have contributed to hedging demand by asset managers. If the basis trade is reemerging, it would suggest that this hedging demand indeed plays a large role in driving the volumes in the trade.

We also note that, since the data ending date of May 9th, 2023, when this note was drafted, hedge fund short futures positions have continued to rise. This increase has been particularly prominent in the 2-year contract; between May 9th, 2023, and June 13th, 2023, hedge fund 2-year short Treasury futures rose by $94 billion, reaching a level only $65 billion lower than their all-time high.

Should these positions represent basis trades, sustained large exposures by hedge funds present a financial stability vulnerability. While the contribution of sales from the basis trade to March 2020 Treasury market liquidity remains debated, several papers suggest that absent prompt intervention by the Federal Reserve, the situation may have been far worse. At present, measures suggest the Treasury market remains volatile, with the MOVE index still at levels comparable to the peak of March 2020. Consequently, cash-futures basis positions could again be exposed to stress during broader market corrections. With these risks in mind, the trade warrants continued and diligent monitoring.

References

Andreas Schrimpf, Hyun Song Shin, and Vladyslav Sushko, 2020. "Leverage and Margin Spirals in Fixed Income Markets during the COvid-19 Crisis," BIS Bulletin, 2.

Daniel Barth and R. Jay Kahn, 2023. "Hedge Funds and the Treasury Cash-Futures Disconnect," Working Papers 21-01, Office of Financial Research, US Department of the Treasury.

Samuel Hempel, R. Jay Kahn, Robert Mann and Mark Paddrik, 2023. "Why is so much repo not centrally cleared?" OFR Brief 23-01.

Samuel Hempel, R. Jay Kahn, Vy Nguyen and Sharon Y. Ross, 2022. "Non-centrally Cleared Bilateral Repo," The OFR Blog.

Mathias S. Kruttli, Phillip J. Monin, Lubomir Petrasek and Sumudu W. Watugala, 2021. "Hedge Fund Treasury Trading and Funding Fragility: Evidence from the COVID-19 Crisis," Finance and Economics Discussion Series 2021-038, Board of Governors of the Federal Reserve System (U.S.).

Vissing-Jorgensen, Annette, 2021. "The Treasury Market in Spring 2020 and the Response of the Federal Reserve," Journal of Monetary Economics, Elsevier, vol. 124(C), pages 19-47.

1. Daniel Barth ([email protected] ) is a Principal Economist in the Division of Financial Stability of the Federal Reserve Board of Governors. R. Jay Kahn ([email protected] ) is a Senior Economist in the Division of Research and Statistics of the Federal Reserve Board of Governors. Robert Mann ([email protected]) is a Research Economist with the Office of Financial Research, U.S. Department of the Treasury. The views expressed are solely those of the authors and do not necessarily reflect the views of the Board of Governors of the Federal Reserve System, the Office of Financial Research, or the U.S. Department of the Treasury. Return to text

2. For details on the mechanics of the Treasury cash-futures basis trade, see Barth and Kahn (2023). Return to text

3. For more details on hedge fund borrowing in non-centrally cleared bilateral repo see Hempel et al (2022) and Hempel et al (2023). Return to text

4. These terms of art are described in detail in Barth and Kahn (2021). Return to text

5. For instance, the 2-year Treasury futures contract allows for delivery of U.S. Treasury notes with "an original term to maturity of not more than five years and three months and a remaining term to maturity of not less than one year and nine months from the first day of the delivery month and a remaining term to maturity of not more than two years from the last day of the delivery month." Return to text

Barth, Daniel, R. Jay Kahn, and Robert Mann (2023). "Recent Developments in Hedge Funds' Treasury Futures and Repo Positions: is the Basis Trade "Back"?," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, August 30, 2023, https://doi.org/10.17016/2380-7172.3355.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.