FEDS Notes

July 19, 2019

Substitutability of Monetary Policy Instruments

Cynthia Doniger, James Hebden, Luke Pettit, and Arsenios Skaperdas1

In response to the 2007-2009 global financial crisis, the Federal Reserve (Fed) and other major central banks turned to unconventional policy measures such as asset purchase programs to provide further accommodation after short-term policy rates reached their effective lower bounds. Roughly a decade after the crisis, central banks are now at various stages in the process of policy normalization.

Since short-term rates are the primary tool for adjusting the stance of monetary policy, the effects of changes in these target rates are generally well understood by the public. The same is not true for the effects of changes in asset holdings, as there is much less precedent for such changes. This note presents an approach to infer the magnitude of changes to the level of the policy target rate--a more commonly used metric of monetary policy actions--that would lead to approximately the same macroeconomic outcomes as induced through changes in the central bank's balance sheet.

Background

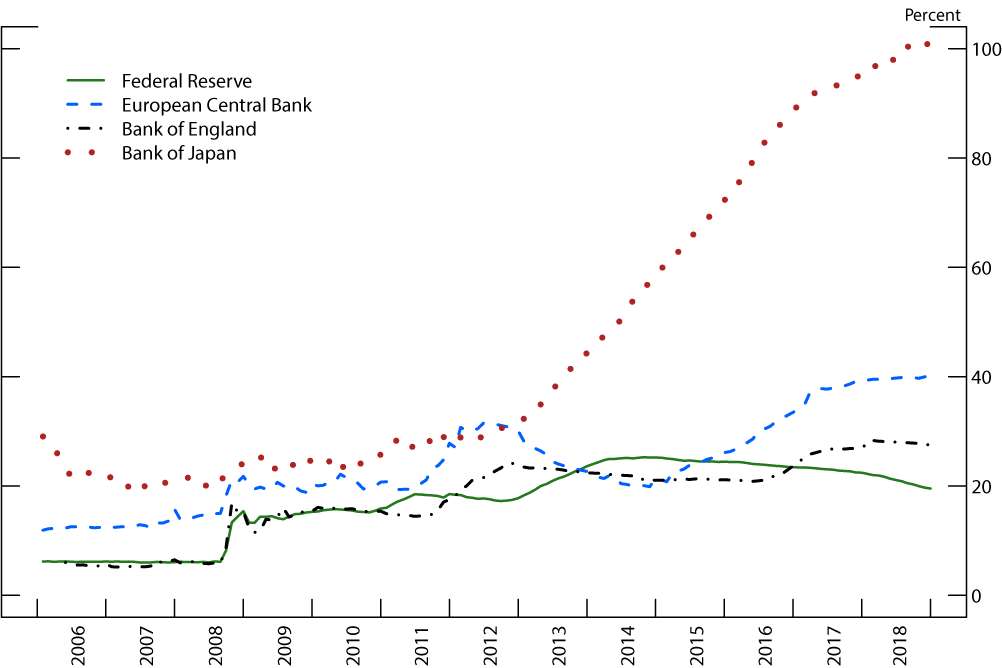

Following the global financial crisis, central banks in major advanced economies engaged in asset purchase programs, expanding their balance sheets in order to provide monetary accommodation (Figure 1). The expansion in central banks' asset holdings aimed to exert downward pressure on yields on a variety of longer-term securities by decreasing the supply of longer-term securities held by private investors, thereby easing financial conditions and stimulating economic activity.

Ten years after the crisis, central banks are at different stages of normalizing their policy stance, as shown in Figure 1. The green line illustrates the evolution of the Fed's balance sheet, which has been declining gradually as a share of GDP since October 2014, when the Fed began keeping its System Open Market Account (SOMA) holdings roughly constant. In October 2017, the Fed began its balance sheet normalization program by gradually redeeming Treasury and agency mortgage-backed securities. Most recently, in March 2019 the Federal Reserve announced its plans for concluding the reduction of its securities holdings.2 Just as asset purchases provide monetary accommodation by decreasing longer-term interest rates, shrinking the size of the balance sheet works in the opposite direction.

In this note, we characterize the macroeconomic effect of alternative balance sheet paths in terms of equivalent paths for the federal funds rate. We use the Federal Reserve Board's FRB/US macroeconomic model of the US economy, the SOMA model, and the Li-Wei term premium model to gain a better understanding of the effects of balance sheet normalization on financial and macroeconomic conditions in the U.S. These models allow us to obtain an estimate of the balance sheet and federal funds rate paths that would lead to equivalent macroeconomic outcomes.

Baseline and Alternative Scenarios

We set up two scenarios: a "baseline" scenario in which the Federal Reserve reduces the size of its balance sheet, and an "alternative" scenario in which asset holdings are kept constant and the path for the federal funds rate is chosen to arrive at the same macroeconomic outcomes.

In the baseline scenario, we assume that policymakers gradually reduce the size of the SOMA portfolio in accordance with the normalization program laid out in the March 2019 Balance Sheet Normalization Principles and Plans. We further assume that macroeconomic outcomes follow the median paths of the Summary of Economic Projections (SEP).3

In the alternative scenario, we assume that the Fed instead had held the SOMA portfolio roughly constant since October 2017 by continuing to fully reinvest maturing securities, implying that the FOMC never initiated a balance sheet normalization program. The size of the balance sheet is assumed to remain constant until demand for Federal Reserve liabilities necessitates growing the balance sheet. The crucial feature in this scenario is that we allow the level of the federal funds rate to adjust in order to achieve approximately the same macroeconomic outcomes as in the baseline scenario.

The difference in the implied paths of federal funds rate between these two scenarios represents the tradeoff between choices for the short-term policy rate and for the Federal Reserve's balance sheet.

Results

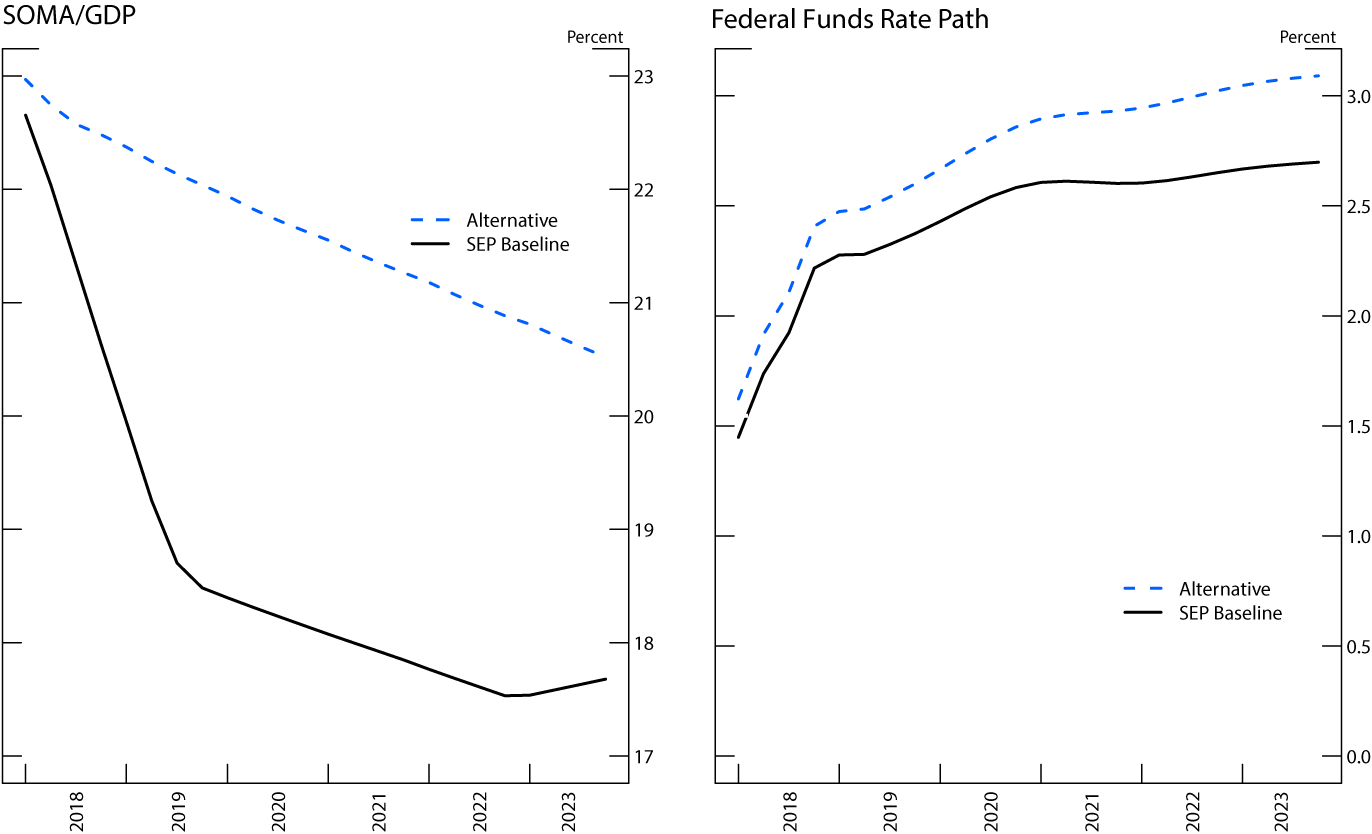

The left panel of Figure 2 shows the projected size of asset holdings by the Fed in both scenarios. In the baseline scenario, the size of the balance sheet is gradually reduced from the beginning of October 2017 until the end of September 2019. In the reinvestment scenario, the continued reinvestment of maturing securities leads to a constant dollar amount of asset holdings, which decreases slowly as a fraction of GDP over the horizon shown.4

The right panel of Figure 2 shows the baseline federal funds rate path and the alternative path that, by construction, generates nearly identical macroeconomic outcomes in the FRB/US model. By comparing the path for the federal funds rate in the alternative scenario with the corresponding path in the baseline, we obtain an approximation of the effect on the stance of monetary policy implied by balance sheet normalization, expressed in terms of a difference in the path of the federal funds rate relative to the baseline path.5

Because normalization of the size of the balance sheet gradually tightens financial conditions, the alternative path of the policy rate rises steadily above the baseline policy path to generate an equivalent gradual tightening in financial conditions. Over the horizon shown, the path for the federal funds rate in the reinvestment scenario is, on average, about 30 basis points above the baseline path.

These results also imply that, absent the reduction in the size of the Fed's balance sheet of about 2 percent of GDP that has occurred since October 2017, the federal funds rate would need to be roughly 20 basis points higher in 2019 Q2 in order for macroeconomic outcomes to be approximately equivalent. This amount of monetary tightening is relatively modest in comparison to the degree of monetary accommodation provided though asset purchases, which are estimated to have reduced 10-year Treasury yields by as much as 100 basis points.6

Our results rely on several assumptions that are both model- and forecast-dependent.7 As such, the results presented in this note may not generalize beyond the near-term forecast for the United States. Nonetheless, we hope that this exercise provides a useful framework that can help the public better understand the effects of balance sheet policy on broader macroeconomic outcomes.

References

Seth Carpenter, Jane Ihrig, Elizabeth Klee, Daniel Quinn, and Alexander Boote (2015). "The Federal Reserve's Balance Sheet and Earnings: A Primer and Projections," International Journal of Central Banking, vol. 11, no. 2, pp. 237-283.

Canlin Li and Min Wei (2013). "Term Structure Modeling with Supply Factors and the Federal Reserve's Large Scale Asset Purchase Programs," International Journal of Central Banking, vol. 9, no. 1, pp. 3-39."

1. The authors would like to thank Michele Cavallo, Chris Gust, and Zeynep Senyuz for their comments, and Sofia Baig, Chris Curfman, and Irene Ezran for excellent research assistance. Return to text

2. See the June 2017 Addendum to the Policy Normalization Principles and Plans and the March 2019 Balance Sheet Normalization Principles and Plans, https://www.federalreserve.gov/newsevents/pressreleases/monetary20170614c.htm and https://www.federalreserve.gov/newsevents/pressreleases/monetary20190320c.htm. Return to text

3. We use the March 2019 SEP. Forecast variables include the federal funds rate, headline and core inflation rates, GDP growth, and the unemployment rate. To construct outcomes for other FRB/US variables that are roughly consistent with FOMC participants' forecast submissions, Federal Reserve staff use a combination of models, empirical relationships, and smoothing algorithms. Return to text

4. In both scenarios, we assume that the balance sheet normalizes at a longer-run level of reserve balances of $1.1 trillion, the median value from the December 2018 Survey of Market Participants. Return to text

5. Specifically, to construct the alternative scenario, we compute the optimal control path for the federal funds rate under a loss function that places equal weight on the unemployment gap and on deviations of inflation from the 2 percent target for both the SEP baseline and the reinvestment scenarios. We then add the difference in the federal funds rate paths to the SEP baseline policy rate path. This procedure keeps macroeconomic outcomes essentially unchanged. Return to text

6. Several studies have suggested that, during the recovery, large-scale asset purchases had stronger accommodative effects operating through reductions on longer-term yields. For a summary of various studies' estimated effects of unconventional policy measures, see Table 1 in Fischer (2015), "Conducting Monetary Policy with a Large Balance Sheet," Remarks at the 2015 U.S. Monetary Policy Forum, February 27, available at https://www.federalreserve.gov/newsevents/speech/fischer20150227a.htm.. Return to text

7. We assume in our exercise that balance sheet policies operate via term premium effects (estimates of which are subject to considerable uncertainty). These effects are transmitted to the real economy entirely via aggregate demand channels. Additionally, the effects of both balance sheet and federal funds rate policy--and therefore our policy-equivalence estimates--depend on the modeling of the public's expectations. In our application of the FRB/US and Li-Wei models, we assume that financial market participants and wage and price setters hold expectations consistent with realized future outcomes, while other economic agents form expectations according to a vector autoregression. Finally, the monetary accommodation associated with a particular reinvestment strategy could differ under a different composition or initial size of the SOMA portfolio. Return to text

Doniger, Cynthia, James Hebden, Luke Pettit, and Arsenios Skaperdas (2019). "Substitutability of Monetary Policy Instruments ," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, July 19, 2019, https://doi.org/10.17016/2380-7172.2284.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.