IFDP Notes

November 07, 2017

A New Dataset of Macroprudential Policy Governance Structures1

Ricardo Correa, Rochelle M. Edge, and Nellie Liang

Governance structures are a critical part of a framework for implementing macroprudential policy, alongside methodologies for measuring and monitoring systemic risk, and analyses to understand the impact of policies that may be used to mitigate risk. As part of various research projects to study macroprudential policy frameworks, we have compiled a new dataset of governance structures in 58 countries. One research project, Edge and Liang (2017), examines characteristics of new governance structures that may make them more effective for undertaking macroprudential policy and how they are related to a country's existing financial regulatory structure. Another project, Claessens, Correa, Londono, and Mislang (forthcoming), studies countries' governance structures and authorities' public communications of financial stability risks.

The dataset used for these projects--current as of March 2017--is being made available to other researchers (see, Brookings). In addition to salient characteristics of new governance structures, this dataset includes information on existing financial supervisory and regulatory structures; namely, authorities that conduct microprudential policy with a focus on the safety and soundness of financial institutions, and authorities that set widely-used prudential policy tools. This note documents the construction of our dataset, including the decisions that we made concerning the countries and governance-structure facts to record in our dataset, and it discusses the approach that we followed for collecting this information. We also report a few governance-structure characteristics from this dataset, though we refer the reader to our above-mentioned papers for more detailed discussions of these characteristics.

1. Countries included in our dataset

The starting point for the sample of countries is the sample of 64 countries from Cerutti, Correa, Fiorentino, and Segalla (2016). They document the intensity of usage of prudential instruments, including macroprudential instruments, and show that five instruments are used frequently in 64 countries during 2000 to 2014. We chose this set of countries as our starting point, because we are interested in countries that have used macroprudential instruments relatively frequently and for which governance for their use will be more important.

However, we made some small adjustments to Cerutti et al's country sample. We dropped six of the seven countries that they highlighted as having limited information about the use of prudential instruments.2 We did not drop Saudi Arabia, despite it having limited information, because we wanted to include all of the G‑20 countries. We also dropped Taiwan, because of the lack of information about its governance structure. We added Cyprus, because it is the only EU country excluded from Cerutti et al. This process resulted in a sample of 58 countries, which are reported in Table 1.

Our country coverage is larger than that of Nier et al (2011), whose dataset of 50 countries has been used by a few other researchers--such as Lim et al (2013) and Masciandaro and Volpicella (2016)--to study questions related to financial stability governance structures. The difference in country coverage results from 14 countries in our dataset (marked by a subscript (a) in Table 1) that are not included in Nier et al (2011) and 6 countries in Nier et al (reported in the footnote to the table) that are not included in our dataset. Our country coverage is also larger than that of Lombardi and Siklos (2016), who have 45 countries in their dataset. With the exception of one supranational financial stability authority included in their database, Lombardi and Siklos' country sample is a subset of ours.

Of the 58 countries in our dataset, 28 (or, 48 percent) are advanced economies and 30 (or, 52 percent) are emerging market or developing economies, as categorized by Amone and Romelli (2013), consistent with the IMF's 2007 WEO report. Lombardi and Siklos' (2016) dataset (excluding supranational EU authorities) is similar to ours, 52 percent advanced economies and 48 percent emerging market or developing economies. For comparison, Nier et al's (2011) dataset consist of 44 percent advanced economies and 56 percent emerging market or developing economies, and the papers that use this dataset drop countries from their analyses in a way that skews their samples even more to emerging market or developing economies.

Table 1 – Countries included in our dataset

| Argentina | Finland | Luxembourg(a,b) | Singapore |

| Australia | France | Malaysia | Slovak Republic |

| Austria | Germany | Malta(a,b) | Slovenia(a) |

| Belgium | Greece(b) | Mexico | South Africa |

| Brazil | Hong Kong(b) | Netherlands | South Korea(a) |

| Bulgaria | Hungary | New Zealand | Spain |

| Canada | Iceland(a) | Norway | Sweden |

| Chile | India | Peru | Switzerland |

| China | Indonesia | Philippines(b) | Thailand |

| Colombia | Ireland | Poland | Turkey |

| Croatia(a,b) | Israel(a) | Portugal | Ukraine(a,b) |

| Cyprus(a,b) | Italy | Romania(b) | United Kingdom |

| Czech Republic | Japan | Russian Federation | United States |

| Denmark(a) | Latvia(a,b) | Saudi Arabia(a) | |

| Estonia(a) | Lithuania(a,b) | Serbia(b) |

(a) Countries that are in our dataset but not included in Nier et al's (2011) dataset. Nier et al include Jordan, Lebanon, Mongolia, Nigeria, Paraguay, and Uruguay, which are not in our dataset.

(b) Countries that are in our dataset but not included in Lombardi and Siklos' (2016) dataset. Lombardi and Siklos includes the euro area as an observation, which we do not.

2. Governance-structure facts collected for our dataset

To characterize a country's governance structure for macroprudential policy and financial stability, we chose to focus on a number of features that could determine its effectiveness. In particular, we chose to characterize whether there is a coordinating body (including its membership) and leadership and what policy instruments this body has authority for. The database also captures other arrangements; specifically, whether there is primarily a single agency responsible for macroprudential policy. We collected information on a country's assignments of authorities for microprudential policies, which tend to be focused on safety and soundness, investor protection, or other microprudential objectives. We also collected information on a country's assignment of authorities for the setting and implementation of the countercyclical capital buffer, loan-to-value ratio caps, and stress tests. These are prudential policy instruments that are widely-used and could be adjusted in a time-varying way by individual agencies or a coordinating body.

For countries' macroprudential policy governance structures, we collected information on whether a country has a formal financial stability committee (FSC) and if it does not, what other type of governance arrangement there is for financial stability. If a country has a FSC, we collected information on:

- Whether the FSC is created formally by legislation or exists in more de facto arrangement as a result of memorandum of understanding (MOU) letters across agencies;

- the year the FSC was established;

- the specific agencies on the FSC, which could include the central bank, the ministry of finance, the banking prudential regulator, other financial institutions' or securities markets' regulators (to the extent they exist as separate entities to the banking regulator), and the deposit insurer (also to the extent it exists as a separate agency);

- the number of agencies represented on the FSC;

- the agency or agencies that chair the FSC, if a chair exists; and,

- the FSC's authorities for either macroprudential policy instruments; semi-hard policy instruments, which may include "comply and explain" authorities; or only soft authorities.

For countries that do not have a FSC, we collected information on whether there is a single authority, and which agency it is, or another type of cooperative arrangement, though there are less data for these arrangements than for formal FSCs.

For all countries, we collected information on assignments of authorities for microprudential policy, including:

- Whether the central bank is also a bank prudential regulator;

- whether the central bank regulates any non-bank financial institutions;

- whether the central bank regulates securities' markets; and,

- whether the bank prudential regulator (whether it is the central banks or an independent bank prudential regulator) regulates the whole financial system.

For the assignments of authorities for the setting of the three instruments that are or have the potential to be used as time-varying tools to satisfy macroprudential objectives, we collected information on:

- Which agency has authority to set the Basel III countercyclical capital buffer (CCyB);

- Which agency has authority to set residential mortgage loan-to-value (LTV) ratios; and,

- Which agency conducts bank stress tests.

3. Data sources and collection approach

The main sources for our information on countries' macroprudential policy governance structures; their assignments of authorities for safety and soundness policy; and their assignments of authorities for setting these three time-varying prudential policy instruments are national authorities' websites (and further documents referenced therein), national authorities' financial stability reports, IMF Article IV reports, and, where available, IMF financial sector assessment program (FSAP) reports. We undertook various cross checks, including comparing what we inferred about financial stability governance structures from our sources with Lombardi and Siklos (2016) on macroprudential policies, with Nier et al (2011) on safety and soundness for microprudential policies, and with an appendix table on institutional structure in a recent IMF/FSB/BIS report (2016). For information about the availability of tools, we additionally consulted responses to the IMF's Global Macroprudential Policy Instrument (GMPI) survey for 2013 data.

Our approach to obtaining information on countries' macroprudential policy governance structures from public sources is similar to that followed by Lombardi and Siklos (2016). Nier et al (2011) relied on information from an IMF survey of relevant national authorities in 2010. Their dataset does not reflect all the changes in structures since 2010 and covers fewer countries. While their survey could be more accurate since it is based on countries' responses, it still relies on a country's interpretation of the questions. Our data provides a more consistent interpretation of public statements and recording of facts about governance structures across countries.

4. A few governance-structure facts for the countries in our dataset

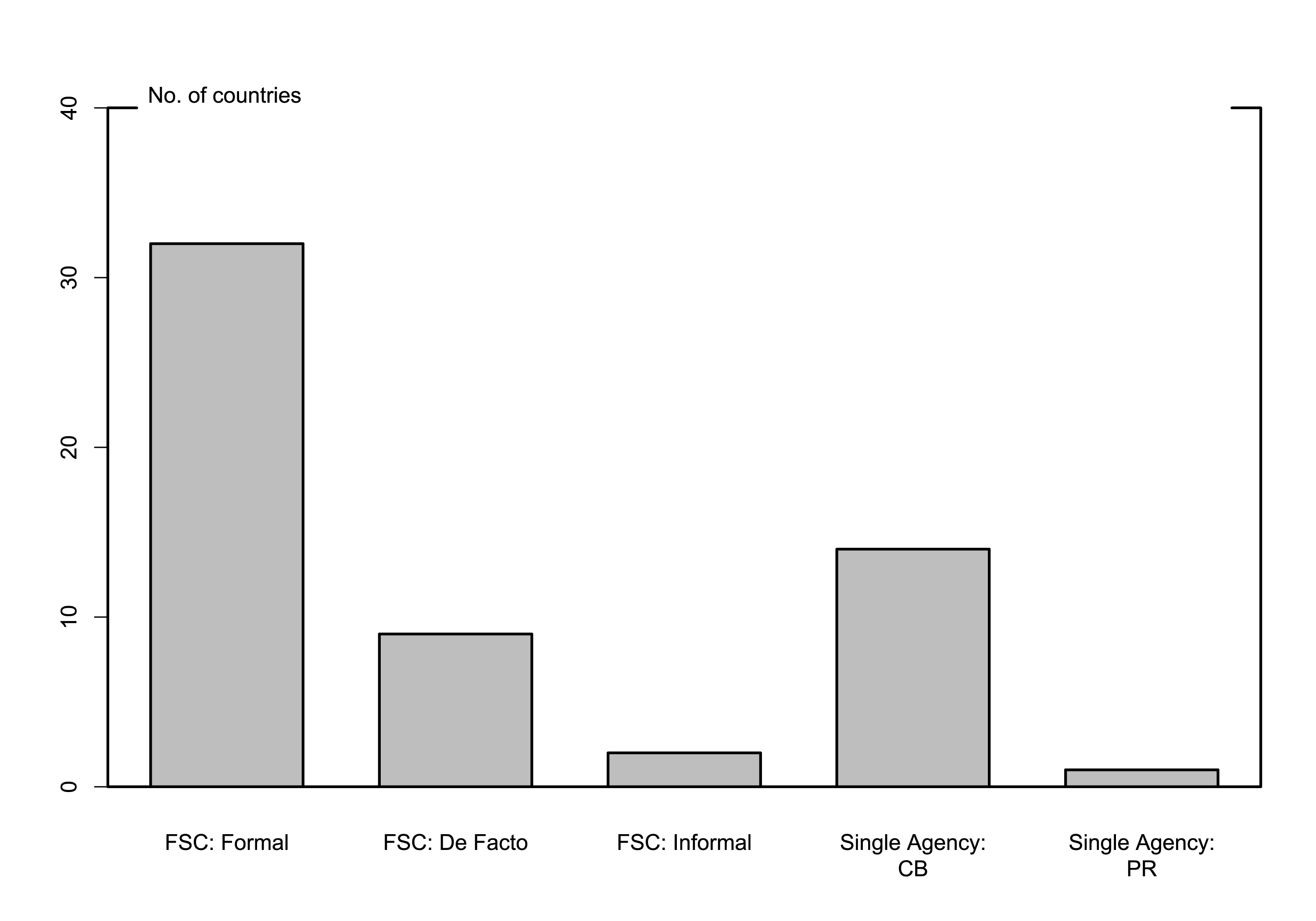

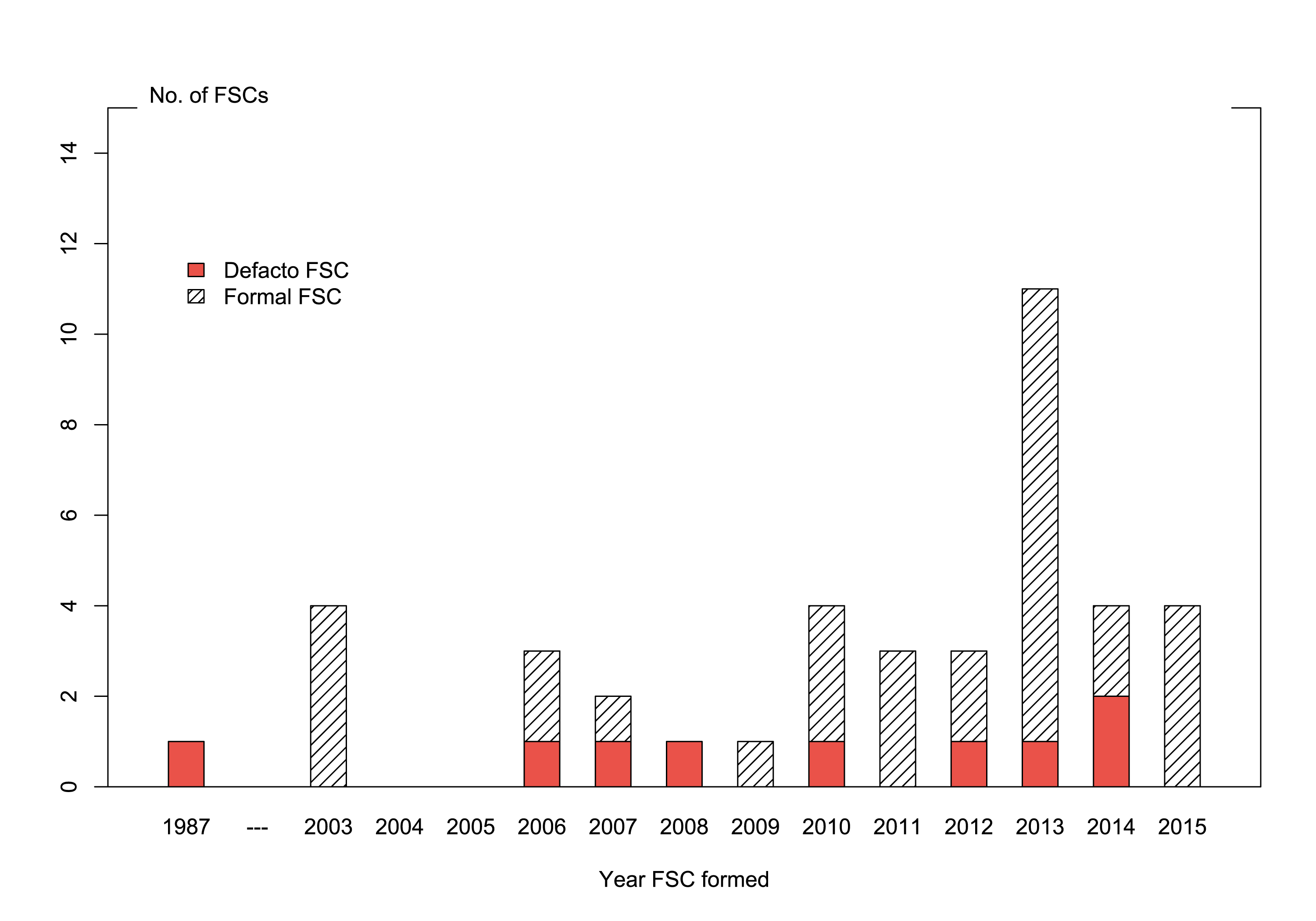

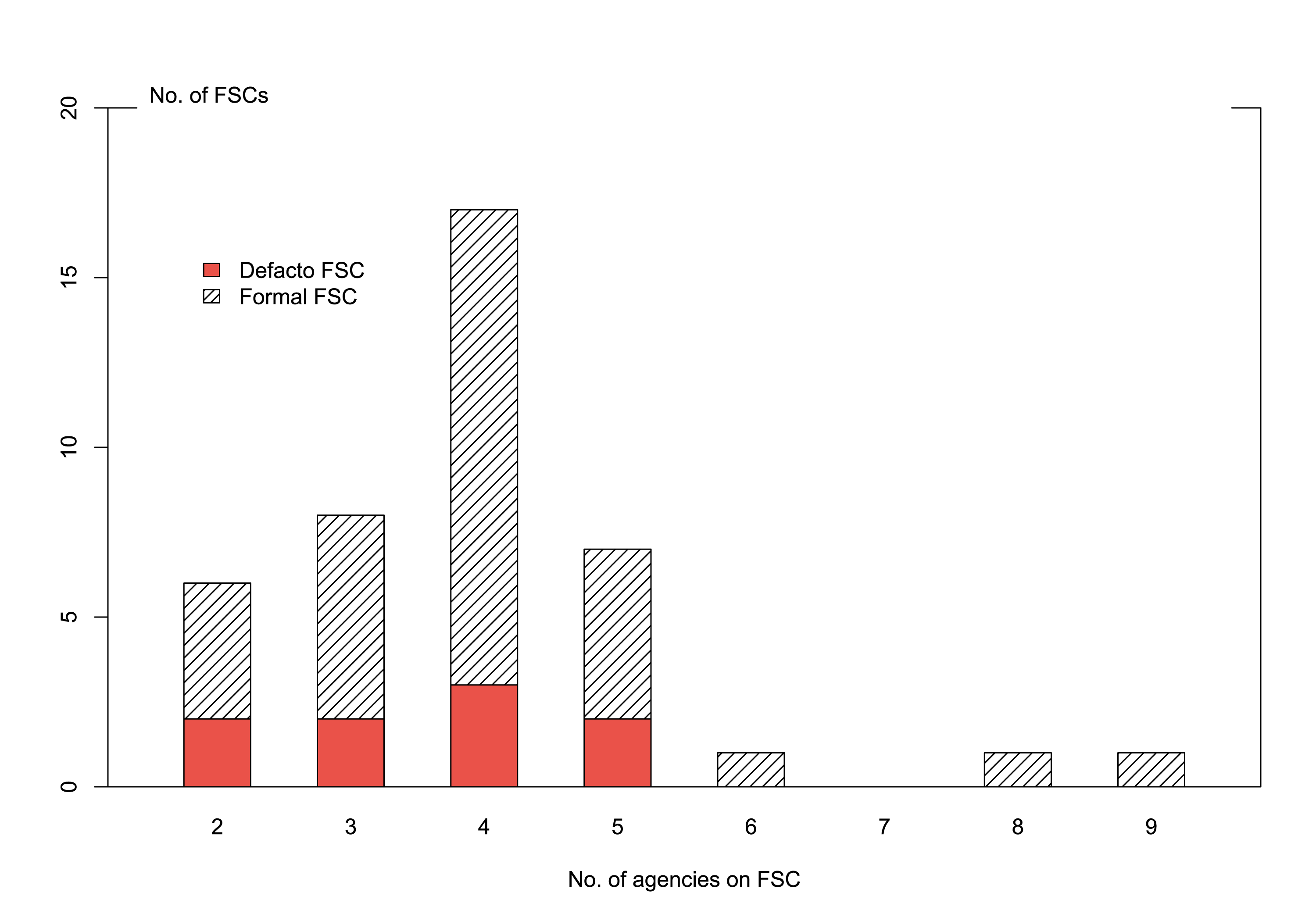

Figure 1 reports some summary governance-structure characteristics of the 58 countries in our sample. Panel a of Figure 1 shows that the most common financial stability governance structure of the 58 countries in our dataset is a formal FSC, followed by a single agency, which in almost all cases is the central bank. Panel b shows the numbers of agencies represented on the formal and de facto FSCs in our dataset. Almost all committees have three to five members with the most common number of members being four. Finally, Panel c shows the years in which the 41 formal and de facto FSCs in our dataset were formed. Clearly, most committees were formed after the crisis, with 2013 being the most common year. (Additional key characteristics of countries' governance--and FSC-structures--particularly, relating to the roles and authorities of specific agencies in these structures--are reported in Tables 1 to 4 of Edge and Liang, 2017.)

Figure 1 – Countries' Financial Stability Governance Structures and Committees

5. References

Amone, M., and D. Romelli, 2013. "Dynamic central bank independence indices and inflation rate: A new empirical exploration." Journal of Financial Stability 9, pp. 385-98

Cerutti, E., R. Correa, E. Fiorentino, and E. Segalla, 2016. "Changes in Prudential Policy Instruments--A New Cross-Country Database." International Finance Discussion Papers 1169, Board of Governors of the Federal Reserve System.

Edge, R., and N. Liang, 2017. "New Financial Stability Governance Structures and Central Banks." Hutchins Center Working Paper No. 32, Brookings Institution.

Lim, C., I. Krznar, F. Lipinsky, A. Otani, and X. Wu, 2013. "The Macroprudential Framework: Policy Responsiveness and Institutional Arrangements." IMF Working Paper 13/166. International Monetary Fund.

Lombardi, D. and P. Siklos, 2016. "Benchmarking Macroprudential Policies: An Initial Assessment." Journal of Financial Stability 27, pp. 35-49.

Masciandaro, D. and A. Volpicella, 2016. "Macroprudential Governance and Central Banks: Facts and Drivers." Journal of International Money and Finance 61, pp. 101-119.

Nier, E., J. Osinski, L. Jacome, and P. Madrid, 2011. "Towards Effective Macroprudential Policy Frameworks: An Assessment of Stylized Institutional Models." IMF 11/250, International Monetary Fund.

1. We thank Nathan Mislang and Tyler Wake for excellent research assistance. Ricardo Correa is Chief of the International Financial Stability section in the Division of International Finance at the Federal Reserve Board; Rochelle M. Edge is a Deputy Director in the Division of Monetary Affairs at the Federal Reserve Board; and Nellie Liang is the Miriam K. Carliner Senior Fellow in Economic Studies at the Brookings Institution. The views in this note are solely the responsibility of the authors and should not be interpreted as reflecting the views of the Board of Governors of the Federal Reserve System or of any other person associated with the Federal Reserve System or the Brookings Institution. Return to text

2. Specifically, we dropped Kuwait, Lebanon, Mongolia, Nigeria, Uruguay, and Vietnam. Return to text

Correa, Ricardo, Rochelle M. Edge, and Nellie Liang (2017). “A New Dataset of Macroprudential Policy Governance Structures,” IFDP Notes. Washington: Board of Governors of the Federal Reserve System, November 2017, https://doi.org/10.17016/2573-2129.38.

Disclaimer: IFDP Notes are articles in which Board economists offer their own views and present analysis on a range of topics in economics and finance. These articles are shorter and less technically oriented than IFDP Working Papers.