Money Stock Measures - H.6 Release

Technical Q&As RSS DDP

This page provides additional information about data in the Board of Governors' statistical release on money stock measures (H.6). Most of the information is of a technical nature and represents answers to questions that may be of interest to a range of analysts and researchers. The page will be updated as such questions arise.

Documentation for the statistics in the H.6 release is available on the About page on the Board's website.

Frequently Asked Questions on Revisions Incorporated in the August 2021 H.6 Release to the Amount of Foreign Currency Denominated Deposits Excluded from the Monetary Aggregates

1. Why did the Federal Reserve revise the amount of foreign currency denominated deposits excluded from the savings deposit and small time deposit components of the aggregates?

Posted: 08/24/2021A. Measures of the money stock exclude deposits denominated in foreign currencies. Data on deposits denominated in foreign currencies are collected once a quarter from the Report of Foreign (Non-U.S.) Currency Deposits (FR 2915), and data from this report are used to adjust total deposit data. Foreign currency denominated savings and small time deposits were not collected separately on the FR 2915 until June 2021. Before June 2021, the Federal Reserve estimated the amount to be deducted from each of the money stock components. The receipt of disaggregated data on savings (included in line 2 “Other liquid deposits” of the revised FR 2915) and small time deposits (line 4 of the revised FR 2915) indicated not enough deposits were being deducted from the savings component while too many deposits were being subtracted from the small time component. This finding led to a review of the estimation technique applied historically to generate deduction amounts for each component, and improved estimates of the necessary adjustments were made going back in time.

2. How did the Federal Reserve revise the amount of foreign currency denominated deposits excluded from the savings deposit and small time deposit components of the aggregates?

Posted: 08/24/2021A. The revisions to these adjustments from September 2000 to June 2015 range from $1 billion to $2 billion. In July 2015, the revisions to the adjustments start to increase steadily until they reach around $20 billion at the beginning of 2017. From 2017 forward, the revisions to the adjustments remain roughly constant at approximately $20 billion. The revised adjustments subtract more foreign currency denominated deposits from savings (and other liquid deposits) and less from small time deposits.

3. What effect did the Federal Reserve’s revisions to the amount of foreign currency denominated deposits excluded from the savings deposit and small time deposit components of the aggregates have on M2?

Posted: 08/24/2021A. There are no revisions to nonseasonally adjusted M2 and only minor revisions to seasonally adjusted M2. The revised adjustments decreased the savings deposit component of M2 and increased the small time deposit component of M2 by the same amounts back to 2000. As a result, the revised adjustments had no effect on nonseasonally adjusted M2. Because savings deposits and small time deposits have different seasonal factors, the revisions to the seasonally adjusted levels of these series did not perfectly offset and when aggregated resulted in minor revisions to seasonally adjusted M2.

Frequently Asked Questions on the H.6 Statistical Release Changes Announced on December 17, 2020

1. What changes to the H.6 statistical release were announced on December 17, 2020?

Posted: 01/28/2021A. A number of changes to Statistical Release H.6, “Money Stock Measures,” were announced on December 17, 2020. The changes, listed here, account for recent amendments to Regulation D and efforts to streamline and modernize the release.

- Recognize savings deposits as a transaction account by combining the H.6 statistical release items “Savings deposits” and “Other checkable deposits” and report the resulting sum, “Other liquid deposits,” as part of the M1 monetary aggregate.

- Publish the H.6 statistical release at a monthly rather than weekly frequency and retain only monthly average data on the release itself. Weekly average, nonseasonally adjusted data will continue to be made available in the Board’s Data Download Program (DDP), while weekly average, seasonally adjusted data will no longer be provided.

- Provide components of the monetary aggregates at a total industry level as opposed to presenting the breakdown of components by commercial banks and thrift institutions.

- Report only data used to construct the monetary aggregates, thereby eliminating the release of data on institutional money funds and memorandum items on U.S. government deposits and deposits due to foreign banks and foreign official institutions.

- Make the release available in only one format—HTML.

A template of the H.6 statistical release reflective of the above changes can be found here.

2. When will the Federal Reserve implement the H.6 statistical release changes announced on December 17, 2020?

Posted: 12/17/2020A. The Federal Reserve will implement the H.6 statistical release changes announced on December 17, 2020, with the first monthly H.6 statistical release to be published on Tuesday, February 23, 2021, inclusive of retroactive updates to the data back to May 2020.

3. Why are savings deposits being recognized on the H.6 statistical release as a transaction account?

Posted: 12/17/2020A. As announced on March 15, 2020, the Board of Governors reduced reserve requirement ratios on net transaction accounts to 0 percent, effective March 26, 2020. This action eliminated reserve requirements for all depository institutions and rendered the regulatory distinction between reservable “transaction accounts” and nonreservable “savings deposits” unnecessary. On April 24, 2020, the Board removed this regulatory distinction by deleting the six-per-month transfer limit on savings deposits in Regulation D. This action resulted in savings deposits having the same liquidity characteristics as the transaction accounts currently reported as “Other checkable deposits” on the H.6 statistical release.

To account for the change in their liquidity characteristics, savings deposits will be recognized as a type of transaction account on the H.6 statistical release.

4. How will savings deposits be recognized on the H.6 statistical release as a transaction account?

Posted: 12/17/2020A. The Board will combine H.6 statistical release items “Savings deposits” and “Other checkable deposits” and report the resulting sum as “Other liquid deposits.” Like other transaction accounts, other liquid deposits will be included in the M1 monetary aggregate. This action will increase the M1 monetary aggregate significantly while leaving the M2 monetary aggregate unchanged. These changes will be made retroactively in the data, starting in May 2020, to align the break in the data series with the timing of the policy decision to delete the six-per-month transfer limit on savings deposits from Regulation D, as reflected in the interim final rule announced on April 24, 2020.

5. How will recognizing savings deposits on the H.6 statistical release as a transaction account affect the monetary aggregates?

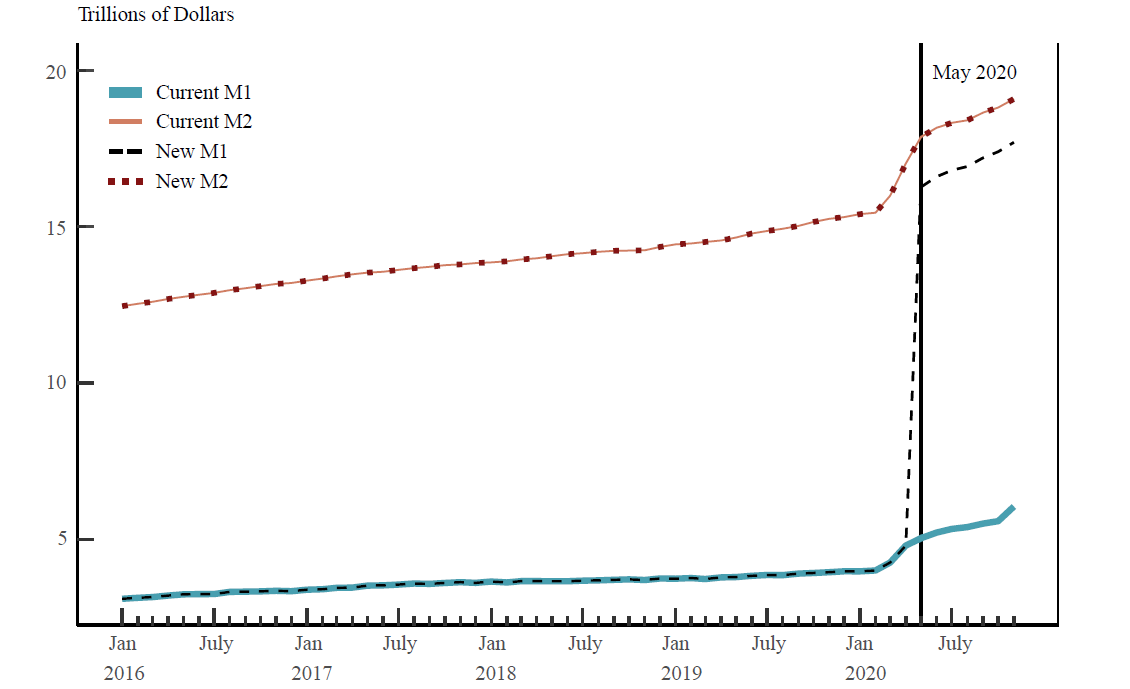

Posted: 12/17/2020A. Recognizing savings deposits as a transaction account as of May 2020 will cause a series break in the M1 monetary aggregate. Beginning with the May 2020 observation, M1 will increase by the size of the industry total of savings deposits, which amounted to approximately $11.2 trillion. M2 will remain unchanged. The following graphic depicts the size and timing of the series break that results from recognizing savings deposits as transaction accounts beginning in May 2020, the first full month after the approval of the deletion of the six-per-month transfer limit on savings deposits.

6. When and in what format will the Federal Reserve publish the H.6 statistical release each month?

Updated: 12/28/2020A. The H.6 statistical release will be published on the fourth Tuesday of every month, generally at 1 p.m. If the fourth Tuesday is a federal holiday, publication of the release may be shifted to the next business day. The monthly release will be published in HTML format only.

7. At what frequency will the release items be presented?

Posted: 12/17/2020A. Release items on the monthly H.6 statistical release will be presented as monthly average levels for the most recent 17 months. Seasonally adjusted and nonseasonally adjusted monthly averages will be provided for all items except the recently consolidated H.3 statistical release items and memorandum items, which will be made available only on a nonseasonally adjusted basis.

8. Which release items will be discontinued once the H.6 statistical release is published at a monthly frequency?

Posted: 12/17/2020A. Release items on institutional money funds and several memorandum items on U.S. government deposits and deposits due to foreign banks and foreign official institutions will be discontinued once the H.6 statistical release is published at a monthly frequency. Data on these release items are available from other sources, as detailed in the following table.

| H.6 Release Item | Alternative Information Source |

|---|---|

| Institutional money funds | Investment Company Institute, money market fund asset statistics, available on a weekly, nonseasonally adjusted basis |

| Demand deposits at banks due to foreign commercial banks |

FFIEC 031/041/051, schedule RC-E, available on a quarterly basis |

| Demand deposits at banks due to foreign official institutions |

FFIEC 031/041/051, schedule RC-E, available on a quarterly basis |

| Time and savings deposits due to foreign banks and official institutions |

FFIEC 031/041/051, schedule RC-E, available on a quarterly basis |

| U.S. government deposits: demand deposits at commercial banks |

FFIEC 031/041/051, schedule RC-E, available on a quarterly basis |

| U.S. government deposits: balance at Federal Reserve | Treasury's Daily Treasury Statement, available on a daily basis, and Board's H.4.1 release, available on a weekly basis |

| U.S. government deposits: time and savings deposits at commercial banks |

FFIEC 031/041/051, schedule RC-E, available on a quarterly basis |

9. Will historical data remain available in the DDP for release items that will be discontinued once the H.6 statistical release is published at a monthly frequency?

Posted: 12/17/2020A. Yes, historical data for the discontinued H.6 statistical release items will remain available in the DDP. Weekly average and monthly average data will remain available for the weeks before and including the week ending February 1, 2021, and the months before and including January 2021, respectively.

10. What reporting detail will be discontinued once the H.6 statistical release is published at a monthly frequency?

Posted: 12/17/2020A. The H.6 statistical release will no longer contain growth rates of the monetary aggregates, nor will it contain weekly average levels of the monetary aggregates and their components on either a seasonally adjusted or a nonseasonally adjusted basis. Also, the deposit components of the monetary aggregates will be presented only at a total industry level; detail by institution type, specifically the totals for commercial banks and thrift institutions, will be discontinued.

11. Will weekly average, nonseasonally adjusted data for the monetary aggregates and their components be available once the release is published at a monthly frequency?

Posted: 12/17/2020A. Even though these data will not be presented on the monthly H.6 statistical release, weekly average, nonseasonally adjusted data for the monetary aggregates and their components will continue to be made available in the DDP for weeks after the week ending February 1, 2021, the last week contained in the weekly H.6 statistical release. The DDP will contain historical weekly average, nonseasonally adjusted data back to 1975 or the early 1980s, depending on the release item, and through the weeks constituting the last month published on the monthly H.6 statistical release.

12. When will weekly average, nonseasonally adjusted data for the monetary aggregates and their components be available in the DDP?

Posted: 12/17/2020A. Weekly average, nonseasonally adjusted data for the monetary aggregates and their components for weeks constituting a month will be available in the DDP at the same time that the monthly average data for that month is made available.

13. Will weekly average, seasonally adjusted data for the monetary aggregates and their components be available once the release is published at a monthly frequency?

Posted: 12/17/2020A. Weekly average, seasonally adjusted data for the monetary aggregates and their components will not be made available on the monthly H.6 statistical release or in the DDP for weeks after the week ending February 1, 2021, the last week contained in the weekly H.6 statistical release. Historical weekly average, seasonally adjusted data for the weeks before and including the week ending February 1, 2021, will remain in the DDP.

Frequently Asked Questions on the Consolidation of the H.3 and H.6 Statistical Releases

1. Why is the Federal Reserve consolidating the H.3 and H.6 statistical releases?

Posted: 08/20/2020A. As announced on March 15, 2020, the Board of Governors reduced reserve requirement ratios on net transaction accounts to 0 percent, effective March 26, 2020. This action eliminated reserve requirements for all depository institutions. As a result, many of the release items on the H.3 statistical release are zero beginning with the two weeks ending April 8, 2020. Consequently, the Board has decided to consolidate the remaining relevant release items from the H.3 statistical release onto the H.6 statistical release.

2. Does the consolidation of the H.3 and H.6 releases mean that the Board’s decision to eliminate reserve requirements is permanent?

Posted: 08/20/2020A. Currently, the Board has no plans to reimpose reserve requirements. However, the Board may adjust reserve requirement ratios in the future if conditions warrant.

3. When will the Federal Reserve consolidate the H.3 and H.6 statistical releases?

Posted: 08/20/2020A. The remaining relevant items from the H.3 statistical release will be consolidated onto the H.6 statistical release with the H.6 statistical release published on Thursday, September 24, 2020. The last H.3 statistical release will be published on Thursday, September 17, 2020.

4. What H.3 release items have been zero since the elimination of reserve requirements? When did these items first go to zero?

Posted: 08/20/2020A. The following H.3 release items have been zero beginning with the two weeks ending April 8, 2020:

- Reserve balance requirements (table 1)

- Top of the penalty-free band (table 1)

- Bottom of the penalty-free band (table 1)

- Balances maintained to satisfy reserve balance requirements (table 1)

- Reserves, required (table 2)

- Vault cash, used to satisfy required reserves (table 2)

5. Which H.3 release items remain relevant after the elimination of reserve requirements and will be consolidated onto the H.6 statistical release?

Posted: 08/20/2020A. The monetary base and nonborrowed reserves, including their components, remain relevant concepts after the elimination of reserve requirements. The components of these concepts include (1) “Currency in circulation” and “Total balances maintained” for the monetary base and (2) “Total reserves” and “Total borrowings from the Federal Reserve” for nonborrowed reserves. These two concepts and their components are H.3 release items and will be consolidated onto the H.6 statistical release. The “Total balances maintained” H.3 release item will be relabeled as “Reserve balances” on the H.6 statistical release. The H.6 statistical release will provide monthly averages of these items.

There are other H.3 release items that are nonzero after the elimination of reserve requirements that will not be consolidated onto the H.6 release. The items include the following:

- Balances maintained that exceed the top of the penalty-free band (table 1): With the elimination of reserve requirements, all reserve balances maintained are balances that exceed the top of the penalty-free band. Reserve balances will be consolidated onto the H.6 statistical release.

- Total and surplus vault cash (table 2): These vault cash measures reflect vault cash held by depository institutions not exempt from reserve requirements, which the H.3 release considered to be those depository institutions that have net transaction accounts greater than the reserve requirement exemption amount. Vault cash held by this subset of institutions is no longer relevant with the elimination of reserve requirements.

- Breakdown of total borrowings from the Federal Reserve by program or facility (table 3): To calculate nonborrowed reserves, total borrowings from the Federal Reserve are subtracted from total reserves. Total borrowings will be consolidated onto the H.6 statistical release. The detailed breakdown of total borrowings by program or facility is not needed for the calculation and will not be consolidated onto the H.6 statistical release. In addition, table 1 of Statistical Release H.4.1, “Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks,” contains the detailed breakdown of “Loans” at a weekly frequency.

6. What is the monetary base?

Posted: 08/20/2020A. The monetary base is one measure of the money supply. The monetary base is the sum of currency in circulation and reserve balances (deposits held by banks and other depository institutions in their accounts at the Federal Reserve). Monthly average data on the monetary base and its components will be made available in table 1 of the H.6 release. The monetary base can also be derived by adding “Reserve balances with Federal Reserve Banks” and “Currency in circulation” from table 1 of the H.4.1 statistical release. This derivation can be done using weekly averages or Wednesday levels.

7. What are nonborrowed reserves?

Posted: 08/20/2020A. Nonborrowed reserves measure the amount of reserves provided through channels that are not considered borrowings. Such channels may include open market operations, foreign currency swap arrangements with foreign central banks, and certain special purpose vehicles.

Nonborrowed reserves are the difference between total reserves and total borrowings from the Federal Reserve.

- Total reserves are equal to the sum of reserve balances and vault cash used to satisfy reserve requirements, the latter of which is zero with the elimination of reserve requirements that was effective on March 26, 2020.

- Total borrowings from the Federal Reserve include credit extended through the Federal Reserve’s regular discount window programs and credit extended through certain Federal Reserve liquidity facilities.

Monthly data on nonborrowed reserves and its components will be available in table 1 of the H.6 release. With the elimination of reserve requirements, nonborrowed reserves can also be derived by subtracting “Loans” from “Reserve balances with Federal Reserve Banks” from table 1 of the H.4.1 statistical release. This derivation can be done using weekly averages or Wednesday levels.

8. Will monthly averages of the H.3 items being consolidated onto the H.6 statistical release continue to be calculated as prorated averages of biweekly figures?

Posted: 08/20/2020A. Yes. Monthly averages of the H.3 release items being consolidated onto the H.6 statistical release will continue to be calculated as prorated averages of biweekly figures. Any differences in the monthly average values of these consolidated items available from the H.3 and H.6 Data Download Program (DDP) are the result of revisions to the consolidated items captured in the H.6 DDP and not differences in the calculation method used to produce the monthly averages.

9. How will the Federal Reserve consolidate the H.3 and H.6 releases?

Posted: 08/20/2020A. Nonseasonally adjusted, monthly average data on the monetary base and nonborrowed reserves will be consolidated onto table 1 of the H.6 release. The monetary base and its components will be added to the left of the columns containing nonseasonally adjusted data on the M1 and M2 money stock measures. Nonborrowed reserves and their components will be added as memorandum items to the right of the columns containing nonseasonally adjusted data on the M1 and M2 money stock measures. A template of table 1 of the consolidated H.6 statistical release can be found here. Please note the amount of monthly data shown on table 1 of the consolidated H.6 statistical release will be reduced from 24 to 17 months. All historical data are accessible in the H.6 DDP.

10. Why is the Federal Reserve removing columns containing data on traveler’s checks concurrent with its consolidation of the H.3 and H.6 statistical releases?

Posted: 08/20/2020A. The Board ceased publication of outstanding amounts of U.S. dollar-denominated traveler’s checks of nonbank issuers in early 2019. The last reported value for this H.6 release item was December 2018. Currently, the columns labeled "Traveler’s checks" are blank and will be removed from the H.6 release as a matter of housekeeping. For more information, see the section below titled "Frequently Asked Questions on the Discontinuance of Nonbank Traveler’s Checks."

11. Will historical data for all H.3 release items remain available in the Data Download Program?

Posted: 08/20/2020A. Yes, historical data for all H.3 release items will remain available in the H.3 DDP. In the H.3 DDP, maintenance period average and monthly average data for all H.3 release items will have data through the two weeks ending September 9, 2020, and August 2020, respectively. The data that will remain available in the H.3 DDP for all H.3 release items will be as of the last publication of the H.3 release on September 17, 2020, and will not be revised.

12. After the consolidation of the H.3 and H.6 statistical releases, where will up-to-date data on the H.3 release items consolidated onto the H.6 statistical release be available?

Posted: 08/20/2020A. With the release consolidation on September 24, 2020, up-to-date data on the H.3 release items consolidated onto the H.6 statistical release will be available in the H.6 DDP. For these items, the H.6 DDP will contain time series of the data items from January 1959 through the last month published on the H.6 release. Unlike the H.3 DDP, the time series in the H.6 DDP for these items are subject to revision. The “build your own” and preformatted packages in the H.6 DDP will incorporate the consolidated items.

13. Why is the Federal Reserve discontinuing the 12 H.6 DDP preformatted packages associated with the H.6 historical tables?

Posted: 08/20/2020A. The Board is discontinuing the 12 “H.6 historical table” preformatted packages because the data items in these packages are contained in the monthly or the weekly “H.6 statistical release” preformatted packages. The Board provided the “H.6 historical table” preformatted packages to mirror the presentation of historical release data that was retired in 2012 once the H.6 DDP became available. Users have gained familiarity with the H.6 DDP and appear to rely on the preformatted packages associated with the current statistical release or the “build your own” functionality to select their desired release items.

Frequently Asked Questions on the Discontinuance of Nonbank Traveler’s Checks

1. Why are the nonbank traveler's check data being discontinued?

Posted: 01/17/2019A. Dollar-denominated traveler's checks serve as an alternative to demand deposits and currency as a means of payment and therefore are included in M1. Nonbank traveler's checks have been included as a separate component of the monetary aggregates since June 1981, while traveler's checks issued by depository institutions are included in demand deposits.

Nonbank traveler's checks have fallen steadily for many years to a point at which they represent an immaterial share of the monetary aggregates--currently less than $2 billion, about 0.05 percent of M1 and 0.015 percent of M2. Very few nonbank companies issue new traveler's checks, and the small remaining amounts are mostly the outstanding stocks of previously issued checks, which will continue to decline over time. The insignificant amounts and lack of growth potential in the business no longer justify the burden of collection and publication of these data.

2. Does the Federal Reserve continue to make historical nonbank traveler's check data available?

Posted: 01/17/2019A. Yes. Historical data on traveler's checks of nonbank issuers will remain available in the H.6 Data Download Program.

3. Are there any adjustments to the calculation of the monetary aggregates to reflect the discontinuation of nonbank traveler's check data?

Posted: 01/17/2019A. No adjustments have been made to historical values of the monetary aggregates, nor is there any break-adjustment to reflect the discontinuation of the nonbank traveler's check data.