The Federal Reserve Payments Study (FRPS) is an ongoing effort to estimate aggregate trends in noncash payments in the United States, offering a periodic benchmark of developments in the U.S. payments system to policymakers, the industry, and the public.

Latest Data

Released March 2025

National Payment Volumes, Detailed Data, DFIPS (CY 2021)

ACH, Checks, Wires, and Alternative Payments

Data included in this release is from the DFIPS, which include a consistent set of large depository institutions and a representative sample of smaller institutions.

Released November 2024

National Payment Volumes, Detailed Data, NPIPS (CY 2021 and 2022)

Cards and Alternative Payments

Data included in this release is from the NPIPS, which include a census of major general-purpose card networks, private-label card issuers and processors, and processors involved with other types of emerging and alternative payment methods and systems.

Latest Figures

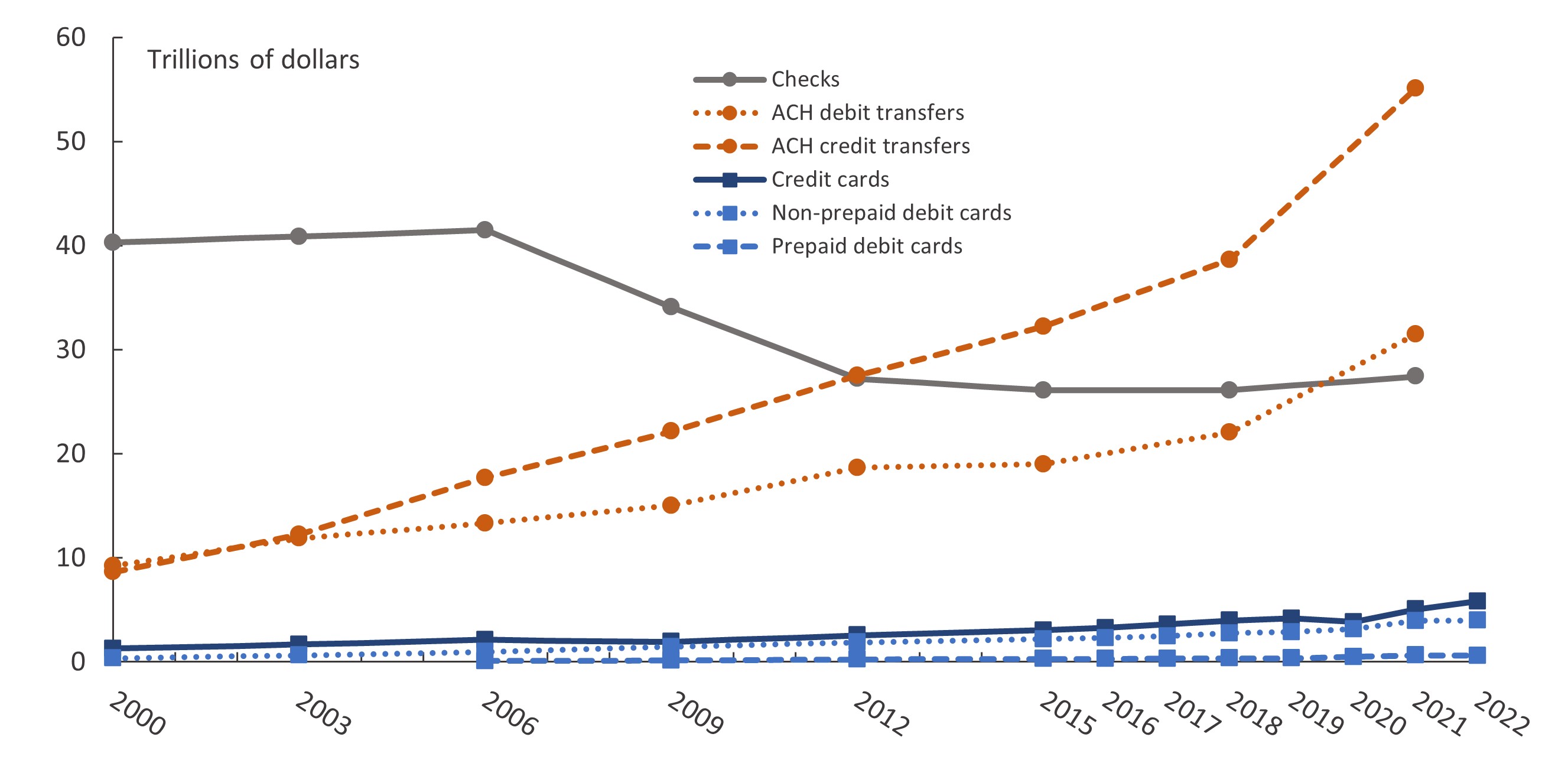

Figure 1. Trends in noncash payments, by value, 2000–22

Note: All estimates are on a triennial basis, except that card payments were estimated for every year since 2015. Credit card payments include general-purpose and private-label versions. Prepaid debit card payments include general-purpose, private-label, and electronic benefits transfer (EBT) versions. Estimates for prepaid debit card payments are not available for 2000 or 2003. The points mark years for which data were collected and estimates were produced. Lines connecting the points are linear interpolations. On March 6, 2025, the figure was updated with the latest data.

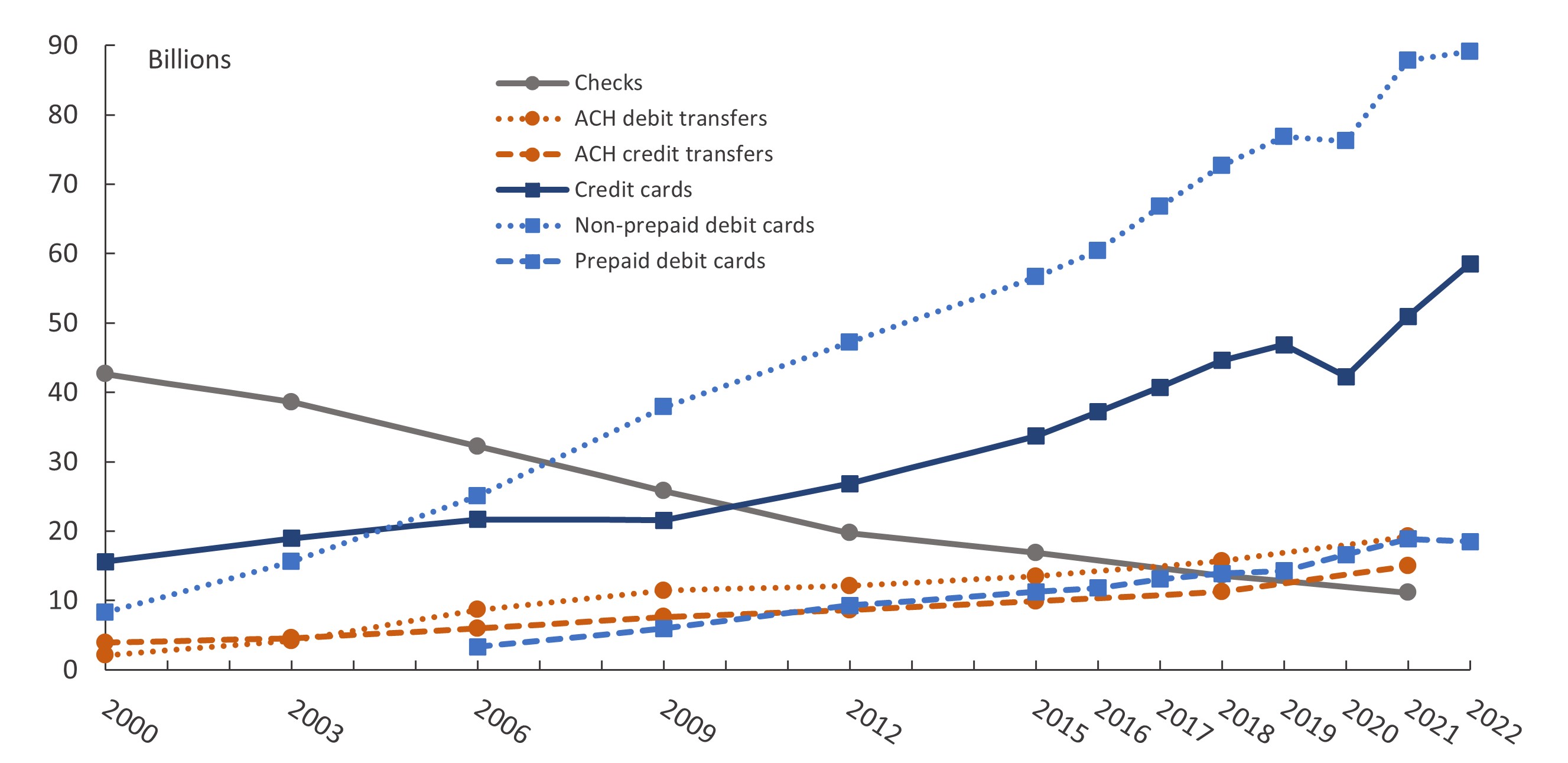

Figure 2. Trends in noncash payments, by number, 2000–22

Note: All estimates are on a triennial basis, except that card payments were estimated for every year since 2015. Credit card payments include general-purpose and private-label versions. Prepaid debit card payments include general-purpose, private-label, and electronic benefits transfer (EBT) versions. Estimates for prepaid debit card payments are not available for 2000 or 2003. The points mark years for which data were collected and estimates were produced. Lines connecting the points are linear interpolations. On March 6, 2025, the figure was updated with the latest data.

Contact

For questions, comments, or to be added to the FRPS mailing list, please contact: [email protected].