FEDS Notes

February 01, 2021

Forecasting During the COVID-19 Pandemic: A Structural Analysis of Downside Risk

Martin Bodenstein, Pablo Cuba-Borda, Jay Faris, and Nils Goernemann1

The Risk of Recessionary Dynamics

The global collapse in economic activity triggered by individual and policy-mandated responses to the spread of COVID-19 is unprecedented both in scale and origin. At the time of writing, U.S. GDP is expected by professional forecasters to contract a staggering 6 percent over the course of 2020 driven by its 32 percent collapse in the second quarter (measured at an annual rate). The rest of the world is expected to suffer a similar decline.2

With government-mandated lockdowns of retail and service spaces as well as workplaces economic activity had to contract in the affected countries. Going forward, the question is when and how quickly the economies around the globe will recover as mandated restrictions are lifted and voluntary precautions disappear.3 Arguably, the shape of the recovery depends on the future course of the virus and the associated lockdown policies as well as the recessionary forces that were unleashed by the deep contraction.

Health crises of the recent past occasionally led to sharp economic contractions—see for example the effects of the 1968-Flu or the SARS outbreaks in 2003—but these epidemics were local or regional events of smaller scale. Ma, Rogers, and Zhou (2020) estimate real GDP growth to have fallen by 3 percentage points in affected countries relative to unaffected ones in the year of past outbreaks across these different crises. Unfortunately, it is unclear how to generalize these findings to the current environment.

We propose an analysis that distinguishes the direct effects implied by the path of the virus and the accompanying individual and policy responses from the indirect recessionary effects. Our goal is to quantify the risks to the recovery from the latter taking the path of infections as given. The economy could bounce back quickly in sync with the easing of restrictions somewhat similar to what is the case after a temporary shock, akin to a well-managed natural disaster or a strike. Alternatively, the lockdowns could have triggered persistent dislocations in the labor market or disruptions in the financial sector; these effects might not cease to exist once restrictions are lifted and will hold back the recovery for a long time. Thus, even if we knew the exact path of the virus, there remains considerable uncertainty about the timing and shape of the (eventual) recovery.

We apply an estimated international macro model (GEMUS) to provide plausible bounds for the evolution of U.S. and foreign GDP.4 These bounds on future GDP reflect the extent to which the lockdowns have triggered persistent recessionary dynamics. Our analysis suggests that there is considerable downside risk to many of the publicly available forecasts.

Details of the analysis

This section describes the procedure we employ to construct the lower and upper bounds for U.S. and foreign GDP from selected time series data until 2020 Q2. The idea behind our procedure is that COVID-related restrictions must directly account for some, but not necessarily all, of the decline in economic activity observed in 2020 with the remaining decline being due to additional recessionary effects that are indirectly triggered by the COVID-related restrictions. This distinction is important as we view the direct economic effects as temporary in the sense that they disappear as restrictions are eased, whereas we view the indirect effects as persistent in the sense that they continue lingering even after the restrictions have long been lifted.

Computing the bounds on economic activity involves three steps. First, we construct a sequence of labor wedges in GEMUS that suppress the labor supply. These wedges capture the most direct impact of mandatory mobility restrictions on people's ability to work.5 We assume these restrictions to be in effect during the first half of the year; starting in 2020 Q3, the labor wedges return to zero as work restrictions are lifted (and voluntary precautions disappear). Second, conditional on the labor wedges, we use GEMUS to filter out the innovations to the various supply-like and demand-like shocks needed to rationalize the recent data up to 2020 Q2. From a technical perspective, we treat the labor wedges as an observed variable in the filtering. Third, we construct the actual bounds. In the "COVID only" case, we assume that all shocks affecting demand and supply that we estimated under step two, are fully offset and are back to their pre-COVID values in 2020 Q3. Thus, starting in 2020 Q3 the dynamics of the model are determined by the values of the endogenous state variables in 2020 Q2 only. In the "COVID+RD" case—where RD stands for recessionary dynamics—we assume that the demand and supply shocks are not offset. These exogenous variables return very slowly to their long-run values according to the estimated persistence of these shock processes. If, for example, our estimation in the second step implies that some of the decline in economic activity was due to a negative technology shock, then, given the high persistence of technology shocks in GEMUS, technology will remain low for an extended period in the "COVID+RD" case, but will jump back to its pre-Covid value in the "COVID only" case.

The labor supply shock constructed in the first step brings to the model the information that some of the decline in economic activity is intentional to limit the spread of the virus. This drag on activity should go away once restrictions are lifted. Without this assumption, GEMUS would predict U.S. and foreign GDP to continue falling over the remainder of the year and stay severely depressed for many years. Such a pessimistic forecast would reflect the fact that historically recessions are highly persistent—a feature common to time-series models estimated using historical data.6

Bounding the Recovery

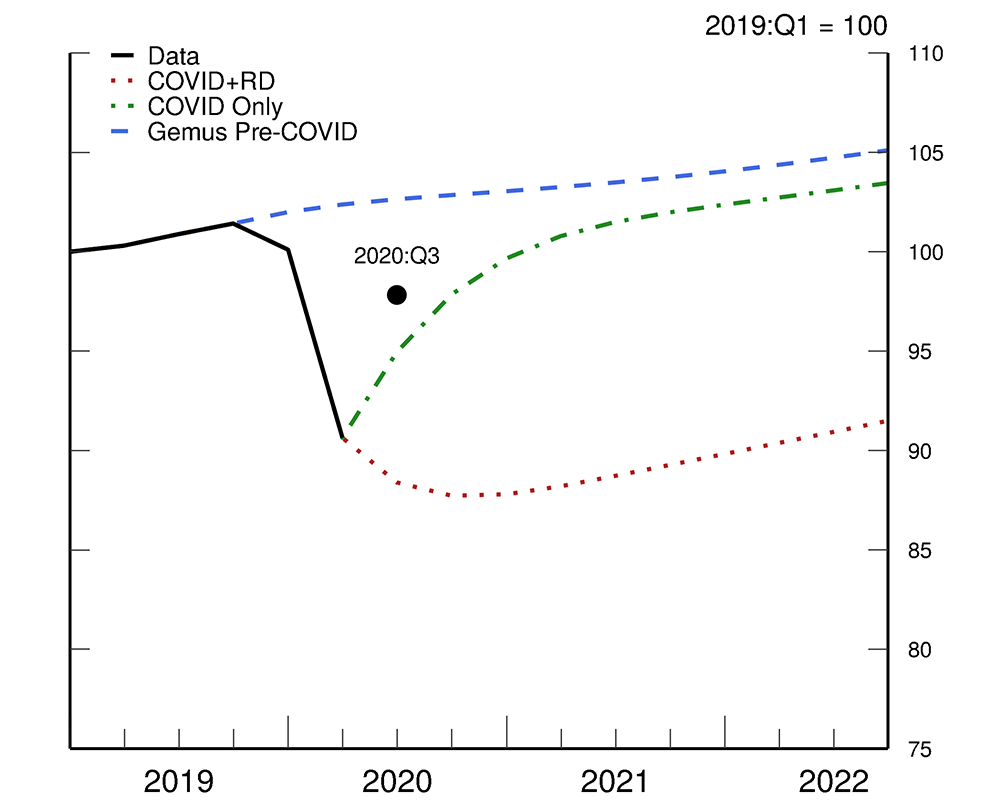

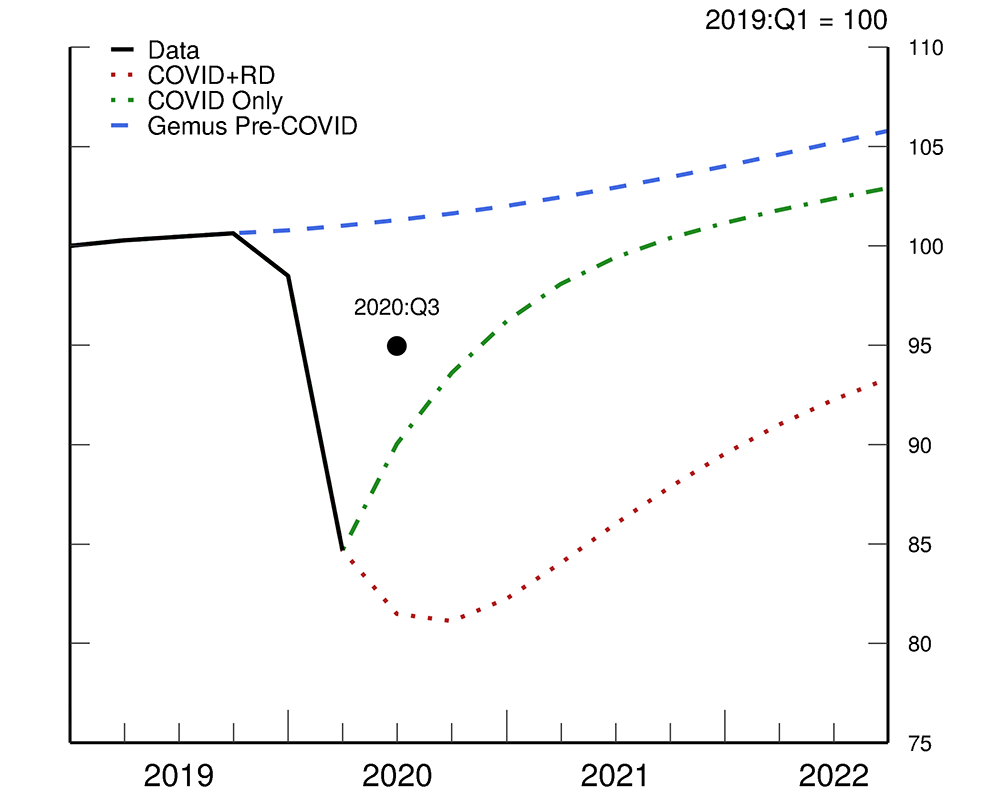

Figure 1 plots the evolution of U.S. and foreign GDP under the "COVID only" (green) and the "COVID+RD" (red) assumption. For comparison, we use GEMUS to produce a model estimate of the evolution of GDP in the absence of the COVID pandemic (blue). Our model implied pre-COVID path is similar to the expectations by outside forecasters as of 2019 Q4 (not shown).

Under the "COVID only" assumption, U.S. and foreign GDP recover with the easing of restrictions. With investment plummeting at the onset of the recession, the investment adjustment costs hold back the return of investment to its long-run growth path. Similarly, habit persistence accounts for the slow recovery of consumption and the drop in net worth of firms amplifies the role of financial frictions. Sticky wages and prices add to the delay of the recovery. All told, U.S. GDP is expected to be back near its pre-crisis level by mid-2021; however, even in this relatively optimistic scenario, it will take years for the economy to return to the path that was projected in early 2020.

Under the "COVID+RD" assumption, global GDP growth is projected not to pick up until the beginning of 2021 and to remain well below its pre-COVID level for years even as COVID-related restrictions have long been lifted and despite the support of fiscal and monetary policies. In this case, those shocks that are needed to explain the decline in GDP not accounted for by the labor supply shock follow their highly persistent patterns estimated for the GEMUS model.

Note: GDP is gross domestic product.

Source: Federal Reserve Board staff calculations.

Note: GDP is gross domestic product.

Source: Federal Reserve Board staff calculations.

We regard the "COVID only" and the "COVID+RD" case as reasonable upper and lower bounds on the plausible outcomes for the recovery. Weighing the roles of the recessionary effects and the lockdowns differently would imply outcomes that lie between these simulation paths. To gauge the plausibility of the scenarios constructed with information available through 2020 Q2, Figure 1 overlays the value of GDP in 2020 Q3 (the black dots). The recovery observed in the data is close to our "COVID only" scenario, with activity bouncing back strongly in the aftermath of the first wave of the virus and the lifting of restrictions around the world. Although the recovery in 2020 Q3 was stronger than expected, the path ahead remains highly uncertain and early data releases for Q4 suggest a slowdown of the recovery.

In Table 1 we compare our results to some recent GDP forecasts. For the United States, we use the September vintage of the Survey of Professional Forecasters (SPF), and for the rest of the world we rely on the June update of the IMF's World Economic Outlook projections. In the United States, the median SPF projection for 2020 and 2021 is somewhat tilted towards our COVID only scenario. For the foreign bloc, our estimates suggest a wider range of negative outcomes in 2020 and stronger rebound in 2021 relative to the IMF's projections.

Table 1: GDP Growth Forecast Comparison

| U.S. | Foreign | |||||

|---|---|---|---|---|---|---|

| SPF* | COVID+RD | COVID only | IMF** | COVID+RD | COVID only | |

| 2020 | -5.2 | -14.5 | -3.6 | -6.7 | -22 | -7.3 |

| 2021 | 3.2 | 1.8 | 4.1 | 5.3 | 8 | 7 |

Note: All figures correspond to year-over-year percent changes.

* The column SPF corresponds to the median forecast from the September 2020 vintage.

** The column IMF corresponds to the broad-real-dollar trade-weighted average of GDP growth forecasts for a selected group of countries accounting for 90% of U.S. trade.

Fiscal and monetary authorities around the globe responded quickly with massive stimulus programs to the COVID-lockdowns to provide funds to people falling into unemployment, to prevent business failures, and to assure the smooth functioning of financial markets. These policies have aimed at providing short-term assistance, but also at reducing the likelihood of prolonged recessionary effects. How successful the various programs may turn out to be is subject to speculation at this stage. Yet, even if, in part owing to a strong fiscal and monetary response, the United States manages to contain the indirect recessionary effects, U.S. GDP is sensitive to events abroad through trade and financial markets.

To explore the effect of these potential spillovers, we compute a counterfactual scenario in which only the filtered shocks originating in the foreign economies materialize in 2020. Shocks originating from the U.S., including the U.S. labor wedge shock, are set to zero for 2020. With foreign shocks only, the expected contraction in U.S. GDP growth would be 60% smaller in 2020 under the "COVID only" assumption compared to our baseline case and the level of U.S. GDP would return faster towards its pre-COVID path. By contrast, under the "COVID+RD" assumption strong recessionary dynamics abroad would generate a sizeable decline in U.S. GDP growth in 2020 and would hold back the recovery significantly with U.S. GDP remaining below pre-COVID levels for several years.

Conclusions

Using an estimated two-country DSGE model (GEMUS) we construct bounds for the recovery paths of GDP in the U.S. and abroad after the lifting of COVID-related restrictions. Our analysis distinguishes between the direct effects of the lockdowns and the indirect recessionary effects triggered by the lockdowns. If labor and financial markets recover quickly from the lockdown, our simulations suggest a fairly quick recovery from the worst global collapse in economic activity in recorded history. However, on the flip side our more pessimistic scenario suggests that such indirect recessionary effects might hold back growth in the world economy for years to come.

Appendix

GEMUS details

GEMUS is an international DSGE model featuring the United States and an aggregate bloc of the major trading partners of the United States. The model has been developed by staff in the International Finance Division. The main contributors have been Pablo Cuba-Borda, Nils Goernemann, Albert Queralto, Ignacio Presno, and Andrea Prestipino of the IF Division.

- The model features consumption and investment-dynamics, wage and price Phillips curves, financial frictions, global trade in assets and goods.

- Monetary policy in the two blocs follows a Taylor-type instrument rule for the short-term nominal interest rate.

- The model is estimated using Bayesian methods using macroeconomic times series from 1985 to 2019.

GEMUS is comparable to SIGMA, a calibrated international DSGE model developed in 2005.

Methodological details for counterfactual paths

Our approach is complementary to the Vector Auto Regression (VAR) analysis in Primiceri and Tambalotti (2020). First, using the forecast-errors obtained from data available in March and April 2020, they synthetizes a COVID-shock as a linear combination of other structural disturbances in the VAR. We impose a tighter structure by assuming the labor supply shock to be the main driver of economic activity at the onset of the pandemic and filtering out the contribution of the remaining structural shocks. In the second step, Primiceri and Tambalotti (2020) assume that the propagation of the synthetic COVID-shock follows the historical dynamics estimated in the VAR. Similarly, we model the propagation of shocks with an estimated DSGE model. Finally, in the third step, Primiceri and Tambalotti (2020) specify alternative scenarios for the time path for the evolution of the COVID-shock. Instead of imposing a time path on a synthetic disturbance, we construct scenarios that are explicit about the path of the underlying structural shocks.

References

Alvarez, F., D. Argente, and F. Lippi (2020). A Simple Planning Problem for COVID-19 Lockdown. Technical report, NBER working paper 26981.

Bodenstein, M., G. Corsetti, and Luca Guerrieri (2020). Social Distancing and Supply Disruptions in a Pandemic (PDF), Covid Economics, issue 19, pp. 1-52.

Ma, C., J. Rogers, and S. Zhou (2020). Modern Pandemics: Recession and Recovery. International Finance Discussion Papers 1295. Washington DC: Board of Governors of the Federal Reserve System.

Primiceri, G., and A. Tambalotti (2020). Macroeconomic Forecasting in the time of COVID-19. Northwestern University, Mimeo.

1. All authors are based at the Board of Governors of the Federal Reserve System, Washington D.C., 20551 USA. Corresponding author: Martin Bodenstein, email: [email protected]. Return to text

2. See the September 2020 Survey of Professional Forecasters and the International Monetary Fund's June 2020 World Economic Outlook. Return to text

3. Much has been written about the possibilities of V, U, W, or L-shaped recoveries in the business press. See, among others, https://www.forbes.com/advisor/investing/covid-19-coronavirus-recession-shape/. Return to text

4. GEMUS is a two-country DSGE model featuring the U.S. and a foreign bloc that represents the major trading partners of the U.S. The model is estimated using data from 1985-2019. To achieve a good empirical fit, the model features a rich set of real and nominal rigidities. The Appendix provides a brief description of the model. Return to text

5. In line with estimates from the Congressional Budget Office, we target a 5 percent decline in the labor force participation. This reduction in the labor supply can be rationalized with a simple SIR model, see for example, Bodenstein et al (2020). Given a labor force participation of 65% and a 30% ability to work from home, about 5% of those not being able to work from home need to be mandated not to work in order to observe a drop of the effective reproduction number from about 4 to 1. This calculation assumes that everybody who can work from home or does not work at all reduces contacts by 80% as in Alvarez et al (2020). Return to text

6. Our approach of merging the forecast from a time series model with some assumptions about the COVID path is complementary to the work of Primiceri and Tambalotti (2020). These authors construct a COVID-shock in the context of a VAR model. We compare their approach to ours in some detail in the appendix. Return to text

Bodenstein, Martin, Pablo Cuba-Borda, Jay Faris, and Nils Goernemann (2021). "Forecasting During the COVID-19 Pandemic: A structural Analysis of Downside Risk ," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, February 01, 2021, https://doi.org/10.17016/2380-7172.2806.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.