FEDS Notes

July 08, 2025

A Note on the Removal of the Nonfinancial Business Sector in the G.19 "Consumer Credit" Statistical Release

Alexander Bruce, Michael M. Chernousov, Simona M. Hannon, and Marc J. Scott*

The G.19 "Consumer Credit" Statistical Release reports outstanding credit extended to individuals, excluding loans secured by real estate, across multiple types of lenders that include depository institutions, finance companies, credit unions, federal government, nonprofit and educational institutions, and nonfinancial business.1 Starting with the May 2025 G.19, released on July 8, 2025, the estimates for the nonfinancial business sector are decommissioned and removed from the G.19. In this note, we provide background on this sector, describe reasons for its discontinuation, and discuss the implications for the measurement of retail loans in the G.19.

The Nonfinancial Business Sector in the G.19

The nonfinancial business sector covered in the G.19 consists of "amounts owed to retail stores by their customers for purchases made on credit."2 Historically, many of the lenders in this sector were retail businesses that issued loans directly to their consumers, often in the form of store credit cards. In the G.19, these lenders have been referred to as the nonfinancial business sector because financial assets (including consumer loans) were not the main assets on these firms' balance sheets.

However, the size of the nonfinancial sector has shrunk markedly in recent years, for two main reasons. First, many nonfinancial businesses had begun to issue consumer loans in partnership with other financial institutions, primarily banks (see Flagg et al., 2024). Second, many of the nonfinancial businesses sold their large legacy consumer credit portfolios to banks.3 As a result, much of the debt originally covered under the nonfinancial business category on the G.19 release migrated to other financial lender categories (for example, depository institutions), causing the size of the nonfinancial business sector to decline, from over $100 billion in the early 2000s to approximately $35 billion in 2019.

Historical Measurement of the Nonfinancial Business Sector in the G.19

Historically, the benchmark data for the nonfinancial business sector were derived from the U.S. Census Bureau's Annual Retail Trade Survey, which collected self-reported information on the values of accounts receivable from U.S. retail trade firms.4 Consistent with the G.19 estimation methodology, the instructions for the relevant component of the Census survey specified the exclusion of credit held by other lender types.5 However, collection of consumer receivables data on this Census survey was discontinued in 2020.6 As a result, the benchmark data used to estimate the G.19 holdings of nonfinancial business balances were kept constant at $35 billion (the last estimated value) from 2019 onwards.

Given the combination of the shrinking relevance of the sector, the discontinuation of existing benchmarking data, and the lack of a sound substitute for the Census data, starting with the May 2025 G.19 released on July 8, 2025, we retired the nonfinancial business sector from the G.19. Our last data point is December 2019, and entries following this month will not be populated in the public repository. The discontinuation of this sector reflects on the release as a $35 billion decline in total outstanding consumer credit in January 2020, consisting of more than $19 billion in revolving credit and $16 billion in nonrevolving credit. In line with our standard practice, we added series breaks to the level series so that the growth rates of consumer credit are unaffected by this definitional change.7

Measurement of Retail Credit in the G.19

As discussed, due to secular changes in the market structure, consumer loans historically issued by nonfinancial businesses have become increasingly originated in partnership with financial institutions that hold these loans on their balance sheets. As such, these types of loans are part of financial holdings reported by depository institutions and finance companies and, therefore, are captured on the G.19 release. Flagg et al., (2024) define consumer loans issued by nonfinancial businesses in partnership with financial institutions as "retail credit".

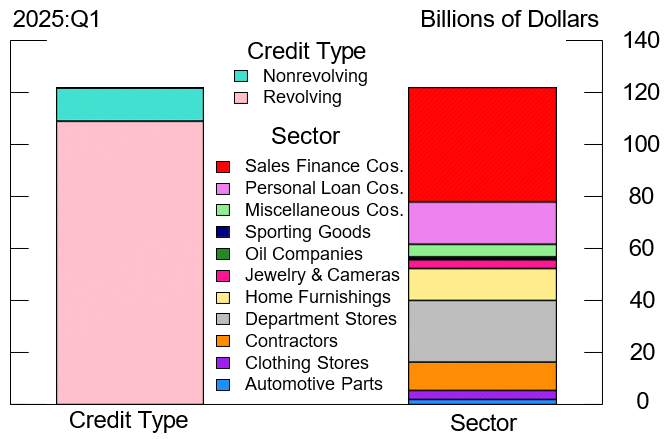

Although retail credit is included in the consumer credit totals in the G.19, it is not separately categorized on the release.8 To estimate the size of this market segment at the end of 2023, Flagg et al. (2024) use data from the Federal Reserve Bank of New York's quarterly Consumer Credit Panel (CCP), a database of consumers' credit use and payment performance drawn from anonymized Equifax credit bureau records.9 In Figure 1, we reproduce the Flagg et al. (2024) estimates using the most recent quarter of available CCP data—2025:Q1. First, we estimate the total size of retail credit at approximately $122 billion, a slight decline from the $130 billion reported in Flagg et al. (2024) for 2023:Q4. Second, the figure shows that retail credit is predominantly revolving in nature, consisting primarily of credit cards (left bar).10 Third, as banks are the major holders of revolving credit (Chernousov et al., 2024), retail credit is likely mostly concentrated in the banking sector. Fourth, retail credit is used for a range of expenditures, from home furnishing to department store purchases (right bar).

Note: Key identifies in order from top to bottom. This figure shows retail credit balances by type of credit and sector expenditure and finance company type holder.

Source: Authors' calculations using Federal Reserve Bank of New York Consumer Credit Panel (CCP)/Equifax.

Although retail loans can be securitized, it is relevant to note that the 2010 FAS 166/167 accounting standard requires financial institutions to consolidate on book consumer credit assets held in special purpose vehicles they are the primary beneficiaries of.11 Following the FAS 166/167 adoption, most credit card balances are held on book, primarily by banks. As a result, we have high confidence that the G.19 estimates of revolving credit held by depository institutions include virtually all credit card loans, including those issued in partnership with retailers.

Finally, in the G.19, the banking sector is benchmarked to regulatory information from the Reports of Condition and Income (Call Reports) and the finance company sector is benchmarked to information reported on the Quinquennial Survey of Finance Companies.12 Both types of reports aim to provide comprehensive and accurate measures for the two sectors, including retail loans. As a result, we believe that retail credit is nearly fully captured on the G.19 release as a subset of these financial sectors and that the discontinuation of the nonfinancial business sector will not affect data quality of the G.19 consumer credit release.

References

Chernousov, Michael M., Jessica N. Flagg, Simona M. Hannon, Virginia L. Lewis, Suzanna M. Stephens, and Alice H. Volz (2024). "A Note On Revolving Credit Estimates," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, June 14, 2024.

Flagg, Jessica N., Simona M. Hannon, Cisil Sarisoy, and Mark J. Wicks (2024). "Estimating Retail Credit in the U.S.," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, June 21, 2024.

Lee, D. and van der Klaauw (2010). "An Introduction to the FRBNY Consumer Credit Panel". Staff Report no. 479, New York: Federal Reserve Bank of New York, November 10.

Tribune News Services (2005). "Department store credit business sold to Citigroup," https://www.chicagotribune.com/store-credit-business-sold-to-citigroup/. Chicago Tribune, June 3.

* We thank Geng Li and Kamila Sommer helpful comments and suggestions, and Sarah DeBerardinis for excellent research assistance. The views in this note are those of the authors and do not necessarily reflect those of the Board of Governors of the Federal Reserve System or its staff.

Alexander Bruce: Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue NW, Washington, DC 20551, USA Email: [email protected].

Michael M. Chernousov: Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue NW, Washington, DC 20551, USA Email: [email protected].

Simona M. Hannon: Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue NW, Washington, DC 20551, USA Email: [email protected].

Marc J. Scott: Board of Governors of the Federal Reserve System, 20th Street and Constitution Avenue NW, Washington, DC 20551, USA Email: [email protected]. Return to text

1. See the G.19 Statistical Release. Return to text

2. More information can be found on the G.19 About page. Return to text

3. For example, in 2003 Sears sold its credit card portfolio to Citigroup. Citigroup further expanded their holdings in 2005 with the acquisition of the credit card portfolios held by Federated Department Stores Inc. and May Department Stores Co, consisting of those for Bloomingdale's, Macy's, Marshall Field's and Lord & Taylor (Chicago Tribune, 2005). Moreover, in 2012, TD Bank purchased Target's credit card portfolio. Return to text

4. The Annual Retail Trade Survey (ARTS) target population consists of all U.S. firms with paid employees that are primarily engaged in retail trade, as defined by the 2017 NAICS. Return to text

5. See https://www2.census.gov/programs-surveys/arts/technical-documentation/questionnaires/ 2019/sa-44-19.pdf. Return to text

6. See the announcement. Return to text

7. For details on series breaks, see the G.19 About page and the G.19 Technical Q&As. Return to text

8. More information can be found on the G.19 About page. Return to text

9. For a description of the design and content of the CCP, see Lee and van der Klaauw (2010), as well as https://www. newyorkfed.org/medialibrary/interactives/householdcredit/data/pdf/data_dictionary_HHDC.pdf. Return to text

10. Revolving credit primarily consists of credit card debt, but it also includes other revolving credit plans linked to overdraft arrangements and other revolving credit plans not accessed by credit cards. See Chernousov et al. (2024). Return to text

11. More information can be found on the FASB website. Return to text

12. Call Reports are regulatory reports that reflect the most comprehensive and accurate measure of outstanding credit for the banking sector. While not regulatory in nature, the finance company Quinquennial report aims to fulfill the same purpose with the Call Reports and provide a complete measure of the credit held by finance companies. Return to text

Bruce, Alexander, Michael M. Chernousov, Simona M. Hannon, and Marc J. Scott (2025). "A Note on the Removal of the Nonfinancial Business Sector in the G.19 "Consumer Credit" Statistical Release," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, July 08, 2025, https://doi.org/10.17016/2380-7172.3848.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.