FEDS Notes

August 26, 2025

U.S. Reciprocal Tariff Announcement and European Bank Stock Performance1

Pinar Uysal, Kellen Lynch and Ilknur Zer

European bank equity prices fell sharply following the April 2, 2025, U.S. reciprocal tariff announcement, reflecting investor concerns about rising trade tensions and their potential impact on global growth and financial stability.2 In this note, we examine how the effects of the tariff announcement on European banks varied with their trade exposure, capital strength, and asset quality. We find that banks with higher exposure to trade-sensitive sectors, weaker capitalization, or poorer asset quality experienced significantly larger declines in their stock prices compared to their peers following the announcement. These results suggest that both trade exposure and financial health are important factors in determining a bank's vulnerability to trade policy shocks.

Introduction

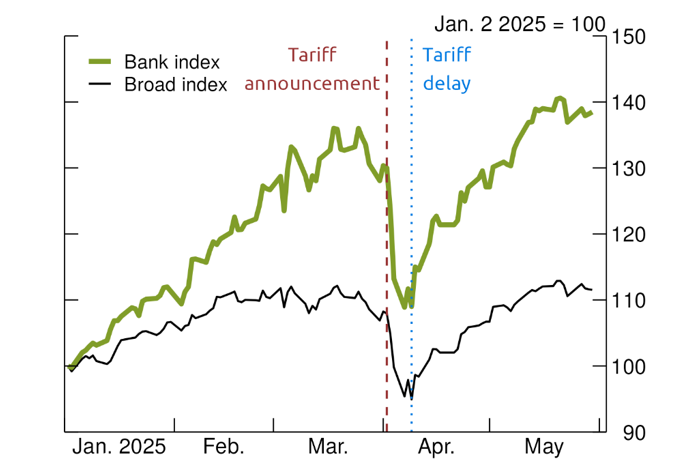

Following the announcement of new reciprocal U.S. tariffs on April 2, 2025, European banks experienced notable stock price declines, as concerns over U.S. and global growth weighed heavily on asset prices. In the two days following the announcement, the euro-area bank index bottomed out around 16 percent below its April 2 value, while the broad euro-area stock index declined by around 12 percent (Figure 1).3

European bank stock prices recovered following the announcement of a 90-day pause in reciprocal tariffs on April 9 and extended their recovery after U.S. Administration comments on April 22 suggested efforts to de-escalate trade tensions with China.4 Stronger-than-expected European bank earnings, which were boosted by trading on market volatility have also recently supported European bank stock prices.5 Overall, European bank stocks returned to their April 2 levels by May 2 and have since risen to year-to-date highs, outperforming the broader market index, which has also since surpassed April 2 levels. Nonetheless, bank stocks remain volatile and highly sensitive to trade and growth-related news.

Last observation: May 30, 2025. The green line is the Euro STOXX Bank Index. The black line is the Euro STOXX index. The red dashed line represents the announcement of reciprocal tariffs on April 2, 2025. The blue dotted line represents the announcement of a 90-day pause in reciprocal tariffs on April 9, 2025.

Source: Bloomberg.

Tariffs and trade policy uncertainty affect banks through a variety of macro-financial channels. The extant academic literature documents that rising global tariffs dampen economic growth by disrupting trade flows, misallocating resources, and increasing input costs for businesses and goods prices for consumers (Furceri, Hannan, Ostry, and Rose, 2019, 2020; Minton and Somale, 2025). Moreover, trade policy uncertainty, including around tariffs, likely causes firms to delay investment, potentially slowing economic activity even without any actual tariff changes (Dixit and Pindyck, 1994; Caldara, Iacoviello, Molligo, Prestipino, and Raffo, 2020). Finally, both rising tariffs and heightened trade uncertainty are associated with increased financial market volatility (Baker, Bloom, Davis, and Kost, 2024; Yilmazkuday, 2025).

These macro-financial developments can spill over to the banking system. In particular, shifts in U.S. trade policy affect European banks through several interconnected channels. First, a slowdown in the global economy and trade threatens credit quality, especially in trade-exposed sectors like manufacturing. Second, rising non-performing loans (NPLs) reduce bank capital and may force banks to set aside higher provisions, constraining capital distributions.

Third, increased trade uncertainty may reduce loan demand and lead banks to tighten credit standards. Indeed, the 2025:Q1 euro-area bank lending survey, conducted in March, noted that economic and trade uncertainty dampened firms' long-term planning and increased banks' scrutiny of corporate borrowers exporting to the U.S. (European Central Bank, 2025). Recent empirical evidence from the Federal Reserve's supervisory FR Y-14 data also shows that banks with higher exposure to trade uncertainty reduce credit supply, not just to directly affected firms but across portfolios (Correa, di Giovanni, Goldberg, and Minoiu, 2023).

Finally, an accommodative ECB response to a tariff-induced slowdown could squeeze net interest margins and erode bank profitability. The recent period of higher interest rates has lifted European bank earnings after years of lackluster performance, but with declining interest rates, banks may once again find themselves in a low-profitability environment.

However, quantifying the effects of tariffs on banks in a timely manner is challenging because data on lending activity, credit quality, and profitability are slow-moving and reported with a lag. To overcome this limitation, we turn to financial markets. Albeit imperfectly, markets incorporate firm-specific and macroeconomic news in ways consistent with forward-looking expectations (see, e.g., Chen, Roll, and Ross, 1986; Cutler, Poterba, and Summers, 1989; and Bernanke and Kuttner, 2005). Therefore, stock prices offer a timely window into how investors perceive the consequences of trade policy changes and any accompanying uncertainty. Accordingly, we focus on the reaction of bank stock prices—measured relative to the broad market—following the April 2 reciprocal trade announcement.

Data and Methodology

We assess the impact of the April 2, 2025, tariff announcement on bank valuations using daily stock return data from January 1 to May 30, 2025 for a panel of 22 European banks. We exploit cross-sectional variation in various bank-specific characteristics that could capture drivers of banks' performance after the reciprocal tariff announcements.

We estimate the following specification:

$$$$ \Delta{Excess Return}_{i,c,t}= \alpha_i+ \mu_c+ \beta_1 {Event} _t+ \beta_2 {Event} _t×{Bank Specific Factor}_i+ {\beta}_4 {\Delta}i_t^{2yr} + \beta_5 \Delta(i_t^{10yr}-i_t^{2yr})+ \epsilon_{i,c,t}\, (1)$$$$

where $$\Delta{Excess Return}_{i,c,t}$$ is the percentage change of bank $$i$$'s stock price, in excess of the percentage change in the broad stock market index. Subscripts c and t represent country and time, respectively, and $$\alpha_i$$ and $$\mu_c$$ are bank and country fixed effects. $${Event} _t$$ is a dummy variable that is equal to 1 for April 3 and 4, representing the two days with the most substantial stock price declines following the April 2 announcement.6 We control for changes in expected interest rates, $${\Delta}i_t^{2yr}$$ (proxied by changes in the two-year German sovereign yields), and changes in the term premium, $$\Delta(i_t^{10yr}-i_t^{2yr})$$ (proxied by changes in the difference between ten-year and two-year German sovereign bond yields), to capture the main drivers of bank stock prices.

The coefficient of primary interest, $$\beta_2$$, quantifies the heterogeneous impact of the tariff announcement on bank excess returns based on bank-specific factors. We use the 2024:Q2 EBA transparency exercise data considering six bank-specific factors: (1) the share of loans to manufacturing firms relative to total non-financial corporation (NFC) loans;7 (2) the share of loans to wholesale and retail trade firms relative to total NFC loans; (3) the Common Equity Tier 1 (CET1) capital ratio; (4) the leverage ratio (Tier 1 capital by total leverage ratio exposure, including assets and off-balance-sheet items); (5) NPL ratio (NPLs over total loans); and (6) trading book as a share of total assets. The first two metrics identify banks with higher exposure to tariff-sensitive sectors. The CET 1 and leverage ratios serve as proxies for bank capitalization, while NPL ratio captures asset quality. The trading book size allows us to assess whether banks with greater trading activities benefited from the elevated market volatility observed during this period. We standardize these measures to ensure comparability across banks.

Findings

Table 1 presents our results from the estimation of equation 1. Each column uses a different bank-specific characteristic—listed in the column header—as the explanatory variable of interest. Banks' excess returns are positively associated with policy rate expectations and with term premiums, as expected. Following the reciprocal tariff announcement, excess returns fell by roughly 2 percentage points, as indicated by the coefficient estimate of Event.

Table 1: Impact of tariff announcements on bank stock prices

| Bank characteristics: | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Manufacturing / NFC loans | Wholesale and Retail Trade / NFC loans | CET 1 Ratio | Leverage ratio | NPL ratio | Trading Book / Assets | |

| Event * Bank Characteristics | -0.53** | -0.70*** | 0.75*** | 0.35** | -0.55*** | -0.17 |

| (0.205) | (0.049) | (0.102) | (0.133) | (0.152) | (0.228) | |

| Event | -2.15** | -2.15** | -2.15** | -2.16** | -2.15** | -2.16** |

| (0.842) | (0.846) | (0.845) | (0.837) | (0.848) | (0.839) | |

| Policy Expectations | 0.32*** | 0.32*** | 0.32*** | 0.32*** | 0.32*** | 0.32*** |

| (0.081) | (0.081) | (0.081) | (0.081) | (0.081) | (0.081) | |

| Term Premium | 0.17* | 0.17* | 0.17* | 0.17* | 0.17* | 0.17* |

| (0.088) | (0.087) | (0.088) | (0.087) | (0.088) | (0.087) | |

| Observations | 2,228 | 2,228 | 2,228 | 2,228 | 2,228 | 2,228 |

| R-squared | 0.099 | 0.101 | 0.102 | 0.098 | 0.100 | 0.098 |

| Bank FE | YES | YES | YES | YES | YES | YES |

| Country FE | YES | YES | YES | YES | YES | YES |

| Economic impact of tariffs on bank excess returns at: | ||||||

| 75th percentile of the bank characteristics | -2.52 | -2.65 | -1.48 | -1.91 | -2.56 | -2.26 |

| 25th percentile of the bank characteristics | -1.89 | -1.68 | -2.83 | -2.42 | -1.74 | -2.03 |

| 75th minus 25th percentile | -0.63 | -0.97 | 1.35 | 0.51 | -0.82 | -0.23 |

Note: The table presents the estimated coefficients from Equation (1). The dependent variable is the percent change in bank excess returns, while key independent variables include a post-announcement dummy, bank-specific characteristics, and their interactions. Additional controls include measures for policy expectations and term premium. Each column represents a different bank characteristic as indicated in the column titles. The bank characteristics are standardized to ease interpretation. Double clustered standard errors at the bank and date level are in parentheses. Significance levels: *** p<0.01, ** p<0.05, * p<0.1. Source: EBA transparency exercise data, Bloomberg, and authors' calculations.

Notably, excess returns of banks with higher exposure to the manufacturing sector and wholesale and retail-trade sectors were more sensitive to tariff announcements (columns (1) and (2)). The economic magnitude of these effects is non-trivial. For banks at the 75th percentile of manufacturing and trade-loan exposure, excess returns declined by roughly 2.5 percentage points following tariff announcements—about 0.6 to 1 percentage points more than those at the 25th percentile.

The sensitivity of a bank's excess return to tariff announcements is significantly correlated with its capital structure and asset quality (columns (3), (4), and (5)). The results imply that capital strength helped cushion losses: banks in the 75th percentile of the CET1- and leverage-ratio distributions experienced excess return declines up to 1.4 percentage points smaller than their less-capitalized peers in the 25th percentile. In contrast, weak asset quality amplified the negative impact—banks with higher NPL ratios saw excess returns that were up to 0.8 percentage points lower than those with stronger loan portfolios.

Finally, the impact of tariff announcements did not vary significantly with banks' trading book size. We also find that other bank risk factors—including market risk, operational risk, credit risk, foreign exchange risk, and risk density—did not have significant impacts either.

Conclusion

Taken together, our findings highlight the significant and heterogeneous effects of trade policy shocks on European banks. Investors respond not only to the broad economic effects of tariffs on banks but also take into account bank-specific vulnerabilities such as exposure to trade-sensitive sectors, capital adequacy, and current asset quality. Overall, the tariff shock hits trade-exposed and less capitalized banks the most.

References:

Scott R. Baker & Nicholas Bloom & Steven J. Davis & Kyle J. Kost, (Forthcoming 2024). Journal of Financial Economics.

Bergin, Paul R., Giancarlo Corsetti, (2023). "The macroeconomic stabilization of tariff shocks: What is the optimal monetary response? ", Journal of International Economics, 143, 103758.

Bernanke, Ben S. and Kenneth N. Kuttner (2005). "What Explains the Stock Market's Reaction to Federal Reserve Policy?", Journal of Finance, 60(3), 1221–1257.

Caldara, Dario, Matteo Iacoviello, Patrick Molligo, Andrea Prestipino, Andrea Raffo (2020). "The economic effects of trade policy uncertainty", Journal of Monetary Economics, 109, 38-59.

Chen, Nai-Fu, Richard Roll, and Stephen A. Ross (1986). "Economic Forces and the Stock Market.", Journal of Business, 59(3), 383–403.

Correa, Ricardo, Julian di Giovanni, Linda S. Goldberg, and Camelia Minoiu (2023). "Trade Uncertainty and U.S. Bank Lending", International Finance Discussion Papers 1383. Washington: Board of Governors of the Federal Reserve System.

Cutler, David M., James M. Poterba, and Lawrence H. Summers (1989). "What Moves Stock Prices?", Journal of Portfolio Management, 15(3), 4–12.

European Central Bank (2025). "The euro area bank lending survey - First quarter of 2025".

Foy, Simon, and Joshua Franklin (2025). "European bank traders deliver best results in more than a decade, https://www.ft.com/content/37ed62d5-1e39-405f-aaa9-4a8213be03f1" Financial Times, May 5.

Furceri, Davide , Swarnali A. Hannan, Jonathan David Ostry, and Mr. Andrew K. Rose (2019). "Macroeconomic Consequences of Tariffs," IMF Working Papers 2019/009, International Monetary Fund.

Furceri, Davide , Swarnali A. Hannan, Jonathan David Ostry, and Mr. Andrew K. Rose (2020). "Are Tariffs Bad for Growth? Yes, Say Five Decades of Data" Journal of Policy Modeling, 42(4), 850-859.

Iercosan, Diana, Ashish Kumbhat, Michael Ng, and Jason Wu (2017). "Trading Activities at Systemically Important Banks, Part 3: What Drives Trading Performance?," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, July 10, 2017.

Minton, Robert, and Mariano Somale (2025). "Detecting Tariff Effects on Consumer Prices in Real Time," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, May 09, 2025.

Schuetze, Arno, Nicholas Comfort, and Noele Illien (2025). "Europe's Trading Desks Score Gains in Midst of Trump Tumult, https://www.bloomberg.com/news/articles/2025-04-30/europe-s-trading-desks-score-gains-in-midst-of-trump-tumult" Bloomberg, April 30.

Yilmazkuday, Hakan (2025). U.S. tariffs and stock prices, Finance Research Letters, 83(107708).

1. Kellen Lynch, Pinar Uysal, and Ilknur Zer. We would like to thank Daniel Beltran, Luca Guerrieri, Todd Messer, and Friederike Niepmann for their helpful suggestions. The views presented in this note are those of the authors and do not necessarily reflect those of the Federal Reserve Board or the Federal Reserve System. Return to text

2. Our sample includes 22 publicly traded European Economic Area/European Union banks domiciled in Finland, France, Germany, Greece, Ireland, Italy, Netherlands, Norway, Portugal, Spain, and Sweden. Return to text

3. We are using the stock prices at market close on April 2, because the European markets were closed prior to the announcement. Return to text

4. The 90-day pause applies only to the reciprocal tariff rates announced on April 9 and is not a full pause on U.S. tariffs. There is still a substantial amount tariffs in the interim, as most targeted countries have faced a baseline 10 percent tariff on goods as they negotiate trade deals with the U.S. government. Additionally, broad U.S. tariffs have been placed on goods from the auto, steel, and aluminum sectors. Return to text

5. On recent European bank earnings driven by trading activity, see Schuetze, Comfort, and Illien, "Europe's Trading Desks Score Gains in Midst of Trump Tumult," Bloomberg, April 30, 2025, https://www.bloomberg.com/news/articles/2025-04-30/europe-s-trading-desks-score-gains-in-midst-of-trump-tumult; and Foy and Franklin, "European bank traders deliver best results in more than a decade," Financial Times, May 5, 2025, https://www.ft.com/content/37ed62d5-1e39-405f-aaa9-4a8213be03f1. Increased volatility typically boosts trading activity, allowing banks to earn more from fees and market-making (Iercosan, Kumbhat, Ng, and Wu, 2017). Return to text

6. The tariffs were announced on April 2nd around 4 pm EST when European markets were closed. Return to text

7. The EBA transparency exercise maps the bank-level NFC loan data to the Statistical Classification of Economic Activities in the European Community (NACE) taxonomy. Exposures are reported at the Level 1-NACE codes, which correspond to 19 broad economic sectors. Return to text

Lynch, Kellen, Pinar Uysal, and Ilknur Zer (2025). "U.S. Reciprocal Tariff Announcement and European Bank Stock Performance," FEDS Notes. Washington: Board of Governors of the Federal Reserve System, August 26, 2025, https://doi.org/10.17016/2380-7172.3857.

Disclaimer: FEDS Notes are articles in which Board staff offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than FEDS Working Papers and IFDP papers.